- Kyiv School of Economics

- About the School

- News

- 69th issue of the regular digest on impact of foreign companies’ exit on RF economy

69th issue of the regular digest on impact of foreign companies’ exit on RF economy

7 October 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 06.09.2024-06.10.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 06.10.2024

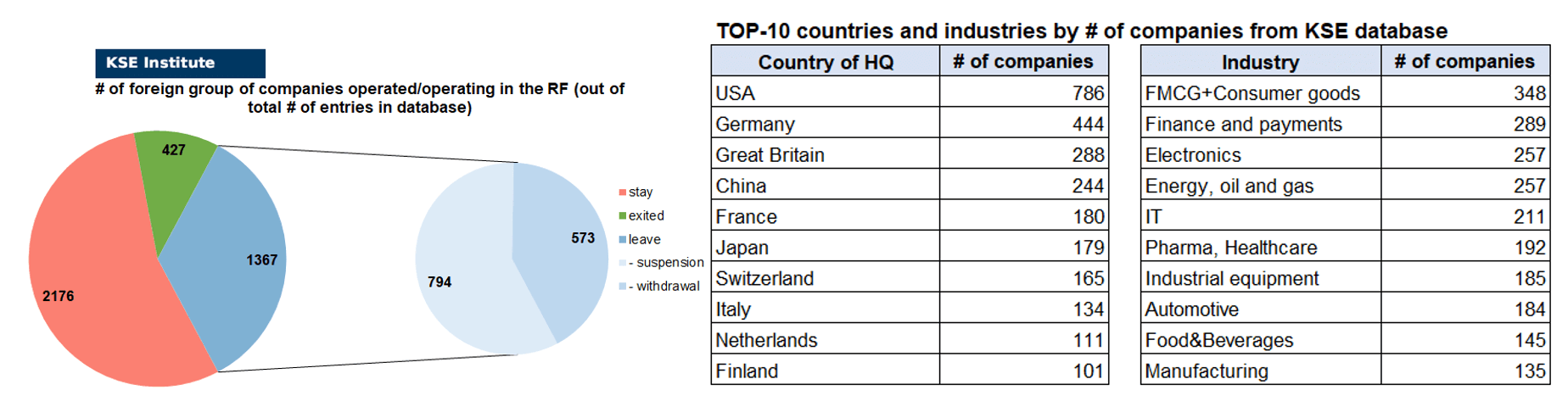

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 176² (+21 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 367 (+9 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 427 (+4 per month)

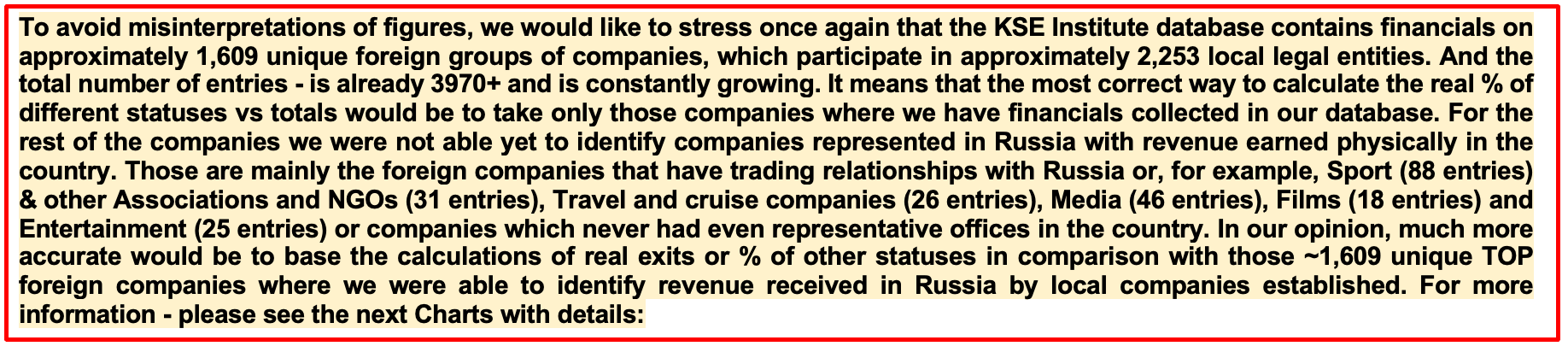

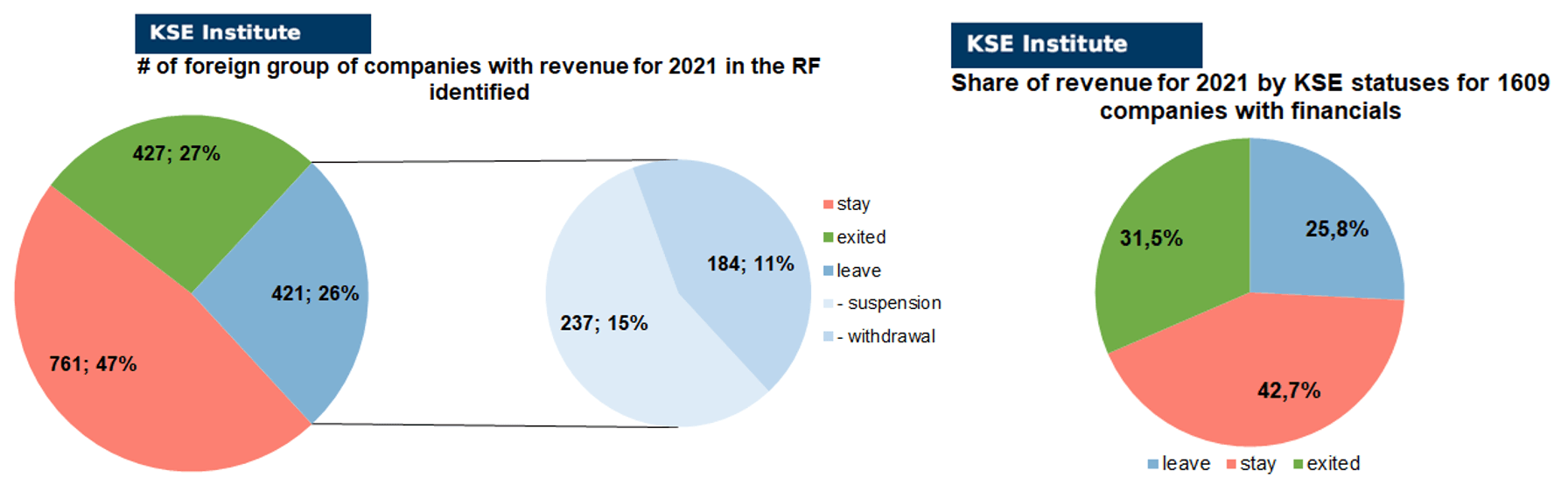

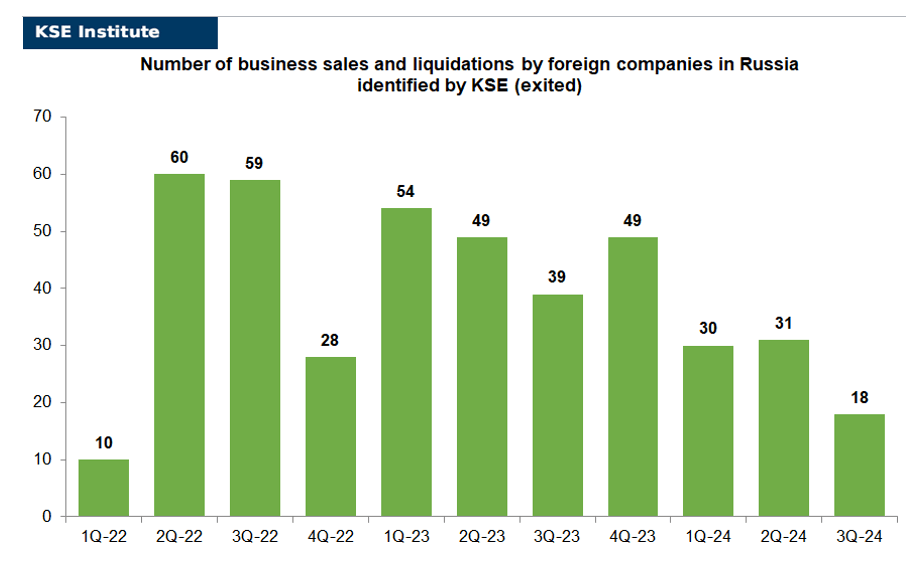

As of October 6, 2024, we have identified about 3,970 companies, organizations and their brands from 107 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’609 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.5 billion), local revenue (about $320.1 billion), local assets (about $343.7 billion) as well as staff (about 1.450 million people) and taxes paid (about $25.6 billion). 1,367 foreign companies have suspended or ceased operations in Russia. Also, we added information about 427 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (3 business sales and 1 full business liquidation took place in September 2024).

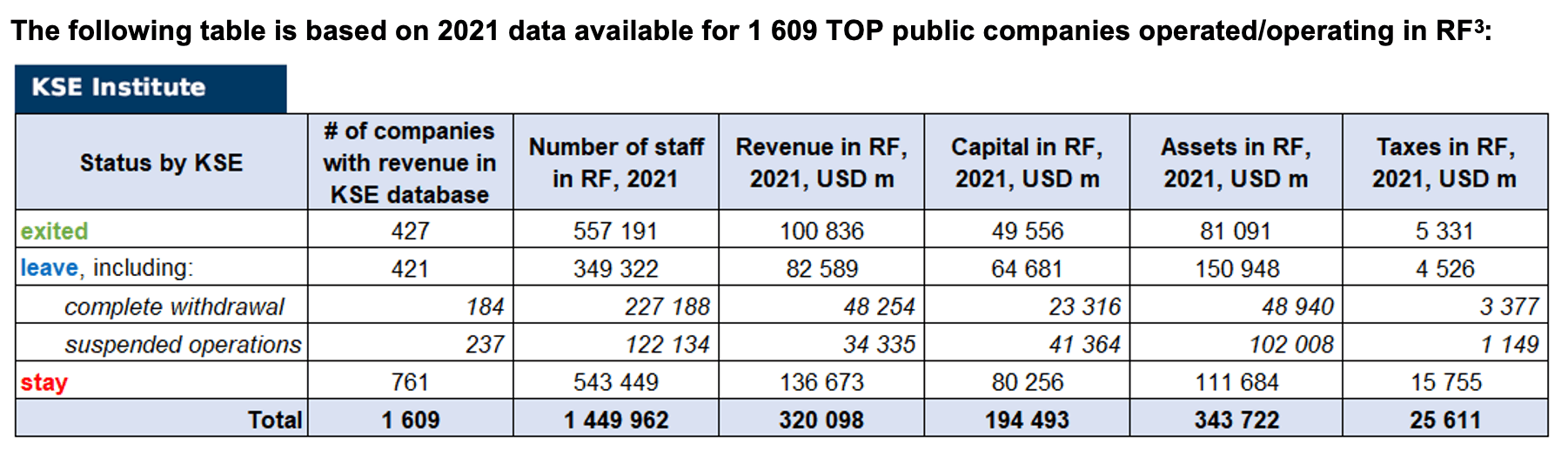

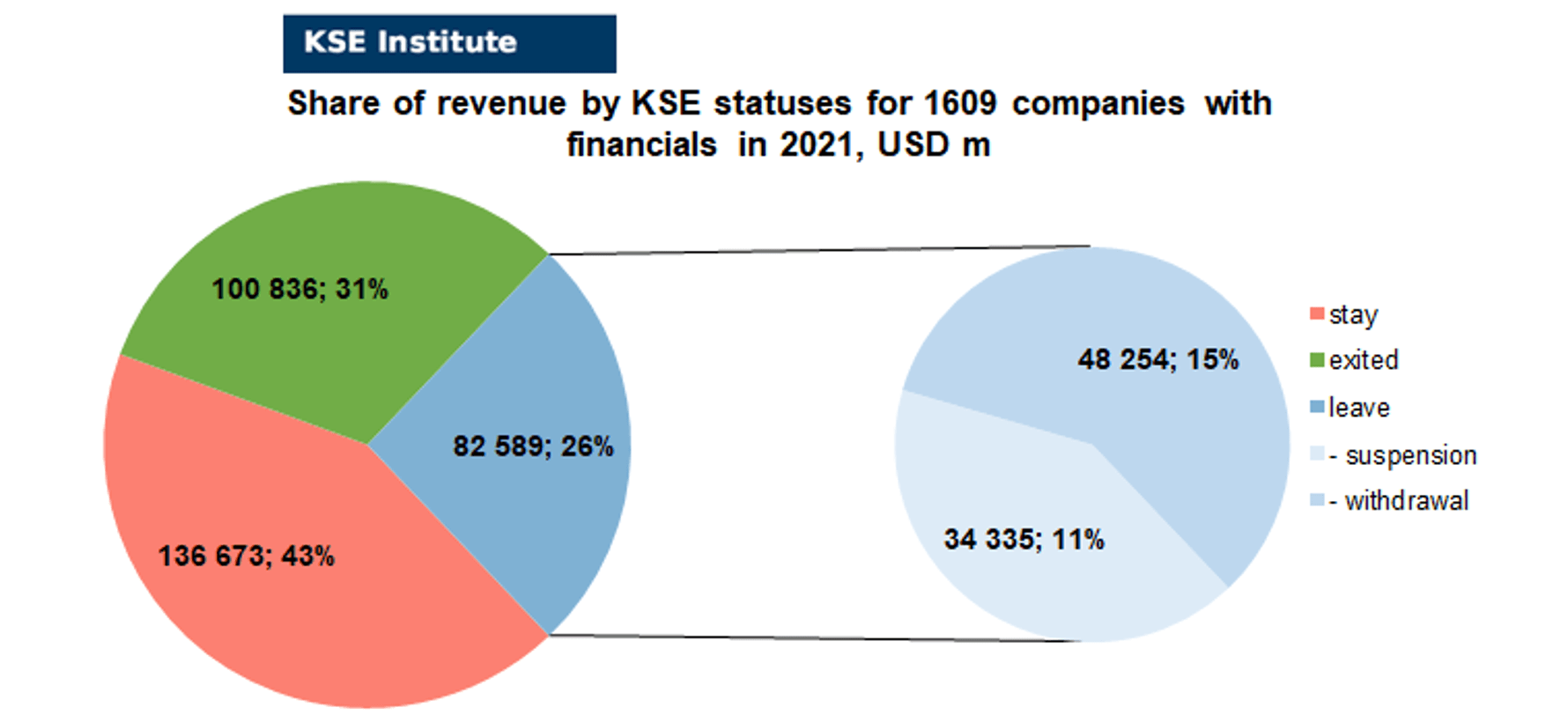

As can be seen from the tables below, as of October 6, 2024, 427 companies which had already completely exited from the Russian Federation, in 2021 had at least 557,200 personnel, $100.8 bn in annual revenue, $49.6bn in capital and $81.1bn in assets; companies, that declared a complete withdrawal from Russia had 227,200 personnel, $48.3bn in revenues, $23.3bn in capital and $48.9bn in assets; companies that suspended operations on the Russian market had 122,100 personnel, annual revenue of $34.3bn, $41.4bn in capital and $102.0bn in assets.

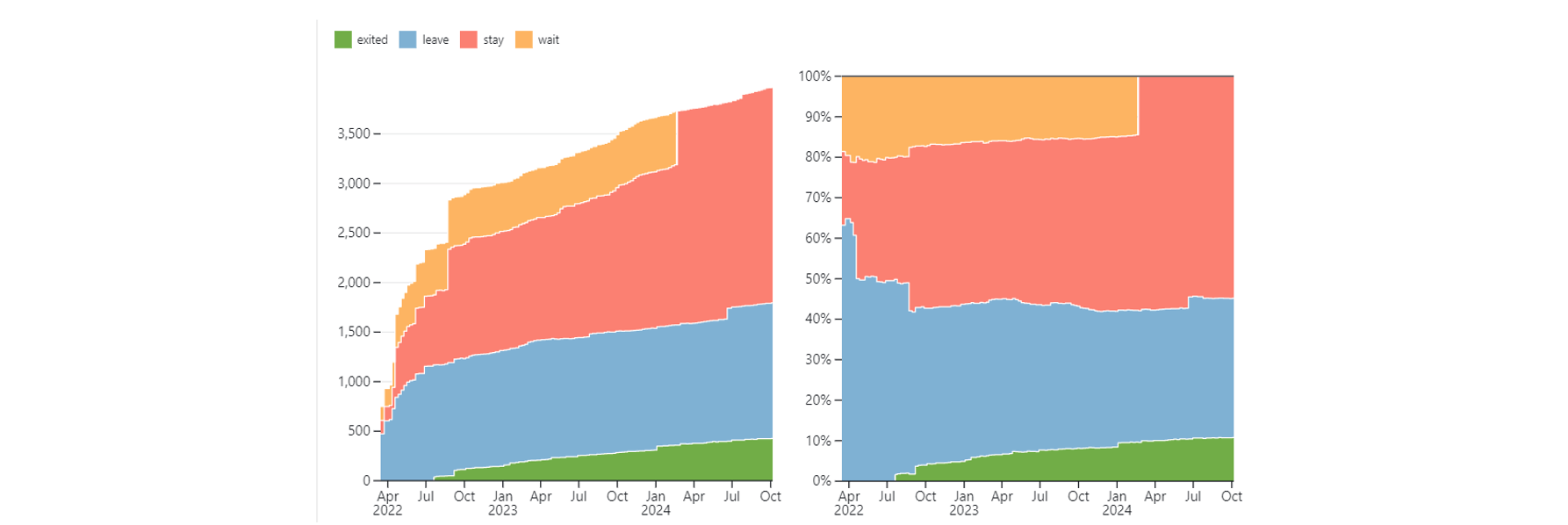

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 25 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 35 were added in September 2024). However, if to operate with the total numbers in KSE database, about 34.4% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 54.8% are still remaining in the country and only 10.8% made a complete exit.⁴

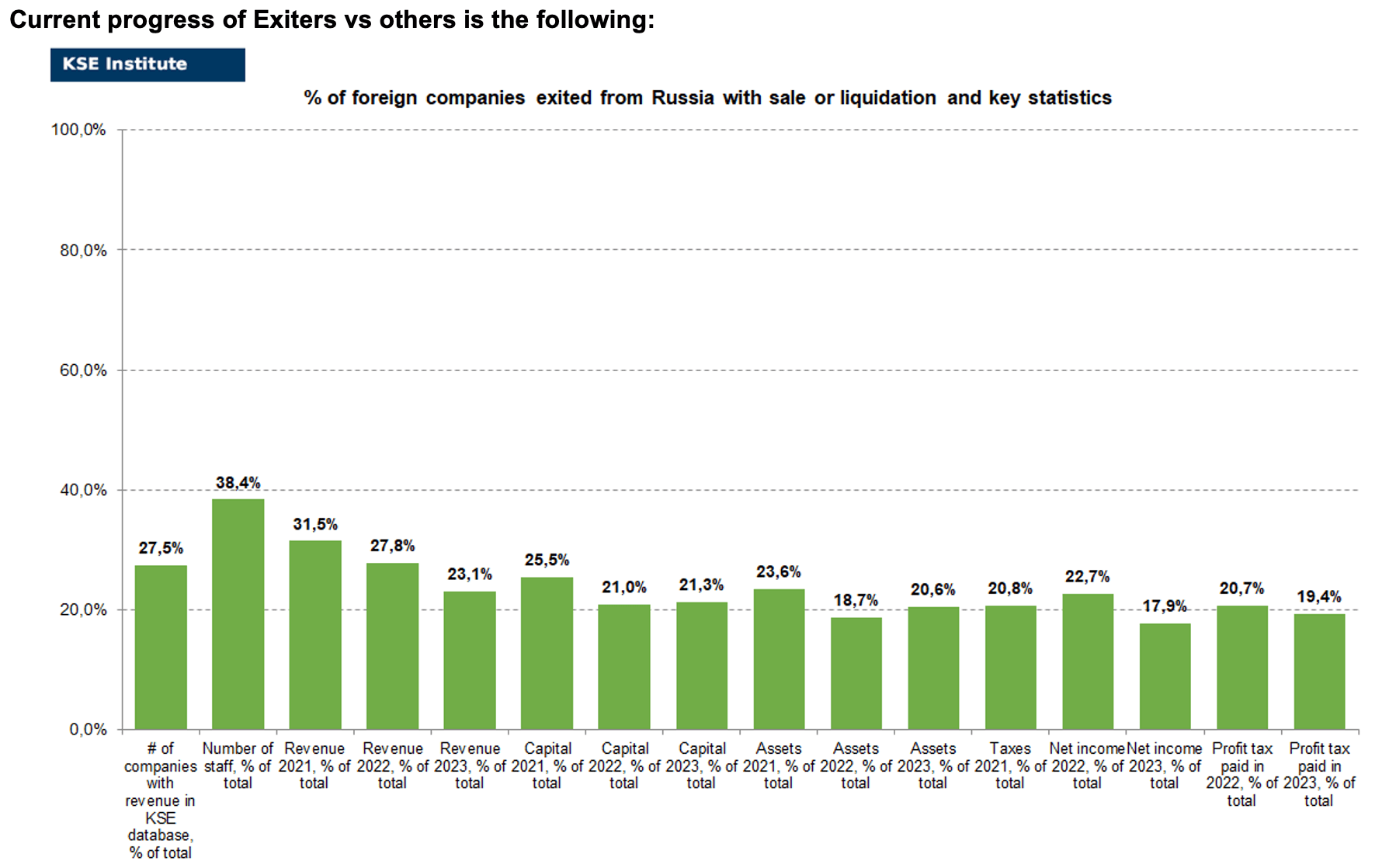

At the same time, it is difficult not to overestimate the impact on the Russian economy of 427 companies that completely left the country, since in 2021 they employed 38.4% of the personnel employed in foreign companies, the companies owned about 23.6% of the assets, had 25.5% of capital invested by foreign companies, and in 2021 they generated revenue of $100.8 billion or 31.5% of total revenue and paid ~$5.3 billion of taxes or 20.8% of total taxes paid by the companies observed. Data on 1,609 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (27%) and on share of revenue withdrawn (31.5%). At the same time, a bit different picture is for those who are still staying – 47% of companies represent 42.7% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect and adding quite a lot of new companies in July 2024.

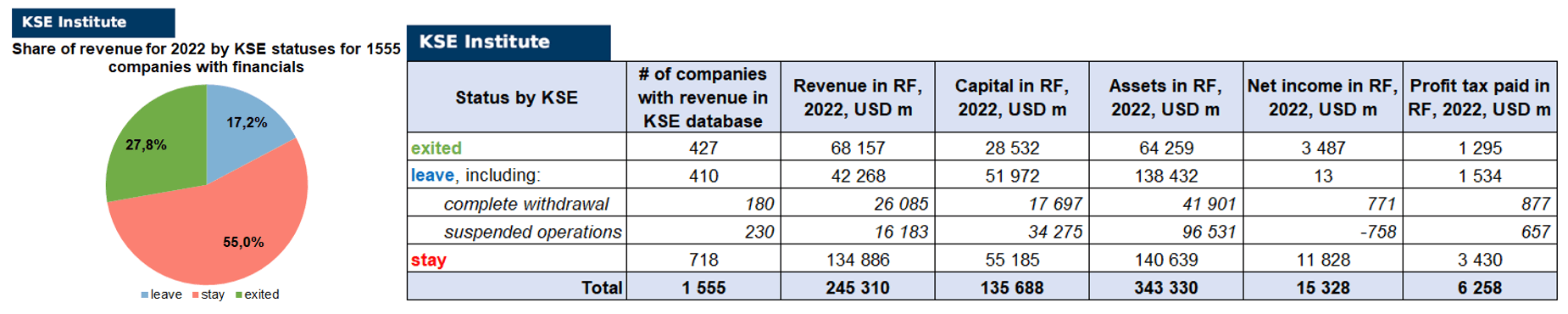

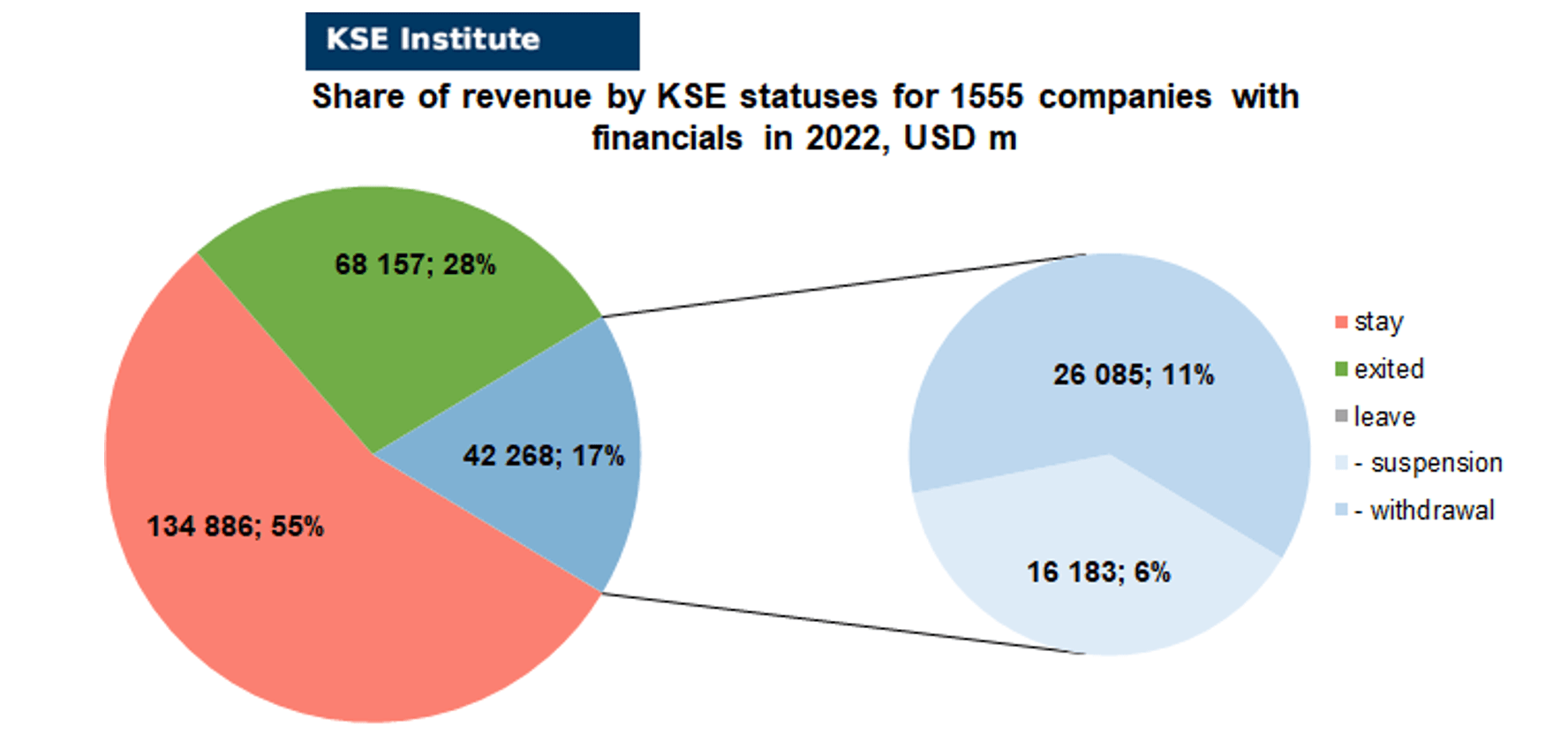

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1555 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.7% less of revenue in 2022 (27.8% from total volume) than in 2021 (31.5% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-8.6%) revenue in 2022 (17.2% from total volume) than in 2021 (25.8% from total volume). At the same time, staying companies were able to generate much (+12.3%) more revenue in 2022 (55.0% from total volume) than in 2021 (42.7% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($343.3bn in 2022 vs $343.7bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, in September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

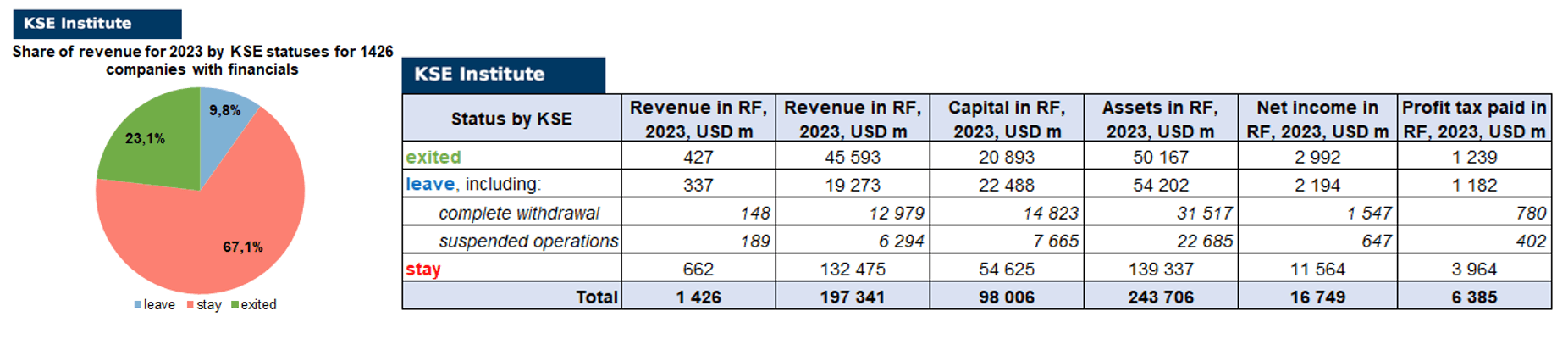

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1426 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 260 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8.4% vs 2021 and -4.7% vs 2022 (from 31.5% in 2021 and from 27.8% in 2022 to 23.1% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -16.0% vs 2021 and -7.4% vs 2022 (from 25.8% in 2021 and from 17.2% in 2022 to 9.8% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24.4% vs 2021 and +12.1% vs 2022 (from 42.7% in 2021 and from 55.0% in 2022 to 67.1% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of September 2024

In this digest, we will summarize the results of September 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’609 companies identified in the KSE database with revenue data available of more than $320.1 billion in 2021 and $245.3 billion in 2022 (which dropped to ~$197.3 billion in 2023). And at least 427 of them have already been sold by local companies or were liquidated and left the Russian market. In September 2024 KSE Institute identified +4 new exits (in reality +3 as one exit, Rönesans Holding, was missed earlier. 2 business sales and 1 liquidations took place in September 2024)⁶, total number of exits observed since the beginning of Russia’s invasion reached 427.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 31% based on revenue allocation, those who are leaving represent 26% of total revenue (with 42% share of suspensions and 58% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 28% based on revenue allocation, those who are leaving represent only 17% of total revenue (with 38% share of suspensions and 62% of withdrawals sub-statuses), % of staying companies represent 56% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

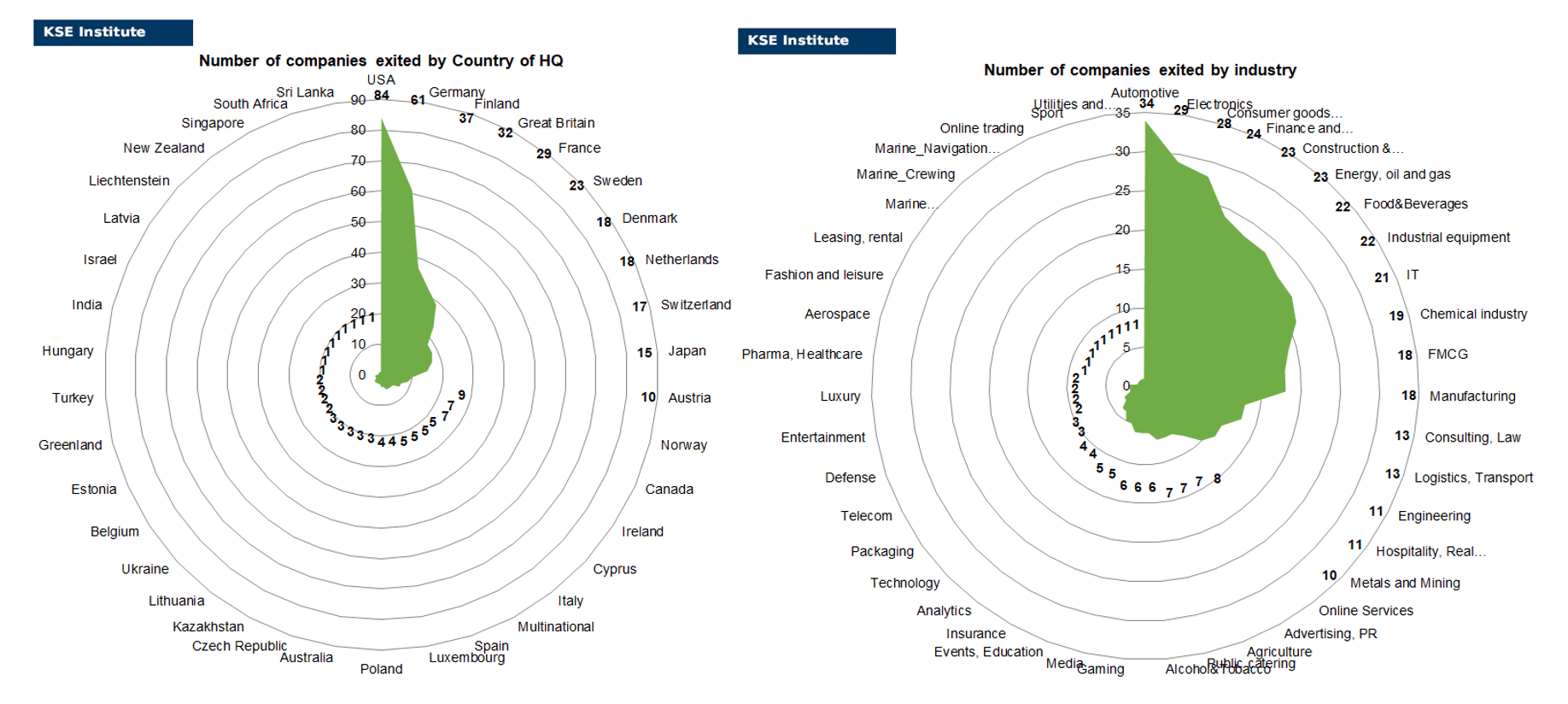

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of September 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Finance and payments”, “Construction & Architecture” and “Energy, oil and gas” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Oilon Oy (liquidation) and Rönesans Holding (sale was missed earlier). Also, 2 business sales took place in September 2024: Apleona and IPG Photonics.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: EOS (German EOS Group may sell its business in Russia to Gazprombank structures. The Russian subsidiary of EOS Group is one of the oldest collection companies in the country. The deal is close to completion and some employees have already announced the new owner), Maersk (Partial liquidation: 16.09.2024: The legal entity MAERSK LLC was liquidated. But MAERSK SOLUTIONS LLC is still operating, although it did not receive revenue in 2023), Nukem Technologies (German company Nukem begins new chapter free from Russian ownership), Purmo Group (Purmo Group, a global leader in indoor climate comfort solutions, has sold its Russian operations, ending all business in Russia. In 2023, Purmo’s Russian business represented nearly 3% of its total net sales), Sotheby’s (The famous auction house Sotheby’s has announced the liquidation of its Russian subsidiary Sotheby’s. This decision was made against the backdrop of sanctions) and Tikkurila (Top managers of Tikkurila’s Russian office have created a structure with the participation of a representative of an investment bank and may be planning to buy out the business of the Finnish parent company).

The next review of deals for October 2024 will be available in a month.

SPECIAL EDITION: Summary of the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?”

Over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP. These are the results of a study released by experts at KSE Institute as part of the “SelfSanctions / LeaveRussia” project in their analytical note, “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?“.

Since the beginning of Russia’s full-scale invasion of Ukraine, the number of foreign companies with assets in Russia has decreased from 1,510 to 1,131. Many companies have sold their assets to local or foreign owners or have liquidated their operations. However, many businesses continue to operate in Russia, facing difficulties in physically exiting or choosing not to leave the market.

The total revenue of foreign companies in Russia fell from $318 billion in 2021 to $193 billion in 2023. Despite the decline in revenue, profits remained almost at the same level—$16.7 billion in 2023 compared to $18.4 billion in 2021, the year before the invasion.

At the same time, the income tax paid by foreign companies in the Russian Federation even increased from $5.4 billion in 2021 to $6.4 billion in 2023. KSE experts attribute this growth to increased tax pressure.

Companies that stayed in Russia (status stay) lost less revenue (from $138.6 billion to $131.9 billion) than those that declared or completed their exit. Their profits significantly increased—from $7.7 billion in 2021 to $11.8 billion in 2023—which may indicate gains from operating in a less competitive environment.

The largest revenue decline was observed in the Consumer Cyclical sector, dropping from $131 billion to $55.9 billion over two years. In contrast, the greatest profit increases were noted in the Financial Services and Consumer Defensive sectors.

Raiffeisen Bank stands out in the financial sector, with its profits in Russia reaching nearly $1 billion in 2023. In the consumer sector, companies like Mondelez and PepsiCo continue active operations and increase their financial indicators. Mondelez increased its revenue from $1 billion to $1.4 billion, with profits rising from $17 million to $62 million. PepsiCo maintained revenue levels above $4 billion, and profits grew from $32 million to $135 million.

Companies from the United States and Germany reduced their revenue in Russia the most, while Chinese companies increased their presence, particularly in the automotive sector. Chinese brands Haval and Chery Automobile are actively replacing Western manufacturers that have left the market, boosting their sales and profits several times over.

Some companies, such as Leroy Merlin, announce their exit from Russia but continue operations through formal asset sales. Investigations indicate that such deals may be purely technical, lacking a real disengagement from the Russian market.

Official sectoral sanctions, particularly on technology exports, also affect the activities of foreign companies in Russia. However, experts note that further business exits are possible only through strengthening such sanctions, as the potential for voluntary self-restrictions has been effectively exhausted.

Experts at KSE Institute conclude that despite the substantial reduction in revenue, many foreign companies continue to earn profits in Russia, thereby financing the budget of the aggressor country. Further exit of foreign businesses from Russia is possible only through the intensification of sectoral sanctions and increased pressure from governments and the international community.

Key findings of the report:

Dynamics of Indicators: The financial indicators of foreign businesses in Russia in 2023, analyzed for the first time in this policy brief, finally allow us to observe revenue and profit dynamics.

Exit of Foreign Companies: Since the full-scale invasion of Ukraine, the number of foreign companies with assets in Russia has decreased from 1,510 to 1,131. Many companies sold their assets to local or foreign owners or liquidated their branches.

Decrease in Revenue: The total revenue of foreign companies in Russia fell from USD 318 billion in 2021 to USD 193 billion in 2023, marking a loss of USD 125 billion over two years.

Stable Profit: Despite falling revenues, profits remained largely unchanged ($18.4 billion in 2021 versus $16.7 billion in 2023).

Profit Tax: At the same time, the profit tax paid by foreign companies in the Russian Federation has even increased from USD 5.4 billion in 2021 to USD 6.4 billion in 2023, attributed to the increased tax pressure.

Strategic Differences: Companies remaining in Russia lost less revenue (from USD 136 billion to USD 129 billion) than those that either declared their intent to exit or completed their exit. At the same time, their profits grew significantly, indicating benefits from a less competitive environment.

Economic Sectors: The largest revenue decline occurred in the consumer cyclical sector, where revenue dropped from USD 131 billion to USD 55.9 billion over two years. However, the highest profits were recorded in consumer cyclical, consumer defensive, and financial services sectors.

Countries of Origin: Companies from the USA and Germany saw the greatest revenue reductions, while Chinese companies increased their presence in the Russian market. Chinese car brands, in particular, are actively replacing Western manufacturers who exited the market.

Opaque Exits: Some companies, such as Leroy Merlin, claim to exit Russia but, in practice, continue operations through formal asset sales, indicating a lack of transparency and possible schemes to evade responsibility.

Impact of Sectoral Sanctions: Official sanctions, particularly on technology exports, also affect the operations of foreign companies in Russia, which should be considered when analyzing their market behavior.

Please get acquainted with the full version of the analytical note by following the link.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

02.09.2024

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – leave

Chivas Brothers cites Russia exit in year of ‘ups and downs’

https://www.heraldscotland.com/news/24550158.russia-exit-hits-sales-scotch-whisky-giant-chivas/

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

Finland’s Fortum uses US nuclear fuel to cut Russia dependence

*Fieldfisher (Great Britain, Consulting, Law) Status by KSE – leave

The Foreign Ministry of Russia has banned several British lawyers from Fieldfisher including the firm’s managing partner for their role in applying the mechanism of sanctions against the country.

https://uk.finance.yahoo.com/news/russia-bans-managing-partner-city-104500623.html

03.09.2024

*Apple Pay (USA, Finance and payments) Status by KSE – stay

Apple bows to Russian censorship: RSF and 27 organisations demand the VPNs removed from Russia’s App Store be restored

*YouTube (USA, Online Services) Status by KSE – stay

YouTube in russia will be completely blocked in 3-5 months – head of Council of Fund for Development of Digital Economy of russian federation

04.09.2024

*International Monetary Fund (IMF) (USA, Finance and payments) Status by KSE – stay

IMF to send first mission to Russia since Ukraine invasion

https://www.reuters.com/world/imf-conduct-first-mission-russia-since-covid-moscow-says-2024-09-03/

*CRH (Ireland, Construction & Architecture) Status by KSE – stay

Despite public statements about leaving the Russian market, CRH continues its operations in Russia through its affiliated entities, specialising in the production of cement, concrete products, lime, and aggregates, such as Fels Werke.

*VEON (Netherlands, Telecom) Status by KSE – exited

*Mondi Group (Great Britain, FMCG) Status by KSE – exited

Chinese automaker Chery has become the largest foreign company in Russia

*Chery Automobile (China, Automotive) Status by KSE – stay

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

Three Chinese automakers entered the top 10 largest foreign companies in Russia

*Heilongjiang Quanrun Beer Co (South Korea, Alcohol&Tobacco) Status by KSE – stay

Russia to Start Importing Beer from North Korea

https://www.moscowtimes.ru/2024/09/03/vrossiyu-nachnut-zavozit-pivo-izsevernoi-korei-a141145

05.09.2024

*Apple Pay (USA, Finance and payments) Status by KSE – stay

*Google Pay (USA, Online Services) Status by KSE – leave

Banks assess the popularity of Russian alternatives to Apple and Google Pay

https://www.rbc.ru/finances/05/09/2024/66d6fc069a7947db4d0b723e

*China Energy Investment (China, Energy, oil and gas) Status by KSE – stay

China has cut off funding for a joint coal project with Russia due to sanctions

https://www.epravda.com.ua/news/2024/09/5/718969/

*Microsoft (USA, IT) Status by KSE – leave

Kremlin Isolation: Microsoft Starts to Cut Off Russian Companies from Cloud Services

*Coca-Cola (USA, Food & Beverages) Status by KSE – stay

*McDonald’s (USA, Public catering) Status by KSE – exited

*Levi Strauss (USA, Consumer goods and clothing) Status by KSE – leave

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – exited

*Harbour Energy (Great Britain, Energy, oil and gas) Status by KSE – stay

*LetterOne Holdings S.A. (Luxembourg, Finance and payments) Status by KSE – stay

Sanctioned oligarchs take stake in largest UK oil firm

https://www.bbc.com/news/articles/c4gdywpe1qpo

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – leave

Moscow approves Unilever deal to offload Russian assets

The buyer of the Russian business of the transnational holding Unilever, headquartered in London, was the Arnest Group.

06.09.2024

*Ambu (Denmark, Pharma, Healthcare) Status by KSE – leave

It’s a legal battle for pharmaceutical company Ambu to liquidate its subsidiary in Russia, but CEO Britt Meelby Jensen remains confident that it will be accomplished before the New Year.

https://medwatch.com/News/medtech/article17416447.ece

*Diamond Aircraft (Austria, Air transportation) Status by KSE – stay

The Austrian company Diamond Aircraft could supply spare parts and engines for its planes to the Russian Federation through China, bypassing sanctions.

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Russian court bans sale of Raiffeisenbank branch

07.09.2024

*Bangkok Dusit Medical Services (Thailand, Pharma, Healthcare) Status by KSE – stay

Bangkok Dusit Medical Services and Russia’s Medsi Group sign MoU to enhance medical tourism

*ASML Holding (Netherlands, IT) Status by KSE – stay

Russian firms acquire ASML spare parts despite EU sanctions

https://www.communicationstoday.co.in/russian-firms-acquire-asml-spare-parts-despite-eu-sanctions/

09.09.2024

*Sucden (France, Finance and payments) Status by KSE – stay

*Lactalis (France, Food & Beverages) Status by KSE – stay

In limbo: what should French companies do in Russia?

https://www.gazeta.ru/comments/2024/08/31_a_19669147.shtml

*Tikkurila Oyj (Finland, FMCG) Status by KSE – stay

Tikkurila prepares a colorful exit

https://www.kommersant.ru/doc/7013875

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

IOC president has sports, personal links to Russia

https://www.statesboroherald.com/sports/ioc-president-has-sports-personal-links-to-russia/

09.08.2024

*Anheuser-Busch (Belgium, Alcohol&Tobacco) Status by KSE – leave

Russia is still not letting go of AB InBev: the authorities refuse to approve the deal. Accordingly, AB InBev will be forced to continue operating in Russia, but already under the management of Anadolu Efes.

https://www.retaildetail.eu/news/food/ab-inbev-banned-from-selling-russian-branch/

https://www.ft.com/content/a4efecae-1249-4162-8979-933cc7258304

10.09.2024

*Google (USA, Online Services) Status by KSE – exited

Google does not allow you to verify the authenticity of your account using your Russian number

11.09.2024

*KIA Motors (South Korea, Automotive) Status by KSE – leave

*Hyundai (South Korea, Automotive) Status by KSE – leave

The Ministry of Industry and Trade has permitted parallel import of Kia and Hyundai spare parts

https://www.kommersant.ru/doc/7044572

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

Hungarian oil and gas company MOL has reached an agreement with suppliers and pipeline operators to transport Russian crude oil to Hungary and Slovakia via the Druzhba pipeline. According to the agreement, ownership of the affected volumes of oil will be transferred to MOL as of today, September 9.

12.09.2024

*Atlassian (Australia, IT) Status by KSE – leave

*Notion Labs Inc (USA, IT) Status by KSE – leave

*Slack (USA, IT) Status by KSE – leave

Leading companies and services announced their exit from the Russian market or the introduction of new restrictions for the Russian Federation from September 12.

*YLB (Bolivia, Metals and Mining) Status by KSE – stay

Russia’s Rosatom signs agreement with Bolivia to build lithium plant

*Petrojet (Egypt, Construction & Architecture) Status by KSE – stay

Petrojet, Russian Atomstroyexport ink coast protection deal for El-Dabaa nuclear plant

https://english.ahram.org.eg/News/531658.aspx

*LG Electronics (South Korea, Electronics) Status by KSE – exited

Russians are furious and crying because now, instead of the LG company, which left the country amid a full-scale war, they will have a cosmetics brand with a very strange name – OHUI.

https://www.rbc.ua/ukr/styler/rosiyi-plachutsya-cherez-te-shcho-zamist-1726127828.html

13.09.2024

*Toronto International Film Festival (TIFF) (Canada, Films) Status by KSE – stay

The Toronto International Film Festival (TIFF) has decided to cancel the screening of Russian propagandist Anastasia Trofimova’s film Russians at War, which whitewashes Russian soldiers fighting in Ukraine.

14.09.2024

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank closes its last branch in Russia

15.09.2024

*FIDE (International Chess Federation) (Switzerland, Sport) Status by KSE – stay

FIDE’s Ethics Commission Appeal Chamber has reduced the Russian Chess Federation’s punishment from a two-year suspension to a €45,000 fine for organizing events in occupied Ukrainian territories.

*Embracer Group (Sweden, Gaming) Status by KSE – leave

Russian Saber refused to buy Metro 4A Games authors: Ukrainian studio remains part of Embracer Group

*Wien Energie (Austria, Energy, oil and gas) Status by KSE – stay

Vienna power firm says will phase out Russian gas in 2025

16.09.2024

*LG Electronics (South Korea, Electronics) Status by KSE – stay

According to Russian media reports on September 12 (local time), LG, which has withdrawn from the Russian market, has recently applied to register a trademark for cosmetics in Russia.

http://www.koreapost.com/news/articleView.html?idxno=43019

*Revolut (Great Britain, Finance and payments) Status by KSE – leave

Fintech Revolut Eyes Expansion in Gulf With License Application

17.09.2024

*International Monetary Fund (IMF) (USA, Finance and payments) Status by KSE – stay

IMF postpones economic consultations with Russia to gather more data

*Mars (USA, Food & Beverages) Status by KSE – stay

Mars to “scale back” Russia business

https://finance.yahoo.com/news/mars-scale-back-russia-business-053613542.html?guccounter=1

*Meta (USA, Online Services) Status by KSE – leave

Meta Bans Russia Today and Other Russian Media Accounts

https://www.epravda.com.ua/rus/news/2024/09/17/719410/

*MSF – Médecins Sans Frontières (France, Association, NGO) Status by KSE – leave

Doctors Without Borders Leaves Russia After 32 Years

18.09.2024

*YouTube (USA, Online Services) Status by KSE – stay

Кремль знову почав публікувати відео з Путіним на YouTube, незважаючи на заміщення відеохостингу

19.09.2024

*Emlak Katılım (Turkey, Finance and payments) Status by KSE – stay

Turkish banks intend to stop transactions with Russia

20.09.2024

*EOS (Germany, Finance and payments) Status by KSE – leave

The German EOS Group has decided on a potential buyer of its collection agency in Russia — the asset can be purchased by the structures of Gazprombank (GPB)

https://www.rbc.ru/newspaper/2024/09/20/66ec199d9a7947855bf7b6fc

*Purmo Group (Finland, Electronics) Status by KSE – leave

Purmo Group, a global leader in indoor climate comfort solutions, has sold its Russian operations, ending all business in Russia. In 2023, Purmo’s Russian business represented nearly 3% of its total net sales.

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Europe’s Gas Supply Solid as Russian Transit Deal Nears End

*CERN (European Organization for Nuclear Research) (Switzerland, Energy, oil and gas) Status by KSE – leave

CERN prepares to expel Russian scientists — but won’t completely cut ties

https://www.nature.com/articles/d41586-024-02982-6

*Taiwan Cement Corporation | TCC Group Holdings (Taiwan, Energy, oil and gas) Status by KSE – leave

TCC Group Holdings’ decision to stop buying Russian coal for its Hoping Power Plant has been met with positive reactions from environmental groups

22.09.2024

*Visa (USA, Finance and payments) Status by KSE – leave

Visa is applying for trademark registration in the Russian Federation: is the payment system returning to the Russian market?

*TikTok (China, Online Services) Status by KSE – leave

TikTok Blocks Dozens of Russian State Propaganda Accounts

https://www.moscowtimes.ru/2024/09/21/tiktok-zablokiroval-okolo-40-akkauntov-sputnik-a142828

*Xiamen Limbach (China, Defense) Status by KSE – stay

Russia produces kamikaze drone with Chinese engine

23.09.2024

*Zeekr Automobile (China, Automotive) Status by KSE – stay

Zeekr to Shut Down “Grey” Electric Cars in Russia

24.09.2024

*Shaanxi Baoji Special Vehicles Manufacturing (China, Defense) Status by KSE – stay

The Russian invading army has used Chinese ZFB-05 armored vehicles in Ukraine for the first time. China denies supplying the vehicle. However, there are many African proxies that Russia could have used”

https://mediavektor.org/94835-rf-nachala-primenyat-kitajskie-bronemashiny-v-ukraine.html

https://bukvy.org/rosijski-vijska-vpershe-zastosuvaly-na-fronti-kytajski-bronemashyny-bild/

*Maersk (Denmark, Logistics, Transport) Status by KSE – stay

In 2022 and 2023, Maersk transported mining equipment for a company owned by the Wagner Group in Sudan. The expert explains that the Danish shipping company provided a centralized service for one of Russia’s important sources of income.

https://danwatch.dk/maersk-sejlede-mineudstyr-til-russiske-lejesoldater-i-sudan/

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

After Pledging To Leave Moscow Over Ukraine War, Tobacco Giant PMI Stays Put—and Rakes In Billions From Russian Sales

25.09.2024

*Entekhab Group (Iran, Electronics) Status by KSE – stay

*Midea Group (China, Electronics) Status by KSE – stay

The largest Iranian manufacturer of household appliances, Entekhab Group, has switched to another enterprise after unsuccessful negotiations on the purchase of the Vestel plant in the Vladimir region.

https://www.kommersant.ru/doc/7181706

*Maersk (Denmark, Logistics, Transport) Status by KSE – stay

In 2022 and 2023, Maersk transported mining equipment for a company owned by the Wagner Group in Sudan. The expert explains that the Danish shipping company provided a centralized service for one of Russia’s important sources of income.

https://danwatch.dk/maersk-sejlede-mineudstyr-til-russiske-lejesoldater-i-sudan/

*Tikkurila Oyj (Finland, FMCG) Status by KSE – stay

Finnish paint maker Tikkurila’s products manufactured at plants in Russia will be sold under a new brand, Tikkivala, from the first quarter of next year

26.09.2024

*Sotheby’s (Great Britain, Finance and payments) Status by KSE – leave

Sotheby’s auction house liquidates Russian legal entity OOO Sotheby’s.

https://www.forbes.ru/forbeslife/521977-aukcionnyj-dom-sotheby-s-likvidiruet-urlico-v-rossii

27.09.2024

*Zurich Film Festival (Switzerland, Films) Status by KSE – leave

The Zurich International Film Festival has canceled all screenings of the film Russians at War. Spectators began receiving letters informing them of ticket cancellations, and all shows were canceled on the festival’s website.

https://www.pravda.com.ua/eng/news/2024/09/27/7477043/

*Discord (USA, IT) Status by KSE – stay

The Discord messenger, popular in the corporate IT culture and among gamers, may be completely blocked in Russia.

https://www.kommersant.ru/doc/7183348

*Binance (China, Finance and payments) Status by KSE – stay

Cryptocurrency exchange Binance still serves some Russian clients despite announcing a complete exit from Russia in 2023. “We continue to serve a limited number of existing Russian users to ensure their digital assets remain safe and secure,” a spokesperson for Binance told Cointelegraph on Sept. 25.

https://cointelegraph.com/news/binance-confirms-russia-presence-after-exit

28.09.2024

*International Ski Federation (Switzerland, Sport) Status by KSE – leave

International Ski Federation extends suspension of Russian athletes for another year

30.09.2024

*Uzbekneftegaz (Uzbekistan, Energy, oil and gas) Status by KSE – stay

Gazprom’s new land of plenty: Uzbekistan

https://www.upstreamonline.com/production/gazprom-s-new-land-of-plenty-uzbekistan/2-1-1715970

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

Russian companies have begun to move en masse to the Hungarian OTP Bank from the Austrian Raiffeisenbank after the latter introduced new restrictions on currency transfers on September 2.

*United Development Company (Qatar, Construction & Architecture) Status by KSE – stay

United Development Company (UDC), the main developer of Perlina and Gevan islands, participated in the 8th International Business Real Estate Forum in St. Petersburg, Russia.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

In September 2024, the KSE Institute published the analytical note entitled “What are the financial results of foreign business in Russia in 2023, and have exit rates slowed down?” where, among other things, we estimated that over the two years since the full-scale invasion, Russia has lost USD 125 billion in revenue from Western companies, equivalent to about 5.6% of the country’s GDP“. You can download its full text in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4961551

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website