- Kyiv School of Economics

- About the School

- News

- 68th issue of the regular digest on impact of foreign companies’ exit on RF economy

68th issue of the regular digest on impact of foreign companies’ exit on RF economy

5 September 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 06.08.2024-05.09.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

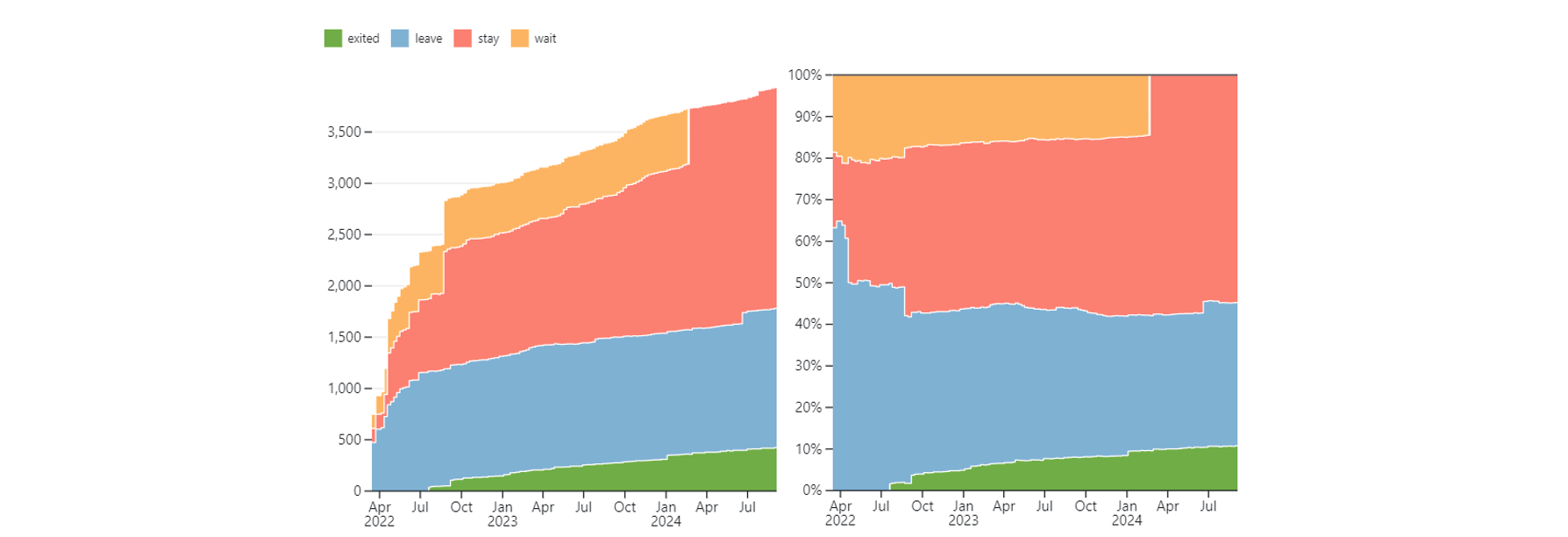

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

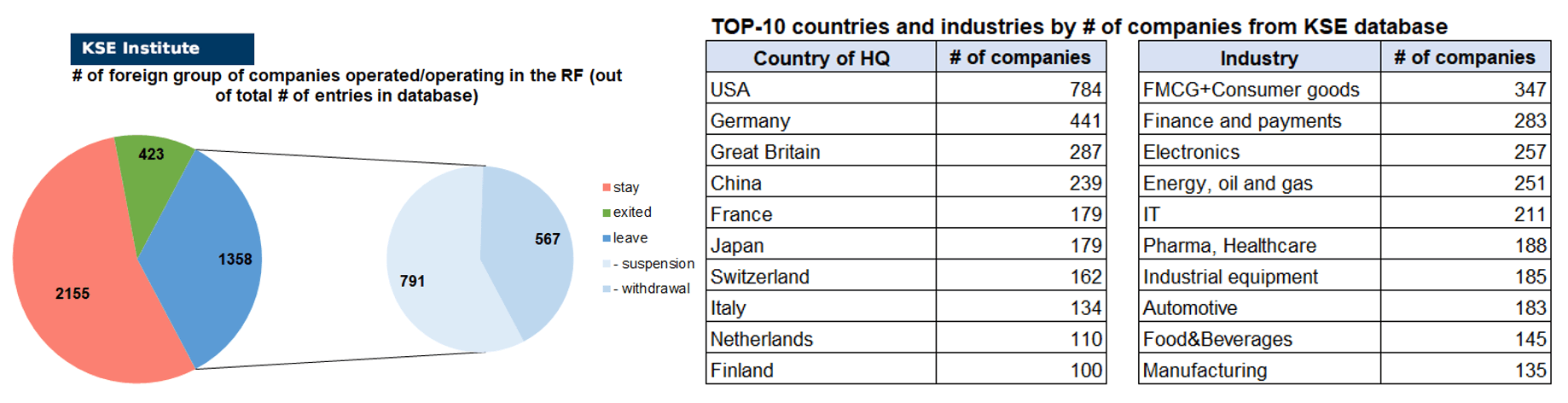

KSE DATABASE SNAPSHOT as of 05.09.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 155² (+16 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 358 (+9 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 423 (+6 per month)

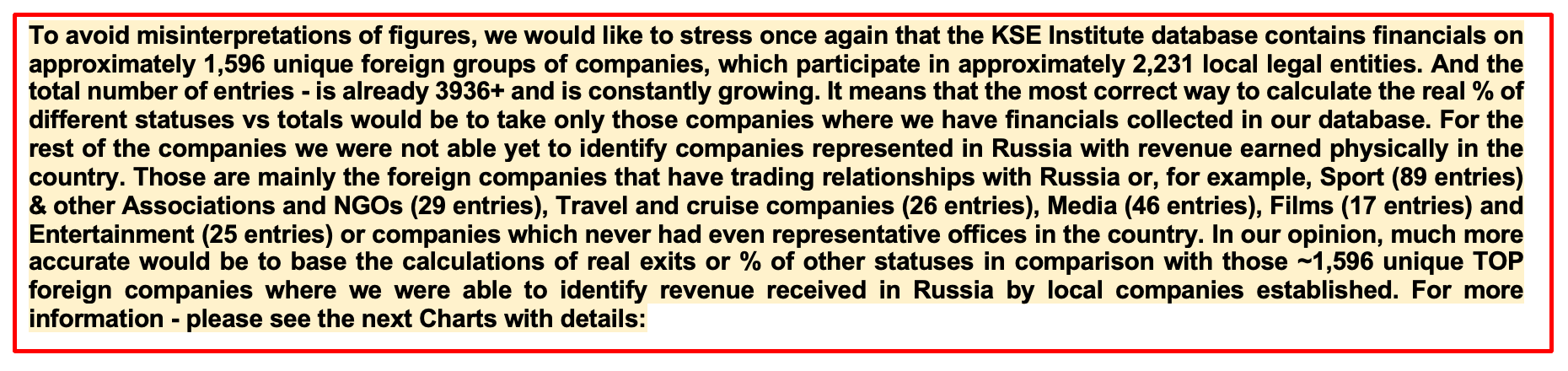

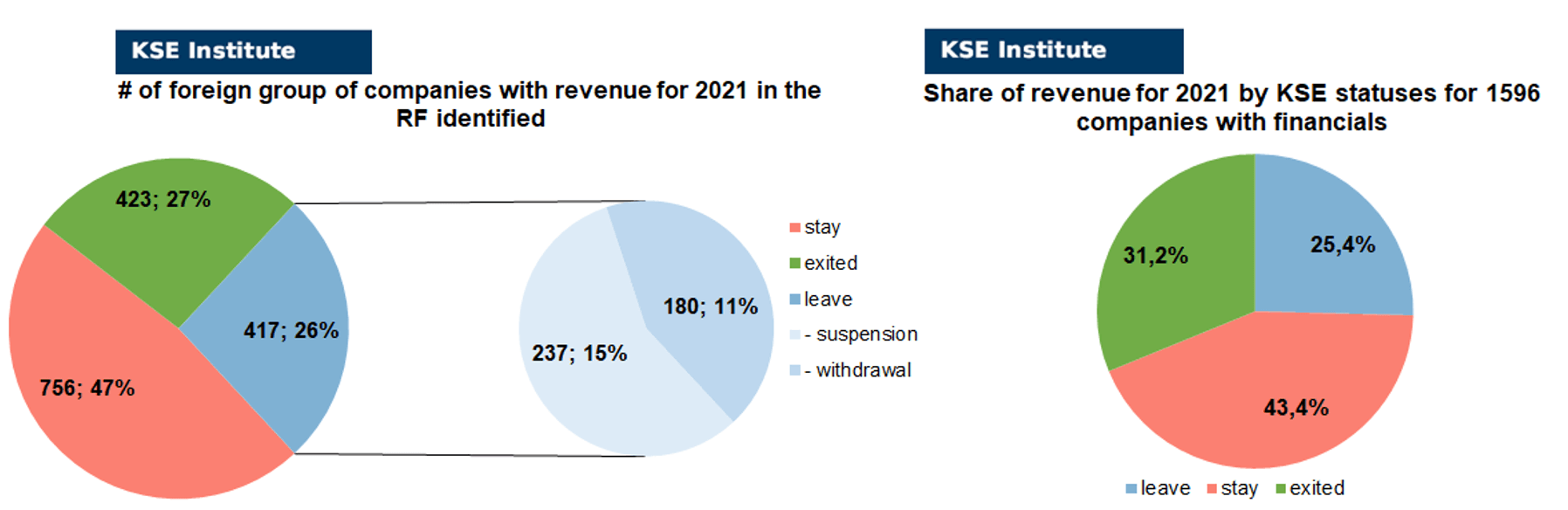

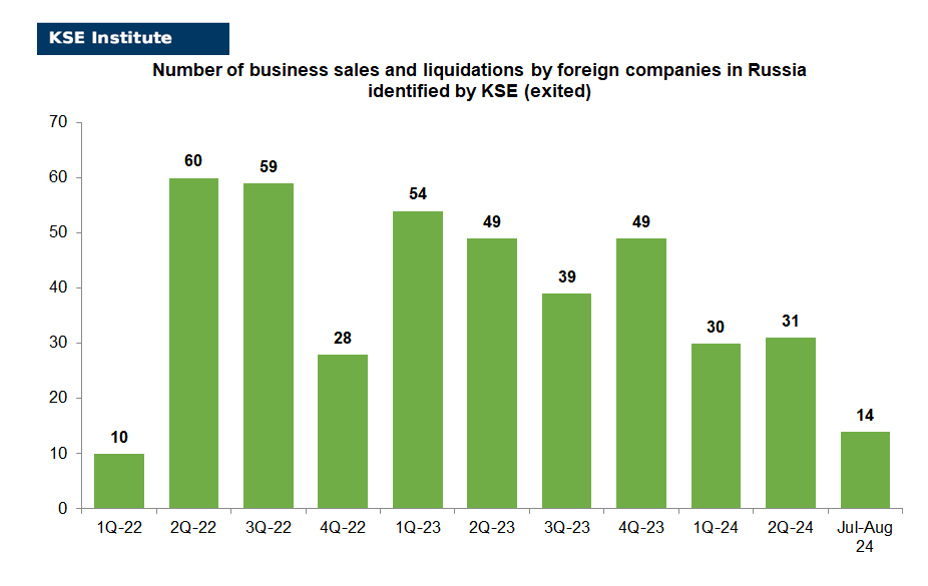

As of September 5, 2024, we have identified about 3,936 companies, organizations and their brands from 106 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1’596 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.2 billion), local revenue (about $318.9 billion), local assets (about $343.1 billion) as well as staff (about 1.449 million people) and taxes paid (about $25.6 billion). 1,358 foreign companies have suspended or ceased operations in Russia. Also, we added information about 423 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (5 full business liquidations and 3 business sales took place in August 2024).

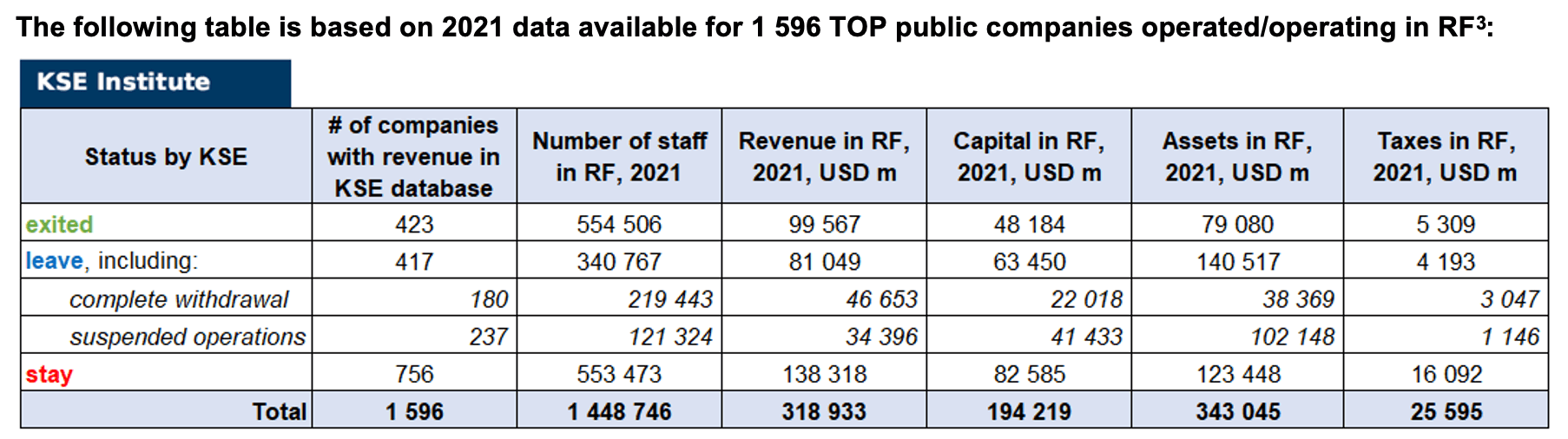

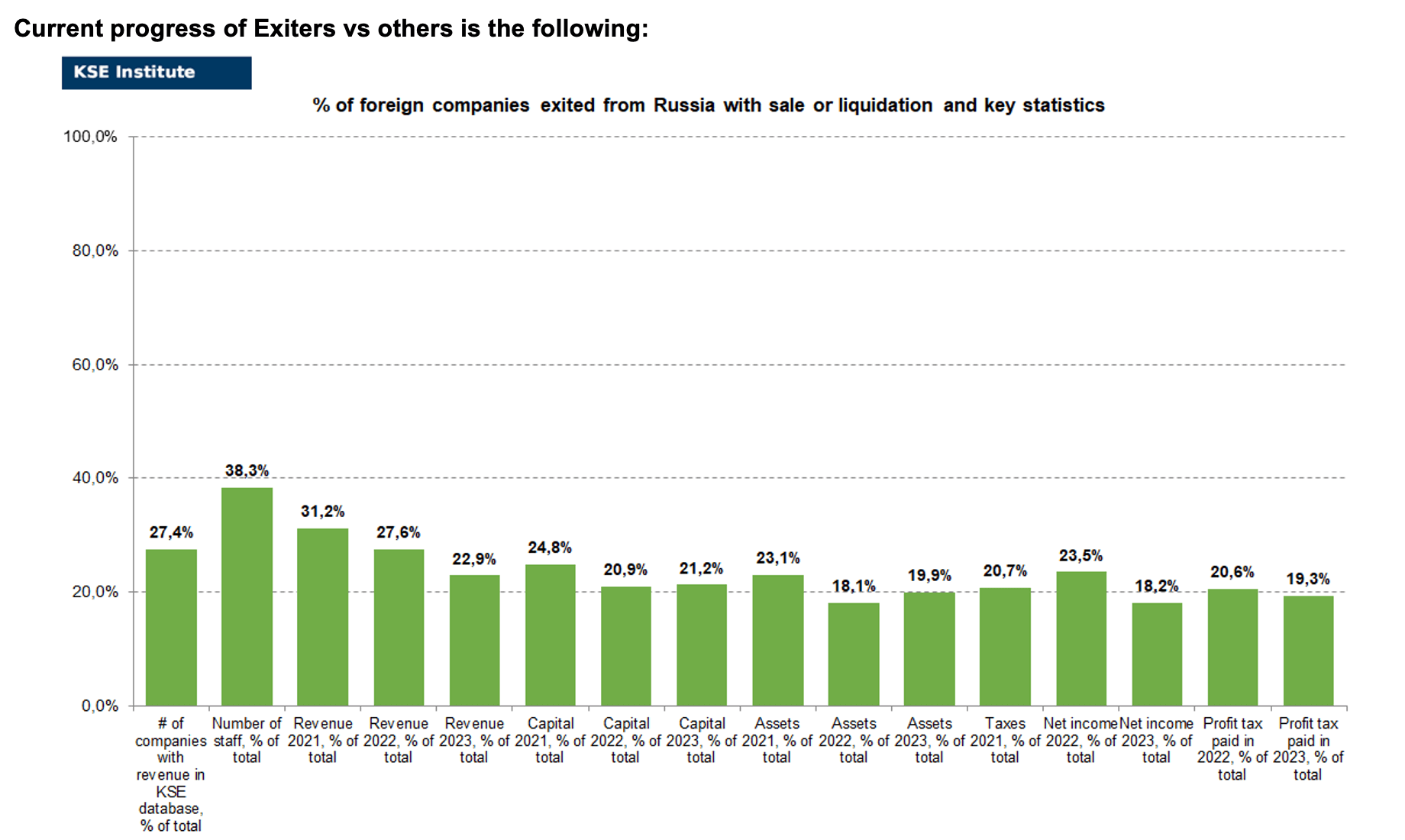

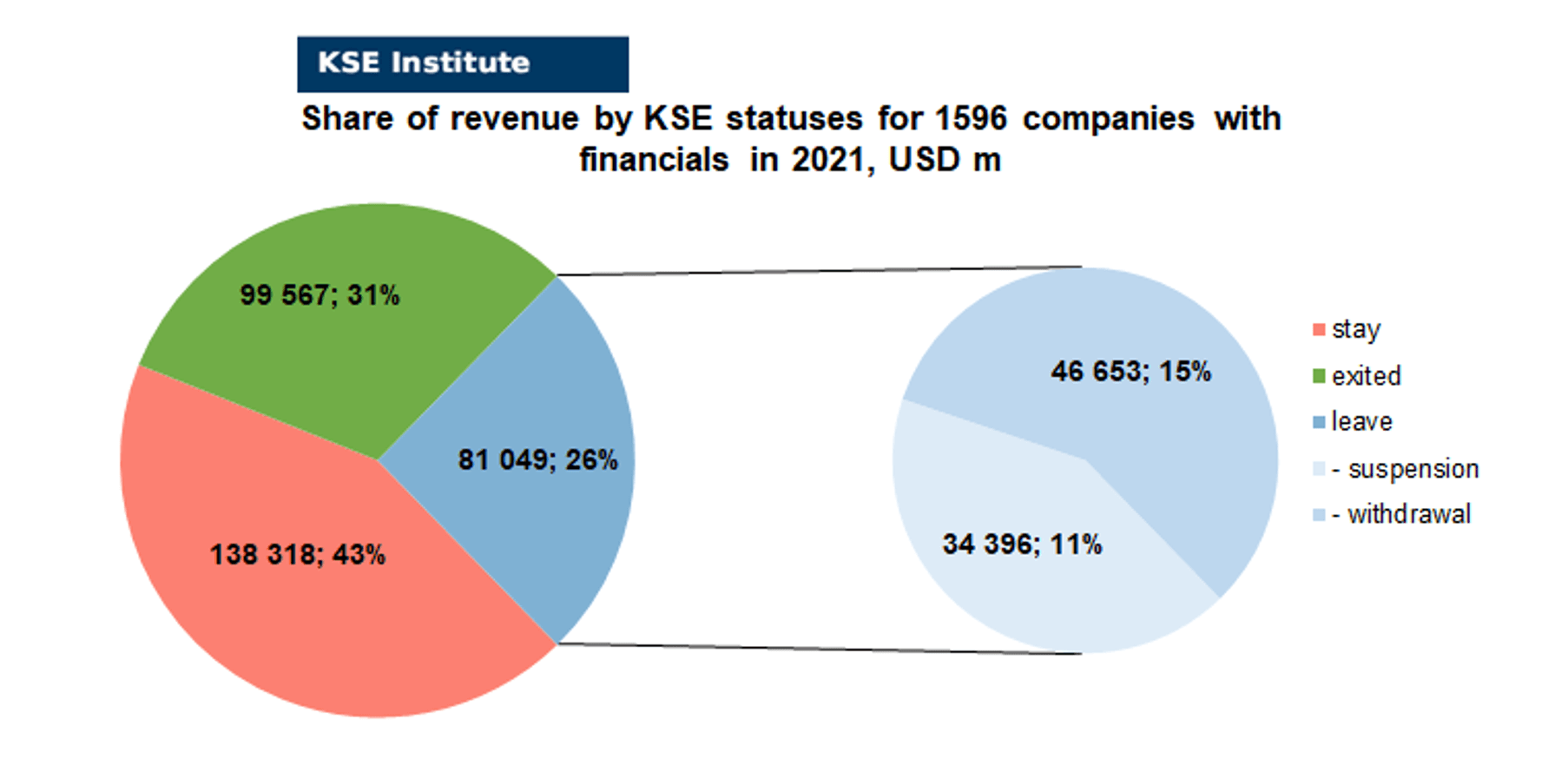

As can be seen from the tables below, as of September 5, 2024, 423 companies which had already completely exited from the Russian Federation, in 2021 had at least 554,500 personnel, $99.6 bn in annual revenue, $48.2bn in capital and $79.1bn in assets; companies, that declared a complete withdrawal from Russia had 219,400 personnel, $46.7bn in revenues, $22.0bn in capital and $38.4bn in assets; companies that suspended operations on the Russian market had 121,300 personnel, annual revenue of $34.4bn, $41.4bn in capital and $102.1bn in assets.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 24 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 31 were added in August 2024). However, if to operate with the total numbers in KSE database, about 34.5% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 54.8% are still remaining in the country and only 10.7% made a complete exit⁴.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 423 companies that completely left the country, since in 2021 they employed 38.3% of the personnel employed in foreign companies, the companies owned about 23.1% of the assets, had 24.8% of capital invested by foreign companies, and in 2021 they generated revenue of $99.6 billion or 31.2% of total revenue and paid ~$5.3 billion of taxes or 20.7% of total taxes paid by the companies observed. Data on 1,596 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (27%) and on share of revenue withdrawn (31.2%). At the same time, a bit different picture is for those who are still staying – 47% of companies represent 43.4% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect and adding quite a lot of new companies in July 2024.

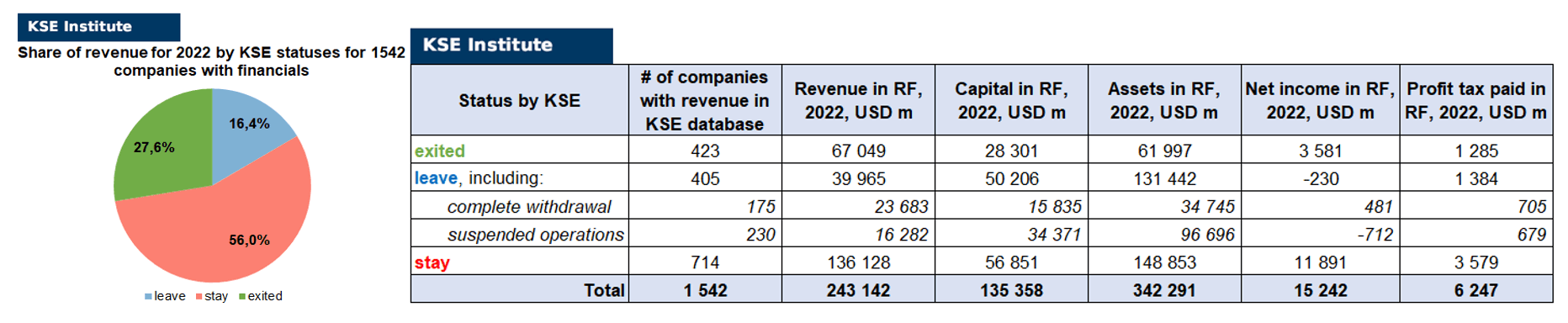

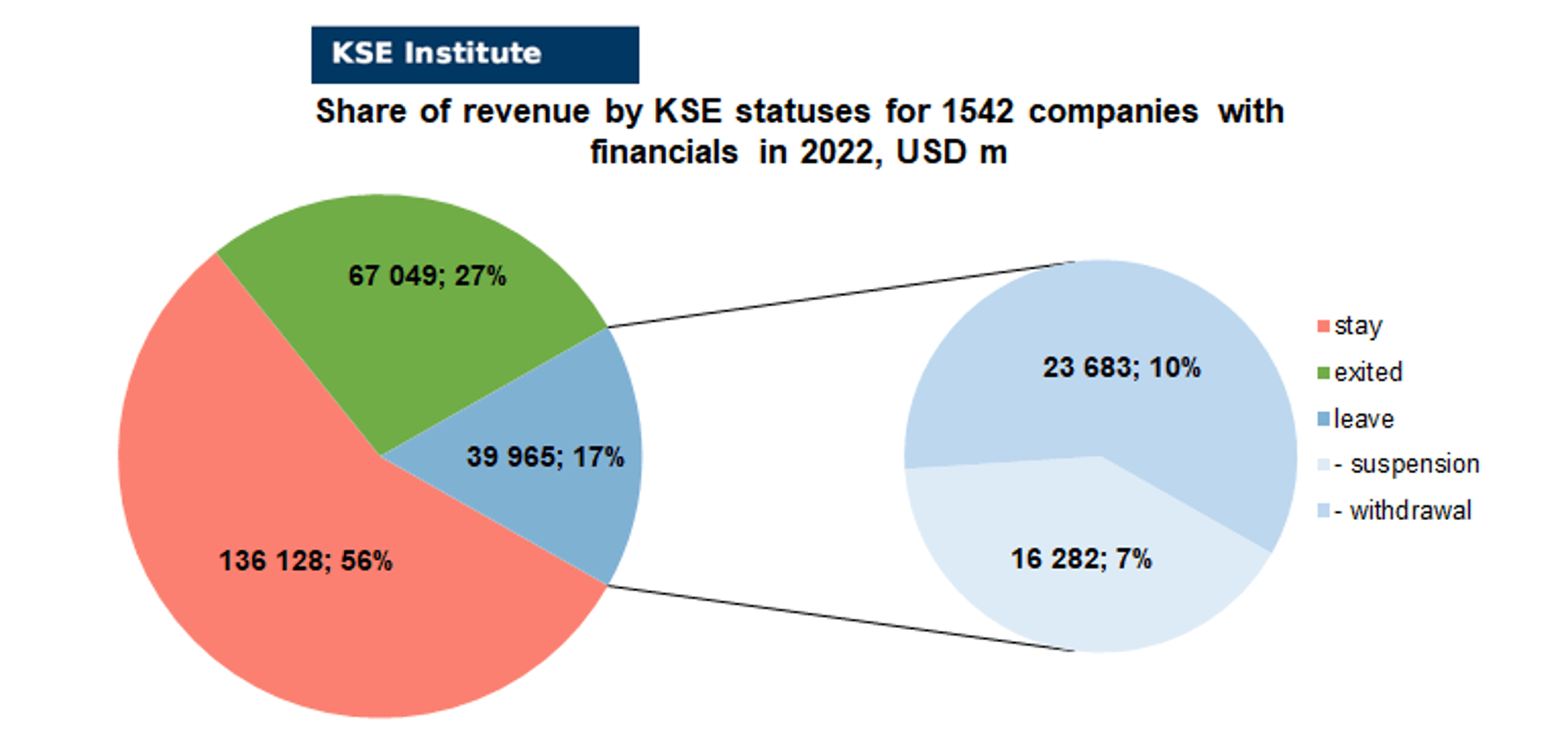

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1542 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.6% less of revenue in 2022 (27.6% from total volume) than in 2021 (31.2% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-9.0%) revenue in 2022 (16.4% from total volume) than in 2021 (25.4% from total volume). At the same time, staying companies were able to generate much (+12.6%) more revenue in 2022 (56.0% from total volume) than in 2021 (43.4% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($342.3bn⁵ in 2022 vs $343.0bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

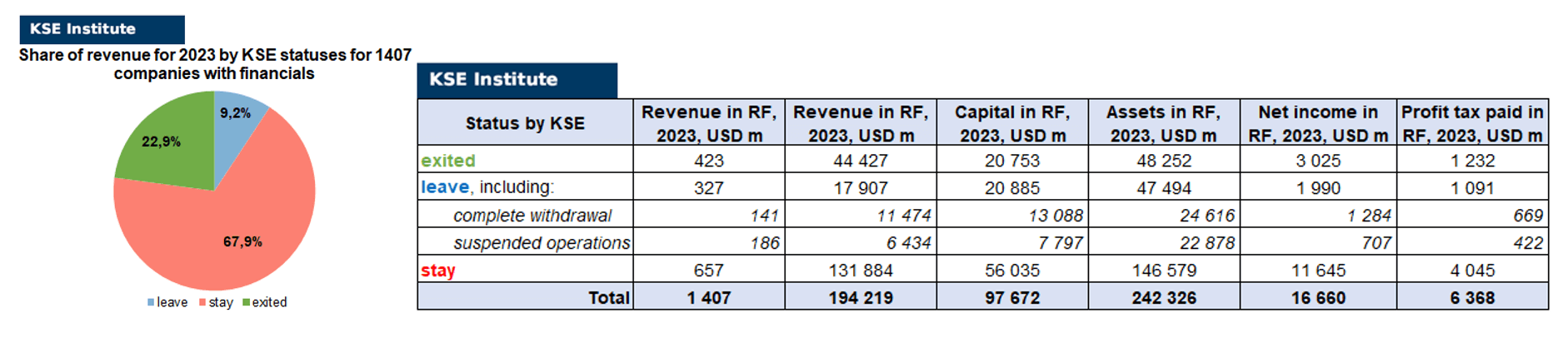

Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1407 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 260 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -8,3% vs 2021 and -4,7% vs 2022 (from 31.2% in 2021 and from 27.6% in 2022 to 22.9% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -16,2% vs 2021 and -7,2% vs 2022 (from 25.4% in 2021 and from 16.4% in 2022 to 9.2% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24,5% vs 2021 and +11,9% vs 2022 (from 43.4% in 2021 and from 56.0% in 2022 to 67.9% in 2023).

MONTHLY FOCUS: On leaving the Russian Federation. Results of August 2024

In this digest, we will summarize the results of August 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’596 companies identified in the KSE database with revenue data available of more than $318.9 billion in 2021 and $243.1 billion in 2022 (which dropped to ~$194.2 billion in 2023). And at least 423 of them have already been sold by local companies or were liquidated and left the Russian market. In August 2024 KSE Institute identified +6 new exits (in reality +8 as status of 2 companies, SPAR and SOCAR were downgraded. 3 business sales and 5 liquidations took place in August 2024), total number of exits observed since the beginning of Russia’s invasion reached 423.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 31% based on revenue allocation, those who are leaving represent 26% of total revenue (with 42% share of suspensions and 58% of withdrawals sub-statuses), % of staying companies represent 43% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 57% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 27% based on revenue allocation, those who are leaving represent only 17% of total revenue (with 41% share of suspensions and 59% of withdrawals sub-statuses), % of staying companies represent 56% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022-2023 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

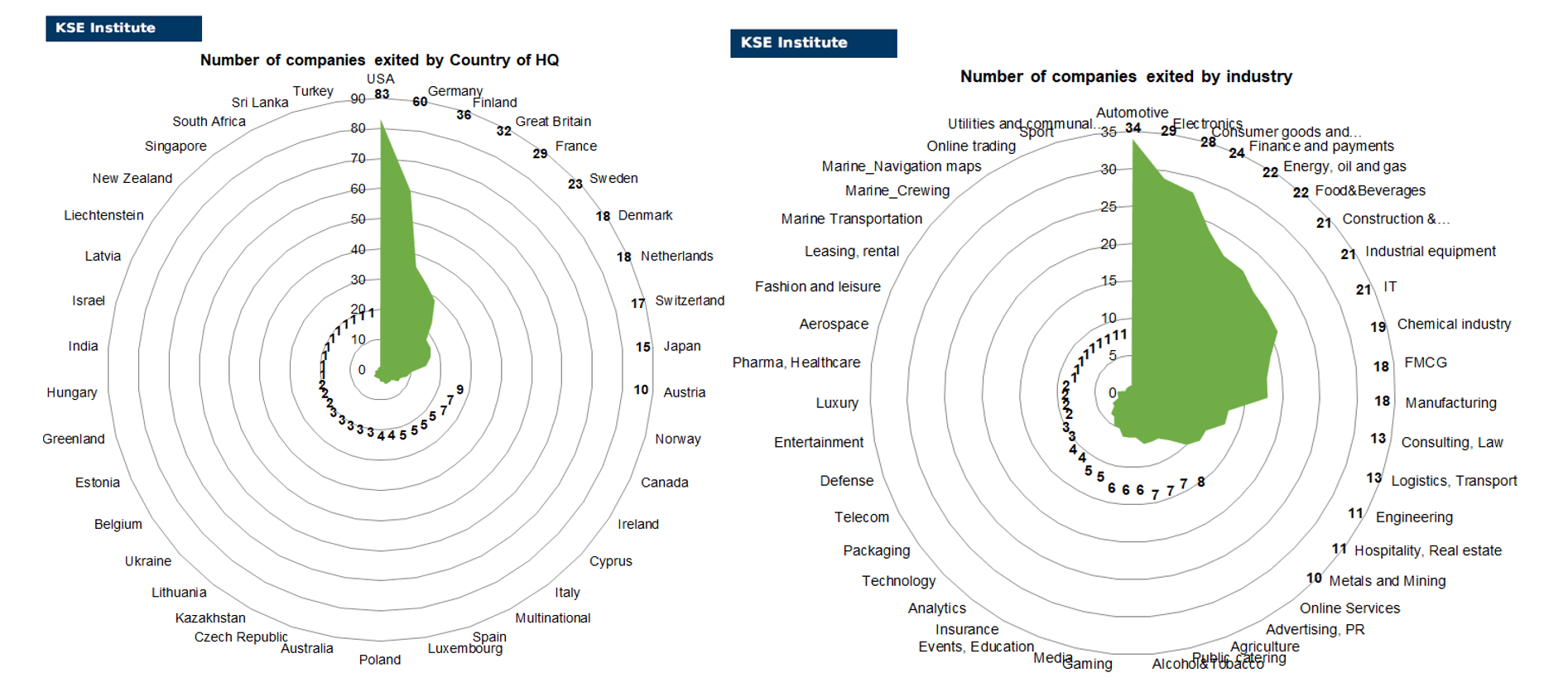

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of August 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Finance and payments”, “Energy, oil and gas” and “Food & Beverages” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: American Express (liquidation), Daniel Wellington (liquidation), Kapsch (liquidation), Momentive (liquidation), Wolters Kluwer (liquidation). Also, 3 business sales took place in August 2024: Brookes Education Group (08.2024: King Zarina Parvizovna becomes the new founder of the organization ANO INTERNATIONAL SCHOOL “BROOKS”), Flint Group (Global manufacturer of paints and varnishes for packaging Flint Group sold its Russian division Flint Group Vostok LLC to Lakra Sintez, according to the Unified State Register of Legal Entities. The corresponding changes to the Unified State Register of Legal Entities were made in August. Previously, Flint Group Vostok belonged to the German Flint Group Packaging Inks Germany GmbH and the Finnish ANI Holdings Oy Ab), and Hugo Boss (08.2024: Hugo Boss sold Russian business to wholesale partner Stockmann. “We can confirm that our Russian subsidiary has been sold to Stockmann JSC – a company belonging to one of Hugo Boss’s long-standing wholesale partners in the country,” Hugo Boss said. Neither party has disclosed financial terms of the deal, but Russia demands that foreign companies sell assets at discounts of at least 50%. Stockmann did not respond immediately to a request for comment. Russian corporate filings showed that the deal closed on Aug. 2 and that Stockmann JSC now owns 100% of Hugo Boss Rus with a nominal value of 40 million roubles or $470,588). Also, we downgraded statuses of 2 companies: SPAR (In August 2024, new stores were opened in Moscow. The company continues to work in Russia) and SOCAR (as a key entity, LLC “SOCAR RUS”, is doing business as usual. Also, at the end of August 2024, Russia (Gazprom) and Azerbaijan (SOCAR) agreed to develop gas cooperation and expand strategic partnership, but specific projects have not been announced yet. Among the public procurement tenders, the company has such customers as the Russian Guard and Russian military units).

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Goldman Sachs (Russia revokes Goldman Sachs’ brokerage license), Hilti (After more than 30 years of operations in Russia and more than 15 years in Belarus, the Hilti Group has decided to exit both markets. Since 2022 the Hilti Group has significantly ramped down its operations and ceased all exports to Russia and Belarus. Pending government approval, the Hilti Group will sell all its local operations to the local management), IPG Photonics (IPG Photonics announced sale of a Russian unit: IPG Photonics sold its entire interest in its Russian unit IRE-Polus, marking its complete exit from Russia following trade sanctions imposed since the start of the war with Ukraine. IPG is netting $51 million in proceeds from the sale to Softline Projects and current management of IRE-Polus), Linde (Russian court orders $1.2 billion of Linde UK assets be frozen), Notion Labs Inc (Notion exits Russia (suspends services) and will terminate client accounts in September 2024). Also, National Investment Company OÜ sold the remaining 24% of shares after Russian owner Dmitry Zuev increased authorized capital 4x in August 2023.

The next review of deals for September 2024 will be available in a month.

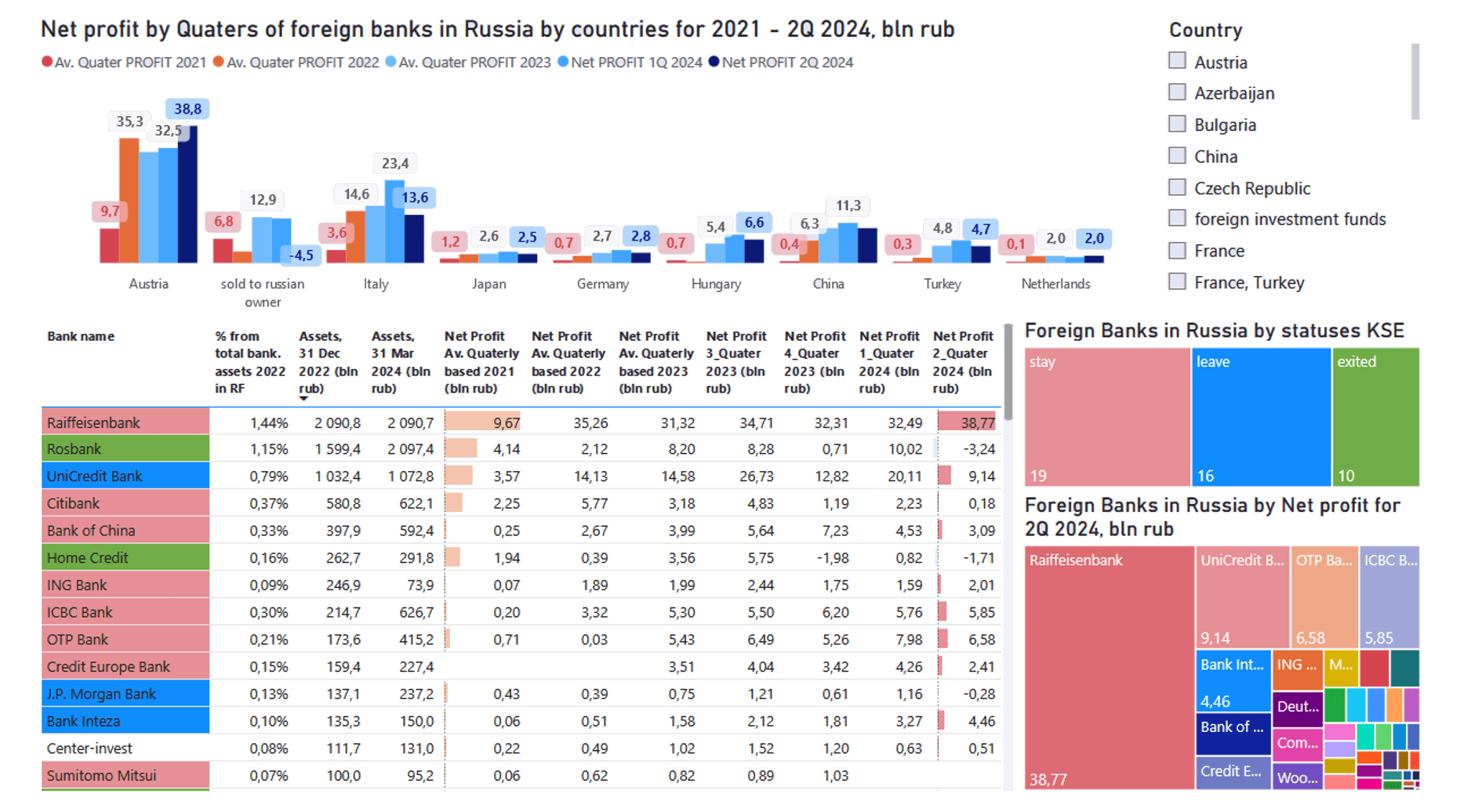

SPECIAL EDITION: Reporting update on the foreign banks in Russia for 1H2024

KSE Institute collected and pre-processed the available reporting data for 1H2024 of foreign banks in Russia.

For the convenience of users, aggregated data are presented in new dashboard on the site https://leave-russia.org/banks:

Data on Net profit as of 30.06.2024:

Source: Central Bank of the Russian Federation ; Full version of the dashboard

As you can see from the above information:

• Banks with status Stay as of 31.03.2024 occupy about 3.03% of all assets of the banking system (Raiffeisenbank – 1.21%, ICBC – 0.36%, Citibank – 0.36%, Bank of China – 0.34%, OTP Bank – 0.24%);

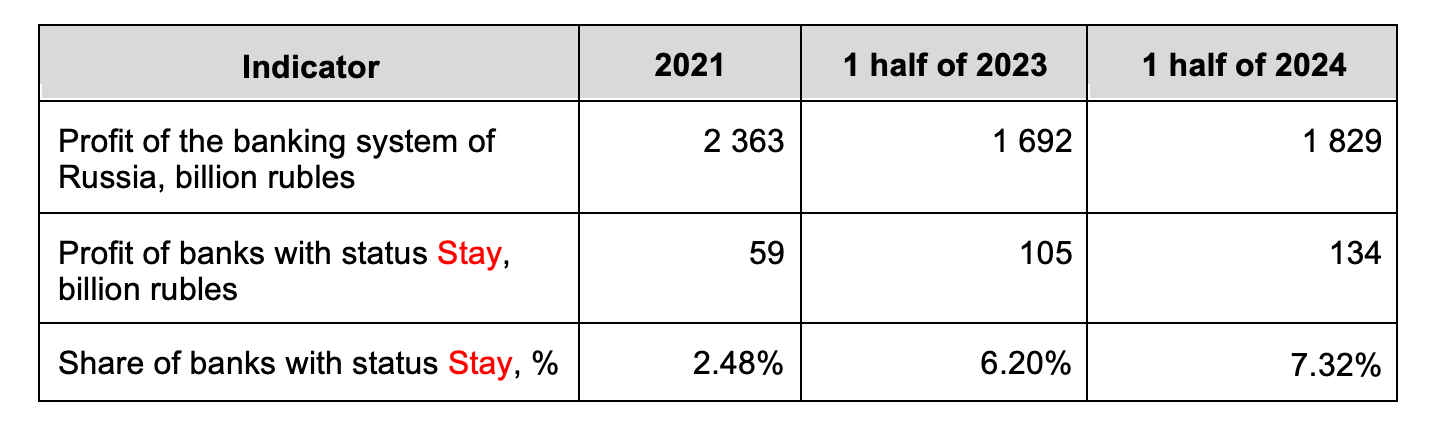

• Foreign banks with status Stay managed to earn 27.7% more net profit in the first half of 2024 than in the first half of 2023. Also, the share of profit in comparison with all banks increased from 6.2% in the first half of 2023 to 7.32% in the first half of 2024 with a share of 3.03% in all assets;

• At the same time, foreign banks charged significantly more income tax (69.5 billion rubles in 2023 versus 55.6 billion rubles in 2022);

• Given that we see a significant increase in accrued income tax in 2023 compared to 2022 and an increase in income in the first half of 2024 – we should expect a further increase in the amounts of accrued/paid income tax in 2024;

• At the same time, the total share of accrued income tax in 2023 was 8.58% with a smaller share of net profit compared to all banks;

Comparison of the net profit of banks with status Stay with the entire banking system:

• As we can see, the share of net profit of foreign banks with status Stay increased significantly in the first half of 2023 to 6.2% compared to 2021, when it was only 2.48%. The share of foreign banks’ profits continues to grow in the first half of 2024 – increasing from 6.2% to 7.32% over the year;

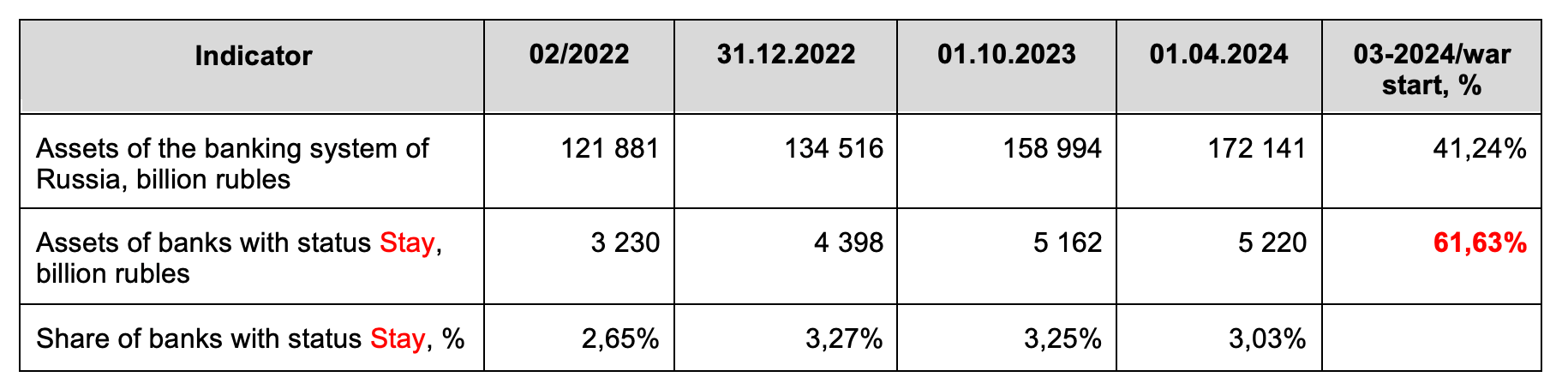

• Comparison of the growth of assets of banks with status Stay with the entire banking system: As you can see, the assets of foreign banks with status Stay have grown since the beginning of the war by about 50% more than the banking system as a whole (but share of foreign banks with status Stay began to gradually decrease from 2023 (2.65% -> 3.27% -> 3.25% -> 3.03% as of end 03.2024):

• Let us remind that when converted into dollars, the largest profit in 2023 was shown by: Raiffeisenbank – $1.471 billion, UniCredit Bank – $0.685 billion, OTP Bank – $0.255 billion, ICBC Bank – $0.25 billion, Bank of China – $0.19 billion, Citibank – $0.15 billion;

• In total, foreign banks accrued $0.97 billion (or 83 billion rubles) of income tax in 2023 against $1.02 billion (or 69.9 billion rubles) in 2022, so in rubles we again see an increase in net income and accrued tax on profit in 2023 compared to 2022 (+18.7% per year);

• The largest income tax payers in 2023: Raiffeisenbank – $0.490 billion, ~50% of all banks with status Stay, UniCredit Bank – $0.152 billion, OTP Bank – $0.069 billion, ICBC Bank – $0.064 billion, Citibank – $0.053 billion;

Banks with status Stay in the KSE database:

• Citibank

• OTP Bank

• ING Bank

• UBS Bank

You will find more details in the dashboards from KSE Institute: https://leave-russia.org/banks

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

01.08.2024

*Interactive Brokers (USA, Finance and payments) Status by KSE – stay

Interactive Brokers has limited account replenishment for Russians in yuan and lira

*TCL Technology (China, Electronics) Status by KSE – leave

The Chinese TV brand TCL has refused to supply its components to Russian contract manufacturers Quantum and STI Group amid the risks of sanctions.

https://www.kommersant.ru/doc/6865134

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Austria’s Raiffeisen sees sale of 60% of Russia business as likeliest option

https://www.reuters.com/business/finance/austrias-rbi-further-decrease-business-russia-2024-07-30/

02.08.2024

*Chateau Miraval (France, Alcohol&Tobacco) Status by KSE – stay

Brad Pitt’s Winery Sells Wine in Russia. At the same time, the actor is suing a “Russian oligarch” for it, calling its origin a threat to business

*CStar Line (United Arab Emirates, Marine Transportation) Status by KSE – stay

Dubai-based Russia-focused CStar Line, which emerged in the market a year ago, is axing most of its Far East Russia feeder services in favour of more-lucrative Red Sea routes.

https://theloadstar.com/cstar-line-to-cut-russia-feeder-services-for-more-profitable-red-sea-routes/

*Wison New Energies (China, Energy, oil and gas) Status by KSE – leave

Chinese shipyard Wison New Energies has signed an agreement with the local government of Qidong City, China, to invest and build a new facility in the Lushi Port Economic Development Zone

*Societe Generale (France, Finance and payments) Status by KSE – exited

At the end of July, the French group Societe Generale closed positions related to the group’s presence in Russia through Rosbank, receiving 301 million euros from the deal, according to the group’s financial statements.

https://www.interfax.ru/business/973537

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

OMV CEO Stern: Independence from Russian Gas and Solid Business Development

https://www.vindobona.org/article/omv-independence-from-russian-gas-and-solid-business-development

*On2Cook (India, Electronics) Status by KSE – stay

Cooking device On2Cook expands global footprint with patents in Russia

*TikTok (China, Online Services) Status by KSE – leave

*Google (USA, Online Services) Status by KSE – exited

Russia fines Google, TikTok over banned content

https://www.reuters.com/technology/russia-fines-google-tiktok-over-banned-content-2024-07-31/

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Mondelez hides earnings as Russian Milka sales soar 600%

04.08.2024

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

UniCredit’s profit from Russia-related assets rose by 20% in the first half of the year

05.08.2024

*Hugo Boss (Germany, Luxury) Status by KSE – exited

Hugo Boss sells Russian business to wholesale partner Stockmann

06.08.2024

*Volkswagen (Germany, Automotive) Status by KSE – exited

German equipment for the roads of Russia

https://www.zeit.de/wirtschaft/unternehmen/2024-07/volkswagen-russland-china-vw-jetta-autoindustrie

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen’s Russian unit pauses brokerage account openings under ECB pressure

*EF Education First (Great Britain, Events, Education) Status by KSE – leave

The Ministry of Justice added the Swiss EF Education First, which owned the English First educational center in Russia, to the register of undesirable organizations.

07.08.2024

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

Zsolt Hernadi, CEO of Hungary’s MOL Group, rejects the idea of doing without Russian oil, despite warnings of fuel shortages in Hungary.

https://energynews.pro/en/mol-ceo-sees-no-advantage-in-weaning-off-russian-oil/

*EMAG (Germany, Industrial equipment) Status by KSE – stay

According to Russian customs databases, a Hungarian company owned by a Lithuanian resident supplied Russia with high-precision thread grinding machines manufactured in Italy at the plant of the German corporation EMAG.

*Christian Dior (France, Luxury) Status by KSE – stay

The Christian Dior company has decided to register trademarks in Russia.

https://finance.rambler.ru/business/53209647-dior-snova-registriruet-svoi-brendy-v-rf/

08.08.2024

*EY (Ernst & Young) (Great Britain, Consulting, Law) Status by KSE – exited

EY fined £250,000 over audit of Russian steel group Evraz

https://www.ft.com/content/95af8018-a6e0-474d-974f-dd4782e67d58

*West Of England Ship Owners (Great Britain, Insurance) Status by KSE – stay

*Gard P&I (Norway, Insurance) Status by KSE – stay

Five insurers, including American Club, Luxembourg-headquartered West of England and Norway’s Gard, have covered 10 tankers that have left Russia for Asia this year

09.08.2024

*Anheuser-Busch (Belgium, Alcohol&Tobacco) Status by KSE – leave

Russia is still not letting go of AB InBev: the authorities refuse to approve the deal. Accordingly, AB InBev will be forced to continue operating in Russia, but already under the management of Anadolu Efes.

https://www.retaildetail.eu/news/food/ab-inbev-banned-from-selling-russian-branch/

https://www.ft.com/content/a4efecae-1249-4162-8979-933cc7258304

10.08.2024

*JPMorgan (USA, Finance and payments) Status by KSE – leave

‘Coerced’ JPMorgan Chase seeks to end NY lawsuit against Russia’s VTB Bank

https://finance.yahoo.com/news/coerced-jpmorgan-chase-seeks-end-230151564.html?guccounter=1

*Belarusian Cement Company (BCC) (Belarus, Construction & Architecture) Status by KSE – stay

Belarusian Cement Company increases supplies to Russian Federation in 2024

*Signal Foundation (USA, Online Services) Status by KSE – leave

Roskomnadzor, Russia’s internet watchdog, recently announced it had blocked Signal amid claims that the app was being used to spread terrorist-related content.

https://evrimagaci.org/tpg/signal-messenger-faces-blockage-and-user-backlash-10400

12.08.2024

*Allied Blenders & Distillers (India, Alcohol & Tobacco) Status by KSE – stay

Allied Blenders & Distillers (ABD), the company behind the popular Officer’s Choice whisky brand, is reportedly in advanced talks with two global spirits giants — Russian Standard and Thai Beverage (ThaiBev) — to market and distribute their products in India

*Google (USA, Online Services) Status by KSE – exited

Google has finally cut off Russian users from monetization

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Freedom Holding Corp. earned $450 million in the 1st quarter of the 2025 financial year

13.08.2024

*American Express (USA, Finance and payments) Status by KSE – exited

The Bank of Russia, by order No. OD-1290 dated 13.08.2024, revoked the banking license of American Express Bank Limited Liability Company American Express Bank LLC

https://www.cbr.ru/press/pr/?file=638591436627035000BANK_SECTOR.htm

*Leroy Merlin (France, FMCG) Status by KSE – stay

The French chain of DIY stores Leroy Merlin made a fifth of its sales and a quarter of its profits in Russia last year, according to financial data from its parent company Adeo

14.08.2024

*Linde (Germany, Chemical industry) Status by KSE – leave

Russian court orders $1.2 billion of Linde UK assets be frozen

https://uk.finance.yahoo.com/news/russian-court-orders-1-2-090758700.html?guccounter=1

*Danfoss (Denmark, Industrial equipment) Status by KSE – exited

Over the past five months, Danfoss products worth more than DKK 13m have ended up in Russia despite EU sanctions, according to Radio IIII based on information from Russian customs authorities collected by the US data company ImportGenius.

https://energywatch.com/EnergyNews/Cleantech/article17348306.ece

15.08.2024

*Auriant Mining AB (Sweden, Metals and Mining) Status by KSE – stay

Tardan Gold and Auriant Mining AB – Sweden’s gold business in Russia

https://www.europeaninterest.eu/tardan-gold-and-auriant-mining-ab-swedens-gold-business-in-russia/

*Caterpillar (USA, Automotive) Status by KSE – leave

Caterpillar’s Russian assets transferred to firm owned by Armenian fund

https://sg.finance.yahoo.com/news/caterpillars-russian-assets-transferred-firm-113610299.html

*Softline International (Great Britain, IT) Status by KSE – stay

Softline acquired control in OMZ-IT

16.08.2024

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

The world’s largest oilfield services company SLB is expanding in Russia after its main Western competitors exited the market in the wake of a full-scale invasion of Ukraine

https://www.ft.com/content/c7bc6486-964f-40d9-9179-c5c9d8adeddb

*Arctech Helsinki Shipyard Oy (Finland, Marine Transportation) Status by KSE – leave

A foreign company is being removed from the company’s founders

19.08.2024

*Uranium One (Canada, Metals and Mining) Status by KSE – stay

Rosatom is a major producer of uranium and nuclear energy. In addition, the state-owned company plays its role in the war, managing the captured Zaporizhzhya NPP. Through its Dutch subsidiary Uranium One Cooperative, the Russian state-owned company is actively engaged in the production of nuclear raw materials in Kazakhstan and Tanzania.

*MBank (Kyrgyzstan, Finance and payments) Status by KSE – leave

MBANK has suspended money transfers through Russian banks, including Sberbank, Tinkoff, and MTS Bank, in both directions starting August 16, 2024.

https://24.kg/english/302471_MBANK_announces_suspension_of_transfers_to_several_Russian_banks/

*Raven Property Group Limited (Great Britain, Hospitality, Real estate) Status by KSE – leave

The Prosecutor General’s Office wants to challenge the sale of the business of one of the largest owners of Raven Russia warehouses to local top management, which took place back in 2022.

https://www.rbc.ru/business/19/08/2024/66c324db9a79475641829bf8

*Vimeo (USA, Media) Status by KSE – stay

The actual slowdown of YouTube in Russia has provoked a growth of interest not only in Russian video hosting sites, but also in less popular foreign services like the American Vimeo.

20.08.2024

*Miami Technics (USA, Aircraft industry) Status by KSE – stay

Florida-based Miami Technics has delivered two batches of Timken bearings for DHС-8-400 aircraft to Russia this year.

*SOCAR (Azerbaijan, Energy, oil and gas) Status by KSE – stay

SOCAR, Russia’s Gazprom agree to expand strategic partnership

https://www.azerbaycan24.com/en/socar-russia-s-gazprom-agree-to-expand-strategic-partnership/

*Flint Group (Great Britain, Chemical industry) Status by KSE – exited

Global manufacturer of paints and varnishes for packaging Flint Group sold its Russian division Flint Group Vostok LLC to Lakra Sintez, according to the Unified State Register of Legal Entities.

https://www.kommersant.ru/doc/6904890

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – exited

*Metro AG (Germany, FMCG) Status by KSE – stay

*Agent Provocateur (Great Britain, Consumer goods and clothing) Status by KSE stay

*Gucci (Italy, Luxury) Status by KSE – stay

Foreign top managers move around Russian companies

21.08.2024

*Moody’s (USA, Finance and payments) Status by KSE – leave

Moody’s unveils Russian nexus data to aid EU institutions in sanctions compliance

*Deutsche Welle (Germany, Media) Status by KSE – leave

Russian lawmakers propose banning Deutsche Welle

https://news.az/news/russian-lawmakers-propose-banning-deutsche-welle

*Keremet Bank (Kyrgyzstan, Finance and payments) Status by KSE – leave

The Kyrgyz Keremet Bank has suspended transfers via mobile applications of a number of Russian banks, as well as via the operator of the Russian national payment system NSPK.

22.08.2024

*Microsoft (USA, IT) Status by KSE – leave

Microsoft to impose restrictions on Russia companies

https://news.am/eng/news/838897.html

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen’s Russian unit to halt outgoing FX transfers for most customers

*Georgian Railway (Georgia, Logistics, Transport) Status by KSE – stay

Georgian Railway purchased locomotives in Russia, outraged in NGOs

23.08.2024

*El’Pharm (Ukraine, Pharma, Healthcare) Status by KSE – stay

Kyiv pharmacy chain “El’Pharm” sells prohibited Russian drugs

*MOLGroup (Hungary, Energy, oil and gas) Status by KSE – stay

Hungarian energy company MOL is in the final stages of negotiations on a new scheme for the transit of Russian oil through Ukraine.

26.08.2024

*GoDaddy (USA, Online Services) Status by KSE – leave

The requirements that the law has imposed on hosting companies in the last year have led to the departure of the Internet registrar GoDaddy from the Russian Federation and the consolidation of Russian companies.

27.08.2024

*Tether (China, Finance and payments) Status by KSE – stay

Tether CEO: Durov’s arrest raises serious concerns

https://incrypted.com/ceo-tether-arest-durova-vyzyvaet-sereznye-opaseniya/

*Notion Labs Inc (USA, IT) Status by KSE – leave

The service for creating notes and databases Notion will stop working in Russia on September 9.

https://www.notion.so/help/restrictions-for-customers-based-in-russia

28.08.2024

*Hyundai (South Korea, Automotive) Status by KSE – leave

South Korean automaker Hyundai filed 18 trademark applications with Rospatent in August. The company wants to protect the names HMC Hyundai, Hyundai Transys and trademarks related to the Genesis sub-brand.

https://www.kommersant.ru/doc/6920130

*TikTok (China, Online Services) Status by KSE – leave

*Netflix (USA, Online Services) Status by KSE – leave

In light of Russia’s new “fake news” law, TikTok has decided to suspend live streaming and new content for its video service while they consider the law’s security implications.

https://menafn.com/1108609546/Tiktok-Netflix-Suspend-Services-In-Russia

*Super Micro Computer (USA, IT) Status by KSE – stay

Analysts Accuse Motherboard Manufacturer of Filing Fraud

https://hindenburgresearch.com/smci/

https://www.kommersant.ru/doc/6919878

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Who is Telegram’s CEO Pavel Durov

https://www.turkiyetoday.com/business/who-is-telegrams-ceo-pavel-durov-44670/

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

The Bank of Russia has revoked the license of a professional participant in the securities market to carry out brokerage activities of the subsidiary of the international Goldman Sachs Group in Russia — Goldman Sachs Bank

29.08.2024

*DSV A/S (Denmark, Logistics, Transport) Status by KSE – exited

Investors demand answers from DSV over Russian shipping

https://amwatch.com/AMNews/Fund_Management/article17394929.ece

*IPG Photonics (USA, Industrial equipment) Status by KSE – leave

IPG Photonics Sells Russian Unit, Nets Proceeds of $51M

https://www.marketwatch.com/amp/story/ipg-photonics-sells-russian-unit-nets-proceeds-of-51m-e41ecaf7

*Ubisoft (France, Gaming) Status by KSE – leave

Game developer Ubisoft launched a campaign with a Russian athlete

https://www.epravda.com.ua/news/2024/08/28/718601/

*Ziraat (Turkey, Finance and payments) Status by KSE – leave

Turkey’s Largest State Bank Stops Ruble Operations

30.08.2024

*LC Waikiki (Turkey, Consumer goods and clothing) Status by KSE – stay

*Colin’s (Turkey, Consumer goods and clothing) Status by KSE – stay

*Koton (Turkey, Consumer goods and clothing) Status by KSE – stay

The number of clothing brands from Turkey has doubled in Russia

31.08.2024

*Decathlon (France, Consumer goods and clothing) Status by KSE – exited

Desport returns Decathlon goods to Russian store shelves

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website