- Kyiv School of Economics

- About the School

- News

- 66th issue of the regular digest on impact of foreign companies’ exit on RF economy

66th issue of the regular digest on impact of foreign companies’ exit on RF economy

3 July 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03.06.2024-03.07.2024

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

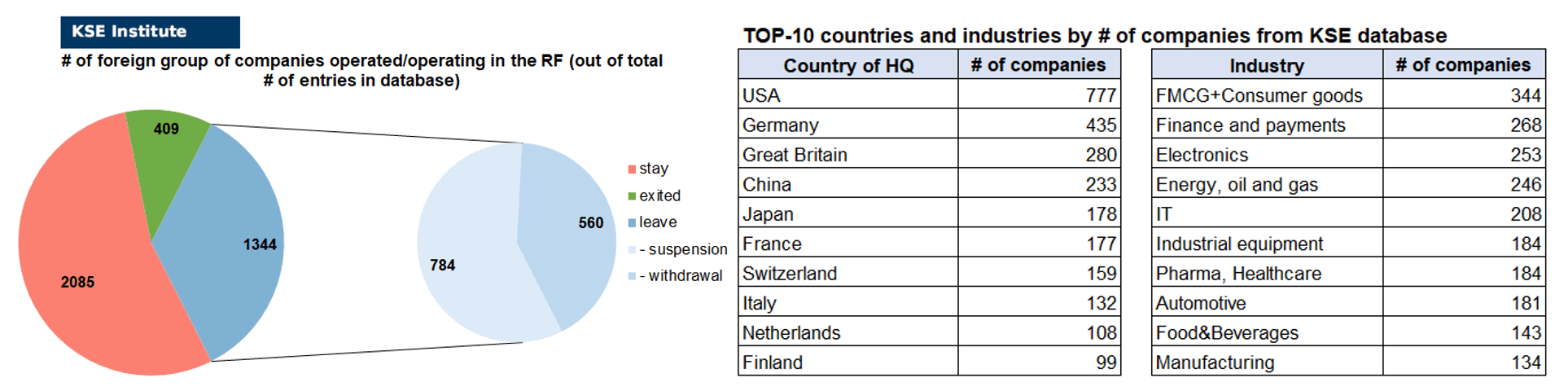

KSE DATABASE SNAPSHOT as of 03.07.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 085 (-90² per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 344 (+113 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 409 (+13 per month)

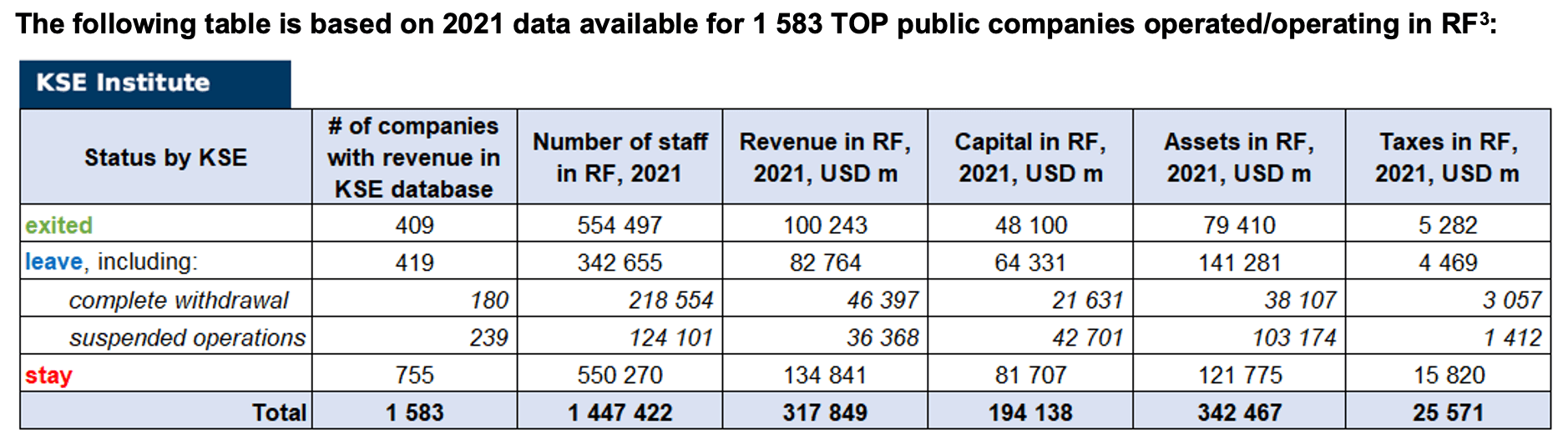

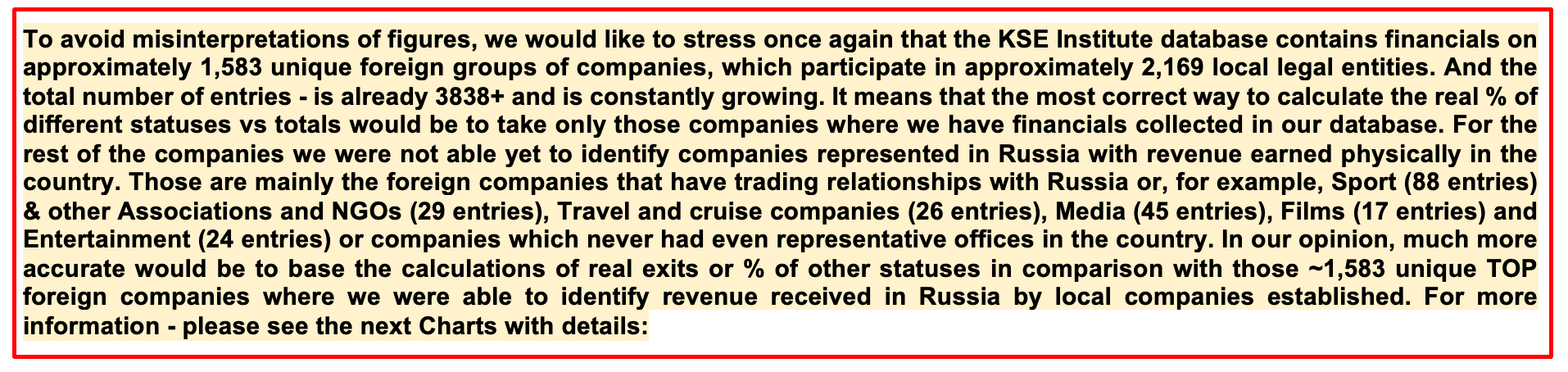

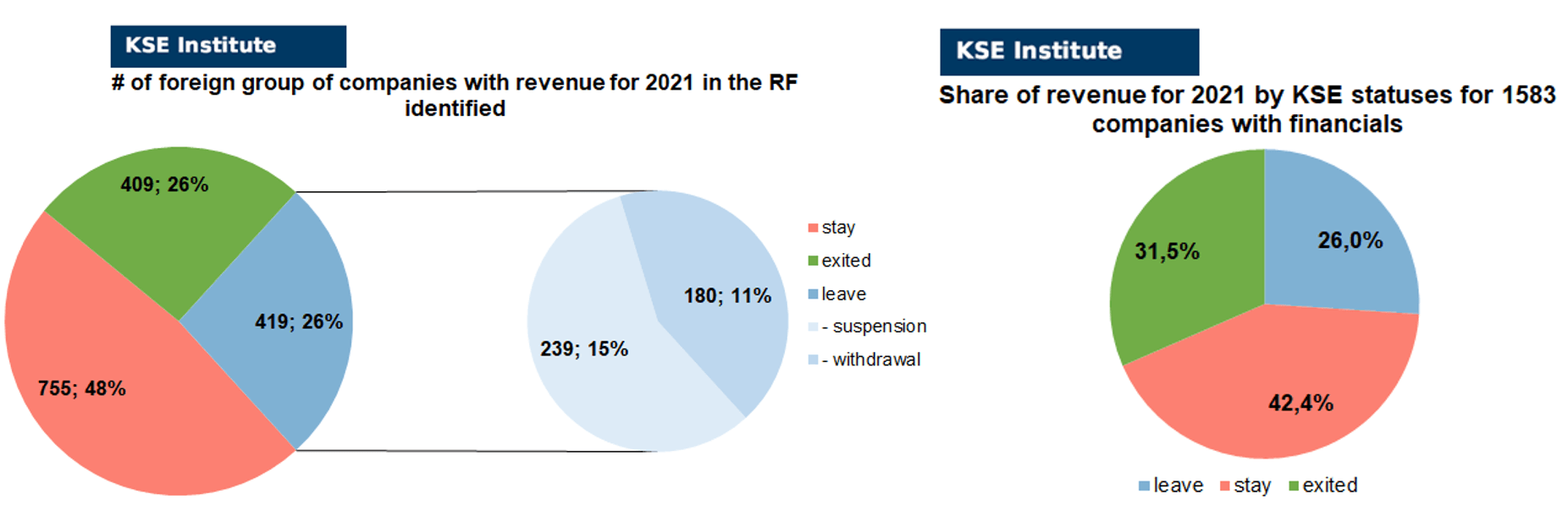

As of July 3, 2024, we have identified about 3,838 companies, organizations and their brands from 103 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 583 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.1 billion), local revenue (about $317.8 billion), local assets (about $342.5 billion) as well as staff (about 1.447 million people) and taxes paid (about $25.6 billion). 1,344 foreign companies have suspended or ceased operations in Russia. Also, we added information about 409 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (4 full business liquidations and 9 business sales took place in June 2024).

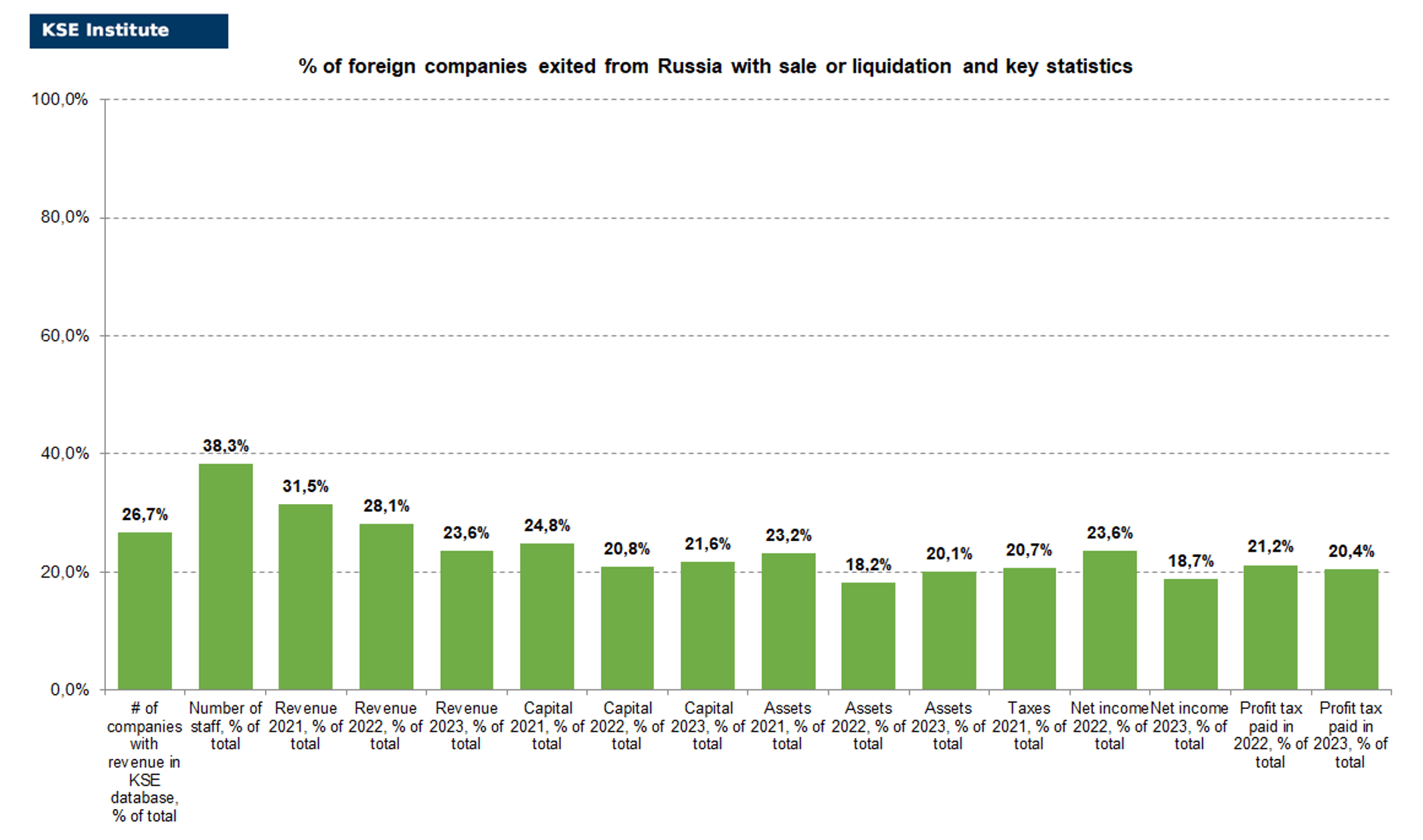

As can be seen from the tables below, as of July 3, 2024, 409 companies which had already completely exited from the Russian Federation, in 2021 had at least 554,500 personnel, $100.2 bn in annual revenue, $48.1bn in capital and $79.4bn in assets; companies, that declared a complete withdrawal from Russia had 218,600 personnel, $46.4bn in revenues, $21.6bn in capital and $38.1bn in assets; companies that suspended operations on the Russian market had 124,100 personnel, annual revenue of $36.4bn, $42.7bn in capital and $103.2bn in assets.

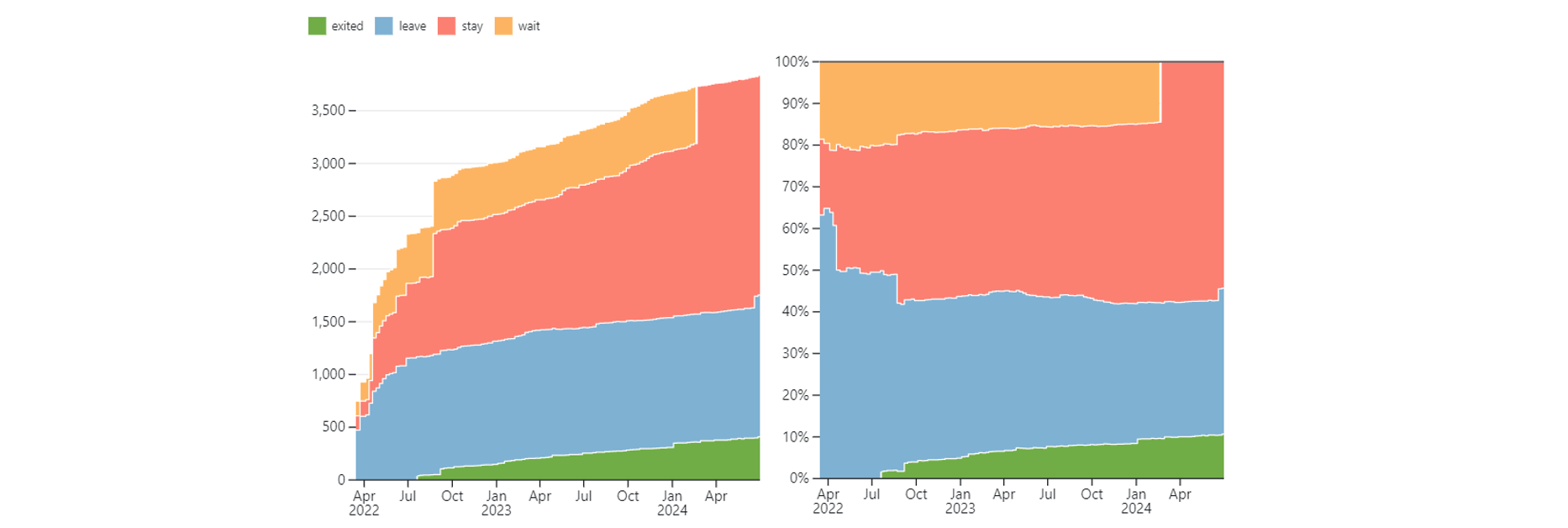

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 22 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 36 were added in June 2024). However, if to operate with the total numbers in KSE database, about 35.0% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 54.3% are still remaining in the country and only 10.7% made a complete exit⁴.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 409 companies that completely left the country, since in 2021 they employed 38.3% of the personnel employed in foreign companies, the companies owned about 23.2% of the assets, had 24.8% of capital invested by foreign companies, and in 2021 they generated revenue of $100.2 billion or 31.5% of total revenue and paid ~$5.28 billion of taxes or 20.7% of total taxes paid by the companies observed. Data on 1,583 TOP companies is presented in the table above.

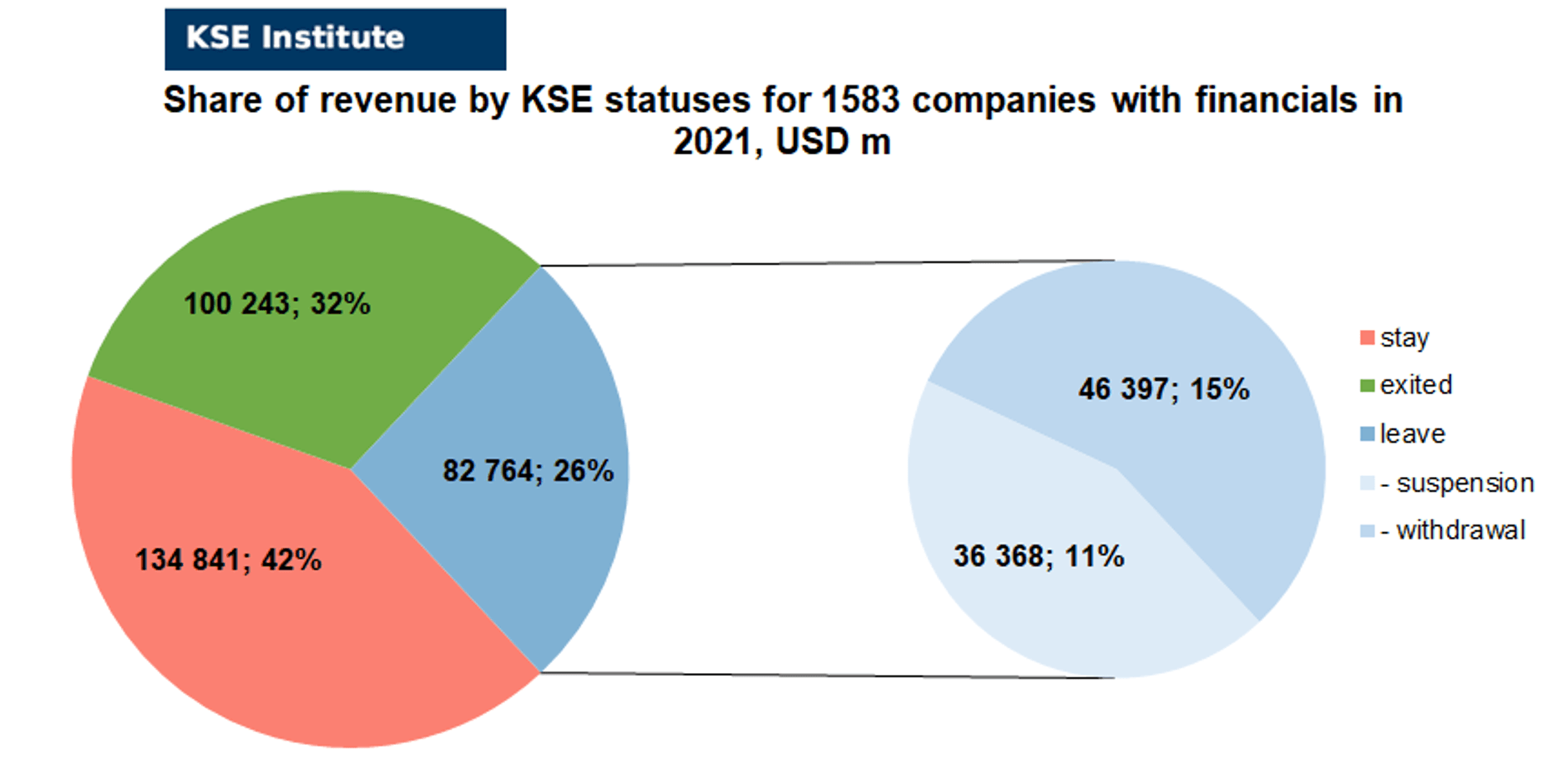

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (26%) and on share of revenue withdrawn (31.5%). At the same time, a bit different picture is for those who are still staying – 48% of companies represent 42.4% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit). Also, migration of statuses in June 2024 made its effect.

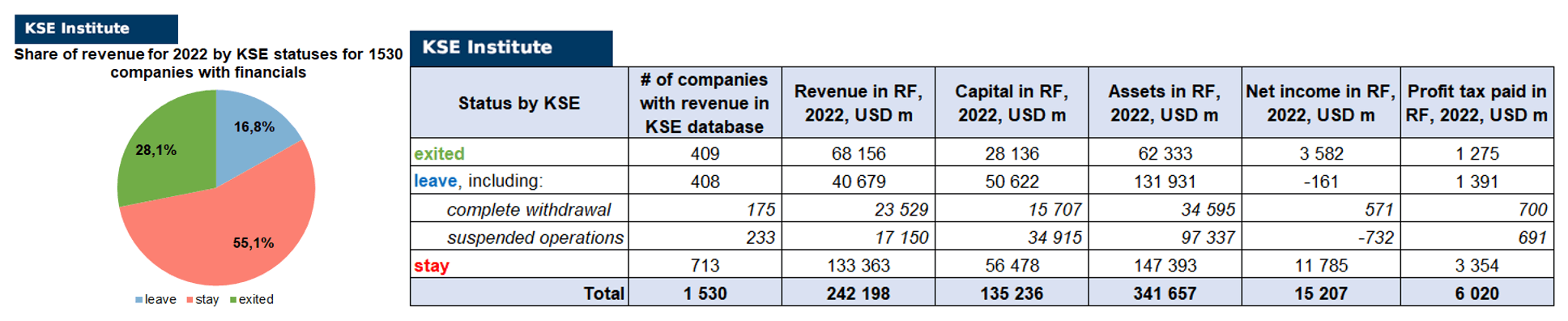

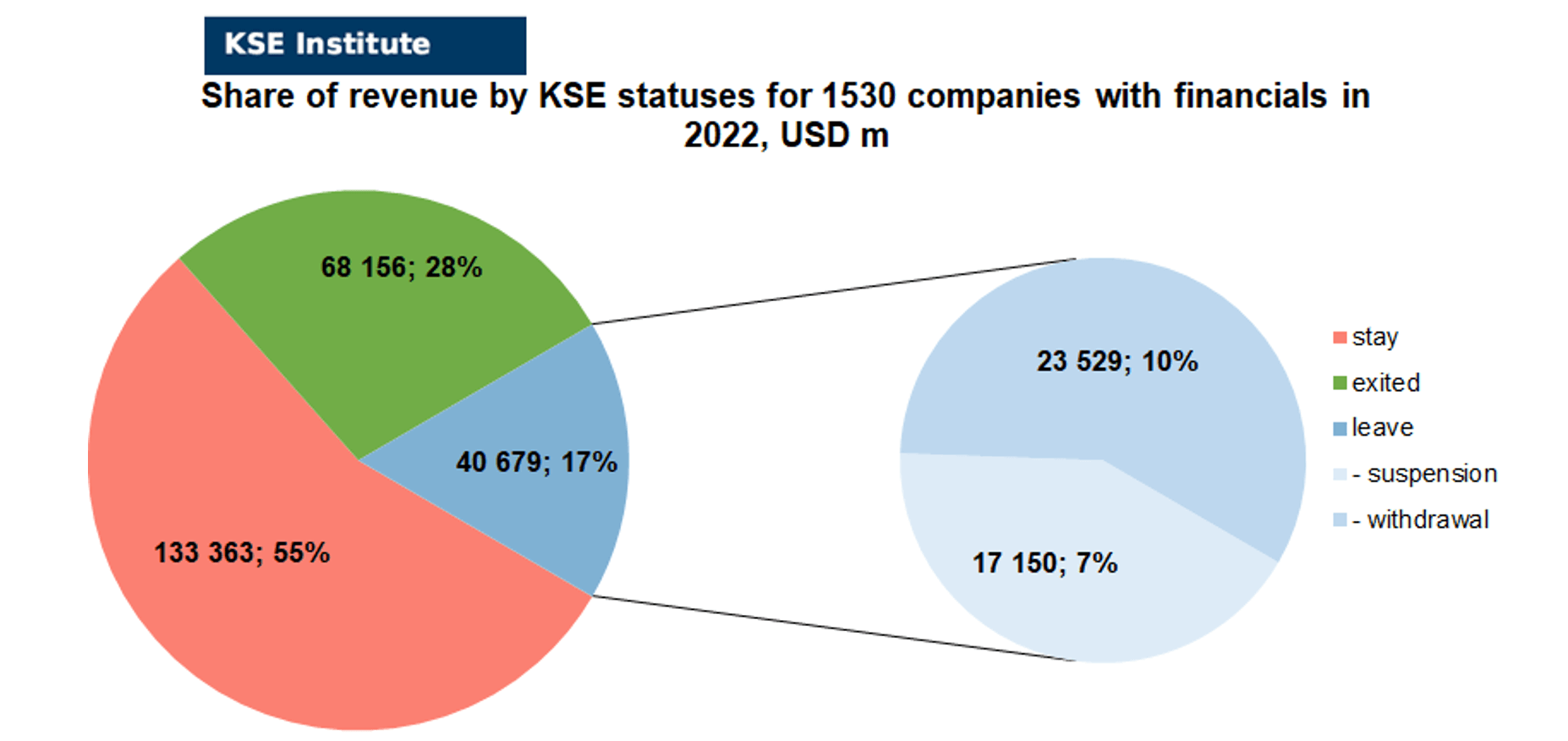

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1530 companies (about 50 companies the data of which we have collected previously have not provided their reporting, we also added revenue data for about 30 banks) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.4% less of revenue in 2022 (28.1% from total volume) than in 2021 (31.5% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-9.2%) revenue in 2022 (16.8% from total volume) than in 2021 (26.0% from total volume). At the same time, staying companies were able to generate much (+12.7%) more revenue in 2022 (55.1% from total volume) than in 2021 (42.4% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($341.7bn⁵ in 2022 vs $342.5bn in 2021) and would even probably increase if the remaining reporting for ~70-80 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

SPECIAL EDITION: Analysis of data for 2023

KSE Institute has already collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1389 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 260 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -7,9% vs 2021 and -4,5% vs 2022 (from 31.5% in 2021 and from 28.1% in 2022 to 23.6% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -16,4% vs 2021 and -7,2% vs 2022 (from 26.0% in 2021 and from 16.8% in 2022 to 9.6% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +24,4% vs 2021 and +11,7% vs 2022 (from 42.4% in 2021 and from 55.1% in 2022 to 66.8% in 2023).

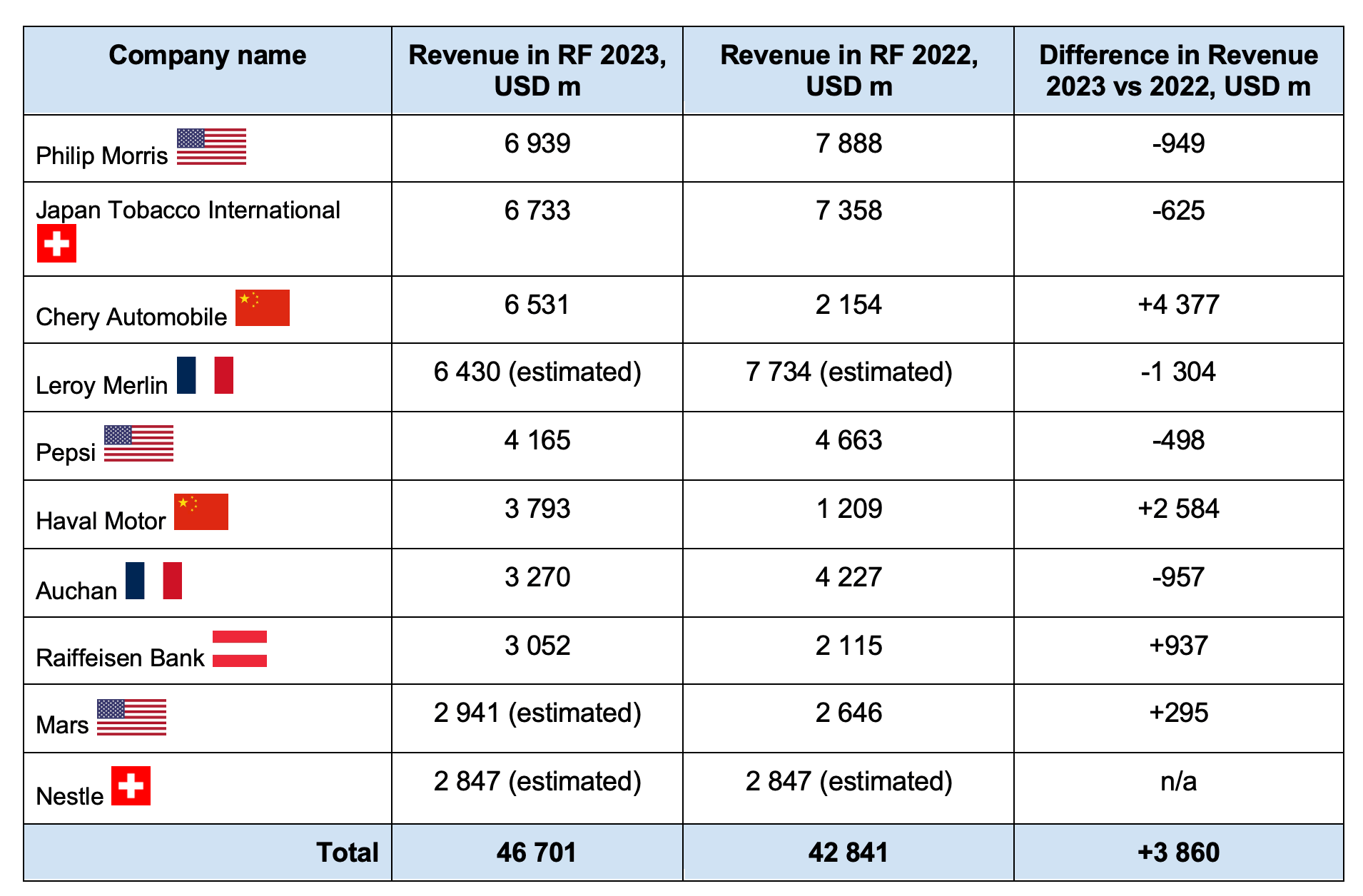

Some companies and banks were even able to generate significant revenue in 2023, here is the list of selected TOP-10 companies based on revenue received in 2023:

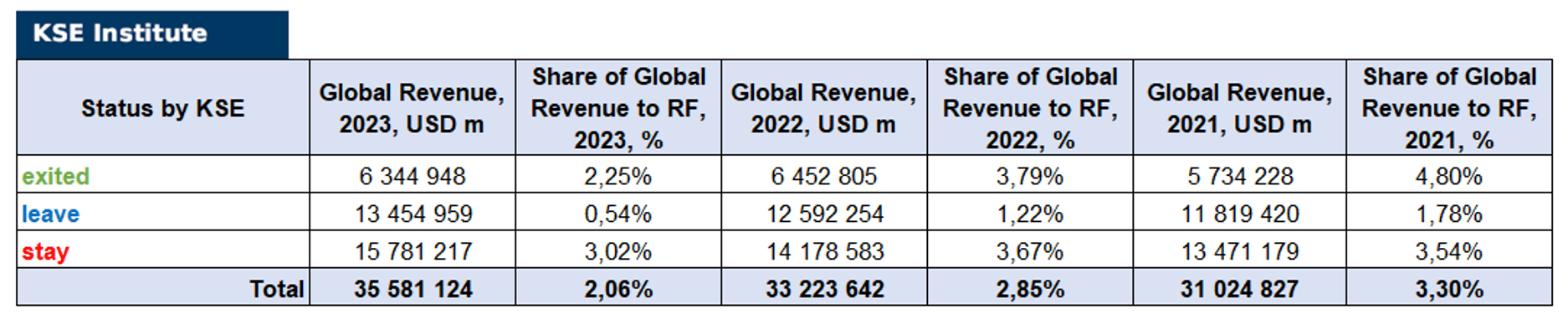

At the same time, based on KSE’s observation since the beginning of the war, we can state the fact that the share of Russian market in global revenue of multinational companies is continuing to rapidly decline: in average, it dropped from 3.30% in 2021 to 2.85% in 2022 and to 2.06% in 2023:

As you can see in the table above, all categories of companies are following the declining trend, the biggest % decline is observed, of course, among exited and leaving companies but among those who are still staying – it is also the case, which mean that the Russian market is becoming less and less attractive for foreign investors.

Also, data shows that the Russian market could be easily replaced by other markets as overall global revenue is constantly growing from year to year. Our previous research showed that most of those public companies which exited first were able to compensate for lost share on the Russian market with increased prices of their shares and increased market capitalization (of course, the situation is totally different now as there is no normal M&A market in Russia and any company is now effectively at risk of business seizure).

MONTHLY FOCUS: On leaving the Russian Federation. Results of June 2024

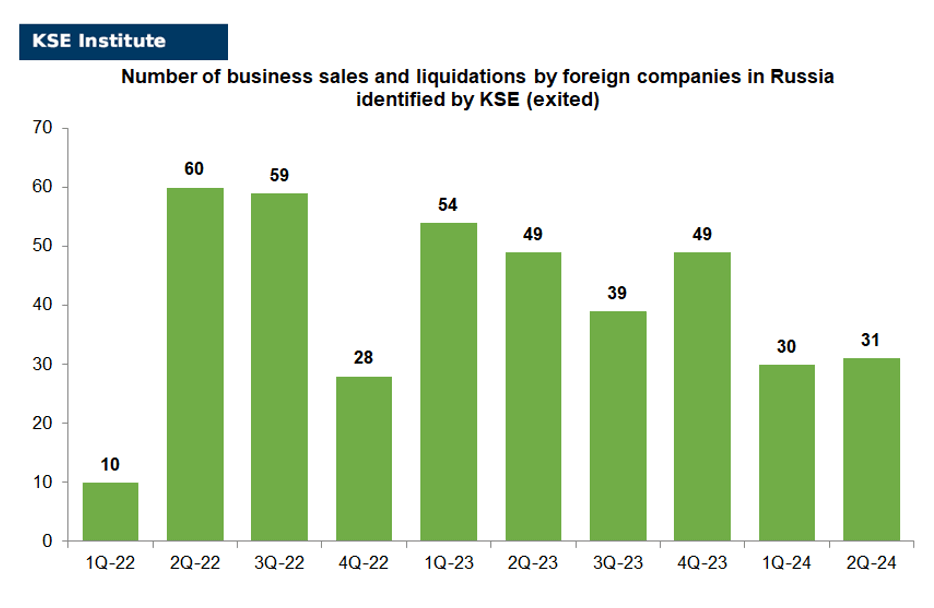

In this digest, we will summarize the results of June 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’583 companies identified in the KSE database with revenue data available of more than $317.8 billion in 2021 and $242.2 billion in 2022 (which dropped to ~$193.3 billion in 2023). And at least 409 of them have already been sold by local companies or were liquidated and left the Russian market. In June 2024 KSE Institute identified +13 new exits (9 business sales and 4 liquidations took place in June 2024)⁶, total number of exits observed since the beginning of Russia’s invasion reached 409.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 32% based on revenue allocation, those who are leaving represent 25% of total revenue (with 44% share of suspensions and 56% of withdrawals sub-statuses), % of staying companies represent 42% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 58% (!) of pre-invasion revenue generated by foreigners is leaving or already left Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 28% based on revenue allocation, those who are leaving represent only 17% of total revenue (with 42% share of suspensions and 58% of withdrawals sub-statuses), % of staying companies represent 55% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

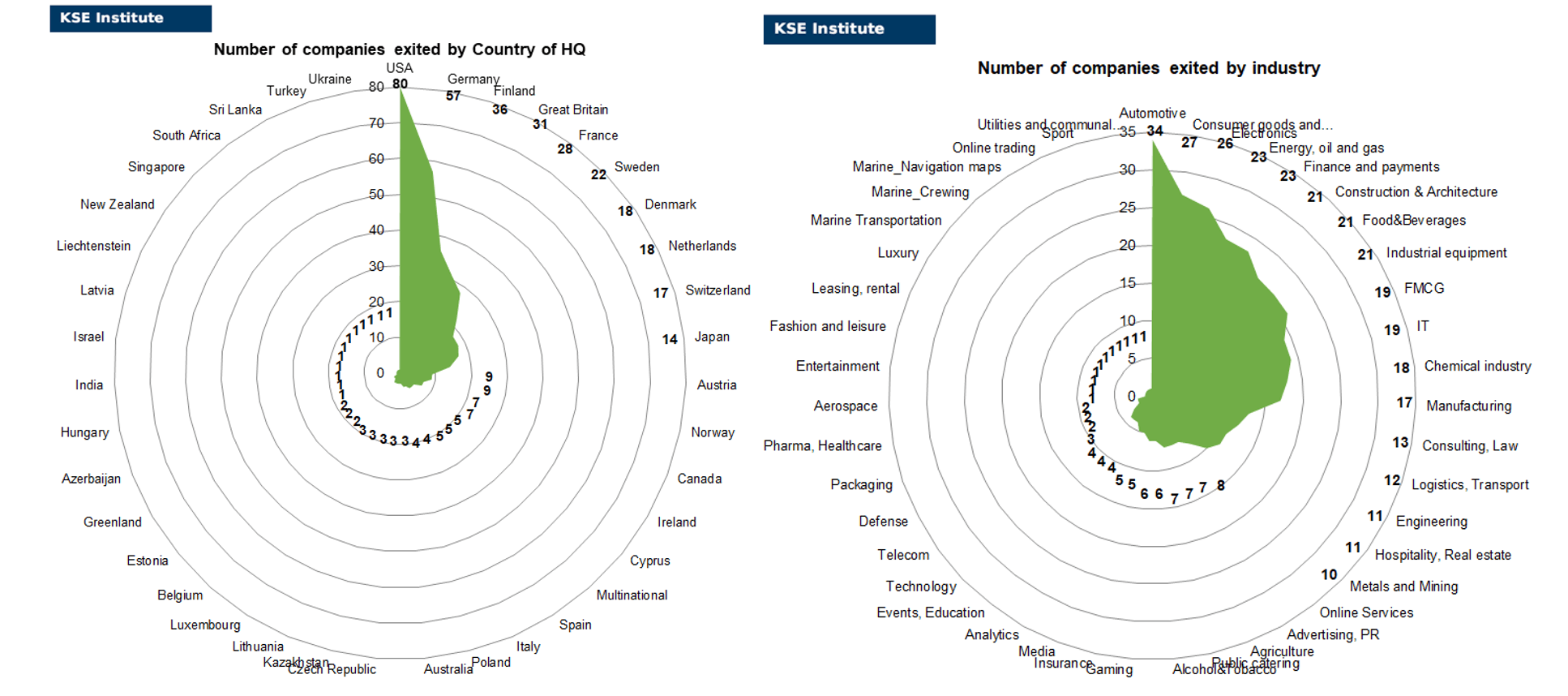

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of June 2024, companies from 38 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and ““Construction&Architecture” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Leica Camera AG (liquidation), NXP Semiconductors (liquidation), Playrix (liquidation), Texas Instruments (liquidation). Also, 9 business sales took place in June 2024: Dialog Axiata, Doka GmbH, Euler Hermes, Global Spirits (The Leninsky District Court of Kursk satisfied the administrative claim of the Prosecutor General’s Office of the Russian Federation to convert the assets of the Global Spirits alcohol holding (vodka brands Khortitsa, Pervak and Shustov), owned by Ukrainian businessman Evgeniy Chernyak, into state income. The consideration of the case took place behind closed doors. 100% of the authorized capital shares and shares of seven enterprises are turned into state income: the Feodosia cognac and wine factory, the Crimean Wine House, the Vologda and Moscow region distilleries “Russian North” and “Rodnik and K” and the distributors “Traditions of Success”, “Quality standard” and “New level”), Grundfos, HSE (Home Shopping Europe), John Deere, Wirtgen-International-Service, and Yusen Logistics.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Amica (Polish Hansa (the brand belongs to the Polish group of companies Amica) transferred its business in Russia to the distributor of household appliances Hyper LLC), Bayerische Landesbank and Landesbank Baden-Wurttemberg (The Arbitration Court of St. Petersburg and the Leningrad Region has seized the property, money and securities of Landesbank Baden-Wurttemberg and Bayerische Landesbank. The court made this decision as interim measures against the claim of the operator of the construction of the complex in Ust-Luga, Ruskhimalyans), Commerzbank and Linde (The Arbitration Court of St. Petersburg and the Leningrad Region upheld the claim of RusKhimAlliance LLC (RHA) against Commerzbank Aktiengesellschaft to recover the guarantee for the engineering contractor Linde in the amount of 94.92 million euros), EOS (The German EOS Group, which owns one of the largest collection companies in Russia, is preparing to exit this business on the financial market. A new investor has been selected and preparations for the deal are now underway. The company has not announced plans to leave Russia. The EOS Group’s decision could have been influenced by “pressure on unfriendly collectors.” According to reports, in 2023, the net profit of the Russian subsidiary of EOS reached 5.1 billion rubles, increasing year-on-year by 75.9%), GfK (One of the largest agencies for analyzing the consumer electronics markets, GfK, part of NielsenIQ, is selling the Russian LLC GFK-Rus to local management), H&M (Hennes and Mauritz) (17.06.2024: The main legal entity of the Swedish retailer H&M in Russia (H&M LLC) has launched the process of liquidating the company, as follows from the Unified State Register of Legal Entities), Knauf (The German manufacturer of building materials Knauf is transferring its business in Russia to local management with the possibility of buyback within two years).

The next review of deals for July 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁷

01.06.2024

*Michelin Tyre (France, Automotive) Status by KSE – exited

Michelin Circumvents Sanctions to Continue Tire Sales in Russia

*Royal Pay Europe (Latvia, Finance and payments) Status by KSE – stay

The Ministry of Justice won the court to recover assets belonging to the sanctioned company Royal Pay Europe

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

A Russian court eased restrictions on UniCredit, allowing the Italian bank to offer Russian sovereign bonds as collateral instead of other assets and property.

https://www.epravda.com.ua/news/2024/06/1/714558/

https://www.reuters.com/business/finance/restrictions-unicredit-eased-russian-lawsuit-2024-05-31/

03.06.2024

*Orano (France, Energy, oil and gas) Status by KSE – stay

Russia Is Said to Seek French-Held Uranium Assets in Niger

*1xBet (Cyprus, Entertainment) Status by KSE – stay

VAKS satisfied the lawsuit of the Ministry of Justice and imposed sanctions on Royal Pay Europe LLC, which is called the wallet of the Russian betting company 1xbet.

https://finclub.net/ua/news/ukraina-konfiskuie-maizhe-2-mlrd-hrn-u-firmy-z-hrupy-1xbet.html

*AliExpress (China, Consumer goods and clothing) Status by KSE – stay

*Alibaba (China, Online trading) Status by KSE – leave

Alibaba, the business-to-business (B2B) equivalent of e-commerce (B2C) platform AliExpress, is reportedly no longer accepting payments in Russian rubles and will stop shipping to Russia.

https://www.kyivpost.com/post/33549

*Amica (Poland, Electronics) Status by KSE – leave

At the end of the first quarter, the household appliances brand Hansa (belonging to the Polish group of companies Amica) handed over its Russian office to the household appliances distributor OOO Hyper.

04.06.2024

*Global Spirits (Multinational, Alcohol & Tobacco) Status by KSE – exited

The Leninsky District Court of Kursk satisfied the administrative claim of the Prosecutor General’s Office of the Russian Federation to convert the assets of the Global Spirits alcohol holding (vodka brands Khortitsa, Pervak and Shustov), owned by Ukrainian businessman Evgeniy Chernyak, into state income.

https://www.kommersant.ru/doc/6746005

*Docker (USA, IT) Status by KSE – stay

The Docker Hub repository has removed geoblocking for users from Russia.

https://www.kommersant.ru/doc/6744910

*Starbucks (USA, Public catering) Status by KSE – exited

Starbucks, which left Russia, filed eight applications for trademark registration with Rospatent at the end of May. All applications relate to coffee and coffee drinks.

05.06.2024

*Zijin Mining Group (China, Metals and Mining) Status by KSE – stay

Workers of Lunsin LLC, a Tuvan subsidiary of the Chinese Zijin Mining Group, accused the company of discrimination in wages. The company is developing the Kyzyl-Tashtyg polymetallic deposit.

https://tlgrm.ru/channels/@moscowtimes_ru/22792

*EOS (Germany, IT) Status by KSE – leave

The German EOS Group, which owns one of the largest collection companies in Russia, is preparing to exit this business, two sources in the financial market told RBC.

https://www.rbc.ru/finances/05/06/2024/665f2aaa9a79475abe4560cc

*Vertex Pharmaceuticals (USA, Pharma, Healthcare) Status by KSE – stay

A US pharmaceutical company complained to Podnosova about a rare drug case

https://www.rbc.ru/business/04/06/2024/665dbad09a79478104813563

*VEON (Netherlands, Telecom) Status by KSE – exited

The former head of the CIA joined the board of directors of Veon

https://www.cnews.ru/news/top/2024-06-04_eks-glava_tsru_voshel_v_sovet

06.06.2024

*Four Season hotels (Canada, Hospitality, Real estate) Status by KSE – stay

Bailiffs came to the Four Season Hotel, located on Manezhnaya Square, to enforce a court decision to arrest the hotel and shopping gallery.

https://nangs.org/news/business/pristavy-izyali-chast-four-seasons-po-delu-khotina

*Belgee (Belarus, Automotive) Status by KSE – stay

The Belarusian automobile brand Belgee announced its official entry into the Russian market.

https://www.rbc.ru/auto/04/06/2024/665ecb2a9a79479a584f1b92?from=short_news

07.06.2024

*Hainan Yangpu NewNew Shipping Co. Ltd (China, Marine Transportation) Status by KSE – stay

The Russian state atomic energy agency Rosatom has signed a memorandum of understanding with a Chinese shipping company to establish a year-round container line between the two countries through the Arctic Northern Sea Route (NSR).

https://gcaptain.com/russias-rosatom-and-chinese-firm-to-establish-year-round-arctic-shipping-route/

*Shanghai Gong Zi Machinery Manufacturing (China, Finance and payments) Status by KSE – stay

A Chinese company will launch production of ATMs in the Moscow region

https://www.interfax.ru/amp/965348

*TCL Technology (China, Electronics) Status by KSE – stay

The Chinese TCL began producing televisions at two enterprises, Kvant and STI Group, formalizing its structure in the Russian Federation as a manufacturer.

09.06.2024

*Amazon (USA, Online Services) Status by KSE – leave

A whistleblower claims Amazon violated UK sanctions by selling facial recognition technology to Russia

*Iran Aircraft Manufacturing Industrial Company (HESA) (Iran, Defense) Status by KSE – stay

*Ghods UAV Industries (Iran, Defense) Status by KSE – stay

The USA and the EU imposed sanctions against Iran for the development and transfer of drones to Russia

https://www.state.gov/u-s-announces-designations-on-irans-uav-industry/

*FIDE (International Chess Federation) (Switzerland, Sport) Status by KSE – leave

The International Chess Federation (FIDE) has deprived the Russian Chess Federation (FSHR) of its membership for two years.

10.06.2024

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – leave

Knauf decided that they would transfer their company in Russia to management, paying the amount due to the budget to the budget. 15% of the valuation amount, but with an option – the ability to buy the business back within two years

https://www.kommersant.ru/doc/6761059

*IPG Photonics (USA, Industrial equipment) Status by KSE – stay

Shipments from Russian laser manufacturer NTO IRE-Polyus to sister company IPG Photonics India increased by 62% year-on-year, and the latter’s receivables to the supplier more than doubled.

11.06.2024

*GfK (Germany, Consulting, Law) Status by KSE – leave

One of the largest agencies for analyzing the consumer electronics markets, GfK, part of NielsenIQ, is selling the Russian LLC GFK-Rus to local management.

https://www.kommersant.ru/doc/6761294

*JPMorgan (USA, Finance and payments) Status by KSE – leave

A subsidiary bank of JP Morgan Chase has become one of the most unprofitable in the Russian Federation

https://www.kommersant.ru/doc/6761467

*Ziraat (Turkey, Finance and payments) Status by KSE – leave

Найбільший держбанк відмовився розблокувати платежі до Росії

https://tinsider.com.tr/krupneyshiy-gosbank-otkazalsya-razblokirovat-platezhi-v-rossiyu

12.06.2024

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Uniper terminates Russian gas supply contracts

https://www.uniper.energy/news/uniper-terminates-russian-gas-supply-contracts

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The Hypocritic Games. Russian and Belorussian sportsmen should be unconditionally banned from Olympics

13.06.2024

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

SBI stops handling transactions with sanctioned Russian entities

14.06.2024

*DeepCool (China, Technology) Status by KSE – stay

The US State Department sanctioned DeepCool for the alleged sale of $1 million worth of products to two Russian companies.

https://www.state.gov/taking-additional-measures-to-degrade-russias-wartime-economy/

*VPower Finance Security (Hong Kong) Ltd. (China, Metals and Mining) Status by KSE – stay

The US imposed sanctions against companies in Hong Kong and the UAE for promoting trade in Russian gold

*Wuchan Zhongda Group (China, Conglomerate) Status by KSE – stay

The Chinese conglomerate Wuchan Zhongda Group, which is also involved in international trade, has launched an investigation due to the disappearance of a large batch of copper purchased in Russia.

https://www.rbc.ru/business/13/06/2024/666ad9359a794758798a23b9

*Nvidia (USA, IT) Status by KSE – stay

NVIDIA technology found in Russian military drones

https://defence-blog.com/nvidia-technology-found-in-russian-military-drones/

*Coca-Cola (USA, Food & Beverages) Status by KSE – stay

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – stay

The Coca-Cola Company, which ceased operations in Russia after the outbreak of war, filed three applications for registration of trademarks in the Russian Federation – Coca-Cola, Sprite and Fanta.

https://www.epravda.com.ua/news/2024/06/14/715206/

*International Tennis Federation (Great Britain, Sport) Status by KSE – stay

The International Tennis Federation (ITF) has allowed all the strongest Russian tennis players who qualify for the Games according to rating to participate in the 2024 Olympic Games in Paris.

15.06.2024

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Individual Neutral Athletes at the Olympic Games Paris 2024

https://olympics.com/ioc/paris-2024-individual-neutral-athletes

*International Luge Federation (Germany, Association, NGO) Status by KSE – leave

The International Luge Federation’s ban on Russian sliders, coaches and other competitors in response to the country’s invasion of Ukraine will continue indefinitely, the sport’s governing body saidʼ

*UniCredit Bank (Italy, Finance and payments) Status by KSE – leave

Unicredit and Russian sanctions: the first sentence overturned, the English Court of Appeal agrees with the bank

16.06.2024

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell trademark recalled in Russia

https://lenta.ru/news/2024/06/15/v-rossii-otozvali-tovarnyy-znak-shell/

17.06.2024

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

OTP Bank has suspended non-cash currency exchange operations

*Trumpf (Germany, Industrial equipment) Status by KSE – stay

Russian weapons are made on foreign machines. Why are they still spinning?

https://istories.media/stories/2024/06/13/stanky/

*Orano (France, Energy, oil and gas) Status by KSE – stay

Orano at Risk of Losing Niger Uranium Mine Sought by Russia

18.06.2024

*IRGC Sahara Thunder (Iran, Defense) Status by KSE – stay

*R&G Faserverbundwerkstoffe (Germany, Chemical industry) Status by KSE – stay

*Goettle Advanced Products GmbH & Co.Kg. (Germany, Chemical industry) Status by KSE – stay

Two German companies are helping Russia to produce shaheds

*H&M (Hennes and Mauritz) (Sweden, Consumer goods and clothing) Status by KSE – leave

The main legal entity of the Swedish retailer H&M has started the process of liquidation of its Russian branch.

https://www.pravda.com.ua/eng/news/2024/06/18/7461372/

*Jägermeister (Germany, Alcohol&Tobacco) Status by KSE – leave

The Federal Service for Intellectual Property of the Russian Federation (Rospatent) has registered the trademark of the Jagermeister liqueur manufacturer.

https://www.vedomosti.ru/business/news/2024/06/18/1044595-rospatent-zaregistriroval

https://www.epravda.com.ua/news/2024/06/18/715388/

*Caterpillar (USA, Automotive) Status by KSE – leave

Caterpillar’s Russian assets transferred to firm owned by Armenian fund

https://finance.yahoo.com/news/caterpillars-russian-assets-transferred-firm-113610299.html

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – exited

Kazakhstan’s Polymetal lives under shadow of sanctions despite Russian asset sales

https://www.ft.com/content/129049ef-6860-4cc7-a153-98dfc446f920

*UEFA (Switzerland, Sport) Status by KSE – stay

Euro 2024: UEFA bans Russian flags at Ukraine match – source

*Coca-Cola (USA, Food & Beverages) Status by KSE – stay

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – stay

*Pepsi (USA, Food & Beverages) Status by KSE – stay

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

*Leroy Merlin (France, FMCG) Status by KSE – stay

Leroy Merlin is changing its name; the French chain in Russia will now be called Lemana Pro.

19.06.2024

*Tether (China, Finance and payments) Status by KSE – stay

‘Next FTX’ crypto giant Tether’s ties to terrorists, trafficking to be exposed through campaign to take down ‘Ponzi scheme’ founded by former Disney child star

20.06.2024

*Zeekr Automobile (China, Automotive) Status by KSE – leave

Chinese car dealers received an official letter from the Zeekr company, which states a complete ban on sales of this brand in the Russian Federation after June 30

21.06.2024

*Yilufa Electronics Limited (China, Defense) Status by KSE – stay

*Asia Pacific Links Ltd (China, Defense) Status by KSE – stay

Japan has imposed trade restrictions against Chinese companies as part of a new round of sanctions against individuals and groups that support Russia’s war against Ukraine. The Hong Kong company Asia Pacific Links, which supplied microchips for Russian drones, and the Chinese Yilufa Electronics Limited were sanctioned.

https://www.mofa.go.jp/erp/c_see/ua/pageite_000001_00413.html

https://www.epravda.com.ua/news/2024/06/21/715544/

*Wison New Energies (China, Energy, oil and gas) Status by KSE – leave

Chinese Wison New Energies (formerly Wison Offshore & Marine), responsible for the construction of modules for NOVATEK’s Arctic LNG 2 project

https://www.kommersant.ru/doc/6776043

*Linde (Germany, Chemical industry) Status by KSE – leave

The Arbitration Court of St. Petersburg and the Leningrad Region, at the request of Ruskhimallians, which is the operator of the project for the construction of a gas processing and liquefaction complex in Ust-Luga, seized the property, funds and securities of subsidiaries of the German Linde.

23.06.2024

*Mercedes-Benz (Germany, Automotive) Status by KSE – exited

*Chery Automobile (China, Automotive) Status by KSE – stay

Exeed assembly at former Mercedes plant to begin in July

https://www.kommersant.ru/doc/6788858

*Samsung (South Korea, Electronics) Status by KSE – stay

The Kaluga Samsung plant, leased by the Russian electronics distributor VVP Group at the beginning of the year, has launched its first contract production

24.06.2024

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Cadbury founder’s descendant criticizes owner’s ‘disappointing’ stance on Russia

25.06.2024

*Grundfos (Denmark, Engineering) Status by KSE – exited

Grundfos completes divestment of its Russian business

https://evertiq.com/news/55954

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – exited

Former Polymetal will delist shares from Moscow Exchange

https://www.kommersant.ru/doc/6790196

*Highland Gold (Russia, Metals and Mining) Status by KSE – stay

Highland Gold may increase investments in Transbaikalia

26.06.2024

*ArcelorMittal (Luxembourg, Metals and Mining) Status by KSE – stay

ArcelorMittal bought coal from Russia as Ukrainian employees died on frontlines

*Gasum (Finland, Energy, oil and gas) Status by KSE – leave

Gasum will stop importing Russian LNG next month, in line the EU’s latest sanctions package adopted this week.

https://www.energyintel.com/00000190-5011-d1e4-a79d-5fdb21190000

*Apple (USA, Electronics) Status by KSE – leave

In Russia, the sale of iPhones should be banned if the manufacturer of these smartphones, the American corporation Apple, does not allow applications to be installed on them through the RuStore store, Senator Artem Sheikin, deputy chairman of the Council for the Development of the Digital Economy under the Federation Council, told RIA Novosti.

*National Iranian Gas Company (NIGC) (Iran, Energy, oil and gas) Status by KSE – stay

Gazprom signed a strategic memorandum with Iran on working out the organization of pipeline supplies of Russian gas. The document with the National Iranian Gas Company (NIGC) was signed during the visit of the Gazprom delegation led by Alexey Miller to Iran.

27.06.2024

*Vestas (Denmark, Energy, oil and gas) Status by KSE – exited

The first attempt to sell the property of the Danish Vestas, a manufacturer of equipment for wind power plants that left the Russian Federation, was unsuccessful.

https://www.kommersant.ru/doc/6791801

*HSE (Home Shopping Europe) (Germany, Online Services) Status by KSE – exited

The German holding HSE (Home Shopping Europe) sold 100% of the Shopping Live TV store to its founder Ilya Kirik. According to the Unified State Register of Legal Entities, since June 25, 2024, Direct Trade LLC, which manages this business, belongs to the company K2 Invest, where Ilya Kirik has 99.9%, Dmitry Kuznetsov has 0.1%.

28.06.2024

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – stay

Poland’s Orlen warned three gas companies it could seize Gazprom payments, sources say

29.06.2024

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The IOC did not allow Russian rowers, shooters and pentathletes to participate in the Paris Olympics

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² In June 2024 KSE Institute reviewed statuses of companies based on new revenue data for 2023, about 100 companies moved from status “stay” to status “leave” due to significant drop of revenue (60%+), usually the same trend took place in 2022 as well

³ When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

⁴ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website