- Kyiv School of Economics

- About the School

- News

- 65th issue of the regular digest on impact of foreign companies’ exit on RF economy

65th issue of the regular digest on impact of foreign companies’ exit on RF economy

3 June 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03.05.2024-03.06.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

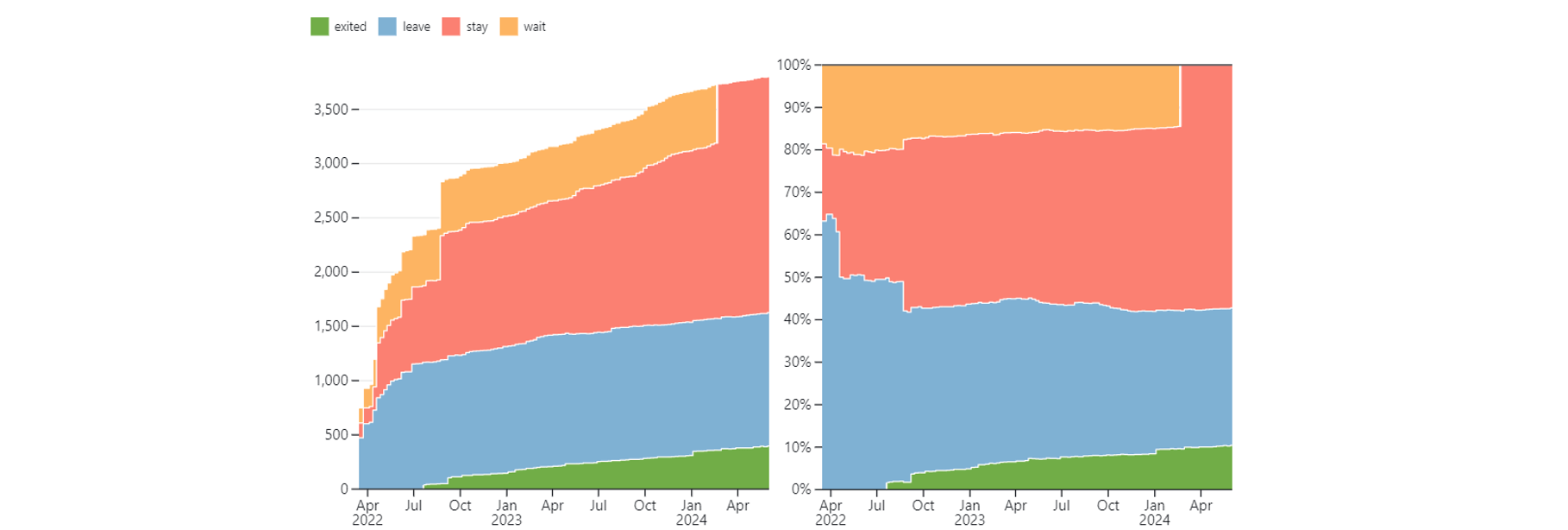

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

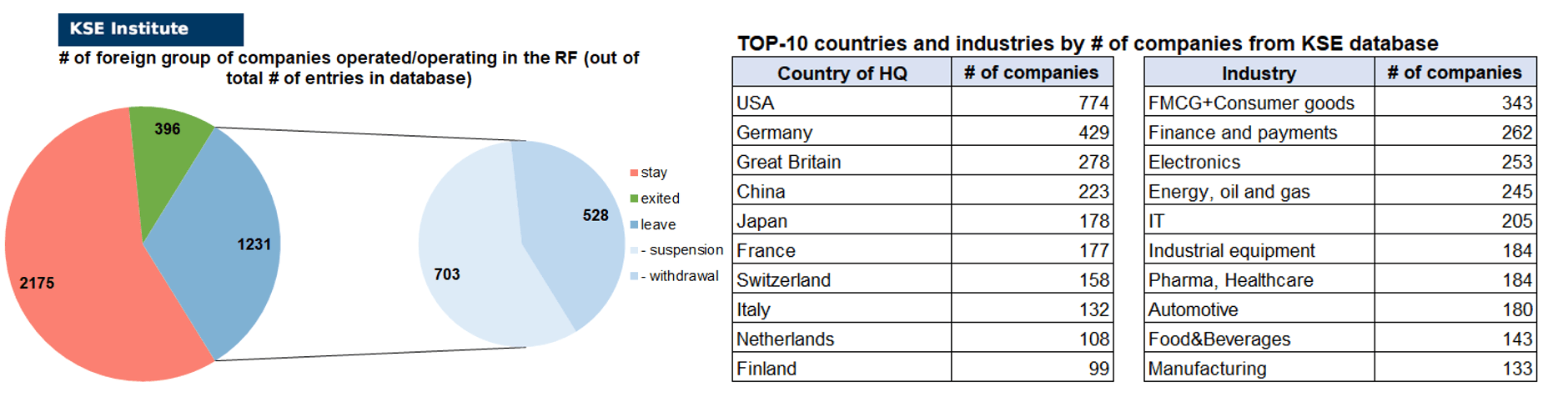

KSE DATABASE SNAPSHOT as of 03.06.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 175 (0 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 231 (+8 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 396 (+9 per month)

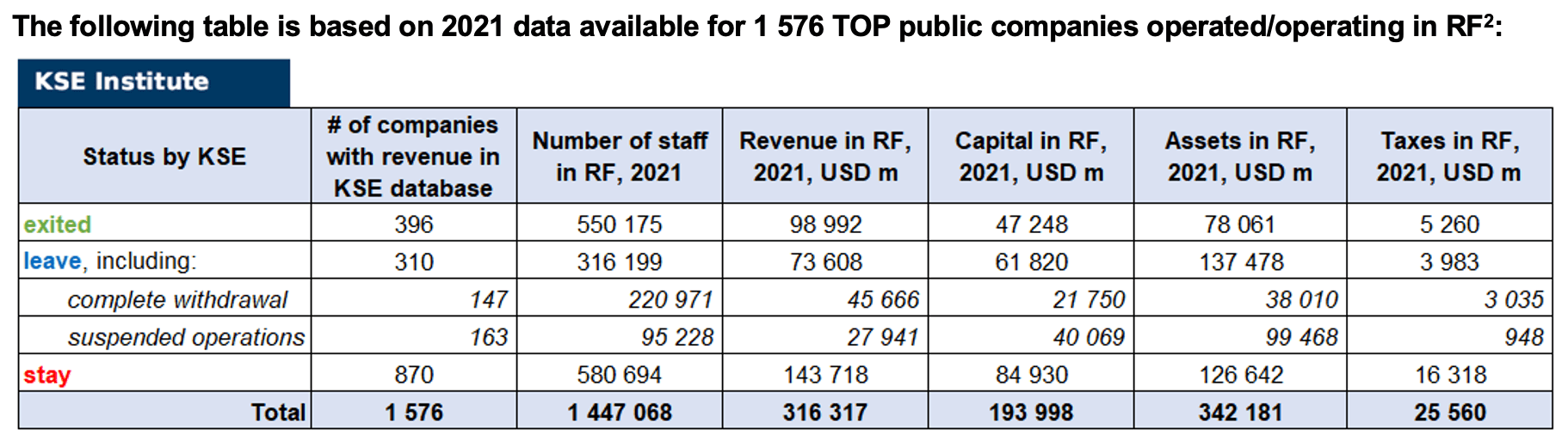

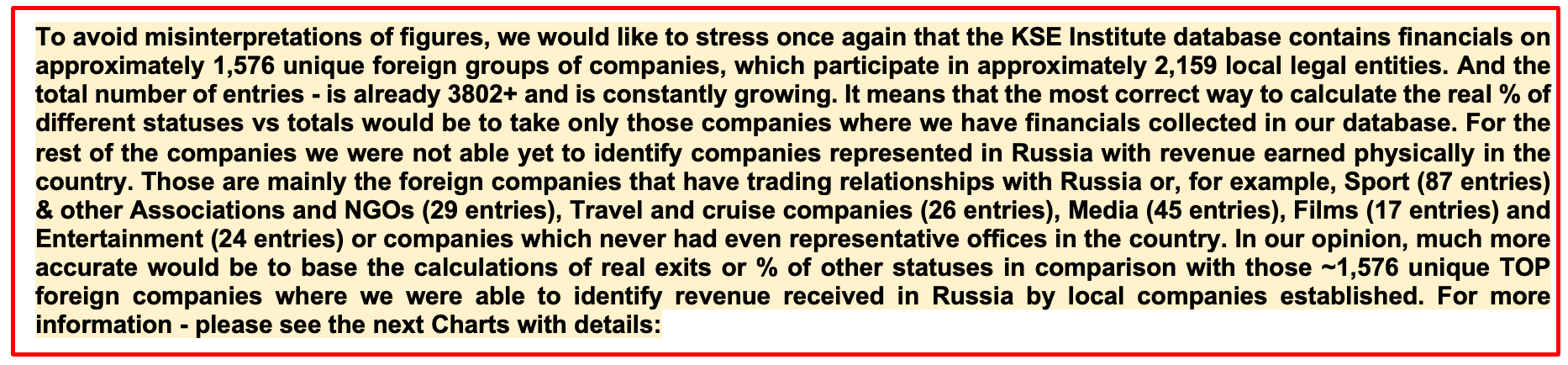

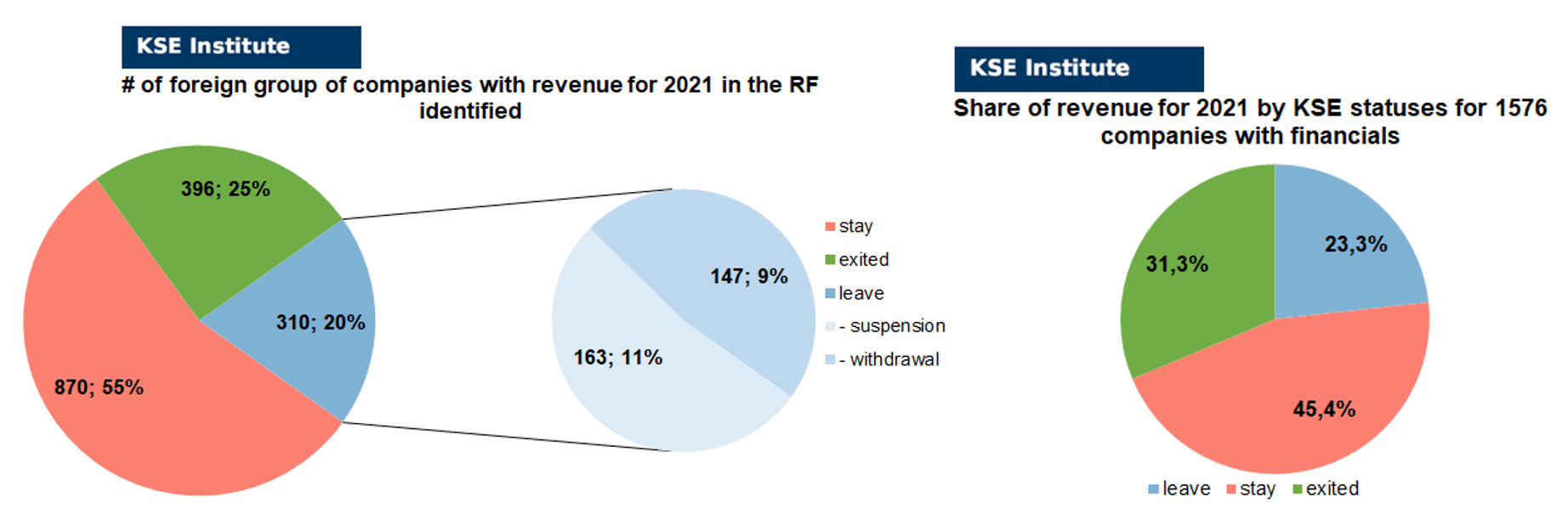

As of June 3, 2024, we have identified about 3,802 companies, organizations and their brands from 103 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 576 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.0 billion), local revenue (about $316.3 billion), local assets (about $342.2 billion) as well as staff (about 1.447 million people) and taxes paid (about $25.6 billion). 1,231 foreign companies have suspended or ceased operations in Russia. Also, we added information about 396 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (3 full business liquidations and 6 business sales took place in May 2024).

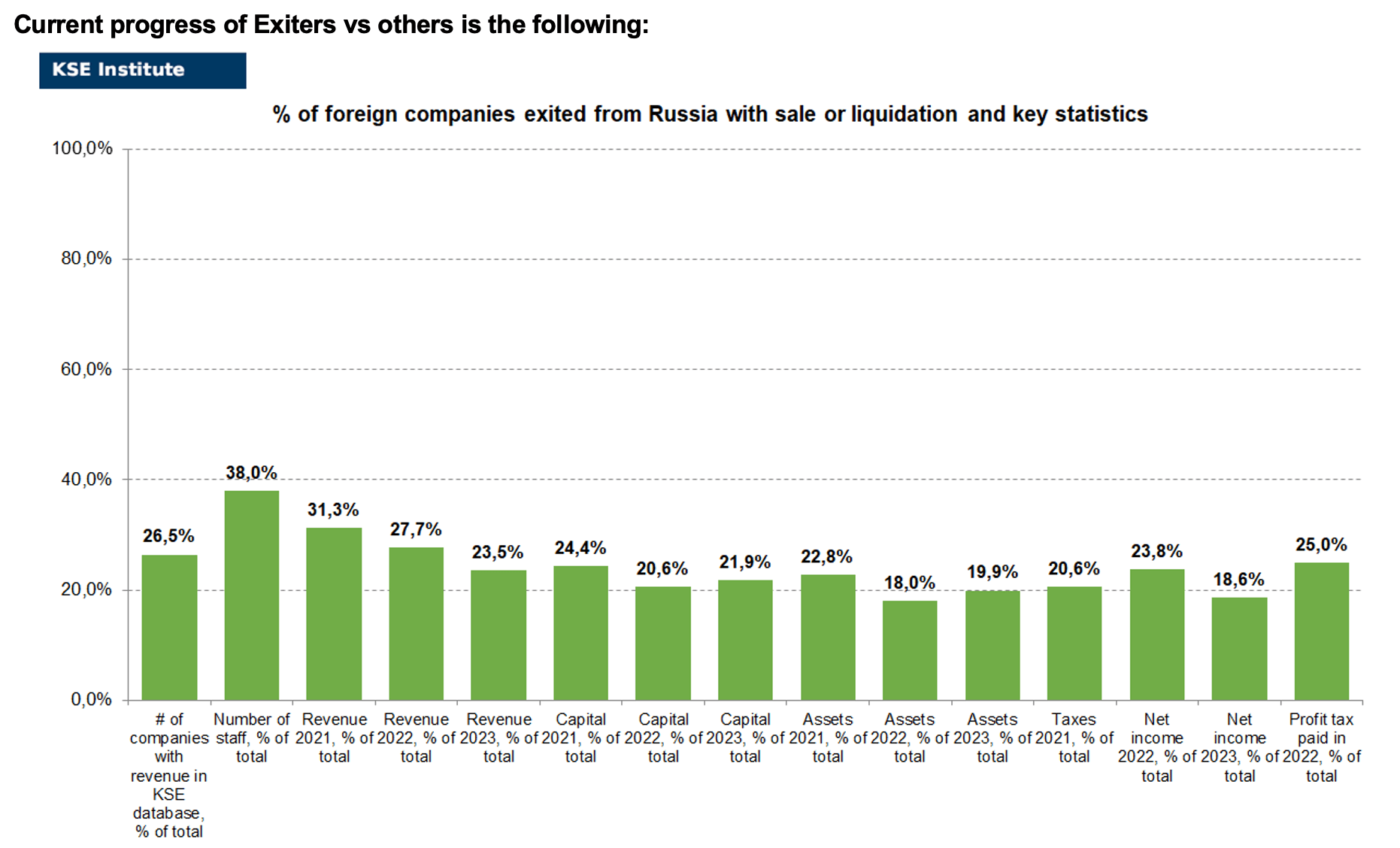

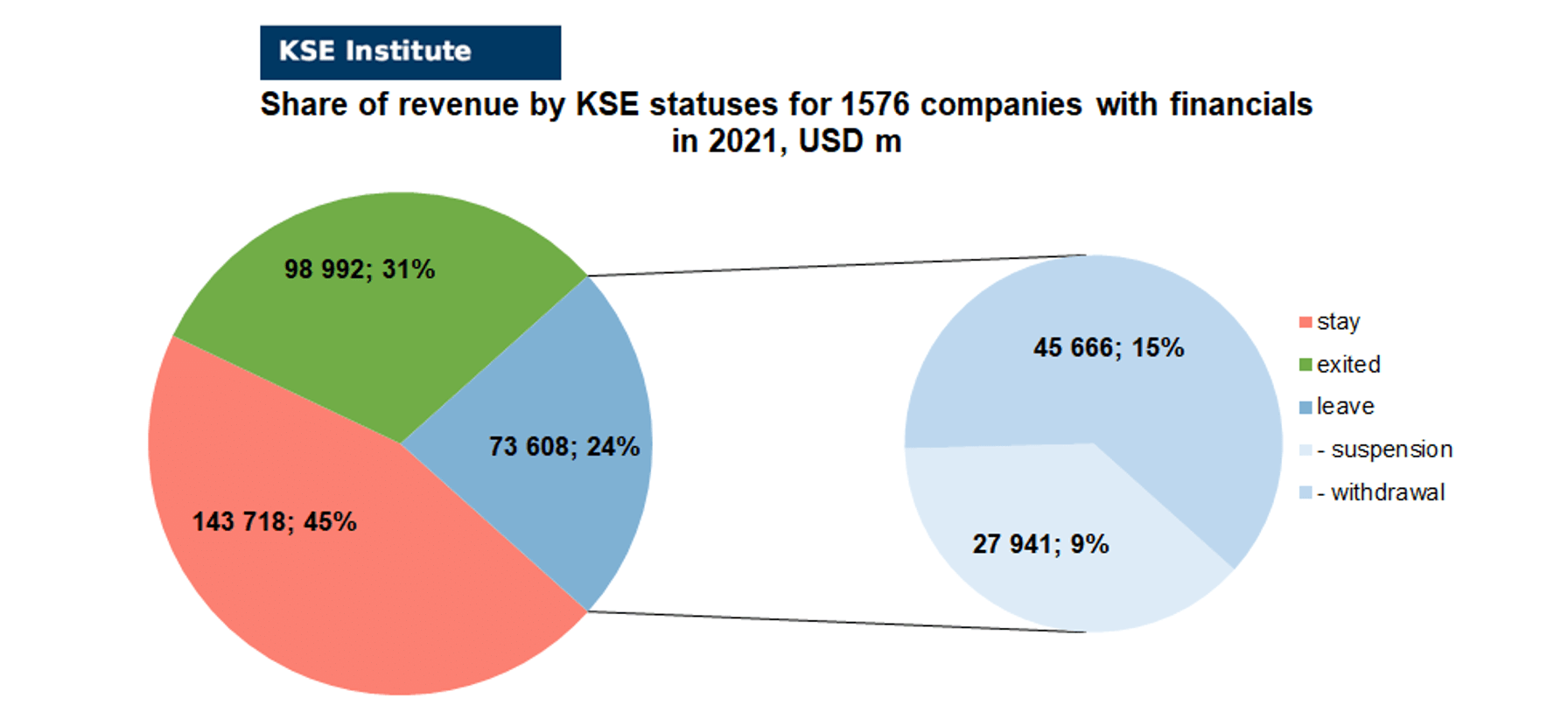

As can be seen from the tables below, as of June 3, 2024, 396 companies which had already completely exited from the Russian Federation, in 2021 had at least 550,200 personnel, $99.0 bn in annual revenue, $47.2bn in capital and $78.1bn in assets; companies, that declared a complete withdrawal from Russia had 221,000 personnel, $45.7bn in revenues, $21.8bn in capital and $38.0bn in assets; companies that suspended operations on the Russian market had 95,200 personnel, annual revenue of $27.9bn, $40.1bn in capital and $99.5bn in assets.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 21 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 20 were added in May 2024). However, if to operate with the total numbers in KSE database, about 32.4% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 57.2% are still remaining in the country and only 10.4% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 396 companies that completely left the country, since in 2021 they employed 38.0% of the personnel employed in foreign companies, the companies owned about 22.8% of the assets, had 24.4% of capital invested by foreign companies, and in 2021 they generated revenue of $99.0 billion or 31.3% of total revenue and paid ~$5.26 billion of taxes or 20.6% of total taxes paid by the companies observed. Data on 1,576 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (25%) and on share of revenue withdrawn (31.3%). At the same time, a totally different picture is for those who are still staying – 55% of companies represent 45.4% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

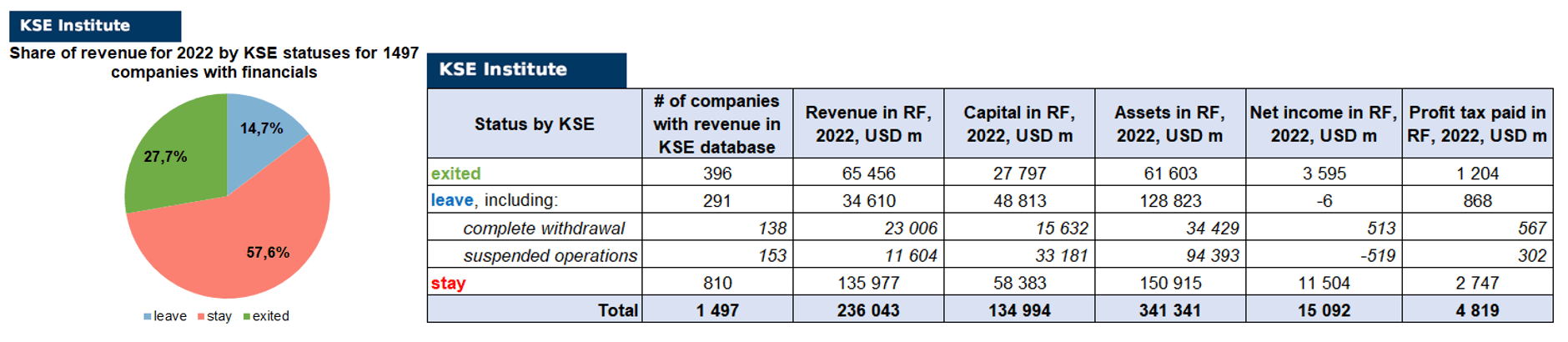

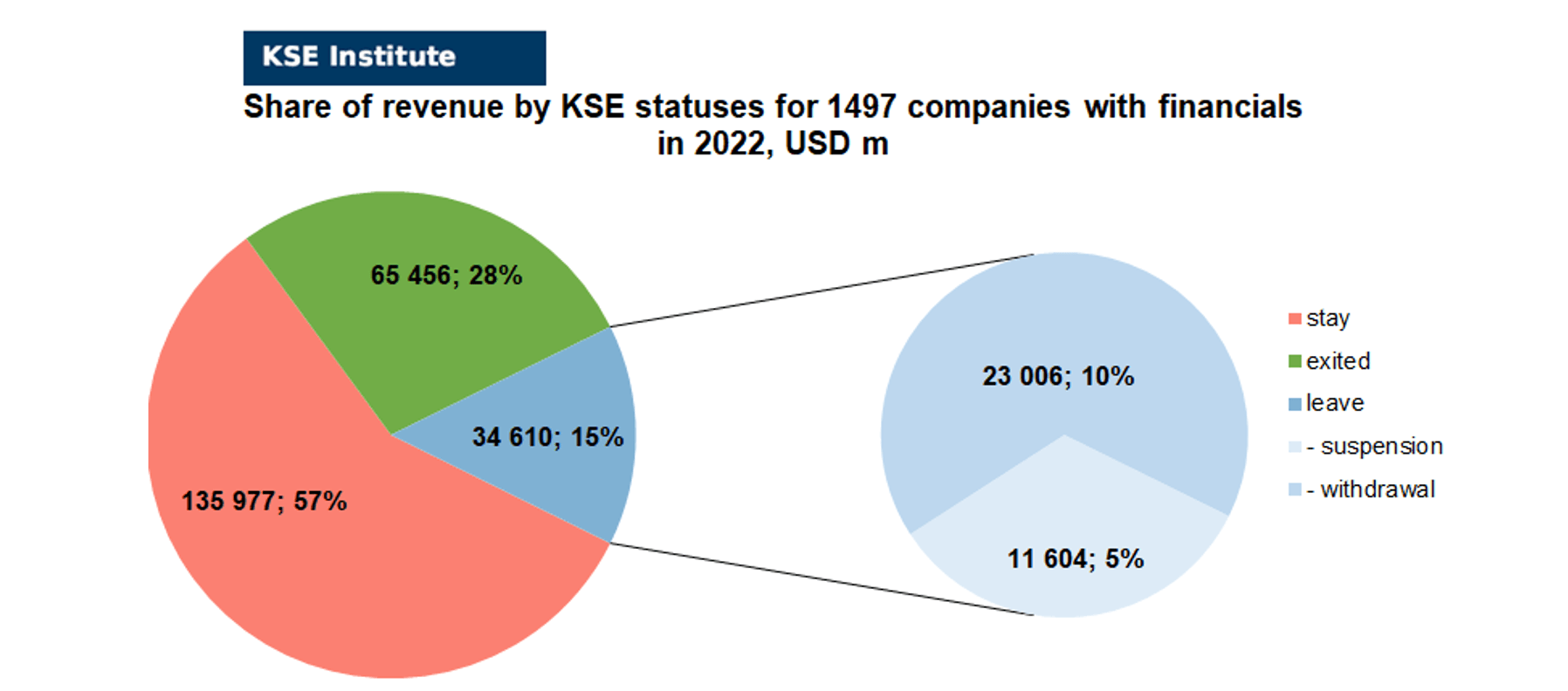

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1497 companies (about 80 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.6% less of revenue in 2022 (27.7% from total volume) than in 2021 (31.3% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-8.6%) revenue in 2022 (14.7% from total volume) than in 2021 (23.3% from total volume). At the same time, staying companies were able to generate much (+12.2%) more revenue in 2022 (57.6% from total volume) than in 2021 (45.4% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($342.2bn⁴ in 2022 vs $341.3bn in 2021) and would even probably increase if the remaining reporting for ~80-90 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

SPECIAL EDITION: Preliminarily analysis of data for 2023

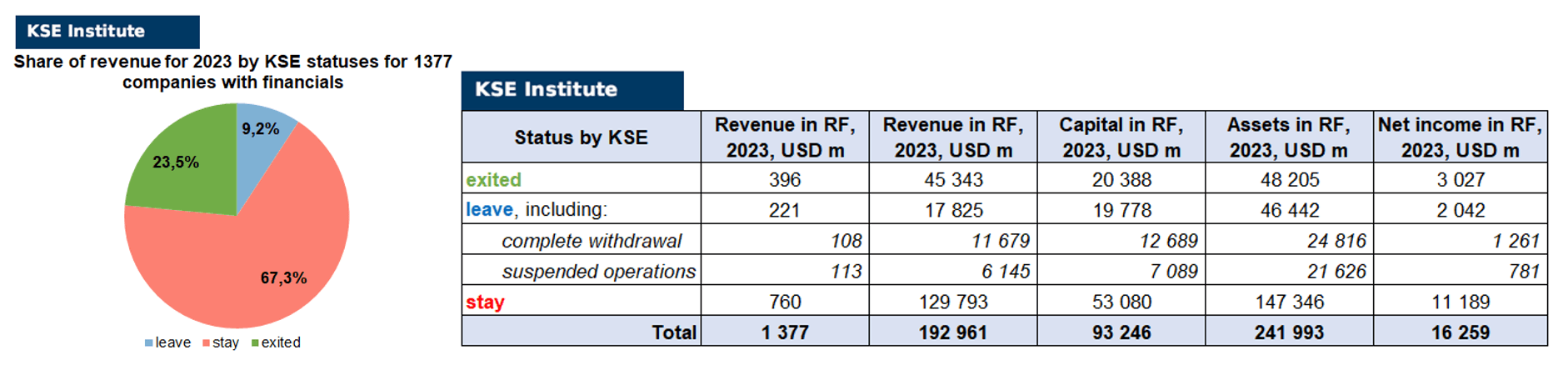

KSE Institute has just collected and preliminarily analyzed data on revenue, capital, assets and net income (profit or loss) in 2023 for ~1377 companies (after it was allowed legally in 2023 about 200 companies the data of which we have collected previously have not provided their reporting and also about 250 companies reported 0 values in revenues). Also, it should be noted that as we convert RUB to USD – the devaluation effect was quite significant, Ruble depreciated in 2023 by more than 24%, from 68.4869 RUB/USD in 2022 to 85.163 RUB/USD in 2023). Please see below charts with the detailed analysis:

As you can see, there is a significant redistribution in revenue allocation based on KSE statuses happened in 2023: share of “exited” has dropped by -7,8% vs 2021 and -4,2% vs 2022 (from 31.3% in 2021 and from 27.7% in 2022 to 23.5% in 2023) which is explained by the fact that more and more companies are being liquidated and those one which were sold are usually not able to generate the previous level of revenue.

Share of companies with status “leave” has dropped even more, by -14,1% vs 2021 and -5,5% vs 2022 (from 23.3% in 2021 and from 14.7% in 2022 to 9.2% in 2023) which is explained by the fact that those companies which are leaving are not concentrated in revenue generation on the Russian market anymore.

As for companies with status “stay” – we see the opposite picture there, they are using momentum to take market share of those who are leaving or left (especially in automotive sector) and are generating comparable with previous years level of revenue: +21,9% vs 2021 and +9,7% vs 2022 (from 45.4% in 2021 and from 57.6% in 2022 to 67.3% in 2023).

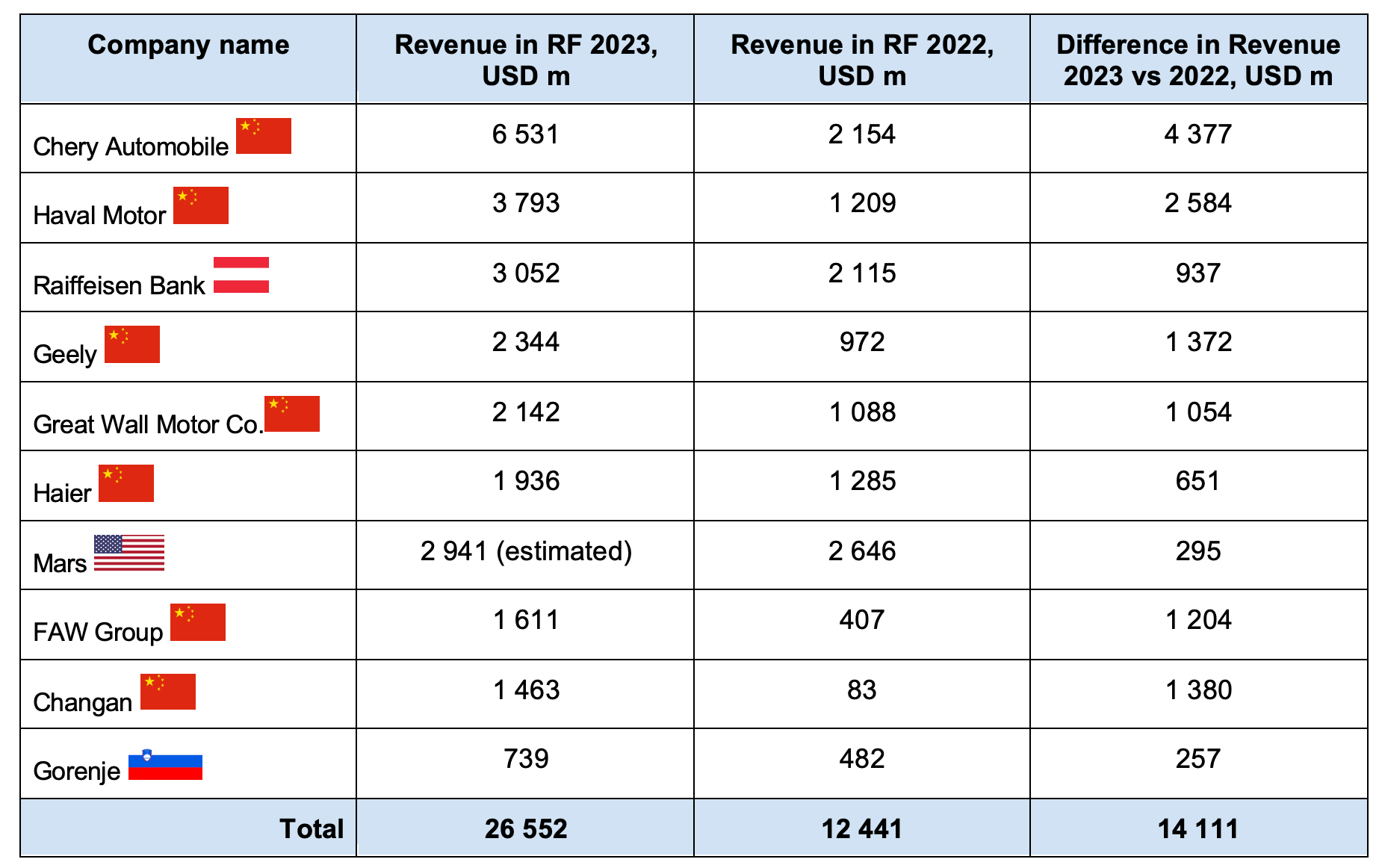

Some companies and banks were even able to generate more revenue in 2023 than in 2022, here is the list of selected TOP-10 “revenue gainers” (7 of them are Chinese automotive groups, exact list may differ based on new data appeared):

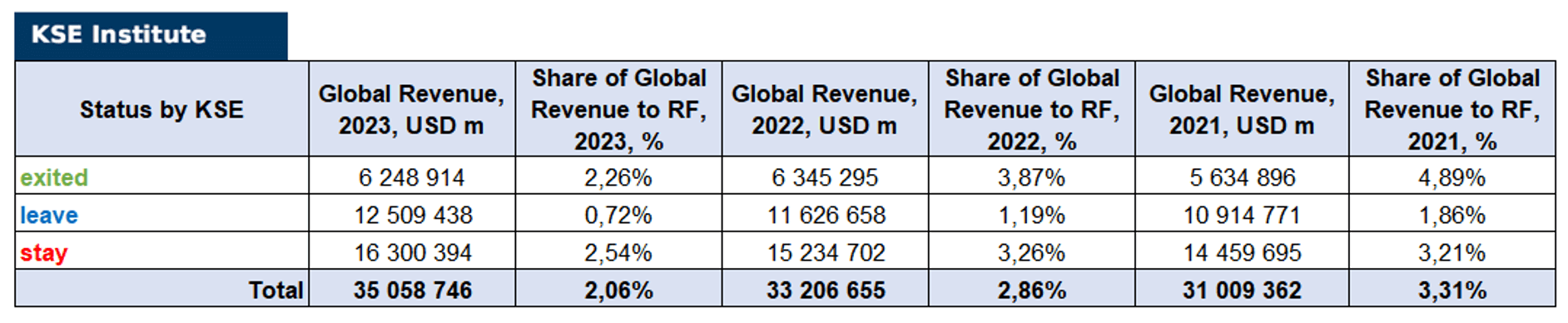

At the same time, based on KSE’s observation since the beginning of the war, we can state the fact that the share of Russian market in global revenue of multinational companies is continuing to rapidly decline: in average, it dropped from 3.31% in 2021 to 2.86% in 2022 and to 2.06% in 2023:

As you can see in the table above, all categories of companies are following the declining trend, the biggest % decline is observed, of course, among exited and leaving companies but among those who are still staying – it is also the case, which mean that the Russian market is becoming less and less attractive for foreign investors.

Also, data shows that the Russian market could be easily replaced by other markets as overall global revenue is constantly growing from year to year. Our previous research showed that most of those public companies which exited first were able to compensate for lost share on the Russian market with increased prices of their shares and increased market capitalization (of course, the situation is totally different now as there is no normal M&A market in Russia and any company is now effectively at risk of business seizure).

MONTHLY FOCUS: On leaving the Russian Federation. Results of May 2024

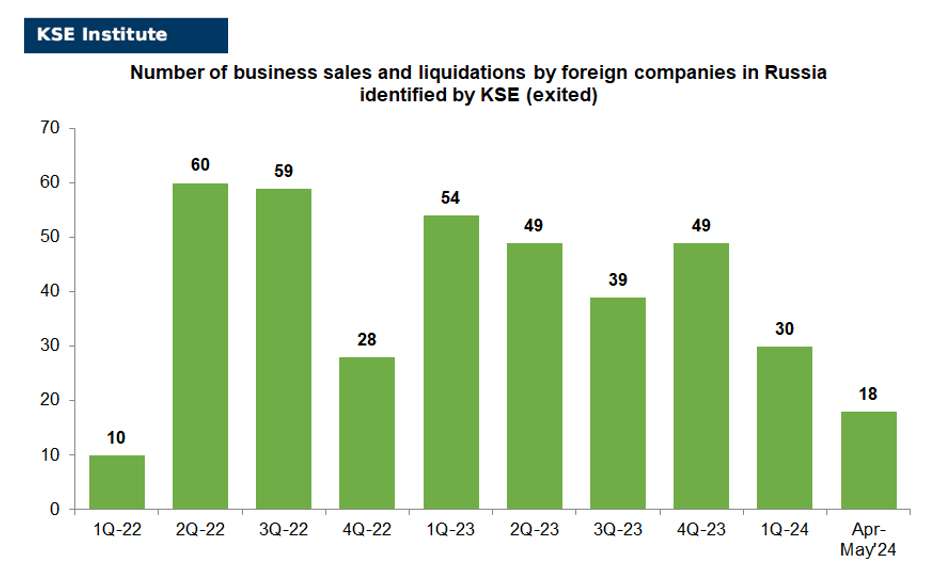

In this digest, we will summarize the results of May 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’576 companies identified in the KSE database with revenue data available of more than $316 billion in 2021 and ~$236 billion in 2022 (which dropped to ~$193 billion in 2023). And at least 396 of them have already been sold by local companies or were liquidated and left the Russian market. In May 2024 KSE Institute identified +9 new exits (6 business sales and 3 liquidations took place in May 2024)⁵, total number of exits observed since the beginning of Russia’s invasion reached 396.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 31% based on revenue allocation, those who are leaving represent 24% of total revenue (with 38% share of suspensions and 62% of withdrawals sub-statuses), % of staying companies represent 45% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is less than % of leaving ones (which means that about 55% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 28% based on revenue allocation, those who are leaving represent only 15% of total revenue (with 34% share of suspensions and 66% of withdrawals sub-statuses), % of staying companies represent 57% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

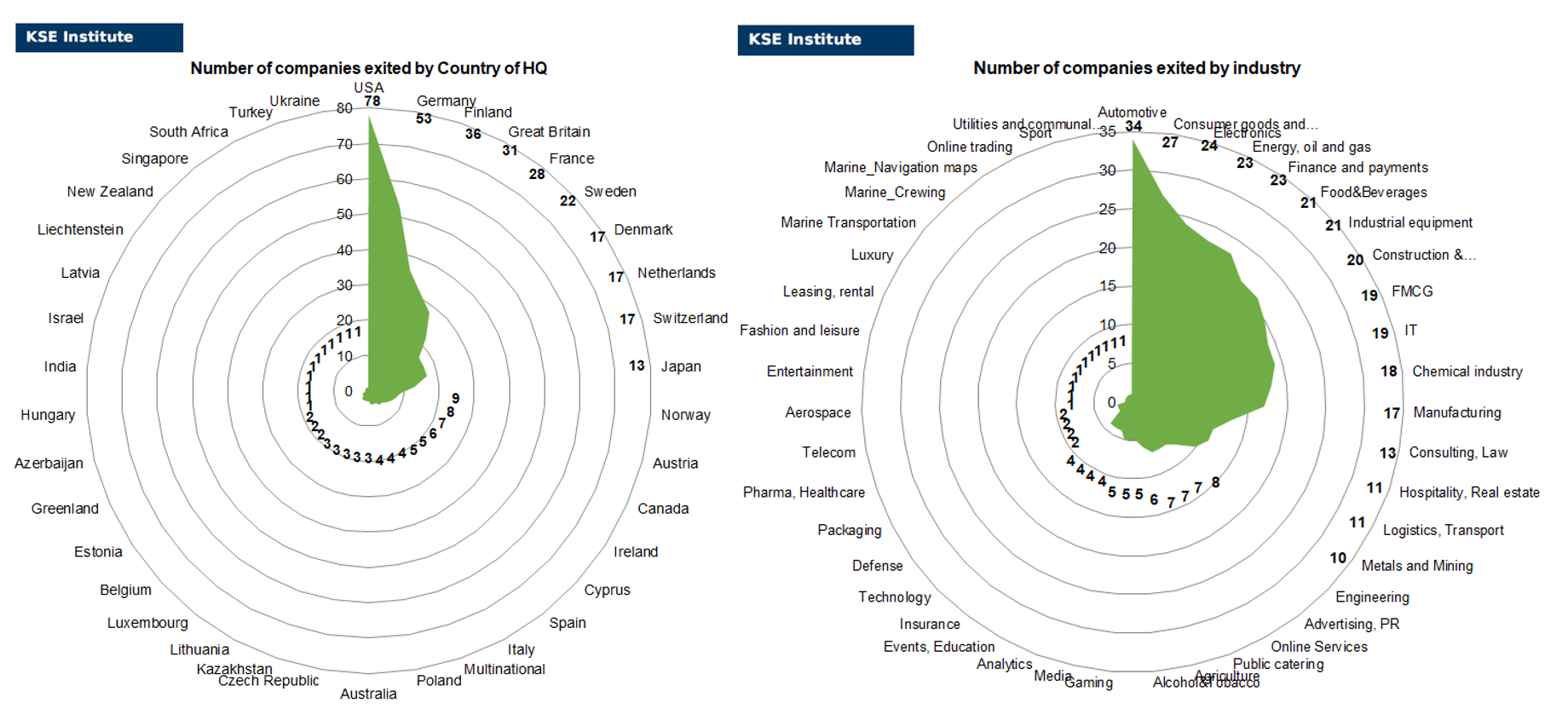

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of May 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Chemours (liquidation), Jack Wolfskin (liquidation), KAZ Minerals (liquidation). Also, 6 business sales took place in May 2024: Danone (completed the sale of Russian assets to Vamin R after the temporary management introduced before), HI-LEX, HSBC (Expobank JSC successfully closed the deal and acquired 100% of the shares of HSBC Bank (RR) LLC from HSBC Europe B.V. after deal allowance of Putin received before), Ipackchem, Metsä Group (The Vologda Timber Industry Group of Companies became the buyer of a 100% share of the Russian assets of the Finnish company) and SRV Yhtiöt Oyj (SRV).

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: BASF SE (Putin allowed Lakra Sintez to buy the Russian subsidiary of BASF), Deutsche Bank, Commerzbank and UniCredit Bank (Russian court seizes €700mn assets from UniCredit, Deutsche Bank and Commerzbank), Kraft Heinz (05.2024: The entry about the founder of AQUALIFE RESOURCE JSC was removed from the Unified State Register of Legal Entities. JSC “GROUP OF COMPANIES “CHERNOGOLOVKA” becomes the new founder of the organization LLC “IVANOVSKY BABY FOOD FACTORY”), Kramp Groep B.V. (According to the Annual Report, “An important change was the official termination of our business in Russia, marking the end of a long process that was initiated in 2022. I am pleased that we have found a new owner for the Russian company, ensuring continuity for the people who have been working for Kramp there for the past 15 years”. But no changes reflected in the ownership structure/EGRUL register yet), Luxoft (05.2024: Key legal entity LLC “Luxoft Professional” (in 2022 renamed to LLC “IBS INFINISOFT”) was liquidated on May 27, 2024), Nokia (Russian President Vladimir Putin signed a decree allowing the Restream company, which is owned by Rostelecom, to acquire a 49% stake in RTK Network Technologies LLC. It is owned by the Finnish Nokia Solutions & Networks Oy), Toyota (Toyota plant in St. Petersburg transferred to Aurus).

The next review of deals for June 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁶

02.05.2024

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Indian Oil Corp. resumed buying Russian crude oil delivered on a tanker owned by Sovcomflot PJSC this week, paving the way for a restoration of oil flows between Russia and India, after tightened US penalties had disrupted shipments.

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever still earning millions in royalties from Russian subsidiary

https://nltimes.nl/2024/05/02/unilever-still-earning-millions-royalties-russian-subsidiary-report

*Finder Technology (China, Defense) Status by KSE – stay

*Juhang Aviation Technology (China, Defense) Status by KSE – stay

*Zhongcheng Heavy Equipment Defense Technology Group Co. Ltd. (China, Defense) Status by KSE – stay

*Hengshui Heshuo Cellulose Co. Ltd (China, Defense) Status by KSE – stay

*Albait Al Khaleeje General Trading LLC (United Arab Emirates, Automotive) Status by KSE – stay

The United States imposed sanctions for aiding the Russian military-industrial complex and circumventing export controls.

*Beko | Arcelik (Turkey, Electronics) Status by KSE – stay

*LG Electronics (South Korea, Electronics) Status by KSE – stay

*Haier (China, Electronics) Status by KSE – stay

The brand’s household appliances are not supplied to the Russian Federation, but they sell well

03.05.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The head of Raiffeisen Bank International (RBI), Johan Strobl, said that in the third quarter of 2024, the banking group will begin to comply with the order of the European Central Bank (ECB) to significantly reduce business in Russia.

https://www.epravda.com.ua/news/2024/05/3/713218/

https://www.forbes.ru/finansy/511605-sud-resil-casticno-otmenit-arest-sredstv-jpmorgan-po-isku-vtb

04.05.2024

*Micron (USA, IT ) Status by KSE – leave

Murata Manufacturing (Japan, Electronics) Status by KSE – leave

Russia imports thousands of components for its fighter jets from 22 countries despite sanctions

https://www.pravda.com.ua/eng/news/2024/05/3/7454174/

*Boeing (USA, Aircraft industry) Status by KSE – leave

The Boeing company faced difficulties in the production of passenger planes 787 Dreamliner – because of the sanctions that the Western countries introduced against Russia.

https://www.epravda.com.ua/news/2024/05/4/713259/

*Maersk (Denmark, Logistics, Transport) Status by KSE – leave

The Danish shipping company Maersk has stopped the liquidation of its Russian business in 2023. In February 2024, the company received 20 million rubles. as an additional contribution to property. In November 2023 and January 2024, Maersk and Maersk Solutions extended the lease of offices in Moscow and St. Petersburg for another 11 months.

06.05.2024

*PowerLine Automotive (Austria, Automotive) Status by KSE – stay

US imposed new sanctions on KAMAZ suppliers from an investigation by Trap Aggressor

*Maersk (Denmark, Logistics, Transport) Status by KSE – leave

Maersk has resumed the liquidation of its Russian business

https://www.rbc.ru/business/03/05/2024/663500669a794763d639307a?from=newsfeed

07.05.2024

*Lego (Denmark, Consumer goods and clothing) Status by KSE – leave

After Lego left the Russian market, local companies had the opportunity to create their own products.

https://www.kommersant.ru/doc/6688187

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

UniCredit’s Russian business doubled its net profit in the first quarter

*Toyota (Japan, Automotive) Status by KSE – leave

Toyota plant in St. Petersburg transferred to Aurus

https://www.rbc.ru/business/07/05/2024/6639fc469a79474dadf9be7e

*Bacardi (Bermuda, Alcohol&Tobacco) Status by KSE – leave

Bacardí cuts presence in Russia

https://www.thedrinksbusiness.com/2024/05/bacardi-cuts-presence-in-russia/

08.05.2024

*Gilat Satellite Networks (Israel, Telecom) Status by KSE – stay

Gilat SkyEdge satellite Internet communication systems manufactured in Ukraine are massively imported to Russia, where they can be used in war.

*Espersen (Denmark, Food & Beverages) Status by KSE – exited

Danish whitefish processing giant Espersen returned to profit in 2023

*Ipackchem (France, Agriculture) Status by KSE – exited

*Syngenta AG (Switzerland, Agriculture) Status by KSE – stay

The global manufacturer of containers for agrochemicals Ipackchem, headquartered in Paris, sold the Russian division of the Agro Asset Management company, according to data from the Unified State Register of Legal Entities in SPARK.

https://www.kommersant.ru/doc/6688861

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The IOC will not award Russians with Olympic medals that have been handed over to them.

https://www.rbc.ru/sport/08/05/2024/663b37669a7947b26fd00075

*BASF SE (Germany, Chemical industry) Status by KSE – leave

President Vladimir Putin signed an order authorizing Lakra Sintez, one of the largest manufacturers of paints and varnishes in the Russian Federation, to buy 100% of shares in BASF Vostok, a subsidiary of the German concern BASF in Russia.

09.05.2024

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

Pentagon Teams Up With SpaceX to Block Russia From Using Starlink

*Baxter International (USA, Pharma, Healthcare) Status by KSE – leave

US drugmaker Baxter suspends Russian operations

https://www.thepharmaletter.com/article/us-drugmaker-baxter-suspends-russian-operations

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Forced to Abandon Russian Plan After Regulators Balk

10.05.2024

*Rumble (Canada, IT) Status by KSE – leave

Rumble is now banned in Russia.

12.05.2024

*Microsoft (USA, IT) Status by KSE – stay

Microsoft has again opened access to Windows and Office updates for Russians without using a VPN. You can install them in two ways: from the company’s official website or through the appropriate menu of the OS/software package.

*JPMorgan (USA, Finance and payments) Status by KSE – leave

JPMorgan Chase Warns Bank’s Assets May Be Seized in Russia After $1,460,000,000 Write-Off

13.05.2024

*Equinor (Norway, Energy, oil and gas) Status by KSE – exited

The Norwegian oil and gas giant pushed the former leader of Gazprom out of Europe

https://www.epravda.com.ua/news/2024/05/13/713599/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen has been a rogue operator in Russia for too long

https://www.ft.com/content/1d12528b-f264-4b88-baf0-f4b718aa36f7

*Boeing (USA, Aircraft industry) Status by KSE – leave

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

The technical department of Russia’s largest private airline S7 learned how to repair aircraft engines of Boeing 737 and Airbus A320 aircraft

14.05.2024

*Bybit (China, Finance and payments) Status by KSE – stay

*OKX (Seychelles, Finance and payments) Status by KSE – stay

In April, Russia accounted for up to 25% of traffic on the largest crypto exchanges

15.05.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Exclusive: U.S. warned Raiffeisen access to dollar system could be curbed over Russia

*Metsa (Finland, Consumer goods and clothing) Status by KSE – exited

Metsä Group completed the sale of its Russian subsidiaries to VLP Group

*Global Spirits (Multinational, Alcohol & Tobacco) Status by KSE – leave

Vodka assets of the Ukrainian Armed Forces sponsor will be confiscated in Russia

https://www.kommersant.ru/doc/6691991

The Russian Prosecutor General’s Office demanded that the assets of the alcohol holding Global Spirits, which before the war in Ukraine produced the popular vodka brands Khortytsya, Morosha and Pervak in the country, be transferred to state ownership.

16.05.2024

*OSChina (China, IT) Status by KSE – stay

The Chinese company OSChina, together with the Russian 3Logic Group, localized in the Russian Federation a platform for the development of open source code Gitee, including access for developers to Chinese software (software)

https://www.kommersant.ru/doc/6692771

*JCB (Great Britain, Manufacturing) Status by KSE – stay

JCB built and supplied equipment to Russia months after saying exports had stopped

17.05.2024

*ShineWing CPA (China, Consulting, Law) Status by KSE – stay

Russian audit companies are beginning to develop closer contacts with their colleagues in China. Thus, the Capt company entered into a partnership agreement with the auditing and consulting ShineWing CPA.

https://www.kommersant.ru/doc/6693642

*Bulgargaz (Bulgaria, Energy, oil and gas) Status by KSE – leave

The Bulgarian state-owned company Bulgargaz intends to obtain about €400 million in compensation from the Russian Gazprom for stopping supplies in 2022.

https://www.kommersant.ru/doc/6693400

*BlackRock (USA, Finance and payments) Status by KSE – stay

The Arbitration Court of the Moscow Region, at the request of gold miner Vysochaishy (GV Gold), temporarily limited the rights of the company’s foreign shareholder, the BlackRock fund.

18.05.2024

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

SLB-based oilfield services provider SLB has said it has no current plans to end its operations in Russia despite the ongoing conflict with Ukraine and resulting Western pressure

*CHR Hansen (Denmark, Chemical industry) Status by KSE – leave

Foreign owners of the company Chr. Hansen has decided to stop supplying Russia, its Russian division said in a letter to customers.

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

*Commerzbank (Germany, Finance and payments) Status by KSE – leave

A Russian court has ordered that Deutsche Bank’s and Commerzbank’s assets, accounts, property and shares be seized in Russia as part of a lawsuit involving the German banks, court documents showed.

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – exited

The transfer of funds from Russia abroad by the IKEA structure is recognized as immoral

https://www.kommersant.ru/doc/6711517

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

The Arbitration Court of St. Petersburg and the Leningrad Region seized the Russian assets and accounts of UniCredit Bank JSC and UniCredit Bank AG (Munich) based on the claim of Ruskhimalliance, it follows from the court file.

https://www.kommersant.ru/doc/6711415?from=top_main_1&ref=dron.media

*Danone (France, FMCG) Status by KSE – exited

Completion by Danone of the sale of its EDP business in Russia

https://www.kommersant.ru/doc/6711485

*Microsoft (USA, IT) Status by KSE – stay

Microsoft began to disconnect Russian companies from cloud services

https://www.epravda.com.ua/news/2024/05/17/713851/

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Ben & Jerry’s owner to keep making Soviet-style ice cream despite pressure to quit Russia

https://www.telegraph.co.uk/business/2024/05/16/unilever-keep-making-ice-cream-russia-spin-off-plan/

20.05.2024

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Cadbury owner Mondelez is set to be probed over selling chocolate in Russia at its AGM

https://www.grocerygazette.co.uk/2024/05/20/cadbury-owner-inquiry-russia/

21.05.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisenbank helped Putin’s oligarch to get his business out of sanctions. How to prevent Russia from unlocking assets?

22.05.2024

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Russian court bans Austria’s OMV from non-Russia arbitration against Gazprom

https://uk.finance.yahoo.com/news/russian-court-bans-austrias-omv-075543357.html

*SAP (Germany, IT) Status by KSE – leave

Billionaire urges Russian firms to build alternative to SAP software

https://www.yahoo.com/tech/billionaire-urges-russian-firms-build-152352737.html

*Changan (China, Automotive) Status by KSE – stay

Volga floods Camry

https://www.kommersant.ru/doc/6713863

*Robert Bosch (Germany, Electronics) Status by KSE – exited

The St. Petersburg Bosch plant was transferred to the control of Gazprom

https://www.kommersant.ru/doc/6714467

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

Nokian Tires will suspend tire production at its plant in Finland

23.05.2024

*ONGC (India, Energy, oil and gas) Status by KSE – stay

Indian ONGC cannot transfer the share of the Sakhalin-1 liquidation fund

*American Express (USA, Finance and payments) Status by KSE – leave

Russian President Vladimir Putin allowed American Express Bank to carry out voluntary liquidation measures in the manner prescribed by the legislation of the Russian Federation.

24.05.2024

*TikTok (China, Online Services) Status by KSE – leave

TikTok Moves to Limit Russian and Chinese Media’s Reach in Big Election Year

*Glencore (Switzerland, Agriculture) Status by KSE – exited

Glencore, Rusal extend aluminium supply contract into 2025

25.05.2024

*Hikvision (China, Electronics) Status by KSE – stay

A giant Chinese surveillance camera manufacturer secretly fled Russia. The site is not working, the phones are not answering

https://biz.cnews.ru/news/top/2024-05-24_gigantskij_kitajskij_proizvoditel

26.05.2024

*FedEx (USA, Logistics, Transport) Status by KSE – leave

FedEx Restores Priority Services To Kyiv Amid Ukraine Crisis; Russian, Belarusian Operations Remain Suspended

*Ajaokuta (Nigeria, Metals and Mining) Status by KSE – stay

FG Seeks $2bn Funding from Russian, Chinese Investors to Revive Ajaokuta Steel Plant

27.05.2024

*Mondelez (USA, Food & Beverages) Status by KSE – stay

The European Commission has fined Mondelēz International, Inc. (Mondelēz) €337.5 million for hindering the cross-border trade of chocolate, biscuits and coffee products between Member States, in breach of EU competition rules.

https://ec.europa.eu/commission/presscorner/detail/en/ip_24_2727

*PCK Raffinerie GmbH (Germany, Energy, oil and gas) Status by KSE – stay

*PERN (Poland, Energy, oil and gas) Status by KSE – stay

The Polish operator PERN, the Russian Transneft and the German PCK Schwedt agreed to resolve problems with payment for the transit of Kazakh oil to Germany,

https://www.rbc.ru/politics/25/05/2024/665227329a79479a8938ee6e

*SAP (Germany, ТІ) Status by KSE – exited

Billionaire urges Russian firms to build alternative to SAP software

28.05.2024

*Tether (China, Finance and payments) Status by KSE – stay

Russian Firms Turn to Crypto for China Commodities Trade

*Tigers Realm Coal (Australia, Metals and Mining) Status by KSE – leave

Tigers Realm Coal Limited (ASX: TIG) has announced plans to sell its Russian assets due to operational challenges stemming from the Russia-Ukraine conflict, including sanctions from Western countries and countermeasures from Russia making business increasingly difficult.

https://www.tipranks.com/news/company-announcements/tigers-realm-coal-announces-russian-asset-sale

*Stellantis (Netherlands, Automotive) Status by KSE – leave

The Automotive Technologies company announced the start of sales of crossovers under the Citroen C5 Aircross brand, assembled at the PSMA Rus plant in Kaluga. Production began in March without permission from the European company Stellantis, which owns the rights to the brand. She left Russia after the start of the war in Ukraine.

https://www.interfax.ru/business/962451

*Avon (USA, Consumer goods and clothing) Status by KSE – stay

*Air Liquide (France, Energy, oil and gas) Status by KSE – stay

Western business began to abandon plans to leave Russia

https://www.ft.com/content/88b047e9-8cad-426a-b649-265ff6582db0

29.05.2024

*HSBC (Great Britain, Finance and payments) Status by KSE – exited

Expobank JSC successfully closed the deal and acquired 100% of the shares of HSBC Bank (RR) LLC from HSBC Europe B.V.

https://expobank.ru/about/press-center/2024.05/921520/

*Reliance (India, Energy, oil and gas) Status by KSE – stay

India’s Reliance Industries operator of the world’s biggest refining complex, has signed a one-year deal with Russia’s Rosneft to buy at least 3 million barrels of oil a month in roubles

*Philips (Netherlands, Electronics) Status by KSE – stay

*Robert Bosch (Germany, Electronics) Status by KSE – exited

*Delonghi (Italy, Electronics) Status by KSE – stay

Household appliances from Bosch, Delonghi and Philips, produced for the Ukrainian market, began to be supplied to the Russian Federation and sold through marketplaces and electronics store chains

https://www.kommersant.ru/doc/6729546?tg

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

The Russian court partially satisfied the claim for the withdrawal of €239 million from Deutsche Bank

https://www.epravda.com.ua/news/2024/05/29/714375/

*Alibaba (China, Online trading) Status by KSE – leave

*AliExpress (China, Consumer goods and clothing) Status by KSE – leave

The Chinese company Alibaba, which owns the AliExpress marketplace, has tightened conditions for Russian business: it has stopped accepting rubles and does not allow delivery to Russia.

30.05.2024

*Kozloduy Nuclear Power Plant (Bulgaria, Energy, oil and gas) Status by KSE – leave

Bulgaria’s sole Kozloduy nuclear power plant (NPP) will terminate its contract with Russia for the supply of fresh nuclear fuel, having switched to fuel delivered by U.S.-based Westinghouse Electric for one of its two operating reactors

https://seenews.com/news/kozloduy-npp-to-cancel-russian-fuel-supply-deal-report-859251

*Habib Al Mulla and Partners (United Arab Emirates, Consulting, Law) Status by KSE – stay

UAE-based law firm Habib Al Mulla and Partners set a new milestone as it established its presence in Russia with the opening of an office in Moscow, becoming the first Arab law firm to do so.

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

The EU wants to force Telegram to fight Russian disinformation

*Nokia (Finland, IT) Status by KSE – leave

On May 29, a decree was issued that allows Rostelecom’s subsidiary to buy 49% of Nokia’s shares.

31.05.2024

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

French President Emmanuel Macron personally intervened to persuade Canadian Prime Minister Justin Trudeau to give Airbus and other aerospace firms relief from sanctions on Russian titanium

*Docker (USA, IT) Status by KSE – leave

On the night of May 30, 2024, the well-known Docker Hub service for programmers closed access for users from Russia.

*Ritter Sport (Germany, Food & Beverages) Status by KSE – stay

The CEO of chocolate manufacturer Ritter Sport – Alfred Ritter – Andreas Ronken said that he considers the right decision to refuse to leave the Russian market after the outbreak of hostilities in Ukraine.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website