- Kyiv School of Economics

- About the School

- News

- 64th issue of the regular digest on impact of foreign companies’ exit on RF economy

64th issue of the regular digest on impact of foreign companies’ exit on RF economy

6 May 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 04.03.2024-01.04.2024

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

KSE DATABASE SNAPSHOT as of 06.05.2024

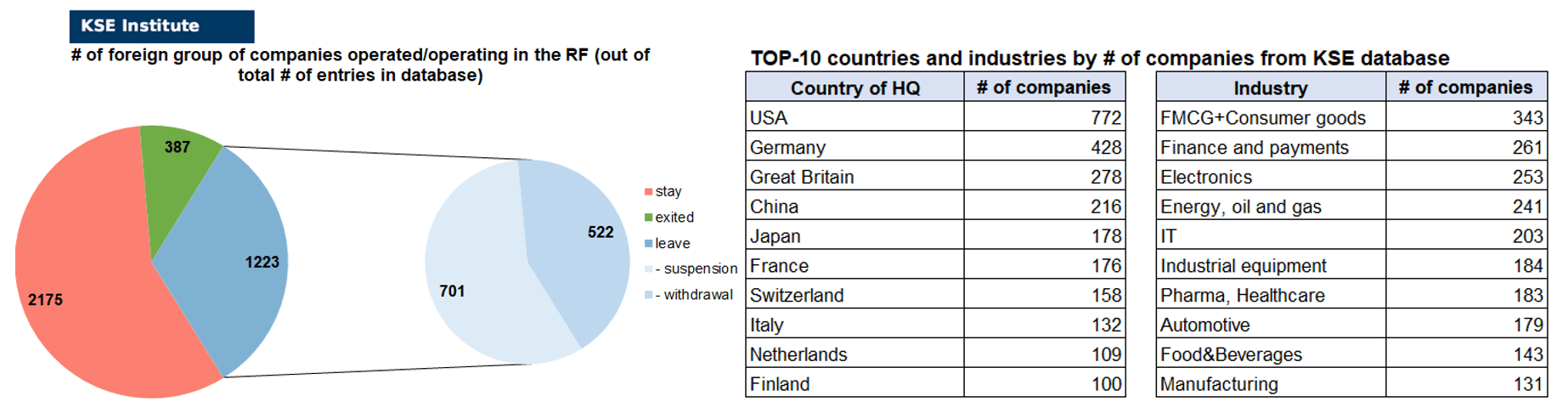

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 175 (+5 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 223 (+12 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 387 (+9 per month)

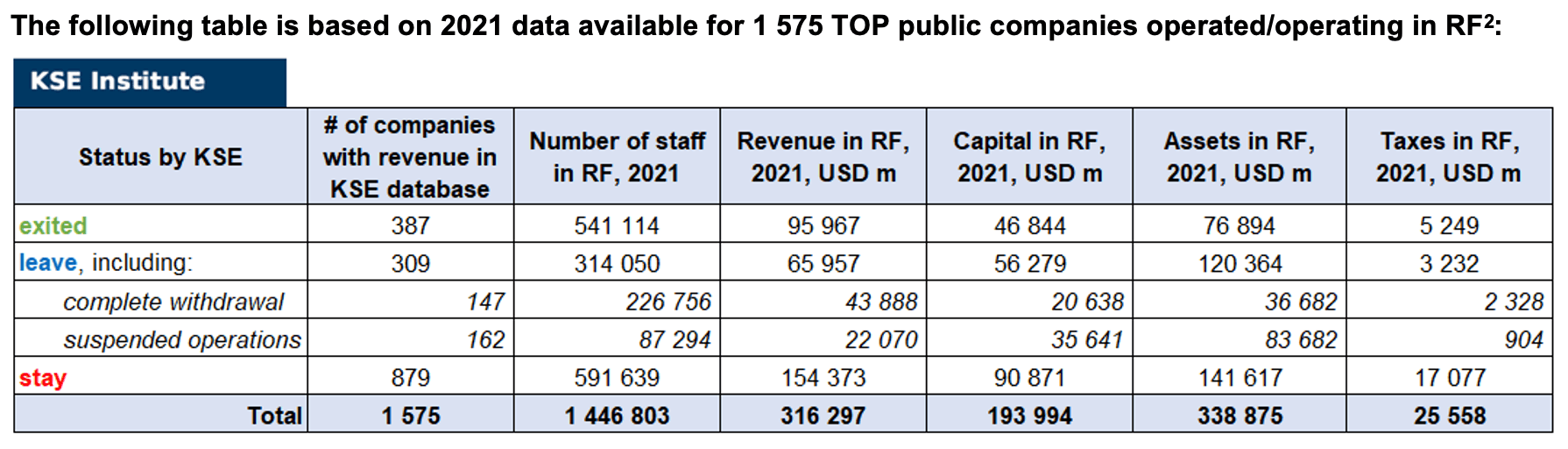

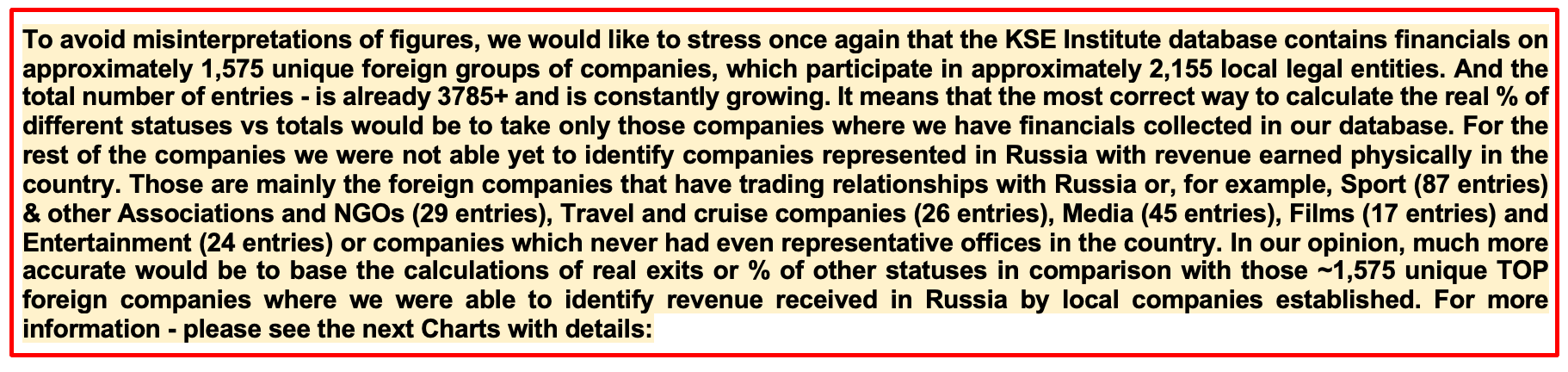

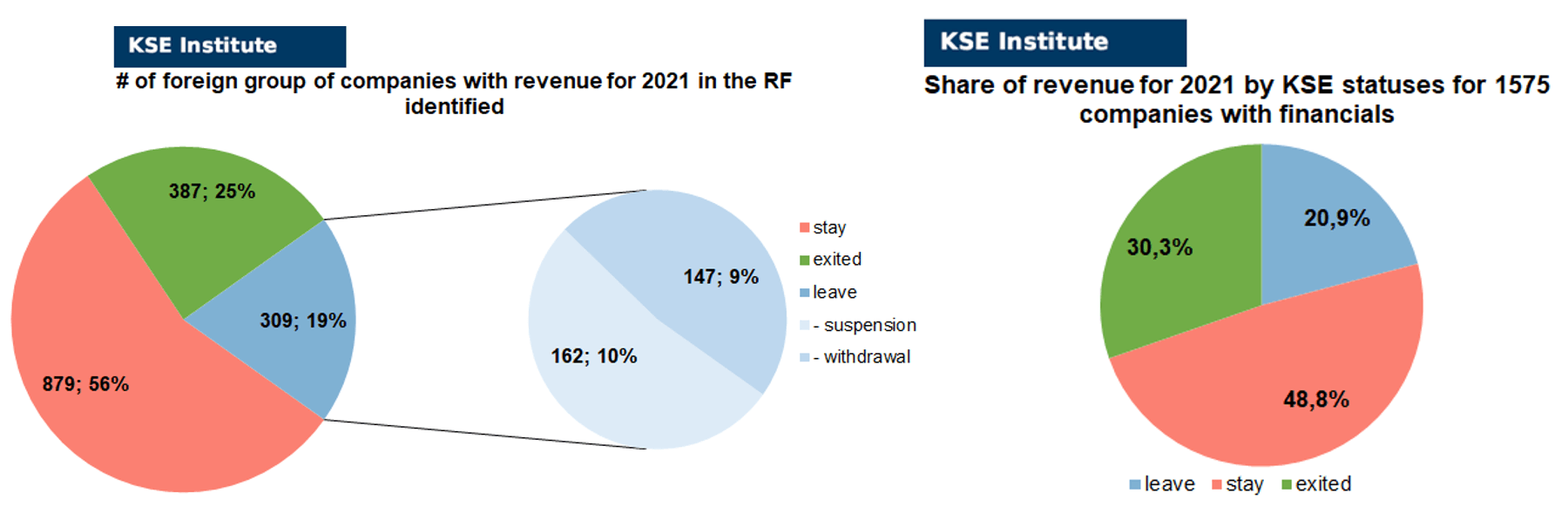

As of May 6, 2024, we have identified about 3,785 companies, organizations and their brands from 102 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 575 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $194.0 billion), local revenue (about $316.3 billion), local assets (about $338.9 billion) as well as staff (about 1.447 million people) and taxes paid (about $25.6 billion). 1,223 foreign companies have suspended or ceased operations in Russia. Also, we added information about 387 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (6 full business liquidations and 3 business sales took place in April 2024).

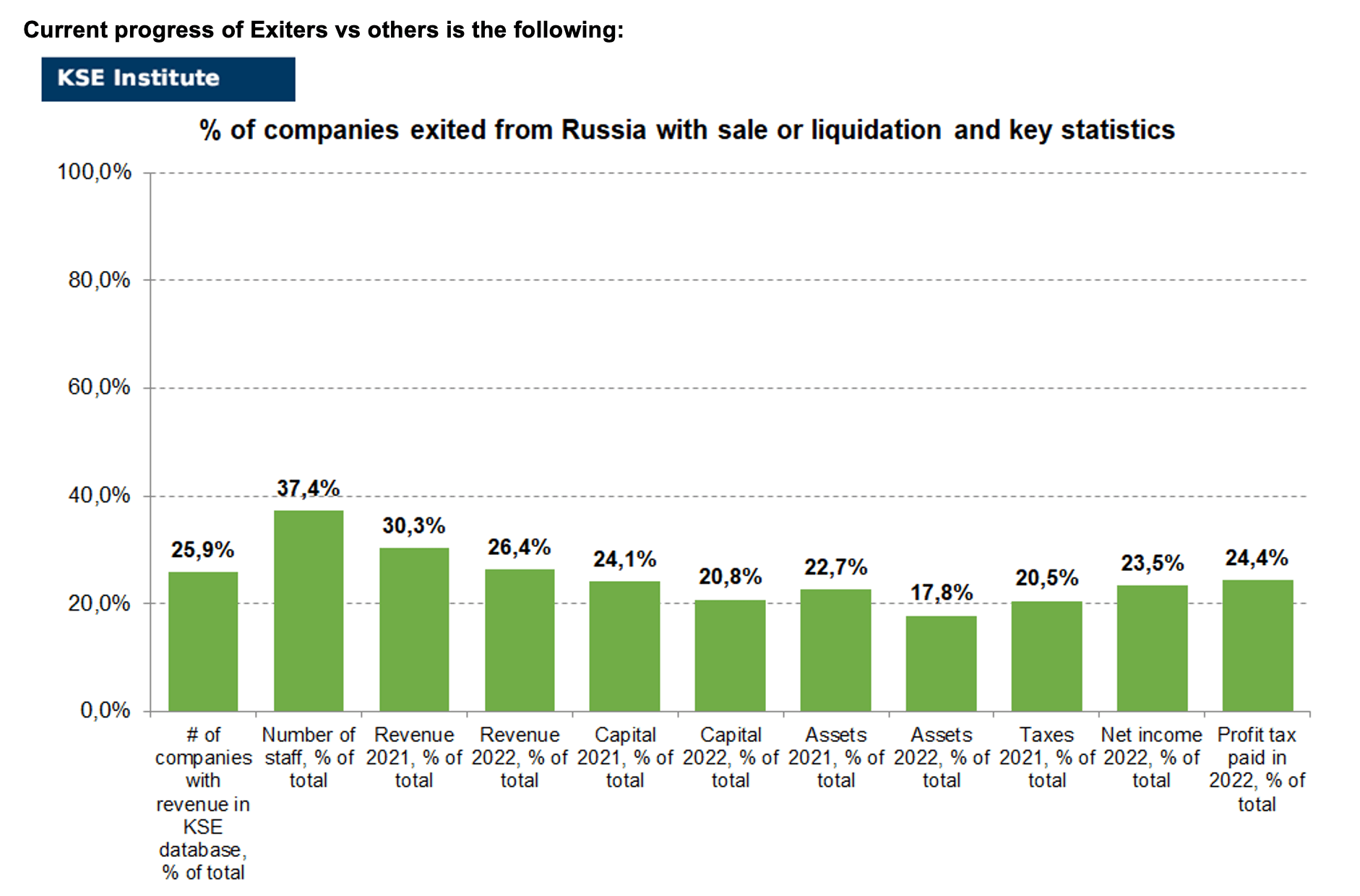

As can be seen from the tables below, as of May 6, 2024, 387 companies which had already completely exited from the Russian Federation, in 2021 had at least 541,100 personnel, $96.0 bn in annual revenue, $46.8bn in capital and $76.9bn in assets; companies, that declared a complete withdrawal from Russia had 226,800 personnel, $43.9bn in revenues, $20.6bn in capital and $36.7bn in assets; companies that suspended operations on the Russian market had 87,300 personnel, annual revenue of $22.1bn, $35.6bn in capital and $83.7bn in assets.

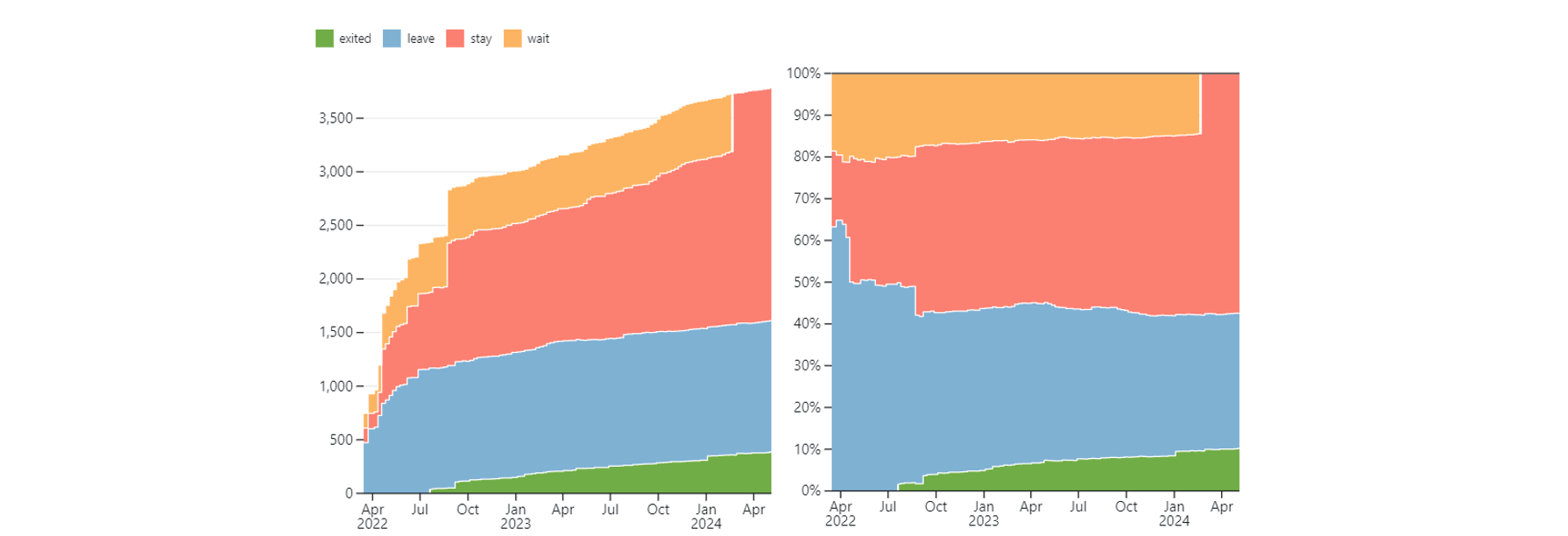

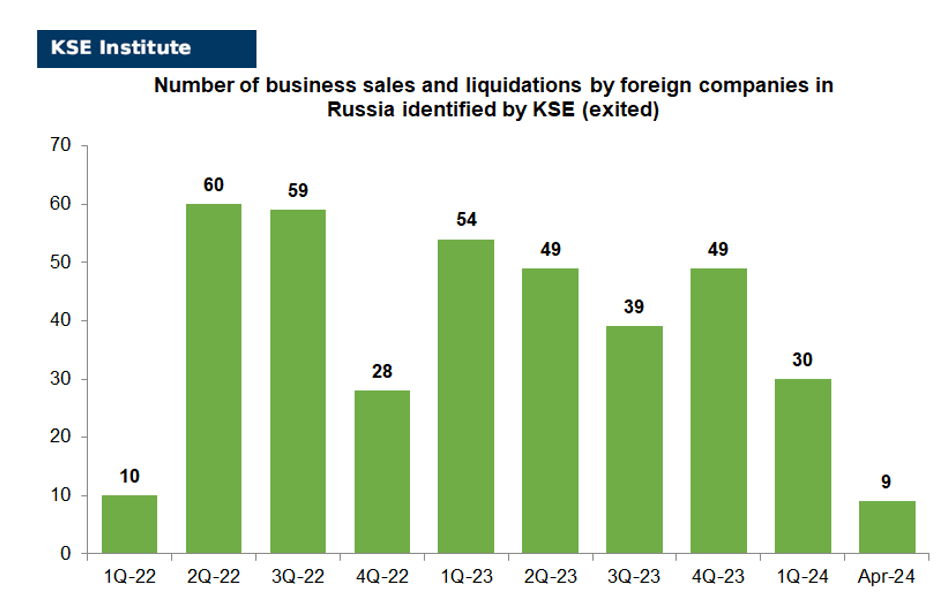

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 20 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 26 were added in April 2024). However, if to operate with the total numbers in KSE database, about 32.3% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 57.5% are still remaining in the country and only 10.2% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 387 companies that completely left the country, since in 2021 they employed 37.4% of the personnel employed in foreign companies, the companies owned about 22.7% of the assets, had 24.1% of capital invested by foreign companies, and in 2021 they generated revenue of $96.0 billion or 30.3% of total revenue and paid ~$5.25 billion of taxes or 20.5% of total taxes paid by the companies observed. Data on 1,575 TOP companies is presented in the table above.

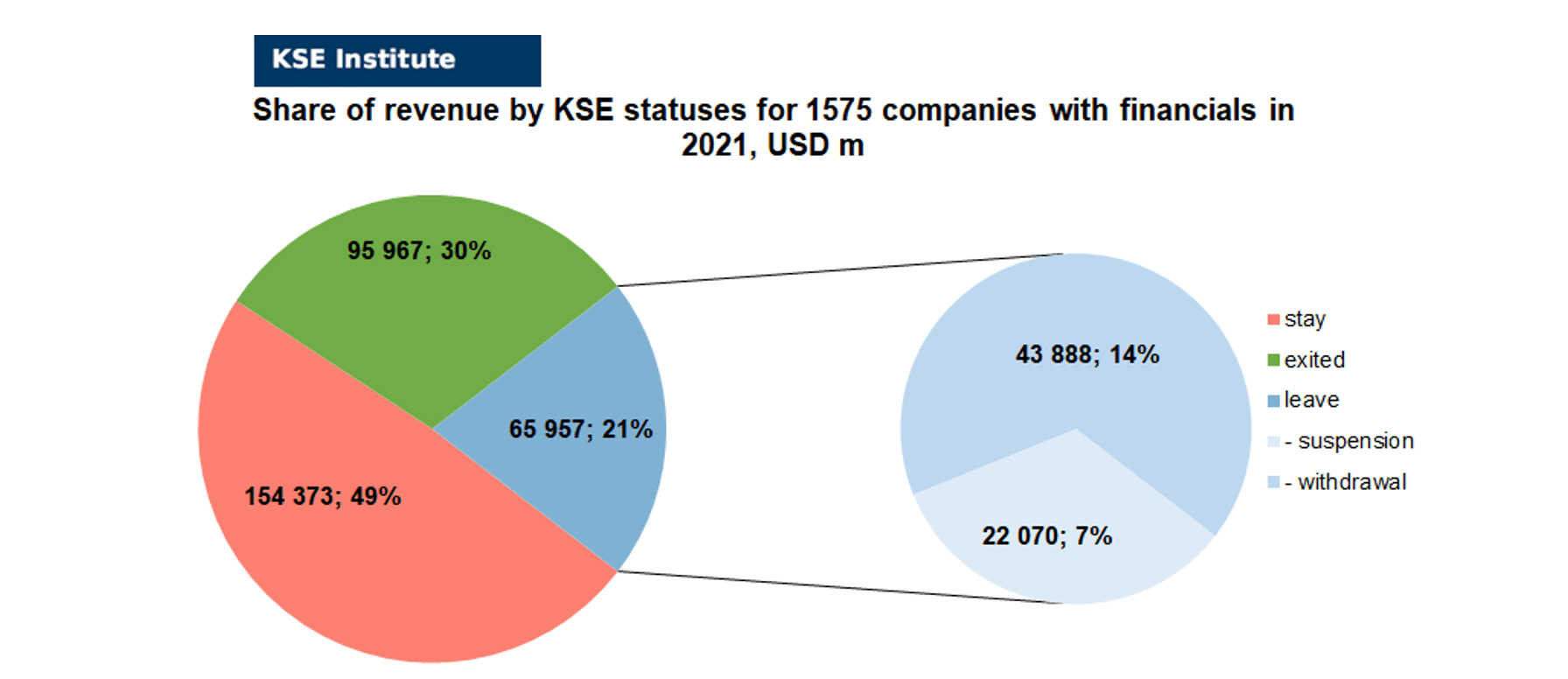

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (25%) and on share of revenue withdrawn (30.3%). At the same time, a totally different picture is for those who are still staying – 56% of companies represent 48.8% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

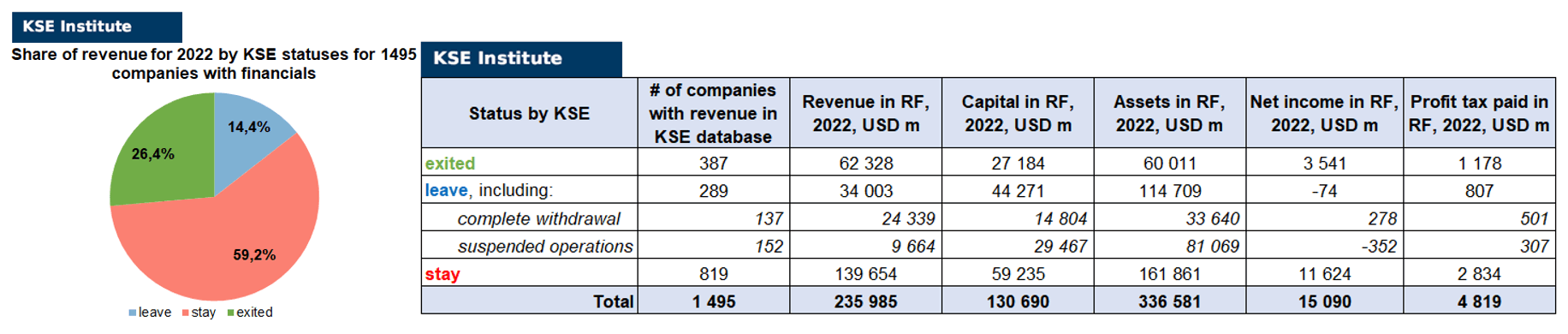

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1495 companies (about 80 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

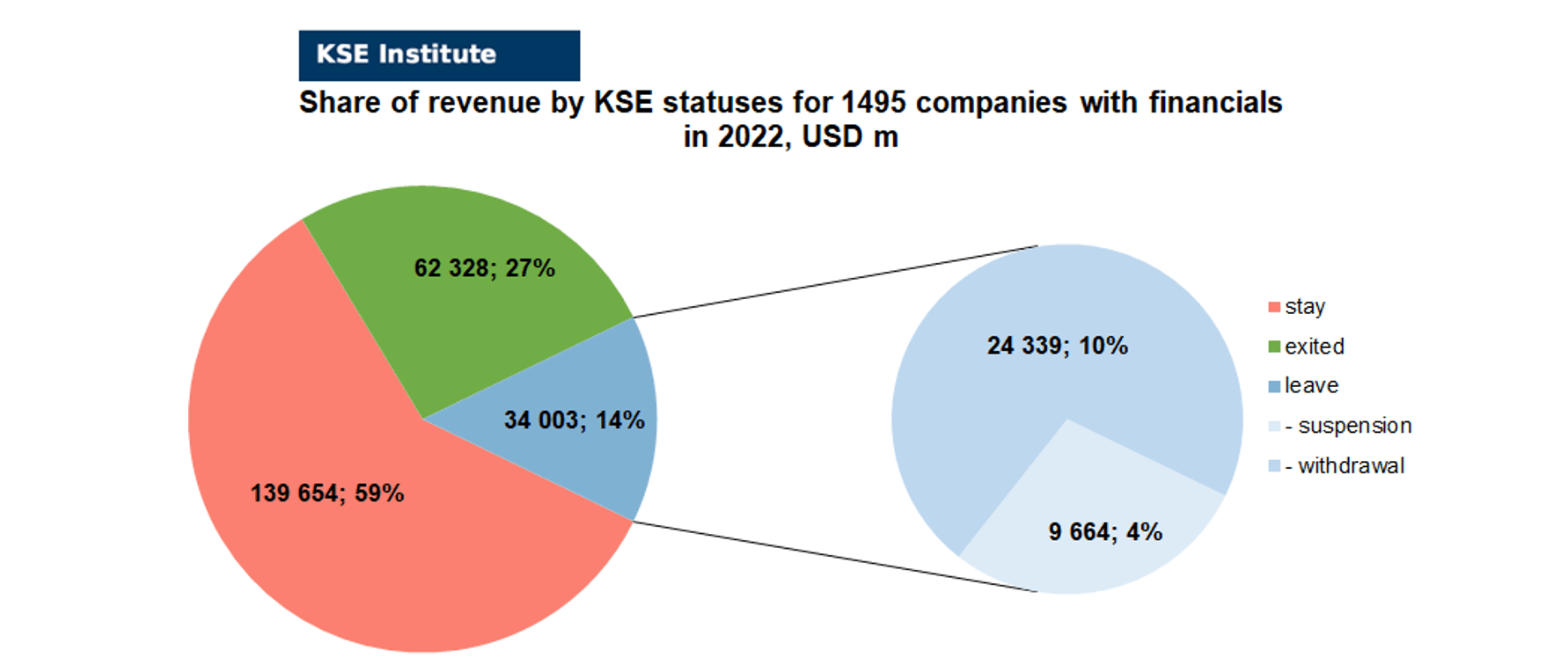

As you can see from the charts above, companies which fully exited Russia were able to generate 3.9% less of revenue in 2022 (26.4% from total volume) than in 2021 (30.3% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.5%) revenue in 2022 (14.4% from total volume) than in 2021 (20.9% from total volume). At the same time, staying companies were able to generate much (+10.4%) more revenue in 2022 (59.2% from total volume) than in 2021 (48.8% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($336.6bn⁴ in 2022 vs $338.9bn in 2021) and would even probably increase if the remaining reporting for ~80-90 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

MONTHLY FOCUS: On leaving the Russian Federation. Results of April 2024

In this digest, we will summarize the results of April 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’575 companies identified in the KSE database with revenue data available of more than $316 billion in 2021 and ~$236 billion in 2022. And at least 387 of them have already been sold by local companies or were liquidated and left the Russian market. In April 2024 KSE Institute identified +9 new exits (also status of Maersk was downgraded and status of Decathlon was upgraded. 3 business sales and 6 liquidations took place in April 2024)⁵, total number of exits observed since the beginning of Russia’s invasion reached 387.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 30% based on revenue allocation, those who are leaving represent 21% of total revenue (with 33% share of suspensions and 67% of withdrawals sub-statuses), % of staying companies represent 49% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is ~ equal with % of leaving ones (which means that about 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 27% based on revenue allocation, those who are leaving represent only 14% of total revenue (with 28% share of suspensions and 72% of withdrawals sub-statuses), % of staying companies represent 59% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

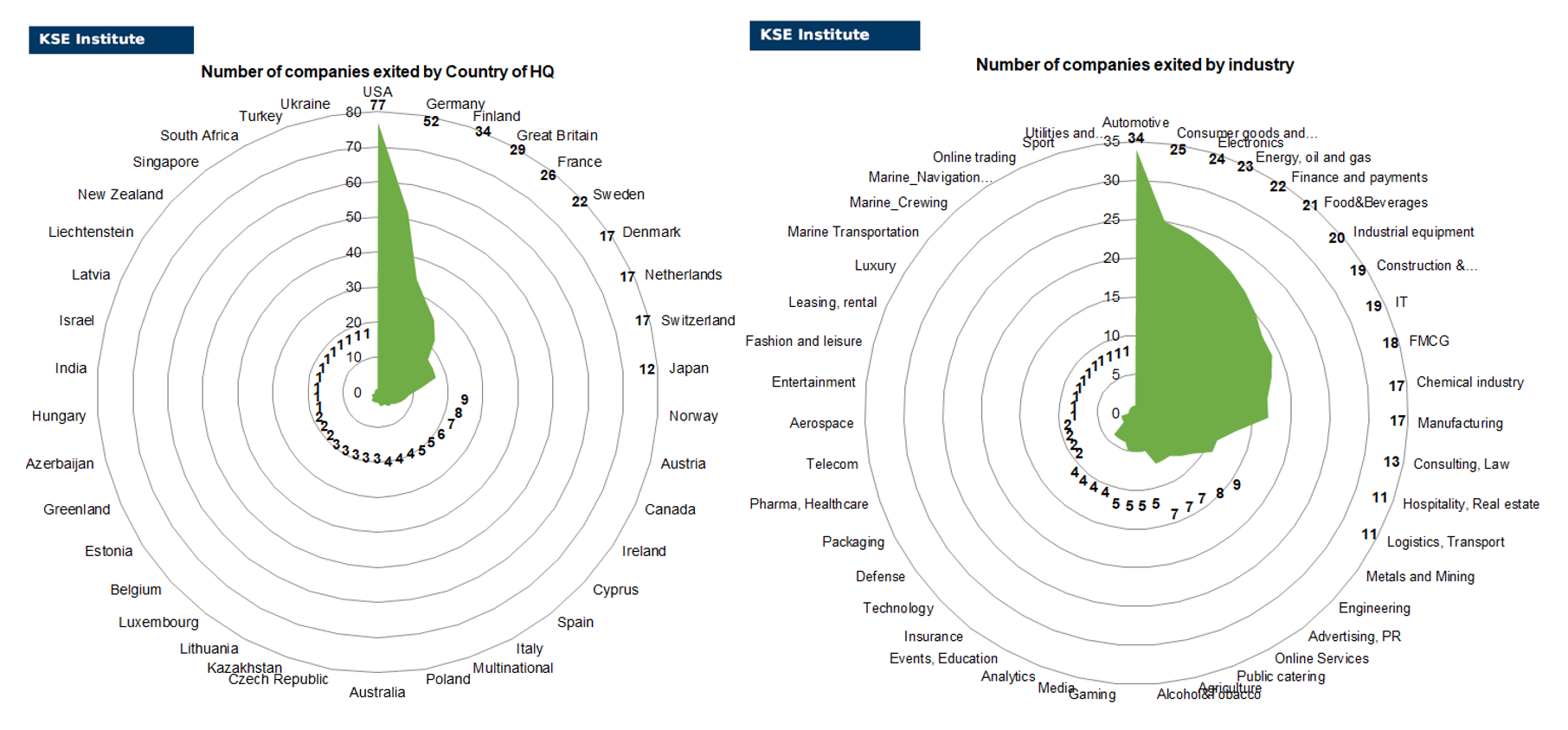

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of April 2024, companies from 37 countries and 43 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Acerinox (liquidation), Banner Batterien (liquidation), DEME Group (liquidation), Gameloft (liquidation), Veeam (liquidation, not accounted before), Vestas (liquidation). Also, 3 business sales took place in April 2024: KION Group, Viciunai group (sold its factory in Russia after a lengthy process, gave up rights to “VICI” trademark in the region) and WeWork.

Additionally, a few final liquidations of the smaller companies which were sold before took place in April 2024: Inditex liquidated legal entities Bershka CIS LLC and STRADIVARIUS CIS LLC; Siemens liquidated LLC “SMART INDUSTRY SOFTWARE”. Also, we downgraded the status of Maersk as it has stopped the liquidation of its Russian business in 2023. In February 2024, the company received 20 million rubles as an additional contribution to property. In November 2023 and January 2024, Maersk and Maersk Solutions extended the lease of offices in Moscow and St. Petersburg for another 11 months. On the other side, we upgraded the status of Decathlon as formally the sale took place in 2023 and the new chain of sports stores Desport has received a noticeable amount of excess retail space in Russia and is trying to fill it by leasing it to players in related sectors – fitness clubs, sports schools and sellers of related products.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: AgroTerra (According to the decree on the transfer of assets of the Agroterra company, one of the top 15 largest landowners in the country, under state control, 100% of Agroterra, which owns lands in Kursk, Oryol, Lipetsk, Tula, Ryazan, Tambov, was transferred to the “temporary management” of the Federal Property Management Agency. and Penza regions. In addition, the Federal Property Management Agency received 100% of its financial subsidiary AgroTerra (Capital AgroFinance), as well as AgroSistema LLC and AgroSistema-Regions LLC. The actual owner of the Russian group is the Dutch holding AgroTerra Invetments B.V.), Ariston and linked with Bosch BSH Hausgerte GmbH (By his decree, Vladimir Putin transferred 100% of the shares of the Russian subsidiaries of Ariston and Bosch (BSH Hausgerte GmbH) to the management of Gazprom Household Systems), Auchan (made just some optimizations in property management, Auchan’s subsidiary sold its assets in Russia. “Trading Galleries” became the new owner of the assets (real estate) of Ceetrus on April 12), Crayon Group AS (Crayon sold 80% of Crayon Russia’s (currently named “Crayon” LLC) shares to local management in December 2022, with the transaction currently being at the final step before the completion of the transaction, awaiting the consent of the Russian Governmental Commission), Embracer Group (Embracer Group will split into three separate companies, and 4A Games will not become a Russian company after all), Hugo Boss (Stockmann became the buyer of the Russian business of the German clothing manufacturer Hugo Boss, which included 19 stores in Russia at the end of 2022. The deal, according to experts, could cost 800 million rubles, taking into account all the discounts. with a market value of the business of 1.8 billion rubles), JPMorgan (Russia to seize $440 million from JPMorgan: Russian Court Freezes JPMorgan Assets Under $440 Million Claim), Knauf (Knauf Group has decided to abandon its business in Russia and transfer it to local management. To complete the transaction, it is necessary to obtain approval from the Russian authorities. Knauf expects that the deal will save jobs for more than 4 thousand employees), Stellantis (The Stellantis concern in February 2024 announced that at the end of 2023 it was no longer related to both the joint venture in China with Dongfeng and the plant in Kaluga, control over which it considered lost. But the car plant in Kaluga, which had been shut down since April 2022, resumed production of French Stellantis cars: the Automotive Technologies company with little-known owners launched the assembly of the Citroen C5 Aircross. According to customs data, vehicle kits for assembly come from China from the Dongfeng Peugeot-Citroen Automobile plant. The Stellantis concern in February announced that at the end of 2023 it was no longer related to both the joint venture in China with Dongfeng and the plant in Kaluga, control over which it considered lost), Vanke (The Chinese Vanke Group has decided to finally get rid of its only project in Russia – the restoration of the former Imperial Orphanage near Zaryadye Park in the center of Moscow. The group agreed to sell an asset valued at RUB 30 billion).

The next review of deals for May 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁶

30.03.2024

*Southwind Airlines (Turkey, Air transportation) Status by KSE – stay

The Finnish transport and communications agency Traficom has banned the flights of the Turkish airline Southwind Airlines to Finland due to its connections with Russia.

https://www.unian.ua/economics/transport/tureckiy-aviakompaniji-zaboronili-litati-do-odniyeji-z-krajin-yevropi-cherez-zv-yazki-z-rf-12586869.html

https://www.turizmguncel.com/haber/avrupada-southwinde-skandal-yasak

01.04.2024

*Vanke (China, Hospitality, Real estate) Status by KSE – leave

The Chinese Vanke Group has decided to finally get rid of its only project in Russia – the restoration of the former Imperial Orphanage near Zaryadye Park in the center of Moscow.

02.04.2024

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Rosneft and Indian Oil Corp have yet to renew an oil supply deal that expired in March after they failed to agree on price and volumes, forcing India’s top refiner to return to spot markets.

*Southwind Airlines (Turkey, Air transportation) Status by KSE – stay

EU denies sanctions against Turkish airline flying to Russia

https://www.rbc.ru/politics/01/04/2024/660b02e69a794705a6859b55

*Entekhab Group (Iran, Electronics) Status by KSE – stay

*Vestel (Turkey, Electronics) Status by KSE – stay

Difficulties arose with the sale of the Turkish Vestel plant

https://www.kommersant.ru/doc/6609342

*Swatch (Switzerland, FMCG) Status by KSE – leave

*Prada (Italy, Luxury) Status by KSE – leave

*Fendi (Italy, Fashion and leisure) Status by KSE – leave

Global luxury closes stores

https://www.kommersant.ru/doc/6609338

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Gazprom asks Russian court to ban Austria’s OMV from pursuing international arbitration

*Pepsi (USA, Food & Beverages) Status by KSE – stay

The first stage of the Pepsico snacks and salty snacks plant was launched near Novosibirsk.

https://tass.ru/ekonomika/20404547

https://www.epravda.com.ua/news/2024/04/2/711911/

https://suspilne.media/718140-pepsico-vidkrila-novij-zavod-solonih-zakusok-u-rosii/

03.04.2024

*OWH SE (Germany, Finance and payments) Status by KSE – leave

The United States removed the former European branch of the Russian VTB bank from sanctions

*Viterra (Netherlands, Agriculture) Status by KSE – exited

The Russian assets of the international trader Viterra, who left the country, were transferred to different owners.

https://www.kommersant.ru/doc/6612078

*Apple (USA, Electronics) Status by KSE – stay

Apple Settles Russian Fine in In-App Payments Dispute

https://www.pymnts.com/cpi-posts/apple-settles-russian-fine-in-in-app-payments-dispute/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The petition regarding the withdrawal of Raiffeisen Bank from the Russian Federation has received 50,000 votes

04.04.2024

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – stay

*WKB Systems GmbH (Germany, Construction & Architecture) Status by KSE – stay

German companies help Russia rebuild occupied Mariupol

https://www.pravda.com.ua/eng/news/2024/04/4/7449621/

https://www.tagesschau.de/investigativ/monitor/ukraine-mariupol-wiederaufbau-russland-100.html

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Strabag (Austria, Construction & Architecture) Status by KSE – leave

Austrian central bank chief sees ‘tail risk’ in Raiffeisen’s Strabag deal

*Robert Bosch (Germany, Electronics) Status by KSE – exited

The German Bosch has found bidders for the purchase of its headquarters in Khimki near Moscow.

https://www.forbes.ru/biznes/509644-bosch-nasla-pretendentov-na-pokupku-svoej-stab-kvartiry-v-himkah

05.04.2024

*HP (Hewlett-Packard) (USA, Electronics) Status by KSE – leave

HP ends ties with Russia, shutting down its Russian website — website redirects to Kazakhstan with no support

06.04.2024

*Intel (USA, IT) Status by KSE – leave

Intel Corporation has sold its Nizhny Novgorod office – the largest in Russia, as follows from the reporting of one of Intel’s legal entities in the Russian Federation.

https://tass.ru/ekonomika/20450979?ysclid=lumqwam3cl776497857

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – stay

*Hellenic Bottling Company (Greece, Food & Beverages) Status by KSE – stay

*Coca-Cola (USA, Food & Beverages) Status by KSE – stay

Coca-Cola HBC’s Russian division quadruples profits on “Dobry Cola” sales after corporation vows to leave the country

07.04.2024

*KazMunayGas (Kazakhstan, Energy, oil and gas) Status by KSE – stay

LUKOIL paid $200 million to enter into joint projects with Kazmunaigas to develop the Kalamkas-Sea, Khazar and Auezov fields on the Caspian shelf.

09.04.2024

*AgroTerra (Netherlands, Agriculture) Status by KSE – leave

Putin confiscated one of the largest agricultural holdings in Russia from foreigners

*Viciunai group (Lithuania, Food & Beverages) Status by KSE – leave

Lithuanian surimi producer Viciunai Group has found a buyer for its Russian business almost two years after announcing its exit from the country.

*Pepsi (USA, Food & Beverages) Status by KSE – stay

PepsiCo’s subsidiary in Russia almost tripled its profits

11.04.2024

*Google (USA, Online Services) Status by KSE – exited

Russian court rejects Google’s appeal against $50-million fine over Ukraine content

*Microsoft (USA, IT) Status by KSE – leave

Microsoft Corporation does not plan to liquidate its legal entities in Russia, their financial statements for 2023 show.

12.04.2024

*MSD (USA, Pharma, Healthcare) Status by KSE – stay

Over the two years since the Russian-Ukrainian military conflict, the American pharmaceutical company MSD has reduced its portfolio of drugs sold in the Russian Federation by a quarter, although the pharmaceutical industry was not subject to Western sanctions.

https://www.kommersant.ru/doc/6636984

*Chakra (Turkey, Consumer goods and clothing) Status by KSE – stay

*Teddy Group (Italy, Consumer goods and clothing) Status by KSE – stay

Eight retailers have already opened their stores in Russian shopping centers since the beginning of this year.

https://www.kommersant.ru/doc/6636995

*Bacardi (Bermuda, Alcohol&Tobacco) Status by KSE – stay

The products of Bacardi Limited, the only transnational alcohol company that operated in Russia after the outbreak of the war in Ukraine, have almost completely disappeared from the shelves of Russian storeshttps://www.moscowtimes.ru/2024/04/11/chislo-atakuyuschih-rossiyu-hakerskih-gruppirovok-rezko-viroslo-s-nachala-goda-a127551

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Former Russian subsidiary demands US$950m from Carlsberg Group

13.04.2024

*Viciunai group (Lithuania, Food & Beverages) Status by KSE – leave

The Lithuanian company Vičiūnai supplied Russia with sanctioned goods, in particular, for the production of tanks

14.04.2024

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – stay

LME bans Russian-origin metal after UK, US impose new sanctions

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – leave

Japanese companies have withdrawn from the capital of a Russian lumber manufacturer

15.04.2024

*Asus (Taiwan, Electronics) Status by KSE – stay

*Micro-Star International Co. (MSi) (Taiwan, IT) Status by KSE – stay

Since the beginning of the year, the Taiwanese laptop brand MSI has lost its sales leadership in the Russian Federation to its compatriot Asus. Asus increased its share in the Russian market by about a third, occupying almost 18% of the market.

https://www.kommersant.ru/doc/6648387

*Tigers Realm Coal (Australia, Metals and Mining) Status by KSE – leave

Australian coal miner to sell Russian mines, port in fire sale

16.04.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank trumpets Russia growth plans in dozens of job ads

https://www.ft.com/content/380a348d-aade-4079-89d0-65cc0ca96d99

*Amazon (USA, Online Services) Status by KSE – stay

*GoDaddy (USA, Online Services) Status by KSE – leave

Amazon Web Services and GoDaddy websites blocked in Russia

https://www.rbc.ru/technology_and_media/16/04/2024/661edad59a794759567f8a4d?from=short_news

*Industrial and Commercial Bank of China (ICBC) (China, Finance and payments) Status by KSE – stay

*Industrial Bank (China) (China, Finance and payments) Status by KSE – stay

System block: four more large banks in China have stopped accepting yuan from the Russian Federation

17.04.2024

*Auchan (France, FMCG) Status by KSE – stay

Auchan denies rumors of leaving the Russian market

18.04.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

ECB to push Austria’s Raiffeisen to cut back in Russia

*MinFound (China, Pharma, Healthcare) Status by KSE – stay

The Chinese manufacturer of tomographs MinFound registers its products in Russia, and R-Pharm, founded by Alexey Repik, can handle its distribution

https://www.kommersant.ru/doc/6650749

*Starbucks (USA, Public catering) Status by KSE – exited

Russian court contemplates terminating Starbucks trademark rights

https://menafn.com/1108109505/Russian-court-contemplates-terminating-Starbucks-trademark-rights

8UniCredit Bank ( Italy, Finance and payments) Status by KSE – stay

Gazprom Unit Fights Ruling Blocking Russian UniCredit Claim

https://www.law360.com/articles/1826313/gazprom-unit-fights-ruling-blocking-russian-unicredit-claim

*LDV Group (Great Britain, Automotive) Status by KSE – stay

Russian carmaker GAZ Group agreed to buy British vanmaker LDV on Monday and said it planned to expand production at the firm’s plant in central England.

https://www.wardsauto.com/russias-gaz-group-buy-ldv-expand-uk-plant

*Axa (France, Finance and payments) Status by KSE – stay

FRENCH INSURER AXA SUPPORTS THE MAIN IMPORTER OF RUSSIAN GAS INTO EUROPE

19.04.2024

*Autodesk ( USA, IT) Status by KSE – exited

Autodesk stops access in the Russian Federation even to pirated versions of its software

https://www.kommersant.ru/doc/6651581

8UniCredit Bank ( Italy, Finance and payments) Status by KSE – stay

ECB set to order UniCredit to reduce Russia business

22.04.2024

*Tigers Realm Coal (Australia, Metals and Mining) Status by KSE – leave

Tigers Realm Coal said it will sell its assets, including two Siberian coking coal mines and an export terminal, for $49 million to APM-Invest, owned by Russian businessman Mark Buzuk.

https://news.finance.ua/ua/avstraliys-ka-hirnychodobuvna-kompaniya-vyhodyt-z-rynku-rf21.04.2024

*TikTok (China, Online Services) Status by KSE – leave

House approves bill to divest TikTok, freeze Russian assets

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – leave

German Knauf is leaving Russia after the construction scandal in occupied Mariupol

https://www.epravda.com.ua/news/2024/04/22/712712/

https://www.dw.com/ru/nemeckaa-kompania-knauf-obavila-o-polnom-uhode-iz-rossii/a-68885901

23.04.2024

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – leave

The Würzburg prosecutor’s office has launched an investigation into the German concern Knauf in connection with German media reports that the company’s products are widely used in the reconstruction of Mariupol, which was destroyed by Russian troops and captured by them during the war against Ukraine.

https://www.dw.com/ru/prokuratura-v-frg-nacala-dosledstvennuu-proverku-koncerna-knauf/a-68893710

*Turkish Airlines (Turkey, Air transportation) Status by KSE – stay

The Turkish airline Turkish Airlines continues to remove Russians from flights to Latin American countries.

24.04.2024

*Astronics (USA, Aerospace) Status by KSE – stay

The French company continues to service Putin’s and Shoigu’s liners, despite the sanctions

https://focus.ua/world/642177-francuzskaya-kompaniya-osnashchaet-park-vip-samoletov-putina-i-shoygu-le-parisien

*Airbus (Netherlands, Aircraft industry) Status by KSE – stay

Airbus wins reprieve from Canadian sanctions on Russian titanium

*Hugo Boss (Germany, Luxury) Status by KSE – leave

Stockmann became the buyer of the Russian business of the German clothing manufacturer Hugo Boss, which included 19 stores in Russia at the end of 2022. The deal, according to experts, could cost 800 million rubles, taking into account all the discounts. with a market value of the business of 1.8 billion rubles.

25.04.2024

*JPMorgan (USA, Finance and payments) Status by KSE – leave

A Russian court has ordered the seizure of JPMorgan Chase funds totalling $439.5mn a week after Kremlin-run lender VTB launched legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime.

https://www.ft.com/content/c2fc7827-fdce-458b-8416-1476208c22da

26.04.2024

*Ariston (Italy, Electronics) Status by KSE – leave

*Robert Bosch (Germany, Electronics) Status by KSE – exited

Russian dictator Vladimir Putin transferred the Russian subsidiaries of the Italian water heating company Ariston and the German manufacturer of household appliances BSH Hausgeraete to the temporary management of the Gazprom company.

*Scan Global Logistics (SGL) (Denmark, Logistics, Transport) Status by KSE – stay

Denmark’s Scan Global Logistics (SGL) has defended its continued use of Russia’s rail network to transport cargo between China and Europe, claiming its actions comply with all of the rules currently in place.

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

European Parliament calls on Austria to pressure Raiffeisen bank to leave Russia

https://finance.yahoo.com/news/european-parliament-calls-austria-pressure-231114300.html

*Turkish Airlines (Turkey, Air transportation) Status by KSE – stay

Russia accuses U.S. of pressuring Turkish Airlines to deny Russians flights to Mexico

https://uk.news.yahoo.com/russia-accuses-u-pressuring-turkish-120741299.html?guccounter=1

27.04.2024

*Nikon (Japan, Electronics) Status by KSE – stay

The Russian office of Nikon Corporation – Nikon LLC, whose founder is the Dutch legal entity of the corporation, does not rule out resuming supplies of products to the Russian market in the near future. This follows from the explanations to its financial statements, published in the Federal Tax Service database in early April.

https://www.tadviser.ru/a/373362

*Ice Pearl Navigation Corp (Turkey, Marine Transportation) Status by KSE – stay

US lifts sanctions on Turkish tanker for violating oil price ceiling

https://www.rbc.ru/politics/26/04/2024/662bc6799a79477d3afa53cf?from=newsfeed

28.04.2024

*Ariston (Italy, Electronics) Status by KSE – leave

Italy’s Ariston says it wasn’t notified of transfer of Russian assets

*Autoliv (Sweden, Automotive) Status by KSE – leave

Autoliv’s profits swell 75% in Q1, finds buyer for Russian business

*Peugeot Citroën (France, Automotive) Status by KSE – stay

Peugeot-Citroen to build Russia car plant-paper

https://www.wardsauto.com/peugeot-citroen-build-russia-car-plant-paper

29.04.2024

*Ariston (Italy, Electronics) Status by KSE – leave

*Robert Bosch (Germany, Electronics) Status by KSE – exited

The EU called on Russia to cancel the transfer of Ariston and Bosch assets to Gazprom

https://www.rbc.ru/rbcfreenews/662d33b19a7947323fb6ac8f

*Meta (USA, Online Services) Status by KSE – leave

EU to probe Meta over handling of Russian disinformation

https://www.ft.com/content/70dc27e8-07bd-40af-8b0e-d4623a3bcc0b

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Telegram blocked a number of official chatbots of Ukraine – GUR

https://www.epravda.com.ua/news/2024/04/29/713000/

Official Ukrainian bots, which help in the fight against Russian aggression, have resumed work

*International Basketball Federation (FIBA) (Switzerland, Sport) Status by KSE – leave

At the meeting of the FIBA Central Board held in Switzerland on April 26, it was decided to extend the current status of the national basketball federations of Russia and Belarus.

30.04.2024

*Japan Tobacco International (Switzerland, Alcohol&Tobacco) Status by KSE – stay

Japan Tobacco reshapes supply chains to protect Russia business

https://www.ft.com/content/a96fde2e-838f-4a86-bf37-27d9dffca613

*Delamode Baltics (Lithuania, Logistics, Transport) Status by KSE – stay

*Zetemzeja (Lithuania, Logistics, Transport) Status by KSE – stay

Lithuanian companies exported 130 million euros worth of military goods to the Russian Federation

01.05.2024

*Michelin Tyre (France, Automotive) Status by KSE – exited

Former Michelin Russian tire operations rebranded as Davydovo

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website