- Kyiv School of Economics

- About the School

- News

- 63rd issue of the regular digest on impact of foreign companies’ exit on RF economy

63rd issue of the regular digest on impact of foreign companies’ exit on RF economy

1 April 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 04.03.2024-01.04.2024

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

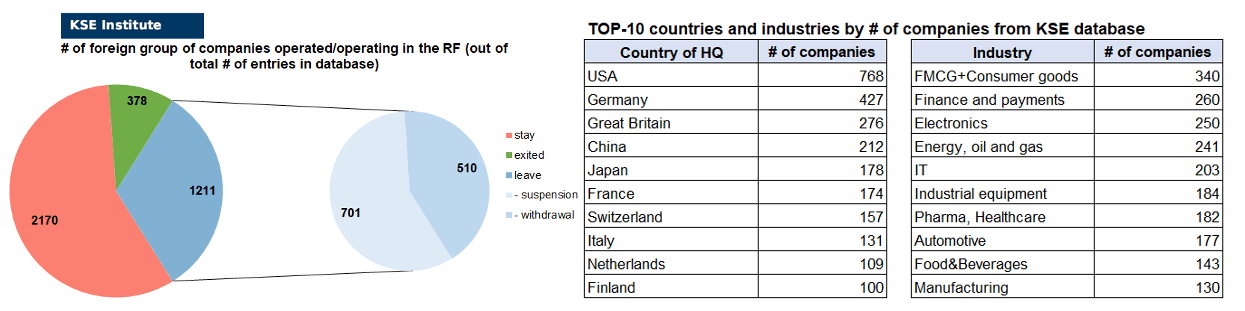

KSE DATABASE SNAPSHOT as of 01.04.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 170 (+19 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 211 (-4 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 378 (+6 per month)

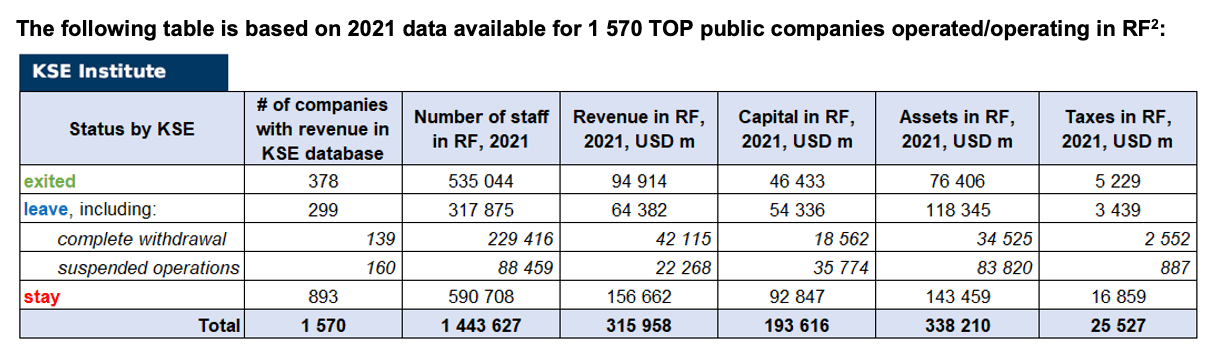

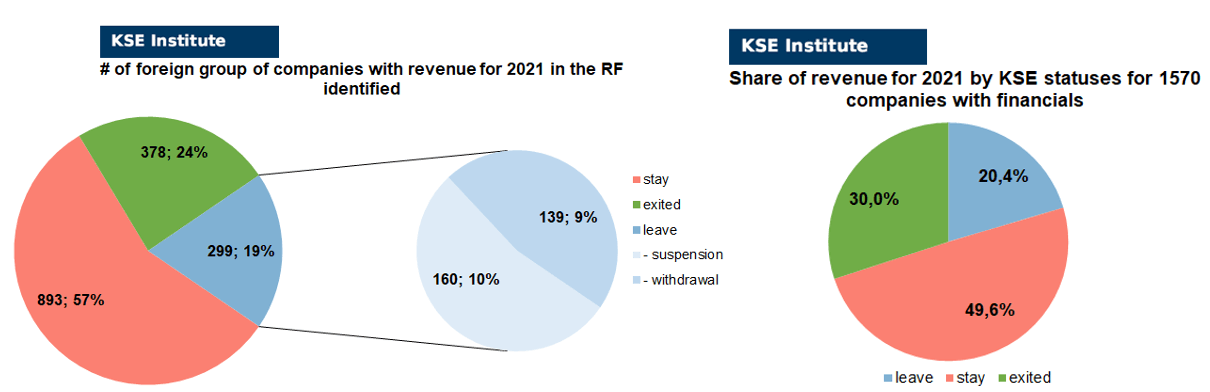

As of April 1, 2024, we have identified about 3,759 companies, organizations and their brands from 102 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 570 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.6 billion), local revenue (about $316.0 billion), local assets (about $338.2 billion) as well as staff (about 1.444 million people) and taxes paid (about $25.5 billion). 1,211 foreign companies have suspended or ceased operations in Russia. Also, we added information about 378 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (3 full and 2 partial business liquidations took place in March 2024).

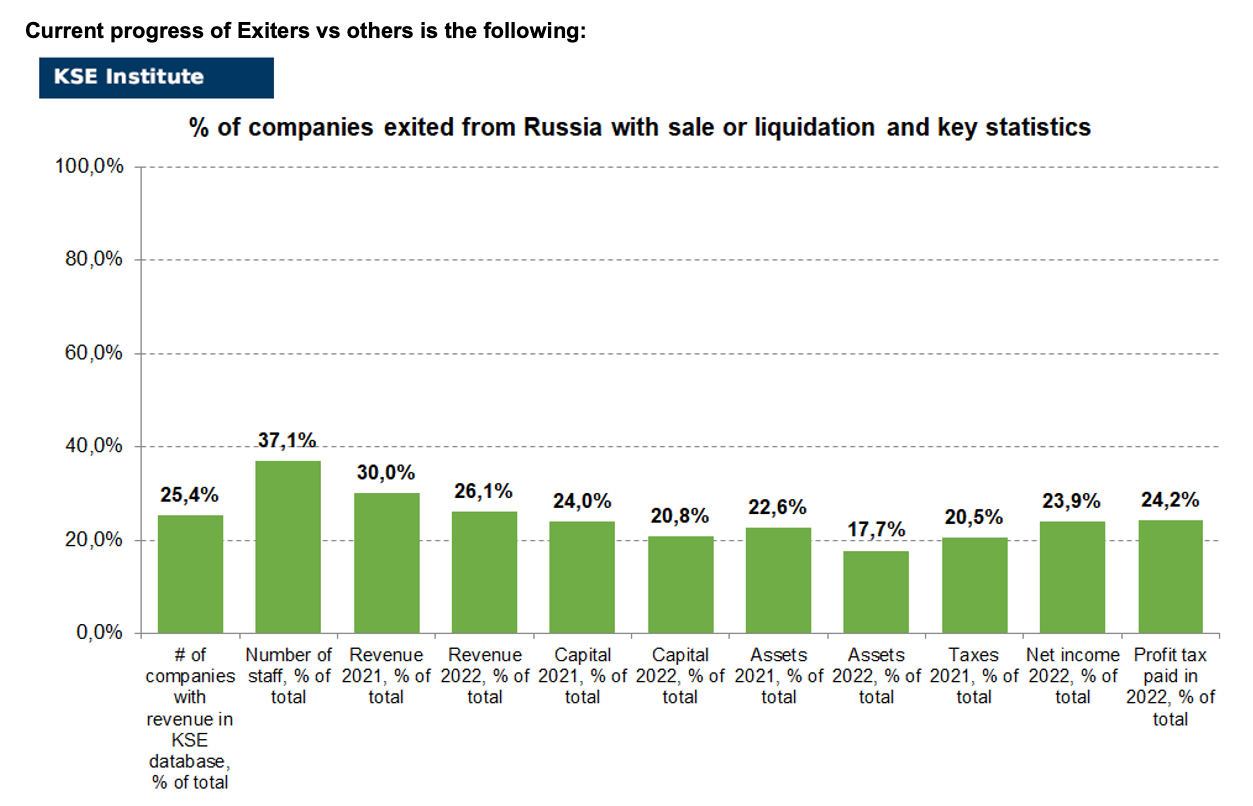

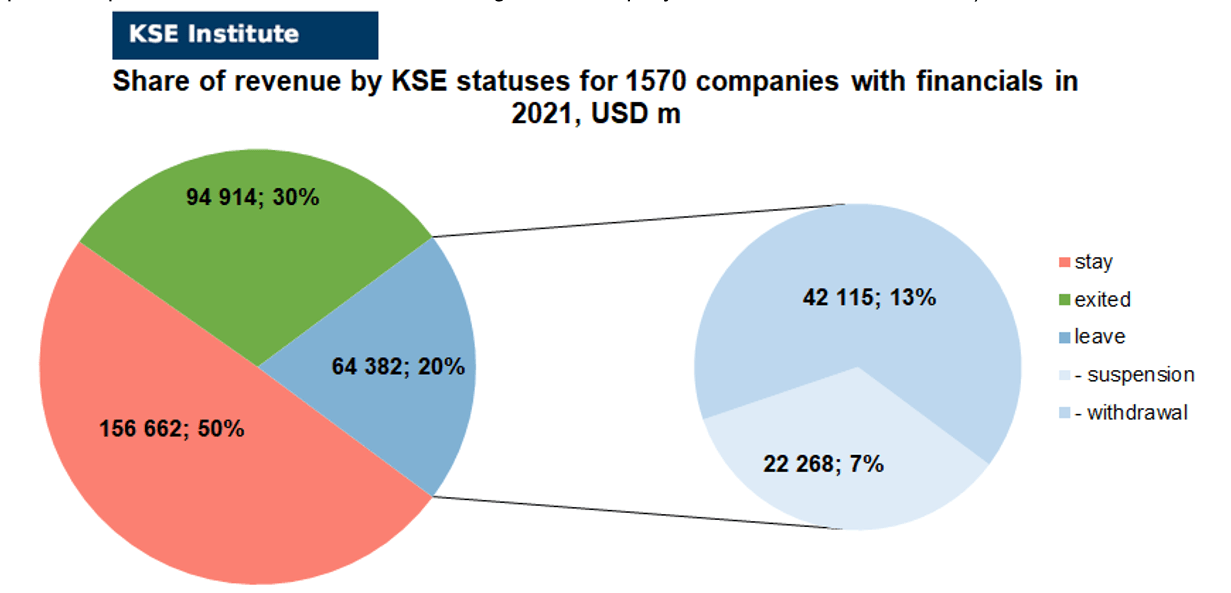

As can be seen from the tables below, as of April 1, 2024, 378 companies which had already completely exited from the Russian Federation, in 2021 had at least 535,000 personnel, $94.9 bn in annual revenue, $46.4bn in capital and $76.4bn in assets; companies, that declared a complete withdrawal from Russia had 229,400 personnel, $42.1bn in revenues, $18.6bn in capital and $34.5bn in assets; companies that suspended operations on the Russian market had 88,500 personnel, annual revenue of $22.3bn, $35.8bn in capital and $83.8bn in assets.

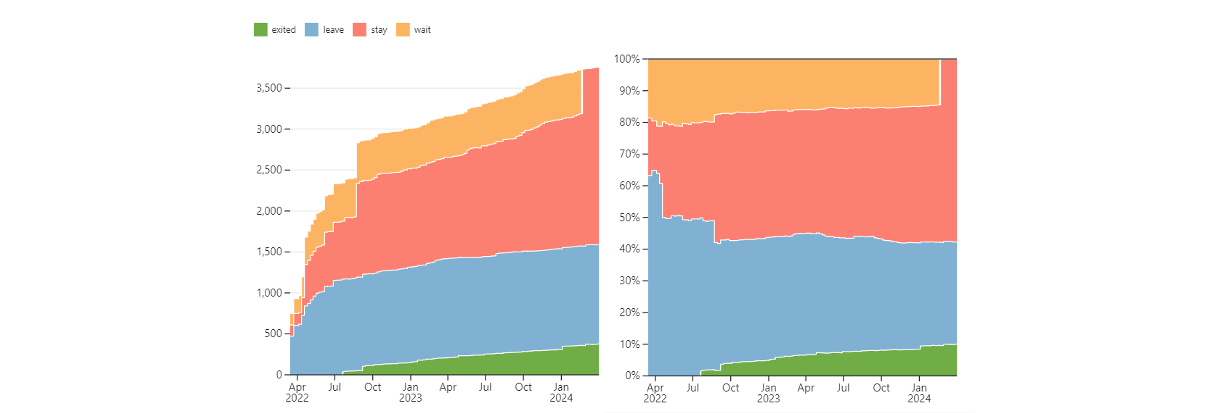

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 19 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 21 were added in March 2024). However, if to operate with the total numbers in KSE database, about 32.2% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 57.7% are still remaining in the country and only 10.1% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 378 companies that completely left the country, since in 2021 they employed 37.1% of the personnel employed in foreign companies, the companies owned about 22.6% of the assets, had 24.0% of capital invested by foreign companies, and in 2021 they generated revenue of $94.9 billion or 30.0% of total revenue and paid ~$5.2 billion of taxes or 20.5% of total taxes paid by the companies observed. Data on 1,570 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (24%) and on share of revenue withdrawn (30.0%). At the same time, a totally different picture is for those who are still staying – 57% of companies represent 49.6% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

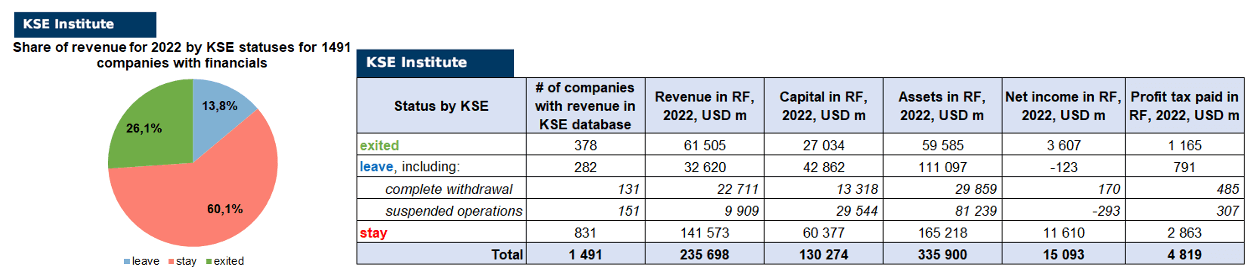

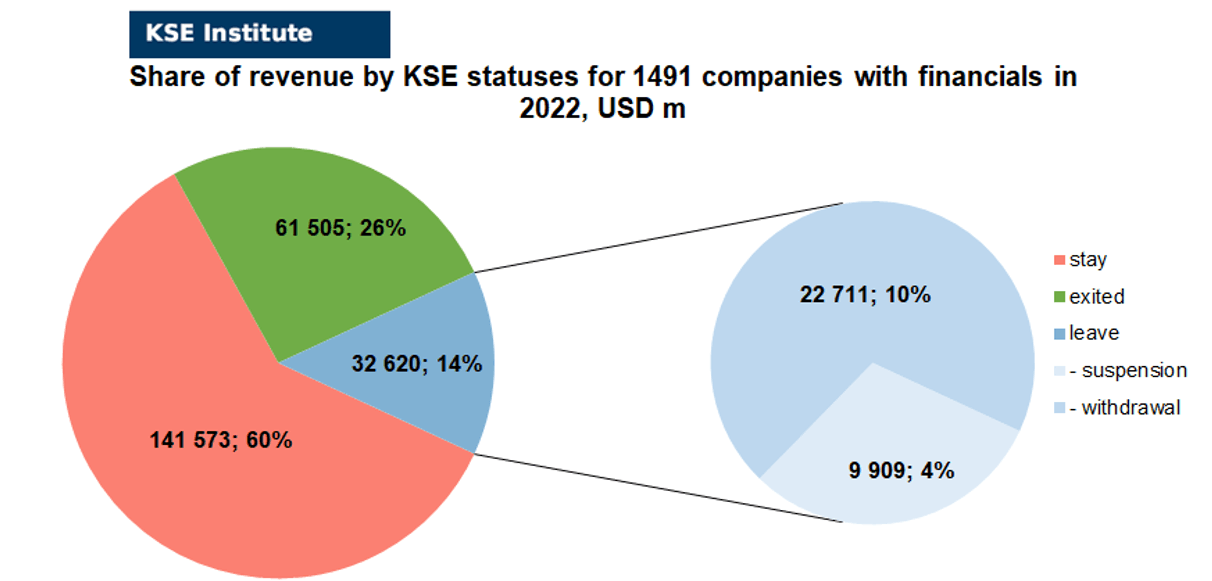

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1490 companies (about 80 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 3.9% less of revenue in 2022 (26.1% from total volume) than in 2021 (30.0% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.6%) revenue in 2022 (13.8% from total volume) than in 2021 (20.4% from total volume). At the same time, staying companies were able to generate much (+10.5%) more revenue in 2022 (60.1% from total volume) than in 2021 (49.6% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($335.9bn⁴ in 2022 vs $338.2bn in 2021) and would even probably increase if the remaining reporting for ~80-90 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

MONTHLY FOCUS: On leaving the Russian Federation. Results of March 2024

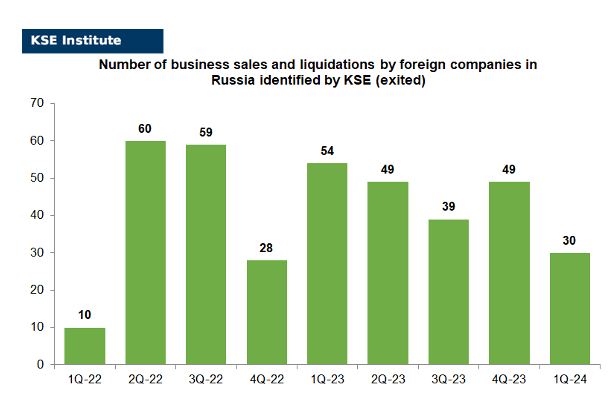

In this digest, we will summarize the results of March 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’570 companies identified in the KSE database with revenue data available of more than $315 billion in 2021 and ~$235 billion in 2022. And at least 378 of them have already been sold by local companies or were liquidated and left the Russian market. In March 2024 KSE Institute identified +6 new exits (in reality +7 as status of 1 company, LPP Group was downgraded. 3 business sales and 3 liquidations took place in March 2024), total number of exits observed since the beginning of Russia’s invasion reached 378.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 30% based on revenue allocation, those who are leaving represent 20% of total revenue (with 35% share of suspensions and 65% of withdrawals sub-statuses), % of staying companies represent 50% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is ~ equal with % of leaving ones (which means that about 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 26% based on revenue allocation, those who are leaving represent only 14% of total revenue (with 30% share of suspensions and 70% of withdrawals sub-statuses), % of staying companies represent 60% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

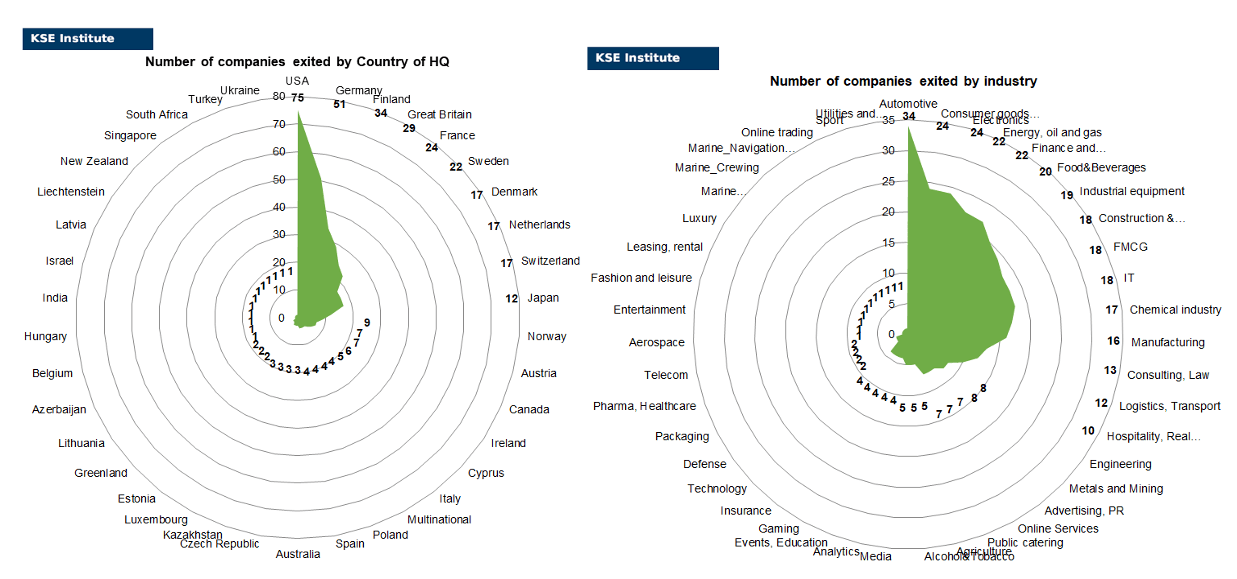

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of March 2024, companies from 37 countries and 42 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain, France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Deezer (liquidation), Denso (liquidation), DXC Technology, Foraco, Grant Thornton (not accounted before), Herpa, Teijin (liquidation). Additionally, 2 partial liquidations took place in March 2024: IKEA liquidated one of the small remaining legal entity LLC “IKEA PURCHASING SERVICES RUS” (tax id 5047183743) and Fischer Sports liquidated legal entity FISCHER SPORTS RETAIL LLC (tax id 7716885692), but the main legal entity FISCHER LLC (tax id 7716588925) continues to work. Also, we downgraded the status of LPP Group. In the course of a detailed investigation of Hindenburg Research, it turned out that “LPP was able to publish these excellent results because the denial of the Russian business was a complete sham. Far East Services was listed just a day before LPP announced it had reached an agreement to sell its Russian subsidiary,” Hindenburg Research reported. The report says that LPP’s Russian operations are still controlled by the head office in Poland. Hindenburg Research sent out secret shoppers and discovered in Russian stores the same clothes that LPP sells in Poland. In addition, the researchers found out that the business planned to modify the barcodes to hide the true origin of the goods and maintain control over the flow of products. Following the publication of Hindenburg Research, LPP shares fell sharply in price. The company considers this a targeted attack on the business. KSE Institute also had doubts about that exit and decided to downgrade the status until more proofs from both sides will appear.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Alstom (French railway transport concern Alstom sold its 20% stake in Transmashholding to Russian shareholders. The transaction amount is not disclosed. TMH CEO Kirill Lipa said that the deal was completed “at half the objective cost.”), Fischer Sports (the legal entity FISCHER SPORTS RETAIL LLC (tax id 7716885692) was liquidated, but the main legal entity FISCHER LLC (tax id 7716588925) continues to work), Grundfos (ISTRATECH GROUP LLC becomes the new founder of the organization LLC “Grundfos Istra”. The entry about the founder of GRUNDFOS HOLDING A/S was removed from the Unified State Register of Legal Entities. Another legal entity LLC “Grundfos” (tax id 5042054367) continues to work), HP (Hewlett-Packard) (HP company left the Russian market early: the operational activities of the Hewlett-Packard (HP) company in the Russian Federation were terminated early, although this was supposed to happen in May. The support service and services for customers stopped working regularly. The Russian site with a redirect to Kazakh is also disabled. The last deliveries to customers in the Russian Federation were in February 2024. In parallel with this, the liquidation of the company’s Russian representative office – HPI Inc. LLC took place. But another legal entity, LLC “HEWLETT PACKARD ENTERPRISE” (tax id 7743098542) continues to work), Iveco (Iveco to leave Russia, to transfer stake in truck JV to local partner), JKX Oil & Gas (Russia declares UK player ‘extremists’ and confiscates gas assets), Kraft Heinz (“Chernogolovka” has closed a deal to purchase the Russian baby food business of the American Kraft Heinz. For six months, products at the two factories transferred to Chernogolovka will be produced under the Heinz brand. But in the spring, Chernogolovka will launch a new brand of baby food on the market. 03.2024: LLC “MANAGEMENT COMPANY “CHERNOGOLOVKA” becomes a management organization. 19.03.2024: JSC “AQUALIFE RESOURCE” becomes the new founder of the organization. The entry about the founder of the PRIVATE LIMITED LIABILITY COMPANY “H.J. HEINZ GLOBAL HOLDING B.V. was removed from the Unified State Register of Legal Entities), Mikenopa (Authorized capital increased from 10,000 rubles up to 30,000 rubles. 25.03.2024: Evgeniy Ivanovich Vostrikov becomes the new main shareholder of the organization. Mikenopa retained 33% of the capital after its increase).

The next review of deals for April 2024 will be available in a month.

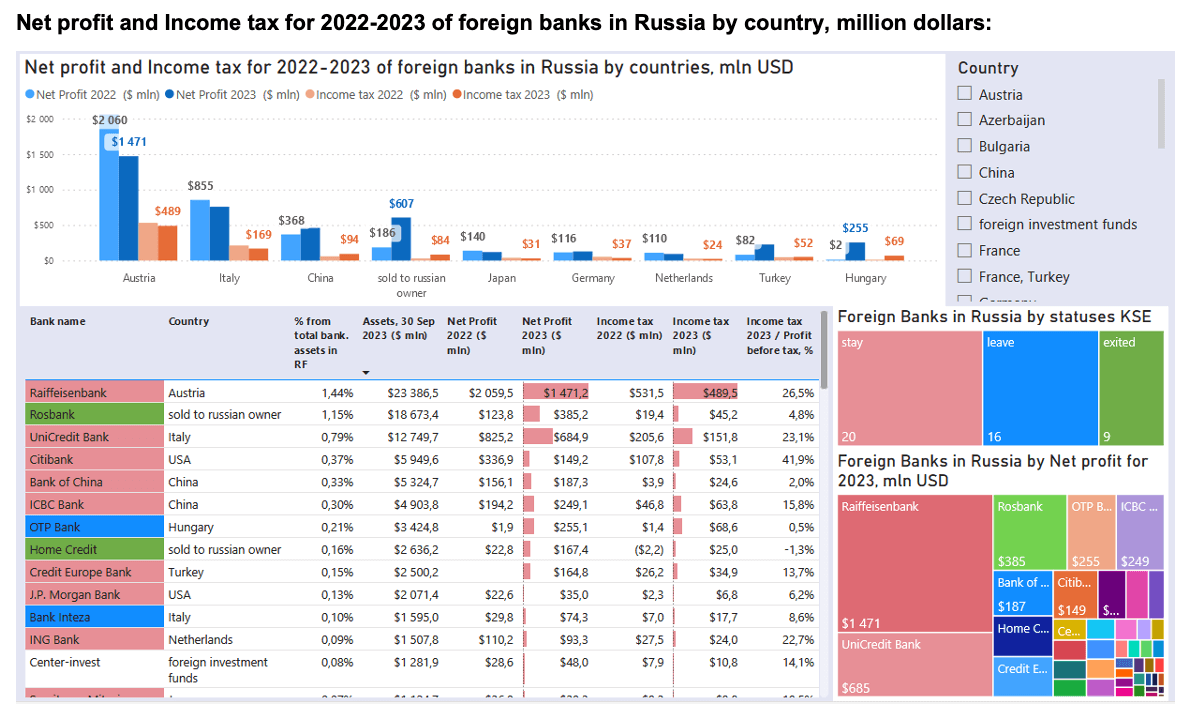

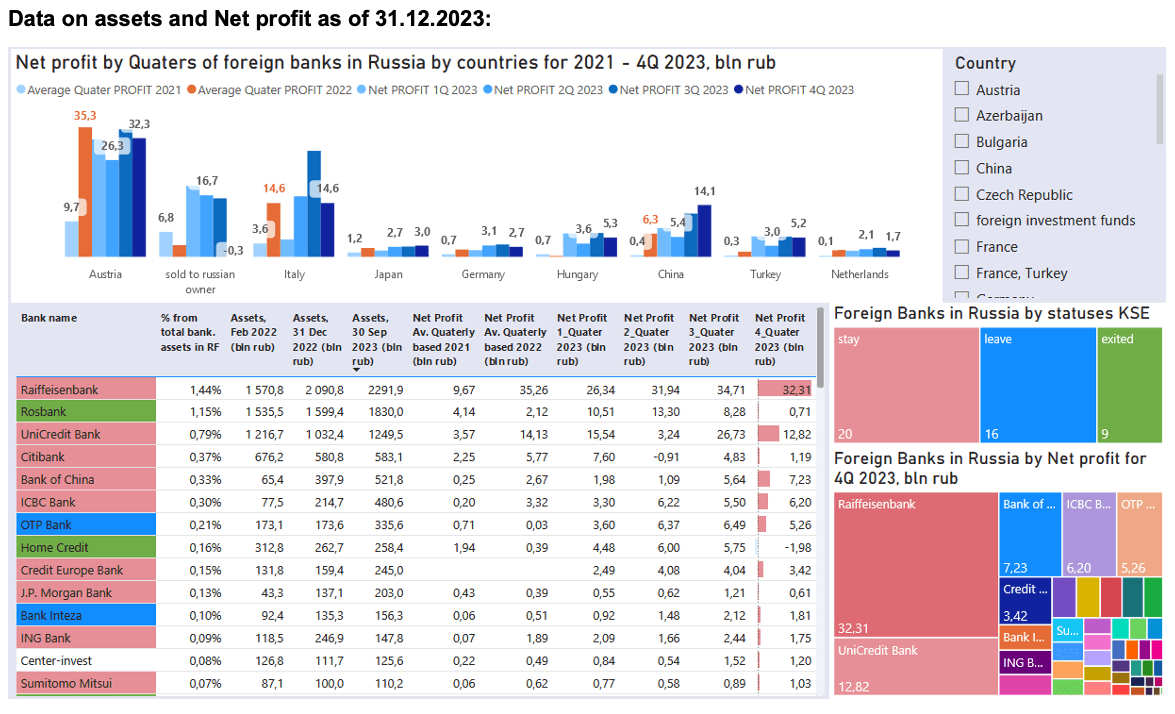

SPECIAL EDITION: Update on the presence of foreign banks in Russia

KSE Institute collected and pre-processed the available reporting data for 2023 of foreign banks in Russia.

For the convenience of users, aggregated data are presented in new dashboards on the site https://leave-russia.org/banks:

As you can see from the above information:

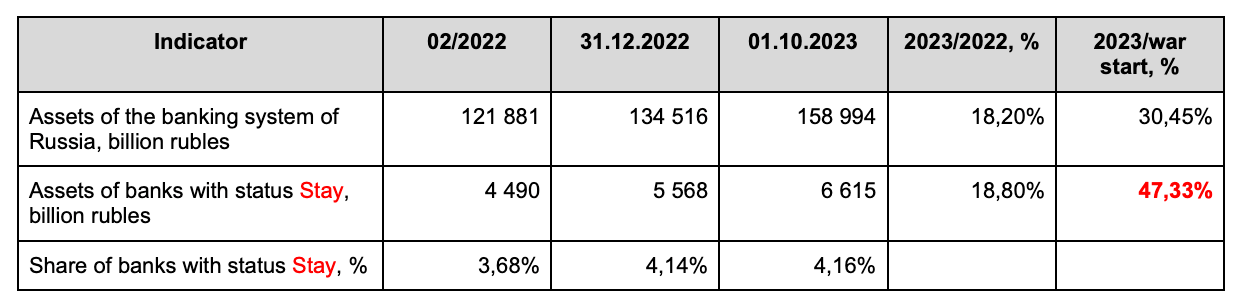

• banks with status Stay occupy about 4.2% of all assets of the banking system (Raiffeisenbank – 1.44%, UniCredit Bank – 0.79%, Citibank – 0.37%, OTP Bank – 0.21%);

• foreign banks managed to earn $3.5 billion in net profit in 2023 (compared to $3.93 billion in 2022). At the same time, the decrease in profit in dollars is explained, first of all, by the devaluation of the ruble (if in 2022 the average exchange rate was 68.4869 rubles/dollar, then in 2023 it was already 85.163 rubles/dollar);

• if analyzed in rubles, then we even see an increase in net profit and accrued income tax in 2023 compared to 2022 (297.7 billion rubles in 2023 against 269.1 billion rubles in 2022 or +10.6% for year);

• when converted into dollars, the largest profit in 2023 was shown by: Raiffeisenbank – $1.471 billion, UniCredit Bank – $0.685 billion, OTP Bank – $0.255 billion, ICBC Bank – $0.25 billion, Bank of China – $0.19 billion, Citibank – $0.15 billion;

• in total, foreign banks accrued $0.97 billion (or 83 billion rubles) of income tax in 2023 against $1.02 billion (or 69.9 billion rubles) in 2022, so in rubles we again see an increase in net income and accrued tax on profit in 2023 compared to 2022 (+18.7% per year);

• The largest income tax payers in 2023: Raiffeisenbank – $0.490 billion, ~50% of all banks with status Stay, UniCredit Bank – $0.152 billion, OTP Bank – $0.069 billion, ICBC Bank – $0.064 billion, Citibank – $0.053 billion;

a comparison of the growth of assets of banks with status Stay with the entire banking system: as you can see, the assets of foreign banks with status Stay have grown since the beginning of the war by about 50% more than the banking system as a whole:

banks with status Stay in the KSE database:

• Citibank

• OTP Bank

• ING Bank

• UBS Bank

You will find more details in the new dashboards from KSE Institute: https://leave-russia.org/banks

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) ⁶

01.03.2024

*Reliance (India, Energy, oil and gas) Status by KSE – stay

India Looks Elsewhere for Oil as US Sanctions Crimp Russia Trade

*EUMETSAT (Germany, Technology) Status by KSE – leave

EUMETSAT suspended Russia’s membership shortly after the invasion of Ukraine began, but individual member states, including the UK and the US, continued to share data with Russian specialists. This information is necessary for “forecasting activities,” but recently the information flow from Western satellites has practically dried up

https://charter97.org/ru/news/2024/2/29/585685/

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Investors Challenge Mondelez on Russia Operations: Human Rights and Business Risk at Forefront

02.03.2024

*NASA (USA, Aerospace) Status by KSE – stay

Science News Roundup: NASA to discontinue $2 billion satellite servicing project on higher costs, schedule delays; Iran’s Pars 1 satellite enters space after Russian launch and more

03.03.2024

*United Nations (UN) (USA, Association, NGO) Status by KSE – stay

Russian airlines lost contracts with the UN

https://biz.liga.net/all/avto/novosti/rossiyskie-aviakompanii-lishilis-kontraktov-s-oon

05.03.2024

*Global Terminal Services (Turkey, Energy, oil and gas) Status by KSE – leave

Turkish oil terminal halts Russian oil business

https://www.reuters.com/business/energy/turkish-oil-terminal-halts-russian-oil-business-2024-03-06/

*Sinokor (South Korea, Marine Transportation) Status by KSE – stay

South Korean sea carrier Sinokor announced the cessation of operations at the Russian port of Vostochny in Primorye.

*Geely (China, Automotive) Status by KSE – stay

*Haval Motor (China, Automotive) Status by KSE – stay

*Chery Automobile (China, Automotive) Status by KSE – stay

*Changan (China, Automotive) Status by KSE – stay

Sales in February increased by 85% year-on-year

https://www.kommersant.ru/doc/6552554

*8 seconds (South Korea, FMCG) Status by KSE – stay

The first mono-brand stores of the South Korean fashion retailer 8 Seconds, which positions itself as a competitor to the Japanese Uniqlo and managed by Samsung, are preparing to open in Russia.

06.03.2024

*International Tennis Federation (Great Britain, Sport) Status by KSE – stay

The International Tennis Federation (ITF) has decided to allow Russians and Belarusians to compete at the 2024 Olympic and Paralympic Games in Paris as neutrals.

https://www.pravda.com.ua/eng/news/2024/03/6/7445313/

*AGC (Japan, Construction & Architecture) Status by KSE – exited

AGC COMPLETES TRANSFER OF RUSSIAN OPERATIONS

https://www.glassmagazine.com/news/agc-completes-transfer-russian-operations

*Henkel (Germany, Chemical industry) Status by KSE – exited

Henkel posts losses after divestment from Russian

https://starconnectmedia.com/2024/03/henkel-posts-losses-after-divestment-from-russian/

*Danone (France, FMCG) Status by KSE – leave

Danone to withdraw from Russia, with a €1 bln write-off as result

https://ca.movies.yahoo.com/movies/danone-withdraw-russia-1-bln-060000158.html

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

*Gaztransport & Technigaz (GTT) (France, Engineering) Status by KSE – leave

Russia’s gas cardinal: who is behind the Kremlin’s new wave of export expansion

07.03.2024

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

*Hindustan Petroleum (India, Energy, oil and gas) Status by KSE – stay

India Cautious on Contracted Russian Oil as US Sanctions Bite

*Leroy Merlin (France, FMCG) Status by KSE – stay

The Leroy Merlin chain has changed the name of its Russian legal entity

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – stay

Gazprom wants to recover $935 million from Polish Orlen through a Russian court

08.03.2024

*Auchan (France, FMCG) Status by KSE – stay

Ceetrus, owned by the Auchan group, may sell its assets in Russia.

*Space Exploration Technologies Corp. (SpaceX) (USA,Aerospace) Status by KSE – stay

The Russians have Starlink at the front: the USA has launched an investigation against Elon Musk’s company

10.03.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The United States has threatened to impose sanctions against the Austrian group Raiffeisen Bank International (RBI) for doing business in Russia

https://minfin.com.ua/2024/03/11/122987592/

*Pepsi (USA, Food & Beverages) Status by KSE – stay

*Mars (USA, Food & Beverages) Status by KSE – stay

*Nestle (Switzerland, FMCG) Status by KSE – stay

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

*Mondelez (USA, Food & Beverages) Status by KSE – stay

The Ministry of Defense of Estonia refuses the products of companies operating in Russia

11.03.2024

*BBC (Great Britain, Media) Status by KSE – leave

BBC halts journalists’ work in Russia after Kremlin passes law threatening jail for spreading ‘fake’ information

https://uk.style.yahoo.com/style/bbc-suspends-journalists-staff-russia-171807404.html?guccounter=1

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

A Russian court arrested IKEA property worth 12.9 billion rubles. The company wanted to finally leave the Russian Federation

*Stellar Group (Netherlands, Alcohol & Tobacco) Status by KSE – stay

The producer of strong alcohol Stellar Group (brands Steersman, Old Barrel, etc.) plans to enter the cocktail market, according to data from Rospatent and RosAccreditation.

https://www.kommersant.ru/doc/6561165

*Honor (China, Electronics) Status by KSE – stay

*Xiaomi (China, Electronics) Status by KSE – stay

*Samsung (South Korea, Electronics) Status by KSE – stay

*Acer (Taiwan, Electronics) Status by KSE – stay

Departed brands resumed advertising activity in the Russian Federation

12.03.2024

*PGNiG (Poland, Energy, oil and gas) Status by KSE – leave

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – stay

*Europol Gaz (Poland, Energy, oil and gas) Status by KSE – stay

The Federal Tax Service has decided to file a bankruptcy petition for the Polish energy company PGNiG.

https://www.interfax.ru/business/949830

*Alstom (France, Industrial equipment) Status by KSE – leave

The large French engineering concern Alstom sold its entire stake in Russian Transmashholding (20%) to local shareholders.

13.03.2024

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

The local structure of Unilever received the rights to some brands in Russia, including Clean Line and Inmarko, which should ease possible legal disputes.

https://www.kommersant.ru/doc/6562652

*Rolls-Royce Motor Cars (Great Britain, Automotive) Status by KSE – stay

*Bentley (Great Britain, Automotive) Status by KSE – stay

Cars from British manufacturers, including Rolls-Royce and Bentley, are still coming to Russia despite sanctions imposed over the war in Ukraine. Elite cars are imported, bypassing restrictions, through third countries, mainly through Azerbaijan.

*Nuovo Pignone SRL (Italy, Industrial equipment) Status by KSE – stay

*Optaperiph (France, Industrial equipment) Status by KSE – stay

European companies, bypassing sanctions, supplied equipment for the LNG project of Putin’s friend worth half a billion euros

*CERN (Switzerland, Energy, oil and gas) Status by KSE – stay

Russian scientists were finally cut off from work at the Large Hadron Collider

14.03.2024

*Danone (France, FMCG) Status by KSE – leave

Russian President Vladimir Putin canceled the transfer of the assets of the French company Danone in Russia to the temporary management of the Federal Property Management Agency.

https://www.kommersant.ru/doc/6563514

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

The Arbitration Court of St. Petersburg and the Leningrad Region satisfied the application of Gazprom Export LLC to prohibit the German Uniper Global Commodities SE and the Swiss METHA-Methanhandel GmbH from continuing proceedings in international commercial arbitration. In case of violation of the ban, the Uniper subsidiary is obliged to pay a fine of €14.3 billion.

15.03.2024

*Embracer Group (Sweden, Gaming) Status by KSE – leave

Embracer Group will sell selected parts of Saber Interactive for SEK 2.52 billion ($247 million) to B eacon Interactive, controlled by Saber co-founder Matthew Karch.

https://gameworldobserver.com/2024/03/14/embracer-sells-saber-247-million-exit-from-russia-details

*Electrolux Professional (Sweden, Electronics) Status by KSE – exited

Manufacturers of household appliances Electrolux, Tefal, Braun and Rowenta began to actively block the supply of products to the Russian Federation through parallel imports, including sales on marketplaces.

https://www.kommersant.ru/doc/6564261

*Google (USA, Online Services) Status by KSE – exited

Russia has fined Google for failing to enforce restrictions on banned content

16.03.2024

*LPP (Poland, Consumer goods and clothing) Status by KSE – stay

The largest Polish clothing manufacturer falsified data on exiting the Russian market

https://www.lpp.com/en/press-releases/lpp-statement/

*Microsoft (USA, IT) Status by KSE – leave

*Amazone (Germany, Agriculture) Status by KSE – stay

*Google (USA, Online Services) Status by KSE – exited

Suspension of access to cloud products of foreign vendors for customers from Russia

*Framatome (France, Energy, oil and gas) Status by KSE – stay

Rosatom is working with French state-owned Framatome SA to gather fuel needed for reactors that generate electricity for 100 million Eastern Europeans

17.03.2024

*Nemiroff (Ukraine, Alcohol&Tobacco) Status by KSE – leave

Russian manufacturer Nemiroff may start producing Demiroff drinks

https://www.kommersant.ru/doc/6578511

18.03.2024

*Adidas (Germany, Consumer goods and clothing) Status by KSE – stay

*Nike (USA, Consumer goods and clothing) Status by KSE – leave

*JOMA (Spain,Consumer goods and clothing) Status by KSE – stay

They came out, but not completely. How top sports brands continue to make money in the Russian Federation

https://www.epravda.com.ua/publications/2024/03/18/711260/

*Foraco (France, Metals and Mining) Status by KSE – exited

Foraco International exits Russia

https://stockhouse.com/news/the-market-online-news/2024/03/18/foraco-international-exits-russia

19.03.2024

*Renishaw (Great Britain, Engineering) Status by KSE – stay

Bypassing sanctions. How British Renishaw works for the Russian army

*LPP (Poland, Consumer goods and clothing) Status by KSE – stay

“LPP does not work in Russia”. The company that owns Sinsay and Cropp reacted to the scandal

*CERN (Switzerland, Analytics) Status by KSE – leave

On November 30, CERN will cease cooperation with about 500 employees with ties to Russia.

https://www.kommersant.ru/doc/6579591

*Kraft Heinz (USA, Food & Beverages) Status by KSE – leave

GC Chernogolovka has closed a deal to purchase the baby food business of Kraft Heinz in Russia.

https://www.interfax.ru/business/951165

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever will cut 7,500 jobs and spin off its ice cream business

20.03.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Washington pressures Austria’s Raiffeisen to drop Russian tycoon deal

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

IOC blocks Russian athletes from Olympic opening ceremony

https://www.dw.com/en/ioc-blocks-russian-athletes-from-olympic-opening-ceremony/a-64837576

*Ericsson (Sweden, Telecom) Status by KSE – stay

Ericsson says that it does not export hardware to Russia, only software support

https://ca.movies.yahoo.com/movies/ericsson-says-no-hardware-exported-081849269.html

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Reliance (India, Energy, oil and gas) Status by KSE – stay

Indian refiners are closing in on buying the largest volumes of American oil in nearly an hour after tightening US sanctions enforcement curbed trade with Russia and forced it to look for suppliers elsewhere.

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

War sponsor Philip Morris still operates in Ukraine and receives benefits

21.03.2024

*Avind International (Finland, Logistics, Transport) Status by KSE – leave

Logistics company Avind from Khamina left its main market – “We left Russia because of the war, business is turning 180 degrees”

https://www.kymensanomat.fi/paikalliset/6381131

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Baltika is collecting more than 84 billion rubles from Carlsberg Group.

22.03.2024

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Reliance (India, Energy, oil and gas) Status by KSE – stay

India Halts Russia Oil Supplies From Sanctioned Tanker Giant

*Chanel (Great Britain, Luxury) Status by KSE – leave

Chanel, which did not officially leave the Russian market after the outbreak of the military conflict between the Russian Federation and Ukraine, began to refuse to rent space for its boutiques.

23.03.2024

*Autodesk (USA, IT) Status by KSE – exited

Autodesk has banned Russian companies from using its software

https://dzen.ru/news/story/504a3924-d62a-5998-b55d-9abcdc86d506

https://www.rbc.ru/technology_and_media/22/03/2024/65fd84b09a7947213a06d174

24.03.2024

*Microsoft (USA, IT) Status by KSE – leave

Microsoft to shut down 50 cloud services for Russian businesses

25.03.2024

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

World’s largest oilfield services group has no plans to leave Russia

https://www.ft.com/content/8741411f-9d0c-4295-949a-2345fc87730c

*Binance (China, Finance and payments) Status by KSE – leave

The world’s largest crypto exchange, Binance, announced that it is in negotiations with several platforms about the sale of its Russian business and is looking for a new buyer to replace CommEX, which announced its intention to cease operations.

26.03.2024

*Akkuyu Nuclear Power Plant (NPP) (Turkey, Energy, oil and gas) Status by KSE – stay

Türkiye keen to extend cooperation with Russian nuclear power company Rosatom

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Russia to Sell Shell’s Sakhalin-2 Stake to Gazprom

https://www.energyintel.com/0000018e-7683-dbff-a7cf-fe933e2b0000

*Damen Group (Netherlands, Defense) Status by KSE – leave

Rosmorport won a lawsuit against the Dutch Damen for sea tugs

https://www.rbc.ru/business/25/03/2024/65fdb4879a7947d34f0ebce3

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – stay

*Reliance (India, Energy, oil and gas) Status by KSE – stay

Indian refiners buy more US crude as Russia sanctions tighten

27.03.2024

*Samsung Pay (South Korea, Finance and payments) Status by KSE – stay

The payment system for mobile devices Samsung Pay will stop working with cards of the Russian payment system Mir.

https://www.samsung.com/ru/samsung-pay/

https://www.epravda.com.ua/rus/news/2024/03/27/711669/

*Strabag (Austria, Construction & Architecture) Status by KSE – leave

Deripaska transfers Strabag stake to Russian firm Iliadis

https://www.nasdaq.com/articles/deripaska-transfers-strabag-stake-to-russian-firm-iliadis

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank, pull out of Russia!

https://action.wemove.eu/sign/2024-03-raiffeisen-russia-petition-EN

28.03.2024

*Stellantis (Netherlands, Automotive) Status by KSE – leave

Citroen returned to Russia via China

https://www.kommersant.ru/doc/6595862

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

The Kremlin announced the transformation of Telegram into “a tool in the hands of terrorists”

*HP (Hewlett-Packard) (USA, Electronics) Status by KSE – exited

HP left the Russian market ahead of schedule

https://news.finance.ua/ru/kompaniya-hp-dosrochno-ushla-s-rynka-rossii

29.03.2024

*Commerzbank (Germany, Finance and payments) Status by KSE – leave

The Russian developer is ready to sue Commerzbank only in the Russian Federation

https://www.kommersant.ru/doc/6596715

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

Why does the government give tax preferences to the sponsor of war and what to do about it?

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website