- Kyiv School of Economics

- About the School

- News

- 62nd issue of the regular digest on impact of foreign companies’ exit on RF economy

62nd issue of the regular digest on impact of foreign companies’ exit on RF economy

4 March 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 05.02.2023-03.03.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

On February 24, 2024 KSE Institute merged KSE status “wait” with status “stay” as 2 years of the war gave enough time for companies to leave Russia

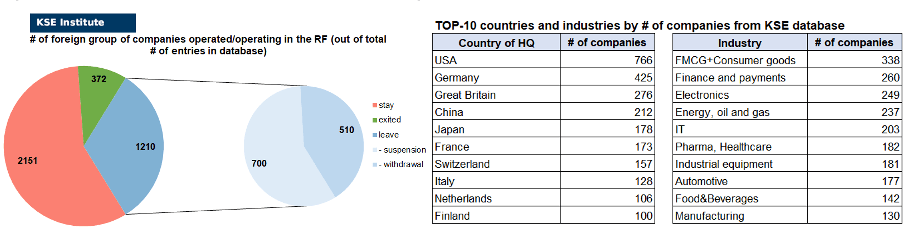

KSE DATABASE SNAPSHOT as of 03.03.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 2 151 (+13 per month and +544 moves with status “wait”)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 0 (-544 per month, moved to status “stay”)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 215 (+5 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 372 (+16 per month)

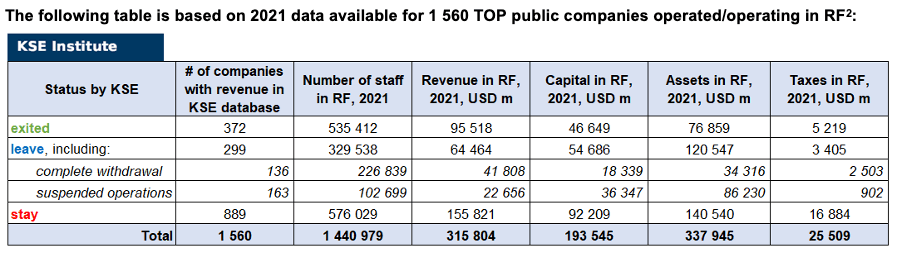

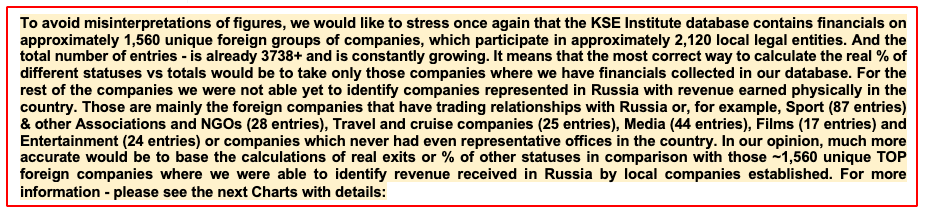

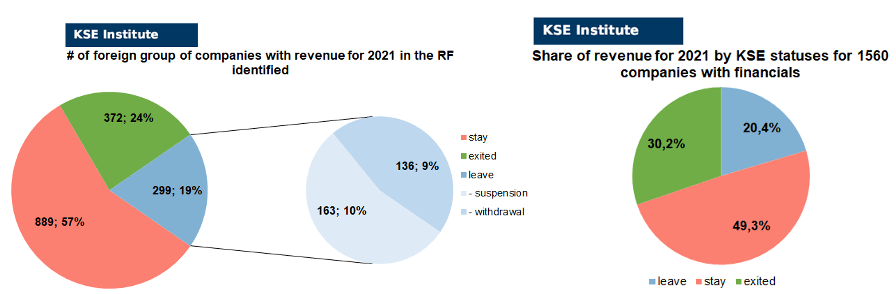

As of March 3, 2024, we have identified about 3,738 companies, organizations and their brands from 101 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 560 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.5 billion), local revenue (about $315.8 billion), local assets (about $337.9 billion) as well as staff (about 1.441 million people) and taxes paid (about $25.5 billion). 1,215 foreign companies have suspended or ceased operations in Russia. Also, we added information about 372 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (7 business liquidations took place in February 2024).

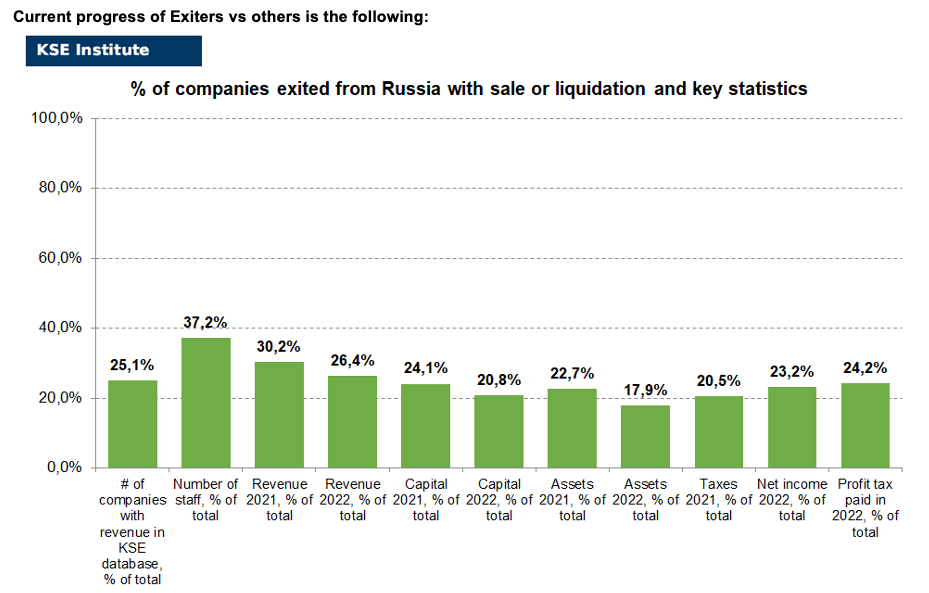

As can be seen from the tables below, as of March 3, 2024, 372 companies which had already completely exited from the Russian Federation, in 2021 had at least 535,400 personnel, $95.5 bn in annual revenue, $46.6bn in capital and $76.9bn in assets; companies, that declared a complete withdrawal from Russia had 226,800 personnel, $41.8bn in revenues, $18.3bn in capital and $34.3bn in assets; companies that suspended operations on the Russian market had 102,700 personnel, annual revenue of $22.7bn, $36.3bn in capital and $86.2bn in assets.

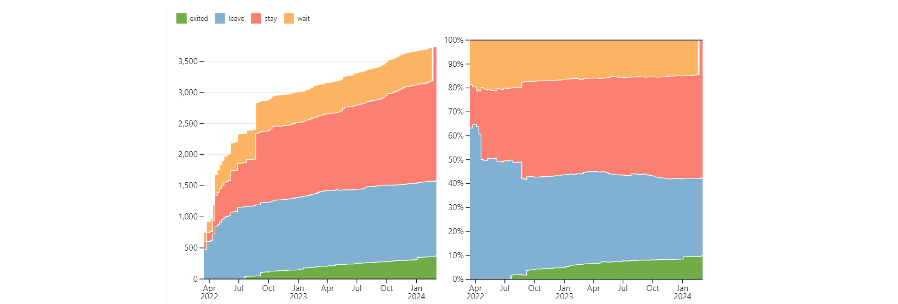

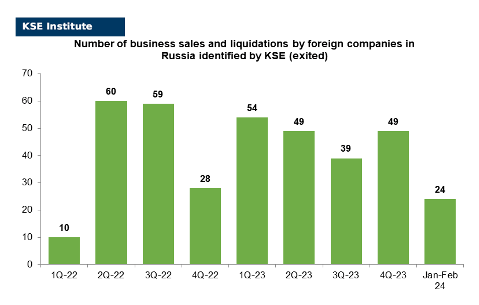

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 18 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 34 were added in February 2024). However, if to operate with the total numbers in KSE database, about 32.5% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 57.5% are still remaining in the country and only 10.0% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 372 companies that completely left the country, since in 2021 they employed 37.2% of the personnel employed in foreign companies, the companies owned about 22.7% of the assets, had 24.1% of capital invested by foreign companies, and in 2021 they generated revenue of $95.5 billion or 30.2% of total revenue and paid ~$5.2 billion of taxes or 20.5% of total taxes paid by the companies observed. Data on 1,560 TOP companies is presented in the table above.

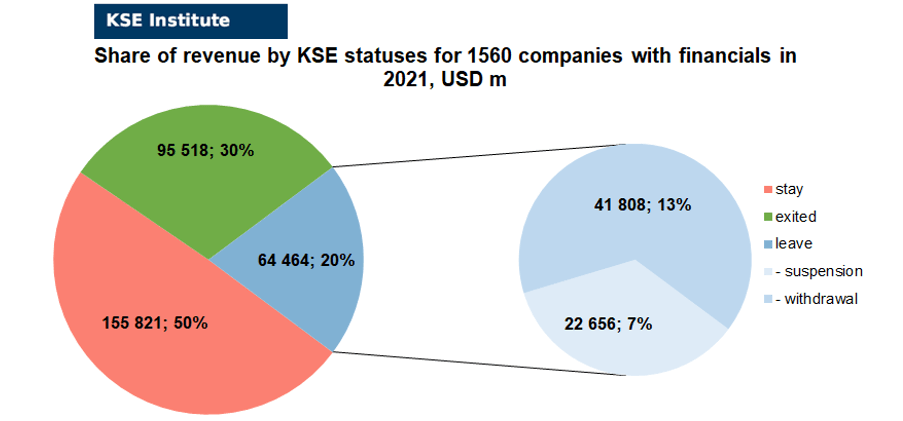

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (24%) and on share of revenue withdrawn (30.2%). At the same time, a totally different picture is for those who are still staying – 57% of companies represent 49.3% of revenue received in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

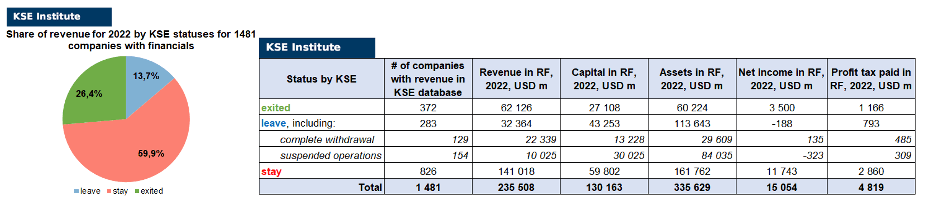

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1480 companies (about 80 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

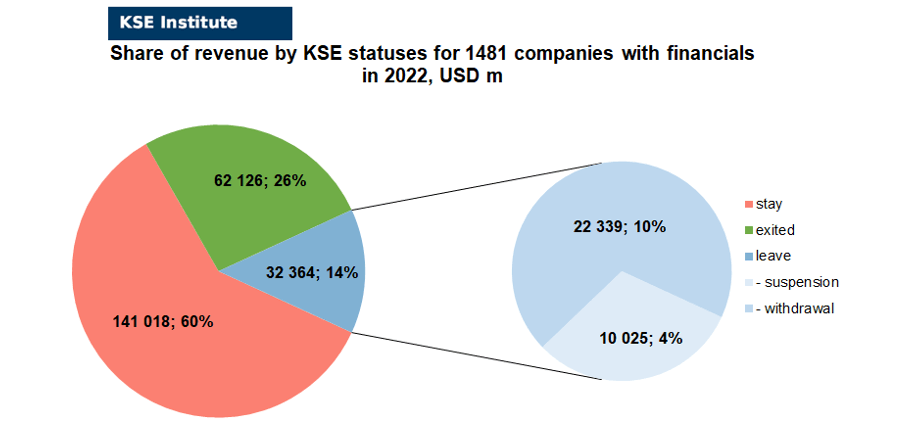

As you can see from the charts above, companies which fully exited Russia were able to generate 3.8% less of revenue in 2022 (26.4% from total volume) than in 2021 (30.2% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.7%) revenue in 2022 (13.7% from total volume) than in 2021 (20.4% from total volume). At the same time, staying companies were able to generate much (+10.6%) more revenue in 2022 (59.9% from total volume) than in 2021 (49.3% from total volume). So the key conclusion is that money matters for those companies who are still tied with its local business in Russia and they were even able to gain more.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($335.6bn⁴ in 2022 vs $337.9bn in 2021) and would even probably increase if the remaining reporting for ~80-90 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

MONTHLY FOCUS: On leaving the Russian Federation. Results of February 2024

In this digest, we will summarize the results of February 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’560 companies identified in the KSE database with revenue data available of more than $315 billion in 2021 and ~$235 billion in 2022. And at least 372 of them have already been sold by local companies or were liquidated and left the Russian market. In February 2024 KSE Institute identified +16 new exits (in reality +18 as statuses of 2 companies, Leroy Merlin and Playrix were downgraded. 11 business sales and 7 liquidations took place in February 2024), total number of exits observed since the beginning of Russia’s invasion reached 372.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 30% based on revenue allocation, those who are leaving represent 20% of total revenue (with 35% share of suspensions and 65% of withdrawals sub-statuses), % of staying companies represent 50% of revenue based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is ~ equal with % of leaving ones (which means that about 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 26% based on revenue allocation, those who are leaving represent only 14% of total revenue (with 31% share of suspensions and 69% of withdrawals sub-statuses), % of staying companies represent 60% of revenue based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

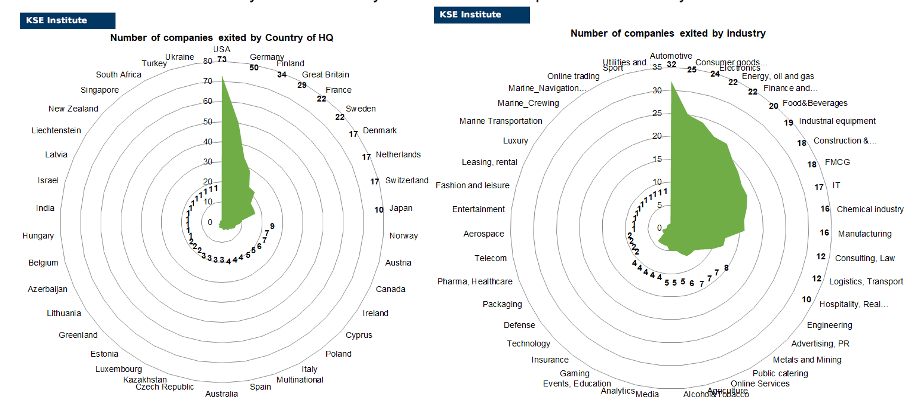

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of February 2024, companies from 37 countries and 42 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain France and Sweden and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Drees & Sommer (liquidation), GE Digital (liquidation), Gett (liquidation), Idexx Labs (liquidation), Inditex (liquidation, liquidated the remaining entities after sale), Lindt & Sprüngli (liquidation), ON Semiconductor (liquidation); sales: AGC, Equifax, Hempel, Holcim Group, Hydroscand, IKEA (JSC “INVEST PLUS” becomes the new founder of the organization but IKEA extended the registration of its trademark under one of four applications until August 2033), LeasePlan, Leoni AG, Polymetal, Sephora, Wienerberger. Also, we downgraded the statuses of Leroy Merlin and Playrix. In the course of a detailed investigation, it turned out that Leroy Merlin signed a technical agreement on the alleged sale of the main business in Russia (to SCENARI HOLDING LP from the UAE), but the CEO (Defassier Laurent, Louis, Claude) stayed the same since 2019, the company signs new contracts with the group and authorities of the Russian Federation (including the Ministry of Defence and the Ministry of Internal Affairs), trademarks are extended in Rospatent until 2031. In addition, as the L’Express investigation showed, SCENARI HOLDING LP has the same General Director as in Russia – Laurent Defassier, so the company used a tax optimization scheme, also called layering. Also, most of the imports in 2023 by Leroy Merlin Vostok in Russia were received from ADEO. As for Playrix, it appeared that despite 4 group’s companies in Russia are in the process of liquidation the same owner (RIMUTE HOLDINGS LIMITED LLC, Cyprus) remained in the key company LLC “PLAYRIX” which was renamed to LLC “ITIDEV LAB”.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: DMG Mori Seiki (part of DMG MORI AKTIENGESELLSCHAFT. Russian President Vladimir Putin signed a decree on the transfer of 100% of the shares of the Ulyanovsk Machine Tool Plant to the temporary management of the Federal Property Management Agency. In fact, he nationalized the Russian plant of the world’s largest machine tool manufacturer DMG Mori. The plant belonged to the German subsidiary of DMG MORI – Seiki Gildemeister Beteiligungen. It produced a wide range of turning and milling machines), Global Spirits (The Ministry of Finance of Russia is preparing to nationalize assets that previously belonged to Evgeny Chernyak’s international alcohol holding Global Spirits), HSBC (Russian President Vladimir Putin approved the purchase of 100% shares of HSBC by Expobank), Konecranes (Konecranes, a titan in the crane manufacturing industry, has initiated the liquidation of its Russian subsidiary, Konecranes Demag Rus JSC, headquartered in St. Petersburg. This decision, set to culminate by February 2, 2024, marks the end of Konecranes’ operations in a country that has become increasingly isolated due to geopolitical tensions), Linde (In Russia, the property of the German company Linde, which complied with EU sanctions, was confiscated), ThyssenKrupp (Partial exit. OJSC “KRASNOYARSK NON-FERROUS METALS PLANT NAMED AFTER V.N. GULIDOV” and JSC “AKXION-RARE AND PRECIOUS METALS” become the new founder of the organization THYSSENKRUPP INDUSTRIAL SOLUTIONS (RUS) (abbreviated as LLC “TKIS (RUS)”). The entry about the founder of THYSSENKRUPP INDUSTRIAL SOLUTIONS AG has been removed from the Unified State Register of Legal Entities).

The next review of deals for March 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis) 5

02.02.2024

*Myanmar Airways International (Myanmar, Air transportation) Status by KSE – stay

Russia’s S7 Airlines, Myanmar’s Myanmar Airways International (MAI) sign codeshare.

https://www.ch-aviation.com/news/136608-russias-s7-airlines-myanmars-mai-sign-codeshare

*ConocoPhillips (USA, Energy, oil and gas) Status by KSE – leave

Russian Oil Hits US Shores Under Sanction-Busting Loophole

*Ingka (Netherlands, Consumer goods and clothing) Status by KSE – exited

IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

The Federal Tax Service filed a claim in the Moscow Arbitration Court against IKEA Torg LLC, which belongs to the Swedish IKEA, for 12.9 billion rubles, as follows from the file of arbitration cases.

https://www.kommersant.ru/doc/6480712

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian OMV called the sale of its Russian asset expropriation

https://www.kommersant.ru/doc/6481075

*Euroclear (Belgium, Finance and payments) Status by KSE – stay

Frozen Russian assets yielded €4.4bn in 2023, says Euroclear

https://www.ft.com/content/f4c21b08-5f89-4abb-b72c-6f4b110c790b

04.02.2024

*Maschio Gaspardo (Italy, Agriculture) Status by KSE – stay

*KINZE MANUFACTURING (USA, Agriculture) Status by KSE – stay

*Gregoire Besson (France, Agriculture) Status by KSE – stay

*Farmet (Czech Republic, Agriculture) Status by KSE – stay

*BEDNAR (Czech Republic, Agriculture) Status by KSE – stay

*Kverneland Group (Norway, Agriculture) Status by KSE – stay

*Pottinger (Austria, Agriculture) Status by KSE – stay

*Kuhn (France, Industrial equipment) Status by KSE – stay

*AGCO (USA, Agriculture) Status by KSE – leave

*Zetor (Czech Republic, Agriculture) Status by KSE – leave

*HORSCH (Germany, Agriculture) Status by KSE – stay

*Vaderstad (Sweden, Agriculture) Status by KSE – leave

*LEMKEN (Germany, Agriculture) Status by KSE – stay

“Mission to save the world from hunger”, or Why famous manufacturers of agricultural machinery have not yet left Russia

https://www.epravda.com.ua/rus/publications/2024/02/7/709610/

*ZDAS S.A. (Czech Republic, Manufacturing) Status by KSE – stay

Continuous import of products manufactured by ZDAS S.A. (Czech) to Russia was identified.

https://drive.google.com/file/d/1cDyXIy4qTOYrnUKInj1G6phb_rcniHOa/view

*PFZW (Netherlands, Finance and payments) Status by KSE – stay

Dutch pension funds write off Russian investments, except PFZW

*Rönesans Holding (Turkey,Construction & Architecture) Status by KSE – leave

The Turkish company Rönesans Holding ceased its activities in the Russian Federation.

https://www.rbc.ua/ukr/news/velika-turetska-investitsiyna-kompaniya-pripinila-1706912197.html

*Nayara (India, Energy, oil and gas) Status by KSE – stay

Putin spoke about Rosneft’s plans to build a plant in India

05.02.2024

*Jospong Group (Ghana, Events, Education) Status by KSE – stay

Jospong Group to sponsor 600 students to study in Russia.

https://www.myjoyonline.com/jospong-group-to-sponsor-600-students-to-study-in-russia/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen bank is still considering exit from Russia

https://www.epravda.com.ua/news/2024/02/4/709504/

https://www.rbc.ru/finances/31/01/2024/65ba02749a794712ff3b26eb

*Glencore (Switzerland, Agriculture) Status by KSE – exited

The trader received permission to close a transaction to sell his stake

https://www.kommersant.ru/doc/6493008

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

Unicredit CEO:scaling down of Russian business will have 300 mln euro negative effect in 2024

07.02.2024

*Skyworth (China, Electronics) Status by KSE – stay

One of the largest Chinese manufacturers of household appliances, Skyworth, will officially enter the Russian market.

https://www.kommersant.ru/doc/6494443

*Chouzhou Commercial Bank (China, Finance and payments) Status by KSE – leave

The Chinese bank Chouzhou Commercial Bank informed clients about the suspension of transactions with Russia.

https://www.epravda.com.ua/news/2024/02/7/709608/

*Changan (China, Automotive) Status by KSE – stay

At once, five Chinese car models left Russia in January

*Lukoil Neftohim Burgas (Bulgaria, Energy, oil and gas) Status by KSE – stay

Lukoil refinery in Bulgaria completely abandoned Urals

*SAP (Germany, IT) Status by KSE – leave

The German supplier of business applications SAP will close access to cloud services for Russian clients from March 20

*De Beers (Great Britain, Luxury) Status by KSE – stay

De Beers and Botswana express G7 concerns over diamond sanctions

*Arrival (Great Britain, Automotive) Status by KSE – exited

In the UK, the startup of the ex-Deputy Minister of Communications of Russia began to go bankrupt

*Amazon (USA, Online Services) Status by KSE – stay

Russian court fines Amazon 2 million roubles for failing to remove banned content -court

08.02.2024

*Allied Mineral Products (USA, Defense) Status by KSE – stay

Ukraine’s National Agency on Corruption Prevention (NACP) has added US refractory products manufacturer Allied Mineral Products, LLC to the list of international sponsors of war.

https://www.pravda.com.ua/eng/news/2024/02/8/7441016/

https://www.epravda.com.ua/news/2024/02/8/709694/

*Net4Gas (Czech Republic, Energy, oil and gas) Status by KSE – stay

According to the Czech gas operator NET4GAS, gas supplies from the Russian Federation in January accounted for 62% of the total volume of this type of energy raw material supplied to the republic.

https://www.kommersant.ru/doc/6494931

*Beretta Holding (Italy, FMCG, Defense) Status by KSE – stay

The Italian arms manufacturer Beretta, despite the sanctions, still exports small arms to the Russian Federation through its own “daughter” and the company of Russian arms baron Mikhail Khubutia.

https://www.epravda.com.ua/news/2024/02/8/709667/

https://theins.ru/obshestvo/268896

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

TotalEnergies announced the suspension of construction of the third line of Arctic LNG-2

https://www.kommersant.ru/doc/6494919

*Apple (USA, Electronics) Status by KSE – stay

PC unchanged: sales of Apple laptops in Russia increased by 20%

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Things have gone from bad to worse for the Carlsberg Group. Their breweries in Russia have been taken over by the state and now two of their Russian executives have been arrested.

https://www.americancraftbeer.com/carlsberg-russian-brewery-executives-arrested-in-kremlin-action/

09.02.2024

*Hellenic Bank (Cyprus, Finance and payments) Status by KSE – exited

Cyprus Bank Hellenic closes accounts for Russians

https://www.epravda.com.ua/rus/news/2024/02/9/709728/

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – leave

Intesa CEO says still trying to finalize Russian exit

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

SpaceX: We Are Not Selling Starlink Dishes to Russian Merchants or Military

*UEFA (Switzerland, Sport) Status by KSE – stay

UEFA has made a decision regarding the suspension of Israel and Russia from competitions

*Metro AG (Germany, FMCG) Status by KSE – stay

Metro AG will continue to operate in Russia: it does not want the stores to go to oligarchs

10.02.2024

*Oil Tankers SCF Mgmt Fzco (United Arab Emirates, Logistics, Transport) Status by KSE – stay

*Talassa Shipping DMCC (United Arab Emirates, Logistics, Transport) Status by KSE – stay

*ZEENIT SUPPLY & TRADING DMCC (United Arab Emirates, Logistics, Transport) Status by KSE – stay

*NS Leader Shipping Incorporated (Liberia, Logistics, Transport) Status by KSE – stay

The United States imposed sanctions against four companies from the UAE that transported Russian oil in violation of the price ceiling

11.02.2024

*MStoryLink (South Korea, Media) Status by KSE – stay

The Korean company MStoryLink plans to create a joint venture (JV) in Russia to develop the My Comic platform for Asian comics.

https://www.kommersant.ru/doc/6507369

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Bharat Petroleum (BPCL) (India, Energy, oil and gas)Status by KSE – stay

*Hindustan Petroleum (India, Energy, oil and gas) Status by KSE – stay

Indian companies are negotiating oil supplies from Russia

*Duolingo (USA, IT) Status by KSE – stay

Roskomnadzor is checking the language learning service Duolingo for the spread of LGBT propaganda

https://tass.ru/ekonomika/19949209

*Space Exploration Technologies Corp. (SpaceX) (USA, Aerospace) Status by KSE – stay

Musk denies selling Starlink terminals to Russia after Kyiv alleges their use in occupied areas

12.02.2024

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Freedom Holding Corp.’s revenue according to the results of the III quarter of the 2024 fiscal year, it amounted to $418.6 million

13.02.2024

*ByteDance (China, IT) Status by KSE – stay

*TikTok (China, Online Services) Status by KSE – leave

The EU could fine TikTok if it proves that the platform poses risks to children

https://www.epravda.com.ua/news/2024/02/9/709751/

*OMV (Austria, Energy, oil and gas) Status by KSE – exited

Austrian Energy Minister Leonor Gewessler announced plans to explore options for exiting gas supply contracts between the Austrian OMV and the Russian Gazprom.

https://www.kommersant.ru/doc/6508611

*International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

The International Ice Hockey Federation (IIHF) has extended the ban on participation in competitions for the national teams of Russia and Belarus for the 2024/25 season.

14.02.2024

*Siemens Energy AG (Independent) (Germany, Energy, oil and gas) Status by KSE – leave

Systems LLC (formerly Siemens LLC, the Russian structure of Siemens AG) plans to initiate a voluntary liquidation procedure in February 2024 due to the inability to continue its normal activities related to the import of goods into the Russian Federation, according to the company’s report on the results of 2023.

https://www.interfax.ru/business/945669

*FATF (France, Association, NGO) Status by KSE – stay

Ukraine once again called on the FATF to include the Russian Federation in the “black list” against the background of strengthening ties with the DPRK and Iran

15.02.2024

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Ukraine has refused to remove Raiffeisen Bank International from a “sponsors of war” blacklist, challenging the biggest Western bank in Russia to sever its ties to Moscow.

*Stellantis (Netherlands, Automotive) Status by KSE – leave

Exclusive-Russians use Chinese partner to produce Citroen cars at idled Stellantis plant

*Haval Motor (China, Automotive) Status by KSE – stay

Haval remained his own in Russia

https://www.kommersant.ru/doc/6509473

*Daimler Truck (Germany, Automotive) Status by KSE – exited

Mercedes-Benz Group’s Daimler Truck, which halted operations in Russia in 2022 but was still a “dormant shareholder” of Kamaz , sold its 15% stake in the leading Russian truck maker in 2024, Kamaz CEO Sergei Kogogin said in an interview with Vedomosti published

16.02.2024

*DenizBank (Turkey, Finance and payments) Status by KSE – stay

A large Turkish bank began checking residence permits for Russian clients

https://www.rbc.ru/finances/15/02/2024/65ce3d759a79473d637c1cc0

*Euroclear (Belgium, Finance and payments) Status by KSE – stay

Euroclear warns against G7 plan to backstop Ukraine debt with Russian assets

https://www.ft.com/content/01a4da27-109e-4db9-bd0e-160ec55a5cd0

*Baring Vostok Capital Partners (Russia, Finance and payments) Status by KSE – leave

The authorities agreed on the division of the Baring Vostok business: Vostok Investments (Russian team) will buy 12 assets of the fund. But the sale of one of them – a share in Ozon – will come with a condition: it must be sold to an “unauthorized person”

https://www.rbc.ru/technology_and_media/15/02/2024/6565be589a794708d3d37386

*Weatherford (USA, Energy, oil and gas) Status by KSE – stay

Oil production equipment manufacturer Weatherford was listed as a war sponsor

https://sanctions.nazk.gov.ua/en/boycott/1036/

*Gühring KG (Germany, Industrial equipment) Status by KSE – stay

Should I stay or should I go? German drill manufacturer Gühring KG announced withdrawal from Russia, but supplies of its production continued

17.02.2024

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Mondelez revamps European operations after boycotts over Russian business, internal memos show

18.02.2024

*Vivalon AG (Switzerland, Agriculture) Status by KSE – stay

*ADM (USA, Agriculture) Status by KSE – stay

*Cargill (USA, Agriculture) Status by KSE – stay

*Louis Dreyfus (France,Agriculture) Status by KSE – leave

Russian Grain Plundering in Ukraine

*Sitrak | SINOTRUK (Hong Kong) Limited (Hong Kong, Automotive) Status by KSE – stay

For the first time in modern history, KamAZ lost its leadership in Russia

https://motor.ru/news/kamaz-vs-sitrak-17-02-2024.htm

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – exited

Polymetal to Drop Out of Top 10 Gold Miners on Russia Sale

https://finance.yahoo.com/news/gold-miner-polymetal-sell-russian-051618871.html

Precious metals producer Polymetal International has agreed to sell its Russian assets to a Siberian gold miner for about $3.7 billion

19.02.2024

*Liberian International Ship & Corporate Registry (USA, Marine Transportation) Status by KSE – leave

The National Agency for the Prevention of Corruption (NACP) excluded the American company Liberian International Ship & Corporate Registry (LISCR) from the list of international sponsors of the war.

20.02.2024

*Leroy Merlin (France, FMCG) Status by KSE – stay

Leroy Merlin in Russia, our revelations: opaque agreements, false starts and contracts with the state

*PBS Velka Bites (Czech Republic, Engineering) Status by KSE – stay

*Tallysman (Canada, IT) Status by KSE – stay

*STMicroelectronics (Switzerland, IT) Status by KSE – stay

*Analog Devices (USA, Electronics) Status by KSE – stay

*NXP USA, Inc. (USA, Electronics) Status by KSE – stay

*Intel (USA, IT) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – stay

Disassembly of the Shahed-238 jet: engine from the Czech Republic, navigation from Canada

*Siemens Mobility (Germany, Logistics, Transport) Status by KSE – leave

Siemens Mobility LLC, which belongs to the German concern Siemens, wants to recover 1.15 billion rubles from Ural Locomotives. In 2022, Siemens announced the cessation of business in Russia.

https://www.kommersant.ru/doc/6524663

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

Putin allowed Expobank to acquire all shares of HSBC Bank

https://ria.ru/20240219/bank-1928302885.html

*DMG Mori Seiki (Japan, Industrial equipment) Status by KSE – leave

President Vladimir Putin signed an order transferring 100% of the shares of Ulyanovsk Machine Tool Plant LLC to the Federal Property Management Agency for temporary management. The plant belonged to the German subsidiary of DMG MORI – Seiki Gildemeister Beteiligungen.

21.02.2024

*Rohde & Schwarz (Germany, Technology) Status by KSE – leave

As an international technology group, Rohde & Schwarz also had business relationships with Russia in the past. Once the war began, Rohde & Schwarz immediately enacted the sanctions imposed on Russia and halted its business relationships with Russia.

*Danone (France, FMCG) Status by KSE – leave

Danone plans to sell its Russian business to a member of the Kremlin-installed leadership with ties to the nephew of Chechen leader Ramzan Kadyrov, seven months after Putin ordered the confiscation of the French company’s local operations.

https://www.ft.com/content/6c1c5fe0-5a98-4d67-acfb-caf482e109cf

https://minfin.com.ua/2024/02/21/121907842/

*Industrial Bank (China) (China, Finance and payments) Status by KSE – stay

*Bank of China (China, Finance and payments) Status by KSE – stay

*China Construction Bank (China, Finance and payments) Status by KSE – stay

The three largest banks in China have stopped accepting payments from Russian sanctioned financial organizations, Izvestia found out. We are talking about Industrial and Commercial Bank of China (ICBC), China Construction Bank and Bank of China. This decision is associated with the risks of secondary sanctions.

*Orion Pharma (Finland,Pharma, Healthcare) Status by KSE – leave

Finnish drug manufacturer Orion Pharma suffers critical losses after leaving the Russian market

https://www.pravda.ru/news/economics/1953944-finljandija/

*Campari (Italy, Alcohol&Tobacco) Status by KSE – stay

One of the few global alcohol companies remaining in Russia, the Italian Campari Group, which owns the Aperol brand, has replaced the head of its local division.

22.02.2024

*Jacbac Technology (Turkey, Agriculture) Status by KSE – stay

Despite strict export controls and sanctions, Russia continues to obtain Western technology — including computer numerical controlled (CNC) machine tools.

https://c4ads.org/commentary/putting-the-pieces-together/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The Austrian regulator is checking the control of money laundering at Raiffeisen Bank

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Dirk Van de Put, CEO of the Mondelez company, which is included in the list of sponsors of the war from NAZK, said that the confectionary group did not face pressure from shareholders to completely leave the Russian market.

https://www.epravda.com.ua/news/2024/02/22/710268/

*Linde (Germany, Chemical industry) Status by KSE – leave

A court in Russia confiscated the assets of the German company Linde GmbH, which refused to build a gas processing complex for Gazprom in Ust-Luga and supply high-tech equipment due to EU sanctions against Russia.

https://www.epravda.com.ua/rus/news/2024/02/22/710281/

*AGC (Japan, Construction & Architecture) Status by KSE – leave

Japan’s AGC, which is the world’s largest glass producer, sold its Russian business. Borsk glass factory (BSZ) and Klinsk glass factory were acquired by St. Petersburg holding “Adamant”, which is one of the largest glass processors in Russia. The price of the deal is not known.

https://www.kommersant.ru/doc/6531268

https://www.gazeta.ru/business/news/2024/02/22/22393669.shtml

23.02.2024

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The Court of Arbitration for Sport (CAS) has rejected the Russian Olympic Committee’s (ROC) appeal against the International Olympic Committee’s (IOC) decision to terminate its membership.

*Royal Jordanian (Jordan, Air transportation) Status by KSE – stay

Jordanian airline Royal Jordanian plans to resume direct flights from Aqaba to Moscow in April

https://tourism.interfax.ru/ru/news/articles/106322/

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – exited

Polymetal shares rose 15% after delisting plans were denied

https://quote.rbc.ru/news/article/65d6f3349a79472a859dcf83

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Foreign companies managed by the Federal Property Management Agency will be able to receive government support

25.02.2024

*FATF (France, Association, NGO) Status by KSE – stay

The Financial Action Task Force (FATF) continued to suspend Russia’s membership without imposing further restrictive measures.

https://www.epravda.com.ua/news/2024/02/23/710361/

*Mondelez (USA, Food & Beverages) Status by KSE – stay

UK MPs Express ‘Deep Concern’ Over Cadbury Owner’s Russian Activity

26.02.2024

*Fennovoima (Finland, Energy, oil and gas) Status by KSE – leave

The first stage of hearings on the claims was held at the Arbitration Court in Paris.

https://www.kommersant.ru/amp/6533238

27.02.2024

*Konecranes (Finland, Engineering) Status by KSE – leave

Finnish Crane Giant Konecranes Winds Down Russian Subsidiary Amid Global Tensions

*LG Electronics (South Korea, Electronics) Status by KSE – stay

*Robert Bosch (Germany, Electronics) Status by KSE – exited

*Sony (Japan, Electronics) Status by KSE – leave

LG, Bosch and Sony stores are selling off stock before closing

https://www.kommersant.ru/doc/6533576

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Kazakh bank Freedom Finance has banned transactions with Mir cards

https://www.rbc.ru/finances/27/02/2024/65de3adc9a7947f42d497beb

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

The Finnish energy giant Fortum demands from the Russian Federation several billion euros in compensation for seized assets

28.02.2024

*FATF (France, Association, NGO) Status by KSE – stay

FATF lowered Russia’s rating in the field of control over transactions with cryptocurrency

*UnionPay (China, Finance and payments) Status by KSE – leave

In Russia, cards from the Chinese payment system UnionPay linked to the Huawei Pay service have stopped working.

*Ipak Yuli Bank (Uzbekistan, Finance and payments) Status by KSE – leave

Account holders in the Uzbek Ipak Yuli Bank received a message from the organization asking them to provide a personal identification number for an individual,

https://www.kommersant.ru/doc/6534655

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Groups that stay in Russia risk complicity in Putin’s war crimes

https://www.ft.com/content/81db4adf-0b46-4bee-bd02-51e7f9d1b0f2

29.02.2024

*OWH SE (Germany, Finance and payments) Status by KSE – leave

VTB Bank reported that it had received from its European subsidiary, the German OWH SE (formerly VTB Bank Europe), a notice of intention to deprive the bank of its ownership rights.

https://www.kommersant.ru/doc/6535581

*Apple (USA, Electronics) Status by KSE – stay

Apple products, including Vision Pro, still available in Russia despite company’s export ban

https://finance.yahoo.com/news/apple-products-including-vision-pro-172834629.html

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

Also, at the end of February 2024, the KSE Institute jointly with the B4Ukraine coalition partners published the report entitled “2024 Is the Year to Defund Russia’s War – The West Holds the Key” where, among other things, we estimated that the amount of taxes paid by foreign companies operating in Russia in 2022-2023 may amount to $20 billion annually. You can download its full text in English here: https://b4ukraine.org/pdf/b4u_report_2024.pdf

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business On February 24, 2024 KSE status “wait” was merged with status “stay”

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website