- Kyiv School of Economics

- About the School

- News

- 61th issue of the regular digest on impact of foreign companies’ exit on RF economy

61th issue of the regular digest on impact of foreign companies’ exit on RF economy

5 February 2024

We will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 08.01.2023-04.02.2024.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed an application in the Apple Store which is available only for mobile devices in addition to our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

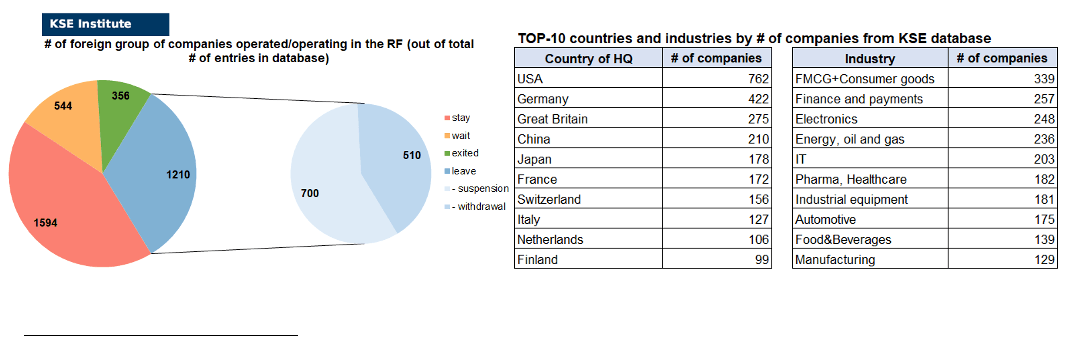

KSE DATABASE SNAPSHOT as of 04.02.2024

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 594 (+18 per month)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 544 (-3 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 210 (+4 per month)

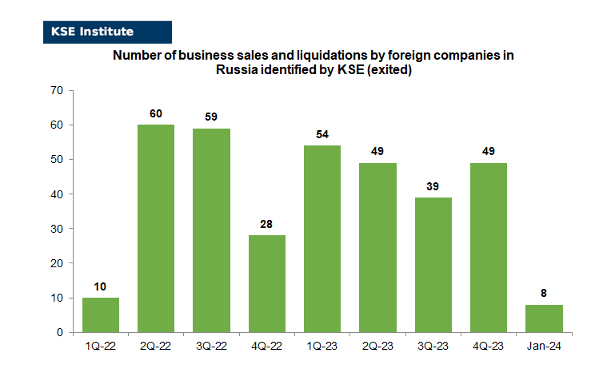

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 356 (+8 per month)

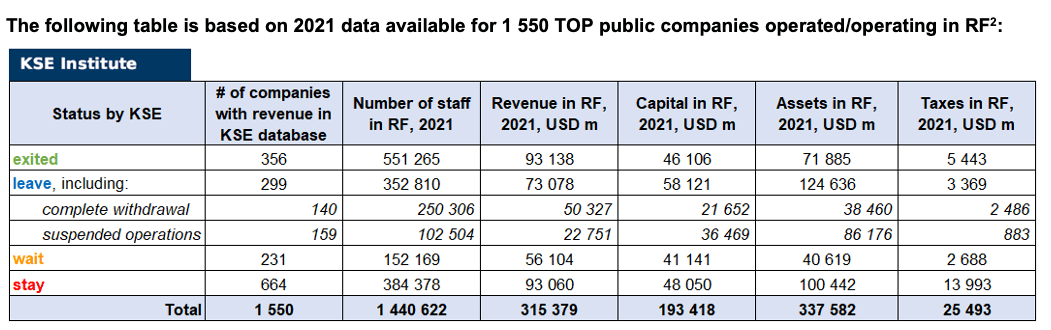

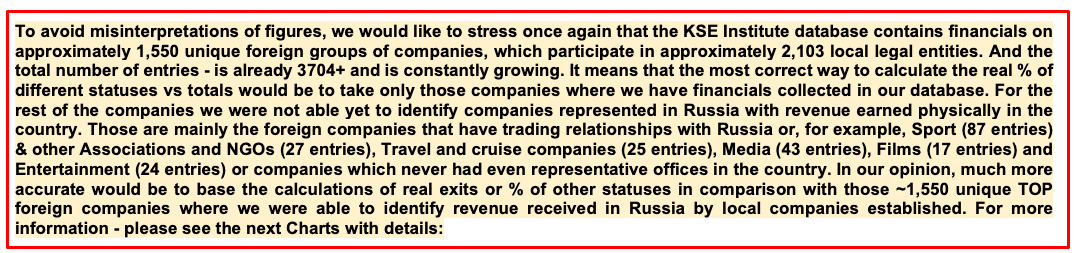

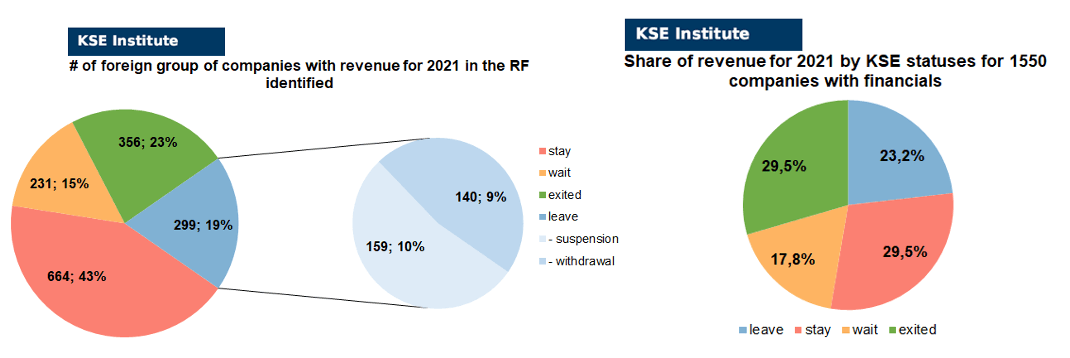

As of February 4, 2024, we have identified about 3,704 companies, organizations and their brands from 99 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 550 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.4 billion), local revenue (about $315.4 billion), local assets (about $337.6 billion) as well as staff (about 1.441 million people) and taxes paid (about $25.5 billion). 1,210 foreign companies have suspended or ceased operations in Russia, 544 – reduced and limited their activities. Also, we added information about 356 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers (4 business liquidations took place in January 2024).

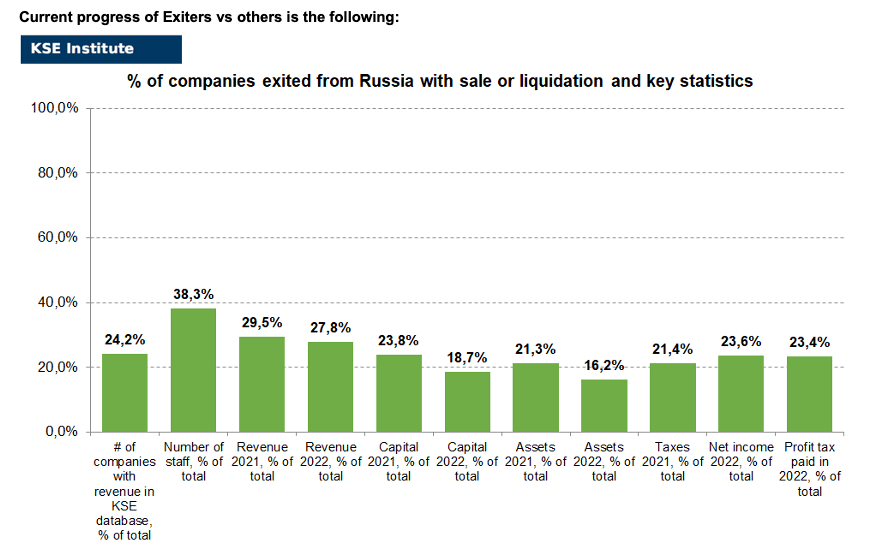

As can be seen from the tables below, as of February 4, 2024, 356 companies which had already completely exited from the Russian Federation, in 2021 had at least 551,300 personnel, $93.1 bn in annual revenue, $46.1bn in capital and $71.9bn in assets; companies, that declared a complete withdrawal from Russia had 250,300 personnel, $50.3bn in revenues, $21.7bn in capital and $38.5bn in assets; companies that suspended operations on the Russian market had 102,500 personnel, annual revenue of $22.8bn, $36.5bn in capital and $86.2bn in assets.

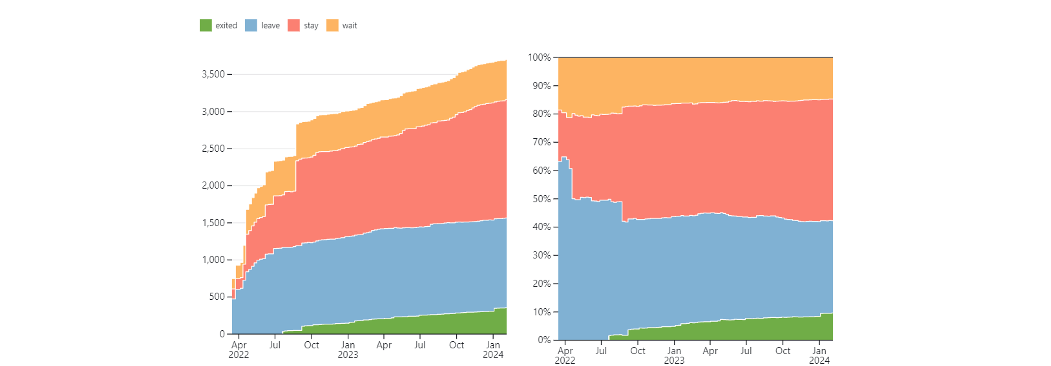

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 17 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 34 were added in January 2024). However, if to operate with the total numbers in KSE database, about 32.7% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 43.0% are still remaining in the country, 14.7% are waiting and only 9.6% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of 356 companies that completely left the country, since in 2021 they employed 38.3% of the personnel employed in foreign companies, the companies owned about 21.3% of the assets, had 23.8% of capital invested by foreign companies, and in 2021 they generated revenue of $93.1 billion or 29.5% of total revenue and paid ~$5.4 billion of taxes or 21.4% of total taxes paid by the companies observed. Data on 1,550 TOP companies is presented in the table above.

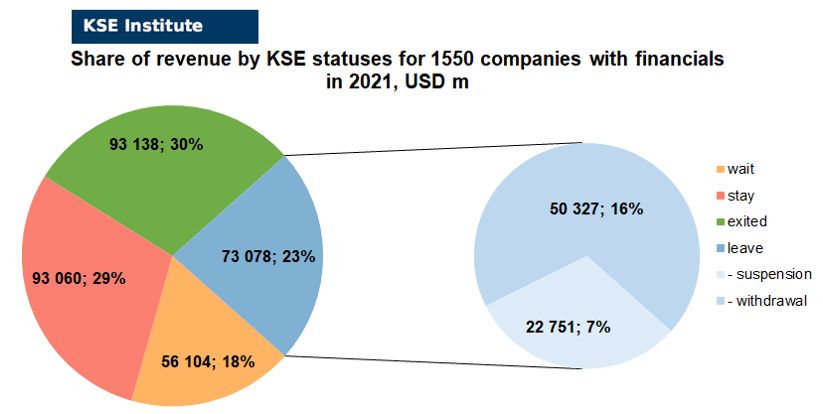

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (23%) and on share of revenue withdrawn (29.5%). At the same time, a totally different picture is for those who are still staying – 43% of companies represent 29.5% of revenue and 15% of waiting companies represent 17.8% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

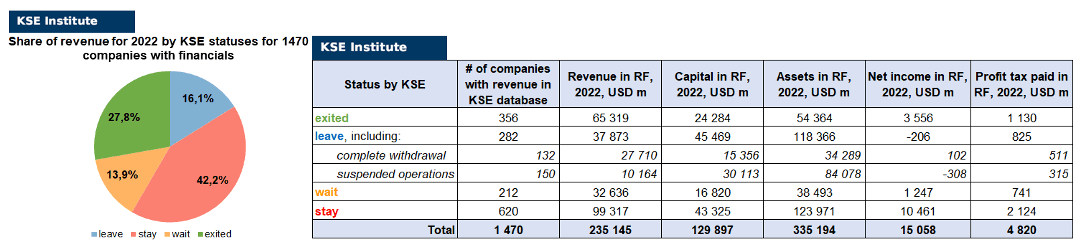

KSE Institute has also collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1470 companies (about 80 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

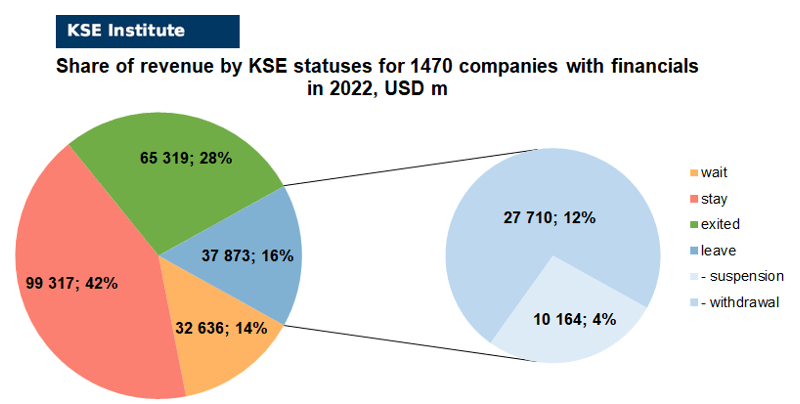

As you can see from the charts above, companies which fully exited Russia were able to generate 1.7% less of revenue in 2022 (27.8% from total volume) than in 2021 (29.5% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.1%) revenue in 2022 (16.1% from total volume) than in 2021 (23.2% from total volume). At the same time, staying companies were able to generate much (+12.7%) more revenue in 2022 (42.2% from total volume) than in 2021 (29.5% from total volume). Companies with status “wait”⁴gained a lower share (-3.9%) of revenue in 2022 (13.9% from total volume) vs 17.8% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($335.2bn⁵ in 2022 vs $337.6bn in 2021) and would even probably increase if the remaining reporting for ~80-90 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Iran to sign currency agreement with Russia

28.12.2023 | The head of the Central Bank (CB) of Iran, Mohammad Farzin, announced the signing of a currency agreement with Russia. According to him, the parties will sign a currency agreement, which will allow trading in rubles and rials, in the first quarter of 2024.

https://lenta.ru/news/2023/12/28/iran-anonsiroval-podpisanie-valyutnogo-soglasheniya-s-rossiey/

The government admitted that no one is waiting for Russian goods in China, India and other “friendly” countries

29.12.2023 | Russian goods, which were sold in Europe before the war in Ukraine, turned out to be of no use to anyone in “friendly” countries, said First Deputy Prime Minister of the Russian Federation Andrei Belousov. According to him, there are currently no Russian goods in China, India and Vietnam. For them to appear there, manufacturers need to create competitive advantages.

The Kremlin announced the preparation of lists for confiscation of assets from foreigners

29.12.2023 | Russia has prepared a list of assets of foreign investors that will be confiscated as a retaliatory measure in the event of confiscation of frozen Central Bank reserves. Kremlin press secretary Dmitry Peskov spoke about this at a briefing on Friday, December 29, 2023. “We analyzed possible retaliatory steps in advance. We will do everything so that it best suits our interests,” Peskov said, adding that the idea of confiscation discussed by the West violates international law and is “theft.” Previously, the Russian authorities had already transferred large assets of such Western investors as Fortum, Uniper, Carlsberg and Danone to the management of the Federal Property Management Agency. The Russian government does not believe that the West will decide on confiscation, which has been discussed since the beginning of the war against Ukraine, a high-ranking source in the Cabinet told Reuters.

https://www.moscowtimes.ru/2023/12/29/kreml-zayavil-opodgotovke-spiskov-nakonfiskatsiyu-aktivov-uinostrantsev-a117563 ; https://www.kommersant.ru/doc/6440572

Putin gave China $9 billion through oil discounts

29.12.2023 | The reversal of Russian oil flows to the east after Western sanctions and the European embargo resulted in multi-billion dollar losses for oil companies. The forced discounts that oil companies gave to sell their barrels to China cost them $9 billion in lost revenue, experts from the Gaidar Institute calculated. From March to December 2022, the total discount provided to Chinese buyers of Russian oil amounted to $5.3 billion, and for January–September 2023 – another $3.7 billion.

China will become the world’s top auto exporter for the first time thanks to rising sales in Russia

29.12.2023 | In the first 11 months of 2023, China supplied about 730 thousand cars to the Russian Federation, which is seven times more than in 2022, Nikkei reports.

https://tass.ru/ekonomika/19649203

Russia nationalized the assets of another Russian billionaire

29.12.2023 | Another Russian billionaire fell under the steamroller of nationalization of the property of large businesses, launched by the state after the start of the war with Ukraine. Alexander Klyachin, who became rich in real estate, whose fortune Forbes estimates at $1.2 billion, lost the key assets of his development business – Danilovskaya Manufactory, the Vernadsky and Aviator business centers, as well as a mansion on Smolensky Boulevard.

Imports of Chinese transport equipment to Russia increased 8 times

30.12.2023 | Imports of Chinese transport equipment to Russia – railway cars, cars and trucks, as well as aircraft and ships – have grown by 800% since March 2022.

https://tlgrm.ru/channels/@banksta/46535

One of the main beneficiaries of the conflict between the West and Russia was the yuan

02.01.2024 | One of the main beneficiaries of the West’s conflict with Russia was the yuan. The share of the Chinese currency in settlements through the international SWIFT system increased from 2% at the beginning of 2022 to 5% by the end of 2023. It is still far from being the leader in the dollar (85%), but it was possible to push the euro into third place. Despite the fact that SWIFT does not take into account settlements with Russia, Iran and other sanctioned countries, i.e. in reality, the share of the yuan in international trade is noticeably higher. In fact, it has already become a new reserve currency.

https://www.tinkoff.ru/invest/social/profile/basebel/46d4e491-b87f-4790-b0fa-efb3d1c54a2f/

Putin signed a decree on granting citizenship to foreigners serving in the Russian army

04.01.2024 | Russian President Vladimir Putin signed a decree providing for the possibility of obtaining Russian citizenship in a simplified manner by foreigners who have entered into a contract for military service in the Russian Armed Forces or other military formations. Members of their families will also be able to apply for citizenship.

https://www.kommersant.ru/doc/6442104 ; http://publication.pravo.gov.ru/document/0001202401040001?index=1

Exports of machine tools from China to Russia increased 10 times. We are talking about CNC milling machines

04.01.2024 | Exports rose to $68 million from $6.5 million in February 2022. At the same time, imports of CNC machines from the EU have dropped sharply. CNC machines of Chinese origin accounted for 57% of Russian imports by value in July, up from 12%.

Finland remains a transit country for Russian nuclear fuel

05.01.2024 | Finland remains a transit country for Russian nuclear fuel; the last delivery from Russia was in December 2023. This was reported to TASS by Risto Isaksson, a representative of the press service of the Finnish Radiation and Nuclear Safety Authority. “Nuclear fuel itself is not subject to sanctions, and transit can be expected to continue until sanctions are imposed on nuclear fuel,” Mr. Isaksson said.

https://www.kommersant.ru/doc/6442298 ; https://tass.ru/ekonomika/19677575

Finland plans to ban Russian LNG imports in 2025

05.01.2024 | Finnish authorities plan to ban imports of Russian liquefied natural gas (LNG) for a limited period in 2025. This was reported by the Finnish newspaper Helsingin Sanomat with reference to the Minister of Environment and Climate Affairs Kai Mykkänen. “The government is preparing to ban the import of Russian LNG into Finland, and the goal is that the ban can come into force in 2025,” the minister said. He emphasized that the volumes of LNG supplies from Russia are small, so “this issue is not significant.”

https://www.kommersant.ru/doc/6442356

“There won’t be enough for a new crisis.” The war “ate” half of the available funds of the National Welfare Fund

05.01.2024 | The stability of the economy in conditions of war and sanctions, which the authorities insist on, is largely ensured by the injection of trillions from the budget, and those by the active spending of funds from the National Welfare Fund (NWF). In less than two years of war, half of this stash, which had been accumulating for many years, was spent. At the end of 2023, the fund will have 12 trillion rubles, said Finance Minister Anton Siluanov. This amount includes everything, including a controlling stake in Sberbank and other assets that the Ministry of Finance does not intend to sell or cannot sell, which means they are useless for fighting the crisis. Therefore, the so-called liquid part of the National Welfare Fund, which the authorities can dispose of, is much more important. From it, the Ministry of Finance finances the budget deficit and takes money to support the economy. This part will amount to approximately 4.7 trillion rubles by the end of the year. This is approximately $52 billion. Over two years, the liquid part of the National Welfare Fund has decreased by approximately half: by 44% in ruble terms and by 54% in dollars.

Russians’ demand for foreign citizenship soars to record level since the start of the war

08.01.2024 | By the end of 2023, Russians began to actively take an interest in the possibility of obtaining foreign citizenship. This is evidenced by the statistics of search queries in Yandex. Over the last three months of 2023, the number of search queries for “foreign citizenship” in Yandex from users from Russia did not fall below 94,000 per month. This figure reached its peak value of 134,832 requests in November. This is the maximum figure since the beginning of the war in Ukraine. Previously, a surge in interest in foreign citizenship was observed in December 2022 – 103,301 views.

Two Russian banks received a foreign portfolio investor license in India in December 2023

09.01.2024 | In December 2023, two Russian banks received a foreign portfolio investor license in India. The license provides access to the local stock market. In particular, Tinkoff Bank (13th in terms of assets in the Russian Federation) received a license of the second category, and Centrocredit (78th) received a license of the first and second categories. Until now, licenses from Russian entities were held by Sberbank, several management companies and a number of citizens. In conditions of limited access to the stock markets of Western countries, this opportunity allows not only to retain clients, but also to earn money by providing brokerage services.

https://www.kommersant.ru/doc/6442955

From January 9, the Bank of Russia will begin selling currency from the National Welfare Fund to support the ruble exchange rate

09.01.2024 | It is explained that the daily volume of transactions will be determined depending on the volumes of sales or purchases of foreign currency announced by the Ministry of Finance on the third working day of each month as part of regular operations under the budget rule. Approximately, the daily volume of foreign exchange transactions will exceed 11.5 billion rubles. They will be adjusted by the balance value of such operations as the difference in the volume of regular operations deferred from August 10 to December 31 of last year within the framework of the budget rule (RUB 1,529 billion) and the amount of money spent from the National Welfare Fund to finance the federal budget deficit outside the budget rule for the past year (2,900 billion rubles).

https://rg.ru/2024/01/09/cb-nachinaet-prodavat-valiutu-iz-fnb-radi-podderzhki-kursa-rublia.html

Russia, Denmark and Latvia terminated the double tax treaties

09.01.2024 | The Russian Foreign Ministry announced the termination of the agreement from January 2024. It was concluded in December 2010. The double tax treaty between the governments of Russia and Denmark has also been terminated as of January 1, 2024.

https://frankmedia.ru/150886 ; https://tass.ru/ekonomika/19691639

Rosstat warned of the threat of a decline in Russia’s population to 19th-century levels

10.01.2024 | Over the next two decades, Russia may be dying out at a rate of 800,000 people per year, and by the middle of the 21st century it could lose 15.1 million people, according to a “negative” forecast by Rosstat. According to the “basic” forecast, the natural population decline of the Russian Federation in 2023-46 will average 500,000 people per year, and the population will decrease by 7.6 million people, to 138.8 million—the minimum since 1981. In Rosstat’s “pessimistic” scenario, Russia will meet the second half of the 19th century with only 130.6 million permanent population, which corresponds to the level of the RSFR in the early 1970s (130 million), or the Russian Empire in 1897 (129 million).

Russia strengthens its leadership in the number of sanctions imposed on the country, continuing to update world records

10.01.2024 | As of December 15, 2023, 18,772 sanctions have been imposed against Russia, which is 3.8 times higher than Iran, which is second on the list.

https://www.tinkoff.ru/invest/social/profile/RUSSTYLE_/ac5886c1-4749-49b4-a192-e3f93a88eba1/

Ingosstrakh filed a claim against 20 foreign reinsurers

10.01.2024 | Among the defendants are major international players: the German Allianz and Hannover Re, the Swiss Swiss Re, the American Transatlantic Reinsurance, the Korean Korean Reinsurance Company, the Indian General Insurance Corporation of India and the Qatari Qatar Reinsurance Company. The claim relates to unrecovered debt under reinsurance contracts.

Russia has increased oil drilling to a record level for the second year in a row, despite sanctions

10.01.2024 | According to Bloomberg, in the first eleven months of 2023, Russia drilled oil wells with a total depth of 28 thousand kilometers. Thus, the agency notes, citing data from analysts Kpler and Yakov and Partners, at the end of the year, the scale of drilling could reach an indicator unprecedented in the entire post-Soviet period. The volume of work set records for the second year in a row. The number of wells launched in January-November 2023 has already exceeded the entire figure for 2022. And the number of completed wells is close to a five-year record.

The Ministry of Finance will resume the sale of foreign currency according to the budget rule from January 15

11.01.2024 | Oil and gas revenues of the Russian budget for December amounted to 199.9 billion rubles. below the forecast, therefore the Ministry of Finance of the Russian Federation will switch to foreign currency sales, having allocated 69.1 billion rubles for these purposes according to the budget rule from January 15 to February 6, the daily sales volume will amount to 4.1 billion rubles, according to materials on the ministry’s website.

https://www.kommersant.ru/doc/6444616

For the first time in 1.5 years, the United States resumed imports of Russian oil

11.01.2024 | According to the American statistical service, the United States imported oil from Russia for the first time in a year and a half. In October 2023, 36,800 barrels were purchased. oil for $2.7 million. In November, the United States purchased another 9,900 barrels from Russia for $750 thousand. In both cases, the fuel was purchased for consumption. At the same time, the cost of one barrel of Russian oil was $74, and in November – $76, which is higher than the established “price ceiling” of $60/barrel.

https://www.dk.ru/news/237196453 ; https://ria.ru/20240111/ssha-1920646672.html ; https://www.kommersant.ru/doc/6444474

Russia has lost almost 10 thousand companies with foreign participation since the start of the war in Ukraine

11.01.2024 | During the two years of war in Ukraine, the number of companies with foreign participation in Russia decreased by 9.6 thousand, Vedomosti writes, citing an assessment by SPARK-Interfax. In particular, in 2022 there were 6,200 fewer of them, and over the 10 months of last year – by another 3,400. The net decrease in the total number of companies with foreign participation is due to the fact that the number of liquidated entities was greater than new registrations. Thus, in 2023, 9,500 legal entities were liquidated, while 6,100 new ones were opened. In total, since March 2022, 23.5 thousand companies with the participation of non-residents have ceased to operate. These were mostly small organizations: according to SPARK-Interfax, only 2 thousand of them had revenue of more than 50 million rubles. At the end of 2023, there were 37% fewer companies operating than in the peak year for the number of such legal entities in 2017 – 116,400 versus 185,000. At the same time, the activity of residents from China and the CIS increased sharply.

https://www.vedomosti.ru/economics/articles/2024/01/11/1014512-za-dva-goda-chislo-kompanii-s-inostrannim-uchastiem-sokratilos ; https://www.moscowtimes.ru/2024/01/11/rossiya-poteryala-pochti-10-tisyach-kompanii-s-inostrannim-uchastiem-s-nachala-voini-v-ukraine-a118114

The budget deficit exceeded ₽3 trillion for the second year

11.01.2024 | The budget deficit exceeded 3 trillion rubles for the second year. The Ministry of Finance revealed the preliminary results of the execution of the federal budget in 2023: revenues amounted to 29.12 trillion rubles, expenses – 32.36 trillion. Thus, the budget deficit at the end of 2023 amounted to 3.24 trillion rubles. This is slightly less than in 2022, when the negative balance amounted to 3.3 trillion rubles. As a percentage of GDP, the budget deficit fell to 1.9%, down from 2.1% of GDP in 2022. The budget law planned that the deficit would be 2.93 trillion rubles, or 2% of GDP.

https://www.rbc.ru/economics/11/01/2024/659fcb249a794776968fe8a8 ; https://www.kommersant.ru/doc/6444931

Trade turnover between Russia and China in 2023 reached a record $240.11 billion

12.01.2024 | Trade between Russia and China in 2023 increased by 26.3%, to a record $240.11 billion, Chinese customs reported. Exports from China to the Russian Federation increased by 46.9%, to $110.97 billion, imports of Russian goods – by 12.7%, to $129.14 billion.

https://www.kommersant.ru/doc/6445076

Swiss bank Cramer closes its representative office in Russia

12.01.2024 | The Bank of Russia excluded from the register of representative offices of foreign banks that are accredited in Russia another credit organization – the Swiss bank Banque Cramer & Cie SA (Bank Cramer & Cie SA), it follows from the regulator’s materials.

https://frankmedia.ru/151284 ; https://www.cbr.ru/registries/bank_sektor/#a_135318

Russia will challenge the confiscation of frozen assets in court

12.01.2024 | Russia is preparing legal action to prevent attempts by the United States or Europe to confiscate $300 billion in frozen Central Bank assets in favor of Ukraine. Bloomberg reports this, citing sources. Russian officials, speaking on condition of anonymity, told the agency that the Bank of Russia is now close to concluding an agreement with international law firms to represent the country’s interests in the event of litigation. Russian authorities have also commissioned expert reports analyzing relevant foreign legislation and precedents, the sources said.

https://www.kommersant.ru/doc/6452505

Importers of electronics in the Russian Federation refused to purchase them for dollars and euros

15.01.2024 | Russian electronics importers have abandoned payments in dollars and euros. Last year, almost all purchases were paid for in yuan, dirhams, rupees and other currencies of friendly countries.

Oil supplies from the Russian Federation to Turkey reached a record in December 2023 due to an increase in sea shipments from Baltic ports

16.01.2024 | Russian oil companies continue to increase seaborne oil shipments to Turkey, mainly from Baltic ports. In December, Turkey set a new record for imports of Russian oil – 444 thousand barrels per day. A significant increase in oil and fuel supplies to Turkey was a consequence of the sanctions embargo on oil and petroleum products, as a result of which the Russian Federation practically stopped supplies to Europe. Importers benefit significantly from the fact that Russian oil and petroleum products are trading at discounts amid Western sanctions.

https://www.kommersant.ru/doc/6453926

Foreign top managers are leaving Russian companies en masse

16.01.2024 | The number of foreign directors in Russian companies has decreased since the start of the war. According to research by the KFR consulting group, cited by TASS, this figure decreased from 30% to 11.7%. A large outflow of foreign executives occurred in 2022. Then their number in Russia fell by more than half: in 2021 their share was 30%, and in 2022 – 14%. The bulk of foreign directors turned out to be US citizens – they account for a third (33%) of all managers, and Europeans account for another quarter (25%). In 2023, changes in the composition of the boards of directors occurred in only 12% of companies. The share of new directors elected to boards was just over 16%. This is more than two times less than in 2022 (34%). Most companies (67%) added at least one new director, 8.5% of whom were foreigners.

https://tass.ru/ekonomika/19735777 ; https://www.moscowtimes.ru/2024/01/16/inostrannie-top-menedzheri-massovo-pokidayut-rossiiskie-kompanii-a118500

India explains the decline in oil purchases from Russia by tightening sanctions

16.01.2024 | India, the largest importer of seaborne shipments of Russian oil, has increasingly begun to seek lower prices for raw materials from the Russian Federation. Indian authorities explain the break in oil purchases from the Sakhalin-1 project by the desire to comply with the established ceiling on oil prices, the conditions of which were tightened by the United States in December. The lack of agreements between the Russian Federation and India has led to the fact that about a dozen loaded tankers with Sakhalin oil are now idle at sea, awaiting unloading.

https://www.kommersant.ru/doc/6454659

The EU announced the start of the confiscation of Russian reserves

16.01.2024 | The EU countries have begun to implement the European Commission’s proposal to use the proceeds from Russia’s $300 billion frozen assets in the interests of Ukraine, Belgian Finance Minister Vincent van Peteghem said. He and his colleagues confirmed their “firm intention to move quickly on this issue.” “Work on the technical level has already started and we are going to make rapid progress,” emphasized van Petegem. The assets of the Russian Central Bank worth $300 billion were frozen by the G7 countries and Australia in 2022 after the outbreak of war in Ukraine. More than $220 billion is in the EU: this includes cash and government bonds in euros, dollars and other currencies. In Kyiv they have repeatedly called for these funds to be transferred to the reconstruction of the country.

https://www.moscowtimes.ru/2024/01/16/esobyavil-onachale-konfiskatsii-rezervov-rossii-a118600

There are no euros left in the Russian National Welfare Fund: only yuan, gold and rubles, the Ministry of Finance reported

17.01.2024 | The money received was credited to a single federal budget account to cover its deficit. As a result of these transactions, a zero balance was formed on the euro account. The total volume of the National Welfare Fund at the end of 2023 amounted to 11.965 trillion rubles. The dollar was abandoned back in 2021.

https://ria.ru/20240117/fnb-1921830529.html

2,500 leading scientists have left Russia since the start of the war in Ukraine

18.01.2024 | The war in Ukraine accelerated the “brain drain” from Russia: during two years of military conflict in the neighboring country, Russian science lost about 2,500 scientists, Novaya Gazeta calculated. Europe” based on data from the international ORCID database.

Large foreign companies are having difficulty obtaining licenses to service medical devices under the new rules

19.01.2024 | Russian representative offices of the American Medtronic and Becton Dickinson, the German Draeger, and the Japanese Fujifilm lost their licenses to service medical devices from January 1, 2024. This is due to changes in licensing rules for companies involved in servicing medical devices, which came into force this year.

https://www.kommersant.ru/doc/6456104

Russia plans to sever relations with “unfriendly countries” in response to the confiscation of $300 billion in Central Bank reserves

19.01.2024 | Russian authorities are considering the possibility of severing diplomatic relations with “unfriendly” countries in response to the confiscation of $300 billion in reserves, which is being prepared in the West. This was reported by Reuters, citing sources familiar with the position of the government and the Central Bank. Another response, according to one of the agency’s interlocutors, could be the confiscation of Western assets stuck in Russia.

Russian exports collapsed by $170 billion in a year

19.01.2024 | High oil prices, which helped the Russian economy avoid collapse after the start of the war, are left behind. Last year, Russian exports amounted to $422.7 billion – $169.4 billion (almost 30%) less than in the record year of 2022 ($592.1 billion) – this is the preliminary assessment of the Central Bank. This is the minimum since 2020, and if we exclude the pandemic year, then since 2018.

https://charter97.org/ru/news/2024/1/19/580107/ ; https://cbr.ru/statistics/macro_itm/svs/bop-eval/

How much income do instruments bring in Chinese currency?

21.01.2024 | The Chinese currency has confidently taken a key place in the Russian foreign exchange market. Banks and issuers are increasingly forced to compete for yuan. As a result, deposit returns reached 3.5–5% per annum. Higher yields are available on yuan bonds – 3.5–8.2% per annum. However, not all issues are equally liquid, which must be taken into account when choosing securities.

https://www.kommersant.ru/doc/6464488

Russian banks increase balances on correspondent accounts in US dollars

22.01.2024 | Exporters continue to hold currency abroad. Balances in dollar correspondent accounts of Russian banks abroad as of December 1, 2023 reached their highest level since October 2022. Their value has been growing continuously over the previous five months. Experts point out that international payments are heavily “dollarized” and this will not change soon. The main operations are carried out by subsidiaries of foreign banks in Russia, which are not limited in access to the “toxic currency,” experts note.

https://www.kommersant.ru/doc/6464554

The Hamburg court upheld the claim of Alisher Usmanov against the American Forbes

23.01.2024 | A Hamburg court found unreliable the words of an anonymous expert published by Forbes that Alisher Usmanov “acted as a figurehead” for Russian President Vladimir Putin. The EU authorities previously used these statements to justify the imposition of sanctions against the businessman.

https://www.kommersant.ru/doc/6465986

The Ministry of Finance advocated the extension of the mandatory sale of foreign currency earnings

23.01.2024 | The Ministry of Finance is in favor of extending the mechanism for mandatory repatriation and sale of foreign currency earnings by the largest Russian exporters, as it has proven to be “effective.” The department allows for adjustments to the scheme if necessary: this will happen if exporters begin to encounter difficulties.

https://www.kommersant.ru/doc/6466028

Air travel in Russia has risen in price to a record high in 15 years amid problems with foreign aircraft

23.01.2024 | Western sanctions, which hit Russian civil aviation and cut off carriers from repairs and spare parts for aircraft, provoked a strong jump in prices for air tickets. At the end of 2023, the cost of an economy class ticket per thousand kilometers of flight increased by 24.5%, according to Rosstat statistics. The rise in prices for air travel has become unprecedented since 2008, when, against the backdrop of the global financial crisis and the collapse of the ruble, carriers raised prices by an average of 33.5%. As a result of the cumulative total over two years of war, air tickets became more expensive by 48.4%, and last year the price increase accelerated: in 2022 it was 19.2%.

The largest bank in Cyprus left Russia

23.01.2024 | Bank of Cyprus closed its branches in Moscow and St. Petersburg on January 22, according to data from the Central Bank of Russia. From this moment on, the bank ceases accreditation of its representative offices in the country. Since the beginning of 2024, this is the third representative office of a foreign bank to close in Russia. Their total number in the country has decreased to 23.

https://riamo.ru/article/706309/krupnejshij-bank-kipra-ushel-iz-rossii

Russia has lost the largest offshore in Europe: Cyprus banks closed the accounts of 82% of clients from the Russian Federation

24.01.2024 | The largest offshore of Russian business in Europe, where tens of billions of dollars of raw material surplus income flowed in the “fat” years before the annexation of Crimea, has finally closed its doors to Russians. Banks in Cyprus closed the accounts of 82% of clients from the Russian Federation from 2014 to 2022, reports the Associated Press. The volume of funds “expelled” from Cyprus by the authorities is estimated at 43.5 billion euros.

The authorities demanded that bankrupt companies pay a “war tax”

25.01.2024 | Even those companies that have been declared bankrupt must pay excess profit tax by January 28. This follows from the explanations of the Ministry of Finance. The department recalled that the levy covers large businesses that have shown positive financial results for several years. Given such criteria, it is difficult to imagine an insolvent enterprise of this scale, the Ministry of Finance noted. They also added that in this case the question arises about the economic justification for the bankrupt status of the company.

https://iz.ru/1639229/milana-gadzhieva-mariia-stroiteleva/platezhnaia-vidimost-nalog-na-sverkhpribyl-dolzhny-perechislit-dazhe-bankroty ; https://www.moscowtimes.ru/2024/01/25/vlasti-potrebovali-ot-kompanii-bankrotov-zaplatit-nalog-na-voinu-a119432

Putin spoke about Rosneft’s plans to build a plant in India

25.01.2024 | President Vladimir Putin spoke about Rosneft’s plans to expand its presence in the Indian market. In particular, according to the head of state, the oil and gas company intends to build a new plant in India. Since 2017, Rosneft has owned a 49.13% stake in the first-class assets of the Indian Nayara Energy Limited, which includes a refinery in the city of Vadinar.

https://www.kommersant.ru/doc/6467445

Art-Finance purchased Hyundai’s Russian assets

26.01.2024 | The Russian company Art-Finance, which owns the former Volkswagen plant in Russia, has closed a deal to acquire the Hyundai plant in St. Petersburg.

https://www.kommersant.ru/doc/6476735

Putin signed a decree allowing important companies not to disclose information

27.01.2024 | Russian President Vladimir Putin signed a decree that allows economically significant organizations (ESO) and persons who have transferred to direct ownership of shares and interests in them not to disclose information about their activities. The document was posted on the website of the official publication of legal acts. Presidential Decree No. 73 of January 27, 2024 allows the EEO not to post information that must be made public in accordance with the laws on joint stock companies, banks, limited liability companies, auditing and others. It is noted that companies must provide information about activities at the request of federal executive authorities, but they should not be posted in the public domain.

https://www.kommersant.ru/doc/6477929 ; http://publication.pravo.gov.ru/document/0001202401270001?index=1

The start of construction of Russia’s largest gas pipeline to China is in jeopardy

28.01.2024 | The construction of the Power of Siberia-2 gas pipeline, which Russia planned to begin in the first quarter of 2024, may be postponed, writes The Financial Times with reference to the leadership of Mongolia, through whose territory the pipeline should pass.

https://www.moscowtimes.ru/2024/01/28/nachalo-stroitelstva-krupneishego-rossiiskogo-gazoprovoda-vkitai-okazalos-pod-ugrozoi-sriva-a119728 ; https://www.ft.com/content/f37f4b84-0d2c-4e7b-882c-3fb26822bb9c

Equipment and mechanical devices grew by 258%: what Russia began to import more from China. Infographics

29.01.2024 | In 2023, Russia increased imports of ground transport from China by 258% (to $22.52 billion). In terms of volume, equipment and mechanical devices are in first place, of which $25.24 billion were imported last year.

https://www.rbc.ru/economics/29/01/2024/65b6b5429a7947ee190a4a8a

Russian banks earned a record 3.3 trillion rubles in 2023

30.01.2024 | At the end of 2023, the Russian banking sector received a profit of 3.3 trillion rubles. This is the result of business growth, a reduction in the cost of risks and income from currency revaluation, according to the review of the Central Bank of Russia on the dynamics of bank development. “This result should not be considered in isolation from the weak results of 2022, when the sector earned 0.2 trillion rubles. Thus, the average profit of the sector for 2022–2023 amounted to 1.7 trillion rubles, which is 27% lower than in 2021. At the same time, total income for the year was lower by 0.2 trillion rubles. due to negative revaluation of debt securities through capital, bypassing profit,” the Central Bank clarified.

https://www.kommersant.ru/doc/6479306 ; https://www.cbr.ru/Collection/Collection/File/47805/razv_bs_23_12.pdf

How Lukashenko and Western countries help Russia circumvent sanctions

30.01.2024 | Experts from the Norwegian Helsinki Committee, in collaboration with the risk analysis company Corisk, the law firm Wikborg Rein and the European consulting agency Rud Pedersen, in their report, believe that the Russian Federation is able to continue the war in Ukraine largely thanks to Western technologies that it receives bypassing sanctions. Experts cite evidence that Turkey and Kazakhstan are key gateways for the flow of sanctioned goods to Russia. “Even more surprising is that a large number of military goods are sent directly from Europe to Russia,” the paper says. Particularly large direct supplies of sanctioned goods come from several Western countries, namely Poland, Germany and Lithuania, with the latter partially supplying sanctioned goods through Belarus.

https://charter97.org/ru/news/2024/1/30/581444/ ; https://www.nhc.no/en/violations-of-export-controls-regarding-war-critical-goods-to-russia/

Nabiullina reported a significant increase in the share of the yuan in Russian export payments

30.01.2024 | Over two years, the share of the yuan in Russian exports increased 86 times – to 34.5%, in imports – more than 8 times, to 36.4%, said the head of the Central Bank Elvira Nabiullina.

Russia in 2023 became the largest exporter of diesel to Brazil

30.01.2024 | Brazil has become the leader in terms of diesel fuel purchases from Russia, displacing Turkey from first place, the Financial Times writes, citing Kpler data. In 2023, imports of diesel fuel from Russia to the Latin American country jumped by 4,600%, and fuel oil by almost 400%. The country purchased 6.1 million tons of fuel for a total amount of $4.5 billion.

https://tass.ru/ekonomika/19854839

Medvedev announced the deployment of “new weapons” in the Kuril Islands

30.01.2024 | Russia is not against a peace treaty with Japan, but the issue of ownership of the Kuril Islands is “closed forever,” said Deputy Chairman of the Russian Security Council Dmitry Medvedev. He noted that the “strategic role” of these territories will grow, including that Russia will place new weapons there. “We don’t care deeply about the “feelings of the Japanese people” regarding the so-called Northern Territories. These are not “disputed territories,” this is Russia,” Medvedev emphasized. He also reproached the Japanese authorities for turning towards the United States.

MONTHLY FOCUS: On leaving the Russian Federation. Results of January 2024

In this digest, we will summarize the results of January 2024 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’550 companies identified in the KSE database with revenue data available of more than $315 billion in 2021 and ~$235 billion in 2022. And at least 356 of them have already been sold by local companies or were liquidated and left the Russian market. In January 2024 KSE Institute identified only +8 new exits (4 business sales and 4 liquidations), total number of exits observed since the beginning of Russia’s invasion reached 356. On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 30% based on revenue allocation, those who are leaving represent 23% of total revenue (with 31% share of suspensions and 69% of withdrawals sub-statuses), % of staying companies represent 29% of revenue and 18% are waiting companies based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is lower than % of leaving ones (which means that more than 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 28% based on revenue allocation, those who are leaving represent only 16% of total revenue (with 27% share of suspensions and 73% of withdrawals sub-statuses), % of staying companies represent 42% of revenue and 14% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

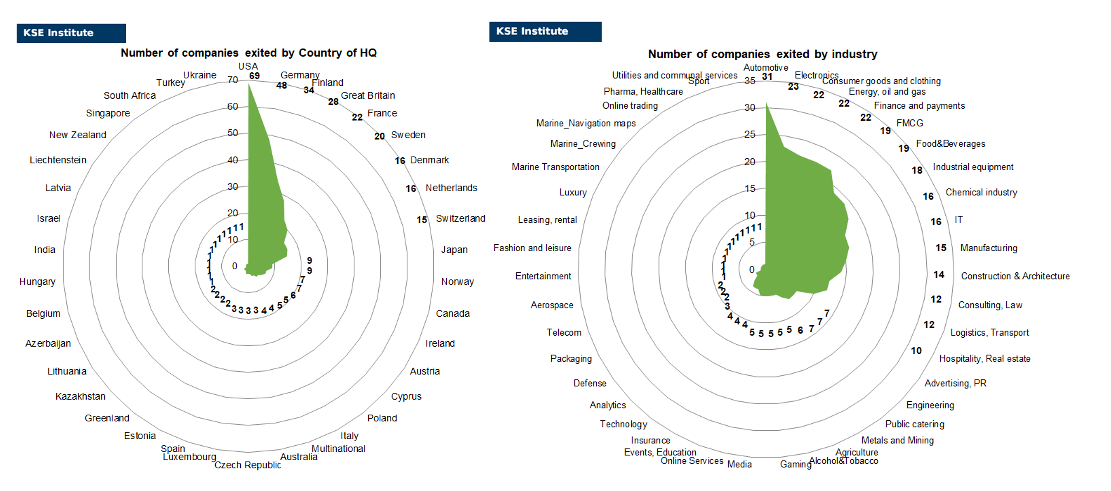

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of January 2023, companies from 37 countries and 42 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain and France and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments”, “FMCG” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Axis Communications (liquidation), Bank of Cyprus (liquidation), Banque Cramer & Cie SA (liquidation), ExxonMobil (liquidation), Famur, Faurecia, GEFCO Group, Royal Greenland.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Dow Chemical (01.2024: Partial exit, one of the 4 companies sold. Bendenko Sergey Nikolaevich and JSC “PLASTIC ” became the new founders of the organization. The entry about the founder of DOW EUROPE HOLDING B.V. was removed from the Unified State Register of Legal Entities. Previously Russian President Vladimir Putin has authorized the sale of the Finndisp chemical enterprise, owned by Dow Europe Holding B.V. The company is registered in the Netherlands and owned by the American Dow Inc.), Huntsman Corporation (S8 Capital agreed to acquire the Russian business of the American chemical company Huntsman), Fraport (Russia nationalizes St Petersburg Airport; Fraport et al left with shares with no voting rights), Hyundai (The Russian company Art-Finance, which owns the former Volkswagen plant in Russia, has closed a deal to acquire the Hyundai plant in St. Petersburg. According to Reuters, the transaction amount was $77.67 or about 7 thousand rubles), KIA Motors (Kia plans to sell shares in Hyundai’s Russian Factory amidst market shifts), WeWork (The American coworking network WeWork has agreed to sell its business in Russia. Both companies went bankrupt several years ago. The deal with O1 Properties will include four sites in Moscow with a total area of about 18 thousand square meters. m. for 3 thousand jobs. The sale is being considered by a government commission).

The next review of deals for February 2024 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis)⁷

07.01.2024

*TikTok (China, Online Services) Status by KSE – leave

*Netflix (USA, Online Services) Status by KSE – leave

In a remarkable move, major digital platforms TikTok and Netflix have suspended their services in Russia, a response to the country’s newly enacted ‘fake news’ law.

https://bnnbreaking.com/world/tiktok-and-netflix-suspend-services-in-russia-amid-fake-news-law-and-escalating-ukraine-conflict/

*International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

The head of the IIHF linked the admission of Russians to tournaments with the safety of their holding

https://www.kommersant.ru/doc/6442410

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Telegram Calls Out Russian Authorities For Mysteriously Removing Fines Against Tech Giants

08.01.2024

*Google (USA, Online Services) Status by KSE – exited

The European Commission has accused Google of spreading Kremlin propaganda

*Airbus (Netherlands, Aircraft industry) Status by KSE – wait

Lessor Settles $65 Million Airbus A320 Insurance Claim With Russia’s S7 Airlines

https://simpleflying.com/lessor-settles-airbus-a320-insurance-claim-s7-airlines/

09.01.2024

*Astellas Pharma (Japan, Pharma, Healthcare) Status by KSE – leave

Astellas explains decision on Wilprafen production in Russia

https://www.thepharmaletter.com/article/astellas-explains-decision-on-wilprafen-production-in-russia

*Morgan Stanley (USA, Finance and payments) Status by KSE – leave

*Allen & Overy (Great Britain, Consulting, Law) Status by KSE – leave

Morgan Stanley and Allen & Overy helping oligarch’s efforts to seize Russian oil firm

*Sotheby’s (USA, Culture and art) Status by KSE – wait

Russian Billionaire Rybolovlev’s Case Against Sotheby’s Kicks Off With a Fiery First Day in a New York Court

10.01.2024

*Allianz (Germany, Finance and payments) Status by KSE – leave

*Hannover Re (Germany, Insurance) Status by KSE – leave

*Swiss Re (Switzerland, Insurance) Status by KSE – wait

The company continued deliveries to Russia, although it said it would stop them

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Ukrainian athletes ask France to ban Russia at 2024 Olympics

*Hyundai (South Korea, Automotive) Status by KSE – leave

Former Hyundai Plant in St. Petersburg Reopens Under New Russian Owner

11.01.2024

*Subway (USA, Public catering) Status by KSE – stay

Included in the list of international war sponsors by NACP. The reason was that the company continues to operate in Russia and pay taxes to the Russian budget; Subway also managed to find legal mechanisms to receive royalties from Russia.

https://sanctions.nazk.gov.ua/boycott/1032/

https://www.epravda.com.ua/news/2024/01/10/708605/

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

Share of Russian aluminium in LME warehouses rises to 90% after UK curbs

*Campari (Italy, Alcohol&Tobacco) Status by KSE – stay

The Italian Campari Group, which owns the Aperol brand, has planned to launch its new aperitif Sarti Rosa on the Russian market.

https://www.kommersant.ru/doc/6444365

*Bybit (China, Finance and payments) Status by KSE – wait

Almost 20% of the traffic of the largest crypto exchanges came from Russia in December 2023

*Windar Renovables (Spain, Energy, oil and gas) Status by KSE – exited

Spain’s Windar Renovables exits Russian JV, Russian corporate filings show

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Russia to Cut Shell’s Sakhalin-2 Stake Compensation

https://www.energyintel.com/0000018c-f27a-d1af-a5bc-f7fe39230000

12.01.2024

*Royal Greenland (Greenland, Food & Beverages) Status by KSE – exited

Having suspended trade with the Russian Federation, a major supplier of northern shrimp to the world, Royal Greenland, headquartered in Greenland, has left the local business.

https://www.kommersant.ru/doc/6444981

*Pepsi (USA, Food & Beverages) Status by KSE – stay

Global food and beverage giant PepsiCo has banned any mention of the war in Ukraine in its advertising, even in Ukraine, the Ukrainian Council of Shopping Centers (UCSC) reported on Jan. 11.

https://uk.news.yahoo.com/global-beverage-giant-pepsico-bans-162300695.html?guccounter=1

https://www.epravda.com.ua/news/2024/01/14/708719/

*Banque Cramer & Cie SA (Switzerland, Finance and payments) Status by KSE – exited

Swiss bank Cramer closes its representative office in Russia

13.01.2024

*ASML Holding (Netherlands, IT) Status by KSE – stay

Russia imports ASML equipment for the production of microchips in parts.

https://www.epravda.com.ua/publications/2024/01/12/708637/

*Summit Ascent Holdings (China, Finance and payments) Status by KSE – leave

Oriental Regent Ltd, a subsidiary of Hong Kong-listed Summit Ascent Holdings Ltd, is set to sell its gaming and hotel operations in Russia.

*Agrana (Austria, Food & Beverages) Status by KSE – stay

The Austrian food company “Agrana”, which continues to work in the Russian Federation, announced negative consequences for itself from the duty-free import of Ukrainian sugar.

https://www.epravda.com.ua/news/2024/01/13/708714/

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

Loviisa plant cuts dependence on Russian nuclear fuel

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

Russian Citibank has blocked customer dividends worth about $4.7 billion

15.01.2024

*OTP Bank (Hungary, Finance and payments) Status by KSE – leave

OTP Bank is in communication with the national agency and the European Commission in the process of implementing the exit plan from the Russian Federation

https://banker.ua/uk/ugorskij-otp-bank-v-procesi-vixodu-z-rf/

*Binance (China, Finance and payments) Status by KSE – leave

The world’s largest crypto exchange will close Russians’ access to trading

16.01.2024

*Faurecia (France, Automotive) Status by KSE – exited

The assets of the French manufacturer of auto components Faurecia in Russia were transferred to the company of its Russian top managers – “Format Invest”.

https://www.epravda.com.ua/news/2024/01/17/708823/

*Mondi Group (Great Britain, FMCG) Status by KSE – exited

Mondi investors okay EUR 775 million special dividend after Russia exit

*Match Group (USA, Online Services) Status by KSE – leave

Match Group brands, including Tinder, are taking steps to end their services in Belarus.

https://zn.ua/ukr/WORLD/tinder-vijde-z-rinku-bilorusi-pislja-dnja-zakokhanikh.html

*Tether (China, Finance and payments) Status by KSE – wait

Tether has filed trademark applications in Russia

17.01.2024

*TotalEnergies (Франція, Енергетика, нафта і газ) Статус за KSE – вийшли

TotalEnergies посилається на форс-мажор щодо санкційного російського Arctic LNG 2

*Epicentr K (Украіна, Товари широкого вжитку) Статус за KSE – залишаються

Герега заперечує, що «Епіцентр» працював в окупації

18.01.2024

*Hennesea Holdings Limited (United Arab Emirates, Marine Transportation) Status by KSE – stay

*Cielo Marine Ltd (Hong Kong, Marine Transportation) Status by KSE – stay

The US Treasury Department’s Office of Foreign Assets Control (OFAC) imposed sanctions against 19 tankers carrying Russian oil under the flags of Liberia and Panama. The tankers belong to two companies: Hennesea Holdings Limited (UAE) and Cielo Marine Ltd (Hong Kong).

https://www.epravda.com.ua/news/2024/01/18/708910/

*Summit Ascent Holdings (China, Finance and payments) Status by KSE – leave

Oriental Regent Ltd, a subsidiary of Hong Kong-listed Summit Ascent Holdings Ltd, is set to sell its gaming and hotel operations in Russia. The wholly-owned subsidiary, G1 Entertainment LLC, is being sold to Russian entity Dalnevostochniy Aktiv LLC for a price consideration of $116 million.

*World Aquatics (Switzerland, Sport) Status by KSE – wait

World Aquatics has established strict selection criteria for the participation of Russians. Due to these criteria, none of the Russians under the neutral flag will be able to take part in the February World Championship

https://www.kommersant.ru/doc/6455355

*Barry Callebaut (Switzerland, Food & Beverages) Status by KSE – stay

The Swiss chocolate manufacturer Barry Callebaut is included in the list of sponsors of the war in Ukraine. As NAZK emphasizes, Barry Callebaut remained working in Russia, using manipulative statements about the supply of primary necessities to the Russian Federation and asserting that “chocolate is part of the daily diet of many.”

https://www.epravda.com.ua/news/2024/01/18/708900/

https://sanctions.nazk.gov.ua/en/boycott/1033/

*Amazon (USA, Online Services) Status by KSE – wait

A magistrate in Moscow imposed a fine of more than 200 million rubles on the American company Amazon. for an administrative offense. It is due to the company’s lack of representative office in the Russian Federation.

19.01.2024

*International Esports Federation (IESF) (South Korea, Association, NGO) Status by KSE – leave

The International eSports Federation (IESF) supported Ukraine’s complaint by suspending the membership of the Russian Computer Sports Federation (RESF).

https://www.epravda.com.ua/news/2024/01/19/708922/

https://iesf.org/boards-decision/

*Medtronic (Ireland, Pharma, Healthcare) Status by KSE – wait

*Dräger (Germany, Pharma, Healthcare) Status by KSE – stay

*Fujifilm (Japan, Electronics) Status by KSE – leave

Large foreign companies have encountered difficulties in obtaining medical device service licenses under the new rules that came into effect on January 1, 2024.

https://www.kommersant.ru/doc/6456104

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

The Russian company is trying to retain the rights to the Carlsberg brand

20.01.2024

*Microsoft (USA, IT) Status by KSE – leave

Microsoft disclosed that it fell victim to a cyberattack orchestrated by a Russian-backed group, identified as Midnight Blizzard or “the Russian state-sponsored actor also known as Nobelium.”

22.01.2024

*WeWork (USA, Hospitality, Real estate) Status by KSE – leave

The American coworking network WeWork has agreed to sell its business in Russia. Both companies went bankrupt several years ago.

*Apple (USA, Electronics) Status by KSE – wait

Federal Antimonopoly Service (FAS) of Russia: Apple paid a fine of 1.1 billion rubles (~$12mn) to the Russian budget.

https://www.kommersant.ru/doc/6465280

https://www.epravda.com.ua/news/2024/01/22/709027/

*Tennis Australia (Australia, Sport) Status by KSE – stay

Russian tennis player Andrey Rublev reached the quarterfinals of the Australian Open

https://www.kommersant.ru/doc/6464738

*KFC (USA, Public catering) Status by KSE – exited

Yunyrest, the owner of the rights to the Rostic’s fast food chain brand and the KFC master franchise in Russia, continues to buy up the business of its counterparties.

23.01.2024

*HPCL-Mittal Pipelines Limited (India, Energy, oil and gas) Status by KSE – stay

Russian oil, Ukrainian steel: how two companies owned by one of Britain’s richest men trade with both Moscow and Kyiv

*United Nations (UN) (USA, Association, NGO) Status by KSE – stay

The UN confirmed the opening of an account in a Russian bank

https://www.epravda.com.ua/rus/news/2024/01/25/709152/

*VVP Group (Kazakhstan, Electronics) Status by KSE – stay

VVP Group can start production at the plant of the Korean concern

https://www.kommersant.ru/doc/6465386

*Chennai Petroleum Corp Ltd (India, Energy, oil and gas) Status by KSE – stay

Chennai Petroleum Q3 Review – Weak Core Performance On Narrowing Of Russian Crude Discounts: Yes Securities

24.01.2024

*Bank of Cyprus (Cyprus, Finance and payments) Status by KSE – exited

Bank of Cyprus closed its representative offices in Moscow and St. Petersburg on January 22

https://www.moscowtimes.ru/2024/01/23/krupneishii-bank-kipra-ushel-iz-rossii-a119270

*Huntsman Corporation (USA, Chemical industry) Status by KSE – leave

Armen Sargsyan’s S8 Capital wants to acquire the Russian business of American Huntsman.

https://www.kommersant.ru/doc/6466169

*Haier (China, Electronics) Status by KSE – stay

The number of televisions sold in the Russian Federation in 2023 increased by 28%, to 8.7 million devices, retailers said. According to them, the leader was the Chinese Haier

25.01.2024

*Technip Energies (France, Engineering) Status by KSE – exited

France did not oppose the supply of key structures for the construction of a liquefaction plant by the French group Technip Energies at the height of the war in Ukraine.

TotalEnergies complaint against Yannick Jadot: Senate Ethics Committee decision issued within a day

*HP Enterprise (Independent from HP Inc.) (USA, IT) Status by KSE – leave

HPE hacked by same Russian intelligence group that hit Microsoft

https://www.cnbc.com/2024/01/24/hpe-hit-by-russian-intelligence-group-that-hacked-microsoft.html

*Binance (China, Finance and payments) Status by KSE – leave

Binance Pulls the Plug on Russian Ruble: Delisting Confirmed by January 30

26.01.2024

*Goalong Group (China, Alcohol & Tobacco) Status by KSE – stay

Manufacturer and distributor of alcohol Ladoga (Tsarskaya, Barrister, Fowler’s, etc.) began producing whiskey under its Kubao brand at the Chinese Goalong Distillery for supplies to Russia

https://www.kommersant.ru/doc/6467539

*Hyundai (South Korea, Automotive) Status by KSE – leave

The Russian company Art-Finance, which owns the former Volkswagen plant in Russia, has closed a deal to acquire the Hyundai plant in St. Petersburg.

*Google Pay (USA, Online Services) Status by KSE – leave

The owner of 2GIS, through the court, managed to declare the removal of the application from Google Play illegal.

https://www.rbc.ru/technology_and_media/26/01/2024/65b2459c9a7947e68f371982

*DTEK (Ukraine, Energy, oil and gas) Status by KSE – exited

Putin gave the “green light” for the acquisition of Akhmetov’s coal assets

https://www.epravda.com.ua/news/2024/01/25/709182/

*Intel (USA, IT) Status by KSE – stay

*AMD (USA, IT) Status by KSE – wait

*Analog Devices (USA,Electronics) Status by KSE – wait

*Infineon (Germany, Electronics) Status by KSE – exited

*STMicroelectronics (Switzerland, IT) Status by KSE – leave

*NXP Semiconductors (Netherlands, Electronics) Status by KSE – stay

Most of Russia’s War Chips Are Made by US and European Companies

27.01.2024

*Hyundai (South Korea, Automotive) Status by KSE – leave

The Russian company “Art-Finance” has completed the agreement on the purchase of all Russian assets of the South Korean manufacturer Hyundai.

29.01.2024

*Sociedade Mineira de Catoca (Angola, Metals and Mining) Status by KSE – leave

Angola demands Russia to withdraw from diamond mining project due to sanctions

https://dron.media/anghola-triebuiet-ot-rossii-vyiti-iz-proiekta-po-dobychie-almazov-iz-za-sanktsii/

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – leave

Maaden International Investment LLC (a subsidiary of Oman’s state fund Mercury Investments International LLC) bought 23.9% of the share capital of the Russian Polymetal from Powerboom Investments Limited (a subsidiary of the ICT Holding group).

https://www.vedomosti.ru/business/news/2024/01/29/1017200-mars-vikupila-polymetal

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The Court of Arbitration for Sports hears Russia appeal against International Olympic Committee ban

30.01.2024

*Inpex (Japan, Energy, oil and gas) Status by KSE – leave

*Itochu (Japan, Energy, oil and gas) Status by KSE – stay

Japan’s Inpex selling stake in Russian oil project to Itochu.

*Silmet (Estonia, Metals and Mining) Status by KSE – stay

THE MANUFACTURER OF IDA-VIRU, WHO RECEIVED 18 MILLION EUROS FROM THE TAXPAYER, IS SUPPLIED BY THE RUSSIAN STATE

*International Skating Union (Switzerland, Sport) Status by KSE – stay

The International Skating Union (ISU) awarded the Russian team third place instead of first in the team figure skating tournament at the Beijing Olympics in 2022

https://www.kommersant.ru/doc/6479262

*Samsung (South Korea, Electronics) Status by KSE – wait

*LG Electronics (South Korea, Electronics) Status by KSE – wait

Samsung, LG Differ from Hyundai in Handling Russian Appliance Plants

https://www.businesskorea.co.kr/news/articleView.html?idxno=210453

*TikTok (China, Online Services) Status by KSE – leave

Head of the Ministry of Digital Development: the resumption of full-fledged operation of TikTok in the Russian Federation is not yet being discussed

https://www.kommersant.ru/doc/6478745

*Avon (USA, Consumer goods and clothing) Status by KSE – stay

Beauty giant Avon under fire over Russia links

https://www.bbc.com/news/business-67425366

*McDonald’s (USA, Public catering) Status by KSE – exited

Kadyrov’s associates could become the “shadow owners” of Russian McDonald’s

31.01.2024

*Hill’s Pet Nutrition (USA, Food & Beverages) Status by KSE – wait

From February 6, feed for animals will not be imported into Russia from the Italian company Hill’s, where Rosselkhoznadzor found violations.

https://www.rbc.ru/business/30/01/2024/65b9483e9a794761d4b85f19

*Marker Nordic Ou (Estonia, Industrial equipment) Status by KSE – stay

Estonian entrepreneur from the Insider investigation: “I don’t work with Russia anymore – I’m not crazy”

*Pfizer (USA, Pharma, Healthcare) Status by KSE – wait

Russian “Axelfarm” demands from the structure of the American Pfizer a compulsory license, probably for the anti-tumor drug based on bosutinib, purchased at the public auction in 2023 for 681 million rubles.

https://www.kommersant.ru/doc/6479684

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Sakhalin-1 oil flowed to India to the refineries of project participants

https://www.kommersant.ru/doc/6479709

*Global Spirits (Multinational, Alcohol & Tobacco) Status by KSE – leave

Cognac, “Russian trail” and 5 criminal stories. How the SBU investigates the case against the “vodka tycoon” Chernyak

01.02.2024

*Farmina Pet Foods (Italy, Food & Beverages) Status by KSE – stay

*Nestle (Switzerland, FMCG) Status by KSE – stay

Rosselkhoznadzor accused an Italian company of trying to poison Russian cats with arsenic

*Airrock Solutions (Moldova, Air transportation) Status by KSE – stay

*Aerostage Services (Moldova, Air transportation) Status by KSE – stay

*Maxjet Service (Moldova, Air transportation) Status by KSE – stay

Three Moldovan companies began selling aircraft parts to Russia just months after the full-scale invasion of Ukraine and sold about $15 million worth of aircraft parts https://english.nv.ua/nation/moldova-companies-sold-15-billion-worth-of-plane-spare-parts-to-russia-despite-sanctions-50389055.html

*PBF Energy (USA, Energy, oil and gas) Status by KSE – stay

An American refinery imported 10,000 barrels of Russian oil through a storage terminal in the Bahamas.

https://www.epravda.com.ua/news/2024/02/1/709393/

*OKX (Seychelles, Finance and payments) Status by KSE – stay

At the end of 2023, the growth of traffic from the Russian Federation on the OKX cryptocurrency exchange amounted to about 400% – from 250,000 to almost 1.25 million visits.

https://forklog.com/news/okx-zafiksirovala-pyatikratnyj-rost-trafika-iz-rf-po-itogam-2023-goda

*Hill’s Pet Nutrition (USA, Food & Beverages) Status by KSE – wait

The share of imported feed for animals is decreasing

https://www.kommersant.ru/doc/6480406

*Rio Tinto (Great Britain, Metals and Mining) Status by KSE – leave

Rio Tinto wins in Russian sanctions lawsuit

https://www.afr.com/companies/mining/rio-tinto-wins-in-russian-sanctions-lawsuit-20240201-p5f1p6

*London Stock Exchange Group (Great Britain, Finance and payments) Status by KSE – leave

Traders divert Russian oil products around Africa to avoid Red Sea

*Sony (Japan, Electronics) Status by KSE – leave

Sony, Zee clashed over Russia assets, Star cricket deal before India merger collapse

*Einhell (Germany, Electronics) Status by KSE – stay

The German tool company Einhell increased its profits in Russia five times

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

In September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

Also, at the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

In January 2024, KSE Institute with support of volunteers developed a new application for Apple Store in addition to our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market.

Leave Russia App allows you to find any international brand or foreign company that is operating and paying taxes in Russia. Additionally, you can find out such statistics (if a company has local entity/ies in Russia): number of staff, revenue generated, amount of capital, assets etc. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public news that can confirm this information. Click to download Leave Russia from the App Store!

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 23 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.