- Kyiv School of Economics

- About the School

- News

- 59th issue of the regular digest on impact of foreign companies’ exit on RF economy

59th issue of the regular digest on impact of foreign companies’ exit on RF economy

18 December 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 04.12-17.12.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

KSE DATABASE SNAPSHOT as of 17.12.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 573 (+10 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 547 (0 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 232 (+5 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 304 (+2 per 2 weeks)

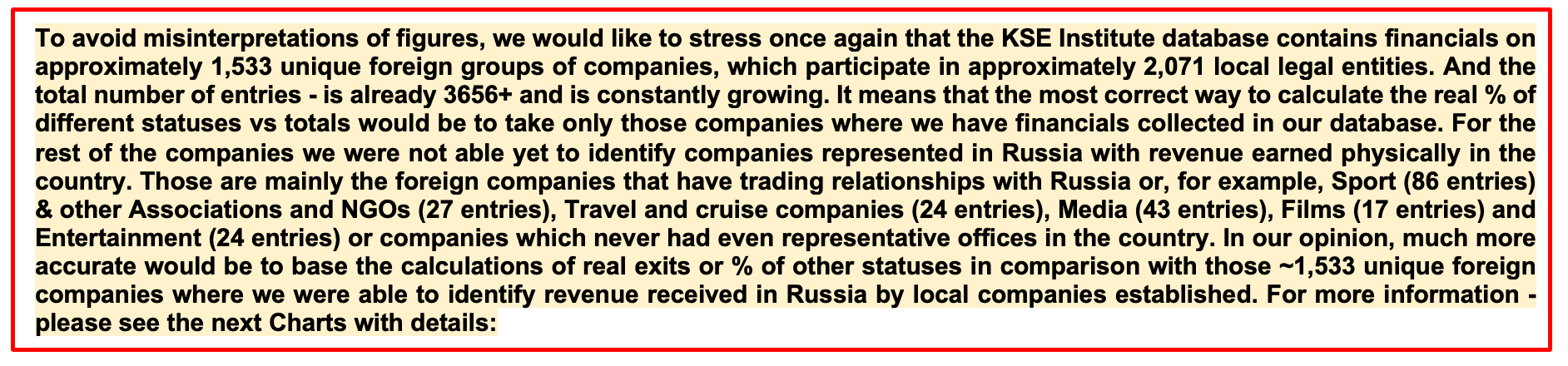

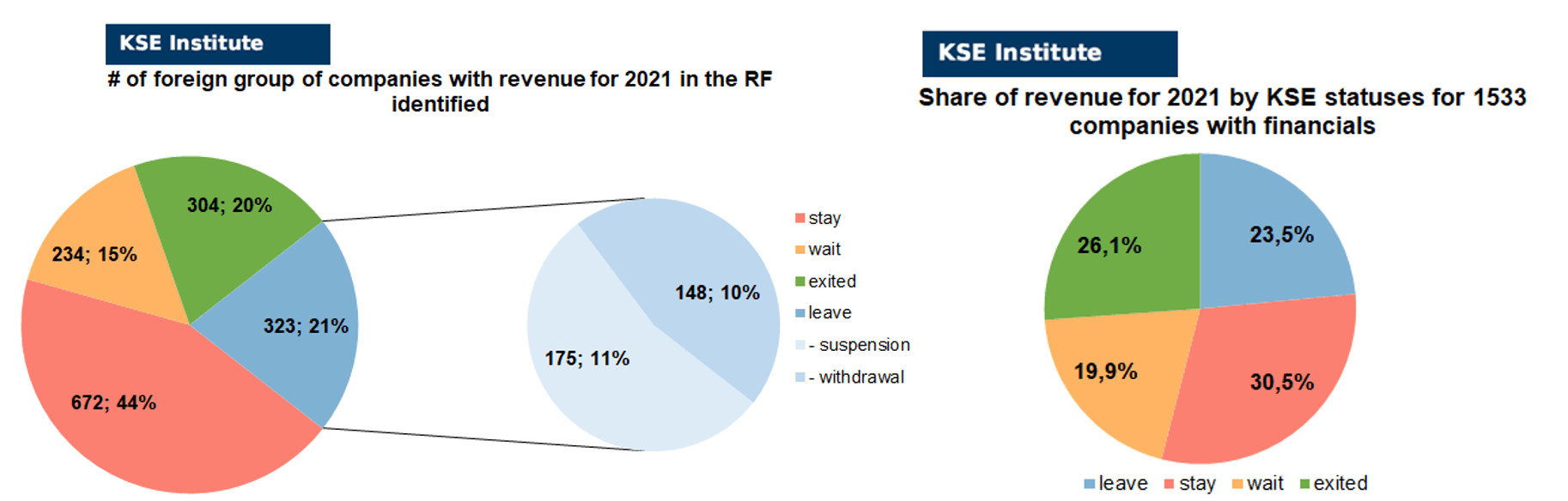

As of December 17, we have identified about 3,656 companies, organizations and their brands from 97 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 533 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.2 billion), local revenue (about $314.7 billion), local assets (about $336.8 billion) as well as staff (about 1.440 million people) and taxes paid (about $25.4 billion). 1,779 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 304 companies that have completed the sale/liquidation of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 17, 304 companies which had already completely exited from the Russian Federation, in 2021 had at least 496,200 personnel, $82.3 bn in annual revenue, $42.6bn in capital and $69.3bn in assets; companies, that declared a complete withdrawal from Russia had 291,300 personnel, $48.2bn in revenues, $20.4bn in capital and $32.2bn in assets; companies that suspended operations on the Russian market had 93,000 personnel, annual revenue of $25.7bn, $35.6bn in capital and $85.0bn in assets.

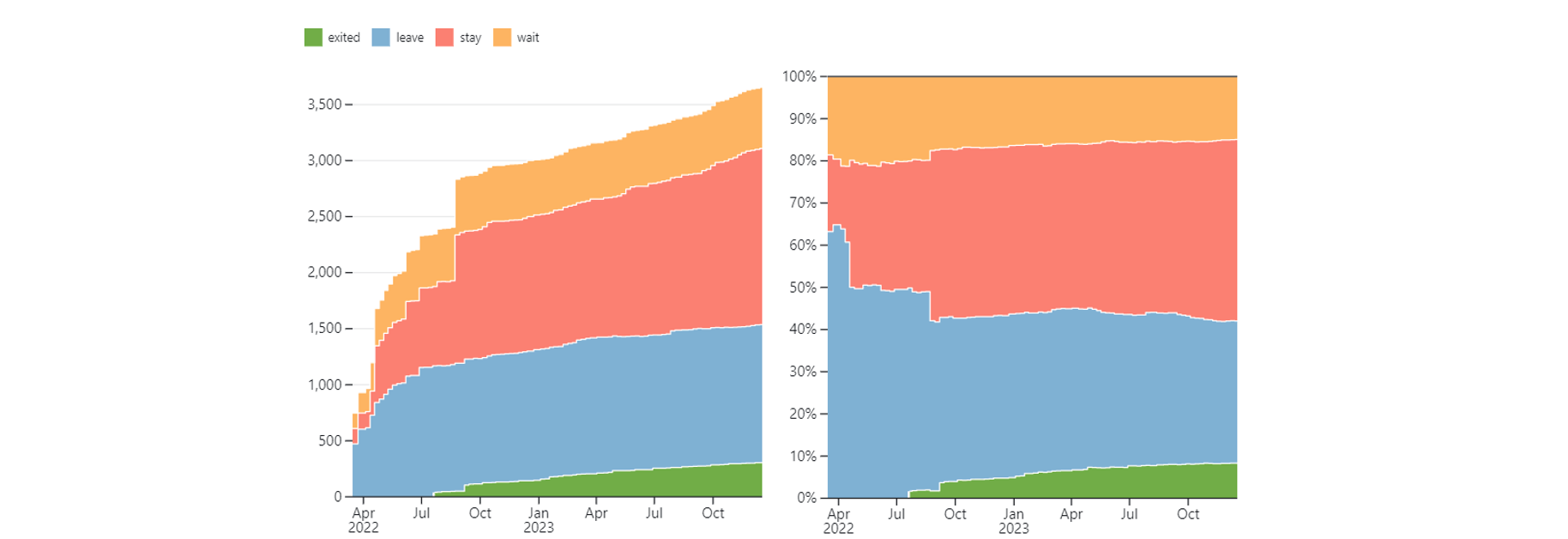

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 16 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 17 were added in December 2023). However, if to operate with the total numbers in KSE database, about 33.7% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 43.0% are still remaining in the country, 15.0% are waiting and only 8.3% made a complete exit³.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 16 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 17 were added in December 2023). However, if to operate with the total numbers in KSE database, about 33.7% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 43.0% are still remaining in the country, 15.0% are waiting and only 8.3% made a complete exit

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (20%) and on share of revenue withdrawn (26.1%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 30.5% of revenue and 15% of waiting companies represent 19.9% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1446 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.5% less of revenue in 2022 (23.6% from total volume) than in 2021 (26.1% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-5.5%) revenue in 2022 (18.0% from total volume) than in 2021 (23.5% from total volume). At the same time, staying companies were able to generate much (+13.0%) more revenue in 2022 (43.5% from total volume) than in 2021 (30.5% from total volume). Companies with status “wait”⁴ gained a lower share (-5.0%) of revenue in 2022 (14.9% from total volume) vs 19.9% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($334.2bn⁵ in 2022 vs $336.8bn in 2021) and would even probably increase if the remaining reporting for ~90-100 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Officials will be prohibited from using foreign instant messengers for personal purposes

04.12.2023 | Civil servants in the Russian Federation want to ban the use of foreign instant messengers for personal purposes. A letter with such a proposal was sent to Deputy Prime Minister and Chief of the Government Staff Dmitry Grigorenko by Deputy Chairman of the State Duma Security Committee Anatoly Vyborny.

85% of Russian companies complained about staff shortages

04.12.2023 | Over the past year, 85% of Russian companies have faced staff shortages. Only 11% of organizations did not notice problems with personnel, and another 4% found it difficult to answer. These results of the SuperJob study are published by RBC.

https://www.moscowtimes.ru/2023/12/04/na-kadrovii-golod-pozhalovalis-85-rossiiskih-kompanii-a115073

The income of Russian companies has fallen by half

04.12.2023 | Revenues of Russian companies fell sharply in the first half of 2023. In January–June they amounted to 342.2 trillion rubles. against 694 trillion for the same period a year earlier. This follows from the data of the analytical portal of the Federal Tax Service. The Bank of Russia’s financial stability review also states that the revenue of the largest oil and gas exporters decreased by 41% compared to the same period last year.

https://www.moscowtimes.ru/2023/12/04/dohodi-rossiiskih-kompanii-ruhnuli-vdvoe-a115078

The authorities will establish total control over the sale of foreign currency earnings by exporters

04.12.2023 | The authorities decided to tighten control over the sale of foreign currency earnings by exporters and developed a five-point control mechanism: 1) approve the currency sales schedule with the authorities and update the schedule weekly; 2) disclose the asset and liability management plan (information on loans, foreign account balances) and update the data monthly; 3) inform the government about non-fulfilled contract obligations by buyers; 4) name the group companies that will sell currency; 5) report on the implementation of the currency sale plan.

The main owner of the Russian structure Leroy Merlin became a company from the UAE

04.12.2023 | The Scenari Holding company, registered in the United Arab Emirates, has become the main owner of Leroy Merlin Vostok, the Russian structure of the store chain, follows from the Unified State Register of Legal Entities.

https://tass.ru/ekonomika/19449727

The Russian budget received 305 billion rubles from windfall tax

06.12.2023 | Finance Minister Anton Siluanov said that the budget has already received 305 billion rubles from a one-time collection from large businesses (windfall tax). He recalled that the authorities planned to collect 300 billion rubles. According to experts, the final contribution by January 28, 2024 may exceed 400 billion rubles.

https://www.interfax.ru/business/935005

Trade turnover between Russia and China in January – November reached a historical record of $218.17 billion

07.12.2023 | Trade between Russia and China in January-November increased by 26.7% year-on-year and reached a record high of $218.17 billion. During this reporting period, Russia increased supplies of goods to China by 11.8%, to $117.84 billion. China imported goods worth $100.33 billion into Russia, thus increasing exports of goods by 50.2%. https://tass.ru/ekonomika/19475037

Putin: the number of foreign companies operating in Russia has increased after sanctions

07.12.2023 | President Vladimir Putin believes that working with Russia and in Russia “was profitable, is profitable now and will be profitable.” According to him, this is confirmed by the fact that the number of foreign companies operating in the country, despite the sanctions imposed by the West, has not decreased, but, on the contrary, has increased. From March 2022 to November 2023, the number of such companies increased by almost 1.5 thousand: from 24.1 thousand organizations to 25.6 thousand.

https://www.kommersant.ru/doc/6381945

Exporters sold over 90% of foreign currency earnings in October

07.12.2023 | In October, exporters sold 91% of their foreign currency earnings, the Bank of Russia reported. At the end of September, the Central Bank estimated the share of sales at 77%. A significant increase in sales occurred after the signing of a decree on mandatory repatriation and sale of foreign currency earnings by a number of exporters. The last time such a share of sales was recorded was in May, when exporters sold 90% of foreign currency earnings. In monetary terms, the volume of net sales of foreign currency by exporters in October amounted to $12.5 billion compared to $9.2 billion in September. In November, monetary sales continued to grow, as indicated in the Central Bank review, and reached $13.9 billion rubles.

https://www.rbc.ru/finances/07/12/2023/6571d4539a79474f3b2e8f40

The share of the yuan in the exchange and over-the-counter markets of the Russian Federation reached a new high in November

07.12.2023 | The share of the yuan in the exchange and over-the-counter markets of the Russian Federation reached a new maximum in November, the figures increased to 46.2% and 31.5%, respectively, the Central Bank of the Russian Federation reports. At the same time, the share of currencies of unfriendly countries decreased to 52.3% (54.6% in October).

https://tass.ru/ekonomika/19483627

Russians have been buying cash currency at a record pace since March 2022

07.12.2023 | TIn October, the population transferred 95.8 billion rubles into cash. or more than $1 billion, the Central Bank reported. This is the maximum since February-March 2022, when, during the panic caused by the beginning of the SVO, Russians bought or withdrew almost 1.3 trillion rubles in foreign currency from their accounts.

https://www.cbr.ru/statistics/macro_itm/households/pkshouse2022/

Putin said that Russia has ceased to be a “gas station” and has become the largest economy in Europe

07.12.2023 | Russia is no longer a “gas station country” and is superior to other European countries in economic development, said Russian President Vladimir Putin. According to him, in the first ten months of 2023, Russia’s GDP increased by 3.2%, and by the end of the year it could grow by 3.5%. “Today it is already higher than it was before the Western sanctions attack,” Putin emphasized.

The Duma gave the president new powers to ensure economic sovereignty

08.12.2023 | The Duma allowed Putin to nationalize foreign companies – the State Duma adopted a government law that gave the president the right to establish a special procedure for the fulfillment of obligations to persons from unfriendly foreign states, as well as to introduce temporary management of their movable and immovable property in Russia..

Russian companies have gathered with an outstretched hand to China

11.12.2023 | At least ten Russian companies are looking for a way to enter China’s debt market in order to start borrowing in yuan, Marina Chekurova, general director of the Expert RA rating agency, told Vedomosti. According to her, both large exporters and importers purchasing goods and equipment in China are interested in this.

Russian rich people are buying gold bars by the ton

11.12.2023 | Wealthy Russians are buying gold bars. Sberbank, VTB, Gazprombank and Promsvyazbank reported an increase in precious metal sales. Thus, since the beginning of the year, VTB clients bought about 23 tons of bars, and Promsvyazbank – 7 tons, Vedomosti writes. At VTB, the average “weight” of one transaction increased by a third – to 17.7 kg. According to the Ministry of Finance, in 2022, Russians bought more than 75 tons of gold bars, which is 15 times more than in 2021.

https://www.moscowtimes.ru/2023/12/11/rossiiskie-bogachi-tonnami-skupayut-zolotie-slitki-a115788

Swiss banks began charging commissions for storing blocked money of Russian billionaires

12.12.2023 | Large banks in Switzerland began charging commissions on blocked assets of Russians. “The idea is that there is an account, it needs to be serviced, it doesn’t matter that a person cannot use the service, in fact it is still provided,” explained an interlocutor in one audit company. At the same time, commissions are accrued “for years to come,” he claims.

The largest buyers of assets of foreign companies that left Russia, businessmen Ivan Tavrin and Vladislav Sviblov, came under US sanctions

12.12.2023 | The Office of Foreign Assets Control (OFAC) of the US Treasury has imposed sanctions against businessmen Ivan Tavrin and Vladislav Sviblov. Expobank and the gold mining company Highland Gold Mining, which belongs to Mr. Sviblov, were also sanctioned. In total, more than 200 companies and 23 individuals from Russia, China, Pakistan, South Korea and Turkey were included in the sanctions list.

https://www.moscowtimes.ru/2023/12/12/krupneishii-pokupatel-aktivov-ushedshih-iz-rossii-inostrannih-kompanii-popal-pod-blokiruyuschie-sanktsii-ssha-a115946 ; https://www.kommersant.ru/doc/6396110

The EU will begin to imprison and confiscate profits for violating sanctions against Russia

12.12.2023 | The Spanish Presidency of the Council of the EU and the European Parliament have successfully completed negotiations on the introduction of criminal penalties for violating EU sanctions against Russia. This was reported by the press service of the Council of the EU, cited by Interfax. According to the published communiqué, the new European law aims to bring to justice those who violate or circumvent EU sanctions. The document provides for the obligation of member states to classify certain actions as criminal offenses. https://www.interfax.ru/world/935903 ;

A draft on the right of the Central Bank to prohibit transactions with shares and currency has been submitted to the State Duma

13.12.2023 | Chairman of the State Duma Committee on the Financial Market Anatoly Aksakov, together with a group of deputies and senators, introduced amendments that would allow the Central Bank to limit the operations of market participants or prohibit certain transactions to all participants in the stock or foreign exchange market. The press service of the Central Bank explained that the amendments provide “additional tools” that will allow the regulator to “perform functions to ensure financial stability.”

https://www.kommersant.ru/doc/6397011

Nine regions showed an increase in payroll taxes by more than 20%

13.12.2023 | The Federal Tax Service reported an increase in personal income tax collections. Over the 10 months of 2023, it was possible to collect 4.9 trillion rubles, which is 13.2% more than during the same period in 2022. Data from tax officials perfectly confirms the words of the president and Russian officials about income growth in the country. Just a few days ago at the VTB forum “Russia Calling!” Putin said that real wages have increased by 7% since the beginning of the year, and real disposable income of the population (income minus mandatory payments) by 4.4%.

https://www.rbc.ru/economics/13/12/2023/657854989a7947bbba09e954

Reuters identified that fuel supplies to Afghanistan from Russia have doubled

13.12.2023 | Afghan authorities doubled purchases of Russian liquefied petroleum gas (LPG) from January to November 2023, Reuters reports citing industry data. Deliveries of Russian LPG by rail in January-November exceeded 176 thousand tons, which is more than double the supply for the same period in 2022, the agency notes. It indicates that the total volume of LPG exports from Russia to Central Asia for 11 months of 2023 also doubled and amounted to 390.1 thousand tons.

https://www.rbc.ru/politics/13/12/2023/6579b3af9a794775762c43af

US Treasury: Russia lost 5% of its economy due to the war against Ukraine

14.12.2023 | The Russian economy could have been 5% larger if Russian President Vladimir Putin had not started a war against Ukraine. This conclusion was reached by the US Treasury, writes the Financial Times with reference to the department’s report. The invasion of Ukraine and occupation of Ukrainian territories “contributed to rapid increases in costs, depreciation of the ruble, increased inflation and labor market tensions reflecting the loss of labor” in the economy, noted the report’s author, chief economist of the US Treasury Department’s Office of Foreign Assets Control (OFAC), Rachel Lingaas. . In her opinion, the combination of war, Western sanctions and Moscow’s retaliatory actions is causing “significant economic stress” in Russia.

The UK will ban the import of Russian diamonds from January 1, 2024

14.12.2023 | The UK plans to ban the import of Russian diamonds from January 1, 2024. From the same time, Japan’s ban on the import of non-industrial diamonds from Russia will come into force.

https://www.kommersant.ru/doc/6397849 ; https://www.kommersant.ru/doc/6397949

The World Bank reported an increase in other countries’ debts to Russia

15.12.2023 | The total debt of residents of foreign countries to Russia in 2022 increased by $2.3 billion and amounted to $28.9 billion (+8.7%). This is stated in the annual report of the World Bank (WB) on debt statistics of developing countries. At the end of 2022, 37 states had outstanding debt to Russian creditors. The largest debtors to Russia at the end of 2022 were: 🇧🇾 Belarus ($8.24 billion), 🇧🇩 Bangladesh ($5.86 billion), 🇮🇳 India ($3.75 billion), 🇪🇬 Egypt ($1.82 billion), 🇻🇳 Vietnam ($1.39 billion).

https://www.kommersant.ru/doc/6398058 ; https://openknowledge.worldbank.org/entities/publication/02225002-395f-464a-8e13-2acfca05e8f0

The Central Bank raised the key rate for the fifth time – 16%

15.12.2023 | The Central Bank raised the key rate to 16% per annum. Chairman of the Bank of Russia Elvira Nabiullina said that the regulator is close to completing the rate increase cycle.

https://www.kommersant.ru/doc/6397989 ; https://www.kommersant.ru/doc/6409285

Western banks’ business in Russia has fallen to Cold War levels

15.12.2023 | The volume of business of banks from Western countries in Russia has decreased to the level of the times of the USSR. This happened due to the fact that anti-Russian sanctions limit their business, Bloomberg writes, citing data from Raiffeisen Bank International. According to the RBI forecast, this year the level of presence of Western banks in Russia will be $60 billion. In the early 80s, this figure was $10 billion, in the late 80s – $40 billion. A year before the start of the armed conflict in Ukraine, the presence of Western banks was at $119 billion.

WEEKLY FOCUS: Review of KSE’s new research on exiting Russia

The value of transactions of 300 companies that have left the Russian market may reach up to $25 billion – KSE Institute research.

Out of more than 1,500 foreign companies that own or have owned assets in Russia, only 300 have finally completed their exit. The potential value of the deals could reach up to $25 billion. However, even these amounts are far from market prices.

These are the conclusions reached by KSE Institute experts in their recent study “Analysis of Foreign Business Exits from Russia.”

In addition to those who have completed transactions, another 320 companies are trying to leave Russia by publicly announcing their intentions or suspending operations. The largest companies that have fully withdrawn generated $82 billion in revenue, while those in the process of leaving generated $65 billion.

According to the Kyiv School of Economics, the estimated cost of the exits ranges from $16.7 billion to $21 billion. Moreover, given the undisclosed deals, it could potentially approach $25 billion (which suggests sales at a substantial discount).

However, this only reinforces the thesis that prices do not correspond to market prices. For example, a number of companies (Heineken, Nissan, OBI Group, Renault, Tetra Pak) were sold for €1. At the same time, others, such as Carlsberg Group and Danone, were effectively nationalized by the Russian authorities.

Among the largest deals were the sale of the Russian classifieds business Avito ($2.4 billion), which was owned by the Dutch investment group Prosus, and the sale of Eni’s stake (40% or $1.8 billion) in Rosneft’s Arctic gas project.

Of the 386 legal entities owned by nearly three hundred Western companies, 25% were purchased by individuals, and almost half by local top management. Most of the buyers (94%) were from Russia, while others were from China, Turkey, and the UAE.

It is noteworthy that some companies sent $3.6 billion worth of goods to Russia immediately before the exit and $0.4 billion after it. Indirect supplies amounted to $2.5 billion and $1.4 billion, respectively. In particular, we are talking about L’Occitane, a French cosmetics manufacturer that continued to trade through intermediaries after its withdrawal.

A number of others, despite their promises and assurances, are also in no hurry or have not been in a hurry to completely cut ties with Russia: Technip Energies (continues to make a significant contribution to the Arctic LNG-2 project related to liquefied natural gas production), Baker Hughes (shipped oil and gas drilling equipment to Russia after the announcement of its withdrawal), etc.

The full text of the study, prepared by KSE Institute experts, methodology and detailed analysis of the largest transactions, major buyers/beneficiaries, and the facts of continuation of trade relations after the sale, can be found here.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁶

02.12.2023

*HS Atlantica Limited (Liberia, Marine Transportation) Status by KSE – stay

*Sterling Shipping Incorporated (United Arab Emirates, Marine Transportation) Status by KSE – stay

*Streymoy Shipping Limited (United Arab Emirates, Marine Transportation) Status by KSE – stay

The United States added two companies from the UAE and one from Liberia to the SDN-List, as well as the tankers they own, for transporting Russian oil above the “price ceiling”. These are HS Atlantica Limited (Liberia) and its vessel HS Atlantica, and Sterling Shipping Incorporated (UAE) and its vessel NS Champion. The third company against which sanctions have been imposed is Streymoy Shipping Limited (UAE), its tanker is Victor Bakaev.

https://www.epravda.com.ua/news/2023/12/1/707250/

*International Maritime Organization (IMO) (Great Britain, Association, NGO) Status by KSE – leave

Russia has not been included in the renewed composition of the Council of the International Maritime Organisation (IMO), the UN agency dealing with shipping safety issues.

03.12.2023

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

IOC leaves Paris 2024 door open for Russian athletes

https://www.insidethegames.biz/articles/1142779/ioc-paris-2024-russian-athletes

04.12.2023

*Leroy Merlin (France, FMCG) Status by KSE – leave

The company Scenari Holding, registered in the United Arab Emirates, became the main owner of “Leroy Merlin Vostok”, the Russian structure of the chain of stores, according to the data of the EGRUL.

05.12.2023

*ATAIX Eurasia (Kazakhstan, Finance and payments) Status by KSE – leave

The cryptocurrency exchange ATAIX Eurasia has requested Russians to close their accounts.

*Playrix (Ireland, Gaming) Status by KSE – exited

As of September 2023, all offices in Russia and Belarus are closed, employees have been relocated, and some of the staff had to part ways.

https://dev.ua/news/playrix-1694599239

*Microsoft (USA, IT) Status by KSE – leave

Microsoft says Russia responsible for hack of email accounts

https://www.washingtontimes.com/news/2023/dec/4/microsoft-says-russia-responsible-for-hack-of-emai/

*Google (USA, Online Services) Status by KSE – exited

Fadeev proposed introducing international oversight of the work of IT giants.

06.12.2023

*Jiangsu Hengrui (China, Pharma, Healthcare) Status by KSE – stay

“Petrovax,” formerly owned by Vladimir Potanin’s “Interros” until last year, has reached an agreement with the Chinese company Jiangsu Hengrui regarding the supply and subsequent localization of several oncology drugs, including camrelizumab, belonging to the same class as the American MSD’s “Keytruda.”

https://www.kommersant.ru/doc/6380434

*Sanofi (France, Pharma, Healthcare) Status by KSE – stay

Sanofi experiencing serious supply problems from its Russian plant to EU market

*Baring Vostok Capital Partners (Russia, Finance and payments) Status by KSE – leave

Kremlin delays Baring Vostok’s exit as it eyes billion-dollar stake in ‘Russia’s Amazon’

*British American Tobacco (Great Britain, Alcohol&Tobacco) Status by KSE – exited

BAT took a “big hit” on Russia sale, buy back unlikely, CEO says

*International Motorcycling Federation (Switzerland, Sport) Status by KSE – leave

FIM ban on Russians, Belarusians to continue into 2024

https://www.thecheckeredflag.co.uk/2023/12/fim-ban-on-russians-belarusians-to-continue-into-2024/

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

*Authentic Brands Group – Reebok (USA, Sport) Status by KSE – exited

*Nike (USA, Consumer goods and clothing) Status by KSE – leave

Adidas found its way to Russia through a distributor

https://www.kommersant.ru/doc/6380438

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Russia “stole” the Baltika plant from the Danish Carlsberg Group

https://inventure.com.ua/uk/news/world/rosiya-vkrala-zavod-baltika-danskoyi-carlsberg-group

*VEON (Netherlands, Telecom) Status by KSE – exited

VEON quotes soared at the Moscow Stock Exchange in the absence of significant corporate news. VEON Holding sold Beeline and completed its exit from Russia at the beginning of October

https://quote.rbc.ru/news/article/656f08129a7947102a12bb7c?from=newsfeed

07.12.2023

*Parimatch (Ukraine, Gaming) Status by KSE – leave

CEO of the Parimatch group of companies Maksym Lyashko is resigning – after the sanctions and the closure of the Ukrainian branch

https://ain.ua/2023/12/07/ceo-parimatch-maksym-lyashko-jde-u-vidstavku/

*Barclays (Great Britain, Finance and payments) Status by KSE – wait

Barclays Steps In to Bank Charity for Sanctioned Russian’s Money

*Eurasia Mining (Great Britain, Metals and Mining) Status by KSE – stay

Eurasia Mining in stasis as Russian asset sale talks continue

*Hyundai (South Korea, Automotive) Status by KSE – wait

By the end of this year, Hyundai Motor will close its local plant, which once contributed to the automaker’s high sales in Russia.

https://www.businesskorea.co.kr/news/articleView.html?idxno=207300

*Sinno Electronics (China, Electronics) Status by KSE – stay

*Asia Pacific Links Ltd (China, Defense) Status by KSE – stay

*Xinghua Co. (Hong Kong, IT) Status by KSE – stay

*Avio Chem (Serbia, Air transportation) Status by KSE – stay

*MVIZION (Uzbekistan, Industrial equipment) Status by KSE – stay

*Smart Trading Limited (Turkey, Electronics) Status by KSE – stay

UK hits military suppliers propping up Russia’s war machine

https://www.gov.uk/government/news/uk-hits-military-suppliers-propping-up-russias-war-machine

https://www.gov.uk/government/news/uk-hits-military-suppliers-propping-up-russias-war-machine

*LG Electronics (South Korea, Electronics) Status by KSE – wait

Chinese household appliances will be made at the former LG plant

08.12.2023

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

Strict eligibility conditions in place as IOC EB approves Individual Neutral Athletes (AINs) for the Olympic Games Paris 2024

https://www.pravda.com.ua/eng/news/2023/12/8/7432266/

*De Beers (Great Britain, Luxury) Status by KSE – wait

India and De Beers seek clarity and flexibility on G7’s Russian diamond ban

*Mondi Group (Great Britain, FMCG) Status by KSE – exited

Mondi to return proceeds from sale of Russian assets via special dividend

*Lexus (Japan, Automotive) Status by KSE – leave

Lexus bullish on replacing lost sales in Russia

https://europe.autonews.com/automakers/lexus-bullish-replacing-lost-sales-russia

*Danone (France, FMCG) Status by KSE – leave

Danone’s Chechen takeover: inside a Russian expropriation

https://www.ft.com/content/adb43967-06f8-4d60-a6c1-b5ed262f7dbf

10.12.2023

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

*Authentic Brands Group – Reebok (USA, Sport) Status by KSE – exited

A store with Adidas and Reebok products opened in Moscow

https://www.vedomosti.ru/business/news/2023/12/09/1010222-moskve-otkrilsya

*Iran Aircraft Manufacturing Industrial Company (HESA) (Iran, Defense) Status by KSE – stay

The Prosecutor General’s Office named the company that produces “shahedy”

11.12.2023

*Varian (USA, Pharma, Healthcare) Status by KSE – stay

The American company Varian, which supplies used Truebeam linear accelerators for radiation therapy to Russian oncology clinics, is now required to obtain an export license from the US authorities, a process that takes a minimum of three months.

https://www.kommersant.ru/doc/6394522

*Bright Security (Israel, IT) Status by KSE – stay

*Gooxi (China,Electronics) Status by KSE – stay

*xSecuritas (South Korea, IT) Status by KSE – stay

Security products from South Korea, China, and Israel have become available in Russia

*Siemens (Germany, Electronics) Status by KSE – exited

*Volkswagen (Germany, Automotive) Status by KSE – exited

Siemens and Volkswagen seek compensation from German government over withdrawal from Russian market

*SAIPA (Iran, Automotive) Status by KSE – stay

Iran’s SAIPA expanding into Russia, Belarus markets

https://en.mehrnews.com/news/209404/Iran-s-SAIPA-expanding-into-Russia-Belarus-markets

*Binance (China, Finance and payments) Status by KSE – leave

P2P platform Binance will stop supporting the ruble

https://forklog.com/news/p2p-platforma-binance-ostanovit-podderzhku-rublya

12.12.2023

*GoDaddy (USA, IT) Status by KSE – leave

The largest registrar of domain names — the American company GoDaddy — decided to stop serving Russians.

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

US sanctions proposed buyer of HSBC’s Russian business

https://uk.finance.yahoo.com/news/us-sanctions-expobank-proposed-buyer-153005429.html

13.12.2023

*Kartal Exim (Turkey, Logistics, Transport) Status by KSE – stay

US hits Turkish and Chinese companies over Russia trade

https://www.ft.com/content/f34a0bc9-12a0-4a98-a42e-4e008430f824

*Sterling Shipping Incorporated (United Arab Emirates, Marine Transportation) Status by KSE – stay

*Streymoy Shipping Limited (United Arab Emirates, Marine Transportation) Status by KSE – stay

*HS Atlantica Limited (Liberia, Marine Transportation) Status by KSE – stay

Sterling Shipping Incorporation, Streymoy Shipping Limited, HS Atlantica Limited: OFAC Sanctions Additional Maritime Companies & Vessels for Violating Russian Oil Price Cap & Issues Related General License

https://www.jdsupra.com/legalnews/ofac-sanctions-additional-maritime-9206327/

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg CEO plans to continue hiking beer prices and expand in Asia as the brewer tries to offset the loss of its ‘stolen’ Russian business

14.12.2023

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Austria blocks Russian sanctions over Raiffeisen blacklisting – sources

*JetBrains s.r.o. (Czech Republic, IT) Status by KSE – leave

US officials say Russian targeting JetBrains servers for potential SolarWinds-style operations

*VR Group (Finland, Logistics, Transport) Status by KSE – leave

Russian Railways calls Finland’s train seizure unlawful

https://ca.style.yahoo.com/finland-seizes-trains-joint-venture-090722976.html

*Volvo Cars (Sweden, Automotive) Status by KSE – exited

Owner of former Volvo truck plant in Russia relaunches production

15.12.2023

*WWSemicon GmbH (Germany, Electronics) Status by KSE – stay

*Finder Technology (China, Defense) Status by KSE – stay

Germany’s WWSemicon GmbH and Hong Kong’s Finder Technology continued supplies to Russia’s Compel in 2023 and appear to be the company’s largest suppliers, accounting for at least 65% of Compel’s imports from 2022.

*Global Spirits (Multinational, Alcohol & Tobacco) Status by KSE – leave

The Ministry of Finance of Russia is preparing to nationalize assets that previously belonged to Evgeny Chernyak’s international alcohol holding Global Spirits.

https://www.epravda.com.ua/news/2023/12/15/707760/

*Sprandi (China, Consumer goods and clothing) Status by KSE – wait

Chinese brand Sprandi may return to the Russian market.

https://www.kommersant.ru/doc/6397664

*Papa John’s (USA, Public catering) Status by KSE – wait

One of the Russian structures of the American chain of Papa John’s pizzerias – the company “4 Papas” – is threatened with bankruptcy.

16.12.2023

*CERN (Switzerland, Energy, oil and gas) Status by KSE – wait

CERN Council decides to conclude cooperation with Russia and Belarus in 2024

https://home.cern/news/news/cern/cern-council-decides-conclude-cooperation-russia-and-belarus-2024

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell sells stake in Rosneft-owned refinery to Prax as it cuts Russia links

https://www.ft.com/content/1b74d969-a1fa-4566-adbf-0703568ac5d7

*Campari (Italy, Alcohol&Tobacco) Status by KSE – stay

Russian court sides with Campari in Aperol distributor lawsuit

17.12.2023

*Raiffeisen ( Austria, Finance and payments) Status by KSE – stay

Austria blocks Russian sanctions over Raiffeisen blacklisting – sources

The National Agency for the Prevention of Corruption (NAZK) temporarily excluded the Austrian Raiffeisen Bank from the list of companies sponsoring Russia’s war before consultations.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

Also, at the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 21 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website