- Kyiv School of Economics

- About the School

- News

- 58th issue of the regular digest on impact of foreign companies’ exit on RF economy

58th issue of the regular digest on impact of foreign companies’ exit on RF economy

4 December 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 20.11-03.12.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

KSE DATABASE SNAPSHOT as of 03.12.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 563 (+12 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 547 (-1 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 227 (+6 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 302 (+5 per 2 weeks)

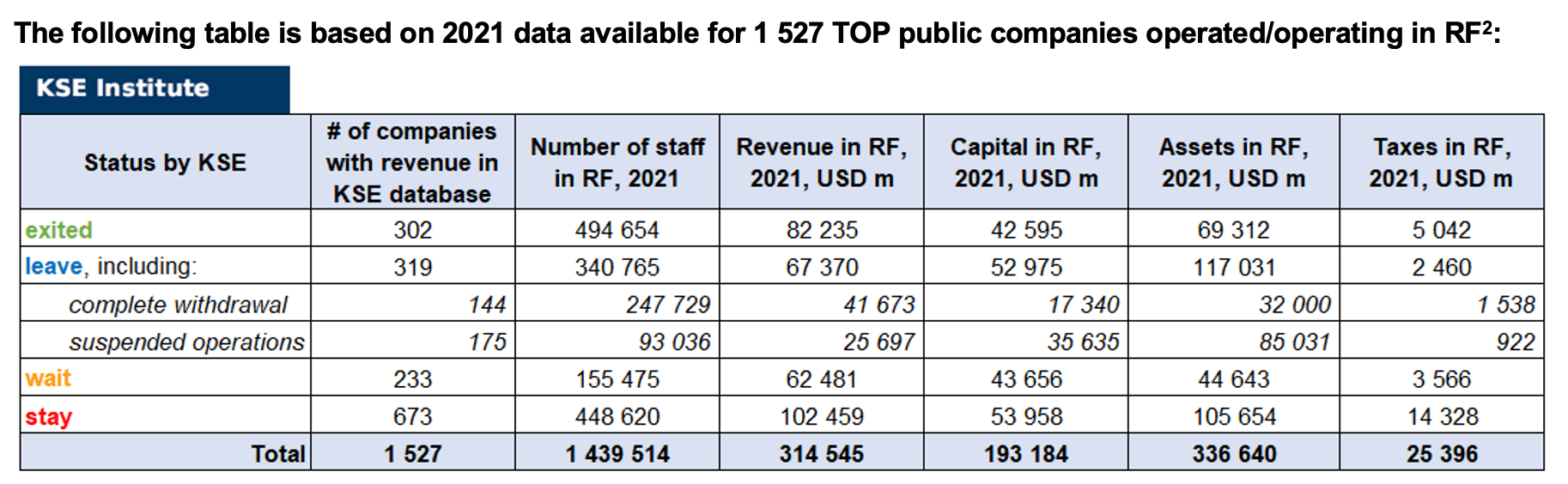

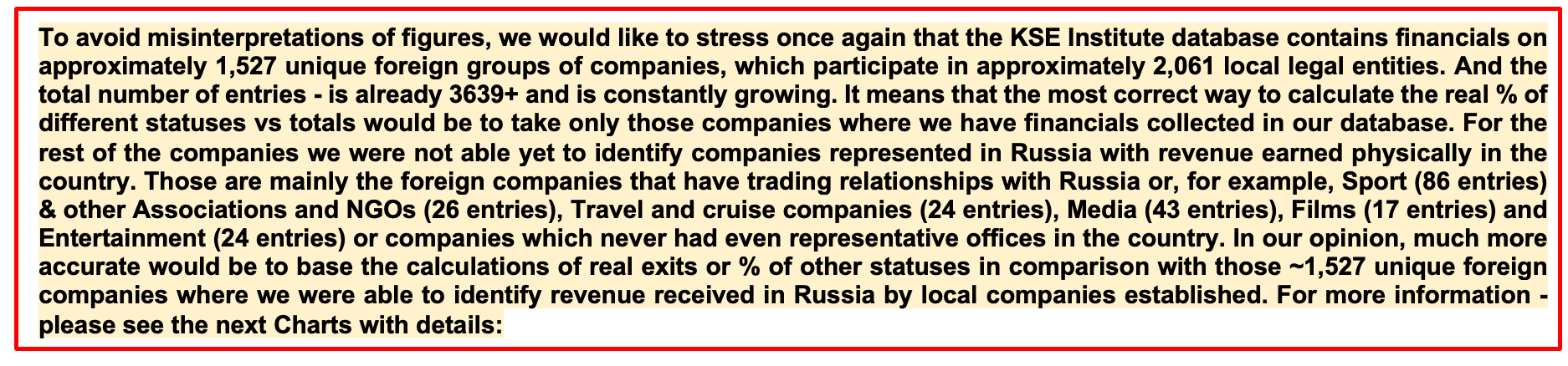

As of December 3, we have identified about 3,639 companies, organizations and their brands from 96 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 527 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.2 billion), local revenue (about $314.5 billion), local assets (about $336.6 billion) as well as staff (about 1.440 million people) and taxes paid (about $25.4 billion). 1,774 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 302 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 3, 302 companies which had already completely exited from the Russian Federation, in 2021 had at least 494,700 personnel, $82.2 bn in annual revenue, $42.6bn in capital and $69.3bn in assets; companies, that declared a complete withdrawal from Russia had 247,700 personnel, $41.7bn in revenues, $17.3bn in capital and $32.0bn in assets; companies that suspended operations on the Russian market had 93,000 personnel, annual revenue of $25.7bn, $35.6bn in capital and $85.0bn in assets.

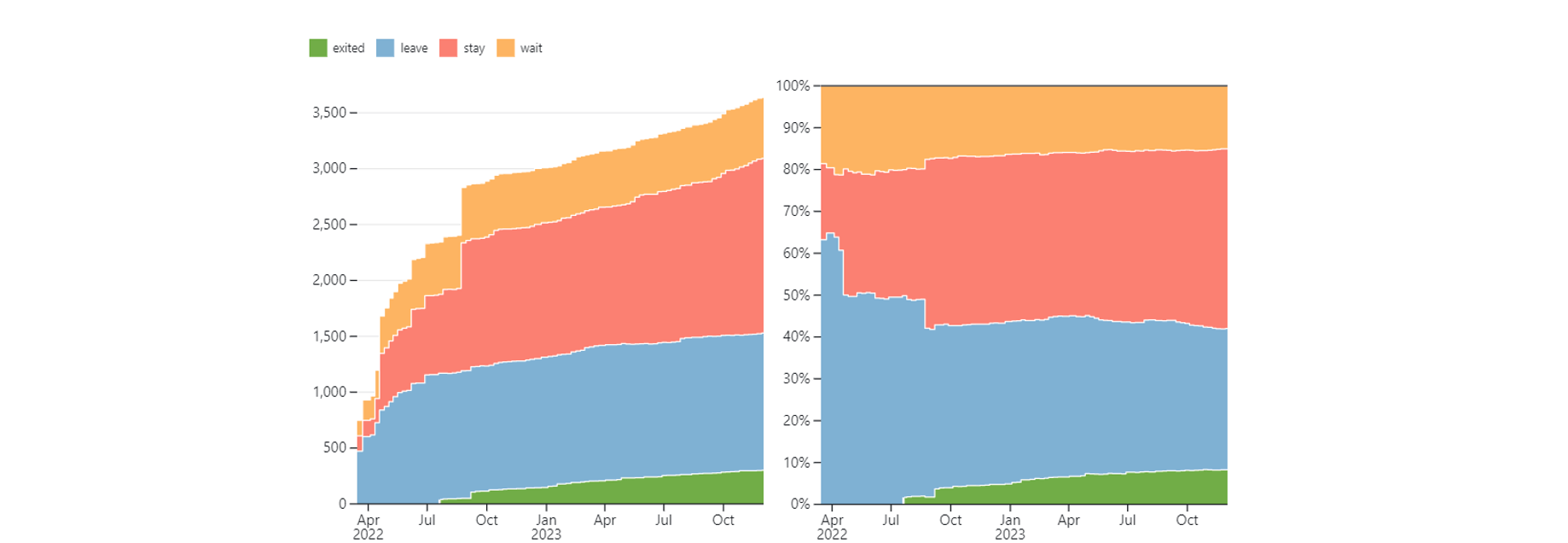

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 15 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 75 were added in November 2023). However, if to operate with the total numbers in KSE database, about 33.7% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 43.0% are still remaining in the country, 15.0% are waiting and only 8.3% made a complete exit³.

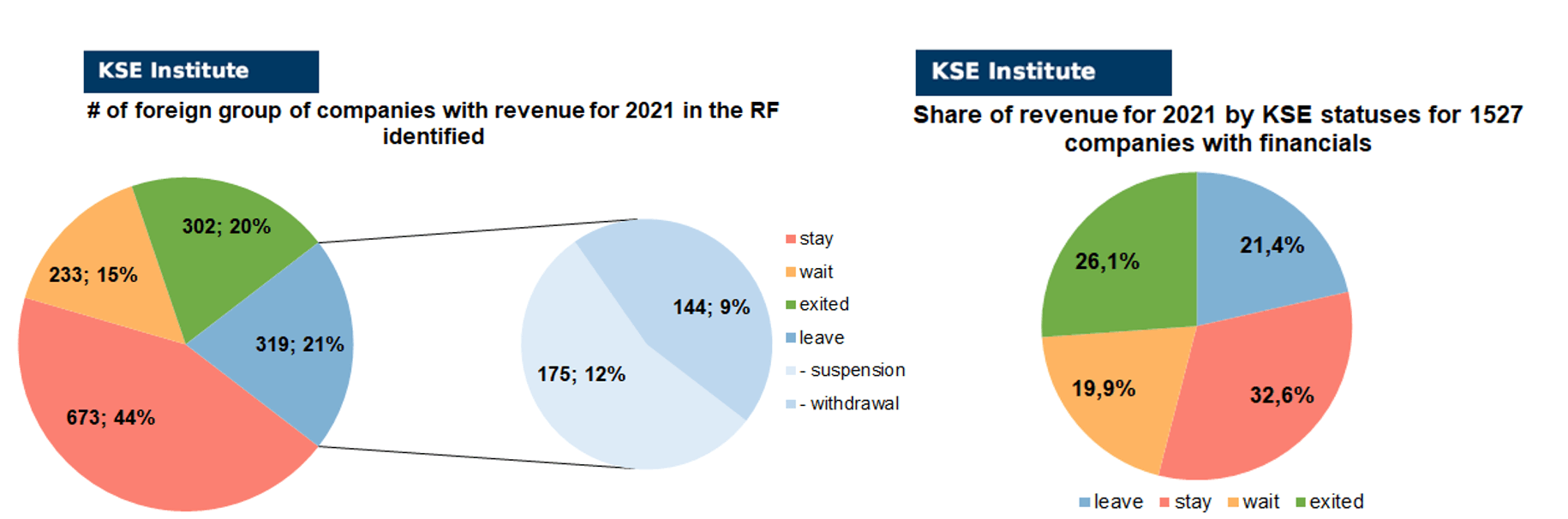

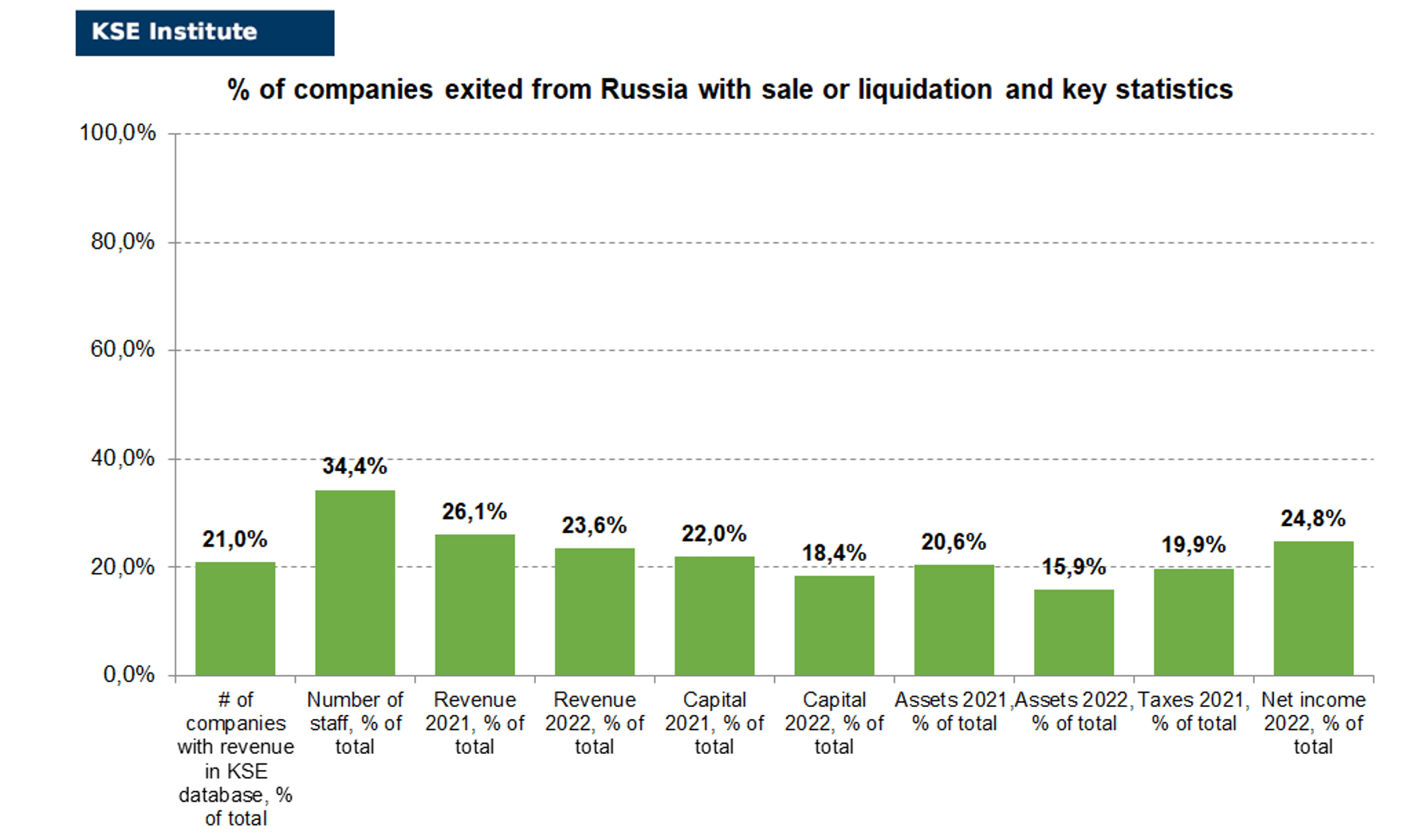

At the same time, it is difficult not to overestimate the impact on the Russian economy of 302 companies that completely left the country, since in 2021 they employed 34.4% of the personnel employed in foreign companies, the companies owned about 20.6% of the assets, had 22.0% of capital invested by foreign companies, and in 2021 they generated revenue of $82.2 billion or 26.1% of total revenue and paid ~$5.0 billion of taxes or 19.9% of total taxes paid by the companies observed. Data on 1,527 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (20%) and on share of revenue withdrawn (26.1%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 32.6% of revenue and 15% of waiting companies represent 19.9% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

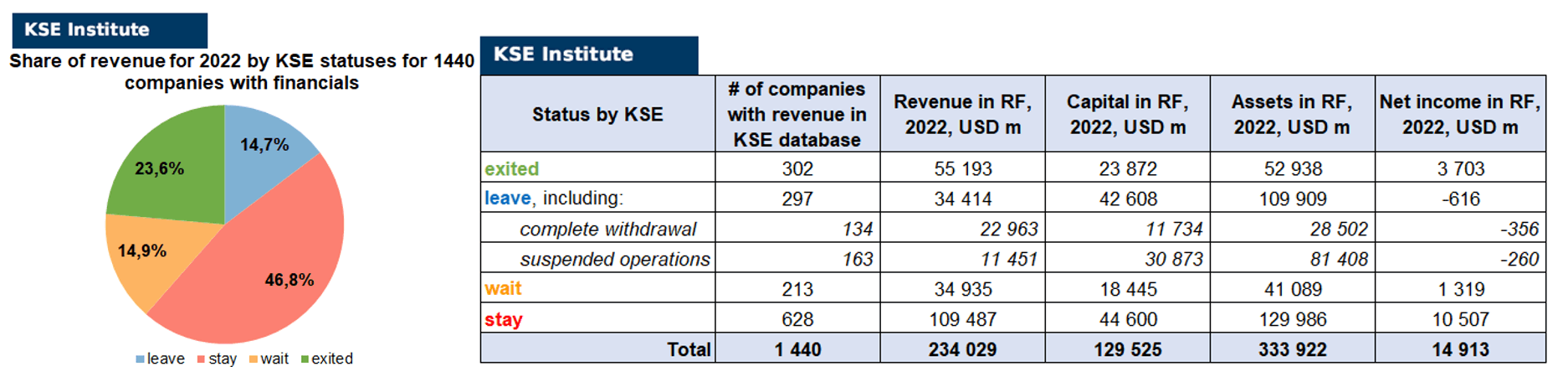

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1440 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.5% less of revenue in 2022 (23.6% from total volume) than in 2021 (26.1% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.7%) revenue in 2022 (14.7% from total volume) than in 2021 (21.4% from total volume). At the same time, staying companies were able to generate much (+14.2%) more revenue in 2022 (46.8% from total volume) than in 2021 (32.6% from total volume). Companies with status “wait”⁴ gained a lower share (-5.0%) of revenue in 2022 (14.9% from total volume) vs 19.9% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($333.9bn⁵ in 2022 vs $336.6bn in 2021) and would even probably increase if the remaining reporting for ~90-100 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

At the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Russian business debts exceeded 100 trillion rubles for the first time

17.11.2023 | Since the beginning of the year, the figure has increased by 16% and at the beginning of August amounted to almost 103 trillion rubles. Since the beginning of the year, business receivables have increased by 14.4% to RUB 99 trillion.

The CIS countries, at the request of the European Union, introduced special controls over the brokerage accounts of Russians

17.11.2023 | Opening accounts with foreign banks and brokers and investing through them in Western assets does not promise a quiet life for Russians. Foreign banks and brokers – at least in the CIS countries – mark “Russian money” and segregate it, taking it into account separately from the rest, said Adil Mukhamedzhanov, Chairman of the Board of the Central Securities Depository of Kazakhstan (CSD).

https://quote.rbc.ru/news/article/6556c8779a7947ada30bd796

Putin will take part in the G20 online summit on November 22

19.11.2023 | Russian President Vladimir Putin plans to take part in the virtual G20 summit, which will be hosted by India and will be held on November 22. “The Russian president and the leaders of Western countries can take part in the same event for the first time in a long time. Next week there will be a virtual G20 summit.

https://www.kommersant.ru/doc/6349511

What foreign currency bonds are available to Russian investors today?

19.11.2023 | The number of available financial instruments in foreign currency for Russian investors has sharply decreased after the introduction of tough sanctions against the St. Petersburg Exchange. However, investors who want to reduce the risks of ruble devaluation have the opportunity to invest in foreign currency bonds. The largest volume of substitute bonds denominated in US dollars is represented on the Russian market. Moreover, the number of issuers in the near future will amount to several dozen. But investors also have access to substitute bonds in euros, pounds sterling, Swiss francs, as well as local bonds in yuan and even dirhams.

https://www.kommersant.ru/doc/6348940

The Russian subsidiary bank of the American JP Morgan Chase is increasing its assets and liabilities in Russia

20.11.2023 | The Russian subsidiary bank of the American JP Morgan Chase, which announced the curtailment of its activities in the country back in March 2022, based on the results of January-September 2023, became the first in terms of assets among foreign investment banks in the Russian Federation. The bank’s assets as a whole have more than quadrupled in two years. Experts believe that the growth of assets and liabilities is associated with the participation of the investment bank in conversion and swap operations. In their opinion, American banks in the current conditions, in general, “are less afraid of secondary sanctions than European ones.”

https://www.kommersant.ru/doc/6349575

Belousov predicted an increase in trade turnover between Russia and China in 2023 to $200 billion

20.11.2023 | First Deputy Prime Minister Andrei Belousov, at a meeting of the intergovernmental Russian-Chinese commission on investment cooperation in Beijing, said that trade turnover between Russia and China will grow to $200 billion by the end of 2023, and to $300 billion by 2030. According to Andrei Belousov, to reach $200 billion in trade turnover was planned for 2024, however, according to his estimates, this volume can be achieved by the end of 2023. “By 2030, this figure will likely reach $300 billion.”

https://www.kommersant.ru/doc/6350088

10 most unprofitable companies in Russia – 2023. Forbes.ru rating

20.11.2023 | According to Forbes, at the end of 2022, the total loss of the 10 most unprofitable companies (6 of them are owned or indirectly controlled by the state) amounted to almost 1.1 trillion rubles. https://www.kommersant.ru/doc/6350716

https://www.forbes.ru/biznes/500644-10-samyh-ubytocnyh-kompanij-rossii-2023-rejting-forbes

The Russian government has changed the form of the report on the movement of funds in foreign accounts

21.11.2023 | The Ministry of Finance wants to oblige companies and entrepreneurs to report quarterly to the tax authorities on the flow of funds, as well as financial assets, in accounts in foreign banks. Companies will be required to provide the tax service with information about revenue left in accounts abroad, as well as “about third parties who participate in mutual settlements for foreign economic activity.” https://www.kommersant.ru/doc/6350247

Consultants named a stop factor when obtaining “golden visas” in Russia

22.11.2023 | Foreign citizens have encountered difficulties in obtaining residence permits in exchange for investments under the golden visa program. The main barrier is the need to pass tests on knowledge of the Russian language, history and legislation of Russia. This became a stopping factor for potential program participants from India, Bangladesh, Iran and China.

The government has banned the export of durum wheat for six months from December 1

23.11.2023 | The government introduced a ban on the export of durum wheat from December 1, 2023 to May 31, 2024 to stabilize prices for durum wheat products. The authorities also established a quota for the export of grain from Russia in the amount of 24 million tons. The Ministry of Agriculture proposed introducing a temporary ban on the export of durum wheat from the country for six months. Together with the Ministry of Economy, the Ministry of Agriculture also initiated the establishment of a quota for the export of wheat, barley, corn and rye to countries that are not members of the EAEU. The measure will be in force from February 15 to June 30, 2024. Tariff benefits have also been approved for certain types of domestic chicken meat.

https://www.kommersant.ru/doc/6352328

Winter Capital’s $1 billion assets came under the control of Rockstone Ventures

24.11.2023 | The Winter Capital fund, which was a co-owner of the Ivy online cinema, the Banki.ru portal and the Skyeng online English language school, will soon cease to exist. His assets worth $1 billion, including investments in Osome, Uolo, Udemy and a number of other (more than 10) technology companies, were acquired by the international investment company Rockstone Ventures. Traditionally, the fund was associated with Vladimir Potanin, who, as reported, withdrew from the investors in early 2022.

https://www.kommersant.ru/doc/6363402

The EU will impose sanctions against Russians involved in the seizure of European assets

24.11.2023 | The European Union intends to add sanctions to the 12th package against individuals and organizations involved in the seizure of assets of European companies in Russia. Until now, Brussels has not punished those who profited from confiscation, but this will change if EU countries approve the latest proposals from the European Commission. According to the proposals, the EU will be able to take restrictive measures against those who “benefit from the forced transfer of ownership or control of entities registered in Russia that were previously owned or controlled by persons from the European Union.”

https://www.moscowtimes.ru/2023/11/24/es-vvedet-sanktsii-protiv-rossiyan-uchastvovavshih-v-zahvate-evropeiskih-aktivov-a114213 ; https://www.politico.eu/article/eu-backs-new-sanctions-european-firms-danone-carlsberg-adidas-seized-russia/

Business hastened to pay 225 billion rubles of “war tax” at a discount

27.11.2023 | Russian companies will pay about 225 billion rubles to the budget. in the form of an excess profit tax until the end of November, Sergei Katyrin, President of the Chamber of Commerce and Industry of the Russian Federation, told Izvestia. According to him, three quarters of the companies that the government obliged to make a one-time payment decided to take advantage of the benefit – the excess profit tax rate reduced from 10% to 5% in 2021-2022, which the government offered for transferring money before November 30 of this year. “We planned to raise about 300 billion rubles from the excess profit tax, of which about 40 billion rubles came from the amount that we are planning today. But the main payment period will be November–December, so by the end of the year we hope that the planned figure will be met in one direction or another,” said Finance Minister Anton Siluanov on November 20.

Putin allowed two companies to buy the assets of Schaeffler and Caterpillar

27.11.2023 | Russian President Vladimir Putin signed a decree that will allow PromAvtoConsult LLC to acquire the Russian business of the German manufacturer of automotive parts Schaeffler. Vladimir Putin signed a similar order for PSK-New Solutions LLC for the purchase of Russian assets of the American company Caterpillar.

https://www.kommersant.ru/doc/6364823

In Russia, production of Hyundai and Kia will resume under a different brand

27.11.2023 | The idle Hyundai plant in St. Petersburg will resume operations next year. The company will begin producing Kia and Hyundai cars; they will be presented on the market under the brand of the Chinese concern GAC.

https://www.vesti.ru/auto/article/3675480

More than 57 thousand Russians have requested asylum in the United States since mobilization began

27.11.2023 | From October 2022 to September 2023, 57,163 Russian citizens crossed the US border to seek asylum. Such data was published by the country’s border department. This number significantly exceeds similar indicators of previous years. In the 2021 fiscal year – from October 2020 to September 2021 – 4.5 times fewer Russians applied for asylum in the United States – only 13,240 people. A year later, this figure almost tripled, reaching 36,271 people.

Putin approved an increase in spending on the army to a record since Soviet times

27.11.2023 | President Vladimir Putin signed the budget law for 2024-26. Next year, for the first time since Soviet times, the authorities intend to allocate almost a third of all spending on the maintenance of the army. Over the year, the budget will spend 10.775 trillion rubles under the heading “national defense” – 70% more than in 2023 (6.8 trillion), 2.3 times more than in 2022 (4.7 trillion), and three times higher than pre-war 2021 levels (3.5 trillion). The share of military expenditures in the budget, the total size of which will be 36.66 trillion rubles, will reach 29.5%. For comparison: the current year’s budget initially included only 19% of defense spending (5 trillion rubles out of 26.1 trillion); in the first year of the war with Ukraine, this share was 17% (4.7 trillion rubles out of 27.8 trillion).

More than 120 mono-brand household appliance stores will open in Russia in 2024

28.11.2023 | Among them are Haier, Candy, Hisense, Kuppersberg. The commercial director of Holodilnik spoke about this. ru Alexey Pogudalov. The retailer expects to receive up to 15% of revenue from them by the end of 2024. Market participants believe that the number of mono-brand equipment stores in the Russian Federation will continue to grow, but to effectively organize their work, serious investments in marketing will be required.

https://www.kommersant.ru/doc/6364825

AFP: The European Commission agreed on a ban on diamonds from Russia – Kommersant

28.11.2023 | The European Commission has approved a proposal to ban the sale of Russian diamonds, AFP reports, citing a draft resolution. In the near future, according to the agency, the document may be sent for consideration to all EU member countries.

https://www.kommersant.ru/doc/6365375

The Central Bank will sell off $12 billion of its last reserves to hold the ruble for Putin’s elections

28.11.2023 | The Bank of Russia is preparing to sharply increase the injection of currency from reserves into the market in order to keep the ruble from falling in anticipation of the presidential elections scheduled for spring. On Monday, the Central Bank announced a new format for operations with gold reserves and the National Wealth Fund, whose assets have been under sanctions since February 2022, with the exception of physical gold and Chinese yuan. From January 2024, the Central Bank will buy foreign currency according to the budget rule (for oil and gas revenues of the treasury above the base level), and will also begin deferred purchases within the framework of this mechanism, which it suspended for the period from August 10 to December 31. At the same time, however, the Central Bank will sell currency. We are talking about using the National Welfare Fund to cover budget expenses and investments.

The Ministry of Internal Affairs proposes to oblige foreigners to sign a “loyalty agreement” to the Russian Federation

29.11.2023 | The Russian Ministry of Internal Affairs (MVD) has taken the initiative to oblige all foreign citizens entering the country to sign a special loyalty agreement. The department notes that, in particular, foreigners, by signing this document, will undertake the obligation “not to discredit the state policy of the Russian Federation.”

https://www.kommersant.ru/doc/6365789

What awaits Russians in December 2023 – Kommersant

29.11.2023 | December 31 is the deadline for employers to bring the proportion of foreign workers in their companies into line with government regulations.

https://www.kommersant.ru/doc/6365929

The head of Rosneft complained about sanctions and accused the Central Bank of freezing export revenues in India

30.11.2023 | Sanctions against Russia have a negative impact on the work of Rosneft and create problems for the return of export earnings, said the head of the company, Igor Sechin. “In almost every round of sanctions, restrictions are introduced that negatively affect the company’s activities,” Sechin noted before a meeting with Russian President Vladimir Putin, which is scheduled to take place on December 1. According to the head of Rosneft, since the beginning of the increase in sanctions pressure, the Bank of Russia has not formulated “reliable routes for the execution of cross-border payments in various currencies.” This “makes it difficult to credit export proceeds in a timely manner,” Sechin emphasized.

Dmitry Gusev: we see an increase in the incomes of Russians – TASS Interview

30.11.2023 | Before the likely official announcement of the IPO, Dmitry Gusev, Chairman of the Board of Sovcombank, gave a keynote interview on TASS. One of the key statements of the head of the Bank: “In the lending market, foreign banks are already barely noticeable or invisible at all. There is no competition here anymore. They collect portfolios and do not issue new loans. Foreign banks have remained in the settlement market and in this sense have a useful function. If they leave completely, then this, of course, will create a negative effect – they help in proceeding payments, this is important.”

https://tass.ru/interviews/19415185

Putin took control of Pulkovo airport from a foreign company

01.12.2023 | The Russian government is creating VVSS Holding LLC to manage Pulkovo Airport, temporarily taking away this right from a foreign company (Fraport, owned a 25% stake, which was valued at €111 million), it follows from the decree. According to the decree, all 100% of the Cypriot company’s shares in the authorized capital of the Northern Capital Gateway (LLC, which has been managing Pulkovo since April 29, 2010) are transferred to the ownership of VVSS Holding. Its authorized capital will be 169 billion rubles. It is noted that the government will not be the founder of the company.

MONTHLY FOCUS: On leaving the Russian Federation. Results of November 2023

In this digest, we will summarize the results of November 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’527 companies identified in the KSE database with revenue data available of more than $314 billion in 2021 and ~$234 billion in 2022. And at least 302 of them have already been sold by local companies or were liquidated and left the Russian market. In November 2023 KSE Institute identified just +6 new exits (actually +7 as status of 1 company was downgraded but it’s visible that the process of withdrawal has significantly slowed down)⁶, total number of exits observed since the beginning of Russia’s invasion reached 302.

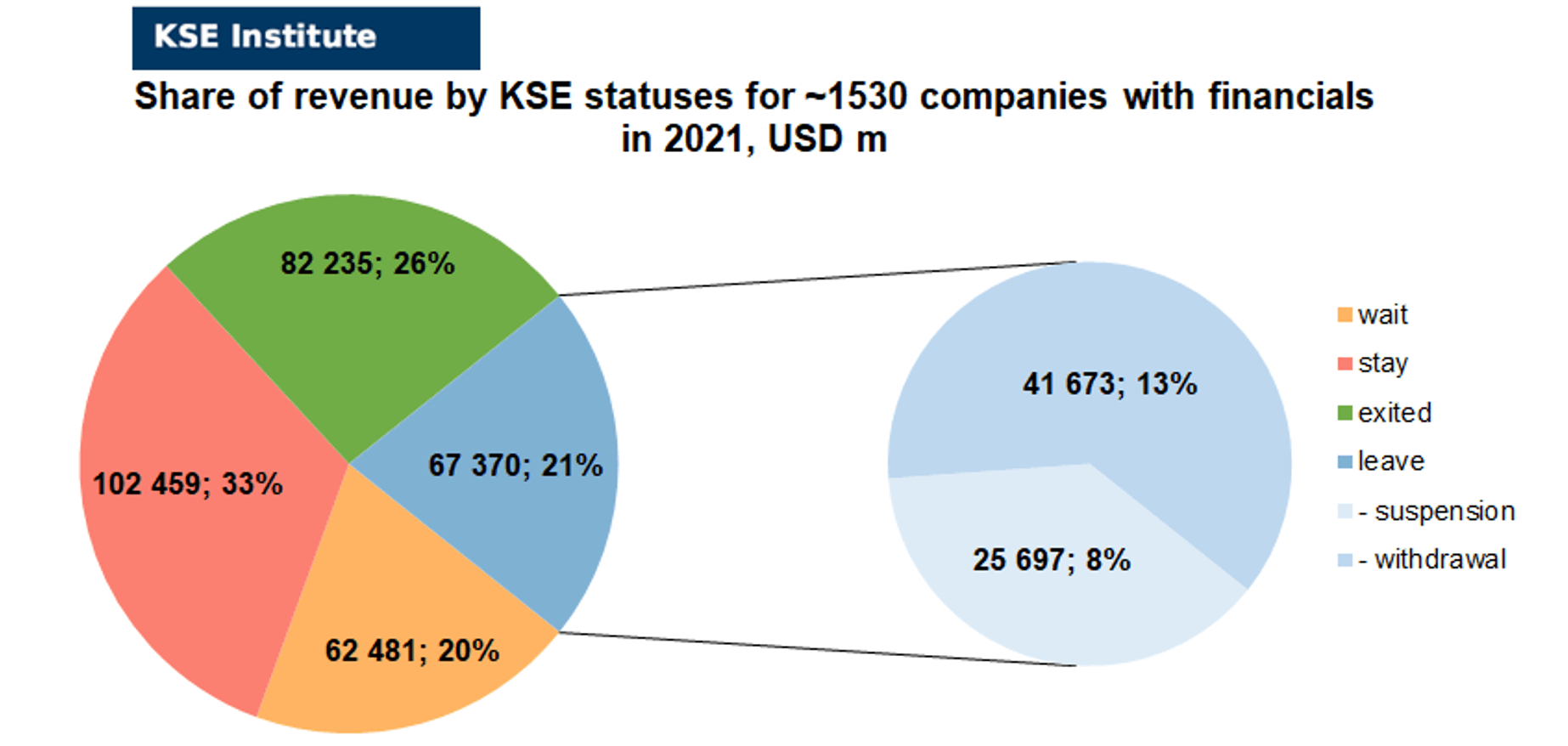

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 26% based on revenue allocation, those who are leaving represent 21% of total revenue (with 38% share of suspensions and 62% of withdrawals sub-statuses), % of staying companies represent 33% of revenue and 20% are waiting companies based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is greater than % of leaving ones (which means that less than 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 23% based on revenue allocation, those who are leaving represent only 15% of total revenue (with 33% share of suspensions and 67% of withdrawals sub-statuses), % of staying companies represent 47% of revenue and 15% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

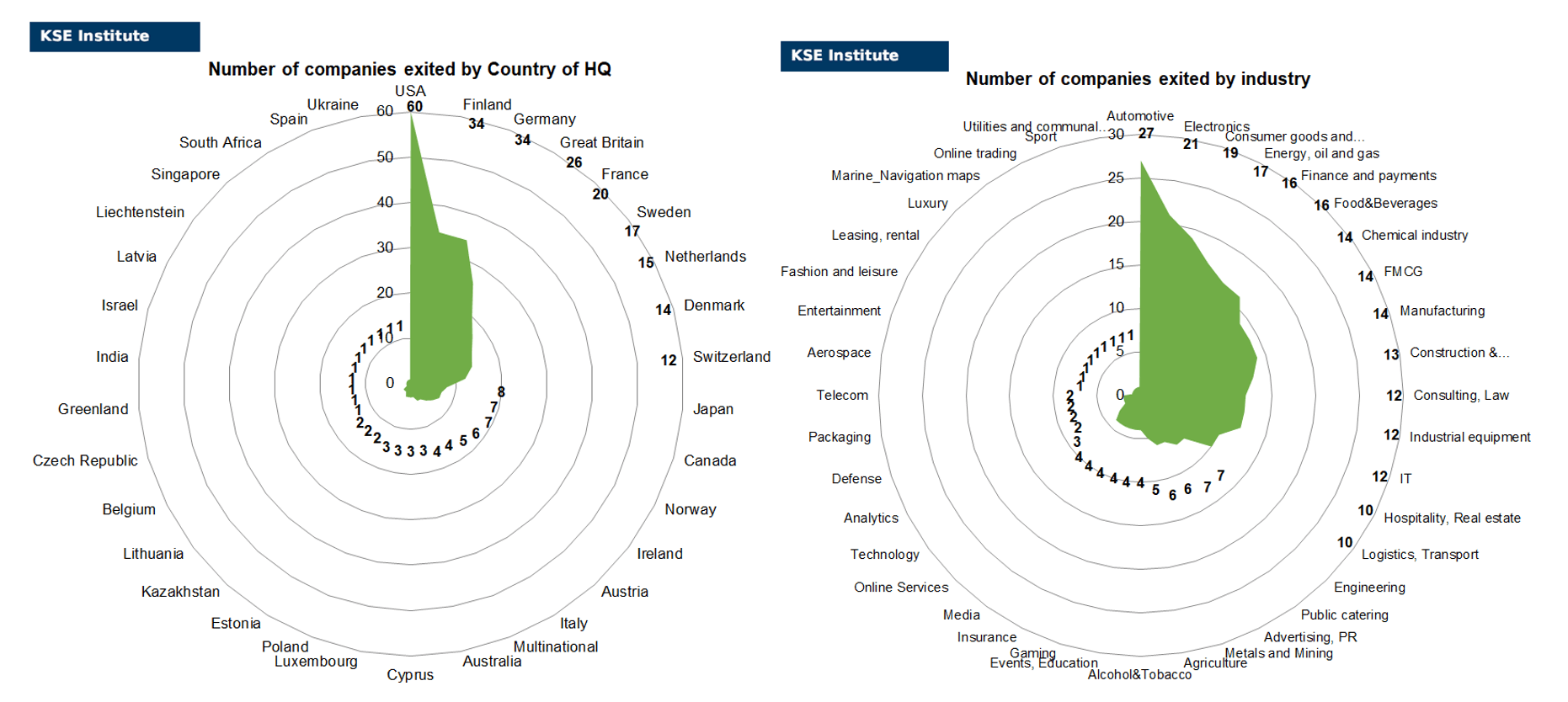

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of November 2023, companies from 34 countries and 40 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, Great Britain and France and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Amedia (another example of business confiscation), Bonava, Clancy Engineering, Eastnine AB, Flugger, Laude Smart Intermodal S.A. (probably internal deal as new owner is “ASIA INTERMODAL” from Kazakhstan) Sandvik (following also the liquidation of Sandvik Coromant legal entity in May, 2023). Also, we downgraded the status of TP-Link as it appeared that the sale accounted before was an intragroup transaction and the company actively continues trade relations with Russia.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them – as you can see below a lot of assets started to be seized with support of Russian courts: Alstom (Alstom to exit Russia’s TMH by year-end -Interfax cites TMH boss), Caterpillar (Russian President Vladimir Putin signed a decree that will allow PSK-New Solutions LLC to acquire the Russian assets of the American company Caterpillar) and Schaeffler (Russian President Vladimir Putin has signed an order that will allow PromAvtokonsult LLC to acquire the Russian business of the German auto parts manufacturer Schaeffler), Fraport (the Russian government is creating VVSS Holding LLC to manage Pulkovo Airport, temporarily taking away this right from a foreign company (Fraport, owned a 25% stake, which was valued at €111 million), it follows from the decree. According to the decree, all 100% of the Cypriot company’s shares in the authorized capital of the Northern Capital Gateway (LLC, which has been managing Pulkovo since April 29, 2010) are transferred to the ownership of VVSS Holding. Its authorized capital will be 169 billion rubles. It is noted that the government will not be the founder of the company), HP (Hewlett-Packard) (the Russian subsidiary of the American HP Inc. – LLC “HP Inc.” – has initiated the liquidation process), JPMorgan (Russian Agricultural Bank files lawsuit against JP Morgan), Konti (Russian court has confiscated the confectionery company Conti-Rus, claiming that it supposedly belonged to ‘a relative of Rinat Akhmetov and his partners’), Linde (Russian court orders seizure of Linde’s liquid helium containers), Mitsubishi Corporation (Businessman Kim’s ExpoCapital bought Mitsubishi leasing structure), Valeo (Valeo announces sale of Russian thermal systems business to NPK Avtopribor).

The next review of deals for December 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁷

20.11.2023

*Fluxys (Belgium, Energy, oil and gas) Status by KSE – stay

Zeebrugge’s independent gas infrastructure operator, Fluxys, provides LNG storage and transshipment capacity to Yamal LNG, a joint venture controlled by the Russian gas company Novatek, which is reportedly directly involved in the financing of military aggression and war crimes.

https://www.epravda.com.ua/columns/2023/11/17/706736/

*JPMorgan (USA, Finance and payments) Status by KSE – stay

The Russian subsidiary bank of the American JP Morgan Chase, which announced the winding down of its operations in the country back in March 2022, became the largest foreign investment bank in Russia in terms of assets at the end of January–September 2023.

https://www.kommersant.ru/doc/6349575

*Celme Sl (Spain, Industrial equipment) Status by KSE – stay

*Belintertrans-Germany GmbH (Germany, Consumer goods and clothing) Status by KSE – stay

*Neuhaus Gmbh (Germany, Automotive) Status by KSE – stay

*Salamander SPS GmbH & Co. KG (Germany, Consumer goods and clothing) Status by KSE – stay

*Jakob KECK Chemie GmbH (Germany, Chemical industry) Status by KSE – stay

*Conceria Cervinia (Italy, Consumer goods and clothing) Status by KSE – stay

The occupier’s boots: this year, boot manufacturers for the Rosarmy bought $4.1 million worth of products from the EU

https://www.epravda.com.ua/news/2023/11/20/706793/

*Binance (China, Finance and payments) Status by KSE – leave

Binance to delist RUB crypto pairs amid Russian market exit

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

*Clearstream (Luxembourg, Finance and payments) Status by KSE – leave

The CIS countries, at the request of the European Union, introduced special control over the brokerage accounts of Russians

*Alibaba (China, Online trading) Status by KSE – stay

A series of bad news stories—including an abandoned cloud spin-off plan—wipe billions from Alibaba’s market cap

21.11.2023

*Penguin Random House (USA, FMCG) Status by KSE – stay

The German and Spanish divisions of one of the world’s largest book publishers, Penguin Random House, have returned to work in Russia.

https://www.kommersant.ru/doc/6350235

*PBS Velka Bites (Czech Republic, Engineering) Status by KSE – stay

*Space Era Materials And Processes (India, Defense) Status by KSE – stay

*Deep Engineering Industries (India,Engineering) Status by KSE – stay

Czech parts make their way to Russian military helicopters despite sanctions

22.11.2023

*Nonghyup Feed Inc. (NOFI) (South Korea, Agriculture) Status by KSE – stay

South Korea’s NOFI seeks Russian feed wheat offers first time since Ukraine invasion

*JPMorgan (USA, Finance and payments) Status by KSE – stay

Russian Agricultural Bank files lawsuit against JP Morgan

*Renault (France, Automotive) Status by KSE – exited

Russian car dealers are suing Renault over the exit of the group from the market.

https://www.kommersant.ru/doc/6351409

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Telegram was fined 4 million rubles for refusing to remove prohibited content in Russia.

23.11.2023

*Amedia (Norway, Media) Status by KSE – exited

Russian printing houses of the Norwegian media holding Amedia were transferred from the temporary management of the Federal Property Management Agency to the management of the Moscow government. Former owners don’t control they assets anymore.

https://www.kommersant.ru/doc/6351829

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Chocolate is still available in Russia: Ukrainian activists call for a boycott of Milka

*Knauf Gips (Germany, Construction & Architecture) Status by KSE – stay

Investing into Russia’s construction industry: Germany’s Knauf branded international sponsor of war.

*Google (USA, Online Services) Status by KSE – exited

Russia has become the world leader in requests for censorship in Google

24.11.2023

*Petroleum Oil and Gas Corporation of South Africa (PetroSA) (South Africa, Energy, oil and gas) Status by KSE – stay

PetroSA pushes for R3.7-billion deal with Russia’s Gazprombank.

*Minerva Marine (Greece, Marine Transportation) Status by KSE – wait

*Thenamaris (Greece, Marine Transportation) Status by KSE – wait

*TMS Tankers (Greece, Marine Transportation) Status by KSE – wait

Greek shippers exit Russian oil trade as U.S. tightens price cap scrutiny

The National Agency on Corruption Prevention (NACP) has removed three Greek shipping companies from the list of international sponsors of war. These are Thenamaris Ships Management Inc., Minerva Marine and TMC Tankers LTD. The decision was made after the companies stopped transporting Russian oil.

*Decathlon (France, Consumer goods and clothing) Status by KSE – exited

The first stores at the Decathlon site will open in late November – early December

https://www.kommersant.ru/doc/6352739

*Polymetal (Kazakhstan, Metals and Mining) Status by KSE – leave

Polymetal” shares fell by 15% on the news of the exchange of securities

https://quote.rbc.ru/news/article/655f44309a79478ae1442d11?from=newsfeed

*JPMorgan (USA, Finance and payments) Status by KSE – stay

*Xerox (USA, Electronics) Status by KSE – exited

How JP Morgan got out of Russian sanctions in New Jersey

https://www.politico.com/news/2023/11/23/new-jersey-jp-morgan-russia-00128528

25.11.2023

*Edelman (USA, Association, NGO) Status by KSE – leave

Revealed: how top PR firm uses ‘trust barometer’ to promote world’s autocrats

https://www.theguardian.com/us-news/2023/nov/24/edelman-pr-trust-barometer-uae-saudi-arabia

*Flugger (Denmark, Manufacturing) Status by KSE – exited

In the company statement dated 10.11.2023 it says that Flugger has sold all of its activities in Russia and Belarus.

https://www.flugger.com/investor/selskabsmeddelelser/

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

Russia’s Gazprom said natural gas supplies to China reached a new all-time high due to rising demand.

https://www.epravda.com.ua/news/2023/11/25/707001/

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg CEO on nationalization of Russian assets and investment in Ukraine – interview

*Haval Motor (China, Automotive) Status by KSE – stay

*Chery Automobile (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

Exclusive: Chinese car sales boom in Russia levels off amid shaky local recovery

27.11.2023

27.11.2023

*HD-Parts (Finland, Automotive) Status by KSE – stay

The Finnish company HD-Parts from Vantaa successfully exports trucks and spare parts to Russia worth millions of euros. This information was revealed by the Yle MOT investigation.

*Synmedic (India, Pharma, Healthcare) Status by KSE – stay

One of the most popular antiviral drugs in Russia, Valenti Pharm’s “Ingavirin”, which is included in the treatment protocols for the coronavirus, may have the first generic in Russia. Its release is planned by “Basis-Metygreens” together with the Indian Synmedic.

https://www.kommersant.ru/doc/6364105

*APS Energia (Poland, Energy, oil and gas) Status by KSE – leave

APS ENERGIA S.A.: Podpisanie Term sheet w sprawie sprzedaży spółki zależnej OOO APS Energia Rus

*Meta (USA, Online Services) Status by KSE – leave

*Facebook (Meta Platforms) (USA, Online Services) Status by KSE – leave

In Russia, the press secretary of the owner of Facebook and Instagram was arrested in absentia and wanted

28.11.2023

*GAC Group (China, Automotive) Status by KSE – stay

Production of Hyundai Solaris, Hyundai Creta and Kia Rio will resume in Russia.

https://www.ixbt.com/news/2023/11/27/hyundai-solaris-hyundai-creta-kia-rio.html

*Schaeffler (Germany, Industrial equipment) Status by KSE – leave

*Caterpillar (USA, Automotive) Status by KSE – leave

Putin allowed two companies to buy out the assets of Schaeffler and Caterpillar

29.11.2023

*Armbrok (Armenia, Finance and payments) Status by KSE – leave

Armbrok broker is closing accounts of non-residents due to domestic legal requirements, according to RBC. The closure will also affect the accounts of some Russians.

https://www.kommersant.ru/doc/6365512

*Google Pay (USA, Online Services) Status by KSE – leave

*Apple (USA, Electronics) Status by KSE – wait

From the Google Play and App Store applications, the applications “Post Bank”, “Absolut Bank”, “Home Bank”, “Russian Standard” Bank, as well as the All-Russian Bank of Reconstruction and Development (RBRR), i.e. those credit organizations, have disappeared which were imposed sanctions by the USA in early November.

*Steel Authority of India Limited (SAIL) (India, Metals and Mining) Status by KSE – stay

India is increasing its import of coking coal from Russia against the backdrop of sanctions.

https://www.blackseanews.net/read/211419

*PPG (USA, Chemical industry) Status by KSE – exited

*Hempel (Denmark, Industrial equipment) Status by KSE – leave

*Jotun (Norway, Chemical industry) Status by KSE – exited

Former Russian factories of PPG, Hempel and Jotun now united

*Women’s Tennis Association (USA, Sport) Status by KSE – wait

WTA will not punish players taking part in Russian tennis exhibition

*Intel (USA, IT) Status by KSE – stay

Intel and AMD supplies have decreased significantly

30.11.2023

*Organisation for the Prohibition of Chemical Weapons (Netherlands, Association, NGO) Status by KSE – leave

Russia fails to be elected to executive council of chemical weapons watchdog for the first time

https://www.pravda.com.ua/eng/news/2023/11/29/7430934/

*Organization for Security and Cooperation in Europe (OSCE) (Finland, Association, NGO) Status by KSE – stay

The Kremlin-Connected Russians Employed By Europe’s Top Security Body

https://www.rferl.org/a/32693816.html

Baltic foreign ministers pull out of OSCE summit over Russia invite

*Badminton World Federation (Malaysia, Sport) Status by KSE – leave

The World Badminton Federation has suspended the membership of the Russian Federation due to collaborating athletes

*Fortenova Group (Croatia, Food & Beverages) Status by KSE – leave

Croatian retail giant Fortenova says it is close to ditching Russian owner

https://www.ft.com/content/02141842-28cc-41ae-b374-b560d3b040c4

*Volkswagen (Germany, Automotive) Status by KSE – exited

Six months after Volkswagen exit, idle Russian car plant offers workers redundancy

*Fluxys (Belgium, Energy, oil and gas) Status by KSE – stay

National Agency on Corruption Prevention lists Belgian gas company Fluxys as international war sponsor

01.12.2023

*L’Oreal (France, Consumer goods and clothing) Status by KSE – stay

L’Oréal maintains ‘limited’ presence in Russia despite ongoing war

https://www.cosmeticsbusiness.com/l-or%C3%A9al-maintains-limited-presence-in-russia-despite-ongoing

*Autel Robotics (China, Electronics) Status by KSE – stay

US lawmakers seek probe of Chinese drone maker Autel Robotics

*Salamander SPS GmbH & Co. KG (Germany, Consumer goods and clothing) Status by KSE – stay

Munz Group, which has been managing the Salamander footwear brand under license since 2020, bought the rights to the brand in Russia and a number of neighboring countries.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

Also, at the end of November 2023, the KSE Institute published a new study entitled “Analysis of foreign business exits from Russia“, which analyzed and systematized the results of 300 exits of foreign companies from the Russian Federation. This paper includes detailed analysis of the largest deals, main buyers/beneficiaries, continuation of trade relations after sales and many other interesting insights. You can download the full text of the study in English here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4648135

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 21 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website