- Kyiv School of Economics

- About the School

- News

- 57th issue of the regular digest on impact of foreign companies’ exit on RF economy

57th issue of the regular digest on impact of foreign companies’ exit on RF economy

20 November 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 02.11-19.11.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

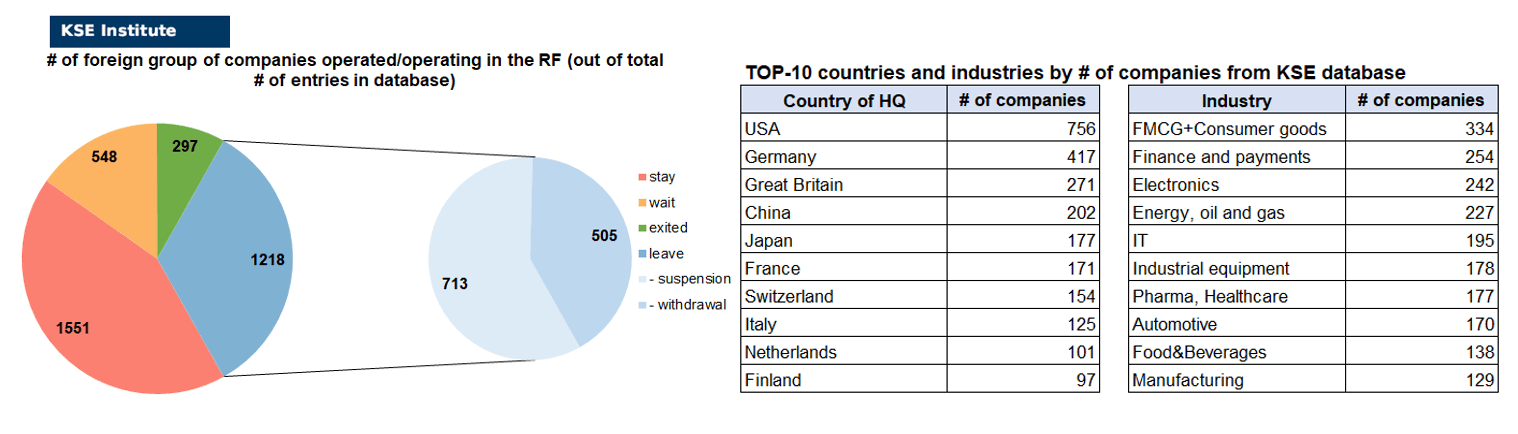

KSE DATABASE SNAPSHOT as of 19.11.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 551 (+48 per 3 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 548 (-4 per 3 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 221 (+6 per 3 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 297 (+1 per 1 weeks)

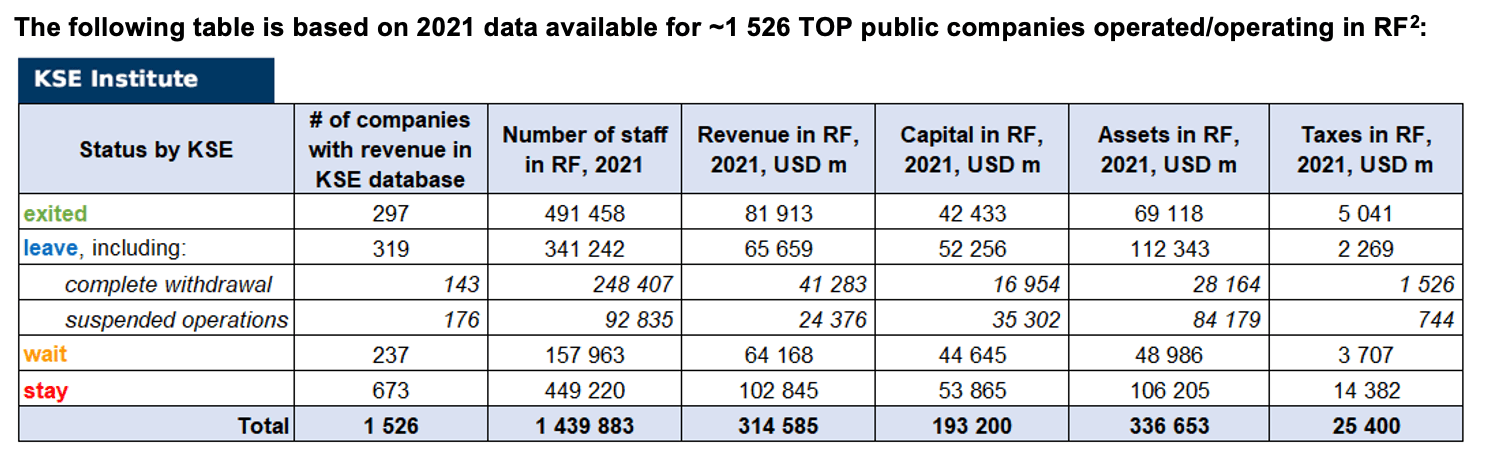

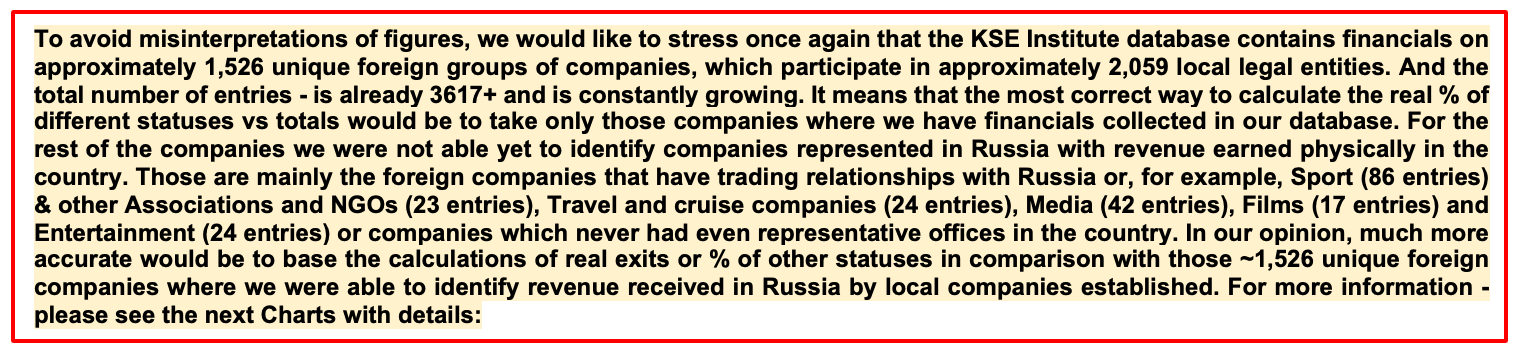

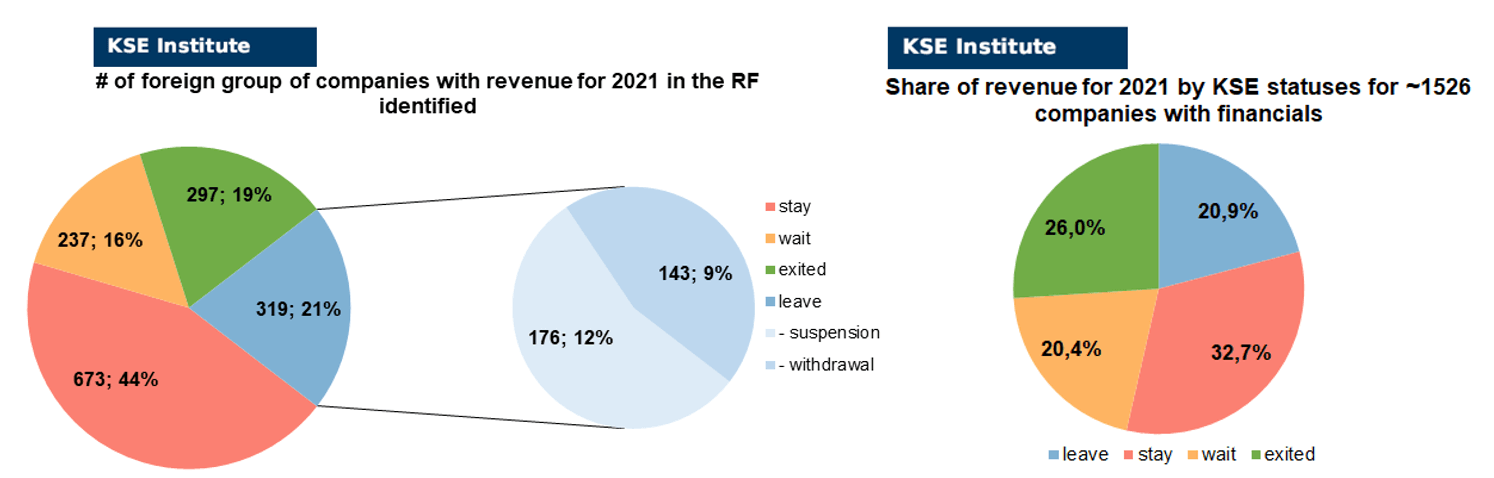

As of November 19, we have identified about 3,617 companies, organizations and their brands from 96 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 526 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.2 billion), local revenue (about $314.6 billion), local assets (about $336.7 billion) as well as staff (about 1.440 million people) and taxes paid (about $25.4 billion). 1,769 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 297 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

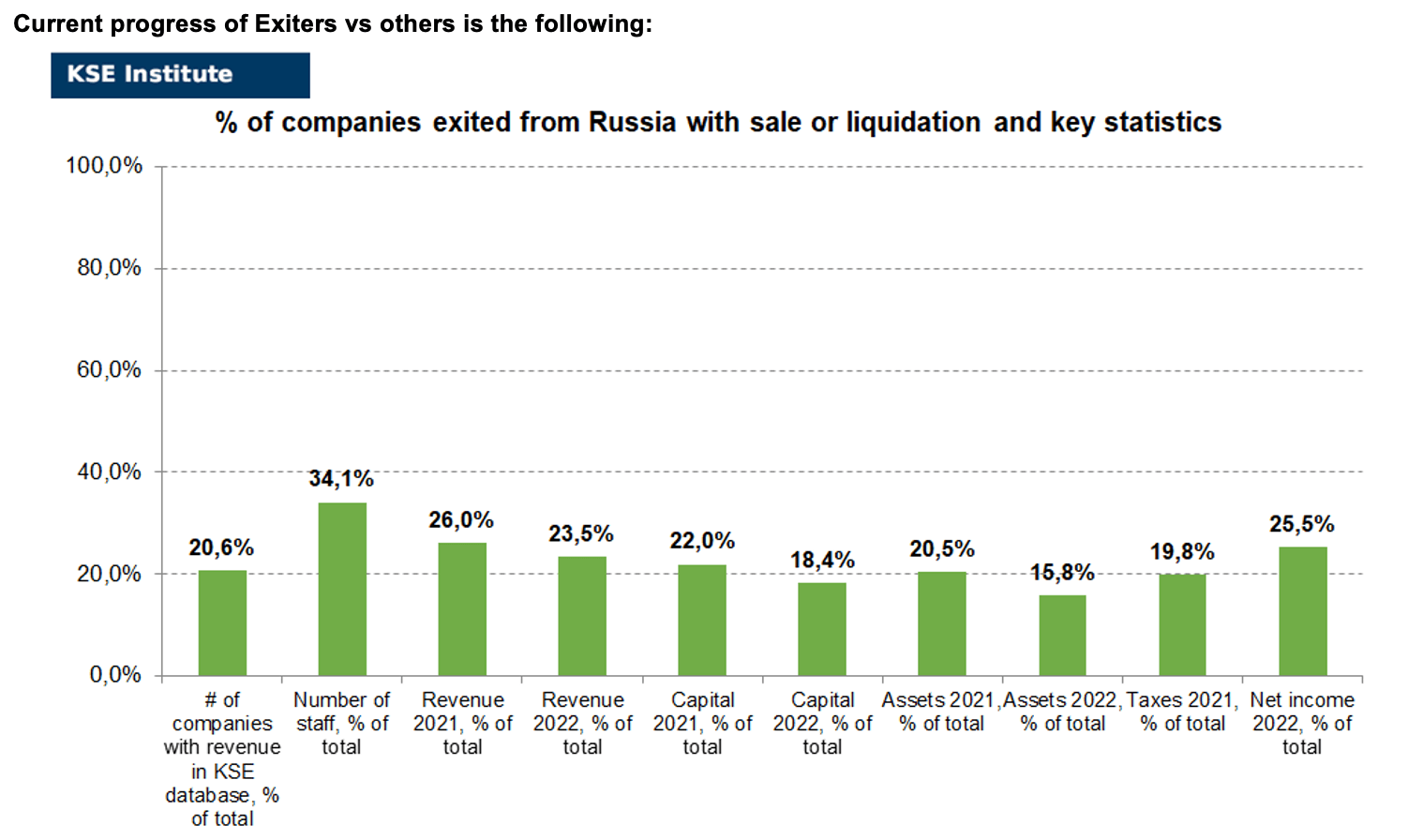

As can be seen from the tables below, as of November 19, 297 companies which had already completely exited from the Russian Federation, in 2021 had at least 491,500 personnel, $81.9 bn in annual revenue, $42.4bn in capital and $69.1bn in assets; companies, that declared a complete withdrawal from Russia had 248,400 personnel, $41.3bn in revenues, $17.0bn in capital and $28.2bn in assets; companies that suspended operations on the Russian market had 92,800 personnel, annual revenue of $24.4bn, $35.3bn in capital and $84.2bn in assets.

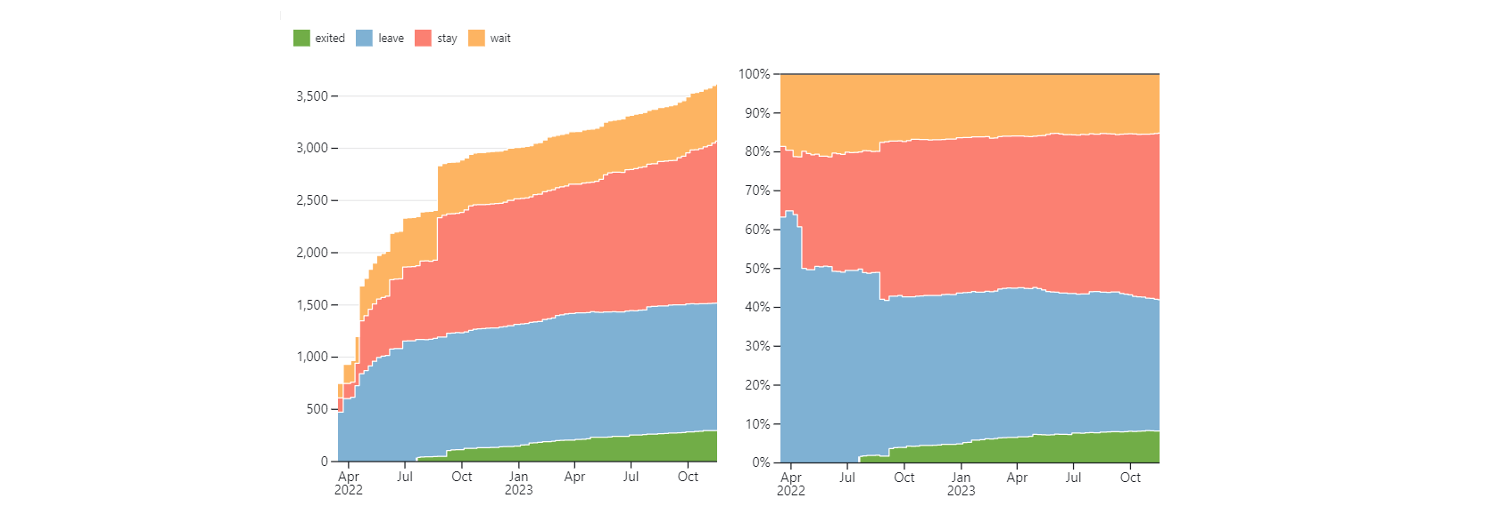

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 15 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 52 were added in November 2023). However, if to operate with the total numbers in KSE database, about 33.8% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 43.0% are still remaining in the country, 15.2% are waiting and only 8.2% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 297 companies that completely left the country, since in 2021 they employed 34.1% of the personnel employed in foreign companies, the companies owned about 20.5% of the assets, had 22.0% of capital invested by foreign companies, and in 2021 they generated revenue of $81.9 billion or 26.0% of total revenue and paid ~$5.0 billion of taxes or 19.8% of total taxes paid by the companies observed. Data on 1,526 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (19%) and on share of revenue withdrawn (26.0%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 32.7% of revenue and 16% of waiting companies represent 20.4% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

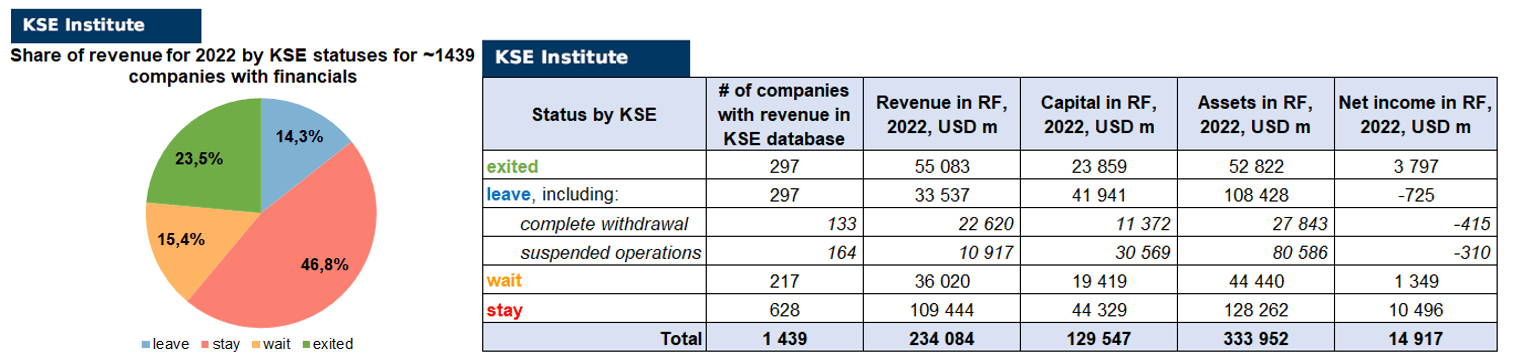

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1439 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.5% less of revenue in 2022 (23.5% from total volume) than in 2021 (26.0% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.6%) revenue in 2022 (14.3% from total volume) than in 2021 (20.9% from total volume). At the same time, staying companies were able to generate much (+14.1%) more revenue in 2022 (46.8% from total volume) than in 2021 (32.7% from total volume). Companies with status “wait”⁴ gained a lower share (-5.0%) of revenue in 2022 (15.4% from total volume) vs 20.4% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($334.0bn⁵ in 2022 vs $336.7bn in 2021) and would even probably increase if the remaining reporting for ~90-100 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

In July 2023, the KSE Institute jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf. Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Russian Medvedev: it will be very difficult for European companies to return to Russia

29.10.2023 | European companies have suffered colossal losses due to leaving the Russian market; it will be difficult for them to return to the country, if at all possible, said Deputy Chairman of the Russian Security Council Dmitry Medvedev.

https://www.rbc.ru/rbcfreenews/653e61d89a794797c6337f0c

Russian authorities are preparing to seize their assets abroad and have prohibited Western companies from withdrawing their profits in US dollars and euros from Russia

31.10.2023 | In an effort to keep the ruble from collapsing further, Russian authorities are imposing increasingly stringent restrictions on the withdrawal of money from the country. Russian authorities have introduced de facto additional currency controls – an unofficial ceiling of $500 million has been established for the withdrawal of currency abroad.

https://www.moscowtimes.ru/2023/10/31/pravitelstvo-zapretilo-uhodyaschim-zapadnim-kompaniyam-vivodit-iz-rossii-bolee-500-mln-a111742 ; https://tlgrm.ru/channels/@NewsObozr/12781

Federal Customs Service: monthly income from exchange duties is comparable to one day of customs work

31.10.2023 | Monthly federal budget revenues from export duties related to the ruble exchange rate are comparable to the results of the Federal Customs Service for all payments in one day. This was stated by the acting head of the Federal Customs Service Ruslan Davydov at the International Customs Forum.

https://www.kommersant.ru/doc/6311463

State Duma deputy proposed expelling all foreign business from Russia

01.11.2023 | State Duma deputy Nikolai Arefiev proposed expelling all foreign businesses from Russia. He believes that this will help restore the country’s economy. The deputy is also confident that parallel imports prevent Russian companies from developing.

https://www.klerk.ru/buh/news/585420/

Trading in foreign shares has been temporarily suspended on the St. Petersburg Exchange. Previously, the site was included in the US sanctions list

02.11.2023 | Trading in foreign shares on the St. Petersburg Exchange has been temporarily suspended. This is reported in applications for brokers, in particular Tinkoff Investments. Transactions with American securities are also not accepted in the BCS application. Earlier today, St. Petersburg Exchange came under US sanctions. St. Petersburg Exchange reported that the sanctions will not affect the assets of its clients.

https://www.kommersant.ru/doc/6319866

Businesses will begin to have their currency taken away for refusing to convert it into rubles

02.11.2023 | The Russian authorities continue to “tighten the screws” on the foreign exchange market in order to keep the ruble from further falling, which after the devaluation of 2023 entered the top weakest currencies in the world. Following the presidential decree on the mandatory sale of foreign currency earnings, which applies to four dozen of the largest Russian exporters, officials are preparing draconian fines (from 75% to 100% of “hidden” earnings) for those who continue to hide currency from the state.

FSPP: the number of loan defaulters exceeded 21 million

03.11.2023 | Compared to the same period last year (January-September), the number of loan defaulters in 2023 increased by 22%. The total amount of debt for the reporting period reached 2.9 trillion rubles.

https://www.kommersant.ru/doc/6320226

Sales of new passenger cars increased 2.6 times in October

03.11.2023 | In Russia, 112,238 new passenger cars were sold in October 2023, which is 2.6 times more than in the same month of 2022, according to vehicle registration data.

China has invested 820 billion rubles in enterprises in the Far East

04.11.2023 | China has become the largest foreign investor in the Far East, spending 820 billion rubles on the development of enterprises.

https://tass.ru/ekonomika/19203975

Belousov: sectors providing import substitution are growing monthly by 5–7%

05.11.2023 | First Deputy Prime Minister of Russia Andrei Belousov clarified that sectors related to the production of equipment, primarily mechanical engineering, as well as the production of temporary goods for the population can be classified as providing import substitution.

https://www.kommersant.ru/doc/6321069

Gref: the fundamental rate is about 85–90 rubles per dollar

07.11.2023 | The fundamental exchange rate of the ruble is in the range of 85-90 rubles per dollar, there is no expectation that it will deviate much from it, said the head of Sberbank German Gref. According to him, the situation will be stable until the end of the year. Gref also said that Sberbank expects record profits in 2023 for both its own and the Russian banking sector as a whole.

https://www.kommersant.ru/doc/6321811

Turkish brands are beginning to reconsider their strategy for working in the Russian Federation

08.11.2023 | Turkish clothing brands, which entered the Russian market after the departure of some Western brands, are beginning to reconsider their strategy for working in the Russian Federation. Thus, the distributor Jamilco closed the only Ipekyol and Twist stores in the country a year later. Experts say that new Turkish brands are poorly known due to low marketing activity, high competition with Russian clothing chains and the growing popularity of online shopping, including from abroad.

https://www.kommersant.ru/doc/6321949

Russian banks are returning to the practice of paying coupons on Eurobonds

08.11.2023 | Russian banks are gradually returning to the practice of paying coupons on subordinated Eurobonds, which they suspended in 2022–2023. The return to payments may be associated either with the issue of replacement bonds or with the payment by the issuer of dividends on its shares. In this way, the inequality in the position of investors who own Eurobonds in Russian and foreign infrastructures is actually removed.

https://www.kommersant.ru/doc/6322017

G7 countries agreed not to return assets to Russia without compensation to Ukraine

08.11.2023 | The G7 countries will leave Russia’s assets frozen until the country’s authorities agree to pay compensation to Ukraine for damage caused during the fighting. This was stated in a joint statement by the foreign ministers of the G7 countries following their two-day meeting in Tokyo.

https://www.kommersant.ru/doc/6322464

Peskov: Russia will respond to the confiscation of its assets by the West, but hardly in a mirror way

08.11.2023 | Confiscation of frozen assets of the Russian Federation abroad will entail “very serious” costs for those who take such a measure, says Russian Presidential Press Secretary Dmitry Peskov. He acknowledged that the legal response is unlikely to be reciprocal.

https://www.kommersant.ru/doc/6322394

In Russia, over 1.5 years, 93 seizures were imposed on the assets of foreign businesses

08.11.2023 | In the context of sanctions and the exodus of foreign companies, courts began to use interim measures against foreign defendants more often than usual, including the seizure of funds and property, shares and interests. In Russia, over 1.5 years, 93 seizures were imposed on the assets of foreign businesses.

https://www.rbc.ru/economics/08/11/2023/654a2f429a7947e5f7db4495

The US Congress approved the confiscation and transfer of Russian assets to Ukraine

08.11.2023 | The Foreign Affairs Committee of the US House of Representatives approved a bill on the transfer of frozen Russian assets to Ukraine. The bill was introduced in the Senate and House of Representatives in June 2023. The authors of the initiative proposed providing additional assistance to Ukraine at the expense of “assets confiscated from the Central Bank of the Russian Federation and other sovereign assets of the Russian Federation.” The document also envisages the creation of an “international compensation mechanism” for the transfer of frozen funds from Russia to Kyiv. In addition, the bill provides for a ban on the release of assets until Russian troops leave the territory of Ukraine and Moscow provides Kyiv with compensation for military aggression.

Putin signed a decree on the possibility of “exchanging” frozen assets

08.11.2023 | Vladimir Putin signed a decree according to which part of the blocked foreign assets in the Russian Federation can be exchanged for assets of Russians frozen in the West. The document prescribes the procedure for the sale of foreign securities that belong to Russians, to foreigners, including from unfriendly countries, at the expense of funds that are actually blocked for these foreigners in type “C” accounts in Russia.

https://tass.ru/ekonomika/19234463 ; https://www.kommersant.ru/doc/6322704

The former CEO of Megafon became the largest buyer of assets of foreign companies that left Russia

09.11.2023 | The departure of Western companies from Russia has created good opportunities to get an effective business at a low price. Some international corporations divested of assets by rapidly leaving the country after the outbreak of the war in Ukraine, while others subsequently had to give buyers deep discounts as the terms of sale became increasingly stricter. As a result, a new business elite is being formed – from entrepreneurs who until now have not been among the country’s largest businessmen.

HSE recorded a doubling of net capital outflow in the third quarter

10.11.2023 | Net capital outflow from Russia in the third quarter of 2023 doubled compared to April–June. Analysts from the National Research University Higher School of Economics report this. According to experts, the trend is explained by difficulties in returning export earnings to the country, as well as payments to foreigners leaving the Russian market.

https://www.kommersant.ru/doc/6323746

The procedure for compensation to foreign companies excluded from offshores has been determined

10.11.2023 | The Government of the Russian Federation has determined the procedure for paying compensation to foreign companies from unfriendly countries whose rights to own shares in an economically significant organization in the Russian Federation were suspended by a court decision. According to the resolution, a foreign holding company can apply for compensation to an economically significant company from whose ownership it was excluded. Compensation is paid in the amount of the market value of the shares owned by the foreign company in an economically significant organization.

https://www.kommersant.ru/doc/6335416

The government has determined the rules for paying compensation to foreign holdings when their rights in economically significant organizations are frozen

13.11.2023 | Large foreign holdings will lose the right to vote at shareholder meetings, receive their dividends, and dispose of shares and shares. In return, they will be offered compensation for the value of the assets, although the money may be frozen in Type C accounts, or await the return of rights. For beneficiaries in the Russian Federation, this will simplify redomiciliation, essentially reducing it to a forced purchase of assets without serious international legal risks. The criteria for classification as significant companies are as follows: annual revenue volume is more than 75 billion rubles, the value of assets is more than 150 billion rubles, staff is more than 4 thousand people, the company operates in critical industries, as well as the share of direct or indirect participation of Russian beneficiaries (more than 50%).

https://www.kommersant.ru/doc/6336146

Foreigners arriving in Moscow began to be interrogated and searched at customs

13.11.2023 | Foreign citizens arriving in Moscow are subject to lengthy procedures of interrogation and searches at the airport. This was reported by British journalist Jonny Tickle, who worked for RT before the outbreak of hostilities in Ukraine. In his Twitter he warned: “Avoid Domodedovo Airport. Arrived in Moscow and was forced to wait for four hours, including a 30-minute interrogation. In September I went to Vnukovo without any questions.” According to him, other citizens of Great Britain and the United States also report similar problems at Domodedovo.

Russian banks increase lending in yuan

14.11.2023 | Russian banks began to actively increase the issuance of loans in yuan. This is happening, among other things, against the backdrop of rising ruble rates, with which participants in foreign economic activity are no longer comfortable working. However, lending in Chinese currency is constrained by insufficient funding for banks. Rising borrowing rates, including in China, threaten the margins of credit institutions.

https://www.kommersant.ru/doc/6336962

The adoption of a list of jurisdictions that do not send country reports to the Russian Federation will make it possible to demand them from Russian companies

14.11.2023 | The Federal Tax Service has compiled a list of 22 countries and territories that do not fulfill their obligations to automatically exchange reports – financial, tax and other information on the activities of international holdings with subsidiaries in the Russian Federation. The list includes, in particular, Germany, France, Cyprus and the Netherlands. With the advent of the blacklist, tax authorities, under the threat of currently increasing fines, will be able to demand country reports directly from Russian subsidiaries of international companies.

https://www.kommersant.ru/doc/6336961

By decision of Russian courts, assets worth $400 million were seized abroad

16.11.2023 | Financial assets in the amount of $400 million and 47 real estate assets were arrested abroad by decision of Russian courts. This was reported by the press service of the Prosecutor General’s Office of Russia following the fifth meeting of the heads of prosecutorial services of the BRICS member states. “Based on decisions of Russian courts, competent authorities of foreign states have seized 47 real estate properties of the accused, as well as their financial assets in the amount of $400 million,” the press service said.

https://tass.ru/ekonomika/19304673

The CIS countries, at the request of the European Union, introduced special controls over the brokerage accounts of Russians

17.11.2023 | Opening accounts with foreign banks and brokers and investing through them in Western assets does not promise a quiet life for Russians. Foreign banks and brokers – at least in the CIS countries – mark “Russian money” and segregate it, taking it into account separately from the rest, said Adil Mukhamedzhanov, Chairman of the Board of the Central Securities Depository of Kazakhstan. This is being done at the request of Euroclear and Clearstream, the largest depositories that record and clear securities. They do not work directly with investors, but open accounts for large players – banks, brokers, central depositories. In order not to accidentally violate sanctions, they want to separate the accounts of Russians and Belarusians from the rest.

https://accentnews.ge/ru/article/101102-strany-sng-po-trebovaniiu-evrosoiuza-vveli-spetskontr

WEEKLY FOCUS: Japanese business in the Far East of Russia is exempted from Western sanctions

In the current climate of globalization and integration, the Russian government pays special attention to regional policy. The Russian Far East is an important link in Russia’s integration into the Asia-Pacific region. Over the past few years, the Russian government has paid considerable attention to the economic development of the Russian Far East, in particular, one of Russia’s key regional economic partners is Japan.

The Russian Far East has always been of interest to many Japanese companies, with the latter increasingly considering Russia as an important part of the global market. Expanding cooperation in the economic sphere should contribute to solving many problems, in particular, the long-standing territorial dispute over the Kuril Islands.

The Far East of Russia, which is the closest part of Russia to Japan, consists of several regions, including the Republic of Sakha (Yakutia), the Khabarovsk Territory and the Kamchatka Region. Beneath these vast regions lie significant mineral resources such as gold and silver and energy resources such as oil and natural gas. At the same time, the coastal part of the Far East of Russia is rich in marine resources, that is, all this indicates the “dormant potential” of this region (which, however, has gradually disappeared in recent years).

Taking this into account, Japan has three consulates general in the Far Eastern Federal District of Russia, in particular, in Vladivostok, Khabarovsk and Yuzhno-Sakhalinsk. The Tottori Trade Center was established in Vladivostok and Hokkaido representative offices and the Wakkanai City Hall operates in Yuzhno-Sakhalinsk. The Permanent Mixed Commission “Far East – Hokkaido” operates at the level of regional administrations of both sides, and at the level of business and economic relations, Russian-Japanese investment forums dedicated to Russian-Japanese cooperation in the Far East are held.

Large-scale development of Russian resources with the participation of Japanese companies is of strategic importance for Japan, since the Russian Far East is geographically close to this country and ensures its energy security, therefore, in Japan, rather close attention is paid to the above-mentioned regions of Russia.

Several small and medium-sized enterprises in Japan have decided to use the system of special economic zones of the Russian Far East for direct investments, in particular, in agriculture, tourism, health care, etc. So, among the largest investors in the economy of the Russian Far East today is Japan, second only to China in a number of indicators.

But, at the moment, the development of Russian-Japanese economic relations is hindered by the crisis situation in Russia. Most of the Japanese companies that worked in Russia before its invasion of Ukraine ignore calls to leave the Russian market, as the companies prefer profits to bloodshed in Ukraine, which is “too distant” for them.

According to a survey by the Japan Foreign Trade Organization, after the start of the Russian-Ukrainian war in 2022, 55.9% of Japanese companies immediately felt the negative effect of Western sanctions⁶

Western sanctions added even more uncertainty to the unfavorable business climate in Russia, and they increasingly became a deterrent to Japanese-Russian economic cooperation. The central role of the US financial system and the dominance of dollar-denominated trade limit the business opportunities of Japanese companies in Russia and suppress the scale of economic cooperation. Despite Tokyo’s full political commitment to Washington, the Japanese Government has been unable to significantly influence the Japanese private business sector regarding its cooperation with Russia. In particular, Japanese and Russian companies gradually adapted to Western sanctions against Russia, in particular, financial restrictions, developing compliance mechanisms.

For reference: in August 2022, one of the largest Japanese companies, JERA, signed a gas supply agreement with the new Russian operator of the Sakhalin-2 oil and gas project in the Russian Far East. At the same time, the Japanese company Toho Gas, the third largest company in the supply of gas in Japan, extended the contract for the purchase of liquefied gas under the same project. Also, according to a review by the Observatory of Economic Complexity (OEC)⁷ in 2022, the main Japanese export goods in Russia were cars and related components, and, on the other hand, energy carriers and precious metals prevail in Russian exports.

In July 2023, Japan increased the export of passenger cars to Russia by 84.9% compared to the same period last year. At the same time, in July of this year, Japan increased its export of buses and trucks to Russia by 60.2% and by 44.4%. Also, in July 2023, Japan increased the volume of exports of medical products to Russia by 1,123.2% (!) compared to the same period last year. In June 2023, this indicator was also growing, increasing by 308.5% compared to the same month in 2022⁸.

Japan’s import of aquatic biological resources from Russia in 2022 reached a record 155 billion yen (1.15 billion US dollars). This is the highest volume of Japanese imports of fish and seafood from Russia since 1992. One of the reasons is the reorientation of Russian exporters from Western markets. In general, the share of Japanese imports from Russia accounts for about 40% of all fish and seafood. In terms of the volume of supplies to Japan, Russia in 2022 came in third place (behind Chile and the USA). Snow crab was the most imported from Russia – for 32.6 billion yen (241 million US dollars), and the value of imports of Russian surimi increased approximately seven times compared to the previous year – to 7.4 billion yen (54.7 million US dollars). At the same time, the supply of sea urchins and salmon also increased⁹.

For reference: the export of products of the agro-industrial complex from the Primorsky Region to Japan in January-May 2023 increased by 1.2 times and amounted to 696 million US dollars. The main volume is accounted for by fish, seafood and soy. Including exports of fish and seafood reached 565 million US dollars, soybeans – 85.3 million US dollars, soybean oil – 23 million US dollars, corn – 12.4 million US dollars, meat and milk – 4 .6 million US dollars¹⁰.

It is especially worth noting that with the beginning of the Russian-Ukrainian war, Russia disrupted the energy landscape in the world. At the same time, the main part of Japanese investments in the Far Eastern region of Russia is directed to the oil and gas sectors (Sakhalin-1 and Sakhalin-2 projects), and Japan intends to continue to hold concessions in these projects, as they are stable sources of long-term and inexpensive energy and important for the lives of Japanese citizens and the country’s business activity. These projects were developed to diversify energy sources in Japan – the Japanese will never forget the oil shock of the 1970-s and the threat to the country’s energy security. Japanese officials view continued exploitation of Sakhalin’s resources as an imperative for Japan’s energy security. At the same time, there are certain fears in Japan that Russia may punish Japan by stopping the supply of energy resources, since Japan has joined Western countries in imposing economic sanctions against Russia and should comply with them not only declaratively.

At the same time, for Japan, the Far East of Russia is the nearest Russia. Moreover, Vladivostok is the closest “European” city to Asian countries, and it is not just about cooperation between Japan and Russia, but about the formation of export energy and industrial bases in the Far East. As an example, Vladivostok is a symbol of economic cooperation between Japan and Russia, in particular, Japan currently ranks fourth in the world among the leading buyers of seafood from Russia. No wonder, as early as 2021, putin emphasized that “the anticipatory development of the Far Eastern regions of Russia is our absolute priority for the entire 21st century” – the significance of the Far East in the context of the search for new markets and investments in the East has increased¹¹.

However, at this time Russian-Japanese economic relations are in a state of pause. The freezing of Russian-Japanese business cooperation in the Far East will not be able to torpedo the economy of this region, since projects with Japanese investments, which are already operating and which are still planned, can be replaced by China, South Korea or India. It is primarily about the forest industry, agriculture and automobile manufacturing. In turn, Japan may miss out on Russian wood, grain and coal. After Japan, under the pressure of the USA, deprived Russia of the status of the country to which the regime of the most favorable trade applies, the supply of seafood to the islands, primarily crab and salmon, came into question.

For reference: the number of cars on sale in the Far East of Russia has halved after Japan imposed a ban on the supply of cars with mileage to Russia, Japan banned the export to Russia of cars with an engine of more than 1.9 liters, as well as all hybrids and electric cars. Japanese manufacturers stopped supplying new cars in the spring of 2022. Japanese cars with powerful engines accounted for 20% of all foreign cars arriving in Russia with mileage, and hybrids accounted for another 30%¹².

In 2022, in Tokyo, it was stated that the world faced the most difficult and complex situation in the field of security since the end of the Second World War. In this context, it should be noted that recently, Japanese Prime Minister Fumio Kishida, speaking online at the 3rd summit of the International Crimean Platform in Kyiv, stated that Japan will provide various assistance to Ukraine in the amount of up to 7 billion US dollars, depending on needs. In addition, Japan will use its experience and knowledge in the field of post-war reconstruction and recovery after natural disasters to provide assistance, he said. Kishida reiterated that Japan consistently supports the sovereignty and territorial integrity of Ukraine, including Crimea, and will continue to cooperate closely with the international community, including the G7 countries, and will join sanctions against Russia, providing constant support to Ukraine. As Kisida emphasized, “Japan is on the side of the people of Ukraine in order to ensure peace and return it to the beautiful Ukrainian land.”¹³.

Considering this, Japan really can and should become an important part of the anti-Russian coalition in the Far East.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹⁴

31.10.2023

*Red Metal (Switzerland, Energy, oil and gas) Status by KSE – leave

*Squarepoint (USA, Finance and payments) Status by KSE – stay

*Trafigura (Singapore, Metals and Mining) Status by KSE – stay

*Open Mineral Ltd (United Arab Emirates, Metals and Mining) Status by KSE – stay

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

Traders and Banks Strike Deals in Russian Metals as Taboo Fades

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

The British financial conglomerate HSBC expects the deal for the sale of its Russian business to be closed in the first half of 2024.

https://www.epravda.com.ua/news/2023/10/30/706042/

*Paldo Food Co (South Korea, Food & Beverages) Status by KSE – stay

*HYSG Pte (SINGAPORE, Food & Beverages) Status by KSE – stay

A major producer of instant noodles under the brand “Dosirak” from South Korea is considering vertical integration of its business in Russia.

01.11.2023

*SH Brothers (USA, Defense) Status by KSE – stay

*SN Electronics (USA, Defense) Status by KSE – stay

In the United States, a Russian channel for smuggling components into Russia for the production of weapons has been exposed.

https://www.epravda.com.ua/news/2023/11/1/706110/

*WalletConnect (USA, Finance and payments) Status by KSE – leave

WalletConnect restricts usage in Russia.

https://cryptonews.net/ru/news/security/27769328/

*Softline International (Great Britain, IT) Status by KSE – stay

The largest cybersecurity companies in Russia

*Binance (China, Finance and payments) Status by KSE – leave

Binance is ending its partnership with the ruble payment provider.

*Forbes Media LLC (USA, Media) Status by KSE – stay

Sale of Forbes Global: the deal has been postponed, and Musayev has withdrawn his purchase statement.

https://www.epravda.com.ua/news/2023/11/1/706108/

*Bayer (Germany, Chemical industry) Status by KSE – wait

Bayer has retained the rights to sorafenib in Russia

https://www.kommersant.ru/doc/6311667

*Valeo (France, Automotive) Status by KSE – leave

French car parts maker Valeo said on Tuesday it had signed an agreement to sell its thermal systems production assets in Russia to NPK Avtopribor for an undisclosed sum.

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg says Moscow steals its Russian business

https://www.pravda.com.ua/eng/news/2023/10/31/7426579/

https://www.theguardian.com/world/2023/oct/31/russia-capital-controls-rouble-vladimir-putin

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

VEB explained its lawsuit against Euroclear for nearly $300 million in compensation

https://www.rbc.ru/rbcfreenews/65400e999a79476e8082b68b

*Pictet (Switzerland, Finance and payments) Status by KSE – leave

The Swiss bank Banque Pictet & Cie will cease to accept transfers in Russian rubles from November 1, 2023

02.11.2023

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

Updated Adidas stores may open in Russia in the spring of 2024 under a new name. The rights to sublease retail spaces have been acquired by a structure owned by ‘Stockmann’ and Lamoda owner Yakov Panchenko.

https://tass.ru/ekonomika/19178871

*Nestle (Switzerland, FMCG) Status by KSE – stay

International sponsors of war: 80 years after World War II, Nestle again “feeds” the aggressor

*Technip Energies (France, Engineering) Status by KSE – exited

Technip Energies meets Q3 result expectations despite Russian-exit

https://www.ft.com/content/c7dd8c3d-736d-4731-9fda-e9a81f3e5856

03.11.2023

*Panasonic (Japan, Electronics) Status by KSE – leave

*Duracell (USA, Consumer goods and clothing) Status by KSE – wait

*VARTA (Germany, Electronics) Status by KSE – exited

*ISUZU (Japan, Automotive) Status by KSE – exited

*Canon (Japan, Electronics) Status by KSE – leave

*Fujifilm (Japan, Electronics) Status by KSE – leave

*Sony (Japan, Electronics) Status by KSE – leave

A new list of goods for which parallel import is permitted has been approved

https://www.garant.ru/news/1655585/

*Japan Tobacco International (Switzerland, Alcohol&Tobacco) Status by KSE – stay

The Director of Corporate Affairs and Communications at Japan Tobacco International (JTI), Sergei Glushkov, informed journalists that the company has decided to maintain its business operations in Russia.

https://www.kommersant.ru/doc/6320655

*Linde (Germany, Chemical industry) Status by KSE – wait

Russian court orders seizure of Linde’s liquid helium containers

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Austria’s RBI says Russian spin-off unlikely this year

*Europol Gaz (Poland, Energy, oil and gas) Status by KSE – wait

Under the threat of a $1.5 billion fine, arbitration prohibited the Polish company Europol Gaz from pursuing a lawsuit against ‘Gazprom Export.

https://www.kommersant.ru/doc/6319751

*DTEK (Ukraine, Energy, oil and gas) Status by KSE – exited

DTEK won a court case in The Hague, Russia, regarding the seized Crimean assets in the amount of $267 million.

04.11.2023

*Konti (Ukraine, Food & Beverages) Status by KSE – leave

Russian court has confiscated the confectionery company Conti-Rus, claiming that it supposedly belonged to ‘a relative of Rinat Akhmetov and his partners.

https://biz.nv.ua/ukr/markets/rosiyskiy-sud-viznav-ahmetova-ekstremistom-50365469.html

*DEPA Emporias (Greece, Energy, oil and gas) Status by KSE – stay

The Greek state gas company DEPA Emporias is discussing prices and terms of supply for Russian natural gas in 2024 with Gazprom, according to the Minister of Environment and Energy, Theodoros Skilakakis

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – stay

*JapanArctic LNG B.V. ( Netherlands, Energy, oil and gas) Status by KSE – stay

Japanese trading company Mitsui & Co (Mitsui) has announced that it will invest in the operating company of Russia’s Arctic LNG 2 project.

*Softline International (Great Britain, IT) Status by KSE – stay

*EBRD (Great Britain, Finance and payments) Status by KSE – leave

The government subcommittee did not approve the deal for the acquisition of a stake in Mosbirzha by the Softline group of companies from the European Bank for Reconstruction and Development (EBRD)

https://www.tinkoff.ru/invest/social/profile/Smichael17/e91ce4e6-1ca9-419a-a773-4faa6ea04bf7/

05.11.2023

*ARX Financial Engineering (United Arab Emirates, Finance and payments) Status by KSE – stay

*Tadawul Financial Services (Oman, Finance and payments) Status by KSE – stay

The company has been sanctioned by the United States for its dealings with individuals from Russia.

06.11.2023

*Steel Authority of India Limited (SAIL) (India, Metals and Mining) Status by KSE – stay

India’s SAIL wants to increase coking coal purchases from Russia

*Future Technology Devices International (FTDI) (Great Britain, Technology) Status by KSE – stay

How a British firm sold tank tech to Russia after the invasion

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

TotalEnergies says assessing impact of US sanctions on Arctic LNG 2

07.11.2023

*Blaser Jagdwaffen GmbH (Germany, Defense) Status by KSE – stay

*Glock (Austria, Defense) Status by KSE – stay

German weapons for Russia

https://correctiv.org/top-stories/2023/11/07/deutsche-waffen-fuer-russland/

*BWT (Austria, Industrial equipment) Status by KSE – stay

*Aquaphor International (Estonia, Pharma, Healthcare) Status by KSE – stay

For clean water: Ukrainian companies Ecosoft and “Aquafor” keep silent about their ties with Russia

*DHL (Germany, Logistics, Transport) Status by KSE – stay

On November 1, logistics operator DHL increased delivery rates, additional services and fees, as well as customs declaration services in Russia by an average of 35%.

https://www.kommersant.ru/doc/6321492

*Mondi Group (Great Britain, FMCG) Status by KSE – exited

The British Mondi was excluded from the list of sponsors of the war: it finally withdrew from the Russian Federation

https://www.epravda.com.ua/news/2023/11/7/706331/

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

Russian Olympic Committee Files Appeal Against Its Suspension By IOC

https://www.rferl.org/a/russia-olympic-suspension-appeal-cas-ukraine/32673059.html

*Siemens Energy AG (Independent) (Germany, Energy, oil and gas) Status by KSE – wait

*Sanofi (France, Pharma, Healthcare) Status by KSE – stay

The French pharmaceutical manufacturer Sanofi cannot fully fulfill its obligations under the special investment contract

08.11.2023

*Alpha Consulting (SEYCHELLES, Consulting, Law) Status by KSE – stay

Criminals and sanctions-busters exploiting UK secrecy loophole

https://www.bbc.com/news/uk-67276289

*SH Brothers (USA, Electronics) Status by KSE – stay

*SN Electronics (USA, Electronics) Status by KSE – stay

*Suntronic F.Z.E. (United Arab Emirates, Electronics) Status by KSE – stay

The U.S. Department of Commerce has imposed export restrictions on seven individuals and three entities.

https://www.kommersant.ru/doc/6322150

*Liberty bank (Georgia, Finance and payments) Status by KSE – leave

“Metalloinvest” has filed a lawsuit against the National Bank of Georgia over the freezing of assets.

https://www.rbc.ru/politics/08/11/2023/654afe1b9a7947ed5dfefb3d

*Xsolla (USA, Gaming) Status by KSE – wait

Mykhailo Fedorov urged IT giants not to work with Xsolla. They remain in the Russian Federation

https://ain.ua/2023/10/27/myhajlo-fedorov-zaklykav-ne-praczyuvaty-z-xsolla/

09.11.2023

*Kominvex (Serbia, Electronics) Status by KSE – stay

Investigation: Serbian Firms Ship Sanctioned Dual-Use Tech To Russia

https://www.rferl.org/a/serbia-russia-sanctions-dual-use-technology/32676159.html

*Lukoil Neftohim Burgas (Bulgaria, Energy, oil and gas) Status by KSE – stay

Neftochim Burgas – the largest oil refinery in Bulgaria, abusing the exception granted to this country regarding the purchase of Russian oil, helps Russia sell oil on world markets.

*Airbnb (USA, Online Services) Status by KSE – leave

A Russian court has fined American company Airbnb 6 million rubles ($65,400) for repeatedly failing to localize data in accordance with Russian law.

https://finance.yahoo.com/news/russian-court-fines-airbnb-refusing-090849473.html

*Paloma Precious DMCC (United Arab Emirates, Metals and Mining) Status by KSE – stay

Britain introduced sanctions against the Russian gold mining sector

https://www.epravda.com.ua/rus/news/2023/11/8/706384/

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Carlsberg is threatening Russia with international legal action over the situation involving “Baltika.”

10.11.2023

*Bolero & Company (Georgia, Food & Beverages) Status by KSE – stay

The National Agency on Corruption Prevention (NACP) has added Bolero, a leading Georgian group of wine companies, to the list of international sponsors of war.

https://sanctions.nazk.gov.ua/en/boycott/1025/

*HP (Hewlett-Packard) (USA, Electronics) Status by KSE – leave

The Russian subsidiary of the American HP Inc. — LLC “HP Inc.” — has initiated the liquidation process, according to data from Fedresurs.

https://www.rbc.ru/technology_and_media/10/11/2023/654cd2f09a7947b4129b30e4

*YouTube (USA, Online Services) Status by KSE – wait

YouTube may block Russian music

https://www.unian.ua/lite/music/v-youtube-mozhut-zablokuvati-rosiysku-muziku-12451281.html

*McDonald’s (USA, Public catering) Status by KSE – exited

*Ball Corporation (USA, Aerospace) Status by KSE – exited

*Henkel (Germany, Chemical industry) Status by KSE – exited

Russia’s New Elite Emerges to Fill Void After Multinationals Flee

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

The Kovalchuk clan has set its sights on “Baltika.”

https://www.moscowtimes.ru/2023/11/10/klan-kovalchukov-polozhil-glaz-na-baltiku-a112854

*Binance (China, Finance and payments) Status by KSE – leave

Binance will cease support for deposits in rubles amid Russia’s exit.

*Tchibo (Germany, FMCG) Status by KSE – exited

The former subsidiary of German Tchibo GmbH, “Chibo СНГ,” which separated in 2022 under local management, is changing its name and umbrella brand to Tibio.

11.11.2023

*Armenian Shipping Company (Armenia, Logistics, Transport) Status by KSE – stay

Armenia is actively utilizing the maritime route between the ports of Batumi (Georgia) and Novorossiysk (Russia) for re-exporting sanctioned goods to Russia.

*VR Group (Finland, Logistics, Transport) Status by KSE – leave

VR ending popular ice cream sales over Russian market ties

*Coinbase (USA, Finance and payments) Status by KSE – wait

Coinbase found guilty of administrative offense, fined 1 million Ruble in Russia for incompliance

13.11.2023

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

Ukraine’s anti-corruption agency has on Monday branded Danish insulation giant Rockwool an “international sponsor of war” for continuing to supply its construction materials via intermediaries to various Russian state institutions, including the Ministry of Defense.

https://sanctions.nazk.gov.ua/en/boycott/1024/

https://b4ukraine.org/whats-new/rockwool-sponsor-of-war

*British American Tobacco (Great Britain, Alcohol&Tobacco) Status by KSE – exited

The Russian division of British American Tobacco (BAT), which produces brands such as Kent, Rothmans, Dunhill, and others and holds the third position among cigarette suppliers in Russia, has been transferred to a company based in Abu Dhabi.

https://www.kommersant.ru/doc/6336090?query=British%20American%20Tobacco

*Sony (Japan, Electronics) Status by KSE – leave

*Sony PlayStation (Japan, Gaming) Status by KSE – leave

Sony has decided not to open the PS Store game shop in Kazakhstan due to accessibility issues for Russians.

14.11.2023

*Motor Oil Hellas (Greece, Energy, oil and gas) Status by KSE – stay

Forbidden Russian oil flows into Pentagon supply chain

https://www.washingtonpost.com/business/2023/11/14/russian-oil-sanctions-us-greece-turkey/

*VEON (Netherlands, Telecom) Status by KSE – exited

VEON Welcomes Former U.S. Secretary of State Mike Pompeo to Kyivstar Board of Directors

*Google (USA, Online Services) Status by KSE – exited

Google fined $164,000 for failing to store user data inside Russia

*SITA (Switzerland, Aircraft industry) Status by KSE – leave

Russian airlines and airports are being disconnected from the international domain zone .aero. This decision was made by the Swiss provider of services for civil aviation, SITA, which administers the mentioned domain zone.

https://www.epravda.com.ua/news/2023/11/14/706570/

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

From Israeli banks, there is a demand to separate the assets of clients with Russian passports.

https://www.moscowtimes.ru/2023/11/13/23-a113057

*Paloma Precious DMCC (United Arab Emirates, Metals and Mining) Status by KSE – stay

Rockfire Pulls Out of Plan to Buy Emirates Gold on UK Sanctions

15.11.2023

*PwC (Great Britain, Consulting, Law) Status by KSE – exited

PwC Cyprus moved £1bn for Russian tycoon on day he was put under sanctions

*London Stock Exchange Group (Great Britain, Finance and payments) Status by KSE – leave

ITI Funds delists Russia ETFs from London Stock Exchange

https://www.etfstream.com/articles/iti-funds-delists-russia-etfs-from-london-stock-exchange

16.11.2023

*Skycope Technologies Inc. (Canada, Defense) Status by KSE – stay

MIREA Russian University of Technology purchased from the Canadian company Skycope Technologies Inc. SkyEye radar detector for detecting drones, worth 4.5 million rubles.

https://www.epravda.com.ua/news/2023/11/15/706617/

*Mitsubishi Corporation (Japan, Conglomerate) Status by KSE – wait

The buyer of the leasing subsidiary of Mitsubishi became ExpoCapital, a fund owned by Kim and his partners (LLC “ExpoCapital”).

https://www.interfax.ru/business/930450

*DTEK (Ukraine, Energy, oil and gas) Status by KSE – exited

DTEK refutes inaccurate information: the company has long divested all assets in Russia.

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

Two executives of the major Russian brewery Baltika have been arrested on suspicion of attempts to sell the rights to its brands to Danish brewer Carlsberg

17.11.2023

*Kazan Shipping (United Arab Emirates, Logistics, Transport) Status by KSE – stay

*Progress Shipping (United Arab Emirates, Logistics, Transport) Status by KSE – stay

*Gallion Navigation (United Arab Emirates, Logistics, Transport) Status by KSE – stay

The U.S. Department of the Treasury has announced sanctions and blocked three oil tankers that were transporting Russian oil in violation of the established price ceiling of $60 per barrel.

https://home.treasury.gov/news/press-releases/jy1915

*Alstom (France, Industrial equipment) Status by KSE – leave

France’s Alstom is set to sell its 20% stake in Transmashholding (TMH) back to the Russian railcar manufacturer by the end of the year

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – wait

*Gunvor Group (Switzerland, Energy, oil and gas) Status by KSE – wait

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

American purchases of laundered Russian oil worth at least $180 million to the Kremlin

*Jodas Expoim (India, Pharma, Healthcare) Status by KSE – stay

The Indian pharmaceutical company Jodas Expoim has been unable to commence construction for nearly two years on the site of a former porcelain factory in the southern part of Moscow, where it plans to establish its first facility in Russia for the production of oncology drugs with a cost exceeding 4 billion rubles.

https://www.kommersant.ru/doc/6339151

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² When we analyze # of local companies, # of staff and local financials (such as revenue, capital, assets, taxes paid) – KSE Institute uses data according to Russian Accounting Standards (or RAS) from the official EGRUL register, all steps how we do it are explained in detail in the Methodology we published here. The key source for local financials is data from the Federal Tax Service of Russia. The latest available consolidated data for each group’s largest Russian units reported in line with local accounting standards excluding intragroup eliminations and other IFRS or GAAP adjustments. More details are available here.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 21 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

¹⁴ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website