- Kyiv School of Economics

- About the School

- News

- 56th issue of the regular digest on impact of foreign companies’ exit on RF economy

56th issue of the regular digest on impact of foreign companies’ exit on RF economy

1 November 2023

We will continue to provide updated information on a bi-weekly basis

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 16.10-01.11.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

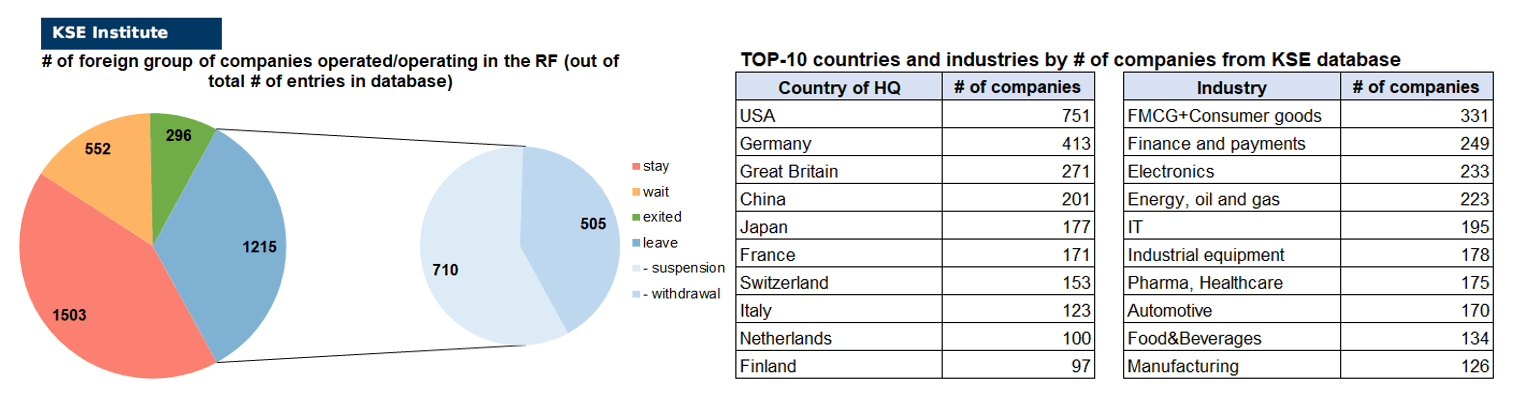

KSE DATABASE SNAPSHOT as of 01.11.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 503 (+25 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 552 (+4 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 215 (-6 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 296 (+4 per 2 weeks)

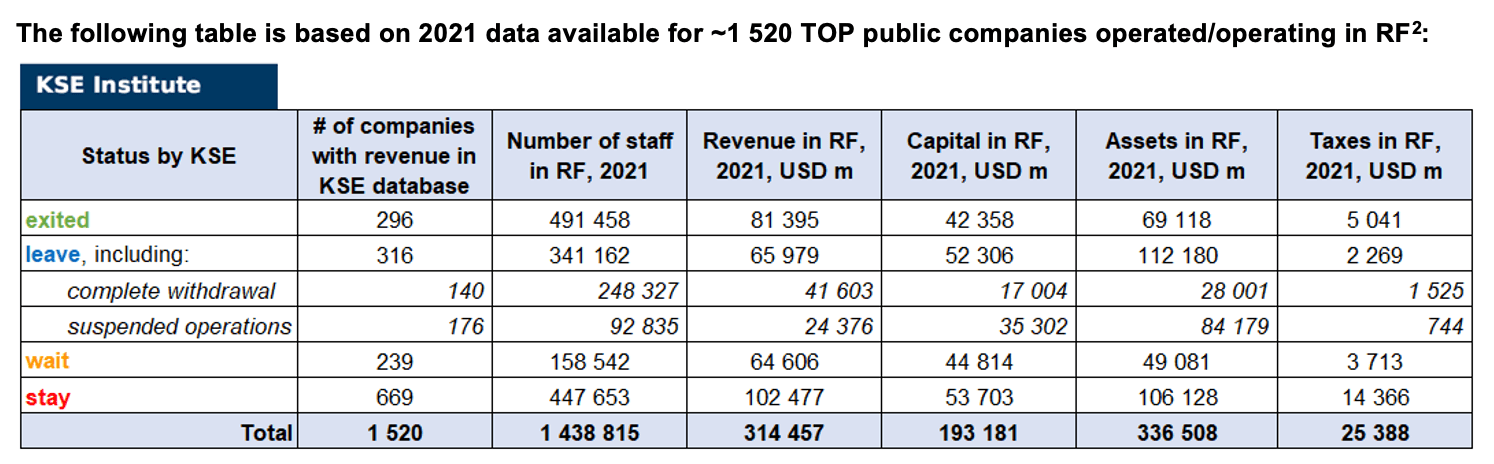

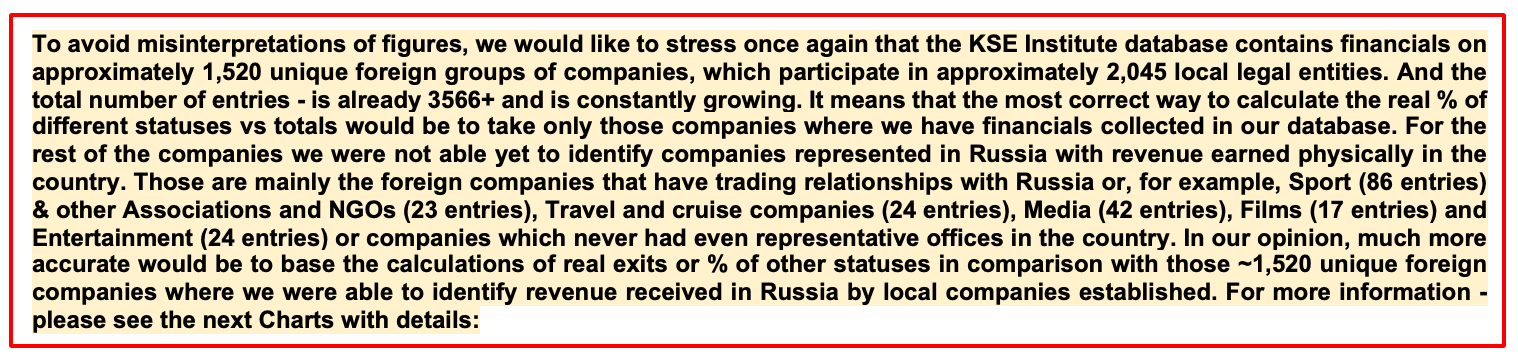

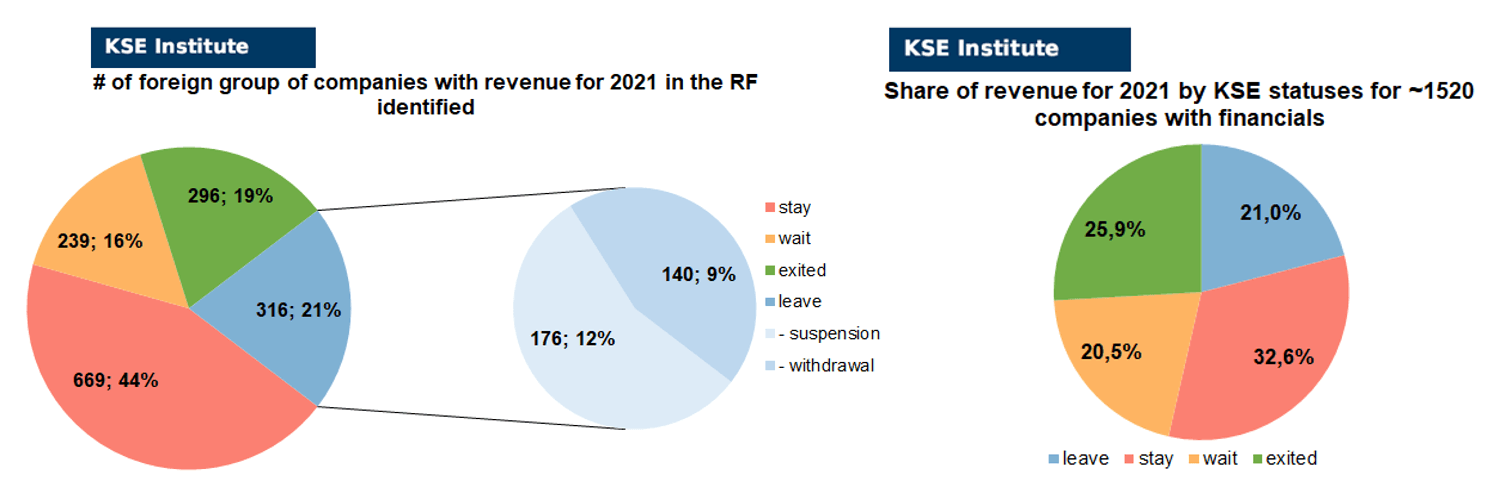

As of November 1, we have identified about 3,566 companies, organizations and their brands from 95 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 520 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $193.2 billion), local revenue (about $314.5 billion), local assets (about $336.5 billion) as well as staff (about 1.439 million people) and taxes paid (about $25.4 billion). 1,767 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 296 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

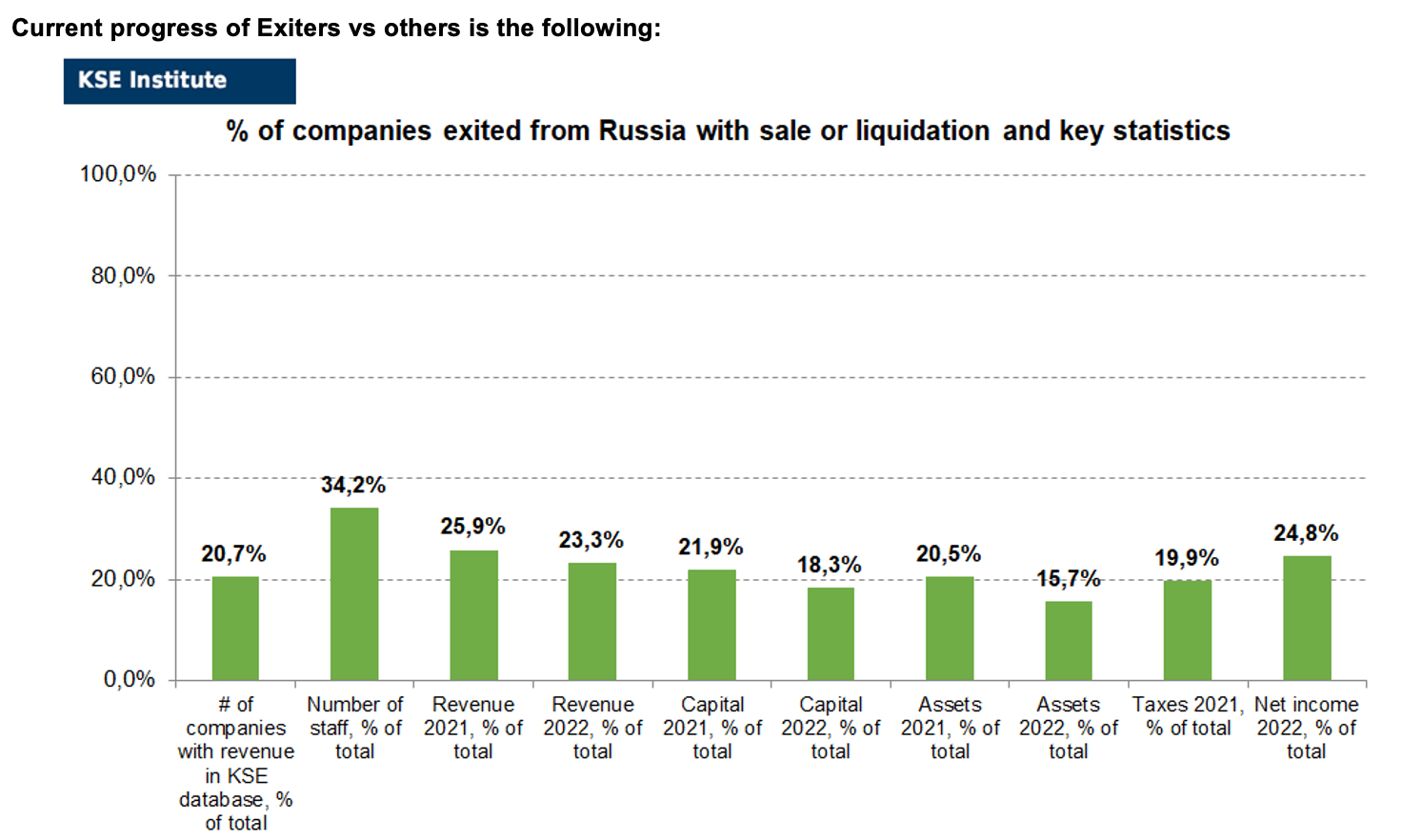

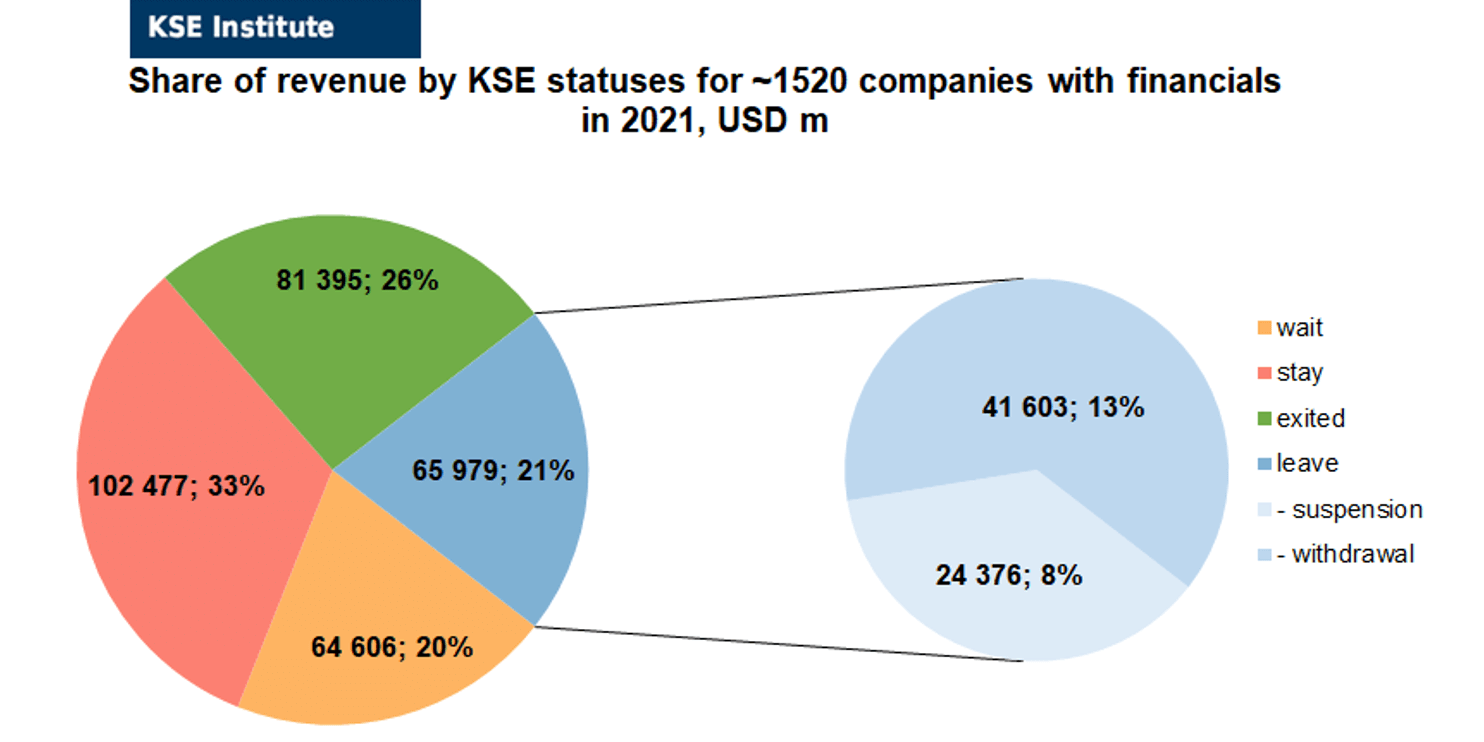

As can be seen from the tables below, as of November 1, 296 companies which had already completely exited from the Russian Federation, in 2021 had at least 491,500 personnel, $81.4 bn in annual revenue, $42.4bn in capital and $69.1bn in assets; companies, that declared a complete withdrawal from Russia had 248,300 personnel, $41.6bn in revenues, $17.0bn in capital and $28.0bn in assets; companies that suspended operations on the Russian market had 92,800 personnel, annual revenue of $24.4bn, $35.3bn in capital and $84.2bn in assets.

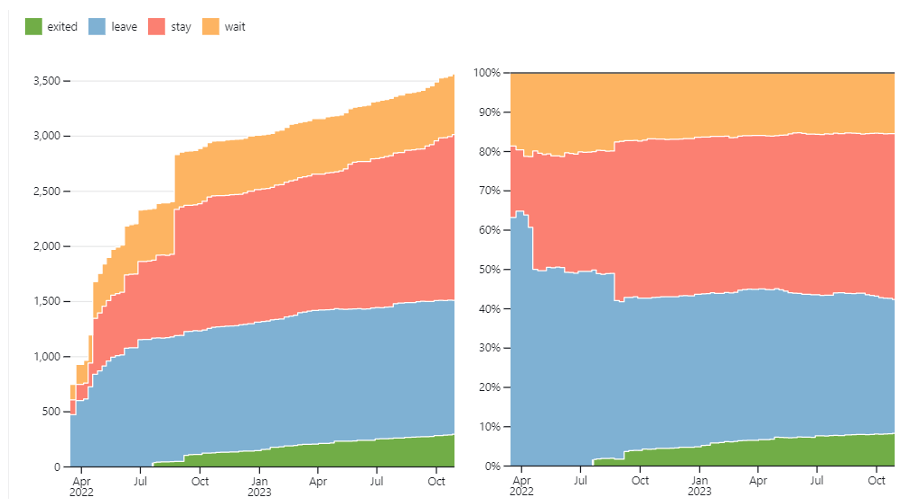

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 14 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 75 were added in October 2023). However, if to operate with the total numbers in KSE database, about 34.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 42.1% are still remaining in the country, 15.5% are waiting and only 8.3% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 296 companies that completely left the country, since in 2021 they employed 34.2% of the personnel employed in foreign companies, the companies owned about 20.5% of the assets, had 21.9% of capital invested by foreign companies, and in 2021 they generated revenue of $81.4 billion or 25.9% of total revenue and paid ~$5.0 billion of taxes or 19.9% of total taxes paid by the companies observed. Data on 1,520 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, % of exited is obtained based on number of companies (19%) and on share of revenue withdrawn (25.9%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 32.6% of revenue and 16% of waiting companies represent 20.5% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

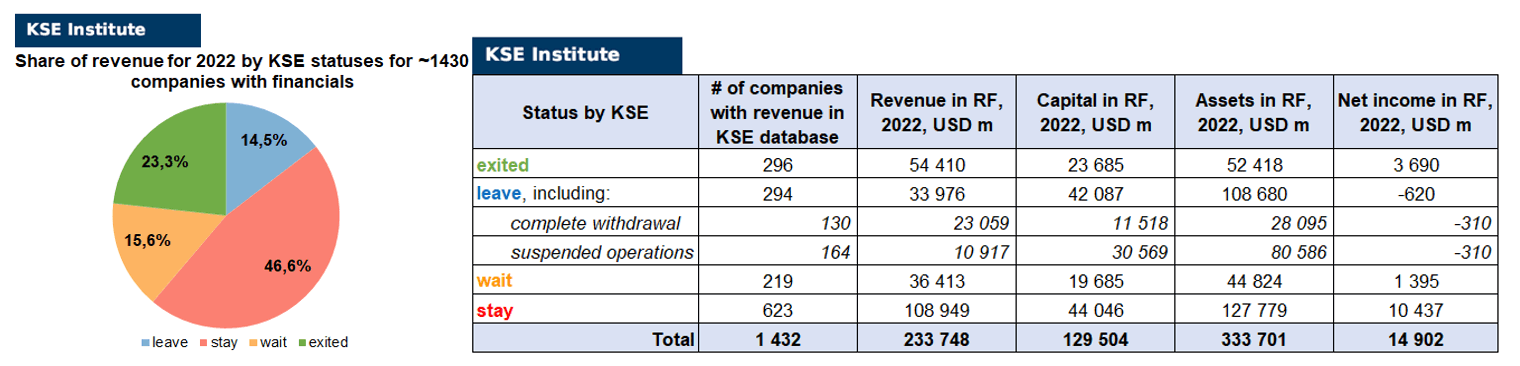

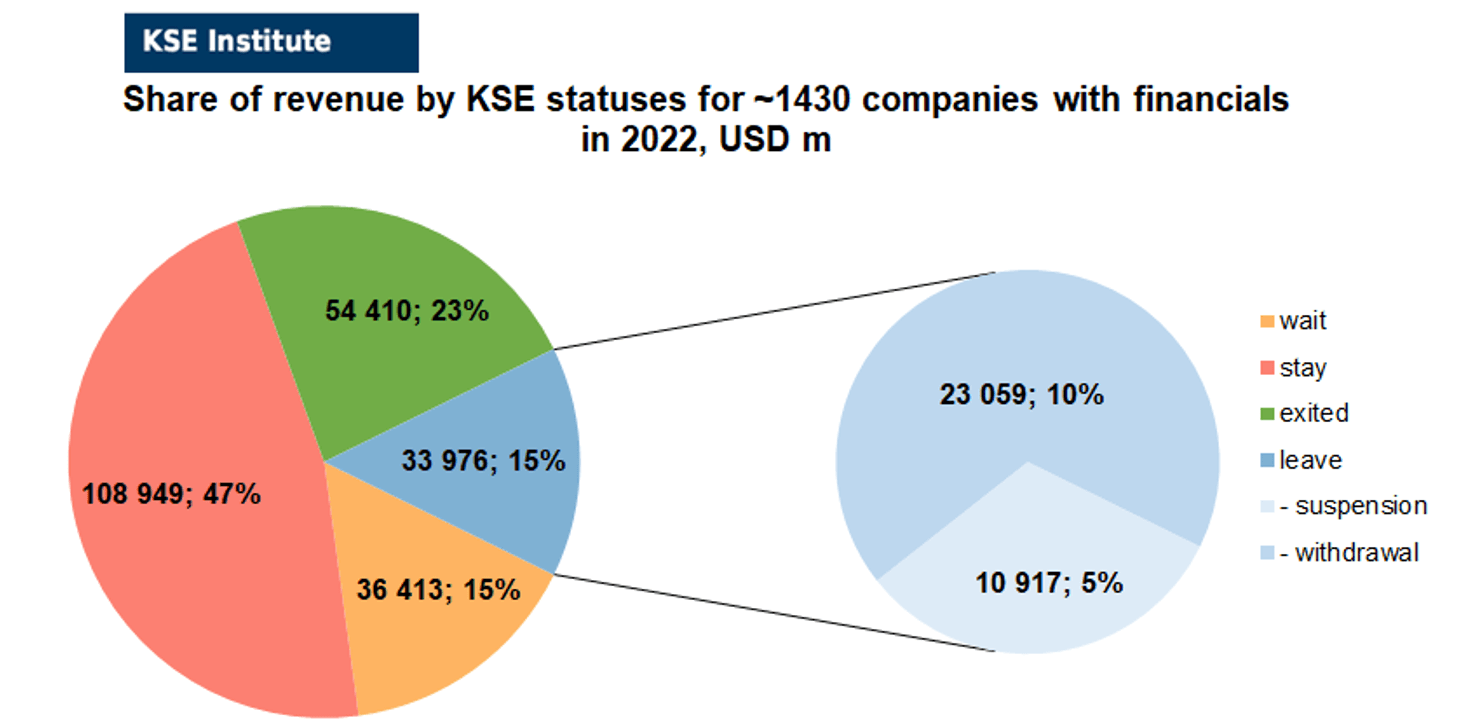

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1430 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.6% less of revenue in 2022 (23.3% from total volume) than in 2021 (25.9% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.5%) revenue in 2022 (14.5% from total volume) than in 2021 (21.0% from total volume). At the same time, staying companies were able to generate much (+14.0%) more revenue in 2022 (46.6% from total volume) than in 2021 (32.6% from total volume). Companies with status “wait”⁴gained a lower share (-4.9%) of revenue in 2022 (15.6% from total volume) vs 20.5% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($333.7bn⁵ 2022 vs $336.5bn in 2021) and would even probably increase if the remaining reporting for ~90-100 companies could be obtained (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

In July 2023, the KSE Institute jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf. Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Putin may not get a million professional workers: the Accounts Chamber pointed out the underfunding of vocational education

13.10.2023 | By the first reading in the bill on the budget for the next three years, there is “obvious underfunding” for the “Professionalism” project; a decision was made to allocate 15.9 billion rubles for it in 2024 (9.7 billion each in the next two years). This is 495.1 million rubles less than allocated in 2023.

A court in Moscow arrested the property of the Russian subsidiary of Adidas for 3.5 billion rubles

13.10.2023 | On October 11, the Moscow Arbitration Court, at the request of the operator of the Moscow amusement park “Dream Island,” took security measures in a claim against the Russian structure of the retailer Adidas for the recovery of 3.5 billion rubles, according to the ruling on the court’s website.

https://www.interfax.ru/russia/925798

The Ministry of Finance has assessed the possibility of seizing income from banks

16.10.2023 | We need to talk about confiscation of income from banks at the end of the year, when there will be results, said Deputy Minister of Finance Alexei Sazanov. The head of the Ministry of Finance of the Russian Federation, Anton Siluanov, reported that not all banks with state participation want to pay dividends. According to him, for this reason, in a number of countries, the income tax for banks is higher than for ordinary sectors.

The government of Russia is considering linking foreign exchange duties to world prices

16.10.2023 | The government is considering the possibility of supplementing the export duty tied to the ruble exchange rate, proposing to take into account world prices for taxable goods in its formula. Thus, if prices fall below a certain level, then the duty will not be applied, as well as if the ruble exchange rate depreciates.

https://www.kommersant.ru/doc/6280591

Russia has limited the import of fish and seafood from Japan

16.10.2023 | Rosselkhoznadzor reported that from October 16 it joined the temporary restrictive measures introduced by the PRC and limited the import of fish and seafood from Japan. China has limited imports due to the release of water purified from radioactive substances from the Japanese Fukushima nuclear power plant into the ocean.

https://www.kommersant.ru/doc/6280789

The Russian Ministry of Finance predicted an increase in the export duty on oil from November 1.

16.10.2023 | According to the Ministry of Finance’s calculations, the export duty on light petroleum products and oils will increase to $7.8 per ton, and on dark oils – $26.2. The export duty on commercial gasoline will reach $7.8, straight-run (naphtha) – $14.4 per ton. The duty on liquefied gas will be $2.2, on pure fractions of liquefied hydrocarbon gas – $1.9, on coke – $1.7 per ton. Currently, the export duty on oil is $23.9.

https://www.kommersant.ru/doc/6281101

Management companies have not submitted documents to all closed-end mutual funds with blocked foreign assets

17.10.2023 | The deadline for management companies to submit rules for closed-end mutual funds for the allocation of blocked foreign assets from market funds has expired. According to the Central Bank, out of more than 80 mutual funds that should be affected by the separation, rules have been submitted for only 60 funds. Latecomers will receive instructions from the regulator and correction of violations in a short time. At the same time, companies still have questions, including the valuation and sale price of distressed assets.

https://www.kommersant.ru/doc/6281402

The federal budget risks shorting 335 billion in three years, the Accounts Chamber predicts.

17.10.2023 | According to the Accounts Chamber, taking into account additional revenues over three years, the shortfall could amount to 84.1 billion rubles. in 2024, 108.2 billion in 2025, 142.7 billion rubles. in 2026. The Accounts Chamber expects shortfalls from VAT on goods and services sold within the Russian Federation, as well as from excise taxes on tobacco products.

https://www.kommersant.ru/doc/6281583

The court for the first time canceled a deal to sell assets of a company from “unfriendly” countries to Russian business

18.10.2023 | In the summer of 2022, a subsidiary of the German construction company Bauer Spezialtiefbau sold its assets to a Russian businessman; the court declared this deal invalid due to the lack of permission from the government commission.

The court declared the Russian subsidiary of Google bankrupt

19.10.2023 | The Moscow Arbitration Court declared the Russian subsidiary of Google, Google LLC, bankrupt, owing 861 creditors 53.6 billion rubles. The court introduced bankruptcy proceedings against the debtor for a period of six months and approved Valery Talyarovsky, who had previously been the temporary manager of the LLC, as a bankruptcy trustee.

https://www.kommersant.ru/doc/6282691

The court arrested Credit Suisse’s assets in Russia worth more than $20 million

19.10.2023 | The court arrested funds in Credit Suisse accounts within the amount of the claim of Kaluga Gazenergobank – €10.12 million and $10.25 million, which are kept in accounts at Bank Credit Suisse JSC. Also, 99.9% of the shares of Credit Suisse AG and Credit Suisse Securities, owned by Credit Suisse AG, were arrested and prohibited from disposing of these shares and shares within the limits of the stated claims in the part not covered by the seizure of funds.

Foreign subsidiaries of Russian exporters will also be required to sell foreign currency earnings

19.10.2023 | Foreign subsidiaries of Russian exporters, which were obliged to sell foreign currency earnings, will also have to comply with the presidential decree on the sale of foreign currency earnings. Businesses will also be allowed to repay external debt within the limit; a number of companies (in the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, grain farming) will report on their foreign currency assets and liabilities abroad.

https://tass.ru/ekonomika/19067103

Rosstat predicted a reduction in Russia’s population to 138.7 million people by 2046

20.10.2023 | The population of Russia by January 1, 2046 will decrease by 7.68 million people compared to 2023 and will amount to 138.77 million people. This is stated in the demographic forecast of Rosstat, calculated taking into account the results of the All-Russian population census in October – November 2021.

Head of the Federal Customs Service names promising corridors for Russian foreign trade

25.10.2023 | Russian trade has reoriented to the East and the South, states Ruslan Davydov, acting head of the Federal Customs Service. He names Azerbaijan, Iran, Uzbekistan among the promising areas where customs procedures are to be simplified.

https://www.rbc.ru/economics/25/10/2023/65377cff9a79478a09afe07a

The authorities planned to collect 570 billion rubles from rich Russians

25.10.2023 | The government expects to receive RUB 569.9 billion to the federal budget from a “tax on the rich” in the next three years, writes Izvestia with a link to materials for the draft financial plan for 2024–2026. In particular, in 2024, the treasury should receive 176.2 billion rubles from the personal income tax rate increased to 15% for “rich” Russians. In 2025 – 189.6 billion, and in 2026 – 204.1 billion.

Companies complain about staff shortages, but index salaries only by inflation

27.10.2023 | According to research by B1, in 2023, 42% of enterprises in the Russian Federation would like to increase the number of their employees – by an average of 13%. At the same time, some of them, especially in the industrial sector, complain about difficulties in recruiting qualified employees – filling a vacancy can take up to four months.

https://www.kommersant.ru/doc/6298837

Tax officials want to control more transactions to combat the withdrawal of profits from Russia

30.10.2023 | The authorities intend to expand the circle of companies whose transactions will be checked for market prices. The Federal Tax Service is concerned about the problem of transferring the tax base from Russia abroad. Tax evasion should be prevented by tightening price controls in intra-group transactions, and increasing fines by five times will increase the cost of a mistake for companies many times over.

The Central Bank will have access to data on the assets and liabilities of exporters abroad

30.10.2023 | The Government of the Russian Federation has submitted to the State Duma amendments to the law on currency regulation and control – they provide for the expansion of the powers of the Bank of Russia in terms of control over the assets and liabilities to non-residents of foreign subsidiaries of Russian resident exporters.

https://www.kommersant.ru/doc/6310327

More than half of the banks in the top 30 in terms of balances on deposits with the Central Bank are foreign

30.10.2023 | Banks controlled by foreign owners have recently held a significant amount of free liquidity in deposit accounts with the Central Bank, in some cases – from 40% to 90% of all assets. According to Kommersant’s interlocutors, this instrument is absolutely risk-free for foreign banks, including from a political point of view.

https://www.kommersant.ru/doc/6310305

It will be easier for citizens of “friendly countries” to open accounts in Russian banks

30.10.2023 | The Government of the Russian Federation has determined a list of 25 friendly countries whose citizens and legal entities will be able to open accounts and deposits in Russian banks in a simplified manner. In particular, this opportunity will appear in Belarus, Kazakhstan, Brazil, India, China, Saudi Arabia, and Turkey.

https://www.kommersant.ru/doc/6310573

Large businesses were ordered to reveal “hides” of currency in order to hold the ruble until the 2024 elections

30.10.2023 | Russian authorities continue to tighten controls over foreign exchange transactions of large companies in order to stabilize the ruble in time for the presidential elections and bring rapidly rising inflation under control. On Monday, October 30, the government introduced a bill to the State Duma that would oblige top exporters to report to the Central Bank on foreign currency assets abroad.

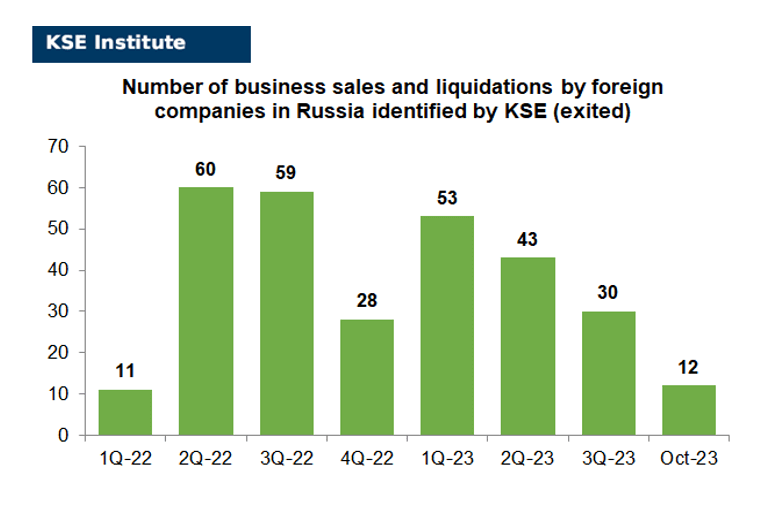

MONTHLY FOCUS: On leaving the Russian Federation. Results of October 2023

In this digest, we will summarize the results of October 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’520 companies identified in the KSE database with revenue data available of more than $314 billion in 2021 and ~$234 billion in 2022. And at least 296 of them have already been sold by local companies or were liquidated and left the Russian market. In October 2023 KSE Institute identified +12 new exits, total number of exits observed since the beginning of Russia’s invasion reached 296.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 26% based on revenue allocation, those who are leaving represent 21% of total revenue (with 37% share of suspensions and 63% of withdrawals sub-statuses), % of staying companies represent 33% of revenue and 20% are waiting companies based on revenue generated in Russia in 2021. So we observe the situation that % of staying companies is greater than % of leaving ones (which means that less than 50% of pre-invasion revenue generated by foreigners is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 23% based on revenue allocation, those who are leaving represent only 15% of total revenue (with 32% share of suspensions and 68% of withdrawals sub-statuses), % of staying companies represent 47% of revenue and 15% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

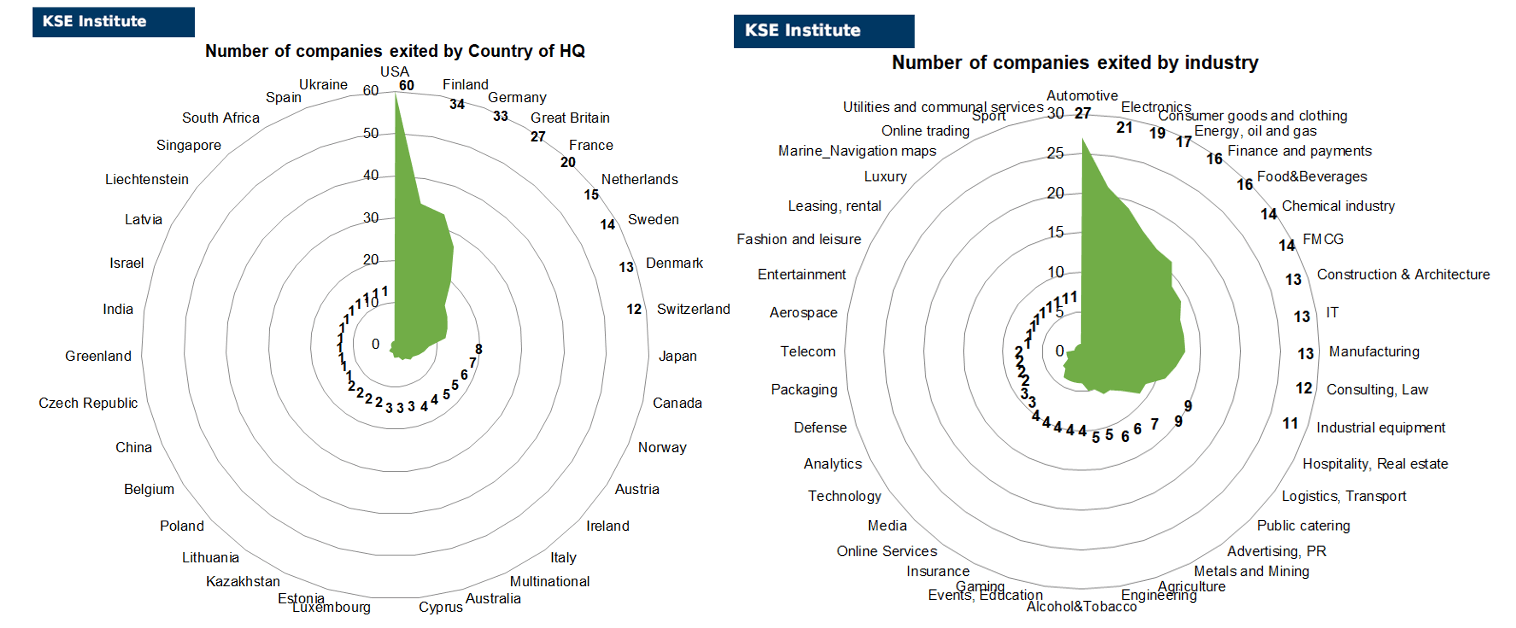

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of October 2023, companies from 35 countries and 40 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, Great Britain and France and operated in the “Automotive”, “Electronics”, “Consumer goods and closing”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Google (part of Alphabet, bankruptcy of the Russian subsidiary declared by the court), ASBIS, Carlsberg (Carlsberg prepares for fight over Russian unit’s right to sell its brands after Russia seized control of shares in Danone and Carlsberg subsidiaries), Decathlon, Ensto, Viterra (part of Glencore which stopped being Russneft’s shareholder in 2022. Sberbank tries to seize the remaining Glencore’s Russian assets over oil debt), Ingka, Legrand, Sulzer, VEON and Xerox. Also, the exit of KONE was finalized but we reported it earlier.

Additionally, we reclassified the status of ThyssenKrupp from “exit” to “wait” as in reality, local companies of this group have not changed their owners and the biggest ones were renamed probably to hide links with the parent company. Moreover, our colleagues from Squeezing Putin identified a big jump of the trade in summer of 2022, mostly attributed to the Murmansk Seaport project for the supply of the new material handling system for coal.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Adidas (the Moscow Arbitration Court arrested the assets of the Russian subsidiary of Adidas for 3.49 billion rubles as part of a claim from the Dream Island amusement park), Credit Suisse (the court arrested funds in Credit Suisse accounts within the amount of the claim of Kaluga Gazenergobank – €10.12 million and $10.25 million, which are kept in accounts at Bank Credit Suisse JSC. Also, 99.9% of the shares of Credit Suisse AG and Credit Suisse Securities, owned by Credit Suisse AG, were arrested and prohibited from disposing of these shares and shares within the limits of the stated claims in the part not covered by the seizure of funds), Fujitsu (the Japanese technology corporation Fujitsu has initiated the process of liquidating its legal entity in Russia. According to the Russian registry, the record of the liquidation of the local LLC “Fujitsu Technology Solutions” appeared in August, and the company has already appointed a liquidator), IKEA (Ingka sold its Russian shopping centres to Gazprombank”s subsidiary. IKEA also did a partial sale – SIBFINANCE LLC became the new founder of the organization. The entry about the founder of INGKA HOLDING EUROPE B.V. was removed from the Unified State Register of Legal Entities. 25.10.2023: Full name changed from INGKA CENTERS RUS OPERATIONS LLC to MEGA MANAGEMENT COMPANY LLC), Rehau (REHAU examines options for exit from Russia but no approval from authorities for sale).

The next review of deals for November 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis) ⁷

14.10.2023

*Loongson (China, IT) Status by KSE – stay

China will not give Russia new Loongson 3A6000 processors, sent old Loongson 3A5000

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

The arbitration imposed an arrest on the funds belonging to LLC “Adidas” “and on any other property within the limits of the price of the claim” in the amount of 3.5 billion rubles.

https://www.interfax.ru/russia/925798

*Haier (China, Electronics) Status by KSE – stay

The Russian television market has shifted to Chinese brands

15.10.2023

*Fossil Trading (India, Energy, oil and gas) Status by KSE – stay

*Energopole (Switzerland, Energy, oil and gas) Status by KSE – stay

*Mercantile & Maritime Group (Singapore, Energy, oil and gas) Status by KSE – stay

*Tejarinaft FZCO (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

*Amur (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

The Trading Tycoon Steering Russia’s Global Oil Business

https://dron.media/siechin-nashiel-sposob-postavliat-rossiiskuiu-nieft-v-obkhod-sanktsii-bloomberg/

*BOTAŞ (Turkey, Energy, oil and gas) Status by KSE – stay

Turkey has rejected its $27.5 billion debt to Russia for gas supplies, as announced by the Turkish state-owned oil and gas company BOTAŞ.

16.10.2023

*Fujitsu (Japan, Electronics) Status by KSE – leave

The Japanese technology corporation Fujitsu has initiated the process of liquidating its legal entity in Russia. According to the Russian registry, the record of the liquidation of the local LLC “Fujitsu Technology Solutions” appeared in August, and the company has already appointed a liquidator.

https://www.epravda.com.ua/news/2023/10/16/705528/

https://delo.ua/business/yaponska-kompaniya-fujitsu-likviduje-svii-pidrozdil-v-rf-425112/

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

*Hindustan Petroleum (India, Energy, oil and gas) Status by KSE – stay

As India frowns on paying for Russian oil with yuan, some payments held up

*Europol Gaz (Poland, Energy, oil and gas) Status by KSE – wait

The company “Gazprom Export,” a subsidiary of Gazprom, has requested a court in St. Petersburg to prohibit the Polish company Europol Gaz from pursuing arbitration in Stockholm.

17.10.2023

*Arta-F (Latvia, Consumer goods and clothing) Status by KSE – stay

Latvia has initiated a case against a supplier of uniforms for the Russian army.

*Asana (USA, IT) Status by KSE – stay

Asana, an American software company for team work, mainly in the IT field, continues to serve teams from Russia.

https://www.epravda.com.ua/news/2023/10/17/705551/

*Apple (USA, Electronics) Status by KSE – wait

*Apple Pay (USA, Finance and payments) Status by KSE – wait

The American company Apple has published new rules for Russian app developers, allowing their users to use external payment methods for making purchases without Apple’s involvement.

https://www.rbc.ru/technology_and_media/18/10/2023/652e8aab9a794769c742bb89

*Nvidia (USA, IT) Status by KSE – exited

Biden intends to cut off China from modern microchips for artificial intelligence.

18.10.2023

*Bauer Spezialtiefbau (Germany, Construction & Architecture) Status by KSE – leave

The court has for the first time canceled a deal conducted without the permission of the antimonopoly commission.

*Google (USA, Online Services) Status by KSE – wait

The Arbitration Court of Moscow has declared the Russian subsidiary of Google, OOO “Google,” bankrupt, with debts totaling 53.6 billion Russian rubles.

*Nvidia (USA, IT) Status by KSE – exited

Nvidia Warns of Product Snags From Tightening US Chip Rules

*Zoom (USA, Online Services) Status by KSE – stay

Russia fines Zoom $1.18 mln for operating without local office

19.10.2023

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

The court has arrested Credit Suisse’s assets in Russia worth over $20 million.

*Linde (Germany, Chemical industry) Status by KSE – wait

*Technip Energies (France, Engineering) Status by KSE – stay

EU companies are assisting the Kremlin in implementing a strategic project in the Arctic.

https://www.epravda.com.ua/news/2023/10/19/705650/

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

The head of Gazprom, Alexey Miller, and the Chairman of the Board of Directors of the China National Petroleum Corporation (CNPC), Dai Houliang, have signed an agreement for additional gas supplies to China through the “Eastern Route

https://www.kommersant.ru/doc/6283438

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

The European Union has agreed to purchase Qatari gas for decades instead of Russian gas.

20.10.2023

*Egmont Group (Canada, Association, NGO) Status by KSE – leave

Russia has been suspended from the Egmont Group of financial intelligence units.

*SEFE Securing Energy for Europe (Germany, Energy, oil and gas) Status by KSE – stay

Germany Still Trades Russian Gas as Canceling Costs €10 Billion

21.10.2023

*General Technology Limited (China, Engineering) Status by KSE – stay

*Beijing Luo Luo Technology Development Co Ltd (China, Logistics, Transport) Status by KSE – stay

*Changzhou Utek Composite Company Ltd (China, Manufacturing) Status by KSE – stay

The USA has imposed sanctions on three companies based in China, as reported by the US Department of Defense.

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

RBI: There is still a buyer for Raiffeisenbank, but the deal depends on the Kremlin.

*Forbes Media LLC (USA, Media) Status by KSE – stay

Russian oligarch boasted about becoming secret owner of Forbes

https://www.pravda.com.ua/news/2023/10/21/7425137/

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – exited

An attempt by the Danish Carlsberg Group to strip the brewing company “Baltika” of its rights to some of the brands encountered resistance from the Russian company.

https://www.kommersant.ru/doc/6295080

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

Russian Rockwool money machine: spitting huge sums into the coffers

23.10.2023

*De Beers (Great Britain, Luxury) Status by KSE – wait

De Beers to ‘Progress’ WDC Protocol on Russian Diamonds

https://rapaport.com/news/de-beers-to-progress-wdc-protocol-on-russian-diamonds/

*Softline International (Great Britain, IT) Status by KSE – wait

*EBRD (Great Britain, Finance and payments) Status by KSE – leave

EBRD reduces Russia holdings by selling stake in Moscow Exchange

*FATF (France, Association, NGO) Status by KSE – wait

The Ministry of Finance and the State Financial Monitoring Service have once again called on the Financial Action Task Force on Money Laundering (FATF) to include Russia in the “blacklist” during the plenary sessions in Paris from October 23 to 27.

24.10.2023

*Hebei Wenfeng New Materials (HWNM) (China, Metals and Mining) Status by KSE – stay

UC Rusal has reached an agreement to purchase one-third of the Chinese metallurgical company Hebei Wenfeng New Materials to ensure the supply of alumina.

*Finnair (Finland, Air transportation) Status by KSE – leave

Not perturbed by Air India’s use of Russian airspace: Finnair India head

*Kone (Finland, Construction & Architecture) Status by KSE – exited

The Finnish elevator manufacturer Kone, which had planned to transfer its Russian subsidiary to local management, has found an external buyer.

https://www.kommersant.ru/doc/6296459

*Interactive Brokers (USA, Finance and payments) Status by KSE – wait

Hypocrisy or business as usual? How Interactive Brokers interacts with Russian clients

25.10.2023

*Intertrans Sp. (Poland, Logistics, Transport) Status by KSE – stay

*KEB (Germany, Electronics) Status by KSE – stay

*IR-Logistik GMBH (Germany, Logistics, Transport) Status by KSE – stay

*Advantek Gmbh (Germany, Logistics, Transport) Status by KSE – stay

*ETC Electronics Ltd (China, Electronics) Status by KSE – stay

“Kinjal” in the back. Russian missile manufacturers have not been subjected to sanctions and continue to receive equipment and components from Europe.

https://theins.ru/politika/265990

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

Deutsche Bank is at risk of having its assets confiscated in Russia due to a lawsuit by “Ruskhimalyans.

https://www.kommersant.ru/doc/6297672

*Bacardi (Great Britain, Alcohol&Tobacco) Status by KSE – stay

National Agency for the Prevention of Corruption is demanding sanctions against the former head of the Bacardi office in Ukraine. This demand may be related to circumstances that hinder the company’s exit from the Russian Federation.

*Safran (France, Defense) Status by KSE – stay

*GGP Metal Powder (Germany, Metals and Mining) Status by KSE – stay

*Elval Halcor (Greece, Manufacturing) Status by KSE – stay

Russia: Europe imports €13 billion of ‘critical’ metals in sanctions blindspot

https://www.investigate-europe.eu/posts/russia-sanctions-europe-critical-raw-materials-imports

*Airbus (Brazil, Aircraft industry) Status by KSE – wait

Airbus and other European companies are still buying titanium, nickel, and other commodities from firms close to the Kremlin more than a year after the invasion, Investigate Europe can reveal.

https://www.investigate-europe.eu/posts/russia-sanctions-europe-critical-raw-materials-imports

*DP World (United Arab Emirates, Logistics, Transport) Status by KSE – stay

Russia strikes deal with Dubai’s DP World to develop Arctic sea route

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

The Russian broker BCS has started offering clients the opportunity to purchase Telegram bonds issued in 2021 on the secondary market.

https://www.kommersant.ru/doc/6297352

*VEON (Netherlands, Telecom) Status by KSE – exited

US and EU investors are concerned about the arrest of a stake in corporate rights of Kyivstar in Ukraine.

26.10.2023

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Depository Euroclear earned 3 billion euros due to frozen Russian assets

https://www.epravda.com.ua/rus/news/2023/10/26/705918/

*International Ski Federation (Switzerland, Sport) Status by KSE – leave

International Ski Federation maintains ban on Russian skiers

27.10.2023

*Camozzi Group (Italy, Industrial equipment) Status by KSE – stay

The Italian company Camozzi operates in occupied Crimea and supplies pneumatic equipment to the Russian industry

*Technip Energies (France, Engineering) Status by KSE – exited

French energy companies have betrayed Macron’s promise to stand with Ukraine

29.10.2023

*Visa (USA, Finance and payments) Status by KSE – leave

Visa has threatened banks in neighboring countries to Russia with fines for opening accounts for Russians

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen to Pay Withheld Dividend After Russia Worries Ease

https://www.bnnbloomberg.ca/raiffeisen-to-pay-withheld-dividend-after-russia-worries-ease-1.1990217

*Camozzi Group (Italy, Industrial equipment) Status by KSE – stay

Hiding their presence in the temporarily occupied Crimea and cooperating with the Military Industry of Russia: Camozzi Group is included in the list of international sponsors of war

https://www.epravda.com.ua/news/2023/10/27/705944/

Italian tech giant Camozzi sticks with Russia, supply chain hints at military collaborations

*Huawei (China, Electronics) Status by KSE – wait

*Samsung (South Korea, Electronics) Status by KSE – wait

*Apple (USA, Electronics) Status by KSE – wait

Demand for budget devices has grown in Russia

https://www.kommersant.ru/doc/6298847

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

International war sponsor Unilever continues business in Russia

30.10.2023

*Bank Melli Iran (Iran, Finance and payments) Status by KSE – stay

In the near future, a new foreign insurer will enter the Russian market – a subsidiary company registered by Mir Business Bank (a Russian entity of the Iranian Bank Melli Iran).

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 20 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before, as well as the addition of several new companies from the TOP-50 largest foreign companies rating by Forbes Russia.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website