- Kyiv School of Economics

- About the School

- News

- 54th issue of the regular digest on impact of foreign companies’ exit on RF economy

54th issue of the regular digest on impact of foreign companies’ exit on RF economy

2 October 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 18.09-01.10.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

KSE DATABASE SNAPSHOT as of 01.10.2023

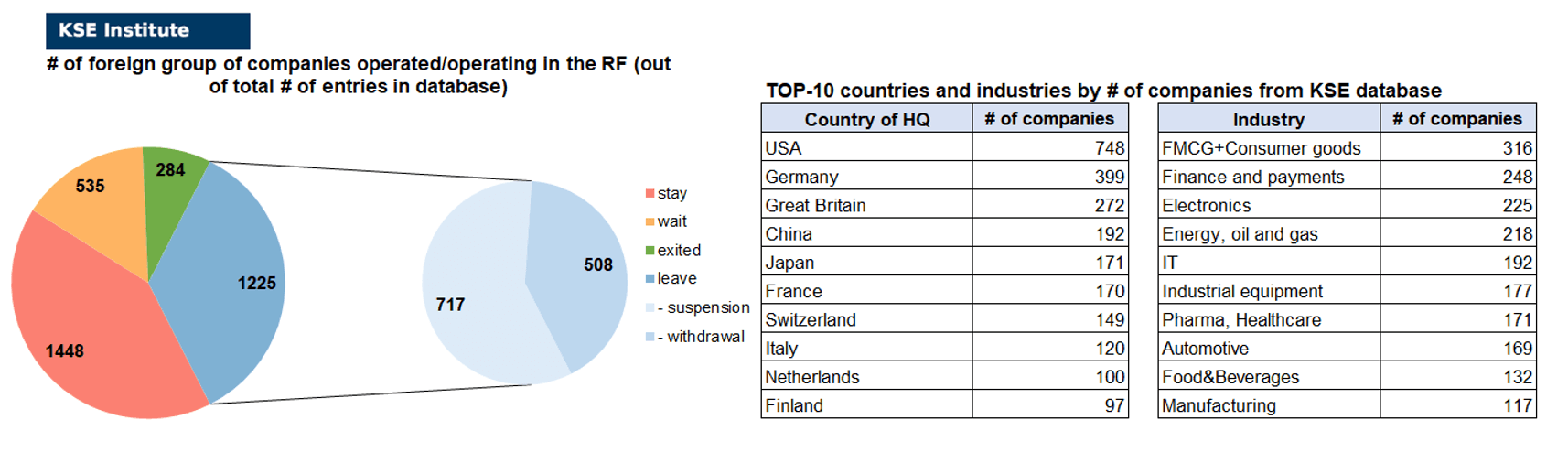

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 448 (+38 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 535 (+2 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 225 (0 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 284 (+9 per 2 weeks)

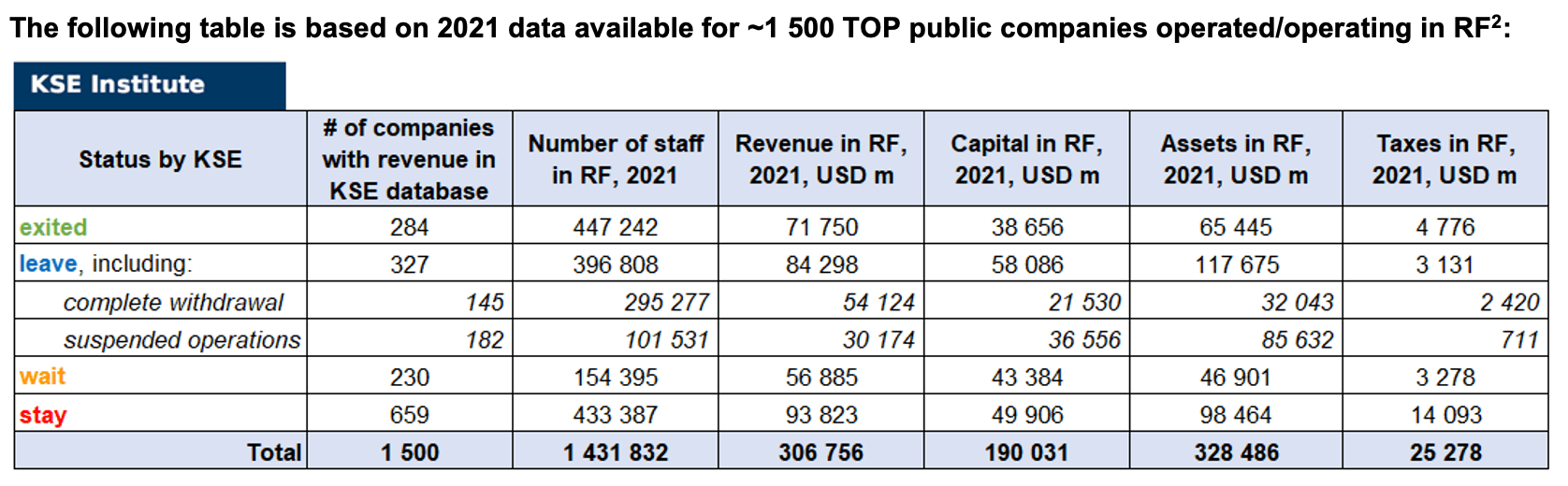

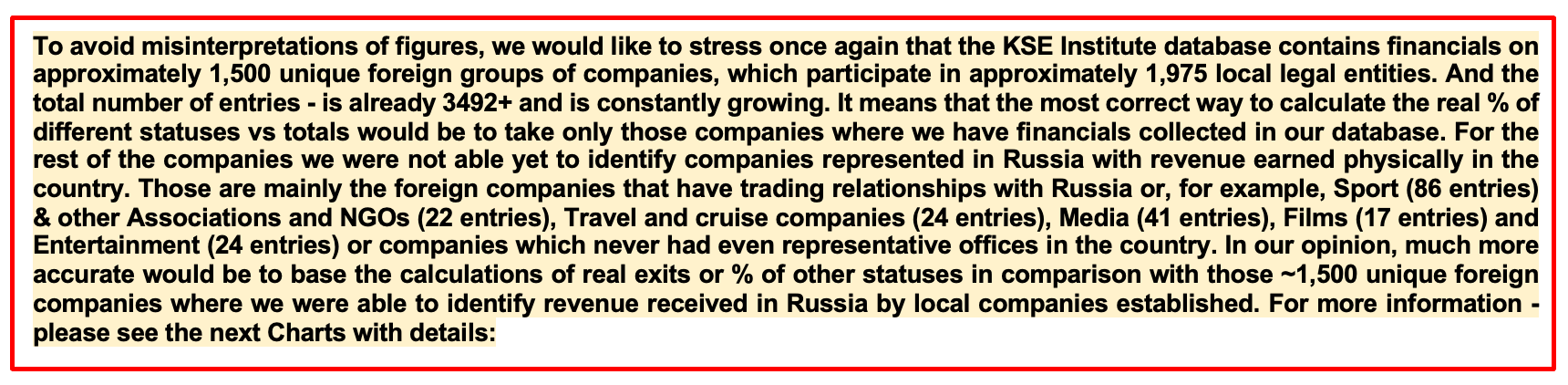

As of October 1, we have identified about 3,492 companies, organizations and their brands from 95 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 500 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $190.0 billion), local revenue (about $306.8 billion), local assets (about $328.5 billion) as well as staff (about 1.432 million people) and taxes paid (about $25.3 billion). 1,760 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 284 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

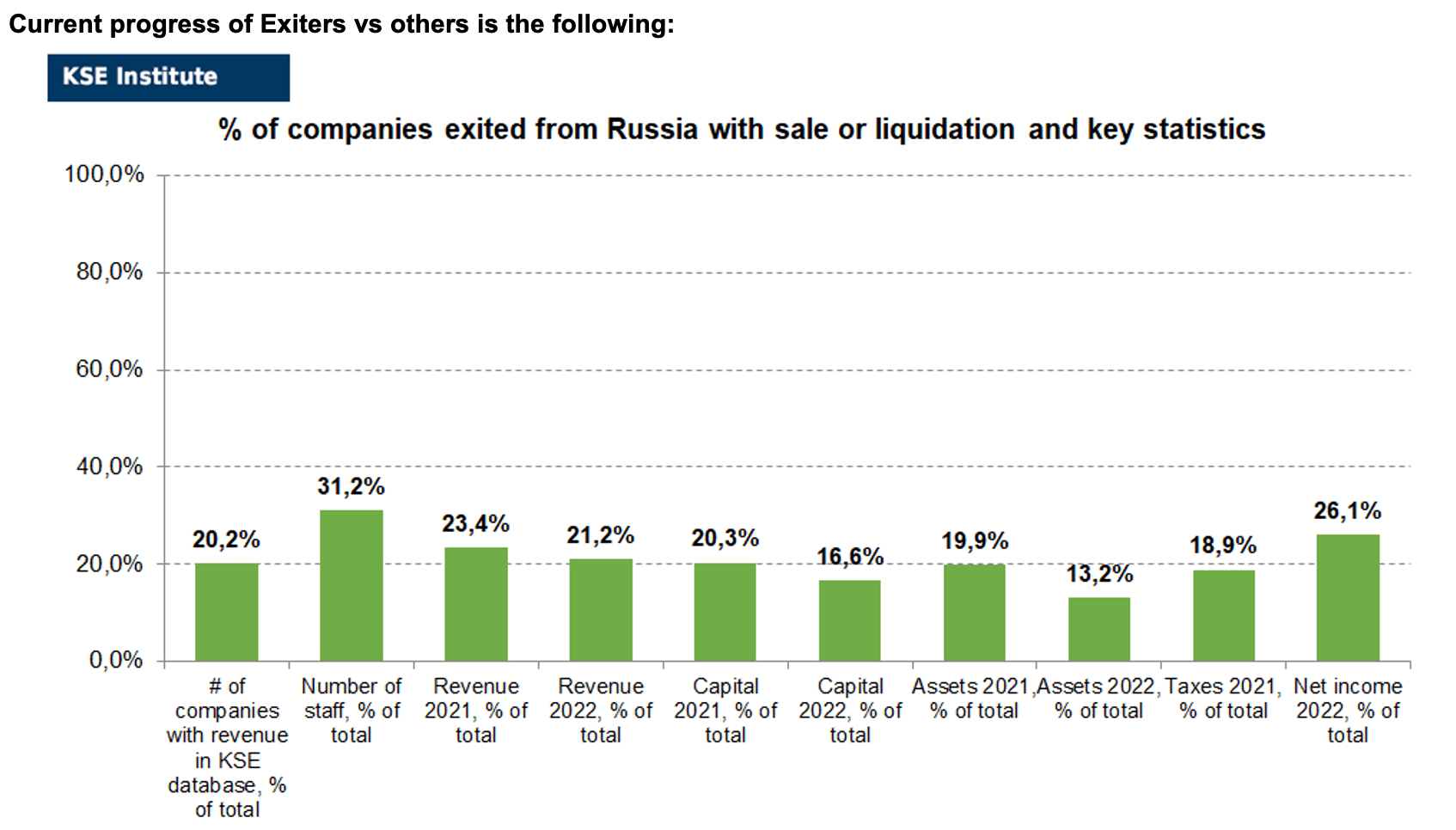

As can be seen from the tables below, as of October 1, 284 companies which had already completely exited from the Russian Federation, in 2021 had at least 447,200 personnel, $71.8 bn in annual revenue, $38.7bn in capital and $65.4bn in assets; companies, that declared a complete withdrawal from Russia had 295,300 personnel, $54.1bn in revenues, $21.5bn in capital and $32.0bn in assets; companies that suspended operations on the Russian market had 101,500 personnel, annual revenue of $30.2bn, $36.6bn in capital and $85.6bn in assets.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 13 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 86 were added in September 2023). However, if to operate with the total numbers in KSE database, about 35.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 41.5% are still remaining in the country, 15.3% are waiting and only 8.1% made a complete exit³.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 13 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 86 were added in September 2023). However, if to operate with the total numbers in KSE database, about 35.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 41.5% are still remaining in the country, 15.3% are waiting and only 8.1% made a complete exit

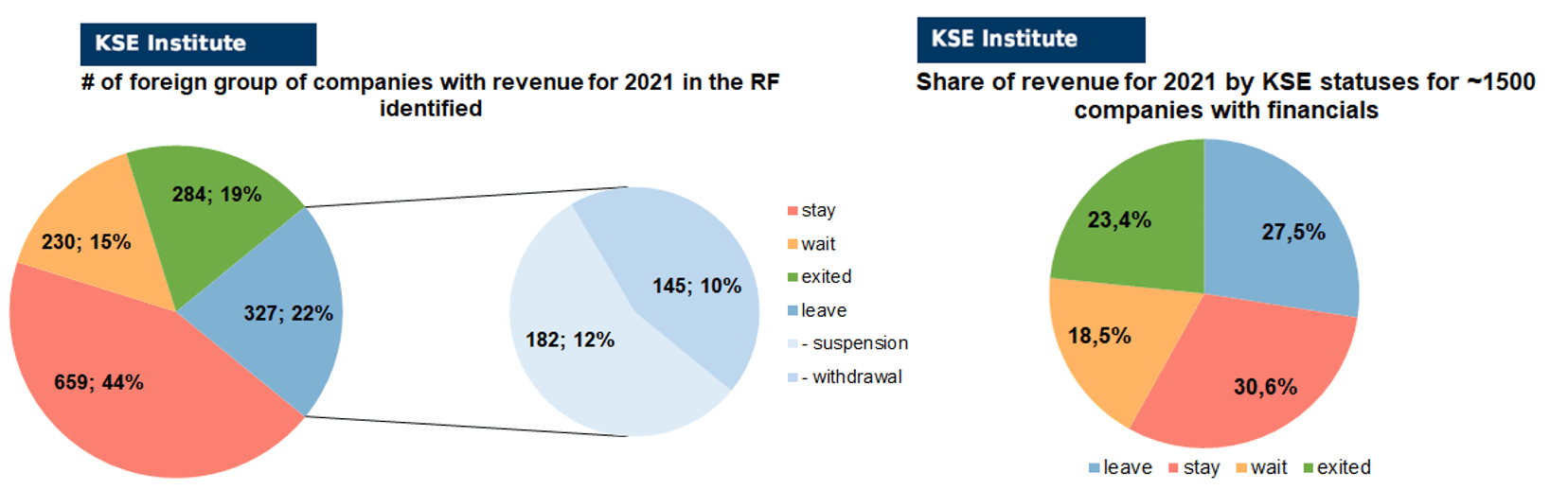

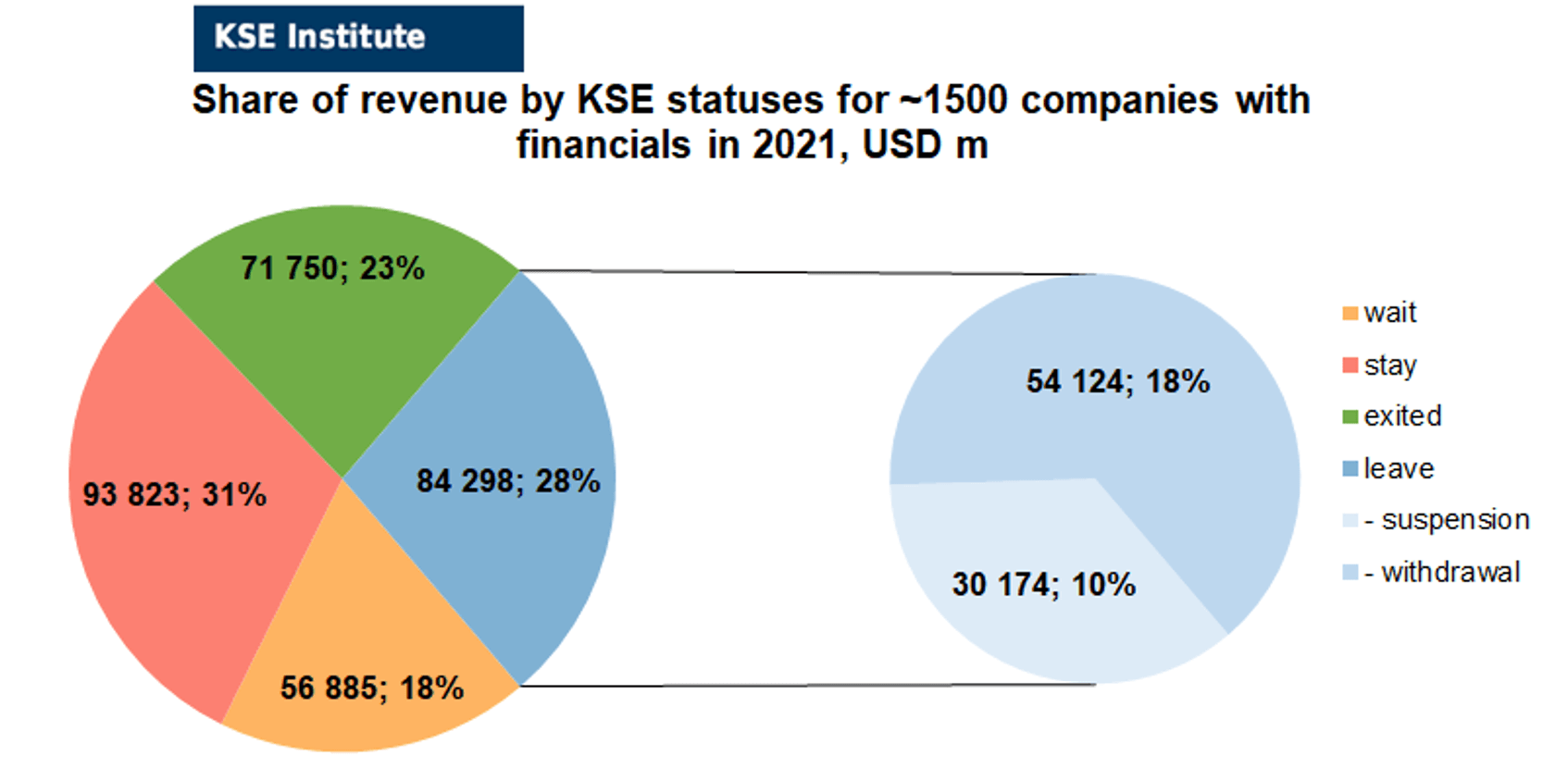

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (19%) and on share of revenue withdrawn (23.4%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 30.6% of revenue and 15% of waiting companies represent 18.5% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

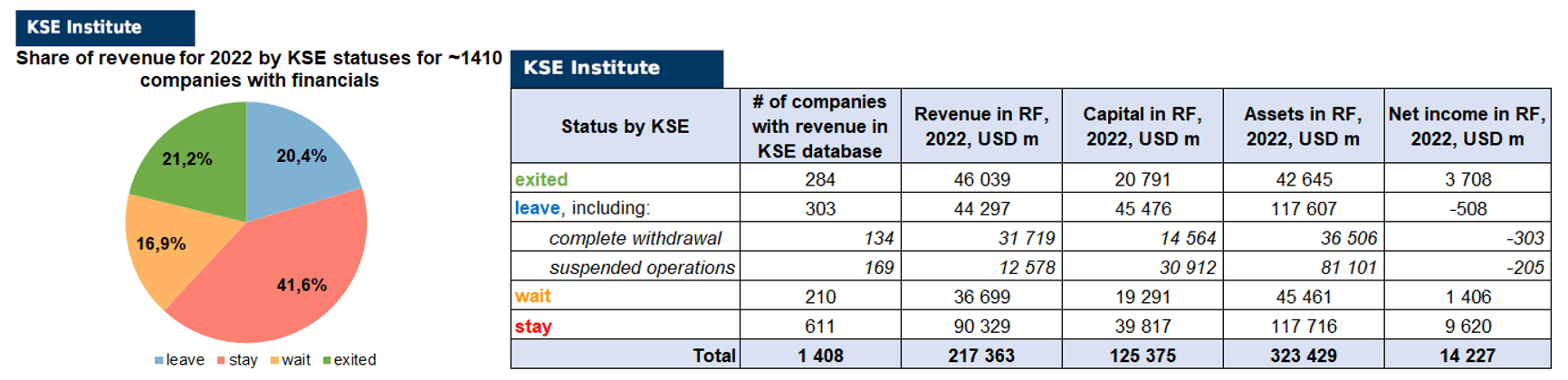

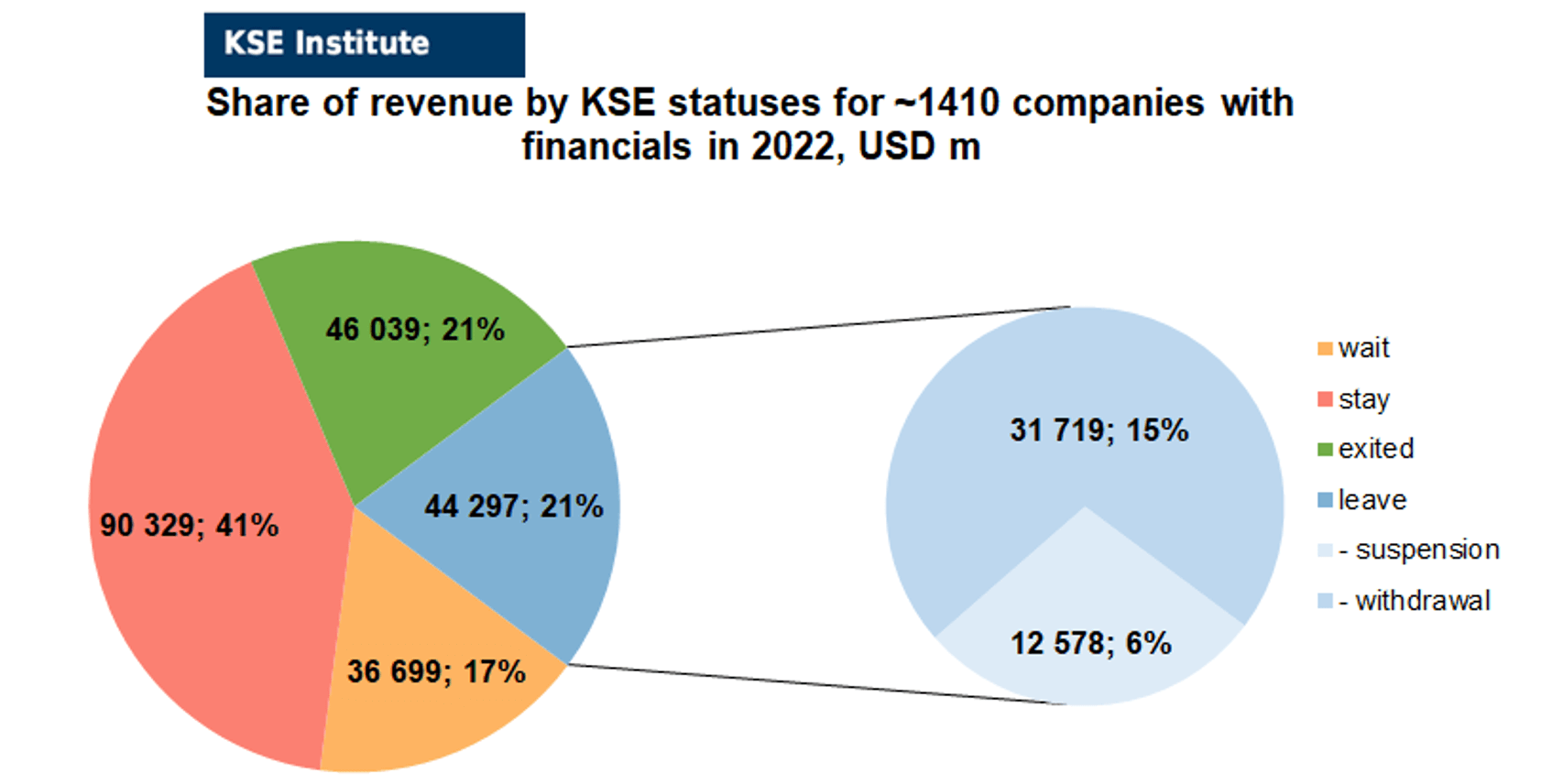

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1410 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.2% less of revenue in 2022 (21.2% from total volume) than in 2021 (23.4% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.1%) revenue in 2022 (20.4% from total volume) than in 2021 (27.5% from total volume). At the same time, staying companies were able to generate much (+11.0%) more revenue in 2022 (41.6% from total volume) than in 2021 (30.6% from total volume). Companies with status “wait”⁴ gained almost the same share (-1.6%) of revenue in 2022 (16.9% from total volume) vs 18.5% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($323.4bn⁵ in 2022 vs $328.5bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

In July 2023, the KSE Institute jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf. Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

FT: Billions of dollars of foreign company profits are stuck in Russia

18.09.2023 | The Financial Time (FT) newspaper reported that companies from unfriendly countries that continue to operate in Russia received more than $18 billion in profits in 2022. However, these funds were frozen in Russia.

https://www.kommersant.ru/doc/6223374

The Ministry of Finance allowed the restoration of foreign exchange controls

20.09.2023 | Deputy Minister of Finance of Russia Alexey Moiseev said that the government is now considering the option of partially restoring foreign exchange controls. These measures, he said, are needed to curb the outflow of capital to friendly countries. The Bank of Russia opposes this idea.

https://www.kommersant.ru/doc/6225076

Exports of medical products from Japan to Russia increased by 577%

20.09.2023 | Japan increased its exports of medical products to Russia by 577.7% in August 2023 compared to the same period in 2022, according to data from the country’s Ministry of Finance.

https://www.rbc.ru/rbcfreenews/650a4c339a79475579ead514

Banks and brokers from 31 countries will be allowed to trade in foreign exchange in Russia

21.09.2023 | The Russian government has approved a list of countries whose banks are allowed to trade on the Russian foreign exchange market. The corresponding order was signed by Prime Minister Mikhail Mishustin. Now banks and brokers from friendly and neutral countries are allowed to trade on the Russian foreign exchange market, as well as on the derivatives market. These countries include: Azerbaijan, Armenia, Belarus, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan, Algeria, Bangladesh, Bahrain, Brazil, Venezuela, Vietnam, Egypt, India, Indonesia, Iran, Qatar, China, Cuba, Malaysia, Morocco, Mongolia , UAE, Oman, Pakistan, Saudi Arabia, Serbia, Thailand, Turkey, South Africa – 31 countries in total.

http://government.ru/news/49557/ ; https://www.kommersant.ru/doc/6225436

The Central Bank extended the ban for non-residents on transfers abroad from broker accounts

26.09.2023 | The Bank of Russia has extended restrictions on transfers abroad of funds of non-residents of unfriendly countries from broker accounts for six months. Restrictions apply to transfers from accounts of both individuals and legal entities opened with Russian brokers and trustees.

https://www.kommersant.ru/doc/6238229

Experts estimate the number of foreign brands that have left Russia since 2022

26.09.2023 | According to analysts at the consulting company Nikoliers, about 140 international brands that were present in Russian shopping centers at the beginning of 2022 have changed their work status. Among them, 32 (approximately 23%) ceased operations completely, and another 52 brands (approximately 37%) resumed operations after selling or transferring the business to Russian management. At the same time, over the past year and a half, the Russian market has been replenished with 27 new brands from other countries. Most of the newcomers come from Turkey, Lebanon and Belarus.

https://realty.rbc.ru/news/65129f609a79470b5a85784f

The government will force companies leaving Russia to pay more than 100 billion rubles to the budget

27.09.2023 | In 2023, the federal budget should receive 114.5 billion rubles. in the form of gratuitous proceeds from non-governmental organizations and foreign companies selling assets in Russia. This assessment is contained in the explanatory note to the draft federal budget for 2024 and the planning period 2025–2026.

The authorities planned to receive ₽114 billion of gratuitous fees from business. Revenues “from other gratuitous income from non-state organizations to the federal budget, including those related to the sale of assets by foreign companies”, in 2023 will amount to 114.5 billion rubles. Such an assessment is contained in the explanatory note to the federal budget project for 2024 and the planning period 2025–2026. This article will amount to about a quarter of all free revenues in 2023.

https://www.moscowtimes.ru/2023/09/27/pravitelstvo-zastavit-uhodyaschie-iz-rossii-kompanii-zaplatit-v-byudzhet-bolee-100-mlrd-rublei-a108092 ; https://www.rbc.ru/economics/27/09/2023/6512c9419a79477313495b96

Merrill Lynch Securities up for sale

27.09.2023 | One of the last remaining brokers in the Russian Federation with foreign shareholders, Merrill Lynch Securities, which was among the top ten on the market before the outbreak of hostilities in Ukraine, may be sold. The company has no customer base left, and the infrastructure is outdated and requires investment, experts warn. Therefore, the buyer is an investor unrelated to the main business, which does not exclude the resale of the company under a new name.

https://www.kommersant.ru/doc/6238430

Profit of the banking sector by the end of 2023 may exceed 3 trillion rubles

27.09.2023 | Forecasts for the performance of Russian banks in 2023 are becoming increasingly optimistic. Expert RA analysts expect the sector’s profit for the year to be more than 3 trillion rubles, which is a third higher than the record of two years ago.

https://www.kommersant.ru/doc/6238366

Nabiullina spoke out against the Chinese model for the Russian financial market

27.09.2023 | On September 26, Chairman of the Bank of Russia Elvira Nabiullina gave a lecture for students of the Faculty of Economics of Moscow State University. M.V. Lomonosov. During the lecture, Ms. Nabiullina, among other things, spoke out against the “Chinese way” and stated that segmenting the domestic and external foreign exchange markets is a backward movement for Russia.

https://www.kommersant.ru/doc/6239016 ; https://www.moscowtimes.ru

The Bank of Russia extended restrictions on transfers of funds abroad for six months

29.09.2023 | The restrictions will remain in effect until the end of March 2024. Citizens will be able to transfer no more than $1 million or the equivalent in foreign currency to foreign banks per month. Through money transfer systems, you can transfer no more than $10 thousand per month.

https://www.kommersant.ru/doc/6240094

In 2022, the profits of Chinese companies in the Russian car market increased by 91%

29.09.2023 | In 2022, the revenue of Chinese companies in the Russian car market increased to 346 billion rubles. We are talking about the companies Chery Automobile, Great Wall Motor, Geely, JAC Motors, Changan Automobile, China FAW Group and Dongfeng Motor. According to Forbes, these companies now have virtually no competitors left in the Russian market.

MONTHLY FOCUS: On leaving the Russian Federation. Results of September 2023

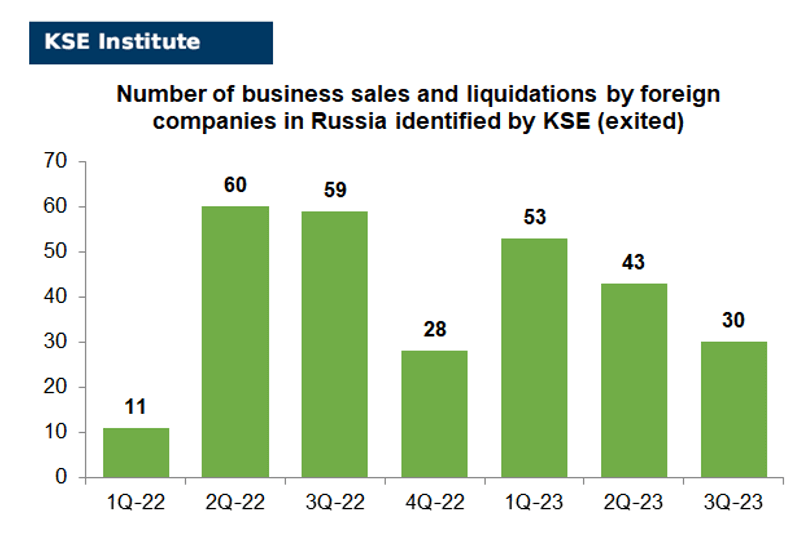

In this digest, we will summarize the results of September 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’500 companies identified in the KSE database with revenue data available of more than $306 billion in 2021 and ~$217 billion in 2022. And at least 284 of them have already been sold by local companies or were liquidated and left the Russian market. In September 2023 KSE Institute identified +11 new exits⁶, total number of exits observed since the beginning of Russia’s invasion reached 284.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 23% based on revenue allocation, those who are leaving represent 28% of total revenue (with 36% share of suspensions and 64% of withdrawals sub-statuses), % of staying companies represent 31% of revenue and 18% are waiting companies based on revenue generated in Russia in 2021. So we observe the situation that % of leaving companies is greater than % of staying ones (which means that more than 50% of pre-invasion revenue is leaving Russia).

If we take a look at the same chart based on revenue-2022 distribution – the picture will be a bit different:

% of exited is 21% based on revenue allocation, those who are leaving represent only 21% of total revenue (with 28% share of suspensions and 72% of withdrawals sub-statuses), % of staying companies represent 41% of revenue and 17% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

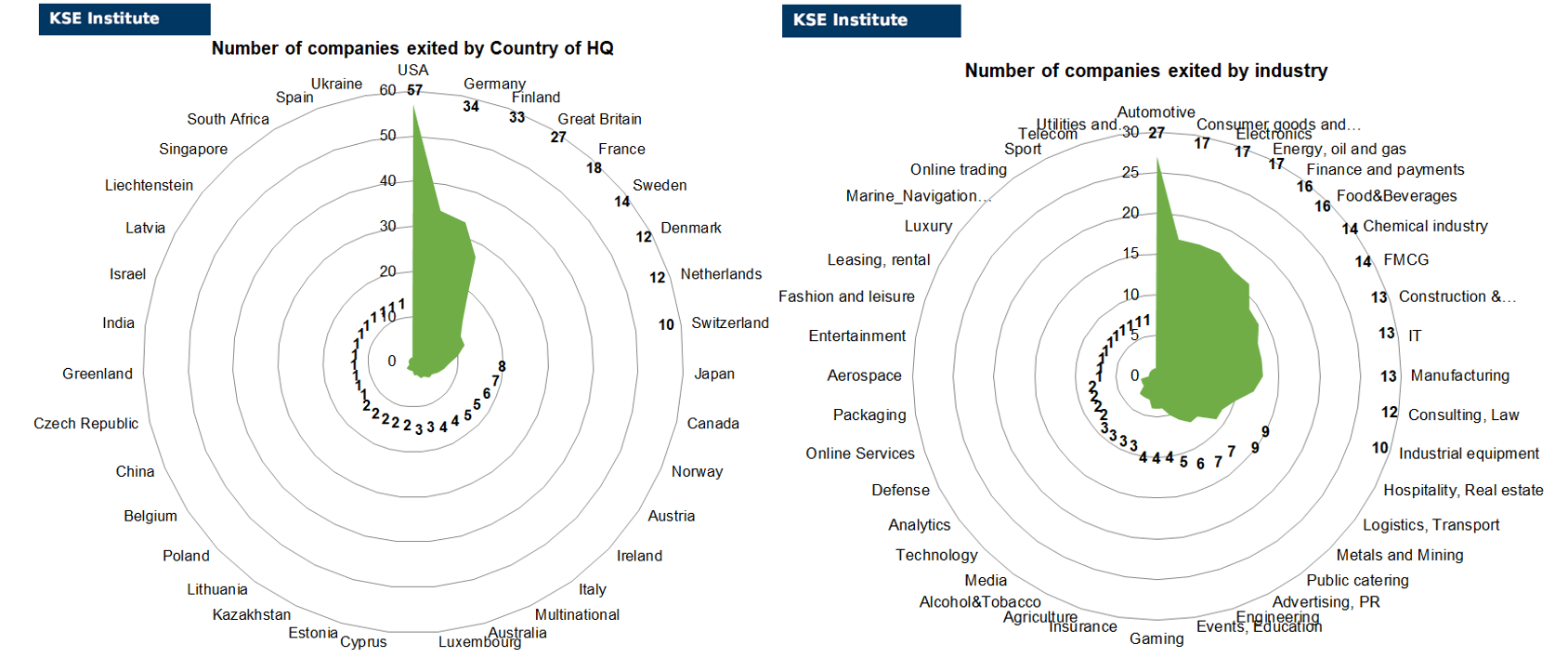

Here are also the breakdowns by by countries and by industries of the companies which already exited:

So, as of the end of September 2023, companies from 35 countries and 40 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain and France and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas”, “Finance and payments” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Bilfinger (Probably internal transfer as new owner became foreign private individual), British American Tobacco, Fletcher Hotels, IHI Corporation, Ingram Micro, Magna International, Mondi Group, National Investment Company, Ponsse PLC, PPG, Volvo Cars. Also, the following companies made partial exits selling part of their local assets: Philips, Softline International, Knorr-Bremse.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already been nationalized, partly sold their business or initiated bankruptcy procedures).

Here are just some of them: Amedia (The Russian printing assets of the Norwegian holding Amedia (Prime-Print printing house network) were transferred to the management of the Federal Property Management Agency – by presidential decree), Baring Vostok Capital Partners (The fund of American investor Michael Calvey Baring Vostok sold a majority stake in the collection agency First Client Bureau (PKB) to the structure of Russian entrepreneur Roman Kovalev), Cargill (The US giant Cargill is selling a share of its grain business in Russia), Danone (The full name was changed from DANONE TRADE LLC to H&N TRADE LLC. 20.09.2023: The entry about the founder of JSC “DANONE RUSSIA” was deleted; JSC “H&N” becomes the new founder of the organization), Diageo (Moscow Brewing Company (MPK) decided to supply Irish Guinness and has already imported the first batch of the drink. IPC imported a batch of Guinness Draught, which includes kegs with a capacity of 30 liters. Guinness will be sold in Russia, Kremlin agency claims), Fraport (Fraport to sell out at Saint Petersburg Pulkovo: part one – sale could be possible this year), Glencore (Glencore stopped being Russneft’s shareholder in 2022. Sberbank tries to seize Glencore’s Russian assets over oil debt), Hyundai (Hyundai Motor may sell the Russian plant to the local firm. Previously Hyundai Motor was in talks to sell the Russia plant to Kazakhstan), IKEA and its owner Ingka (The owner of IKEA has found a buyer for the remains of his assets in Russia, 14 shopping centers), Intesa Sanpaolo (Putin allowed the largest Italian bank to leave Russia), Makrochem SA (On August 11, 2023, the MAKROchem Group closed its representative office in Russia. The Management Board of the MAKROchem Group has decided to sell all shares in the subsidiary in Russia by the end of 2023. Preparations are currently underway to conclude an appropriate agreement, and MAKROchem will inform about the final sale of shares in a special announcement).

The next review of deals for October 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁷

17.09.2023

*Xsolla (USA, Gaming) Status by KSE – stay

Xsolla is still in Russia. Russians have access to client data from Epic Games, Roblox, Valve and others

https://ain.ua/2023/09/16/xsolla-prodovzhuye-praczyuvaty-v-rf/

*PetroNeft Resources (Ireland, Energy, oil and gas) Status by KSE – leave

Petroneft Resources to Sell Russian Business to CEO Pavel Tetyakov for $2 Ml

*JOGMEC (Japan, Energy, oil and gas) Status by KSE – stay

*Mitsui & Co. (Japan, Energy, oil and gas) Status by KSE – stay

Japanese Mitsui will comply with indirect US sanctions regarding Arctic LNG-2

https://www.kommersant.ru/doc/6222752

*Apple (USA, Electronics) Status by KSE – leave

Apple informs journalists Russia is targeting them with Pegasus spyware

https://news.yahoo.com/apple-informs-journalists-russia-targeting-165711499.html

*YouTube (USA, Online Services) Status by KSE – wait

In the State Duma, the conditions for blocking YouTube were named

https://www.moscowtimes.ru/2023/09/17/vgosdume-nazvali-uslovie-blokirovki-youtube-a107171

*Halliburton (USA, Energy, oil and gas) Status by KSE – exited

Halliburton equipment worth $7.1m imported into Russia in past year, customs records show

https://www.theguardian.com/business/2023/sep/17/russia-trade-halliburton-equipment-export-us-oil

18.09.2023

*Spinner GmbH (Germany, Defense) Status by KSE – stay

Ukraine Asks Germany to Halt Machinery Headed for Russia

*Mondi Group (Great Britain, FMCG) Status by KSE – exited

Mondi plc today announces that it has entered into an agreement to sell its last remaining facility in Russia

https://www.mondigroup.com/media/17001/mondi-announces-agreement-to-sell-mondi-syktyvkar.pdf

*Amedia (Norway, Media) Status by KSE – leave

The Russian printing assets of the Norwegian holding Amedia, which left the country after the start of hostilities in Ukraine, have been transferred to the management of Rosimushchestvo.

https://www.kommersant.ru/doc/6223780

*International Paper (USA, Consumer goods and clothing) Status by KSE – exited

International Paper sells Russian JV stake to local shareholders -Ilim Group

*UEFA (Switzerland, Sport) Status by KSE – leave

UEFA told when Russia will return to world football

https://dailysports.net/news/uefa-told-when-russia-will-return-to-world-football/

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

Sovkombank demanded a debt from HSBC in the form of the ruble equivalent of 12,958 ounces of gold

19.09.2023

*Ponsse PLC (Finland, Automotive) Status by KSE – exited

Ponsse Plc has today completed the sale of all shares in OOO Ponsse, its subsidiary that provided PONSSE services in Russia and Belarus. After the conditions of the transaction were met, Ponsse’s business operations in Russia transferred to OOO Bison, a Russian company, and the trade received the approval of the local authorities.

*Luminor (Finland, Logistics, Transport) Status by KSE – stay

*Siberica (Finland, Logistics, Transport) Status by KSE – stay

The head of two Finnish companies was arrested for circumventing anti-Russian sanctions

20.09.2023

*Shenzhen Venz Technology (China, Electronics) Status by KSE – stay

MTS is testing five models of “MTS Center” smart speakers manufactured by the Chinese company Shenzhen Venz Technology Co., Ltd.

https://www.kommersant.ru/doc/6224406

*Glencore (Switzerland, Agriculture) Status by KSE – leave

Glencore stopped being Russneft’s shareholder in 2022 – Russneft

https://www.reuters.com/business/energy/glencore-stopped-being-russnefts-shareholder-2022-russneft-2023-09-20/

*UEFA (Switzerland, Sport) Status by KSE – leave

UEFA urged to act with Russian oil company still sponsoring Champions League club

https://www.mirror.co.uk/sport/football/news/uefa-gazprom-champions-league-sponsor-30975962

https://www.dailymail.co.uk/sport/football/article-12536417/UEFA-urged-act-Russian-owned-Gazprom-set-return-Champions-League-screens-time-Ukraine-invasion-Man-Citys-opponents-Red-Star-Belgrade-sponsored-oil-giants.html

*ONGC Videsh Ltd (India, Energy, oil and gas) Status by KSE – stay

India’s ONGC willing to wait to regain oil from Russian project

21.09.2023

*Fishman Group (Israel, Hospitality, Real estate) Status by KSE – leave

Mirland Development, founded by the Israeli Fishman Group, can transfer part of its last Russian assets with a total value of 5–6 billion rubles. third party company

https://www.kommersant.ru/doc/6225278

*Diageo (Great Britain, Food & Beverages) Status by KSE – wait

Moscow Brewing Company (MPK) decided to supply Irish Guinness and has already imported the first batch of the drink.

https://www.kommersant.ru/doc/6225299

*Xiaomi (China, Electronics) Status by KSE – stay

Three mobile operators in Finland have stopped selling Xiaomi smartphones because of the company’s operations in Russia

https://www.epravda.com.ua/news/2023/09/21/704596/

*Glencore (Switzerland, Agriculture) Status by KSE – wait

Russia’s largest bank is attempting to seize some of Glencore Plc’s Russian assets as compensation for what it says is an unpaid oil trading debt.

*VEON (Netherlands, Telecom) Status by KSE – leave

Kyivstar head expects complete exit of parent VEON from Russia by mid-Oct

https://en.interfax.com.ua/news/general/936188.html

*Polymetal (Great Britain, Metals and Mining) Status by KSE – leave

Gold and silver producer Polymetal International plans to sell all of its Russian assets rather than split them up, and will hire an adviser for the deal soon

https://finance.yahoo.com/news/polymetal-sell-russian-business-one-092857817.html

*Spinner GmbH (Germany, Defense) Status by KSE – stay

The National Agency on Corruption Prevention in Kyiv informed the German government that a so-called CNC machine manufactured by Spinner Werkzeugmaschinenfabrik GmbH is en route to a plant in Russia from Turkey, according to letters seen by Bloomberg News and people familiar with the matter.

*JPMorgan (USA, Finance and payments) Status by KSE – wait

The US asked JPMorgan to show patience, but the bank, on its own initiative, closed the payment channel with the Russian side for agricultural exports after Moscow withdrew from the grain deal https://www.reuters.com/markets/commodities/us-urged-jpmorgan-be-patient-before-halt-processing-russia-grain-payments-2023-09-21/?fbclid=IwAR1H6cstYnem-2KEKWXasZK55td1dATEziYLL35LWQzkmtcHN3uPGdVnCRw

https://www.rbc.ru/politics/21/09/2023/650bb0189a7947eafb3a2db7

*Medtronic (Ireland, Pharma, Healthcare) Status by KSE – wait

*Abbott Labs (USA, Pharma, Healthcare) Status by KSE – wait

There have been problems with the import of products for the treatment of diabetes

22.09.2023

*EuBiologics (South Korea, Pharma, Healthcare) Status by KSE – stay

EuBiologics signed another technology transfer agreement and contract to supply raw materials for its meningococcal quadrivalent vaccine to Nanolek, a Russian biopharmaceutical.

https://www.koreabiomed.com/news/articleView.html?idxno=22139

*Bopel Mobile Technology Co Limited (China, Electronics) Status by KSE – stay

The “anti-espionage” smartphone for Russian officials is actually made in China. The company declared the smartphone under the Ruteq trademark in several models, manufactured by Bopel Mobile Technology Co Limited from Hong Kong.

*Google (USA, Online Services) Status by KSE – wait

Google’s AI system won’t answer negative questions about Vladimir Putin asked in Russian – but does make argument for Trump being racist

*Wargaming (Cyprus, Gaming) Status by KSE – exited

Wargaming lost $250 million from leaving the Russian Federation and the Republic of Belarus

https://ain.ua/2023/09/21/wargaming-bez-rf-rb/

*SEFE Securing Energy for Europe (Germany, Energy, oil and gas) Status by KSE – stay

Germany Faces Criticism Over SEFE’s Renewed LNG Trade With Russia

24.09.2023

*Candy (Italy, Electronics) Status by KSE – leave

*Haier (China, Electronics) Status by KSE – wait

The Chinese manufacturer of household appliances Haier intends to liquidate the factory of Candy household appliances in Kirov.

https://www.kommersant.ru/doc/6236873

*UnionPay (China, Finance and payments) Status by KSE – wait

What are the conditions for using UnionPay cards of Russian banks

https://www.kommersant.ru/doc/6236168

*Metro AG (Germany, FMCG) Status by KSE – stay

*STADA (Germany, Pharma, Healthcare) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The war and the ruble are spoiling the business of EU firms remaining in Russia

https://www.dw.com/ru/vojna-i-slabyj-rubl-portat-biznes-ostavsimsa-v-rossii-firmam-iz-es/a-66551533

*Bank of Georgia (Georgia, Finance and payments) Status by KSE – leave

The Belarusian BNB Bank closes non-resident accounts opened by power of attorney

25.09.2023

*Royal Greenland (Greenland, Food & Beverages) Status by KSE – leave

Royal Greenland takes hit from loss of Russian prawn market.

*Baring Vostok Capital Partners (Russia, Finance and payments) Status by KSE – leave

The fund of American investor Michael Calvey Baring Vostok sold a majority stake in the collection agency First Client Bureau (PKB) to the structure of Russian entrepreneur Roman Kovalev.

https://www.kommersant.ru/doc/6236947

*KFC (USA, Public catering) Status by KSE – exited

*Yum Brands (USA, Public catering) Status by KSE – exited

US sanctions authority delayed KFC’s Russia exit -franchise owner

*SEFE Securing Energy for Europe (Germany, Energy, oil and gas) Status by KSE – stay

Germany confirmed the purchase of LNG from Russia under the current contract

*Mothercare (Great Britain, Consumer goods and clothing) Status by KSE – exited

Mothercare Shares Drop After Pretax Profit Fell on Russia Exit

*Meta (USA, Online Services) Status by KSE – leave

WhatsApp will not launch media channels in Russia after the threat of blocking

*Iran Aircraft Manufacturing Industrial Company (HESA) (Iran, Defense) Status by KSE – stay

According to the American authorities, “UDK-STAR” interacted with the Iranian state aircraft manufacturing corporation Iran Aircraft Manufacturing Industries Corporation (HESA).

26.09.2023

*UEFA (Switzerland, Sport) Status by KSE – wait

The Executive Committee has asked the UEFA administration to propose a technical solution that would enable the reinstatement of the Russian U17 teams (both girls and boys) even when draws have already been held.

*Fortenova Group (Croatia, Food & Beverages) Status by KSE – wait

VTB Bank, which controls about 7% of the shares of the largest retailer in the Balkans — Fortenova Group, is discussing the possible exchange of this share for Yandex shares

https://www.rbc.ru/business/26/09/2023/6512ea6a9a794778db990e03

*Hyundai (South Korea, Automotive) Status by KSE – leave

Hyundai Motor may sell Russian plant to local firm

https://m.koreaherald.com/view.php?ud=20230926000475

*Polymetal (Great Britain, Metals and Mining) Status by KSE – leave

Polymetal CEO: new tax proposals to hit price of Russian assets sale

27.09.2023

*Binance (China, Finance and payments) Status by KSE – leave

Cryptocurrency exchange Binance said on Wednesday it will sell its Russia business to newly-launched exchange CommEX, becoming the latest company to pull out of Moscow since the country began its war against Ukraine.

https://www.reuters.com/markets/deals/binance-says-sell-russia-business-commex-2023-09-27/

The CEO of the Binance crypto exchange, Changpeng Zhao, revealed the details of the transaction for the sale of the Russian business CommEX.

https://forklog.com/news/glava-binance-podelilsya-podrobnostyami-peredachi-biznesa-v-rf

*Pegasus (Turkey, Air transportation) Status by KSE – stay

Turkey’s Pegasus, Still Servicing Russia, Sees Drone Disruptions

*Eni (Italy, Energy, oil and gas) Status by KSE – exited

Eni in talks to sell Plenitude stake, IPO will follow

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

*UBS (Switzerland, Finance and payments) Status by KSE – wait

DOJ Steps Up Probe of Credit Suisse and UBS Over Sanctions Breaches

*Bank of America (USA, Finance and payments) Status by KSE – wait

“Merrill Lynch Securities” (part of the Bank of America group) is put up for sale.

28.09.2023

*OVS (Italy, Consumer goods and clothing) Status by KSE – stay

Italian OVS opens stores in the Russian Federation again

https://www.kommersant.ru/doc/6239088

*Ruck&Maul (Italy, Consumer goods and clothing) Status by KSE – stay

*BonBon Lingerie (Estonia, Consumer goods and clothing) Status by KSE – stay

*2XU (Australia, FMCG) Status by KSE – stay

*Vilhelm Parfumerie (France, FMCG) Status by KSE – stay

*Li-Ning (China, Consumer goods and clothing) Status by KSE – stay

*Coffee Boom (Kazakhstan, Food & Beverages) Status by KSE – stay

The Russian market has been replenished with brands

https://realty.rbc.ru/news/65129f609a79470b5a85784f

*Ericsson (Sweden, Telecom) Status by KSE – wait

The Swedish government did not allow Ericsson to supply equipment to Russian companies

*OMV (Austria, Energy, oil and gas) Status by KSE – stay

Austria will reduce its dependence on gas from the Russian Federation at the expense of Norway

https://www.epravda.com.ua/news/2023/09/28/704854/

*Iridium Communications (USA, Telecom) Status by KSE – stay

Russian drones manufacturer keeps receiving satellite services from American company

*Cargill (USA, Agriculture) Status by KSE – leave

Russian farmers were threatened with massive bankruptcies after the departure of foreign grain traders

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – exited

*Ingka (Netherlands, Consumer goods and clothing) Status by KSE – leave

Gazprombank buys Russia MEGA shopping centers from IKEA affiliated business

*Epic Games (USA, Gaming) Status by KSE – wait

Cybersportsmen said that Epic Games did not pay them $200,000 in prize money for winning the Fortnite tournament because of their Russian citizenship

29.09.2023

*Oil India Ltd (India, Energy, oil and gas) Status by KSE – stay

Oil India Ltd (OIL) has appointed legal and tax consultants to explore ways to repatriate its $150 million in dividend stuck in Russia.

*Helipay (China, Online Services) Status by KSE – stay

The Chinese payment company Helipay is negotiating with three Russian banks to organize cross-border payments between companies in the two countries.

*Jodas Expoim (India, Pharma, Healthcare) Status by KSE – stay

A subsidiary of the Indian Jodas Expoim, filed a lawsuit in the Arbitration Court of the Moscow Region to oblige the Iranian AryoGen Pharmed to supply the drug

https://www.kommersant.ru/doc/6239887

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – leave

Putin allowed the largest Italian bank to leave Russia.

*Chery Automobile (China, Automotive) Status by KSE – stay

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

*JAC Motors (China, Automotive) Status by KSE – stay

*Changan (China, Automotive) Status by KSE – stay

*FAW Group (China, Automotive) Status by KSE – stay

*Dongfeng (China, Automotive) Status by KSE – stay

In 2022, the profits of Chinese companies in the Russian car market increased by 91%

https://www.kommersant.ru/doc/6240096

*KFC (USA, Public catering) Status by KSE – exited

The company, which franchises approximately 100 KFC outlets in Russia, will not change the signs to Rostic’s and intends to keep the same name until at least 2035.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 7500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

Also, in September 2023, the KSE Institute jointly with the B4Ukraine coalition partners published another research entitled “The Business of Leaving: How Multinationals Can Responsibly Exit Russia”, you can download its full text in English here: https://b4ukraine.org/pdf/B4Ukraine_Business_of_Leaving_report.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 18 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website