- Kyiv School of Economics

- About the School

- News

- 52nd issue of the regular digest on impact of foreign companies’ exit on RF economy

52nd issue of the regular digest on impact of foreign companies’ exit on RF economy

4 September 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 14.08-03.09.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

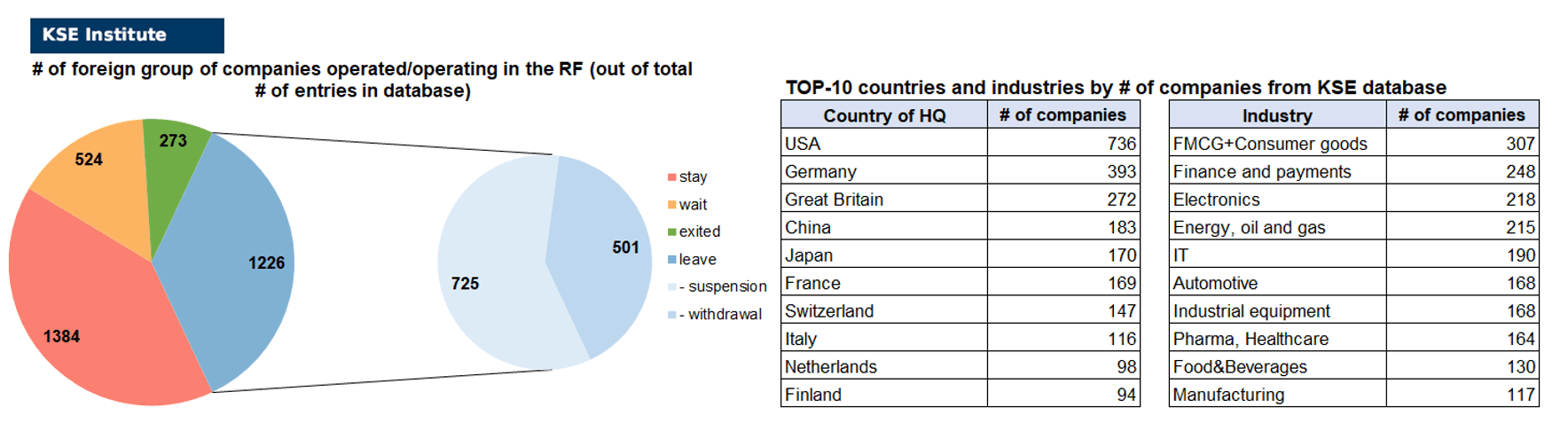

KSE DATABASE SNAPSHOT as of 03.09.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 384 (+7 per 3 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 524 (+5 per 3 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 226 (+3 per 3 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 273 (+8 per 3 weeks)

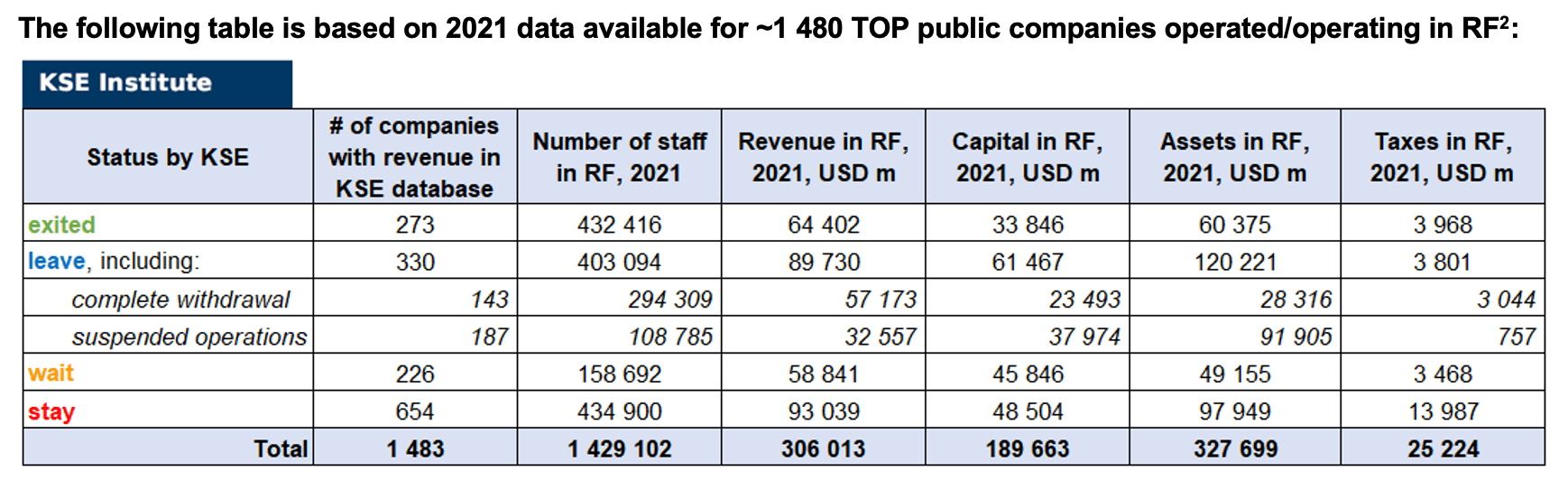

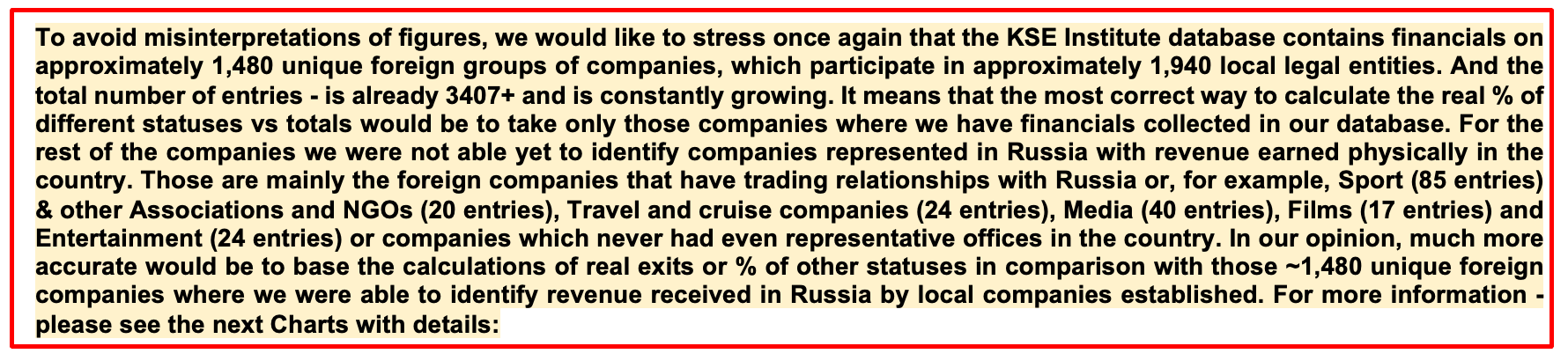

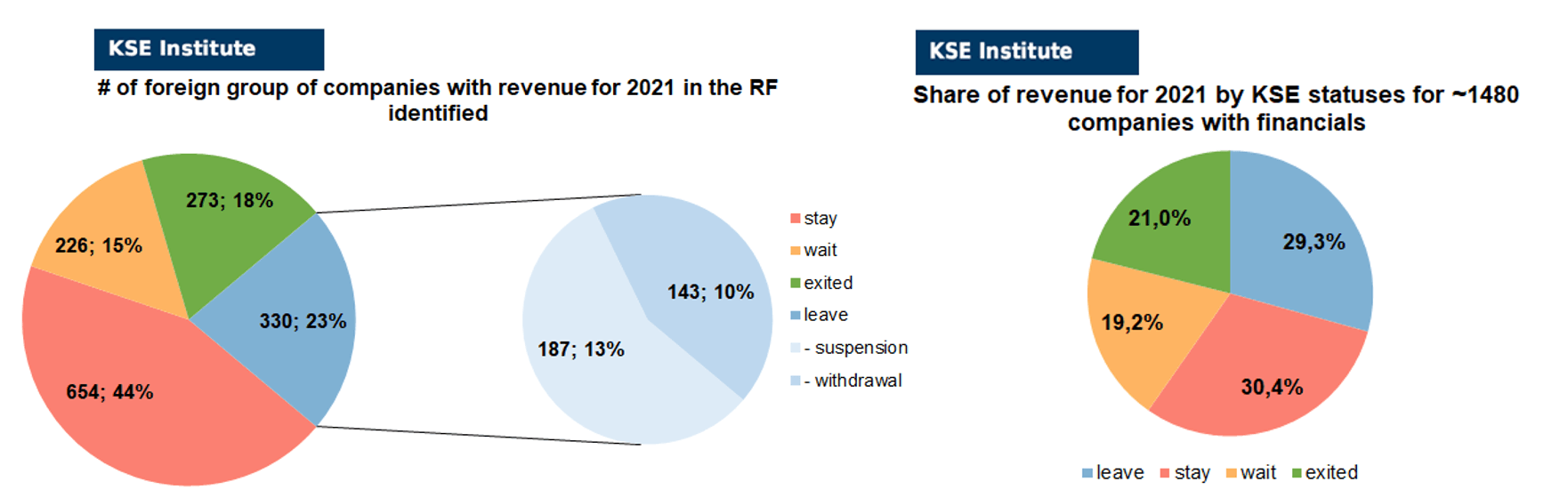

As of September 03, we have identified about 3,407 companies, organizations and their brands from 94 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 480 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $189.7 billion), local revenue (about $306.0 billion), local assets (about $327.7 billion) as well as staff (about 1.429 million people) and taxes paid (about $25.2 billion). 1,750 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 273 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

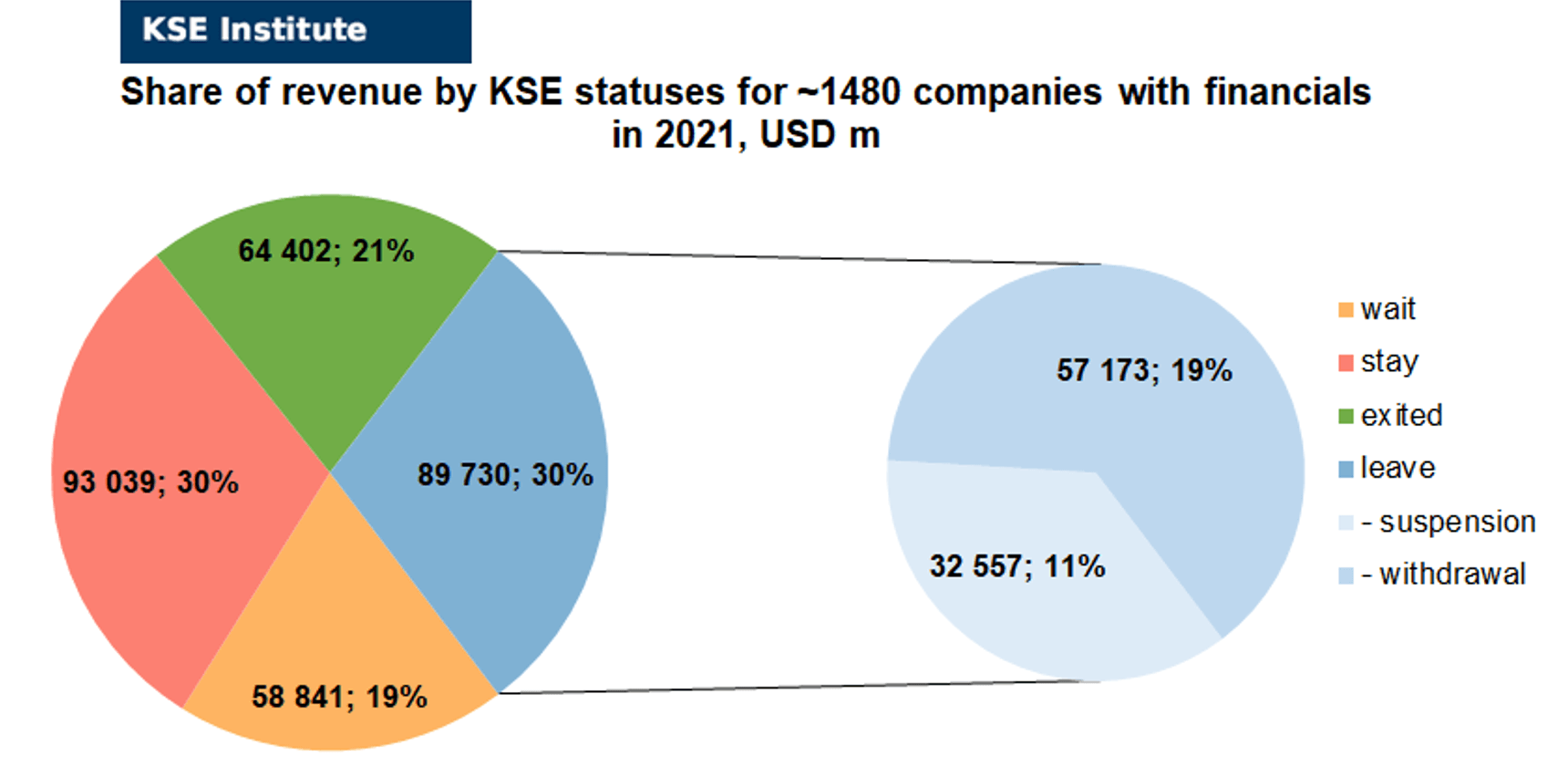

As can be seen from the tables below, as of September 03, 273 companies which had already completely exited from the Russian Federation, in 2021 had at least 432,400 personnel, $64.4 bn in annual revenue, $33.8bn in capital and $60.4bn in assets; companies, that declared a complete withdrawal from Russia had 294,300 personnel, $57.2bn in revenues, $23.5bn in capital and $28.3bn in assets; companies that suspended operations on the Russian market had 108,800 personnel, annual revenue of $32.6bn, $38.0bn in capital and $91.9bn in assets.

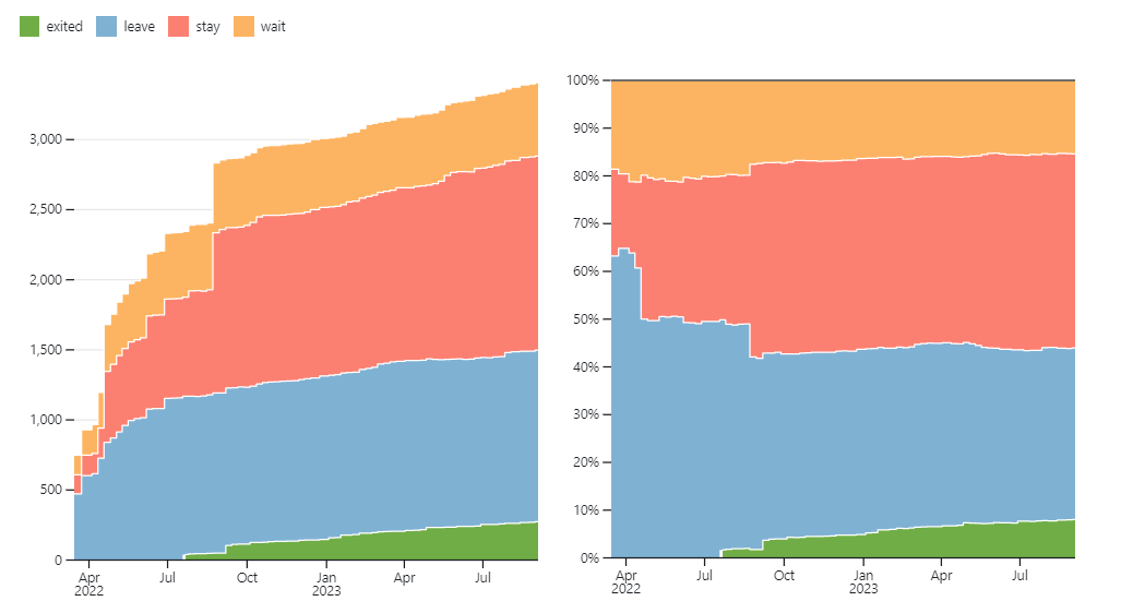

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 12 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 46 were added in August 2023). However, if to operate with the total numbers in KSE database, about 36.0% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.6% are still remaining in the country, 15.4% are waiting and only 8.0% made a complete exit³.

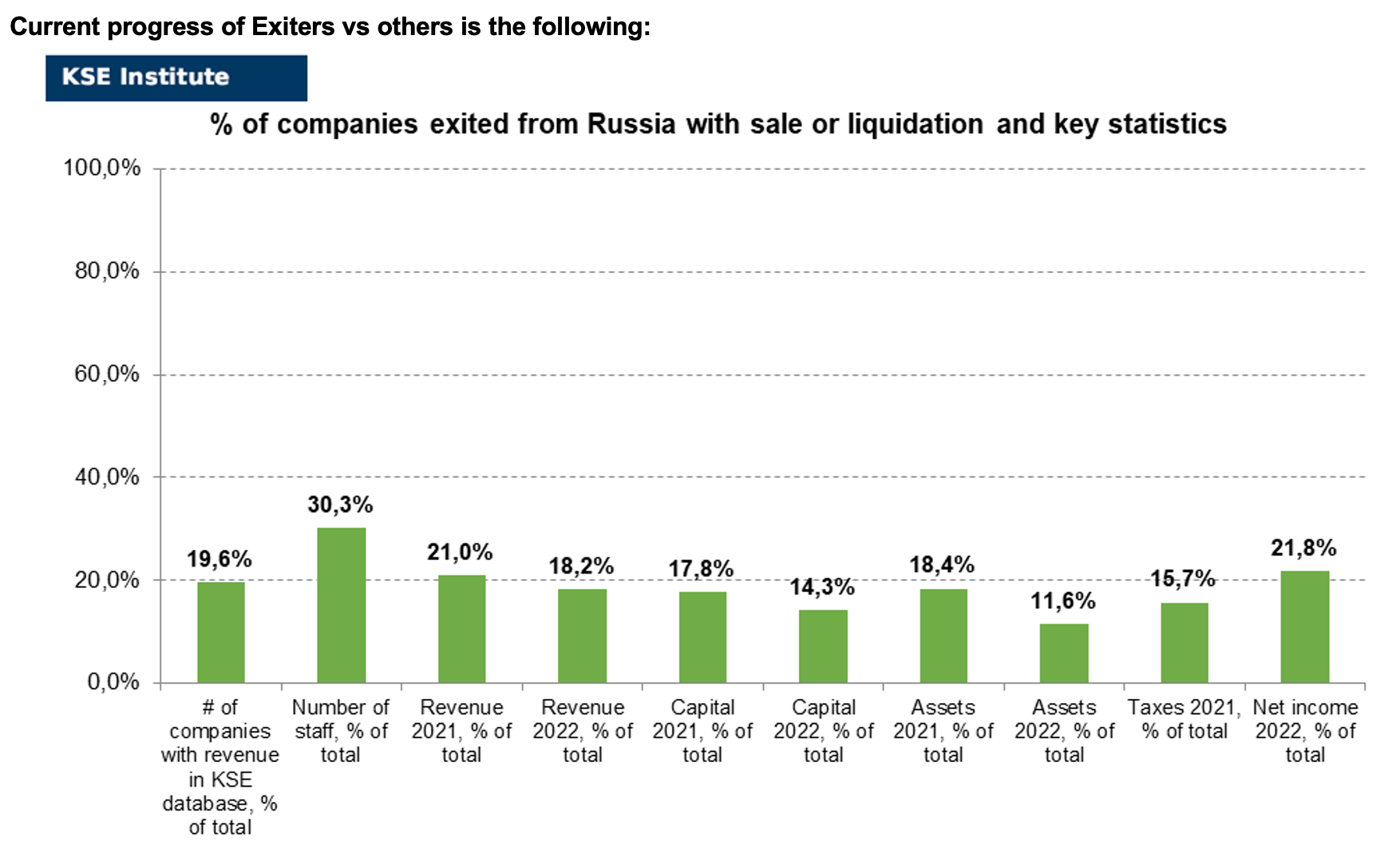

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 273 companies that completely left the country, since in 2021 they employed 30.3% of the personnel employed in foreign companies, the companies owned about 18.4% of the assets, had 17.8% of capital invested by foreign companies, and in 2021 they generated revenue of $64.4 billion or 21.0% of total revenue and paid ~$4.0 billion of taxes or 15.7% of total taxes paid by the companies observed. Data on 1,480 TOP companies is presented in the table above.

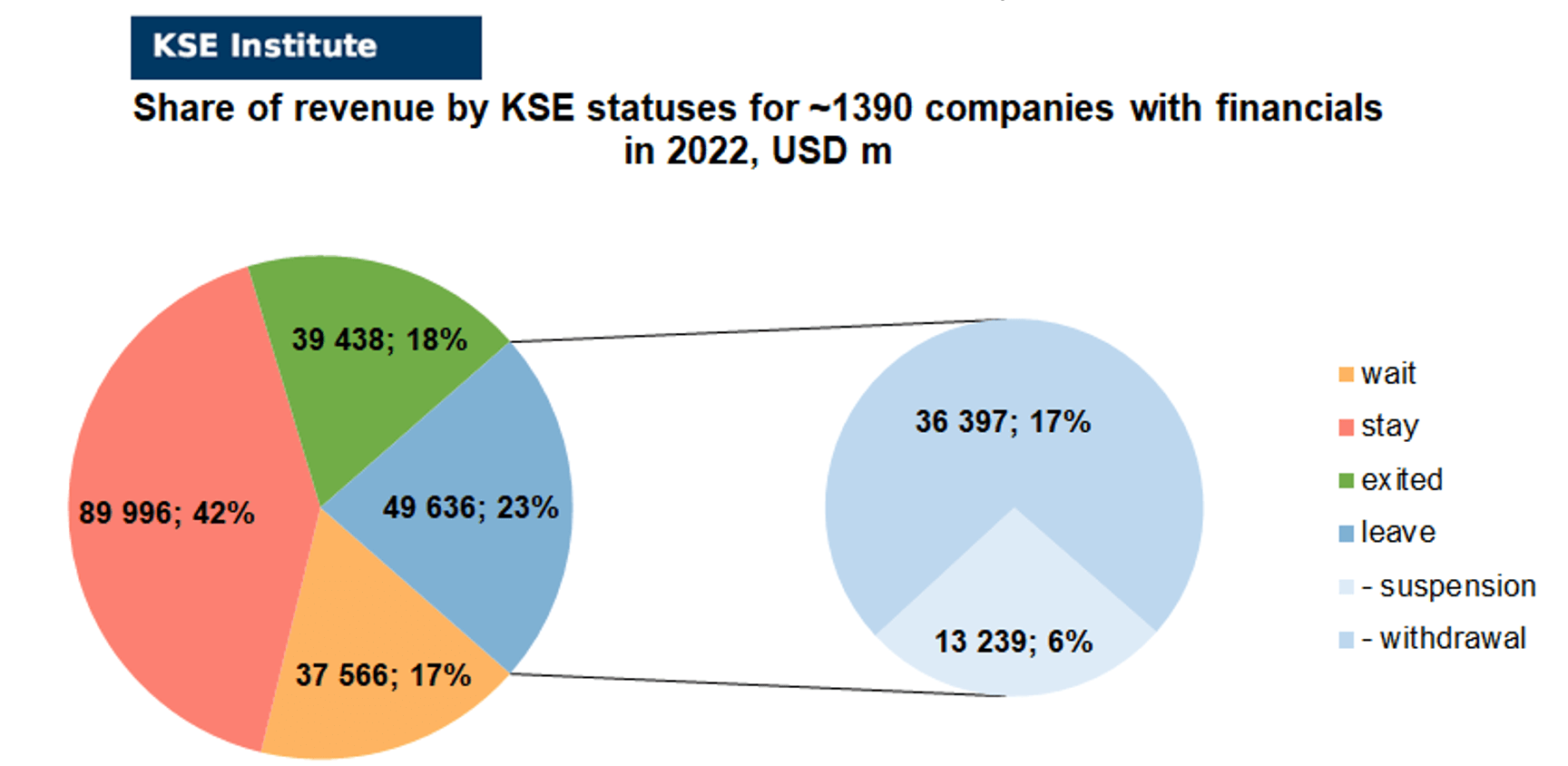

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (18%) and on share of revenue withdrawn (21%). At the same time, a totally different picture is for those who are still staying – 44% of companies represent 30.4% of revenue and 15% of waiting companies represent 19.2% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1390 companies (about 90 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.8% less of revenue in 2022 (18.2% from total volume) than in 2021 (21.0% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.4%) revenue in 2022 (22.9% from total volume) than in 2021 (29.3% from total volume). At the same time, staying companies were able to generate much (+11.1%) more revenue in 2022 (41.5% from total volume) than in 2021 (30.4% from total volume). Companies with status “wait”⁴ gained almost the same share (-1.9%) of revenue in 2022 (17.3% from total volume) vs 19.2% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($322.7bn⁵ in 2022 vs $327.7bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Russian Foreign Ministry: trade turnover with Armenia increased by 86% in January-May 2023

04.08.2023 | Trade turnover between Russia and Armenia grew by 86% between January and May 2023, Denis Gonchar, director of the fourth department of the CIS countries of the Russian Foreign Ministry, told TASS. He noted that Armenia’s exports to Russia also grew by a record 3.3 times.

https://www.rbc.ru/rbcfreenews/64ccb0329a7947356868e5d2

Putin introduces Travel Bans

04.08.2023 | Russian President Vladimir Putin signed a law that prohibits citizens from leaving the country from the moment they receive a summons to the military registration and enlistment office. The travel ban will be in effect from the moment the summons is placed in the register.

http://publication.pravo.gov.ru/document/0001202308040021

Russia became the second largest supplier of gas to Spain

05.08.2023 | In July, Spain purchased the equivalent of 8,764 GWh of liquefied natural gas (LNG) from Russia, the share of Russian imports in total energy supplies was 27.6%, purchases from Algeria reached 28.7% in July, according to data from the Spanish energy company Enagas.

https://www.vedomosti.ru/economics/news/2023/08/05/988677-rossiya-stala

China reported a 36.5% increase in trade with Russia since the beginning of the year

08.08.2023 | The trade turnover between Russia and China in January-July increased by 36.5% year on year and reached $134.1 billion, the General Administration of Customs of the People’s Republic of China reported. Exports from China to Russia grew by 73.4% over the seven months of this year and reached $62.54 billion. China’s imports of services and goods from Russia increased by 15.1%, to $71.55 billion.

https://www.rbc.ru/rbcfreenews/64d1ea699a79478aa52f40fd

Putin signed a decree on special accounts for payment in rubles for agricultural products

08.08.2023 | When paying for agricultural products, a foreign buyer will be able to open a special currency account in a Russian bank, after the sale of the currency, the bank will credit funds in rubles to a special ruble account. The measure will come into force on November 1, 2023. This might have an impact on some of the work under unsanctioned business.

http://publication.pravo.gov.ru/document/0001202308080018?index=1

Consul General of the Russian Federation announced the desire of US big business to resume cooperation with Russia

09.08.2023 | US big business does not want to lose the Russian market and would like to resume cooperation. This was stated to TASS by the Consul General of the Russian Federation in Houston Alexander Zakharov. “The Americans really do not want to lose the large-scale Russian market in the future. It is possible to build new supply chains, but it takes years and even decades,” the Consul General noted. – Of course, big business would like to resume cooperation. American business does not want to lose the Russian market or give it to someone else.“

https://tass.ru/ekonomika/18471905

The amount paid by foreign companies for leaving the Russian market became known

15.08.2023 | Free fees to the Russian budget from the sale of businesses by foreign companies in 2023 reached 54 billion rubles (as of August 10). This income item was replenished from December 2022, when the authorities introduced a commission for approving such agreements. Taking December into account, the amount was 57 billion rubles.

https://www.gazeta.ru/business/news/2023/08/15/21075758.shtml

SberCIB analysts: buying shares of oil companies from foreigners may weaken the ruble

31.08.2023 | Transactions by oil companies to buy shares from foreigners may create additional risks for the ruble, analysts at SberCIB Investment Research say. They drew attention to the statement of Deputy Prime Minister Alexander Novak, who said that LUKOIL had applied to the government for permission to buy shares from foreign investors at a discount of at least 50%. According to Mr. Novak, other oil and gas companies also applied to the authorities with similar requests.

https://www.kommersant.ru/doc/6186935

Russia says it won’t let foreign banks leave easily – Russian Deputy Finance Minister Alexei Moiseev

01.09.2023 | “We have stated our position and it stands – we will be tough in letting foreign banks go, it will depend on the decision to unfreeze Russian assets,” Moiseev said, speaking at the annual international military-technical forum “ARMY” at Patriot Expocentre in Moscow Region. Responding to questions about applications to sell assets, Moiseev said Austria’s Raiffeisen Bank had not made such a request. “I am aware of one foreign bank’s application to sell assets … which is under consideration by the government commission,” he said.

MONTHLY FOCUS: On leaving the Russian Federation. Results of August 2023

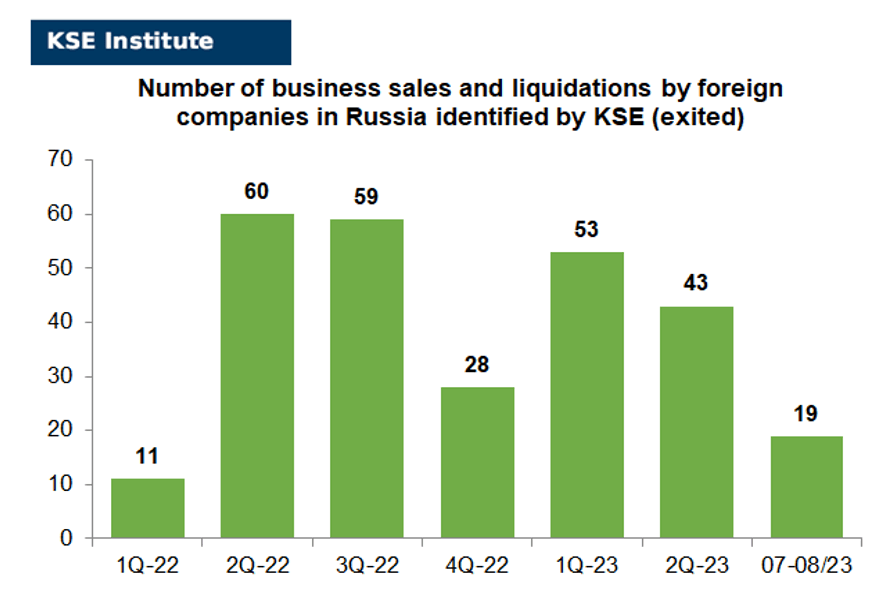

In this digest, we will summarize the results of August 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’480 companies identified in the KSE database with revenue data available of more than $306 billion in 2021 and ~$216 billion in 2022. And at least 273 of them have already been sold by local companies or were liquidated and left the Russian market. In August 2023 KSE Institute identified +11 new exits⁶, total number of exits observed since the beginning of Russia’s invasion reached 273.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” it is also worth paying attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 21% based on revenue allocation, those who are leaving represent 30% of total revenue (with 36% share of suspensions and 64% of withdrawals sub-statuses), % of staying companies represent 30% of revenue and 19% are waiting companies based on revenue generated in Russia in 2021. For the first time we observe the situation that % of leaving companies is greater than % of staying ones (which means that more than 50% of pre-invasion revenue is leaving Russia).

% of exited is 18% based on revenue allocation, those who are leaving represent only 23% of total revenue (with 27% share of suspensions and 73% of withdrawals sub-statuses), % of staying companies represent 42% of revenue and 17% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

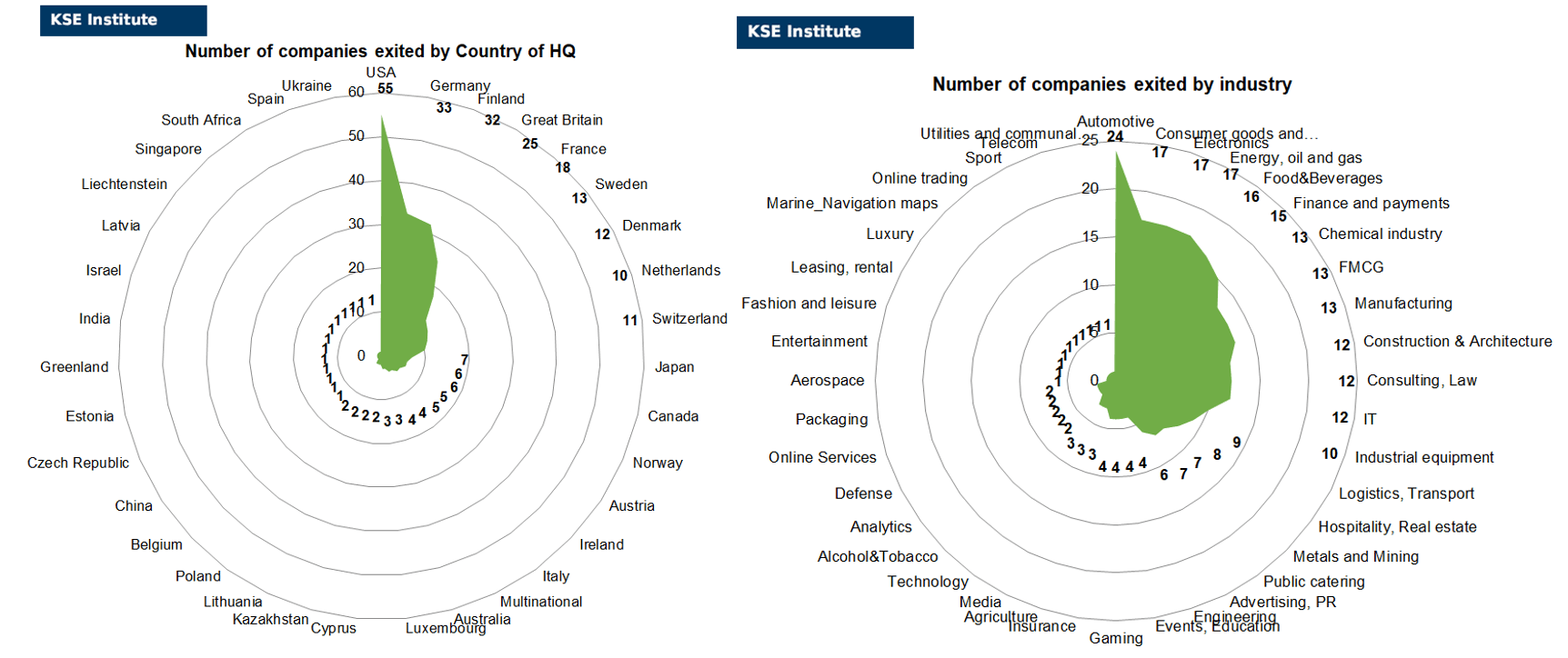

Here are also the breakdowns by by countries and by industries of the companies which already exited:

So, as of the end of August 2023, companies from 35 countries and 40 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain and France and operated in the “Automotive”, “Consumer goods and closing”, “Electronics”, “Energy, oil and gas” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Cosym Holding, EPAM, Fleetcor, Heineken, ISUZU, Kiilto, Lantmännen Unibake, Oracle, PVH, RCI Banque, VARTA.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already partly sold their business or initiated bankruptcy procedures).

Here are just some of them: BASF SE (Partial exit, had 4 companies in Russia. 07.2023: The records about the founders of CONSTRUCTION RESEARCH AND TECHNOLOGY GMBH and MASTER BUILDERS SOLUTIONS DEUCHLAND GMBH have been removed. MBSS HONG KONG LIMITED and MBSS HONG KONG ESTABLISHMENT LIMITED become the new founders of the organization), Domino’s Pizza and its parent company DP Eurasia (The owner of the Domino’s Pizza brand in the Russian Federation, the company DP Eurasia, announced that it had stopped attempts to sell it and initiated the beginning of the bankruptcy of the Russian business. Pinsky and Tymaty will unite Domino’s Pizza franchisees under a new brand), Eastnine AB (Fully exit Russia after selling its operations. The Swedish Eastnine AB announced the conclusion of an agreement with GEM Invest LLC on the sale of its stake in Melon Fashion Group (MFG; manages clothing stores Sela, Zarina, Love Republic). As noted in the message of the Swedish company, the purchase price of 36% of the shares is 15.6 billion rubles. The transaction is expected to be completed within two weeks), Fast Retailing/Uniqlo (The Japanese company Uniqlo, which made the decision to leave the Russian market a year ago, refused to rent premises for its stores in Russia. All lease contracts were terminated with penalties, all staff were fired with 11 salaries, and Japanese managers were transferred to other countries), FM Logistic (The French logistics operator FM Logistic sells for more than 3 billion rubles another warehouse complex Central Properties in Dmitrov near Moscow), IKEA (The owner of the IKEA chain has sold its headquarters in Russia), Linhardt Gruppe (The authorized capital was increased from 101,566,029 ₽ to 120,000,000 ₽. Myasnikov Dmitry Georgievich and Pfaifer Evgeny Georgievich become the new founders of the organization. Linhardt Gruppe left 45% of shares), Magna International (LLC “E-MOBIL” became the new founder of the organization(LLC “MAGNA SEATING RUS”). The record about the founder MAGNA SITING BETEILIGUNGS GMBH has been removed. No changes in ownership of JSC “MAGNA AUTOMOTIVE RU”), Mondi Group (Mondi has completed the sale of its three Russian packaging converting operations to the Gotek Group, receiving net proceeds of €30.4m. 07.2023: partial exit, 3 companies (LLC “MONDI LEBEDYAN”, LLC “MONDI PERESLAVL” and LLC “MONDI ARAMIL”) out of 5 were sold and changed owners, key one (JSC “MONDI SYKTYVKAR LPK” and small LLC “MONDI SALES CIS”) were not sold yet but approved by the Kremlin), National Investment Company (The legal entity is active again. 14.08.2023: The authorized capital was increased from 24,130,000 ₽ to 100,000,000 ₽. Zuev Boris Afanasyevich and Savitsky Sergey Vasilievich become the new founders of the organization. National Investment Company OÜ left 24% of shares), SRV (SRV Yhtiöt Oyj sells most of its remaining Russian holdings, continuing its exit from the country – sold stake in one shopping center, negotiating remaining assets), Toyota Motor Corporation (Toyota plant in St. Petersburg was sold without a buyback option), Uniqa (UNIQA is selling its 75 per cent share in the Russian company Raiffeisen Life to the Russian insurance company Renaissance Life, along with AO Raiffeisenbank, which belongs to the Raiffeisen Bank International Group and owns the remaining 25 percent of the shares), Valeo (The French company Valeo has agreed to sell the Russian power systems business to NPK Avtopribor and is awaiting approval of the deal by government agencies. Moreover, the company wants to retain the right to repurchase assets), Vestas (in the process of liquidation).

The next review of deals for September 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁷

14.08.2023

*Turkmengas (Turkmenistan, Energy, oil and gas) Status by KSE – wait

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

Turkmenistan refused to pump Russian gas to China. The Kremlin’s plans to create a “gas union” in Central Asia to pump more gas to China have met with resistance from Turkmenistan, China’s largest supplier of pipeline gas. https://www.rbc.ru/politics/12/08/2023/64d7a4549a79479f19b76932

https://www.moscowtimes.ru/2023/08/13/turkmenistan-otkazalsya-kachat-rossiiskii-gaz-v-kitai-a51834

*Google (USA, Online Services) Status by KSE – wait

*Alphabet (USA, Online Services) Status by KSE – wait

*YouTube (USA, Online Services) Status by KSE – wait

Users encountered difficulties in using Google services on Saturday, August 12. According to the DownRadar service, problems were recorded in various parts of the country, with complaints from Moscow, St. Petersburg and Kazan being especially frequent. https://t.me/banksta/40468

https://www.kommersant.ru/doc/6159708

https://www.moscowtimes.ru/2023/08/12/v-rossii-nachalis-problemi-s-dostupom-k-google-a51830

https://news.finance.ua/ua/google-pochav-blokuvaty-posluhy-dlya-pidsankciynyh-rosiys-kyh-kompaniy

According to the results of the first half of the year, the income of the top 10 Russian bloggers from advertising integrations on YouTube increased by an average of 19%, to 483 million rubles was calculated by the Association of Bloggers and agencies (ABA).

https://www.kommersant.ru/doc/6159964

*Apple (USA, Electronics) Status by KSE – leave

Employees of the Ministry of Digital Development are prohibited from using Apple equipment for official purposes, said the head of the ministry, Maksut Shadayev.

https://www.kommersant.ru/doc/6159309

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

The Kazakh depository began to refuse to transfer Russian Eurobonds for replacement due to the measures introduced by the Belgian Euroclear. The total amount that Russian investors want to sue from the European depositary Euroclear has exceeded 200 billion rubles.

https://www.rbc.ru/finances/12/08/2023/64d7999e9a794788abe52d85

https://www.kommersant.ru/doc/6159862

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Ukraine war veteran attacks Unilever. Unilever boss promises Ukrainian soldier he will reassess Russian business with ‘fresh eyes.

https://www.thetimes.co.uk/article/ukraine-war-veteran-attacks-unilever-qnntw68m5

15.08.2023

*Argus Media (Great Britain, Consulting, Law) Status by KSE – stay

Argus launches freight rates for Russian petroleum products exports

*Laude Smart Intermodal S.A. (Poland, Logistics, Transport) Status by KSE – wait

Company increased its revenue in Russia in 2022 vs 2021 but transferred €100 million worth of assets to Ukraine

*Azerbaijan Airlines (Azerbaijan, Air Transportation) Status by KSE – stay

Initially suspended flights to Russia but later resumed flights to Moscow (#184) and to Makhachkala (№9232).

*Royal Air Maroc (Morocco, Air Transportation) Status by KSE – stay

Initially сanceled Russian routes but later resumed flights to Moscow (Sheremetyevo) on Fridays and Tuesdays.

https://www.royalairmaroc.com/ru-ru

*MSD (USA, Pharma, Healthcare) Status by KSE – wait

The American pharmaceutical company MSD has stopped deliveries and production in Russia of Isentress based on raltegravir for patients with HIV. Roszdravnadzor confirmed that the Russian subsidiary of the American company MSD Pharmaceuticals notified the service of its plans.

https://www.kommersant.ru/doc/6159871

*Microsoft (USA, IT) Status by KSE – wait

After Russian Licenses Freeze the government announced the ability of Russia to live without Microsoft software.

https://finance.yahoo.com/news/microsofts-stock-top-stories-russian-215855271.html

*Reddit (USA, Media) Status by KSE – wait

A court in Moscow for the first time fined Reddit 2 million rubles for not deleting prohibited information.

https://www.kommersant.ru/doc/6161019

*Bionorica (Germany, Pharma, Healthcare) Status by KSE – leave

German pharmaceutical company Bionorica put up for sale an unfinished plant in Voronezh.

*Eastnine AB (Sweden, Hospitality, Real estate) Status by KSE – leave

Eastnine to sell a 36% stake in Zarina and Love Republic to a Russian company. Swedish Eastnine AB has signed an agreement on the sale of about 36% of the fashion retailer Melon Fashion Group (MFG; manages clothing stores Sela, Zarina, Love Republic) to Russia’s GEM Invest LLC. According to a press release on the Eastnine website, the purchase price of the stake is approximately RUB 15.6 billion. The transaction is expected to be completed within two weeks.

https://www.eastnine.com/en/press/eastnine-enters-agreement-sell-its-investment-mfg-2148111

*Fleetcor (USA, Finance and payments) Status by KSE – exited

FLEETCOR Technologies, Inc., a leading global business payments company, on August 15, 2023 announced the sale of its Russia business to a local investment group.

https://www.businesswire.com/news/home/20230815809320/en/FLEETCOR-Exits-Russia

16.08.2023

Volkswagen (Germany, Automotive) Status by KSE – exited

Production of cars at the former Volkswagen plant in Kaluga may begin before the end of 2023, and as early as 2024, the production of passenger cars at the former Mercedes plant in the Moscow region may begin, Deputy Prime Minister Manturov said.

https://tass.ru/ekonomika/18509457

https://lenta.ru/news/2023/08/15/avto/

*UBS (Switzerland, Finance and payments) Status by KSE – wait

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

The Moscow Arbitration Court imposed restrictive measures on the Swiss banks Credit Suisse and UBS as part of the bankruptcy lawsuit of Bank Zenit. Now they will not be able to dispose of shares and shares in Russian subsidiaries.

https://www.kommersant.ru/doc/6161236

*Faurecia (France, Automotive) Status by KSE – leave

Russian top managers can buy the assets of a major auto components manufacturer Faurecia in Russia, they have already registered a new company for this. Faurecia plans to leave the Russian Federation became known at the beginning of 2023: the company referred, among other things, to the cessation of work of foreign automakers.

https://www.kommersant.ru/doc/6161278

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

Carlsberg ‘shocked’ at seizure of Russian subsidiary: Carlsberg’s CEO in a Reuters comment: We no longer have contacts with our employees in Russia; we have limited contacts with the Russian authorities.

https://www.ft.com/content/ceb08a80-3b88-4f28-b8bb-7bce67743a84

https://www.epravda.com.ua/news/2023/08/16/703285/

*Embracer Group (Sweden, Gaming) Status by KSE – stay

Savvy Games canceled a $2 billion deal with Embracer, which has assets in the Russian Federation

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever’s CEO pledges to reexamine Russia presence following backlash

*Viciunai group (Lithuania, Food & Beverages) Status by KSE – wait

Viciunai successfully defends Russian trademark in court

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Nasdaq-listed Freedom Holding has been evading Russian sanctions, a short-seller charges

*Telegram (United Arab Emirates, Online Services) Status by KSE – stay

Telegram filed a protocol for refusing to localize data. Messenger faces a fine of 6 to 18 million rubles.

https://ria.ru/20230816/telegram-1890363535.html

*Duracell (USA, Electronics) Status by KSE – wait

Duracell will return to Russia under a new name.

https://lenta.ru/news/2023/08/16/medved_vmesto_zaytsa/

*Kiilto (Finland, Chemical industry) Status by KSE – exited

With the approval of the Russian authorities, Kiilto has now been able to sell all its Russian subsidiaries. After a transition period, Kiilto brands will no longer be sold in the Russian market. JSC Kiilto-Klei, Kiilto Family LLC and Kiilto-Klei Ramenskoe LLC were transferred to Bergauf Group.

https://www.kiilto.com/newsroom/kiiltos-business-activities-in-russia-ceased/

17.08.2023

*SEFE Securing Energy for Europe (Germany, Energy, oil and gas) Status by KSE – stay

Gas from Russia will enter Germany via Oman. The German SEFE (Gazprom Germania), which was nationalized from Gazprom in Germany in April 2022, and Oman LNG have agreed to supply LNG from 2026 for the supply of 400 thousand tons of LNG (550 million m3 of gas) per year.

https://www.tinkoff.ru/invest/social/profile/basebel/8e9a4dc4-2d1f-47df-af64-7f6c134fe250/

https://eadaily.com/ru/news/2023/08/16/gazprom-vernetsya-v-germaniyu-cherez-oman

*Defense Engineering (Kazakhstan, Defense) Status by KSE – stay

*Versor (Slovakia, Defense) Status by KSE – stay

The US Treasury Department on Wednesday, August 16, 2023 announced sanctions against three companies from Kazakhstan, Russia and Slovakia that facilitate the arms trade between Moscow and Pyongyang.

https://home.treasury.gov/news/press-releases/jy1697

*OMV (Austria, Energy, oil and gas) Status by KSE – stay

Austria cannot do without gas from Russia, even in the long run. The unilateral termination of the contracts could immediately be challenged by Gazprom. The trial will take a long time, during which Austria is obliged to continue to pay, Musilek, ex-manager of OMV, said.

https://www.tinkoff.ru/invest/social/profile/Ma_ri_hin/dd54197f-96e1-4240-b62e-3e948888d292/

https://ria.ru/20230815/gaz-1890299220.html

*Autodesk (USA, IT) Status by KSE – leave

*General Electric (GE) (USA, Industrial equipment) Status by KSE – wait

*Honeywell (USA, Defense) Status by KSE – exited

The largest companies in the chemical industry are replacing software / products from Autodesk, General Electric and Honeywell

https://www.tadviser.ru/a/685590

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

The United Tea Company, which bought out the capacities of the former Unilever tea factory, among whose co-owners the ex-head of Luzhniki Alexander Pronin, also acquired the Beseda brand, which was part of the Unilever portfolio.

https://www.kommersant.ru/doc/6161947

*Google (USA, Online Services) Status by KSE – wait

*Alphabet (USA, Online Services) Status by KSE – wait

A court in Moscow fined Google 3 million rubles. for not deleting inaccurate videos about a special operation in Ukraine.

https://www.vedomosti.ru/society/news/2023/08/17/990591-google-oshtrafovali-na-3-mln-rublei

*SITA (Switzerland, Aircraft Industry) Status by KSE – leave

Russian and foreign air carriers may face problems when operating flights between Russia and other countries in the fall of 2023. Difficulties may arise after the shutdown of Russia by the Swiss company Societe Internationale de Telecommunication Aeronautiques (SITA). It is the most widely used tool in global civil aviation for the exchange of information between airlines and airports. The system is used by more than 2.5 thousand customers in 200 countries, and its technologies are used on 90% of all international flights.

18.08.2023

*Valeo (France, Automotive) Status by KSE – leave

The French company Valeo has agreed to sell the Russian power systems business to NPK Avtopribor and is awaiting approval of the deal by government agencies. Moreover, the company wants to retain the right to repurchase assets.

https://www.kommersant.ru/doc/6171421?tg

*OKX (Seychelles, Finance and payments) Status by KSE – stay

Crypto exchange OKX reopened access to the site for Russian users, on August 7 Roskomnadzor of Russia restored user access to the okx.com platform

https://www.rbc.ru/crypto/news/64df72dc9a7947b181dfb25a

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Hindenburg target Freedom Holding to keep working with non-sanctioned Russians

*Danone (France, FMCG) Status by KSE – leave

Danone in Russia will be renamed H&N in September

https://www.kommersant.ru/doc/6171443?tg

*Glencore (Switzerland, Agriculture) Status by KSE – wait

The Arbitration Court of Moscow refused to arrest shares of Rosneft owned by Glencore at the request of Sberbank.

19.08.2023

*JDE Peet’s (Netherlands, Food & Beverages) Status by KSE – wait

The owner of Peet’s Coffee is making a series of changes to its business to keep selling in Russia, offering a rare example of how some companies are charting a new normal as the Ukraine war rages on.

https://www.wsj.com/business/retail/why-this-coffee-giant-is-staying-put-in-russia-1c7e9ffa

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

Citigroup Inc. has bought about $160 million of Russian aluminum from the London Metal Exchange, something many banks have refused to touch since the invasion of Ukraine.

21.08.2023

*DP Eurasia (Netherlands, Public catering) Status by KSE – leave

*Domino’s Pizza Inc. (USA, Public catering) Status by KSE – leave

The owner of the Domino’s Pizza brand in the Russian Federation, the company DP Eurasia, announced that it had stopped attempts to sell it and initiated the beginning of the bankruptcy of the Russian business

https://www.ft.com/content/024b9d3a-5ed6-41a0-b342-97d84fc9933d

*Lantmännen Unibake (Sweden, Agriculture) Status by KSE – exited

EMC shareholder Shilov takes ownership of former Lantmannen Unibake subsidiary in Russia

https://interfax.com/newsroom/top-stories/93699/

*Audi (Germany, Automotive) Status by KSE – leave

Car concerns BMW and Audi have limited the access of Russian dealers to their software.

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

Citibank will suspend the purchase of dollars and euros at cash desks

22.08.2023

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The Russian division of Austria’s Raiffeisen Bank will start charging 50% commission on all incoming U.S. dollar transfers

*Valeo (France, Automotive) Status by KSE – leave

NPK Avtopribor to acquire Valeo Russia propulsion systems unit

*Uniqlo/Fast Retailing (Japan, Consumer goods and clothing) Status by KSE – leave

Uniqlo has refused to rent premises for all its stores in the Russian Federation: these spaces have already been occupied or are being occupied by other retailers.

*MSD (USA, Pharma, Healthcare) Status by KSE – wait

The American pharmaceutical manufacturer MSD will stop supplying Zepatir to Russia, one of the most sought-after drugs against hepatitis C.

https://www.kommersant.ru/doc/6172793

*MyGames (Netherlands, Gaming) Status by KSE – leave

The Boosty service, which became one of the most popular content monetization platforms after Patreon was blocked in Russia, may be sold by the end of the year. My.Games, which manages it, is already negotiating with potential buyers.

https://www.kommersant.ru/doc/6172106

*Emirates NBD (United Arab Emirates, Finance and payments) Status by KSE – wait

U.A.E. Cashes In on Russia’s Economic Woes

https://www.wsj.com/world/russia/u-a-e-cashes-in-on-russias-economic-woes-52700157?mod=hp_lead_pos6

https://lenta.ru/news/2023/08/21/oae/

*Xiaomi (China, Electronics) Status by KSE – stay

Russian UltraTrade, which owns the YouSmart brand of smart home products, intends to cancel the legal protection of the Xiaomi brand in the Russian Federation.

23.08.2023

*Novelis (USA, Manufacturing) Status by KSE – wait

Novelis is still buying some aluminum from Rusal under contracts agreed before Russia invaded Ukraine, but since the war started last year it has shunned new deals with the Russian firm

https://finance.yahoo.com/news/no-novelis-deals-buy-russian-114700165.html

(Domino’s Pizza Inc. (USA, Public catering) Status by KSE – leave

Timati allowed the purchase of the Russian business Domino’s Pizza

https://www.kommersant.ru/doc/6173280

*Binance (China, Finance and payments)Status by KSE – stay

Binance claims it adheres to Western sanctions in Russia. At least 5 blacklisted lenders are still processing payments for the exchange

*SAIPA (Iran, Automotive) Status by KSE – stay

Iranian SAIPA cars will be sold in Russia at a price of 1.2 million rubles.

https://www.kommersant.ru/doc/6173783?tg

*Nestle (Switzerland, FMCG) Status by KSE – stay

Since September, due to the devaluation of the ruble, Nestle has increased holiday prices for baby food, including breast milk substitutes, by 9%.

25.08.2023

*Stark Logistics (India, Logistics, Transport) Status by KSE – stay

*Metaprint (Estonia, Manufacturing) Status by KSE – wait

Company part-owned by Estonian PM’s husband continues deliveries to Russia

https://www.radiosvoboda.org/a/rosiya-ukrayina-zahroza-viyny/31703318/lbl0lbi351603.html

Reinsalu: Metaprint supplies essential raw materials to Russia

https://news.err.ee/1609075709/reinsalu-metaprint-supplies-essential-raw-materials-to-russia

*Iran Khodro (Iran, Automotive) Status by KSE – stay

The Russian taxi order aggregator “Yandex.Taksy” took a small batch of 12 Iranian sedans Iran Khodro Tara into trial operation.

https://iz.ru/1563640/2023-08-24/v-iandekstaksi-poiaviatsia-iranskie-mashiny

*ArcelorMittal Temirtau (Kazakhstan, Metals and Mining) Status by KSE – stay

The Ministry of Finance of Kazakhstan announced the possibility of selling the country’s largest metallurgical plant ArcelorMittal Temirtau to Russian investors.

*Slovenske Elektrarne (Slovakia, Energy, oil and gas) Status by KSE – wait

Slovenske Elektrarne picks Westinghouse to diversify from Russian fuel supplies

https://finance.yahoo.com/news/1-slovenske-elektrarne-picks-westinghouse-070607546.html

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – exited

HEINEKEN N.V. announces completion of the transaction to sell its Russia operations to Arnest Group. The transaction has received all the required approvals and concludes the process HEINEKEN initiated in March 2022 to exit Russia, incurring an expected total cumulative loss of €300m.

https://www.theheinekencompany.com/newsroom/heineken-completes-exit-from-russia/

*Japan Tobacco International (Switzerland, Alcohol&Tobacco) Status by KSE – stay

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

NACP included Philip Morris International and Japan Tobacco International in the list of international sponsors of the war

*Uniqa (Austria, Insurance) Status by KSE – leave

UNIQA is selling its 75 per cent share in the Russian company Raiffeisen Life to the Russian insurance company Renaissance Life, along with AO Raiffeisenbank, which belongs to the Raiffeisen Bank International Group and owns the remaining 25 per cent of the shares.

*Binance (China, Finance and payments) Status by KSE – stay

Binance “removed” Sber and Tinkoff from the list of payment systems

26.08.2023

*Continental (Germany, Automotive) Status by KSE – exited

Conti records $85 million expense for exiting Russia

https://www.rubbernews.com/news/continental-records-85m-expense-exit-russia

*Westinghouse (USA, Energy, oil and gas) Status by KSE – stay

Westinghouse Will Supply Nuclear Fuel for Russian-Designed Reactors in Slovakia

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Uniper considering legal options over sale of assets in Russia

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – exited

Heineken exits Russia at a loss of €300mn

https://www.ft.com/content/31fe848b-1b66-4dce-8a9b-72f6dbf4af38

The Russian business of Heineken went to the producer of “Dihlofos”

27.08.2023

*Binance (China, Finance and payments) Status by KSE – wait

Binance suspends P2P trading in Russia after sanctions enforcement investigation ends

28.08.2023

*Grindeks (Latvia, Pharma, Healthcare) Status by KSE – stay

*Olainfarm (Latvia, Pharma, Healthcare) Status by KSE – stay

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – wait

*Green Trace Ltd (Latvia, Electronics) Status by KSE – stay

*iCotton (Latvia, Manufacturing) Status by KSE – wait

LTV’s De Facto looks at businesses continuing exports to Russia

*VEON (Netherlands, Telecom) Status by KSE – leave

Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – leave

Moscow demands bigger discounts from foreign companies exiting Russia

*Binance (China, Finance and payments) Status by KSE – wait

In the Russian Federation, they proposed to block Binance due to restrictions for Russians

https://forklog.com/news/v-rf-predlozhili-zablokirovat-binance-za-ogranicheniya-dlya-rossiyan

29.08.2023

*Model Motors (Czech Republic, Automotive) Status by KSE – leave

The components in Lancets are often manufactured in the European Union. It has recently emerged that the engine mounted on the drone is an AXI 5330/18 made by the Czech company Model Motors. “Our company has never supplied its products to military use. According to our information, we are in connection with the relevant authorities in the Czech Republic and discovered that our products have been misused by a third party abroad for sale into some of the types of weapons the Russian army uses. We would like to assure everyone that we have taken steps to it could no longer happen and our products that were used to we no longer manufacture or market these weapons. War is evil.”

https://www.pravda.com.ua/eng/articles/2023/08/28/7417354/

*Essemtec (Switzerland, Electronics) Status by KSE – stay

Czech engines, US electronics. How the Russian-made Lancet attack UAVs expose holes in anti-Russian sanctions

https://www.pravda.com.ua/eng/articles/2023/08/28/7417354/

*Isuzu (Japan, Automotive) Status by KSE – exited

ISUZU sold the company to the Sollers Group, which disclosed the amount of the transaction to acquire the former Japanese Isuzu plant in the Russian Federation – the asset cost 2.8 billion rubles. The site is planned to be restarted by starting the production of trucks there.

https://www.kommersant.ru/doc/6185591

*OKX (Seychelles, Finance and payments) Status by KSE – wait

On August 29, one of the world’s largest crypto exchanges, OKX, closed the possibility for customers to carry out transactions using the Russian ruble on its p2p platform.

https://www.epravda.com.ua/news/2023/08/29/703704/

*Badminton World Federation (Malaysia, Sport) Status by KSE – stay

The Badminton World Federation (BWF) can confirm that athletes from Russia and Belarus will be allowed to participate as Individual Neutral Athletes in BWF sanctioned tournaments commencing 26 February 2024.

*SuperJet International (Italy, Aerospace) Status by KSE – leave

Emirati investors want to obtain a European certificate of the aircraft for production in the UAE

https://www.kommersant.ru/doc/6184407

*Honeywell (USA, Defense) Status by KSE – exited

According to Rosbank’s application, the court declared the Russian “daughter” of Honeywell bankrupt

https://www.interfax.ru/russia/918100

*Domino’s Pizza Inc. (USA, Public catering) Status by KSE – leave

*DP Eurasia (Netherlands, Public catering) Status by KSE – leave

Pinsky and Tymaty will unite Domino’s Pizza franchisees under a new brand

30.08.2023

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever’s new boss should seize last chance to exit Russia

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Czechia investigates Raiffeisen Bank due to its activities in Russia

https://kyivindependent.com/czechia-investigates-raiffeisen-bank-due-to-its-russia-activities/

https://news.yahoo.com/czechia-investigates-raiffeisen-bank-due-173842029.html

CEO of Austria’s Raiffeisen: cannot give timeframe for Russia exit

https://www.nasdaq.com/articles/ceo-of-austrias-raiffeisen:-cannot-give-timeframe-for-russia-exit

*UBS (Switzerland, Finance and payments) Status by KSE – wait

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

Credit Suisse’s Banker to Russian Billionaires Retained by UBS

31.08.2023

*United Nations (USA, Аssociation, NGO) Status by KSE – stay

The UN Is Still Doing Business With Russia, Is That O.K.?

*VVP Group (Kazakhstan, Electronics) Status by KSE – stay

VVP Group is looking for new routes and markets

https://www.kommersant.ru/doc/6186333

*KazMunayGas (Kazakhstan. Energy, oil and gas) Status by KSE – stay

Kazakhstan will buy tankers to transport oil around Russia

*General Electric (GE) (USA, Industrial equipment) Status by KSE – leave

The joint venture “Inter RAO” and GE in Russia will stop production of turbines

https://www.kommersant.ru/doc/6185970

*KuCoin (Seychelles, Finance and payments) Status by KSE – wait

On the p2p platform of the KuCoin crypto exchange, the Russian banks “Sber”, “Tinkoff” and others, in respect of which sanctions have been imposed, were removed.

https://www.rbc.ru/crypto/news/64edd4ad9a7947bdb0cf1f89?from=newsfeed

*Bybit (China, Finance and payments) Status by KSE – wait

Following Binance, crypto exchanges OKX and Bybit closed operations with sanctioned Russian banks on p2p platforms.

https://www.rbc.ru/crypto/news/64edd4ad9a7947bdb0cf1f89?from=newsfeed

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – wait

Poland charters tankers used for Russian oil to import Arab crude

https://www.reuters.com/business/energy/poland-charters-tankers-used-russian-oil-import-arab-crude-2023-08-31/

*Apple (USA, Electronics) Status by KSE – leave

Apple Sells Over US$1 Billion Of New iPhones In Russia During H1 2023

*Auchan (France, FMCG) Status by KSE – stay

Kyiv Urges Auchan To Exit Russia After Store Hit In Ukraine

https://www.barrons.com/news/kyiv-urges-auchan-to-exit-russia-after-store-hit-in-ukraine-df2ec07

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

China’s Great Wall Motor takes a bigger slice of Russian market

*Hyundai (South Korea, Automotive) Status by KSE – leave

With Losses Snowballing in Russia, Hyundai Motor May Lose Plant

https://www.businesskorea.co.kr/news/articleView.html?idxno=200731

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 4500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After 18 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no significant differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website