- Kyiv School of Economics

- About the School

- News

- 51th issue of the regular digest on impact of foreign companies’ exit on RF economy

51th issue of the regular digest on impact of foreign companies’ exit on RF economy

14 August 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 31.07-13.08.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

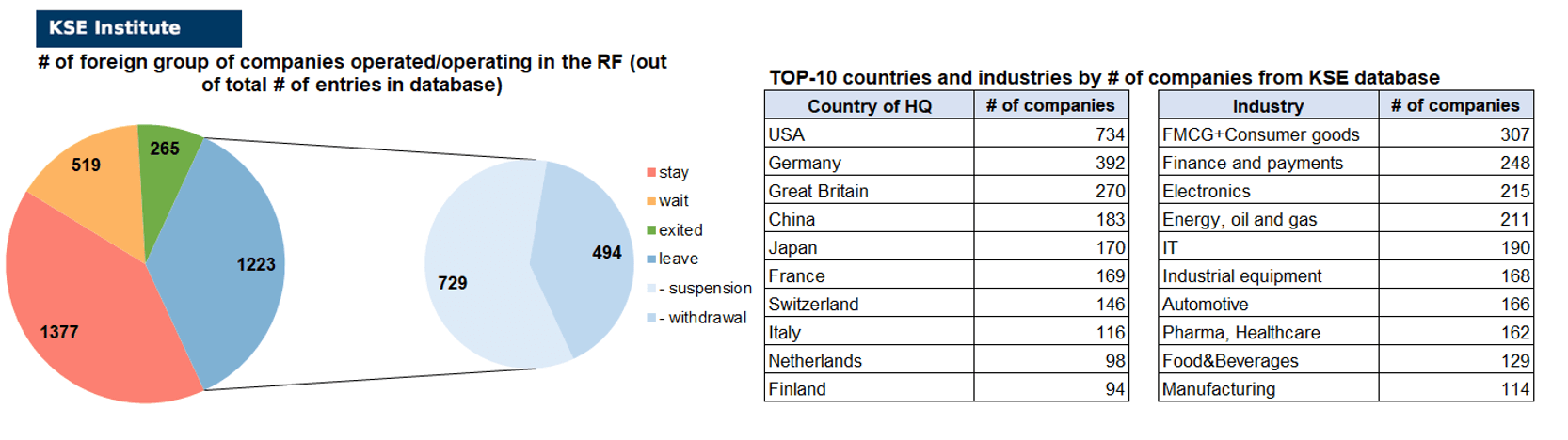

KSE DATABASE SNAPSHOT as of 13.08.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 377 (+11 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 519 (+4 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 223 (+4 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 265 (+3 per 2 weeks)

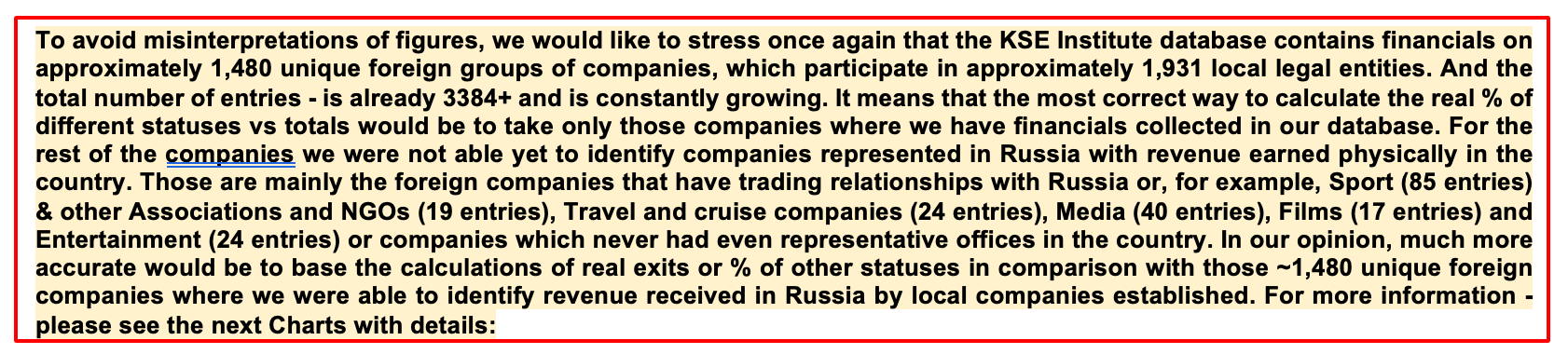

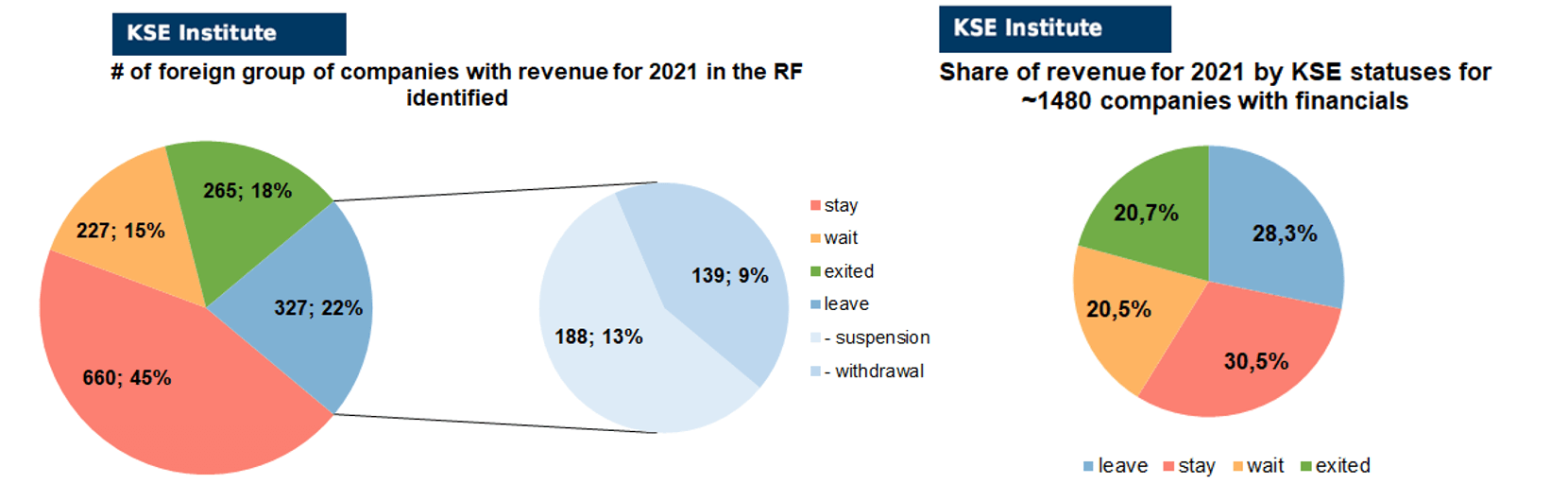

As of August 13, we have identified about 3,384 companies, organizations and their brands from 94 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 480 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $189.5 billion), local revenue (about $305.7 billion), local assets (about $327.4 billion) as well as staff (about 1.428 million people) and taxes paid (about $25.2 billion). 1,742 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 265 companies that have completed the sale/liqudation of their business in Russia based on the information collected from the official registers.

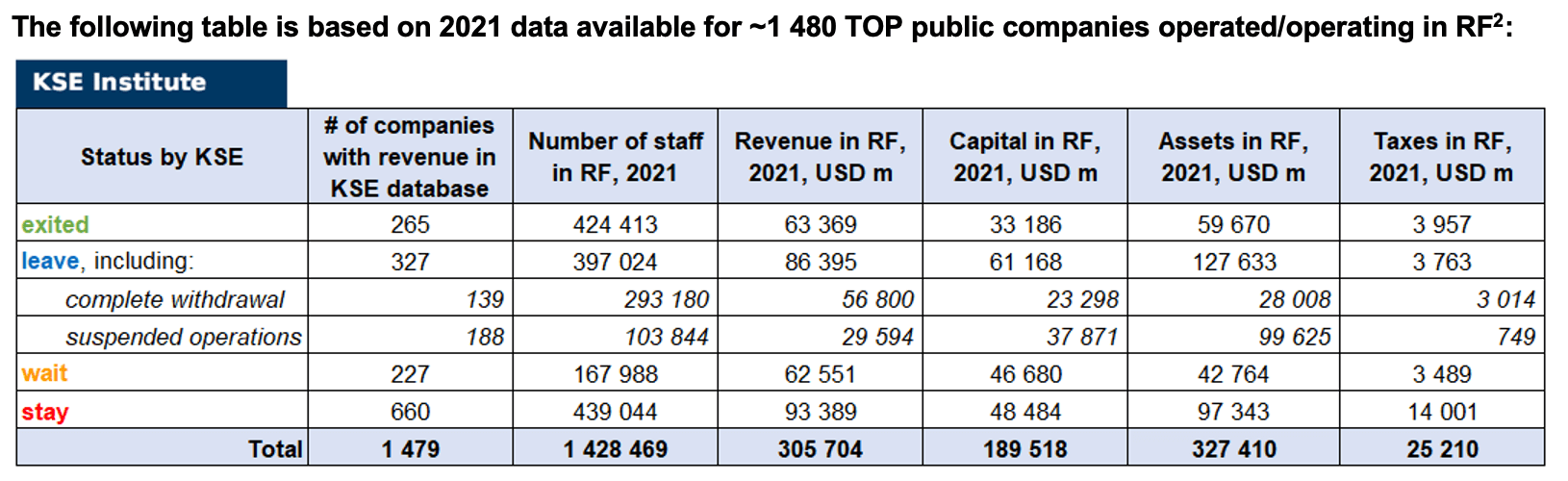

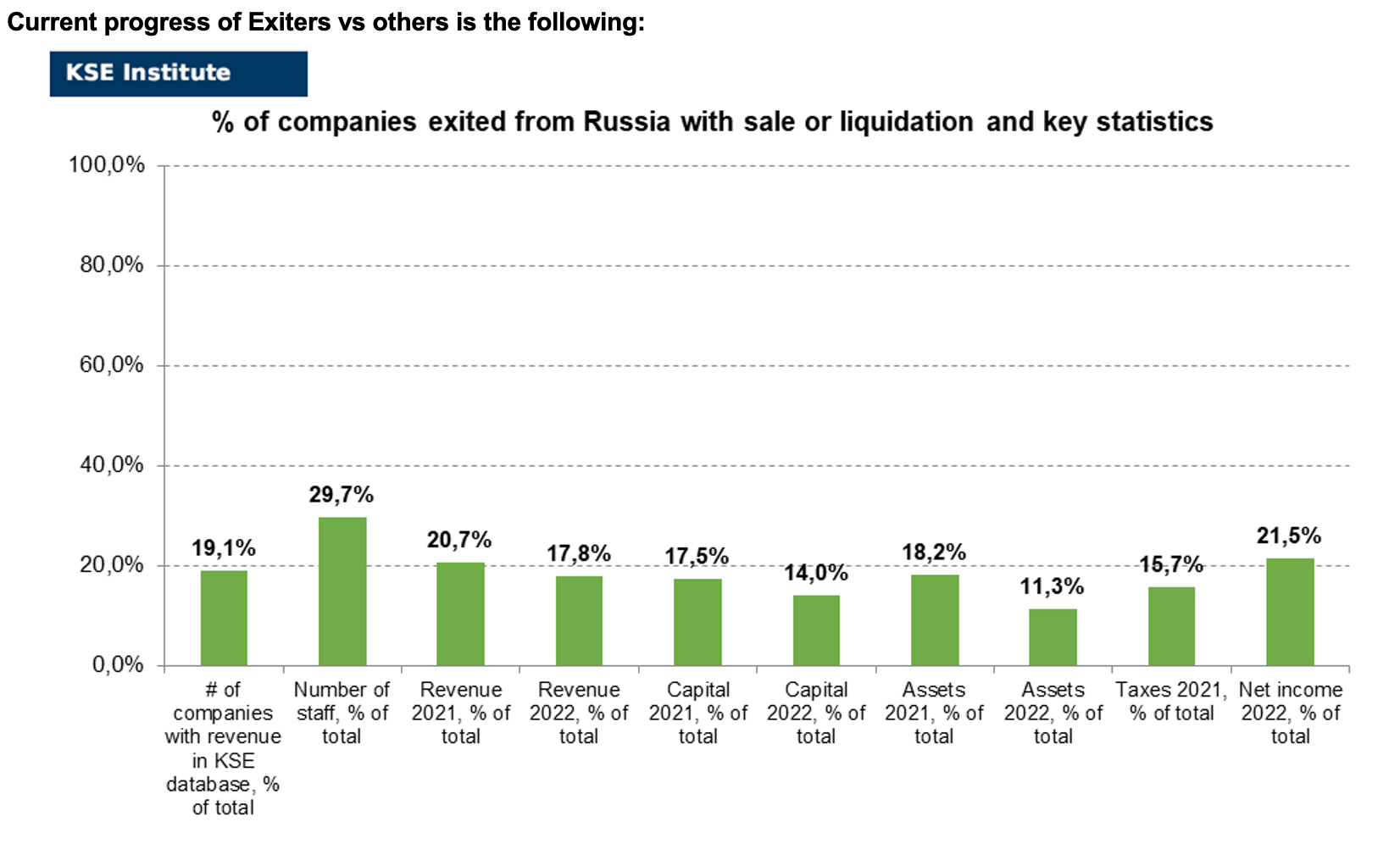

As can be seen from the tables below, as of August 13, 265 companies which had already completely exited from the Russian Federation, in 2021 had at least 424,400 personnel, $63.4 bn in annual revenue, $33.2bn in capital and $59.7bn in assets; companies, that declared a complete withdrawal from Russia had 293,200 personnel, $56.8bn in revenues, $23.3bn in capital and $28.0bn in assets; companies that suspended operations on the Russian market had 103,800 personnel, annual revenue of $29.6bn, $37.9bn in capital and $99.6bn in assets.

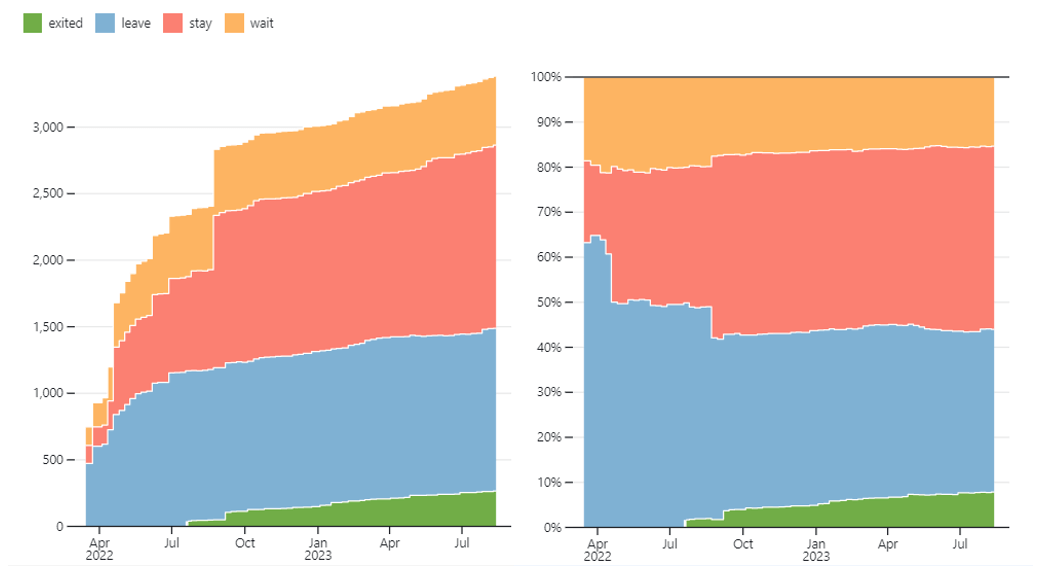

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 11 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 23 were added in August 2023). However, if to operate with the total numbers in KSE database, about 36.1% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.7% are still remaining in the country, 15.3% are waiting and only 7.8% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 265 companies that completely left the country, since in 2021 they employed 29.7% of the personnel employed in foreign companies, the companies owned about 18.2% of the assets, had 17.5% of capital invested by foreign companies, and in 2021 they generated revenue of $63.4 billion or 20.7% of total revenue and paid ~$4.0 billion of taxes or 15.7% of total taxes paid by the companies observed. Data on 1,480 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (18%) and on share of revenue withdrawn (21%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 30.5% of revenue and 15% of waiting companies represent 20.5% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

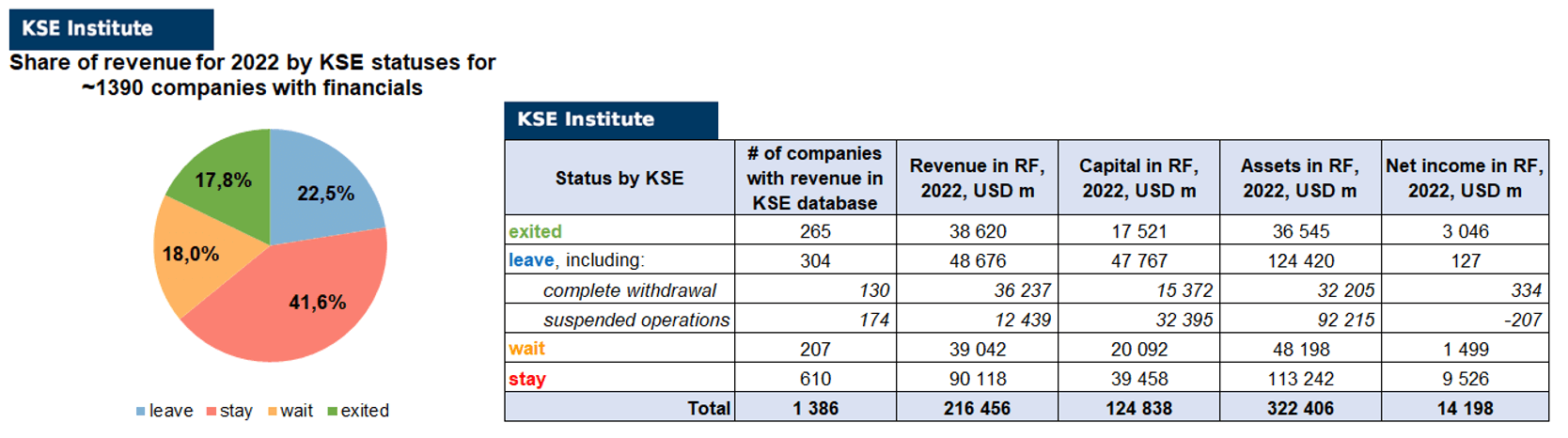

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1390 companies (about 100 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.9% less of revenue in 2022 (17.8% from total volume) than in 2021 (20.7% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-5.8%) revenue in 2022 (22.5% from total volume) than in 2021 (28.3% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+11.1%) more revenue in 2022 (41.6% from total volume) than in 2021 (30.5% from total volume). Companies with status “wait”⁴

gained almost the same share (-2.5%) of revenue in 2022 (18.0% from total volume) vs 20.5% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($322.4bn⁵ in 2022 vs $327.4bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Putin signed a law on blocking the funds of foreign companies that are under Russian sanctions

04.08.2023 | Russian President Vladimir Putin signed a law according to which funds and assets of foreign companies that have been sanctioned in Russia will be blocked in the Russian Federation. It spells out possible blocked persons: foreign states, organizations and citizens, stateless persons. Plus, legal entities controlled by them all – more than 50% of the votes in the highest governing body, including jointly with several blocked ones. All financial organizations will have to block transactions with their money and property – under the threat of Central Bank measures, up to the revocation of the license.

https://www.epravda.com.ua/news/2023/08/4/702911/ ; https://www.kommersant.ru/doc/6146594

Putin signed a law establishing a 10% tax on excess profits for large companies

04.08.2023 | The law will come into force on January 1, 2024. The tax will be credited to the federal budget and will be one-time.

https://www.kommersant.ru/doc/6146676

Putin has simplified the re-registration of significant companies in Russia

04.08.2023 | On August 4, Vladimir Putin signed a law that simplifies the transfer of economically significant companies to the jurisdiction of Russia.

https://www.kommersant.ru/doc/6146749

Russia Unilaterally Suspends Nearly Half of Double Tax Treaties

08.08.2023 | Russia unilaterally partially suspends almost half of the agreements on avoidance of double taxation – with 38 countries “unfriendly” to the Russian Federation. Among them are the countries of the European Union, as well as the USA, Canada, Australia, Japan, Great Britain and other states. As follows from the published new presidential decree, most of the provisions are frozen until the termination of the treaties or until the “violation of interests” of Russia is eliminated. In particular, we are talking about freezing the use of reduced or zero rates on dividends, royalties and interest. The suspension will not affect the norms that are important for individuals on the possibility of offsetting income tax if it is paid in another state. Lawyers note that the decree increases the tax burden on businesses – however, its full consequences depend on the response of unfriendly countries.

https://www.kommersant.ru/doc/6148595; https://www.kommersant.ru/doc/6148402; https://www.kommersant.ru/doc/6148402

Putin amended articles on informing the Council of Europe about martial law

08.08.2023 | A draft of amendments by Russian President Vladimir Putin to the articles on informing the UN and the Council of Europe about martial law and state of emergency in Russia has appeared in the State Duma database. The amendments provide for Russia’s refusal to inform the Council of Europe of its deviation from international treaties in terms of human rights in martial law and state of emergency.

https://www.kommersant.ru/doc/6148399 ; https://www.kommersant.ru/doc/6148883

Vladimir Putin signed a decree that allows the execution of currency state guarantees in rubles

09.08.2023 | According to the document, state guarantees will be able to be executed in rubles at the request of the beneficiary, and without it, if there is no possibility of execution in foreign currency.

WEEKLY FOCUS: Russian concentration in Africa

Fifty-three countries of the African continent ended the second millennium burdened with backwardness, numerous and extremely difficult economic, social, political, military, medical, environmental and other problems. The level of the economy of African countries is mostly determined by the place it occupies in the international division of labor as a source of raw materials, in particular, a third of Africa survives only at the expense of international aid. In general, a large part of the African population began to live poorer than under colonialism.

Africa is experiencing an environmental crisis, manifested in desertification caused by extensive agriculture and deforestation, as well as industrial pollution of the ecosphere. The environmental problems of African countries are largely related to the place they occupy in the system of global economic relations – the production and export of various types of raw materials.

After the end of the Cold War, Russian activity decreased sharply and its influence on the military and economic policy of African countries decreased. As an example, in 1992 Russian share of military exports to Africa was only 11%. At the same time, the weight of Africa in the international arena is growing due to demographics. After overcoming a number of restraining factors, the countries of the Dark Continent have achieved a stable trajectory of population growth. Africa can accommodate 3-4 billion people, 3 billion will probably live there in about 40 years, when the population of the entire planet will be 10 billion people. In addition, Africa is a market for literally everything from raw materials to food to information technology.

Against this background, the intervention of great powers in the affairs of African countries, the desire to tie them to itself, prompted Russia to reconsider its own interests in relation to African countries, since, objectively, the weight of Africa in world affairs increases, the surge of interest in Africa is observed not only in Russia, it is everywhere – in USA, China, Europe, UAE, Iran, Brazil, Argentina, Korea and Turkey.

For reference: at the beginning of this decade, Africa contains 90% of the world’s platinum reserves, 60% of manganese ores, 48.4% of chromium, 44.6% of titanium, 42.6% of bauxite, 19% of uranium, 10% of nickel, 7.1% of zinc; 42% of global production of cobalt, 40% of titanium, 36% of vanadium and 6-7% of copper is concentrated⁶

Fifty-three countries of the African continent ended the second millennium burdened with backwardness, numerous and extremely difficult economic, social, political, military, medical, environmental and other problems. The level of the economy of African countries is mostly determined by the place it occupies in the international division of labor as a source of raw materials, in particular, a third of Africa survives only at the expense of international aid. In general, a large part of the African population began to live poorer than under colonialism.

Africa is experiencing an environmental crisis, manifested in desertification caused by extensive agriculture and deforestation, as well as industrial pollution of the ecosphere. The environmental problems of African countries are largely related to the place they occupy in the system of global economic relations – the production and export of various types of raw materials.

After the end of the Cold War, Russian activity decreased sharply and its influence on the military and economic policy of African countries decreased. As an example, in 1992 Russian share of military exports to Africa was only 11%. At the same time, the weight of Africa in the international arena is growing due to demographics. After overcoming a number of restraining factors, the countries of the Dark Continent have achieved a stable trajectory of population growth. Africa can accommodate 3-4 billion people, 3 billion will probably live there in about 40 years, when the population of the entire planet will be 10 billion people. In addition, Africa is a market for literally everything from raw materials to food to information technology.

Against this background, the intervention of great powers in the affairs of African countries, the desire to tie them to itself, prompted Russia to reconsider its own interests in relation to African countries, since, objectively, the weight of Africa in world affairs increases, the surge of interest in Africa is observed not only in Russia, it is everywhere – in USA, China, Europe, UAE, Iran, Brazil, Argentina, Korea and Turkey.

For reference: at the beginning of this decade, Africa contains 90% of the world’s platinum reserves, 60% of manganese ores, 48.4% of chromium, 44.6% of titanium, 42.6% of bauxite, 19% of uranium, 10% of nickel, 7.1% of zinc; 42% of global production of cobalt, 40% of titanium, 36% of vanadium and 6-7% of copper is concentrated.⁶

In 2014, in connection with the annexation of Crimea, when the West began to impose sanctions against Russia, the geopolitical situation in the world and Russian position in it changed fundamentally. Russia has moved from ordinary, simple revisionism to an open military and political challenge to the countries of the West. As a result, the intensity of the geopolitical struggle in the world acquired a qualitatively different character. Accordingly, the pressure from the West on almost all countries of the world to abandon contacts with Russia has become very powerful. This pressure did not escape the countries of Africa.

Against this background, the Concept of Russian Foreign Policy was adopted in 2016 and it was declared that “Russia will expand multifaceted interaction with African states on a bilateral and multilateral basis by improving political dialogue and developing mutually beneficial trade and economic ties, increasing comprehensive cooperation in common interests, contribute to the prevention of regional conflicts and crisis situations, as well as post-conflict settlement in Africa. An important component of progress in this direction is the development of partnership relations with the African Union and subregional organizations.

Thus, in 2017-2018, the intensity of Russian communications with Africa increased significantly. It was a turning point when the perception of Africa began to change – from the periphery of the world to a priority partner. In 2019, the first “Russia-Africa” summit was held.

The specified summit in 2019 was considered as the starting point of a new promising stage in relations, when Russia will return to Africa and take the place of an important regional power on the continent alongside the “old” (former metropolises and the United States) and “new” (such as China, India and Turkey) states. And indeed, at that time Russia had some unique advantages in Africa: it was created during Soviet times as a hub of human and economic relations, not burdened by historical injuries, reputation, a set of competencies in demand in the region in the field of security, health care, and education. It is not surprising that in 2019 the Presidents or Prime Ministers of 45 of the 54 countries of the continent came to Sochi. The President of Russia set the task of doubling the volume of bilateral trade in the next four to five years, and the organizers boasted of almost a hundred signed agreements and memorandums of understanding worth more than 1 trillion Russian rubles (approximately 15 billion US dollars).

For reference: as of 2019, Russian foreign trade turnover with African countries amounted to 16.8 billion US dollars, and in 2021 it amounted to 14.6 billion US dollars⁷ , respectively Russia’s trade with Africa in 2019 was only 2.5% of Russian foreign trade turnover with other countries, which indicates a rather low level of Russian-African trade. In 2019, Russia exported 13.9 billion US dollars worth of goods to Africa, while it imported 2.9 billion US dollars worth of goods. In 2019, Russian exports has exceeded imports from African countries by 4.8 times⁸

In 2020, due to the COVID-19, the dynamics of the development of relations was lost, but now it is being restored again.

Russian business in Africa is represented by both state and private corporations. However, Africa accounts for only 1,5% of all foreign investments of Russia. However, the circle of states with which investment cooperation takes place is expanding⁹.

Food and fertilizers are included in the list of the main goods exported from Russia to African countries. In particular, these are vegetable oils, cereals, confectionery and chemical products. In turn, Russia imports cocoa, plants, vegetables and fruits from Africa. The 10 main African countries importing products to Russia are: Uganda, Algeria, Morocco, Senegal, Egypt, Nigeria, Tunisia, South Africa, Ivory Coast and Kenya. Russian exports are mainly present on the markets of North and West African countries, less deliveries are made to East Africa.

For reference: in 2022, trade between African countries and Russia amounted to 18 billion US dollars, of which 6.7 billion US dollars accounted for agricultural products (10% more than in 2021). Supplies by June 2023 have increased by more than half. So, from January to June, 10 million tons of grain went to Africa, which is 1.5 million tons more than last year alone.¹⁰

After the start of a full-scale Russian-Ukrainian war in 2022, Western sanctions pressure began on Russian companies that are represented in Africa and that began to experience difficulties in their work, which negatively reflected in Africa itself. At the same time, most African countries took either a neutral or a pro-Russian position in the Russian war with Ukraine. This is evidenced by the fact that when the President of Ukraine Volodymyr Zelenskyy addressed the African Union in June of last year, only a few of the participating countries were represented by the top authorities, many were limited to diplomats of not the highest level, which may suggest that it was done demonstratively.

Against this background of Russia’s international isolation, Moscow is trying to find allies, in particular, in Africa. Thus, on June 27-28 this year, the second “Russia-Africa” summit began in St. Petersburg, and Russian-African economic and humanitarian forums took place within its framework.

The official goal of the summit is to strengthen Moscow’s “comprehensive and equal cooperation” with African countries “in all dimensions”: politics, security, economy, scientific, technical and humanitarian areas. In this regard, Russia, in exchange for its reliable partnership, requires Africa to choose between Russia and the West, which in the current realities – trade and geopolitical – cannot satisfy most African countries. At the same time, the President of Russia recalled that Russia wrote off the debts of African countries in the amount of more than 20 billion US dollars, while declaring that Moscow will transfer up to 50 thousand tons of grain to six African countries: Burkina Faso, Zimbabwe, Mali, Somalia, Eritrea and CAR.

The unofficial goal of the summit is an attempt to break the international isolation of Russia, which came after the beginning of Russian aggression against Ukraine in 2022, after all, the votes of African countries are 25% of the votes in the UN, and also to ensure the unofficial interests of the Russian elites in Africa to receive income from all kinds of illegal operations, including trade in gold, diamonds, wood, in particular with the help of the military Wagner Group.

So to summarize, what has been said, it should be noted that the economic factor is one of the determining factors when building relations with Africa. The topic of security is also of fundamental importance – in some countries the situation is so acute that there is no question of cooperation in some areas, therefore, the task of ensuring security in Africa is a certain minimum, after which it is possible to build economic relations with African countries. A vivid example is Somalia, which is gradually emerging from a crisis after a protracted conflict, in particular, space for new economic projects is opening up there. On the basis of these factors, Russia shrank economically and got involved in an unsuccessful war, as a result of which it will be difficult for it to maintain its pre-war state status. African countries were also affected by the rise in energy prices due to Western sanctions imposed on Russian oil and gas exports.

Increased attention to Russian-African modern relations is quite understandable. Africa may seem a long way from the Russian-Ukrainian war, but in fact the negative consequences of hostilities directly affect the Dark Continent.

Against the backdrop of attempts by Western countries to isolate Russia, almost half of Russian remaining friends are African countries. This is manifested both in Russia’s support at the UN and in economic relations – Russian exports, which used to go to Western countries, are now going to African countries.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹¹

31.07.2023

*ExxonMobil (USA, Energy, oil and gas) Status by KSE – wait

ExxonMobil was (and still is) the largest provider of lubricants and other chemicals to Russia. A couple of interesting observations: first, the overall volume has not decreased after the full-fledged invasion, the second – most of the exports were originated in the United States

https://squeezingputin.com/support.html#Exxon24Jul23

*Vestas (Denmark, Energy, oil and gas) Status by KSE – leave

The exit of Vestas from Russia turned into courts and a criminal case

https://www.kommersant.ru/doc/6135557

Norsk Hydro (Norway, Energy, oil and gas) Status by KSE – leave

Norsk Hydro And Rusal In War Of Words Over Russian Aluminum In LME Warehouses

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

India’s BPCL still in talks for Russian oil deal, discounts narrow

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

ZARA, Massimo Dutti and Bershka may return to Ukraine in the fall, but there is a nuance

*Eutelsat (France, Telecom) Status by KSE – leave

Eutelsat revenues impacted by Russia loss

https://www.broadbandtvnews.com/2023/07/28/eutelsat-revenues-impacted-by-russia-loss/

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

Industry groups urge LME to resist calls to ban Russian aluminum

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

Ikea left Russia — but yet another copycat has popped up in its place. The real store says it could take action.

https://www.businessinsider.com/russia-ikea-copycat-opens-moscow-ukraine-war-dupe-good-luck-2023-7

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

Wintershall Dea CEO says exiting Russia gets harder by the day

01.08.2023

*Aircastle (USA, Leasing, rental) Status by KSE – leave

Aircraft lessor Aircastle has sued its insurers demanding they pay out $102.4mn across two separate claims to cover the loss of planes detained in Russia since the country’s invasion of Ukraine, taking the global tally for claims filed against insurers to more than $10bn.

*Libyan Railroads (Libya, Logistics, Transport) Status by KSE – stay

Libyan Railroads and the Russian Railways Company (RZhD), Libya branch, discussed ways to activate the stalled Sirte-Benghazi rail project

*Northrop Grumman (USA, Aerospace) Status by KSE – wait

Northrop Grumman prepares for final flight of Antares with Russian and Ukrainian components

*UBS (Switzerland, Finance and payments) Status by KSE – wait

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

The Swiss bank UBS decided to abandon a significant part of the Russian clients of Credit Suisse and close their accounts.

*Canon (Japan, Electronics) Status by KSE – leave

*Fujifilm (Japan, Electronics) Status by KSE – leave

*Sony (Japan, Electronics) Status by KSE – leave

*Duracell (USA, Electronics) Status by KSE – leave

Cameras of the Japanese brands Canon, Fujifilm, Sony and batteries of the American Duracell will be included in the list of parallel imports.

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – wait

Heineken states that the timing of the exit from Russia does not depend on the company

https://www.epravda.com.ua/news/2023/07/31/702758/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen’s profit in Russia in the first half of the year grew by 9%

https://ru.investing.com/news/personal-finance-news/article-2279874

Raiffeisen Bank International (RBI) has postponed the deadline for exiting the Russian market from the end of September to the end of 2023

*DJI (China, Technology) Status by KSE – stay

China curbs exports of drone equipment amid U.S. tech tension

02.08.2023

*Turkmenistan Airlines (Turkmenistan, Air Transportation) Status by KSE – stay

Turkmenistan Airlines reported that it has suspended flights to Moscow since August 1 “due to the air situation in the Moscow air zone, as well as on the basis of a risk assessment in order to ensure flight safety”. All flights will be operated on a different route: Ashgabat – Kazan – Ashgabat.

https://www.kommersant.ru/doc/6136799/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank boosts pay for Russian staff by €200mn

https://www.ft.com/content/2bd54bc4-f3ed-4ed0-912e-a154231632e8

Austria’s RBI delays expected Russian asset spin-off till year’s end

https://www.kommersant.ru/doc/6136707

Also, Raiffeisen Bank International (RBI), which owns Raiffeisenbank, has estimated excess profit tax costs (windfall tax) in Russia at 50-100 million euros.

https://www.interfax.ru/business/914272

*Gatik Ship Management (India, Marine Transportation+Energy, oil and gas) Status by KSE – stay

Antwerp detains ‘dark fleet’ Gatik tanker after STS transfers with Greece-owned ships

*UBS (Switzerland, Finance and payments) Status by KSE – wait

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

The Swiss bank UBS will close most of the accounts of Russians that came to it after the takeover of Credit Suisse

*Emirates NBD (United Arab Emirates, Finance and payments) Status by KSE – wait

Investors managed to unlock part of the assets on accounts with Emirates NBD. We are talking about securities of American issuers and part of the funds on investment accounts in ENBD. Access to European securities and payments on them remains limited.

https://www.rbc.ru/finances/01/08/2023/64c77bce9a7947855d6b7bb1

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

The German energy concern Uniper does not count on the resumption of Russian gas supplies and is waiting for a court decision on a lawsuit against Gazprom Export for gas supplies no earlier than 2024

https://tass.ru/ekonomika/18418729

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – stay

Japan’s Mitsui signs SPAs for Russian Arctic LNG 2 equity liftings

*SRV Yhtiot Oyj (Finland, Hospitality, Real estate+Construction & Architecture) Status by KSE – leave

SRV Yhtiöt Oyj sells most of its remaining Russian holdings, continuing its exit from the country

03.08.2023

*Water And Energy Solutions (Morocco, Utilities and communal services) Status by KSE – stay

Water And Energy Solutions (Morocco) and Russia’s Rosatom signs for new water purification solutions

https://www.afrik21.africa/en/morocco-russias-rosatom-signs-for-new-water-purification-solutions /

*Purmo Group (Finland, Electronics) Status by KSE – leave

Signed agreement to divest all Russian operations

https://www.purmogroup.com/en/who-we-are/news/2023/agreement-to-sell-russian-business

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – wait

The largest Italian bank, Intesa Sanpaolo, has decided to close its representative office in Moscow, although it was unable to obtain permission to completely withdraw from Russia due to restrictions on the sale of assets.

https://www.kommersant.ru/doc/6137106

https://www.epravda.com.ua/news/2023/08/2/702831/

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank is introducing a 5% fee for USD and EUR cash deposits from August 15, 2023

https://www.kommersant.ru/doc/6137445

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

*JPMorgan (USA, Finance and payments) Status by KSE – wait

*Halyk Bank (Kazakhstan, Finance and payments) Status by KSE – exited

*Jusan Bank (Kazakhstan, Finance and payments) Status by KSE – wait

*Kaspi.kz (Kazakhstan, Finance and payments) Status by KSE – wait

*Ameriabank (Armenia, Finance and payments) Status by KSE – wait

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

As Western companies and international investors rushed to exit Russia amid the Ukraine invasion and the sweeping sanctions that followed, they were desperate to swap their rubles for dollars. For currency traders at firms including Goldman Sachs, Citigroup and JPMorgan Chase & Co., it was easy money: They found a way to scoop up greenbacks at a low price and then sell them to those fleeing clients for a healthy markup without running afoul of sanctions, people with direct knowledge of the transactions said.

Such banks as Halyk Savings Bank of Kazakhstan JSC, First Heartland Jusan Bank JSC and Kaspi.kz JSC in Kazakhstan and Ameriabank CJSC from Armenia also actively helped foreign companies and international investors who hastened to leave Russia to exchange their rubles for dollars, making good money on this actively helped foreign companies and international investors who hastened to leave Russia to exchange their rubles for dollars, making good money on this. Raiffeisen Bank International AG, the Austrian lender with a large Russian presence, also has been one of the most active sellers.

https://www.epravda.com.ua/news/2023/08/2/702841/

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

The Belgian Ministry of Finance began to review refusals to unlock assets in Euroclear – this was achieved by a private investor with an EU residence permit and accounts in Switzerland

https://www.kommersant.ru/doc/6136870

*FM Logistic (France, Logistics & Transport) Status by KSE – leave

The French logistics operator FM Logistic sells for more than 3 billion rubles another warehouse complex Central Properties in Dmitrov near Moscow

https://www.kommersant.ru/doc/6137534

*JDE Peet’s / Jacobs Douwe Egberts (Netherlands, Food & Beverages) Status by KSE – leave

JDE Peet’s (coffee brands Jacobs, L’Or, Tassimo) will stop selling foreign brands of coffee and tea in Russia before the end of the year.

04.08.2023

*Letim (Turkey, Online Services) Status by KSE – stay

The Letim application, with which Russians can apply for a virtual Turkish card of the Troy payment system, has appeared in the AppStore and PlayMarket. Virtual card payment is available via QR code in “all physical stores in Turkey”. It is also possible to withdraw money from ATMs. For a digital wallet, online replenishment is provided.

https://www.kommersant.ru/doc/6137548

*HashKey Exchange (Hong Kong, Finance and payments) Status by KSE – leave

Russians have been banned from trading on Hong Kong’s first official crypto exchange HashKey Exchange. Russia was on the sanctions list of the local regulator.

https://www.rbc.ru/crypto/news/64cb9aca9a79474bf43048fe

*Future Re Company (North Korea, Insurance) Status by KSE – stay

The North Korean insurance company plans to enter the Russian market. Future Re Company will be engaged in reinsurance of property against emergencies, marine insurance and insurance of construction and installation risks.

https://www.interfax.ru/business/914588

https://www.kommersant.ru/doc/6137580

*South African Nuclear Energy Corporation (Necsa) (South Africa, Energy, oil and gas) Status by KSE – stay

Russian company TVEL and Necsa to cooperate on nuclear fuel production

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Digit Broker (former Freedom Finance) announced that it had received a refusal from the Belgian Ministry of Finance to unfreeze assets frozen in NSD’s accounts at the Euroclear international depository.

https://quote.rbc.ru/news/article/64cb8b219a7947fd3301cf4f

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

The State Bank of India (Central Bank) has approved 34 applications from Russian banks to open rupee accounts with 14 Indian banks, State Minister of Trade and Industry Anupriya Patel said.

https://tass.ru/ekonomika/18434313

https://www.kommersant.ru/doc/6137742

*Apple (USA, Electronics) Status by KSE – leave

Apple was fined for the first time in the Russian Federation for not removing prohibited content, the fine amounted to 400 thousand rubles.

https://www.kommersant.ru/doc/6137944

*UnionPay (China, Finance and payments) Status by KSE – wait

Bankers from Post Bank report that temporary failures with Union Pay cards abroad are associated with the transition to a new settlement platform, and not with sanctions

*Veon (Netherlands, Telecom) Status by KSE – leave

On August 1, Veon CEO Kaan Terzioglu submitted an application for his resignation from the post of Chairman of the Board of Vymplekom (Beeline brand).

https://www.kommersant.ru/doc/6138197

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

Adidas has around 100 stores left to get rid of in Russia, CEO says

*Microsoft (USA, IT) Status by KSE – wait

Russian APT phished government employees via Microsoft Teams

https://www.helpnetsecurity.com/2023/08/03/microsoft-teams-phishing/

05.08.2023

*JPMorgan (USA, Finance and payments) Status by KSE – wait

Russia Says JPMorgan Stopped Processing Its Grain Payments

https://www.voanews.com/a/russia-says-jpmorgan-stopped-processing-its-grain-payments-/7212697.html

https://menafn.com/1106804070/Jpmorgan-Stops-Processing-Payments-For-Russian-Grain-Exports

https://www.epravda.com.ua/news/2023/08/5/702933/

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

The Belgian Ministry of Finance issued a license to Expobank to unlock assets frozen in the accounts of the National Settlement Depository with the Euroclear international depository.

https://www.kommersant.ru/doc/6146584/

*Intel (USA, IT) Status by KSE – stay

*Apple (USA, Electronics) Status by KSE – leave

*Google (USA, Online Services) Status by KSE – wait

*Microsoft (USA, IT) Status by KSE – wait

Intel has officially joined Apple, which had previously refused to use metals from the Russian Federation in its devices. Google, which produces Pixel smartphones, and Microsoft, which produces game consoles, continue to use Russian tungsten, gold and tantalum in their gadgets. The United States has a ban on tantalum from the Russian Federation, but not a single company has been fined for such imports.

https://www.kommersant.ru/doc/6146672/

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

International investment holding Freedom Holding Corp. (FRHC) has released its fiscal year 2023 financials. Revenue rose 15.4% to $795.7 million. Net income was $205.1 million. Earnings per share was $3.5. The holding’s assets grew by 57.4% to $5.085 billion. The number of client accounts increased by 6.9% to 370,000.

https://www.tinkoff.ru/invest/social/profile/bxx/172cc993-8b0e-48b2-bd48-68fc05113542/

*Haas Automation (USA, Industrial equipment) Status by KSE – stay

U.S. company Haas appears to still indirectly supply Russian arms industry with technology

*EPAM (USA, IT) Status by KSE – exited

The owner of the largest IT company in Ukraine sold the Russian business to a firm associated with the sanctioned billionaire Potanin

07.08.2023

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

*Danone (France, FMCG) Status by KSE – leave

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

*British Petroleum (BP) (Great Britain, Energy, oil and gas) Status by KSE – leave

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

*BASF SE (Germany, Chemical industry) Status by KSE – leave

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

*Equinor (Norway, Energy, oil and gas) Status by KSE – exited

*Renault (France, Automotive) Status by KSE – exited

*Volkswagen (Germany, Automotive) Status by KSE – exited

*Societe Generale (France, Finance and payments) Status by KSE – exited

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – wait

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

*Nestle (Switzerland, FMCG) Status by KSE – stay

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

*OMV (Austria, Energy, oil and gas) Status by KSE – stay

European companies suffer €100bn hit from Russia operations

https://www.ft.com/content/c4ea72b4-4b02-4ee9-b34c-0fac4a4033f5

https://www.ft.com/content/29d1618e-b6da-45d0-a7cf-067735aca1d6

https://www.kommersant.ru/doc/6147433

*Facebook (Meta Platforms) | Meta (USA, Online Services) Status by KSE – leave

*Rakuten Group. Inc (Japan, Online Services) Status by KSE – wait

Yandex launched a caller ID in the WhatsApp messengers (owned by Meta) and Viber.

https://www.kommersant.ru/doc/6147567

*Eastnine AB (Sweden, Hospitality, Real estate) Status by KSE – leave

The Swedish Eastnine AB announced the conclusion of an agreement with GEM Invest LLC on the sale of its stake in Melon Fashion Group (MFG; manages clothing stores Sela, Zarina, Love Republic). As noted in the message of the Swedish company, the purchase price of 36% of the shares is 15.6 billion rubles. The transaction is expected to be completed within two weeks.

https://www.kommersant.ru/doc/6147572

*Bank of China (China, Finance and payments) Status by KSE – wait

*Industrial and Commercial Bank of China (ICBC) (China, Finance and payments) Status by KSE – stay

*Agricultural Bank of China (China, Finance and payments) Status by KSE – stay

Bank “Primorye” continues to make swift transfers to the mainland of China through direct correspondent accounts in the largest banks in China

08.08.2023

*NRJ Group (France, Media) Status by KSE – stay

Very important company in creating audience and sales for government owned Gazprom-media

https://www.gazprom-media.com/ru/media/slushay-hity-startovala-reklamnaya-kampaniya-radio-energy

*FEX.NET (Cyprus, Online Services) Status by KSE – stay

They work on the market of the Russian Federation, users can use and pay for the service on the territory of Russia without any problems, and have not published any official reaction to the war.

*National Iranian Gas Company (Iran, Energy, oil and gas) Status by KSE – stay

Iran and Russia have reached certain agreements on the creation of an energy hub, negotiations on this issue are ongoing – Iranian Deputy Oil Minister and CEO of the National Iranian Gas Company. Russia has suggested the formation of an energy hub between Tehran and Moscow, the chief executive of the National Iranian Gas Company (NIGC) said, adding that agreements have been made in this regard and expert-level talks are still ongoing between officials of the two countries.

https://tass.ru/ekonomika/18462425

*Shaanxi Yanchang Petroleum (China, Conglomerate + Energy, oil and gas) Status by KSE – stay

China’s Yanchang seen doubling Russian oil purchases

*Dynacom Tankers Management (DTM) (Greece, Marine Transportation) Status by KSE – stay

*Delta Tankers (Greece, Marine Transportation) Status by KSE – stay

*Thenamaris (Greece, Marine Transportation) Status by KSE – stay

*Minerva Marine (Greece, Marine Transportation) Status by KSE – stay

*TMS Tankers (Greece, Marine Transportation) Status by KSE – stay

The National Agency on Corruption Prevention (NACP) returned the status of five Greek shipping companies on the list of “international war sponsors” because they did not meet the conditions agreed during the negotiations to remove them from the list.

https://www.epravda.com.ua/news/2023/08/7/702970/

*Oracle (USA, IT) Status by KSE – exited

The court declared the division of Oracle in Russia bankrupt. Oracle Corporation, which left Russia, left debts for 1.254 billion rubles.

https://www.kommersant.ru/amp/6147637

https://www.tadviser.ru/a/42876

*EPAM (USA, IT) Status by KSE – exited

Reksoft acquired Russian assets of EPAM

02.08.2023: REKSOFT GROUP LLC becomes the new founder of the organization. Record about founder EPAM SYSTEMS CORPORATION, INC. has been removed from the register.

https://www.tadviser.ru/a/719939

https://www.interfax.ru/business/914593

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

The Moscow Arbitration Court seized a 5% stake in Goldman Sachs in Detsky Mir, property rights to trademarks registered in the Russian Federation, as well as shares of Russian companies owned by the Goldman Sachs III SICAV fund. The latter, in particular, include 1.2 million shares of Sberbank, 750 thousand shares of Aeroflot, 790 thousand shares of Gazprom, 550 thousand shares of VTB and shares of other Russian issuers.

One of the main reasons for the arrest of the shares of Russian companies owned by Goldman Sachs (Aeroflot, Detsky Mir, Sberbank, etc.) at the request of Otkritie Bank could be the announcement of an American corporation about leaving the Russian market.

https://www.ft.com/content/b4886463-c9cd-4568-8f34-411979cd3dca

https://www.kommersant.ru/doc/6147750

https://www.kommersant.ru/doc/6147828

https://www.kommersant.ru/doc/6148004

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

The Rushimalliance company (established by Gazprom and RusGazDobycha) sued UniCredit Bank and demanded to recover 45.7 billion rubles. Previously filed a lawsuit against the German banks Deutsche Bank and Commerzbank.

https://www.rbc.ru/business/07/08/2023/64d119499a794750ae62de8e

*Future Re Company (North Korea, Insurance) Status by KSE – stay

Russian players were not interested in the proposals of Future Re Company

https://www.kommersant.ru/doc/6148041

*Bacardi (Great Britain, Alcohol & Tobacco) Status by KSE – stay

Bacardi’s Russia business grows as other booze makers leave the country. The company continues to develop business in Russia and hires new employees.

https://fortune.com/2023/08/08/bacardi-russia-sales-resume-grey-goose-spirits-rum/

https://www.epravda.com.ua/news/2023/08/9/703039/

*Kyocera (Japan, Electronics) Status by KSE – wait

“We’re Japanese, not Russian.” Kyocera files US lawsuit over Russian sanctions

Kyocera Document Solutions America has sued the New Jersey, USA Department of Treasury over economic sanctions against Russia over the invasion of Ukraine. The NJ state law prevents government entities from contracting with a company whose parent has operations in Russia.

*Volfas Engelman (Lithuania, Alcohol & Tobacco) Status by KSE – wait

The Kaunas brewery “Volfas Engelman” announced its withdrawal from the Russian market more than a year ago. However, Kaunas beer continues to travel not only to Moscow stores, but also to a company controlled by Russian intelligence.

https://www.lrt.lt/naujienos/verslas/4/1971140/volfas-engelman-alus-rusijos-snipu-bokaluose

09.08.2023

*Heilongjiang Dragon-Link International Logistics Co. (China, Automotive) Status by KSE – stay

China’s Heilongjiang Dragon-Link International Logistics Co. will deliver 1,000 used cars to Russia by the end of the year, Deputy General Manager Ge Xin said on the sidelines of the 9th Suifenhe International Cross-Border Trade Fair.

https://www.moscowtimes.ru/2023/08/09/kitai-zavalit-rossiyu-avtohlamom-a51411

*Turkik Union (Turkey, Electronics) Status by KSE – stay

*Aeromotus Unmanned Aerial Vehicles Trading LLC (United Arab Emirates, Aerospace) Status by KSE – stay

*Azu International Ltd (Turkey, IT) Status by KSE – stay

Britain imposed sanctions against Turkish and UAE companies for military supplies to Russia. The sanctions list includes Turkish companies Turkik Union and Azu International, which export microelectronics to Russia.

Also sanctions imposed against Aeromotus Unmanned Aerial Vehicles Trading LLC from Dubai, which supplies Russia with drones and their components.

https://www.pravda.com.ua/eng/news/2023/08/8/7414712/

*VARTA (Germany, Electronics) Status by KSE – exited

VARTA fully exited the Russian market and on August 8, 2023 has liquidated its local entity (tax id: 7703468892).

https://excheck.pro/company/7703468892

*Peugeot Citroën (France, Automotive) Status by KSE – wait

The Governor of Sevastopol canceled the state purchase of Citroen cars for officials

https://www.kommersant.ru/doc/6148749

*Vestas (Denmark, Energy, oil and gas) Status by KSE – leave

Vestas CEO sees continued challenges as wind giant posts another loss. The Russian company is in the process of liquidation.

*Haas Automation (USA, Industrial equipment) Status by KSE – stay

Haas Automation may still be doing business in Russia

10.08.2023

*Belavia (Belarus, Air transportation) Status by KSE – stay

*Minsk Civil Aviation Plant 407 (Belarus, Aircraft industry) Status by KSE – stay

The US Treasury imposed sanctions on the Minsk Civil Aviation Plant and Belavia.

https://www.kommersant.ru/doc/6149217

*Abu Dhabi National Oil Company (ADNOC) (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

According to Kpler, for the first time this year, LUKOIL shipped low-sulfur oil from its Caspian fields to the Emirati ADNOC refinery in Ruwais. This is the second such delivery to the refinery of the Emirati company.

https://www.kommersant.ru/doc/6148671

*Bacardi (Great Britain, Alcohol & Tobacco) Status by KSE – stay

The NACP added the world’s largest private alcohol company Bacardi to the list of international war sponsors. After the full-scale Russian invasion of Ukraine, Bacardi announced that it would stop exporting to Russia and stop investing in advertising, but it continues to do business in Russia and is actively looking for new employees there.

https://sanctions.nazk.gov.ua/en/boycott/1010/

https://www.axios.com/2023/08/10/ukraine-bacardi-russia-war

https://www.kommersant.ru/doc/6149716

https://www.epravda.com.ua/news/2023/08/10/703092/

https://finclub.net/ua/news/nazk-vneslo-bacardi-do-pereliku-mizhnarodnykh-sponsoriv-viiny.html

*Greenfield (Multinational, Food & Beverages) Status by KSE – stay

*JDE Peet’s / Jacobs Douwe Egberts (Netherlands, Food & Beverages) Status by KSE – leave

Tea and coffee producers are preparing to raise prices due to the weakening of the ruble.

https://www.kommersant.ru/doc/6148707

*Pepsi (USA, Food & Beverages) Status by KSE – stay

The American PepsiCo, having just launched ice cream under the Domik v derevne brand, agreed on its production with Chistaya Liniya near Moscow.

https://www.kommersant.ru/doc/6149273

*Polymetal (Great Britain, Metals & Mining) Status by KSE – leave

The largest silver producer decided to leave Russia and redirect money to Kazakhstan. Polymetal plans to sell Russian assets under sanctions in 6-9 months – CEO.

https://tass.ru/ekonomika/18477107

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – leave

Intesa closer to gaining Moscow’s OK for Russia asset transfer

https://www.rbc.ua/ukr/news/naybilshiy-italiyskiy-bank-gotoviy-pripiniti-1691665119.html

https://finclub.net/ua/news/naibilshyi-bank-italii-planuie-pity-z-rf.html

*Aareal Bank (Germany, Finance and payments) Status by KSE – leave

Strong earnings growth offsets non-recurring burdens and higher loss allowance – Full exit from the Russian exposure

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

*Clearstream (Luxembourg, Finance and payments) Status by KSE – leave

Euroclear is trying to undermine the procedure for exchanging Russian Eurobonds from Clearstream for replacement bonds. From Friday, he stopped transferring a number of Russian corporate Eurobonds to his system, and precisely those that were replacing – Gazprom, Lukoil, Borets, Sovcomflot, as well as preparing them – Polyus and TMK.

https://lenta.ru/news/2023/07/14/depozitariy/

*Microsoft (USA, IT) Status by KSE – wait

Microsoft from September 30, 2023 will stop renewing subscriptions for corporate customers from Russia. It will be impossible to extend them. But all active subscriptions will be active for the rest of the term.

https://www.kp.ru/online/news/5401820/

11.08.2023

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Magnit bought back its shares from foreign funds. 5% are in the process of being transferred, going through the Euroclear infrastructure. Among the sellers are the largest international funds, banks, hedge funds, pension savings managers and private investors.

https://www.sostav.ru/publication/magnit-vykupil-svoi-aktsii-u-inostrannykh-minoritariev-62380.html

*Google (USA, Online Services) Status by KSE – wait

*Alphabet (USA, Online Services) Status by KSE – wait

Google began blocking services to Russian companies. On the night of August 10, Google began massively blocking corporate Google Workspace services for Russian companies that are under sanctions.

https://www.kommersant.ru/doc/6149952

The Office of Foreign Assets Control (OFAC) of the US Treasury has extended a license allowing US citizens to pay taxes, fees and import duties in Russia until November 8. The document (.pdf) was published on the OFAC website: https://ofac.treasury.gov/media/932081/download?inline

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 4500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 18 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before.

¹¹ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website