- Kyiv School of Economics

- About the School

- News

- 50th issue of the regular digest on impact of foreign companies’ exit on RF economy

50th issue of the regular digest on impact of foreign companies’ exit on RF economy

31 July 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 17.07-30.07.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

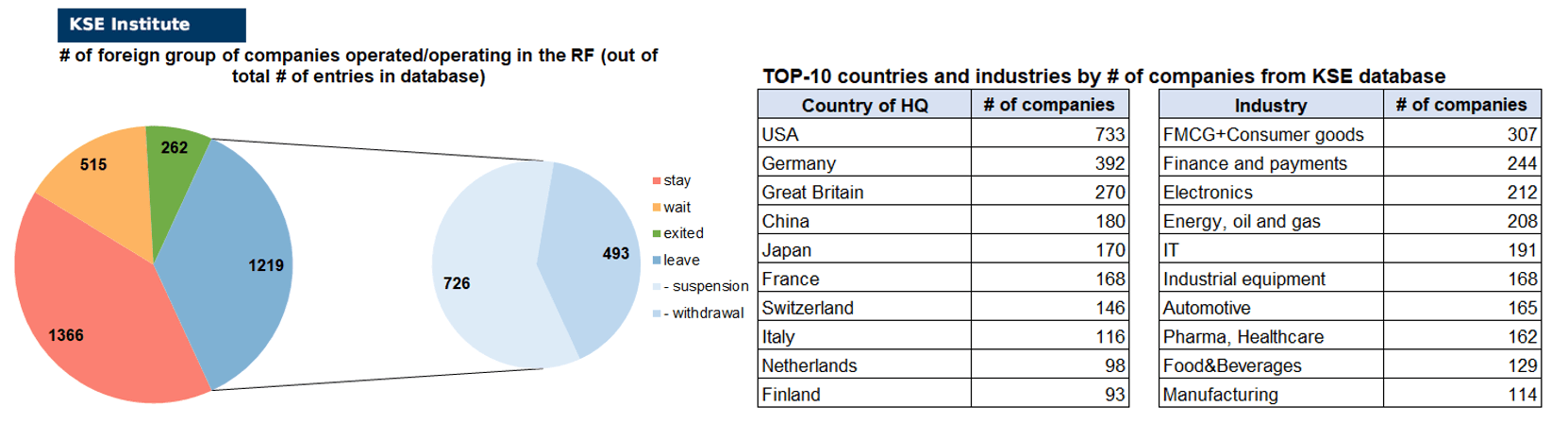

KSE DATABASE SNAPSHOT as of 30.07.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 366 (-1 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 515 (-2 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 219 (+25 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 262 (+7 per 2 weeks)

As of July 30, we have identified about 3,362 companies, organizations and their brands from 92 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 480 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $189.5 billion), local revenue (about $305.6 billion), local assets (about $327.4 billion) as well as staff (about 1.428 million people) and taxes paid (about $25.2 billion). 1,734 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 262 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

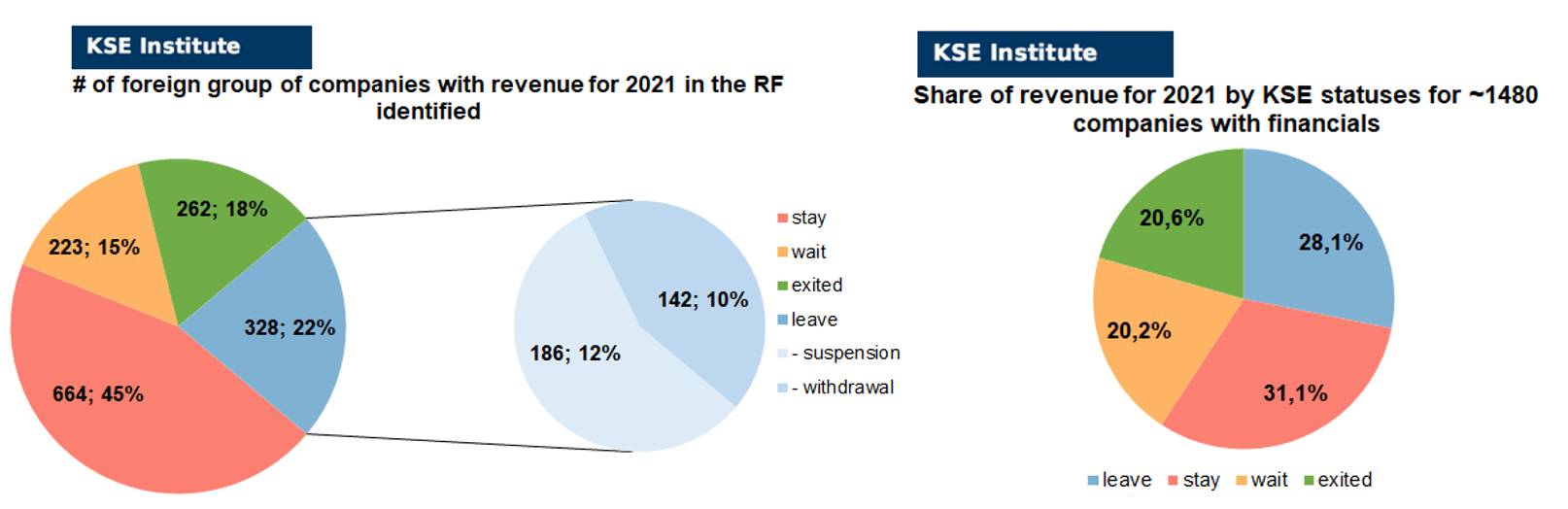

As can be seen from the tables below, as of July 30, 262 companies which had already completely exited from the Russian Federation, in 2021 had at least 420,500 personnel, $62.9 bn in annual revenue, $32.9bn in capital and $59.4bn in assets; companies, that declared a complete withdrawal from Russia had 296,300 personnel, $57.5bn in revenues, $23.9bn in capital and $28.5bn in assets; companies that suspended operations on the Russian market had 92,200 personnel, annual revenue of $28.6bn, $37.4bn in capital and $97.4bn in assets.

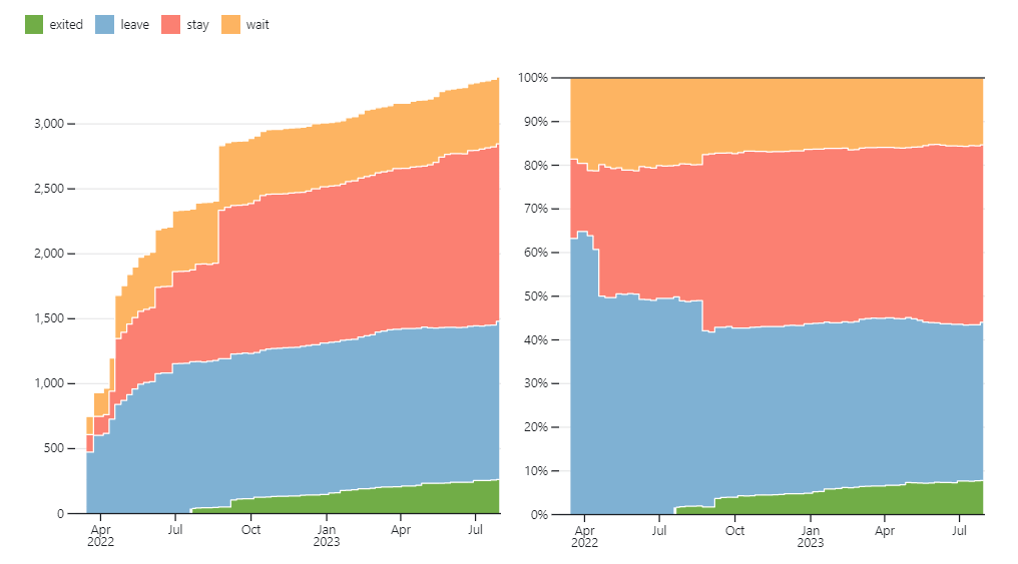

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 11 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 50 were added in July 2023). However, if to operate with the total numbers in KSE database, about 36.3% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.6% are still remaining in the country, 15.3% are waiting and only 7.8% made a complete exit³.

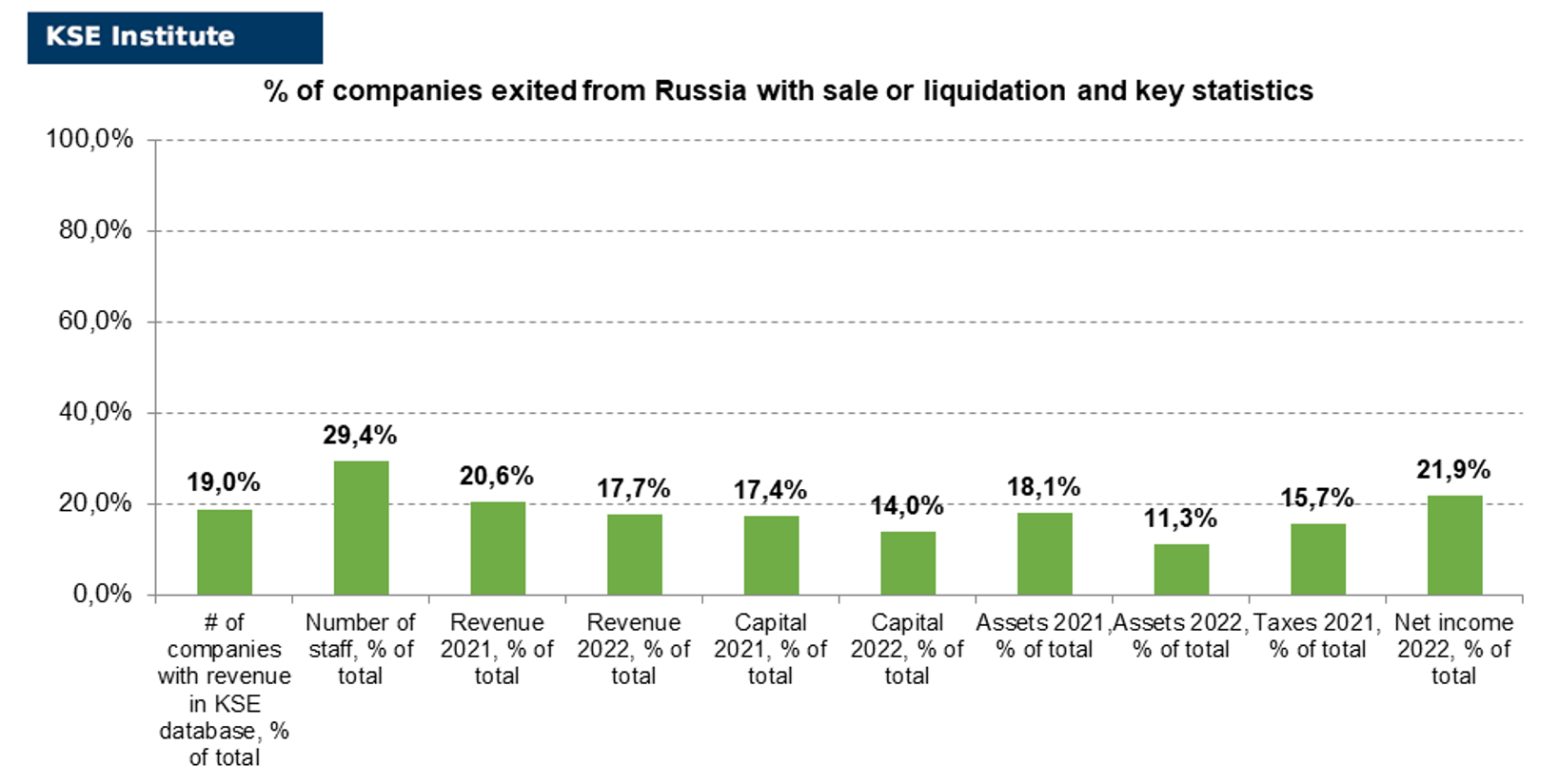

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 262 companies that completely left the country, since in 2021 they employed 29.4% of the personnel employed in foreign companies, the companies owned about 18.1% of the assets, had 17.4% of capital invested by foreign companies, and in 2021 they generated revenue of $62.9 billion or 20.6% of total revenue and paid ~$4.0 billion of taxes or 15.7% of total taxes paid by the companies observed. Data on 1,480 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (18%) and on share of revenue withdrawn (21%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 31% of revenue and 15% of waiting companies represent 20% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1380 companies (about 100 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.9% less of revenue in 2022 (17.7% from total volume) than in 2021 (20.6% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-5.6%) revenue in 2022 (22.5% from total volume) than in 2021 (28.1% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+11.0%) more revenue in 2022 (42.1% from total volume) than in 2021 (31.1% from total volume). Companies with status “wait”⁴ gained almost the same share (-2.5%) of revenue in 2022 (17.7% from total volume) vs 20.2% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($322.3bn in 2022 vs $327.4bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has published before a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

Chinese banking subsidiaries in Russia sharply increased lending to banks during the crisis Their share in this market increased almost fivefold

12.07.2023 | During the year of the crisis in Russia, banks with Chinese roots have significantly increased operations with other credit institutions, it follows from their reporting. They provide the market with yuan in the face of bankers abandoning dollars and euros

https://www.rbc.ru/finances/12/07/2023/64ac27439a79474aac9377af?from=from_main_1

Russia to get “super-privileged right” to buy out shares of strategic enterprises from foreigners

24.07.2023 | The right to buy shares of strategic companies from foreigners leaving the Russian market, which is planned to be assigned to the state, will be “super-privileged”, that is, will have priority over the preferences of other persons. This follows from the draft presidential decree, which is planned to introduce a corresponding norm. https://www.interfax.ru/business/913056

Russia will clarify the procedure for applying sanctions to foreign companies

25.07.2023 | The Russian authorities want to expand the ability to apply economic sanctions not only to foreign companies, but also to Russian legal entities that they control. Such a bill passed the second reading at the plenary session of the State Duma on July 25.

MONTHLY FOCUS: On leaving the Russian Federation. Results of July 2023

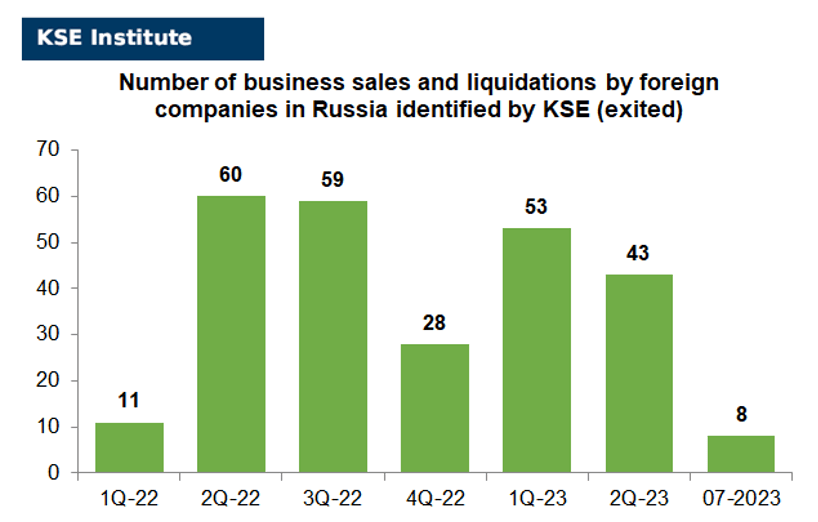

In this digest, we will summarize the results of July 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1’480 companies identified in the KSE database with revenue data available of more than $300 billion in 2021 and ~$216 billion in 2022. And at least 262 of them have already been sold by local companies or were liquidated and left the Russian market. In July 2023 KSE Institute identified +8 new exits⁶, total number of exits observed since the beginning of Russia’s invasion reached 262.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 21% based on revenue allocation, those who are leaving represent 28% of total revenue (with 33% share of suspensions and 67% of withdrawals sub-statuses), % of staying companies represent 31% of revenue and 20% are waiting companies based on revenue generated in Russia in 2021.

% of exited is 18% based on revenue allocation, those who are leaving represent only 22% of total revenue (with 24% share of suspensions and 76% of withdrawals sub-statuses), % of staying companies represent 42% of revenue and 18% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

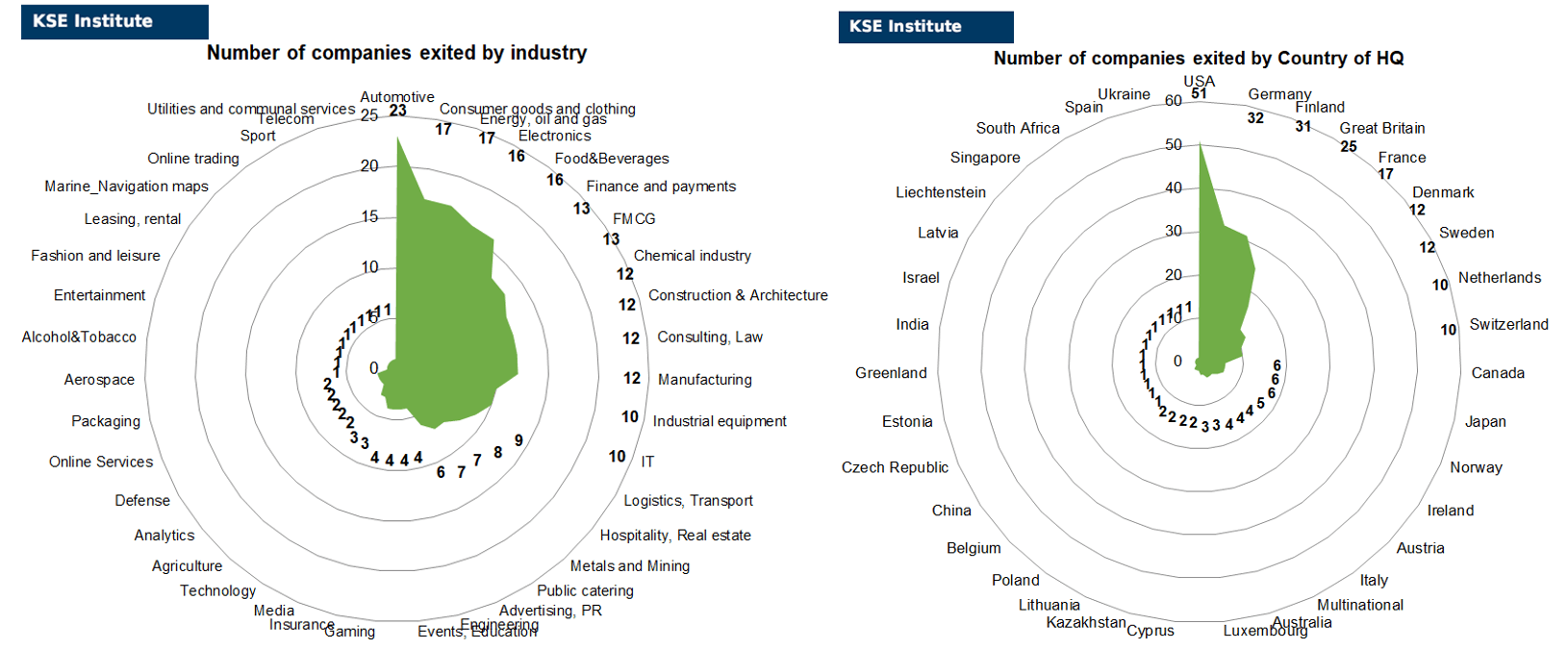

Here are also the breakdowns by industries and by countries of the companies which already exited:

So, as of the end of July 2023, companies from 35 countries and 39 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Germany, Finland, Great Britain and France and operated in the “Automotive”, “Consumer goods and closing”, “Energy, oil and gas”, “Electronics” and “Food & Beverage” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Atradius, Essity, Gerry Weber, Ikano Bank, Ingenico, Kellogg’s, Nordea Bank (identified with delay), ZF Friedrichshafen.

Most of these exits were identified before in their preparation phase. Also, we are not in a hurry to assign “exited” status to many companies that are literally on the verge of exit, although they have not yet finalized this process (even though some of them have already partly sold their business).

Here are just some of them: BASF SE (Partial exit, had 4 companies in Russia. 07.2023: The records about the founders of CONSTRUCTION RESEARCH AND TECHNOLOGY GMBH and MASTER BUILDERS SOLUTIONS DEUCHLAND GMBH have been removed. MBSS HONG KONG LIMITED and MBSS HONG KONG ESTABLISHMENT LIMITED become the new founders of the organization), Commerzbank and Deutsche Bank (Rushimalliance filed claims for 31 billion rubles against Deutsche Bank and Commerzbank. Gazprom arm seeks foreclosure on Deutsche Bank Russia businesses), Decathlon (The government commission approved the deal to sell the Russian business of Decathlon. New buyer was found for asset purchase, Russian company ARM, which owns, in particular, the Mango franchise), Mondi Group (Mondi has completed the sale of its three Russian packaging converting operations to the Gotek Group, receiving net proceeds of €30.4m. 07.2023: partial exit, 3 companies (LLC “MONDI LEBEDYAN”, LLC “MONDI PERESLAVL” and LLC “MONDI ARAMIL”) out of 5 were sold and changed owners, key one (JSC “MONDI SYKTYVKAR LPK” and small LLC “MONDI SALES CIS”) were not sold yet but approved by the Kremlin), Toyota Motor Corporation (Toyota plant in St. Petersburg was sold without a buyback option).

Danone and Carlsberg joined in July 2023 to the Fortum and Uniper SE team as, in fact, nationalized companies. Russia seizes control of shares in Danone and Carlsberg subsidiaries⁷ and introduced its controlled management. Danone said it was investigating the situation and “preparing to take all necessary measures to protect its rights as shareholder of Danone Russia, and the continuity of the operations of the business in the interest of all stakeholders, in particular its employees”. “Following the presidential decree, the prospects for this sales process are now highly uncertain,” Carlsberg said in a statement. “The Carlsberg Group has not received any official information from the Russian Authorities regarding the presidential decree or the consequences for Baltika Breweries.”

FOCUS OF THE 50TH ANNIVERSARY SPECIAL EDITION: The presence of foreign banks in Russia

In the modern world, the banking system is one of the most important institutions of the state’s economic activity. Its efficiency and stability have a direct impact on quality financial relations, both within the country and abroad. Banking products have become an integral part of civil society serving the needs of economic entities.

The banking system of the Russian Federation includes the Central Bank of Russia, credit organizations, as well as branches and representative offices of foreign banks.

In 2014, as a result of the annexation of Crimea, Western sanctions against Russia were introduced in response to the aggravation of the geopolitical situation in Ukraine, which provoked the volatility of the Russian banking system, which was compensated by the current system of monetary policy instruments of the Central Bank of Russia

There is an opinion that not in vain the Head of the Central Bank of Russia, Elvira Nabiullina, is considered one of the best banking managers and financiers in Russia (although, unfortunately, her role was reduced to an “evil genius” who saves the banking system in extremely difficult conditions). Despite the fact that Western sanctions negatively affected the liquidity of the assets of credit organizations in Russia, in particular foreign banks, the measures of the Central Bank of Russia ensured the continuity of the work of the Russian banking sector, which had a positive effect on the Russian economy. At the same time, Western sanctions against Russia became an incentive for the Russian banking system to improve the Russian payment system and the system for transmitting financial messages against the background of threats to disconnect Russia from SWIFT and limit Russian banks to European and American capital markets.

Taking this into account, after February 24, 2022, the Russian economy faced severe sanctions from the international community, against the background of the fact that there was already a crisis in 2014, which enabled Russia to create certain countermeasures in the event of the implementation of new sanctions against Russia by the West, in particular, more powerful.

At the beginning of 2022, the Russian banking system approached with a significant reserve of capital. The total volume of surplus funds relative to their required minimum amounted to approximately 7 trillion Russian rubles.

At the same time, the beginning of 2022 was quite successful for the Russian banking sector. However, after the events of February 24, 2022, the exchange rate of the Russian ruble and the value of shares of Russian companies decreased, the gold and foreign currency reserves of the Central Bank of Russia were partially frozen, and international sanctions were imposed on the largest Russian banks. All this could not help but affect the situation in the Russian economy, in particular, the Russian banking sector was also significantly affected.

However, it is worth noting that despite the EU statements regarding the blocking of a large part of the reserves of the Central Bank of Russia since the beginning of Russian war against Ukraine, and it is a fairly significant amount of 300 billion euros, EU representatives have blocked significantly fewer Russian assets than expected. At the same time, it has not yet been possible to establish the location of all Russian reserves in Europe. Some of the Russian assets may be kept in private banks, whose cooperation with the EU authorities has yet to be ensured.

For reference: as of July 21, 2023 the total amount of international reserves of the Russian Federation amounted to 595.9 billion US dollars.

Western sanctions not only blocked all available channels for Russia on cross-border banking, attracting foreign capital and technology, but also set the Russian financial system back many years. The Russian-Ukrainian war made the presence of international banking groups in Russia a factor that created significant reputational losses for them.

As an example, in accordance with the sanctions imposed by the USA and the EU countries, large foreign financial institutions, in particular, Goldman Sachs, have limited the ability to attract outside capital to Russia.

For reference: with the beginning of the Russian-Ukrainian war, the amount of direct foreign investment in Russia decreased by a third – from 610 billion US dollars at the end of 2021 to 402 billion US dollars by March 2023, despite the efforts of the Russian authorities to limit the repatriation of capital investments of foreign companies and, despite on top of that, since the beginning of 2023 alone, the volume of direct foreign investment in Russia has decreased by more than 35 billion US dollars.

Thus, it has been more than a year since Russian full-scale invasion of Ukraine, and only a few foreign banks have left the Russian market, albeit at a considerable price. Others decided to stick to their businesses. Foreign banks with branches in Russia faced a dilemma, in particular: to quickly sell assets, albeit at a huge loss to themselves, or to remain on the Russian market and begin to slowly wind down their own affairs. Western sanctions and Moscow’s counter-sanctions made the work of foreign banks in Russia almost impossible, one example is the disconnection of a number of Russian banks by the EU from SWIFT financial information exchange systems on March 12, 2022, which in turn indirectly affected the activities of foreign banks that remained in Russia market.

As of March 2022, 52 banks with foreign capital were operating in Russia. According to analysts’ estimates, 20-25 credit organizations were preparing to exit.

Russian invasion of Ukraine and the tough sanctions against Russia that followed forced many foreign players to consider reducing their presence in the Russian financial market. The first major investment banks that announced limitations of activities were JPMorgan Chase and Goldman Sachs from the USA, as well as Deutsche Bank and Commerzbank. The unprecedented freezing of Russian gold and foreign exchange reserves, a barrage of sectoral sanctions against the national banking system and system-building Russian banks, as well as temporary restrictions in response to the withdrawal of capital from Russia effectively stopped foreign investors from trading in currency, securities and derivatives on Russian exchange.

According to foreign investment banks, players who have foreign branches of Western banks in Russia announced plans to close down their business in Russia. Thus, already in March 2022, such banks as BNP Paribas, Credit Agricole, Sumitomo Mitsui, MUFG Bank and Mizuho Bank promised to suspend all operations in Russia.

The first major agreement on the withdrawal of a foreign bank from Russia was the agreement with Societe Generale. In May 2022, the French financial group sold almost 100% of the shares to Rosbank and the insurance business in Russia to Interros Capital. After which, as a countermeasure, the Kremlin decided to take the process of further sales, mergers and acquisitions of banks under special control.

Given this, most Western banks trying to exit Russian assets amid Western sanctions against Moscow have faced difficulties due to the ban on transactions for foreigners from “unfriendly” countries without the approval of the President of Russia.

For reference: in October 2022, by Decree of the President of Russia approved a list of 45 foreign banks, which are subject to a ban on transactions with their shares, as well as shares in the authorized capital. The list includes systemically important Raiffeisen Bank International (RBI), UniCredit, branches of Deutsche Bank, BNP Paribas, Goldman Sachs, UBS, HSBC, JPMorgan and others. Before the Decree of the President of Russia entered into force, some foreign banks were already negotiating the sale of Russian assets.

The first who received a special permission to acquire 100% of the shares of the Russian RN-Bank on November 29, 2022, was AvtoVAZ, which was developed by the Renault-Nissan-Mitsubishi alliance together with the UniCredit branch. At the same time, Vladimir Putin approved the agreement on the exit of J&T Banka from the Russian market. The bank is part of J&T Finance Group SE, which operates in the Czech Republic, Slovakia, Croatia and Germany.

In a year and a half after the Russian invasion of Ukraine, only 13 institutions completely withdrew from the Russian market, according to data from the Leave Russia project from the KSE Institute. Such big players as Societe Generale, Home Credit and PPF have left the market, and such banks as: Deutsche Bank, BNP Paribas, Commerzbank, Citigroup, Pekao SA, Morgan Stanley, Crédit Agricole and others are suspending their business. Remaining in the country are Raiffeisen Bank International, UniCredit Group, OTP Bank, Credit Europe Bank, such Chinese, Japanese and South Korean institutions as: Bank of China, China Construction Bank, ICBC Bank, Agricultural Bank of China, Mizuho Bank and KEB HNB Bank. Thus, according to the Leave Russia project from the KSE Institute, in 2023, 61 foreign banks are continuing to operate fully or partially in Russia (including banks with foreign capital and their representative offices) and financial companies of payment systems.

Western banks, against the background of large-scale anti-Russian sanctions, solve the issue of exiting the Russian market in different ways, because, taking into account the above-mentioned Decree of the President of Russia, Western banks are not allowed to sell their own business in Russia for a decent amount, since the intervention of the Russian President significantly changes the conditions of such deals, leading to a significant drop in prices for such deals, and it is becoming more and more difficult to conclude such deals, as the overall economic situation in Russia is very unstable. At the same time, the management of foreign banks perfectly understands that the key goal of Western sanctions against Russia is the total marginalization of the Russian banking system at the international level.

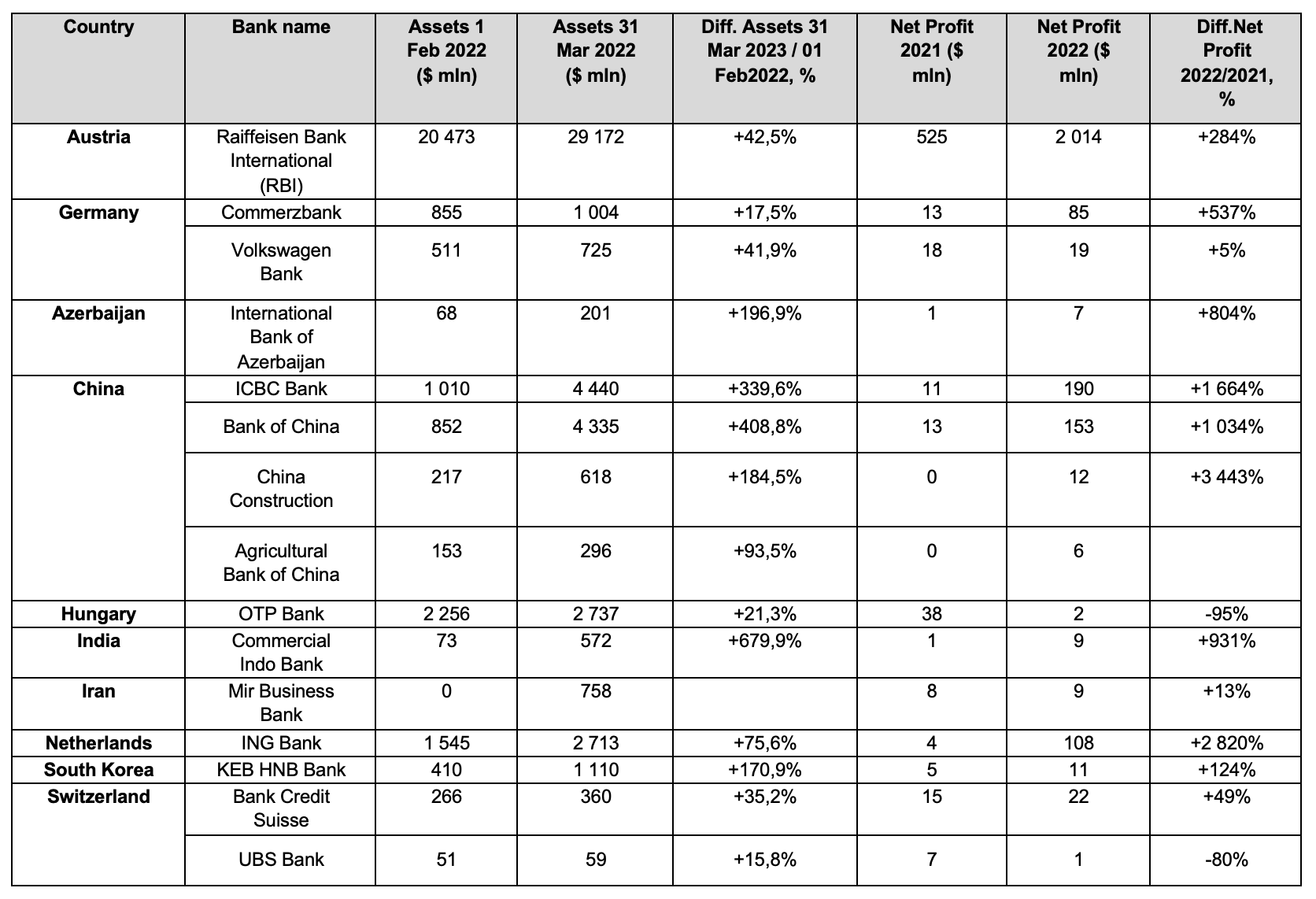

Considering the importance of the banking sector for the economy of any country, KSE Institute collected information on the key financial indicators of banks with foreign participation in Russia as of February 1, 2022 (before the start of aggression) and compared them with the latest available data as of March 31, 2023.

First of all, we analyzed the indicators of capital and assets as of the indicated dates and net profit for 2021-2022 (previously this information was closed), and also collected additional information on the amounts of interest and commission income and net profit received in the 1-st quarter of 2023 and about the countries in which the parent groups of the specified banks are located and additionally checked whether their sale was carried out since the beginning of the war.

The table below lists some foreign banks that managed to increase assets or net income in 2022:

You will find more details in the new dashboards from KSE Institute: https://leave-russia.org/banks

As you can see, foreign banks managed to make good money on the Russian market in 2022. The total profit of foreign-controlled credit organizations exceeded 211 billion Russian rubles in the crisis year. Against the backdrop of a reduction in the loan portfolio, foreign banks increased the amount of funds raised, primarily from corporate clients. Moreover, the largest foreign players managed to earn well both on interest and commissions. At the same time, the profit structure of foreign banks in Russia cannot be called similar.

At the beginning of 2023, the statistics of the Central Bank of Russia included 65 banks that are under the direct or indirect control of foreign legal entities or citizens, as well as organizations where more than 50% of the votes have the right to dispose of the final owners – non-residents. A total of 108 banks operate in Russia with the participation of non-residents in the capital. Among those who disclosed annual reports according to Russian Accounting Standards, the largest profit was shown by banks that are part of the systemically important. For example, Raiffeisen Bank International (RBI) earned more than 141 billion Russian rubles in 2022, Unicredit Group almost 57 billion Russian rubles.

For reference: During the crisis, Chinese bank branches in Russia sharply increased lending to Russian banks and their share in the Russian market increased almost fivefold, in particular, they supplied the market with Yuan in conditions of refusal of Russian bankers from the US dollar and euro. As an example, from February 1, 2022 to June 1, 2023, the Bank of China increased the volume of loans granted to other banks in Russia by 107 billion Russian rubles.

However, despite this, due to Western sanctions, during the year of the Russian-Ukrainian war, the specific weight in the total authorized capital of Russian banks decreased from 10.7% to 8.9%. The share of foreign banks’ assets also decreased significantly – from 6.2% as of February 1, 2022 to 4.9% as of April 1, 2023 – so Russian banks are gradually absorbing the share of foreign banks.

At the same time, branches of foreign banks are not in a hurry to leave the Russian banking market against the background of Western sanctions against Russia and thus finance the economy of the Russian aggressor. And the legislation specially developed for this does not give them such an opportunity, effectively taking them as hostages of the Russian authorities.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹⁸

15.07.2023

*Isuzu Motors (Japan, Automotive) Status by KSE – leave

Isuzu Motors pulls out of Russia as war in Ukraine halts production

16.07.2023

*Danone (France, FMCG) Status by KSE – leave

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

Russia seizes control of shares in Danone and Carlsberg subsidiaries.

https://www.epravda.com.ua/news/2023/07/16/702267/

https://www.ft.com/content/95530b86-dd98-4f26-b115-3f6e8cca6ce5

*Schlumberger (USA, Energy, oil and gas) Status by KSE – wait

Update on SLB’s Russia Operations

https://www.slb.com/resource-library/updates/2023/update-on-slbs-russia-operations

*Clearstream (Luxembourg, Finance and payments) Status by KSE – leave

Clearstream threatened clients with the blocking of Russian Eurobonds

17.07.2023

*Essity (Sweden, Consumer goods and clothing) Status by KSE – exited

The hygiene and health company Essity has completed the divestment of its operations in Russia for a purchase price of approximately SEK 1.2bn on a cash and debt-free basis. Essity has thus exited Russia.

https://www.essity.com/media/press-release/essity-has-exited-the-russian-market/13ed54a1aedb2ef7/

*BNP Paribas (France, Finance and payments) Status by KSE – leave

Arbitration in Moscow ordered Mechel to pay $244 million to Gazprombank for a loan that the mining and metallurgical holding took out in 2019 from French BNP Paribas.

https://www.rbc.ru/business/17/07/2023/64b528989a7947ad843904ec?from=newsfeed

*Danone (France, FMCG) Status by KSE – leave

Update from Danone on its operations in Russia

https://www.danone.com/media/press-releases-list/update-from-danone-on-its-operations-in-russia.html

18.07.2023

*BrahMos Aerospace (India, Aerospace) Status by KSE – wait

BrahMos Aerospace — the Indo-Russian aerospace and defense corporation — is not considering selling its missiles to Russia as long as the Russia-Ukraine war continues

*Orion Pharma (Finland, Pharma, Healthcare) Status by KSE – leave

The Finnish pharmaceutical company Orion Pharma left Russia

https://www.epravda.com.ua/news/2023/07/18/702337/

*Schlumberger (USA, Energy, oil and gas) Status by KSE – wait

Top US firms supplied equipment to keep Russian oil flowing after Ukraine invasion

19.07.2023

*Rail Vikas Nigam Limited (RVNL) (India, Logistics, Transport) Status by KSE – stay

*Indian Railways (India, Logistics, Transport) Status by KSE – stay

Vande Bharat Manufacturing Deal: RVNL And Russian TMH Resolve Differences, To Sign Agreement

*RECORDATI INDUSTRIA CHIMICA E FARMACEUTICA S.p.A. (Italy, Pharma, Healthcare) Status by KSE – stay

Italy’s Recordati boosted by strong sales in Russia.

https://www.reuters.com/article/recordati-results-ceo-idUSL8N3786PK

https://www.importgenius.com/russia/suppliers/recordati-industria-chimica-e-farmaceutica-spa

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

Russian-origin aluminum now represents over 80% of LME warehouse inventories.

https://finance.yahoo.com/news/russian-aluminum-accounts-80-lme-200000078.html?guccounter=1

*Danone (France, FMCG) Status by KSE – leave

Kadyrov’s nephew headed the Russian “daughter” of Danone

https://www.rbc.ua/ukr/news/pleminnik-kadirova-ocholiv-rosiysku-dochku-1689768501.html

https://www.ft.com/content/d5234953-cddf-4b64-8a55-dc749843ab5c

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – leave

Update on temporary management in Baltika Breweries

https://www.carlsberggroup.com/newsroom/update-on-temporary-management-in-baltika-breweries/

The authorities put the ex-head of Baltika in charge of the beer company seized from the Danes

https://www.ft.com/content/d5234953-cddf-4b64-8a55-dc749843ab5c

*Apple (USA, Electronics) Status by KSE – leave

Thousands of Russian officials to give up iPhones over US spying fears

https://www.ft.com/content/6567e7f2-c5fb-4da4-bd95-bf7ceef54038

*Gasum (Finland, Energy, oil and gas) Status by KSE – wait

Finland’s Gasum resumes LNG purchases from Russia’s Kryogaz

*Coca-Cola (USA, Food & Beverages) Status by KSE – leave

How Coca-Cola quit Russia, but stayed on the country’s shelves

https://en.thebell.io/the-bell-weekly-9/

*Hugo Boss (Germany, Luxury).Status by KSE – stay

*Zegna Group (Italy, Fashion and leisure) Status by KSE leave

*Canali (Italy, Luxury) Status by KSE – stay

Man Suits Exports into Russia

20.07.2023

*International Gymnastics Federation (Switzerland, Sport) Status by KSE – wait

The International Gymnastics Federation allowed Russians to compete in neutral status

https://www.gymnastics.sport/site/news/displaynews.php?urlNews=3903623

*DP World (United Arab Emirates, Logistics, Transport) Status by KSE – stay

NACP included one of the world’s largest port operators DP World (Dubai Port World) in the list of international sponsors of the war

21.07.2023

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Euroclear earned more than €1.7 billion on the assets of Russians in six months

https://www.rbc.ru/finances/20/07/2023/64b8fcef9a79474720b3e480

*UnionPay (China, Finance and payments) Status by KSE – wait

“Tinkoff” advised clients abroad to borrow money after US sanctions

*Bank of Georgia (Georgia, Finance and payments) Status by KSE – leave

*TBC Bank (Georgia, Finance and payments) Status by KSE – leave

Two of Georgia’s largest banks, TBC and Bank of Georgia, have excluded Unistream from the list of payment systems due to new US sanctions.

*Pepsi (USA, Food & Beverages) Status by KSE – stay

The company PepsiCo launched the sale of drinks under the brands Evervess and Frustyle, which should replace brands that have left the market.

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – wait

Norsk Hydro says Russian metal threatens benchmark status of LME aluminum

*QazaqGaz (Kazakhstan, Energy, oil and gas) Status by KSE – stay

Kazakhstan QazaqGaz plans to start transporting Russian gas to Uzbekistan from October this year

22.07.2023

*Decathlon (France, Consumer goods and clothing) Status by KSE – leave

The government commission approved the deal to sell the Russian business of Decathlon. New buyer was found for asset purchase, Russian company ARM, which owns, in particular, the Mango franchise.

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

Nokian Tyres profit tumbles amid Russian exit

*Rheinmetall (Germany, Defense) Status by KSE – leave

Moscow’s threats to intensify the bombing of Ukraine will not affect the plans of the German arms company Rheinmetall to build a tank plant in Ukraine.

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Russian investors filed the first collective action against Euroclear

23.07.2023

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever will let Russia employees be conscripted

24.07.2023

*AMD (USA, IT) Status by KSE – wait

*ZILOG (USA, Electronics) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – wait

Parts made by U.S. companies used to build Russian cruise missiles

https://www.pbs.org/newshour/show/parts-made-by-u-s-companies-used-to-build-russian-cruise-missiles

*TBC Bank (Georgia, Finance and payments) Status by KSE – leave

*Bank of Georgia (Georgia, Finance and payments) Status by KSE – leave

*Liberty bank (Georgia, Finance and payments) Status by KSE – leave

*Armeconombank (Armenia, Finance and payments) Status by KSE – leave

*Ardshinbank (Armenia, Finance and payments) Status by KSE – leave

*Converse Bank (Armenia, Finance and payments) Status by KSE – leave

*Evokabank (Armenia, Finance and payments) Status by KSE – leave

*Ipoteka bank (Uzbekistan, Finance and payments) Status by KSE – leave

*Xalq banki (Uzbekistan, Finance and payments) Status by KSE – leave

*Kompanion Bank (Kyrgyzstan, Finance and payments) Status by KSE – leave

*Finсa bank (Kyrgyzstan, Finance and payments) Status by KSE – leave

The USA has closed one of the last channels for withdrawing money from Russia: foreign banks are massively refusing to work with Yunistrim.

*Bank asia (Kyrgyzstan, Finance and payments) Status by KSE – leave

Six Kyrgyz banks suspended work with Yunistrim

25.07.2023

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

Fortum’s Russian business to be renamed Forward Energo after seizure -company

*Haval Motor (China, Automotive) Status by KSE – stay

The head of “Haveil Motor Rus” Andrey Akifyev about new models and future sales

https://www.kommersant.ru/doc/6123205?tg

*Julius Baer (Switzerland, Finance and payments) Status by KSE – wait

One of the largest banks in Switzerland, Julius Baer, is going to stop serving clients from the Russian Federation in the near future.

26.07.2023

*Micron (USA, IT) Status by KSE – leave

*International Rectifier (USA, Electronics) Status by KSE – leave

*Murata Manufacturing (Japan, Electronics) Status by KSE – leave

*STMicroelectronics (Switzerland, IT) Status by KSE – leave

New report sounds alarm over Russian military’s reliance on Western-made components in its war against Ukraine & urgent need to restrict continued supply; incl. co. responses & non-responses

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

The International Olympic Committee did not send Russia and Belarus an invitation to participate in the 2024 Olympics. At the same time, this does not mean that athletes from Russia or Belarus will definitely not compete at the Games. The IOC statement stated that a decision on their participation would be “taken at the right time.”

https://www.pravda.com.ua/news/2023/07/26/7412984/

*New Development Bank (China, Finance and payments) Status by KSE – leave

The New Development Bank (NDB), created by the BRICS countries to finance investment projects and which issued $30 billion in loans over 7 years, will not invest in Russia.

*Reckitt Benckiser Group (Great Britain, Consumer goods and clothing) Status by KSE – wait

*Pepsi (USA, Food & Beverages) Status by KSE – stay

Western Companies in Russia Fear Further Asset Grabs by the Kremlin

*Danone (France, FMCG) Status by KSE – leave

Danone writes down Russia assets, beats on like-for-like sales

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

UniCredit to post strong quarter as Russia draws scrutiny

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisenbank will suspend the purchase of cash euros and dollars from individuals

https://www.rbc.ru/finances/26/07/2023/64c0e9b99a79478a0b7bfed8

27.07.2023

*Volkswagen (Germany, Automotive) Status by KSE – exited

Volkswagen confirmed the sale of Russian assets for €125 million

https://www.kommersant.ru/doc/6125040?tg

*Ommic (France, Electronics) Status by KSE – stay

Ommic, a story of betrayal: the French boss is accused of supplying confidential technology to the Russians

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 4500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 17 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

⁵ Increase in assets vs previous data is explained by adding newly collected information on the bank’s assets which was not available before.

⁶ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

¹⁸ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website