- Kyiv School of Economics

- About the School

- News

- 49th issue of the regular digest on impact of foreign companies’ exit on RF economy

49th issue of the regular digest on impact of foreign companies’ exit on RF economy

17 July 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03.07-16.07.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we developed a barcode scanner, which is available here: https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot. It allows you to find any brand or company that is operating in Russia just by scanning barcodes.

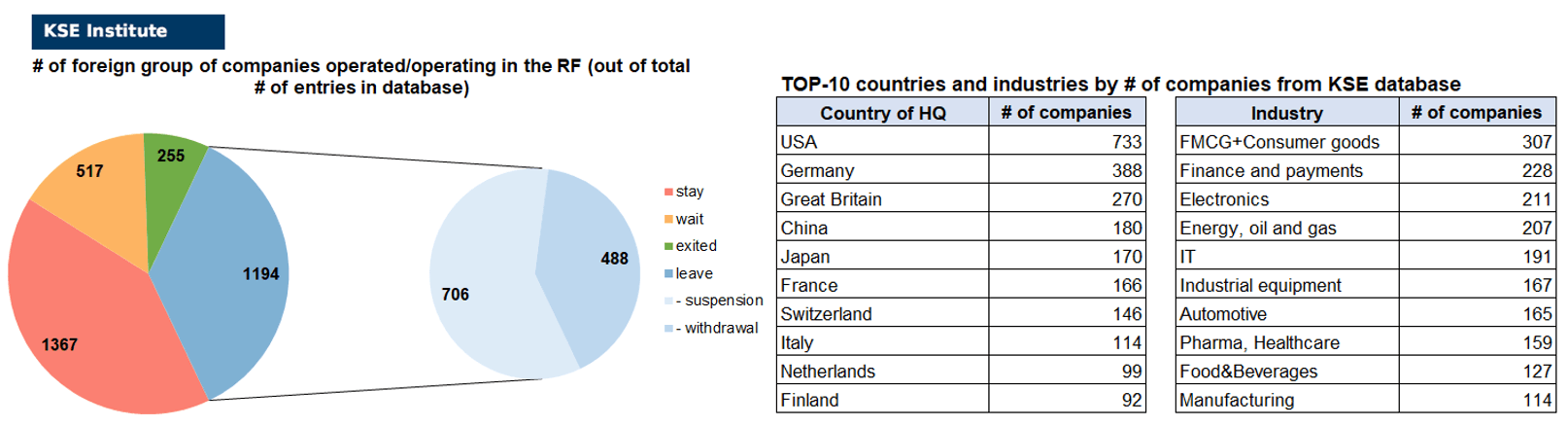

KSE DATABASE SNAPSHOT as of 16.07.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 367 (+15 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 517 (-2 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 194 (+3 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 255 (+1 per 2 weeks)

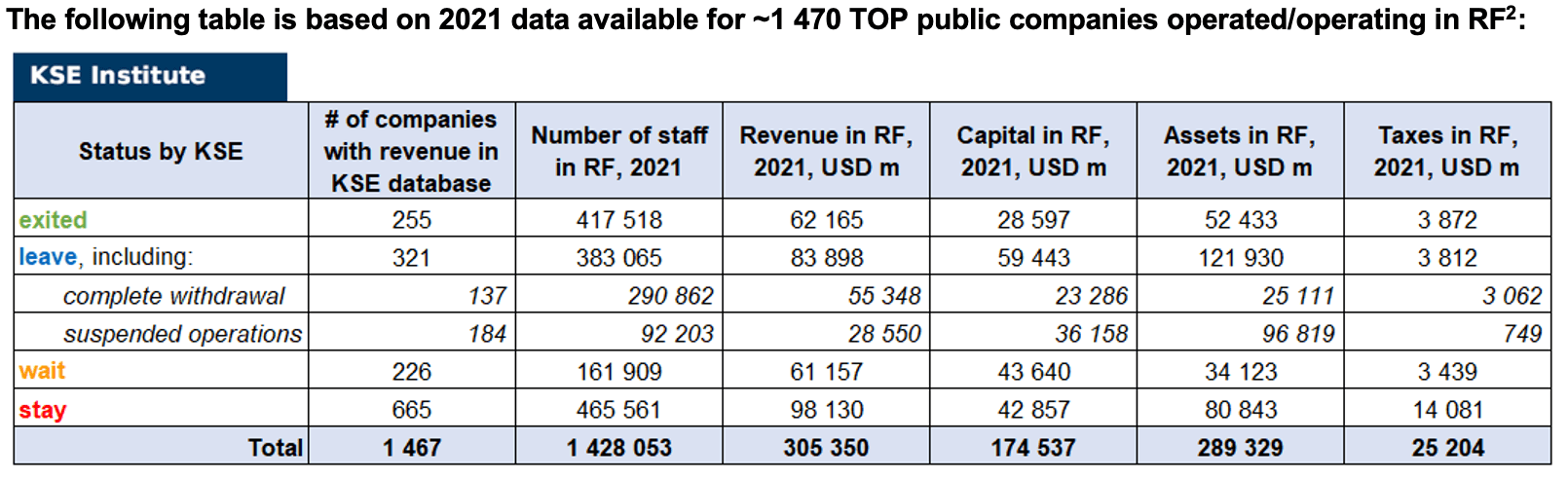

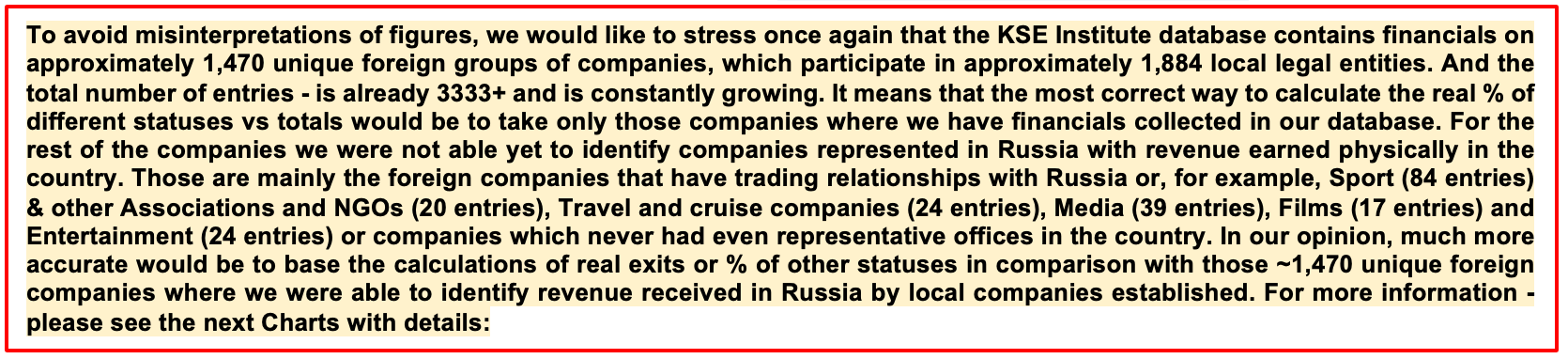

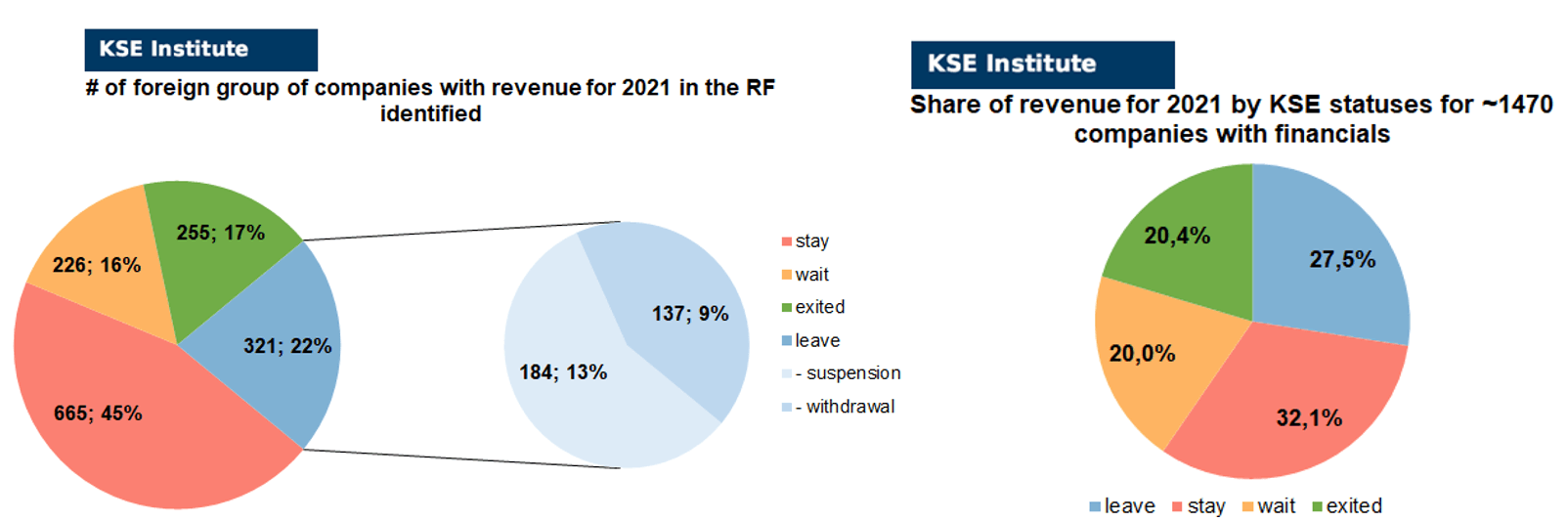

As of July 16, we have identified about 3,333 companies, organizations and their brands from 92 countries and 58 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 470 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021 before invasion was started, which allowed us to calculate the value of capital invested in the country (about $174.5 billion), local revenue (about $305.4 billion), local assets (about $289.3 billion) as well as staff (about 1.428 million people) and taxes paid (about $25.2 billion). 1,711 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 255 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

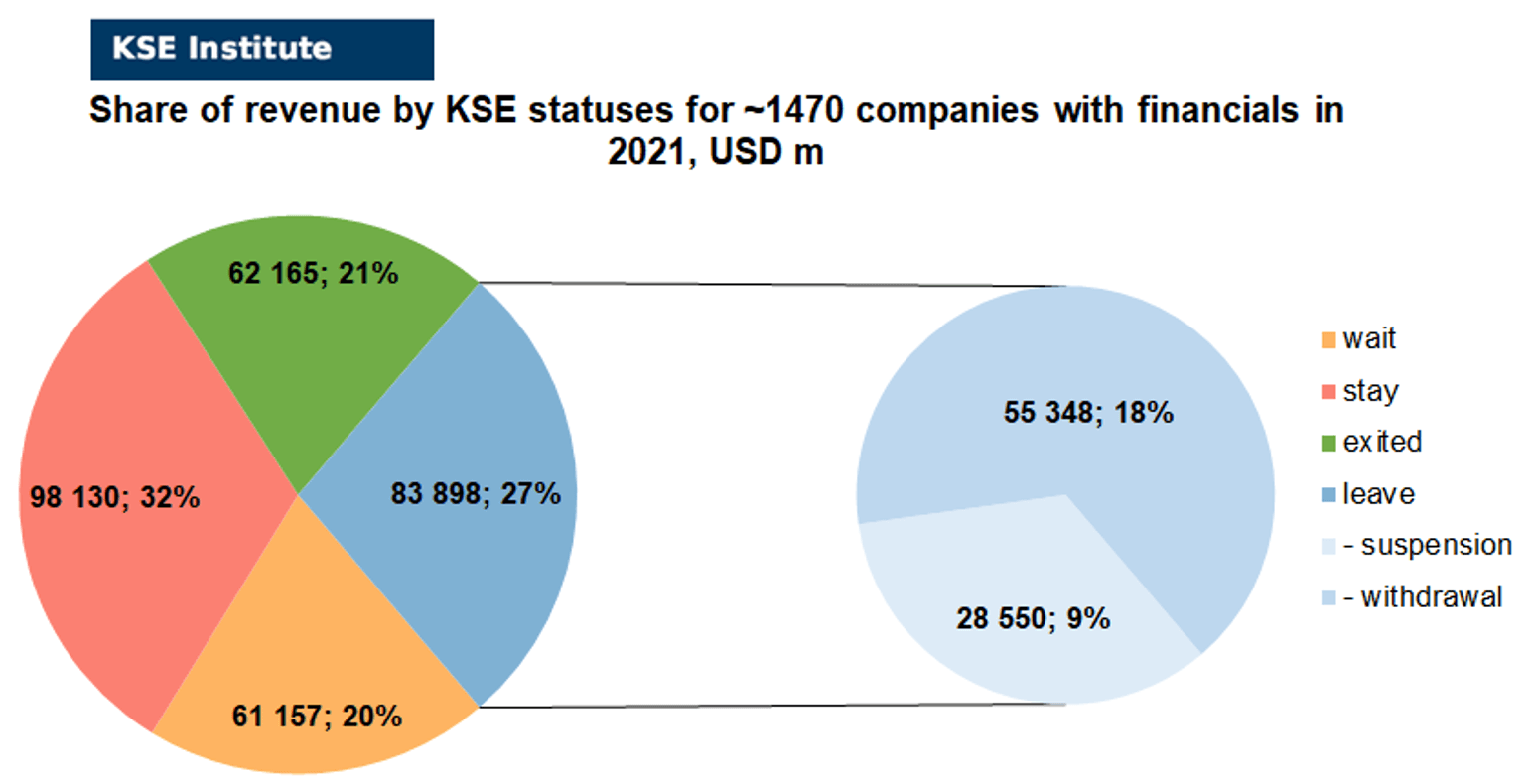

As can be seen from the tables below, as of July 16, 255 companies which had already completely exited from the Russian Federation, in 2021 had at least 417,500 personnel, $62.2 bn in annual revenue, $28.6bn in capital and $52.4bn in assets; companies, that declared a complete withdrawal from Russia had 290,900 personnel, $55.3bn in revenues, $23.3bn in capital and $25.1bn in assets; companies that suspended operations on the Russian market had 92,200 personnel, annual revenue of $28.6bn, $36.2bn in capital and $96.8bn in assets.

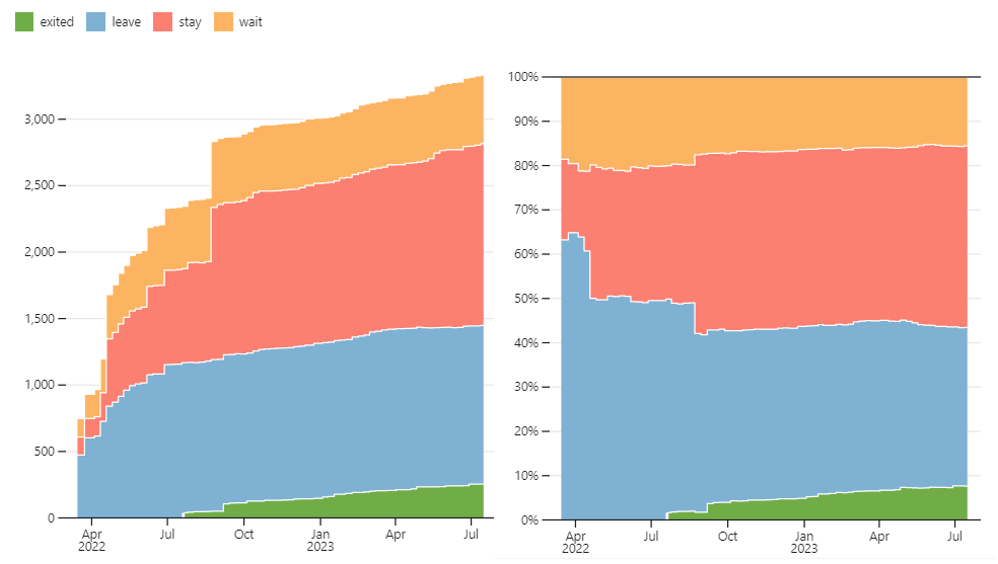

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 10 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 21 were added in July 2023). However, if to operate with the total numbers in KSE database, about 35.8% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 41.0% are still remaining in the country, 15.5% are waiting and only 7.7% made a complete exit³.

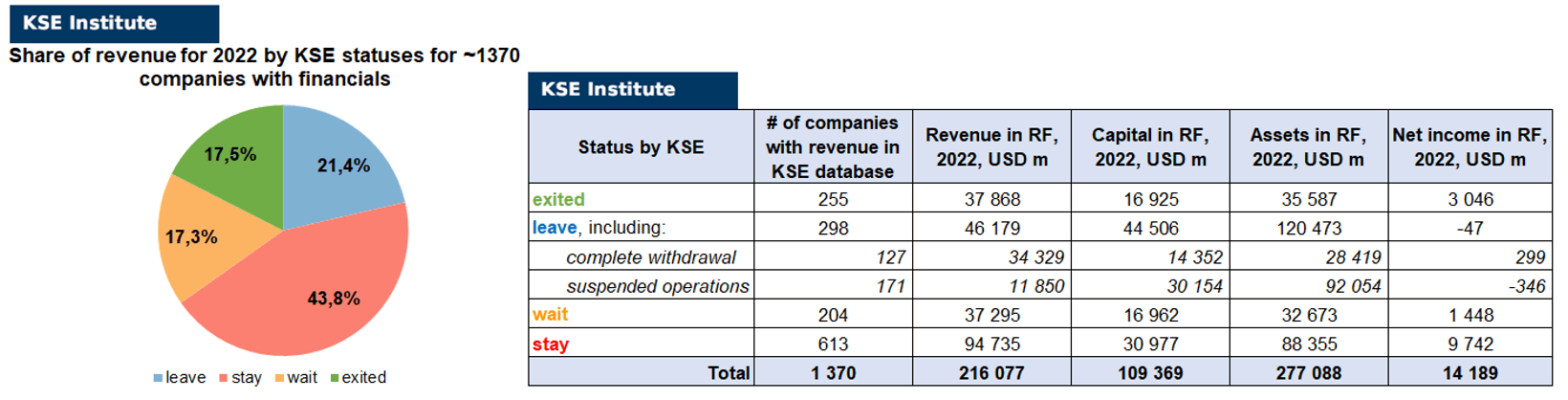

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 255 companies that completely left the country, since in 2021 they employed 29.2% of the personnel employed in foreign companies, the companies owned about 18.1% of the assets, had 16.4% of capital invested by foreign companies, and in 2021 they generated revenue of $62.2 billion or 20.4% of total revenue and paid $3.9 billion of taxes or 15.4% of total taxes paid by the companies observed. Data on 1,470 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (17%) and on share of revenue withdrawn (20%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 32% of revenue and 16% of waiting companies represent 20% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

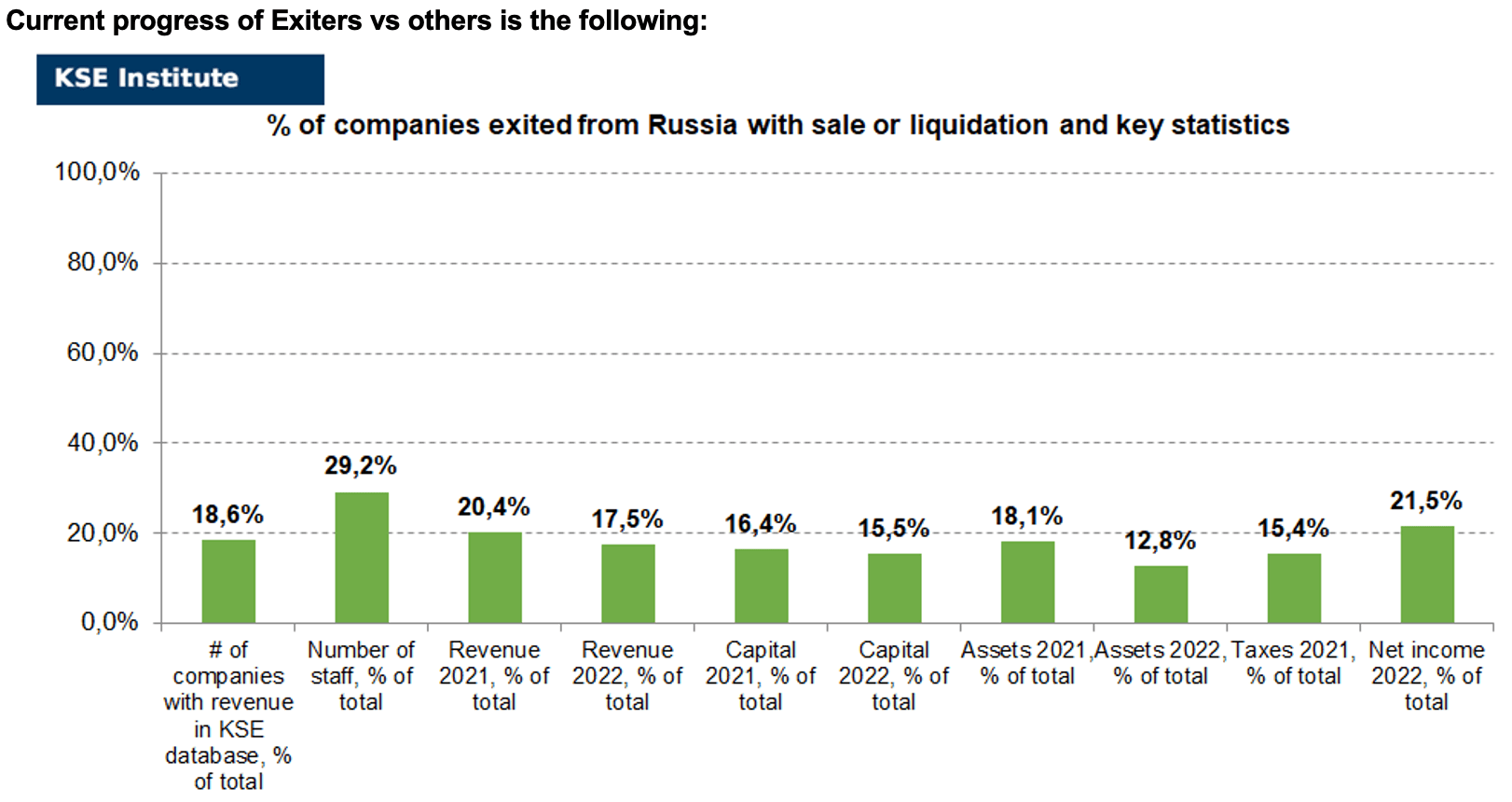

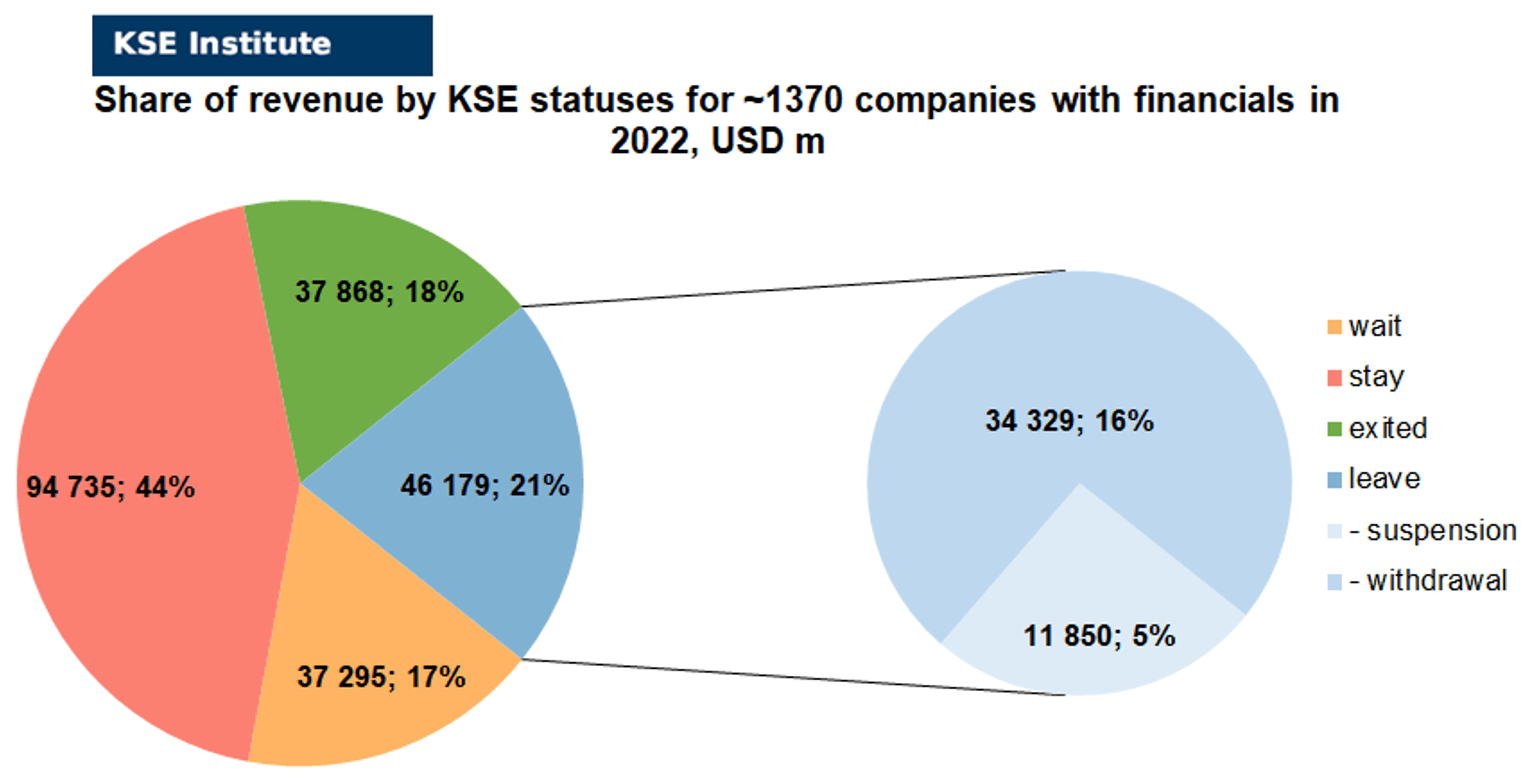

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for ~1370 companies (about 100 companies the data of which we have collected previously have not provided their reporting) and provides below the detailed analysis, more details will be provided further, once we have complete information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.9% less of revenue in 2022 (17.5% from total volume) than in 2021 (20.4% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-6.1%) revenue in 2022 (21.4% from total volume) than in 2021 (27.5% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+11.7%) more revenue in 2022 (43.8% from total volume) than in 2021 (32.1% from total volume). Companies with status “wait”⁴ gained almost the same share (-2.7%) of revenue in 2022 (17.3% from total volume) vs 20.0% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have almost not changed ($277.1bn in 2022 vs $289.3bn in 2021) and will probably even increase once we receive remaining reporting for ~90-100 companies (until companies decide not to disclose it). KSE Institute has already published a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 21% based on revenue allocation, those who are leaving represent 27% of total revenue (with 34% share of suspensions and 66% of withdrawals sub-statuses), % of staying companies represent 32% of revenue and 20% are waiting companies based on revenue generated in Russia in 2021.

If we take a look at the same chart based on revenue-2022 distribution – the picture will be totally different:

% of exited is 18% based on revenue allocation, those who are leaving represent only 21% of total revenue (with 26% share of suspensions and 74% of withdrawals sub-statuses), % of staying companies represent 44% of revenue and 17% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

Key updates from the latest Russian news:

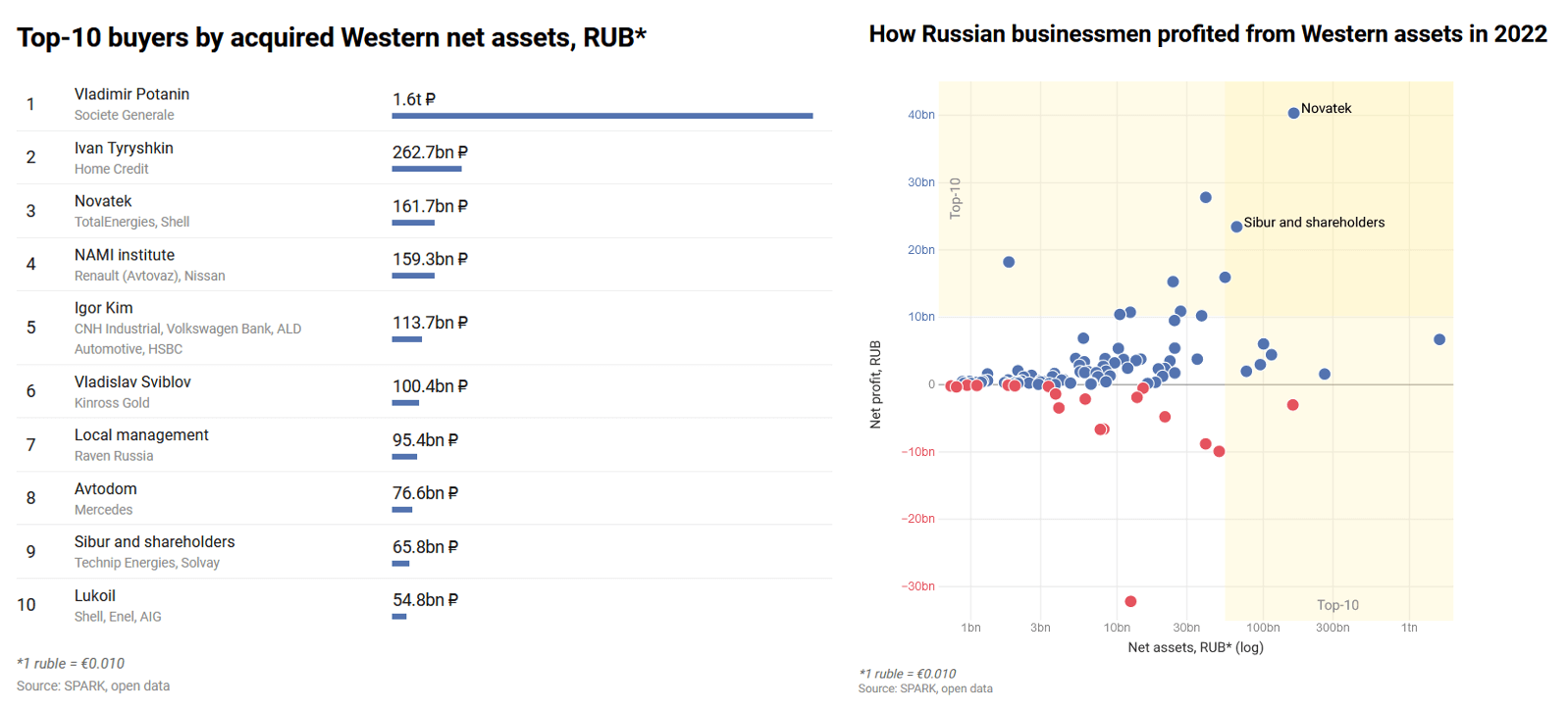

Against the backdrop of massive anti-Russian sanctions imposed in connection with the invasion of the Russian Federation into Ukraine, it became known that Russian business was given the opportunity to buy the assets of the departing companies at a significant discount.

As “Novaya Gazeta Europe” reports⁵, after the start of the war, more than 100 new large owners appeared in Russia. Assets of Western companies bought – as a rule, for nothing – already brought them at least 223 billion rubles (or more than $ 3 billion) of net profit last year.

Even before Russia’s attack on Ukraine, Western companies began to announce their departure from the Russian market, but in reality only about 10% of foreign brands left it.

Nearly half of all assets sold by Western countries (1.6 trillion rubles) was bought up by Vladimir Potanin, Russia’s richest businessman. He acquired Rosbank, formerly a branch of the French Société Générale, and two insurance companies.

Media have named Potanin, who also bought Tinkoff Bank back in 2022, “buyer of the year”. That deal was also a consequence of the war — the bank’s founder Oleg Tinkoff openly opposed the Russian invasion of Ukraine and said that he was forced to sell his company at a huge discount. Potanin, along with other billionaires, also seeks to buy Russian tech giant Yandex.

In second place — far behind Potanin — is Ivan Tyryshkin. The former head of the SPB Stock Exchange acquired Home Credit Bank, a microloan provider, an insurance company, and a collection agency, all of which were owned by the Czech PPF Group. The net assets of its former companies amount to 262 bn rubles (€2.6 bn).

The top 10 includes buyers who have acquired assets in the upstream sector, gold extraction, the manufacturing industry, and financial organizations.

Three buyers from the top 20 were in the red in 2022. Among them is Avtodom, which acquired the currently inactive Mercedes factory, and the state-owned NAMI institute, which got Renault’s share in Avtovaz and Nissan’s plant in St. Petersburg for the symbolic price of €1. Renault retained the right to buy its assets back within six years.

The former McDonald’s chain, now named “Vkusno i Tochka” has also been losing money since the pullout of its American stakeholder. The business was bought by McDonald’s franchise partners in Siberia Alexander Govor and Yury Kushner, both former owners of the coal mining complex Yuzhkuzbassugol. These assets were also sold for next to nothing, but McDonald’s retained the right to a buy-back. McDonald’s estimated its losses from leaving Russia at $1.2 billion. Its net assets in Russia at the end of 2022 were estimated at 41 billion rubles (€410 million).

A total of 14 of all the buyers rated had unprofitable acquisitions in 2022.

Another way to determine who benefited the most from the departure of Western companies is to calculate the net profit of the entities acquired. This amounted to 223 billion rubles (€2.2 billion) for all transactions in 2022. 10 companies have earned over 10 billion rubles (€100 million), whereas for half of the rating their profits exceed 1 billion rubles (€10 million). To calculate this, the experts of “Nova gazeta Europa” subtracted the share of profit that the buyers will receive depending on their share in the company’s authorised capital.

The top-10 buyers when ranked by net income differ sharply from the net assets’ top 10. The only buyers that made it onto both lists are Novatek and Sibur. The most profitable assets went to Novatek — the share of the French TotalEnergies in the Terneftegaz project and Shell’s share in the Sakhalin-2 project. Novatek’s total net profit from these projects in 2022 reached 40 billion rubles (€400 million).

Also, as reported by “Vedomosti”⁶,

the Russian authorities have formed 10 conditions for the exit of foreigners from Russian business.

For more detailed information: https://www.vedomosti.ru/economics/articles/2023/07/14/985254-vlasti-sformirovali-10-uslovii

Previously, the Minister of Finance Siluanov announced⁷ that “new owners of companies that left the Russian Federation will be obliged to place 20% of shares on the stock exchange”. More details:

WEEKLY FOCUS: Russian pharmaceutical market under Western sanctions

The development of the pharmaceutical market is a priority socio-economic task of any country, since, firstly, medicinal products affect the health of the population and the quality of labor resources, secondly, the pharmaceutical industry affects the state of health care, education and other spheres of activity.

Even before the beginning of the Russian-Ukrainian conflict in 2014, many Western pharmaceutical companies had long been present on the Russian market, in particular, they analyzed the Russian market, hired relevant marketers, imported medical goods and localized relevant production in Russia and even transferred some of their own technologies.

In 2014, after the annexation of Crimea, the economic sanctions imposed by the United States and its allies against Russia affected almost all spheres of life, and the medical industry was no exception. However, despite the absence of a direct ban on the supply of medicines and equipment, it is possible to trace the decrease in the volume of supplies of medicines from Western countries to the Russian market. As a countermeasure, the Government of Russia developed the State Strategy for the Development of the Pharmaceutical and Medical Industry until 2020.

As a result, from 2020 to 2022, there is a steady increase in the import of medicinal products. If in 2020 medical products were imported to Russia in the amount of 10.6 billion US dollars, then in 2021 – by 13.2 billion US dollars, and in 2022 by 15.2 billion US dollars⁸.

In 2014, Western countries did not prohibit Western manufacturers from supplying medical equipment to Russia. Thus, by 2022, the Russian medical equipment market could be compared with the German market, which is one of the largest in the world, in terms of the volume of consumption of certain types of medical products. For a number of foreign manufacturers, supplies to the Russian market accounted for a significant share of turnover.

After the start of the full-scale Russian-Ukrainian war in 2022, Western sanctions launched processes of structural changes in many branches of Russian industry.

Since February 2022, the Russian health care system, despite the fact that the sanctions of Western countries did not directly affect it, faced a number of difficulties in the purchase and supply of necessary materials, medical products and equipment, since the majority of the medical component of the Russian market is represented by products of foreign manufacturers. At the same time, prices for a number of foreign medicines have risen, or even stopped their supply altogether, the emigration of Russian medical specialists and problems with import substitution of Western medical equipment and components, etc.

Difficulties with logistics appeared, the delivery time of medical products increased, and many Russian medical products began to be produced from imported raw materials, which already provoked an increase in the corresponding prices. Russian doctors faced the suspension of membership in international organizations, the problems of exchanging experience, and communication with foreign specialists.

Another challenge for Russian medicine was the influx of wounded Russian soldiers to hospitals on the territory of Russia and in the territories occupied by Russia.

For reference: Russia is struggling with a military health crisis after losing an average of about 400 people a day for 17 months. It is likely that up to 50% of Russian combat casualties could have been prevented by providing proper first aid. Russia’s military losses have undermined the normal provision of some Russian civilian medical services, especially in border regions near Ukraine⁹.

Another issue that hit clinical medicine quite hard is the suspension of foreign international clinical research in Russia. At this time, in Russia, access to testing, to the study of new molecules, new medical products is actually closed, which in the future may greatly affect the quality of the provided medical services. Before the war, Russian manufacturers accounted for about 60% of the medical products that were on the Russian pharmaceutical market. 80% of active medical substances in Russia are imported by foreign and Russian pharmaceutical companies from countries that are not “friendly” to Russia, and after appropriate registration and packaging in Russia, these medical products are considered Russian. Also, 90% of Russian medical firms use Western equipment and need Western support at least in order to properly package the dosed medicine. Currently, very serious changes are taking place in this market. Supplies from the countries of Western Europe, the USA, and Switzerland are being replaced by supplies from India and China. But not all medical products can be replaced by Russian ones or imports from China, India and Turkey.

Another challenge for the Russian pharmaceutical market was the buying/selling ratio of the Russian ruble to the US dollar in 2022. The exchange rate of the US dollar affects the price of foreign and Russian medical products, in particular, Russian medical products, since substances used by Russian pharmaceutical companies are mostly purchased in Western Europe.

Considering this, Russian pharmaceutical manufacturers are looking for new options for relevant purchases in China, India, Turkey and other countries. They do not have to wait for the redistribution of the market in favor of the domestic segment due to logistical problems. The main suppliers of raw materials for the manufacture of medical preparations are India and China. Also, most of the medical equipment and components are products of European and American companies. Even without a direct ban on the use of these technologies on the territory of Russia, the volatility of the ruble exchange rate will lead to an increase in the price of the use of these technologies, and, as a result, medicine will be less and less accessible to ordinary citizens of the country.

Sanction measures related to the military and political events in Ukraine did not directly affect the medical supply of the Russian population, but were of an indirect nature. The main task that the participants of the Russian market had to solve was logistical. At first glance, the Russian pharmaceutical industry was not affected by Western sanctions – only 21 pharmaceutical companies announced their exit or suspension of operations from the Russian market in 2022, including such global giants as the American companies Bristol Myers Squibb and Eli Lilly, Japanese company Takeda, Swiss Sandoz etc. At the same time, at least 139 companies continue to work on the Russian market (data from the Kyiv School of Economics as of the middle of July 2023). In 2022, they earned at least 14.3 billion US dollars in revenue (and it was almost unchanged from 14.4 billion US dollars in 2021). At the same time, a number of foreign pharmaceutical manufacturers are making great efforts to continue working with Russia.

For reference: five global pharmaceutical companies are currently operating in Russia, which did not leave after the beginning of Russia’s large-scale invasion of the territory of Ukraine. Each of them paid tens of millions of US dollars to the Russian budget last year, in particular, this is the company Stada (Germany), the amount of taxes for 2022 is 53.6 million US dollars, this is the company Servier (France), the amount of taxes for 2022 is $46.2 million, this is the company KRKA (Slovenia), the amount of taxes for the year 2022 is 42 million US dollars, this is the company Berlin-Chemie (Germany)/Menarini Group (Italy), the amount of taxes for the year 2022 is 36.9 million US dollars, this is the Gedeon-Richter company (Hungary), the amount of taxes for 2022 is 32.6 million US dollars. Thus, the total amount of taxes paid to Russia by these five foreign pharmaceutical companies last year amounted to more than 211 million US dollars¹⁰.

Pharmaceutical products currently account for about a third of all Swiss exports to Russia. Since the full-scale invasion of the Russian Federation into Ukraine, it has grown by approximately 40% to two billion Swiss francs. Many large pharmaceutical companies are registered in Switzerland, including Novartis and Roche ¹¹.

The revenue of the key Russian branch of Novo Nordisk – Novo Nordisk LLC in 2022 amounted to 15.39 billion rubles, of which the net profit was 690 million rubles, in particular, an increase of 15% and 131%, compared to 2021, respectively¹².

Considering the above, it is worth noting the following. During the war and the introduction of Western sanctions, only some Western pharmaceutical companies decided to significantly limit their work on the Russian market. At the same time, more often than not, alternatives were found for the medical products that the Russians lost. However, the collapse of the clinical research market became a real problem. Because of it, Russia risks facing the denial of new medicines into the country. Also, during the year, the prices of medical products, the cost of which is not regulated by the State, increased significantly.

For reference: during the war, the prices of medical products in Russia, which are not controlled by the State, increased by an average of almost 18%¹³

It has become much more difficult for hospitals to repair and purchase foreign equipment, as well as to buy the corresponding consumables, since, in some cases, medical products are subject to sanctions regarding the ban on the export of dual-use products and, above all, the war of Russia against Ukraine is a ticking time bomb that laid under Russian hospitals, polyclinics, pharmacies, under the very future of Russia.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹⁴

01.07.2023

*Ariana Afghan Airlines (Afghanistan, Air transportation) Status by KSE – stay

The Ministry of Transport of the Russian Federation plans to expand air traffic with Afghanistan

https://www.tourister.ru/world/asia/afghanistan/news/34134

*Wimbledon (Great Britain,Sport) Status by KSE – wait

Wimbledon has banned its merchandise from being sold in Russia and Belarus as part of its ongoing condemnation of the war in Ukraine.

*Cargill (USA, Agriculture) Status by KSE – leave

*Viterra (Netherlands, Agriculture) Status by KSE – leave

*Louis Dreyfus (France, Agriculture) Status by KSE – leave

Global grain traders – Cargill, Viterra, Louis Dreyfus have stopped exporting Russian grain since July 1 and are leaving Russia.

https://www.interfax.ru/business/909692

*Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan, IT) Status by KSE – leave

TSMC confirms supplier data breach following ransom demand by Russian-speaking cybercriminal group

https://edition.cnn.com/2023/06/30/tech/tsmc-supplier-ransomware/index.html

02.07.2023

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell still trading Russian gas despite pledge to stop

https://www.bbc.com/news/business-66021325

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Zelensky introduced sanctions against the Georgian airline Georgian Airways

https://www.kommersant.ru/doc/6081928

Georgian Airways, included in Ukrainian sanctions lists, has increased the number of flights to Moscow

03.07.2023

*Hitec USA Group ((USA, Electronics) Status by KSE – stay

*Adesto Technologies (USA, Electronics) Status by KSE – stay

*International Rectifier (USA, Electronics) Status by KSE – stay

*MinMax Technology (Taiwan, Electronics) Status by KSE – stay

*Tallysman (Canada, IT) Status by KSE – leave

*Micron (USA, IT) Status by KSE – wait

*ON Semiconductor (USA, Electronics) Status by KSE – wait

*STMicroelectronics (Switzerland, IT) Status by KSE – stay

*Murata Manufacturing (Japan, Electronics) Status by KSE – stay

*Texas Instruments (USA, Electronics) Status by KSE – wait

*Maxim Integrated ((USA, Electronics) Status by KSE – stay

*Microchip Technology (USA, IT) Status by KSE – leave

*Marvell (USA, Technology) Status by KSE – leave

*Analog Devices (USA, Electronics) Status by KSE – leave

NXP Semiconductors (Netherlands, Electronics) Status by KSE – stay

Hemisphere GNSS, Inc. (USA, Defense) Status by KSE – stay

Companies whose components have been found inside the Shahed-136

https://stories.iphronline.org/terror-in-the-details/index.html

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

The NACP added Unilever to the list of “International Sponsors of War”

https://sanctions.nazk.gov.ua/en/boycott/1008/

https://finclub.net/ua/news/nazk-vyznalo-brytansku-unilever-mizhnarodnym-sponsoriv-viiny.html

*SAP (Germany, IT) Status by KSE – wait

After using SAP for a short time, the Pulkovo airport migrates to the 1C ERP system, which previously did not suit it

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

*Reliance (India, Energy, oil and gas) Status by KSE – stay

Russian oil supplies to India have been breaking records for ten months in a row

04.07.2023

*Adidas (Germany, Consumer goods and clothing) Status by KSE – wait

*Puma (Germany, Consumer goods and clothing) Status by KSE – wait

Adidas and Puma Exports into Russia

https://squeezingputin.com/support.html#Dassler21Jun23

*Halewood (Great Britain, Alcohol&Tobacco) Status by KSE – stay

The owners of the rights to the vodka name are suing the British manufacturer

https://www.kommersant.ru/doc/6082828

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Cocoa Products Exports into Russia

https://squeezingputin.com/support.html#Cocoa23Jun23

*Bharat Petroleum (BPCL) (India, Energy, oil and gas) Status by KSE – stay

*Hindustan Petroleum (India, Energy, oil and gas) Status by KSE – stay

*Nayara (India, Energy, oil and gas) Status by KSE – stay

*Chennai Petroleum Corp Ltd (India, Energy, oil and gas) Status by KSE – stay

*Mangalore Refinery and Petrochemicals Limited (India, Energy, oil and gas) Status by KSE – stay

*HPCL-Mittal Pipelines Limited (India, Energy, oil and gas) Status by KSE – stay

Indian importers of crude oil from Russia

https://squeezingputin.com/support.html#Cocoa23Jun23

*Hugo Boss (Germany, Luxury) Status by KSE – stay

Berlin: Protests against the Hugo Boss business in Russia

*Eurasia Mining (Great Britain, Metals and Mining) Status by KSE – stay

Eurasia Mining’s annual results marked by Russian uncertainty

05.07.2023

*Apple (USA,Electronics) Status by KSE – wait

Iphones Exports into Russia and Kazakhstan

https://squeezingputin.com/support.html#AppleIphones4Jul23

The Ministry of Industry and Trade has banned employees from using iPhones

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

*Commerzbank (Germany, Finance and payments) Status by KSE – leave

“Ruschymalians” filed claims for 31 billion rubles against Deutsche Bank and Commerzbank

*Bacardi (Great Britain, Alcohol&Tobacco) Status by KSE – wait

Bacardi breaks its promise to end trade with Russia, sees profits triple

https://en.thebell.io/bacardi-breaks-its-promise-to-end-trade-with-russia-sees-profits-triple/

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever: Cornetto maker defends decision to stay in Russia

https://www.bbc.com/news/business-66101852

*Chery Automobile (China, Automotive) Status by KSE – stay

The Jetour brand presented its development strategy on the Russian market and new models

https://www.kommersant.ru/doc/6083228?erid=4CQwVszH9pUiKstZPpC

06.07.2023

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

The Ukraine War Changed This Company Forever

https://www.nytimes.com/2023/07/05/business/economy/nokian-tyres-finland-romania.html

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen delays quitting Russia as Austria defends ties

07.07.2023

*TMP Metals Group (USA, Metals and Mining) Status by KSE – stay

Russian nickel and palladium mining and smelting company Nornickel has divested its exclusive distribution company for nickel, platinum group metals and cobalt in the Americas to TMP Metals Group in an all-cash transaction.

https://www.mining-technology.com/news/nornickel-metals-distributor-tmp/

https://www.kommersant.ru/doc/6084918

*Regus (Luxembourg, Hospitality, Real estate) Status by KSE – leave

One of the founders of the Russian coworking market, the Belgian Regus is closing its first site in the Russian Federation near the Foreign Ministry building, which it has been developing for over 20 years.

https://www.kommersant.ru/doc/6084892

*Mars (USA, Food & Beverages) Status by KSE – stay

The Prosecutor’s Office of the Moscow Region is investigating the Mars company due to possible financing of the Ukrainian Armed Forces

https://russian.rt.com/russia/news/1171401-prokuratura-proverka-mars-finansirovanie-vsu

*Mondelez (USA, Food & Beverages) Status by KSE – stay

*Pepsi (USA, Food & Beverages) Status by KSE – stay

*Mars (USA, Food & Beverages) Status by KSE – stay

PepsiCo, Mars See Business Boom in Russia After Staying Behind

08.07.2023

*Olympic Council of Asia (Kuwait, Аssociation, NGO) Status by KSE – wait

China did not allow athletes to compete under the Russian flag

https://www.insidethegames.biz/articles/1138715/russia-belarus-asian-games-hangzhou-2022

09.07.2023

*OMV (Austria, Energy, oil and gas) Status by KSE – stay

Austria’s OMV to continue to import Russian gas, chief says

https://www.ft.com/content/304034be-9cd5-406d-b668-894c4eac5a76

*Ehrmann (Germany, Food & Beverages) Status by KSE – stay

Big dairy Ehrmann is as active as ever in Russia after the war of aggression – and disappears when it comes to Putin’s war.

10.07.2023

*Rheinmetall (Germany, Defense) Status by KSE – leave

Rheinmetall will build and repair tanks in Ukraine, says CEO

https://edition.cnn.com/2023/07/10/business/rheinmetall-german-tank-factory-ukraine/index.html

*Danone (France, FMCG) Status by KSE – stay

Danone renamed Aktivia to Aktibio in Russia

https://www.vedomosti.ru/business/news/2023/07/10/984565-danone-pereimenovala-aktivia-aktibio

11.07.2023

*SK Enmove (South Korea, Chemical industry) Status by KSE – stay

*GS Caltex (South Korea, Energy, oil and gas) Status by KSE – stay

According to data on Russian imports, the main beneficiaries were two companies from South Korea: SK Enmove and GS Caltex, a joint venture between the South Korean GS Group and the American energy giant Chevron.

https://www.ft.com/content/50558284-7a62-40ed-8332-4c74454313a8

*International Olympic Committee (IOC) (Switzerland, Sport) SStatus by KSE – stay

IOC cites support to let Russians compete in Olympics

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

Gazprom arm seeks foreclosure on Deutsche Bank Russia businesses

*London Stock Exchange Group (Great Britain, Finance and payments) Status by KSE – leave

Polyus PJSC plans to spend as much as 579 billion rubles ($6.32 billion) on buying back shares as Russia’s biggest gold miner prepares to delist from the London Stock Exchange.

*Grupa Azoty (Poland, Chemical industry) Status by KSE – leave

Poland left the Russian businessman Kantor shares in Grupa Azoty

https://www.rbc.ru/business/11/07/2023/64ad52529a7947ee351eff80

12.07.2023

*General Electric Healthcare (USA, Pharma, Healthcare) Status by KSE – stay

*Canon Medical Systems (Japan, Pharma, Healthcare) Status by KSE – wait

*Siemens Healthineers (Germany, Pharma, Healthcare) Status by KSE – wait

*Philips (Netherlands, Electronics) Status by KSE – wait

American Firms Push Europeans and Japanese Out of Russian Market

http://eu-chronicle.eu/2023/06/us-under-friendly-fire/

*Mondi Group (Great Britain, FMCG) Status by KSE – leave

Mondi has completed the sale of its three Russian packaging converting operations to the Gotek Group, receiving net proceeds of €30.4m.

*Chery Automobile (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

China Exports Far More Vehicles to Russia Than Anywhere Else

*Jägermeister (Germany, Alcohol&Tobacco) Status by KSE – leave

The Ministry of Industry and Trade decided to exclude Jagermeister from parallel imports

https://www.kommersant.ru/doc/6097698

*Bank of China (China, Finance and payments) Status by KSE – wait

*China Construction Bank (China, Finance and payments) Status by KSE – stay

*Agricultural Bank of China (China, Finance and payments) Status by KSE – stay

*Industrial and Commercial Bank of China (China, Finance and payments) Status by KSE – stay

Chinese “subsidiaries” in Russia sharply increased bank lending during the crisis. Their share in this market increased almost fivefold

https://www.rbc.ru/finances/12/07/2023/64ac27439a79474aac9377af?from=from_main_1

13.07.2023

*Hilding Anders AB (Sweden, Consumer goods and clothing) Status by KSE – stay

KKR to Hand Over Swedish Mattress Firm to Creditors in Restructuring

*Embracer Group (Sweden, Gaming) Status by KSE – stay

The Swedish gaming giant Embracer remains in Russia – hundreds of millions of turnovers

*Mars (USA, Food & Beverages) Status by KSE – stay

The company has replaced the head of the confectionery industry in Russia

https://www.kommersant.ru/doc/6097854

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Russia’s Magnit Extends Buyback Offer To Shares Held Through Euroclear

*Lego (Denmark, Consumer goods and clothing) Status by KSE – leave

Lego constructors may soon appear again on the shelves of Russian stores. The Danish company intends to resume work and does not close the Russian office

https://ruposters.ru/news/13-07-2023/planiruet-vernutsya-rossiyu

*Apple (USA, Electronics) Status by KSE – leave

The Ministry of Digital will prohibit employees from using iPhones for official correspondence

14.07.2023

*Fortum (Finland, Energy, oil and gas) Status by KSE – leave

Finnish Fortum files a lawsuit due to the loss of control over assets in the Russian Federation

https://www.kommersant.ru/doc/6098510; https://www.kommersant.ru/doc/6098501

*Softline International (Great Britain, IT) Status by KSE – wait

Softline Group has closed a deal to acquire a 50.1% stake in Borlas Group, a player in the information technology market in Russia and the CIS.

https://www.tadviser.ru/a/23524

*ISUZU (Japan, Automotive) Status by KSE – leave

Isuzu Motors pulls out of Russia as war in Ukraine halts production

*Grupa Azoty (Poland, Chemical Industry) Status by KSE – leave

Russian fertilizer maker Acron said on Thursday, July 13, 2023 that it will challenge Poland’s decision to take control of its shares in Polish chemicals firm Grupa Azoty.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

KSE team has incredible news about the project again! We are not standing still, and in addition to supporting and developing our database, which currently contains the world’s most comprehensive information on the activities of global corporations on the Russian market, we are also developing our technical products. We developed a barcode scanner, which is available at the link https://leaverussia.kse.ua/ (only for mobile devices!) or in our Telegram bot https://t.me/exit_ru_bot! To use the scanner, you need to have a mobile phone, scan the barcode of the product in the store (or anywhere else) with a camera, and you will see information about its manufacturer and whether it also operates in Russia.

Also, thanks to the use of ChatGPT, for most companies in the consumer sector, we have created the most complete list of 4500+ major brands and trademarks, so the search has become even more convenient and better. In addition, the scanner can be saved as a regular app on the smartphone home screen and Eng/Ukr versions are available.

In July 2023, the KSE Institute, jointly with the B4Ukraine coalition partners published a new research entitled “The Business of Staying: a closer look at multinational revenues and taxes in Russia in 2022”, you can download its full text in English using the following links: https://kse.ua/wp-content/uploads/2023/07/The-Business-of-Staying-1.pdf and https://b4ukraine.org/pdf/BusinessOfStaying.pdf

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 17 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

¹⁴ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website