- Kyiv School of Economics

- About the School

- News

- 47th issue of the regular digest on impact of foreign companies’ exit on RF economy

47th issue of the regular digest on impact of foreign companies’ exit on RF economy

19 June 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 05.06-18.06.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 19.06.2023

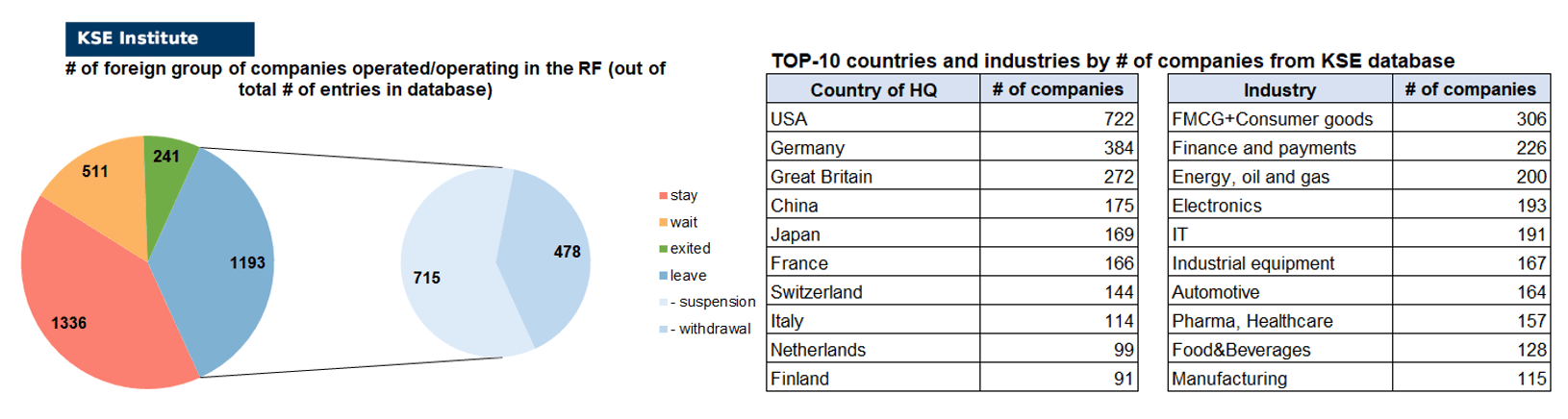

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 336 (0 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 511 (+13 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 193 (-1 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 241 (0 per 2 weeks)

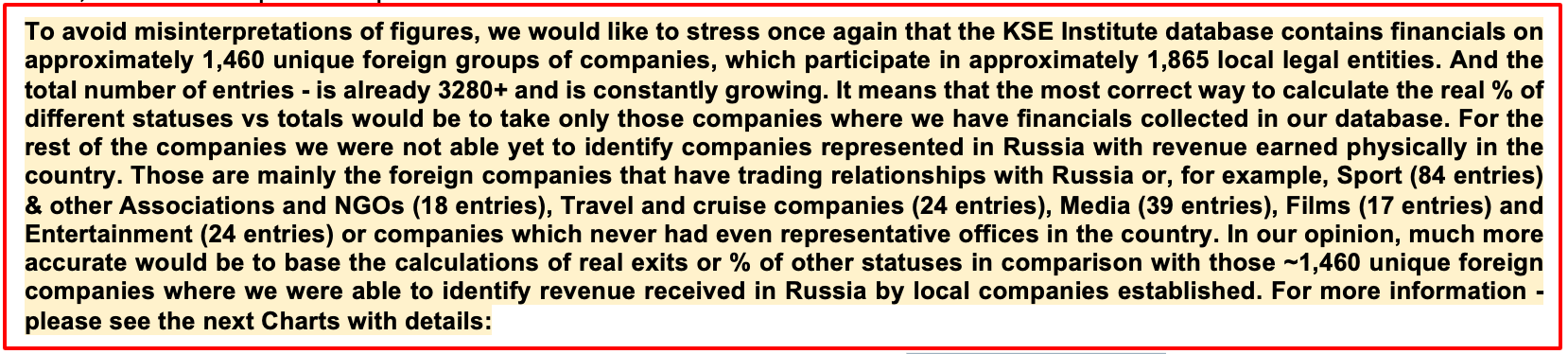

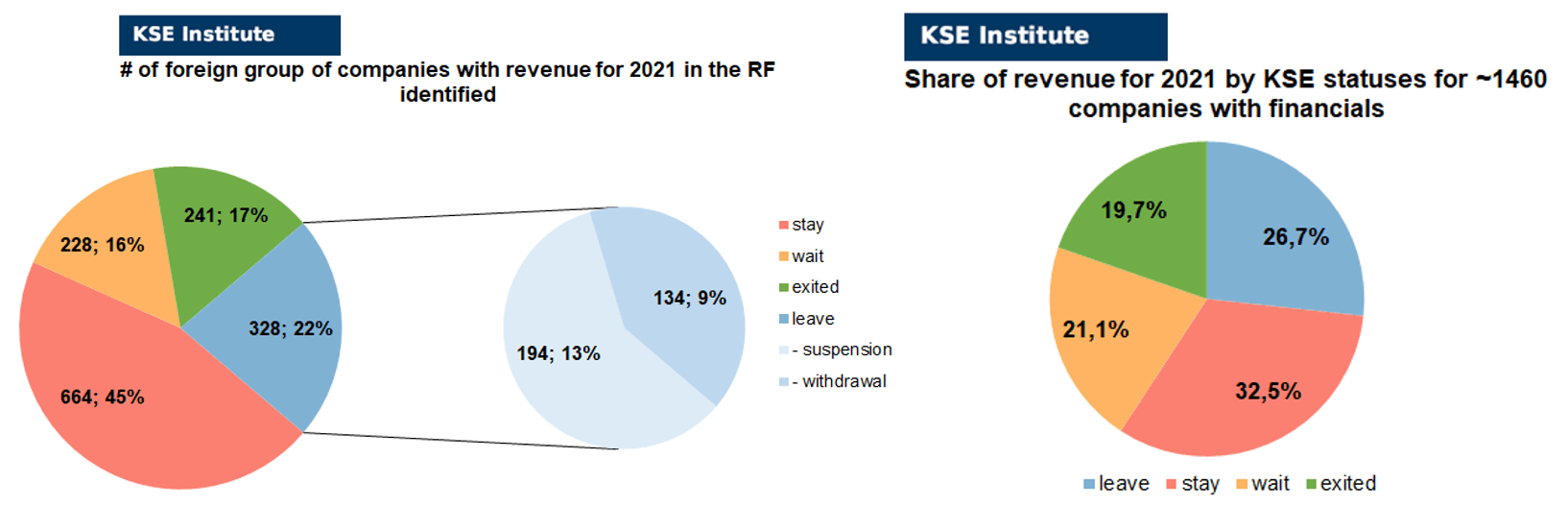

As of June 18, we have identified about 3,281 companies, organizations and their brands from 89 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 460 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.5 billion), local revenue (about $303.8 billion), local assets (about $288.5 billion) as well as staff (about 1.429 million people) and taxes paid (about $25.0 billion). 1,704 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 241 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

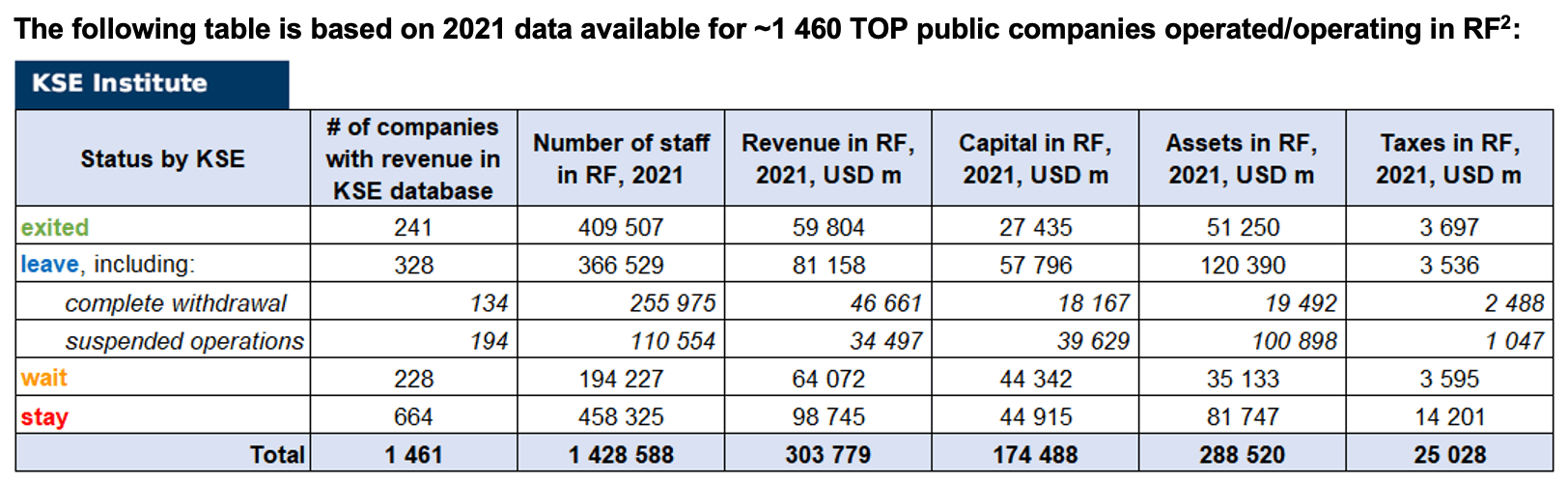

As can be seen from the tables below, as of June 18, 241 companies which had already completely exited from the Russian Federation, in 2021 had at least 409,500 personnel, $59.8 bn in annual revenue, $27.4bn in capital and $51.3bn in assets; companies, that declared a complete withdrawal from Russia had 256,000 personnel, $46.7bn in revenues, $18.2bn in capital and $19.5bn in assets; companies that suspended operations on the Russian market had 110,600 personnel, annual revenue of $34.5bn, $39.6bn in capital and $100.9bn in assets.

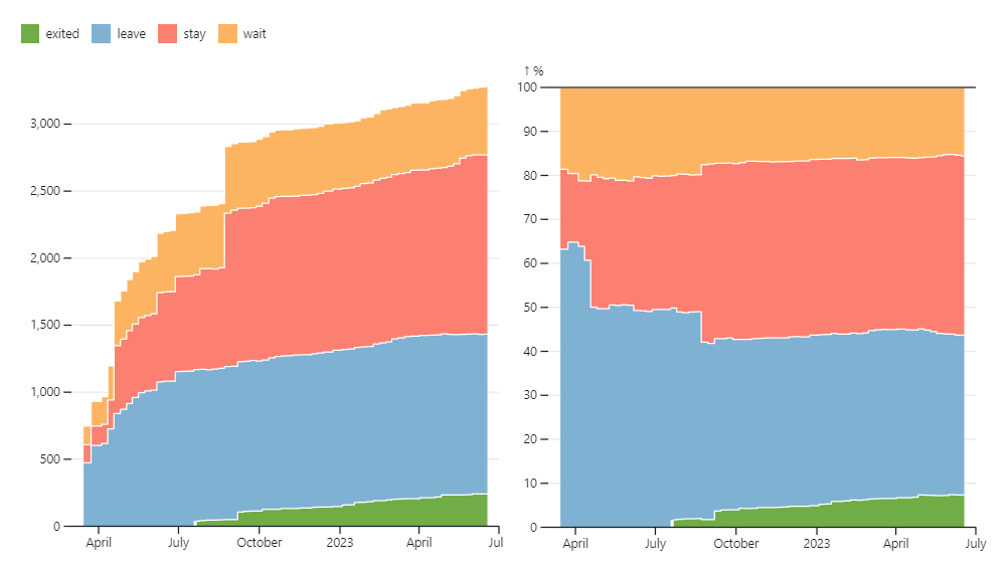

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 9 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 14 were added in June 2023). However, if to operate with the total numbers in KSE database, about 36.4% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.7% are still remaining in the country, 15.6% are waiting and only 7.3% made a complete exit³.

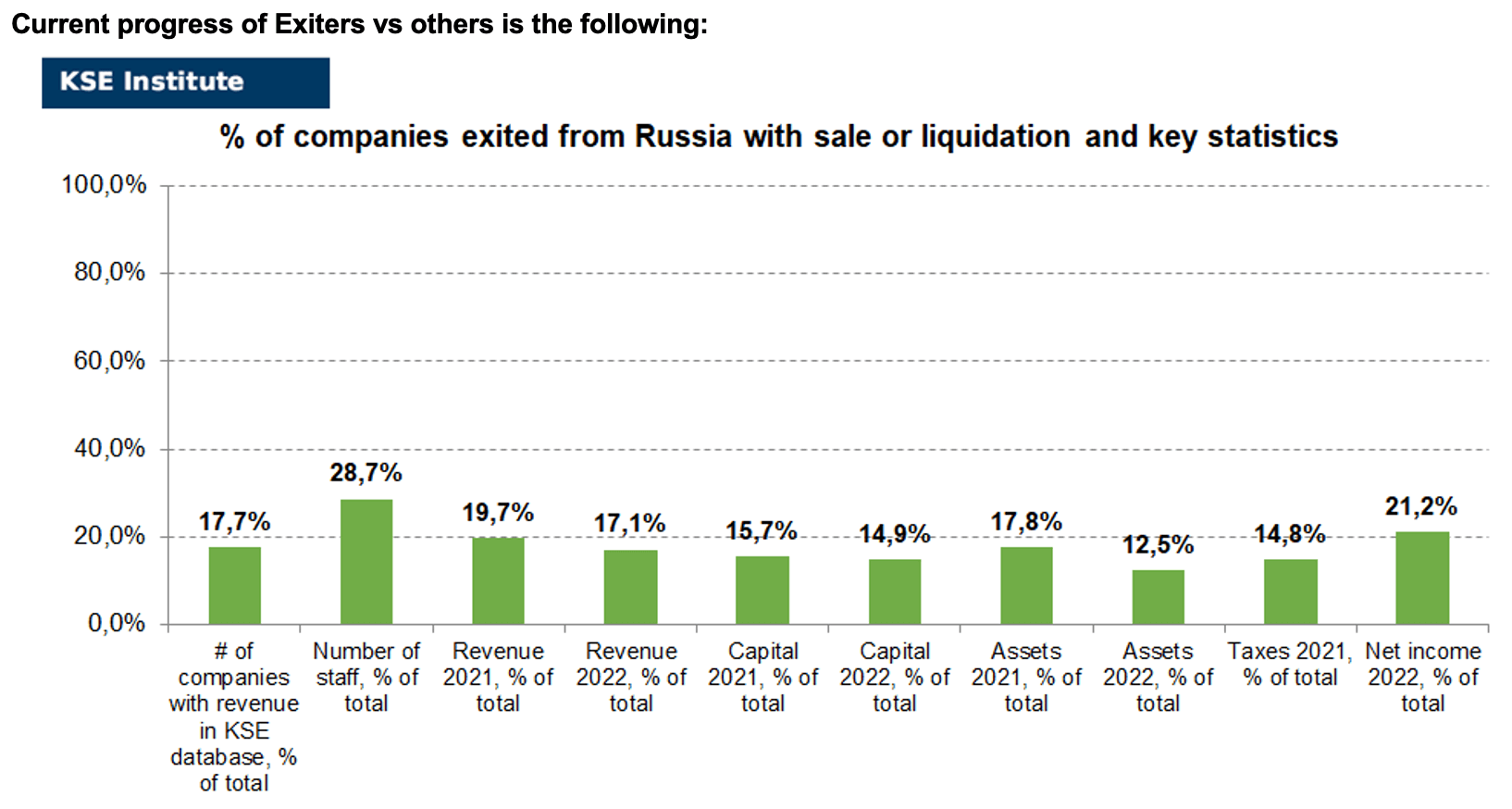

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 241 companies that completely left the country, since in 2021 they employed 28.7% of the personnel employed in foreign companies, the companies owned about 17.8% of the assets, had 15.7% of capital invested by foreign companies, and in 2021 they generated revenue of $59.8 billion or 19.7% of total revenue and paid $3.7 billion of taxes or 14.8% of total taxes paid by the companies observed. Data on 1,460 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (17%) and on share of revenue withdrawn (20%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 32.5% of revenue and 16% of waiting companies represent 21% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

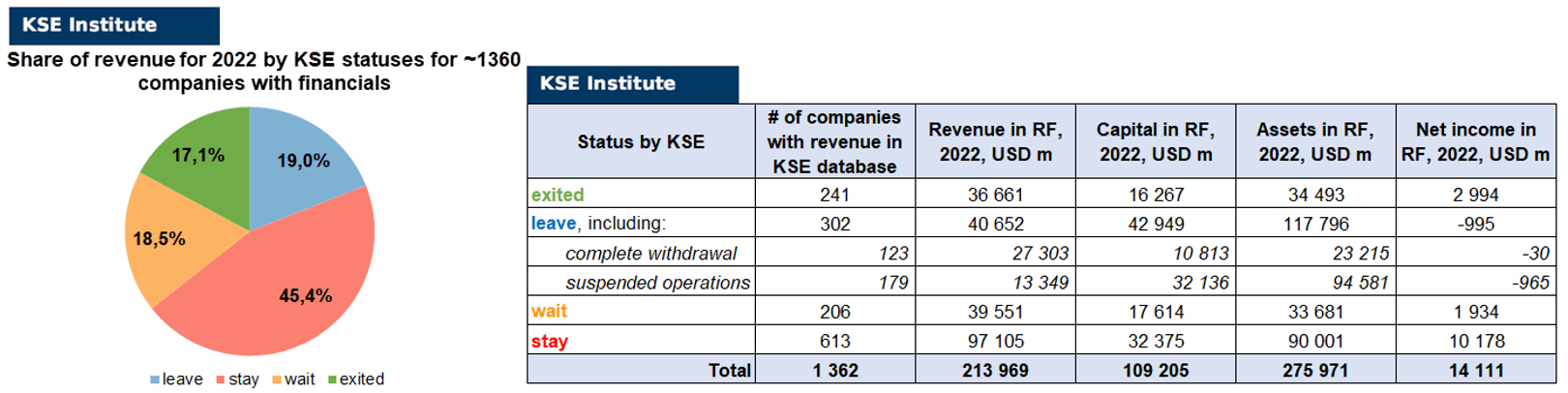

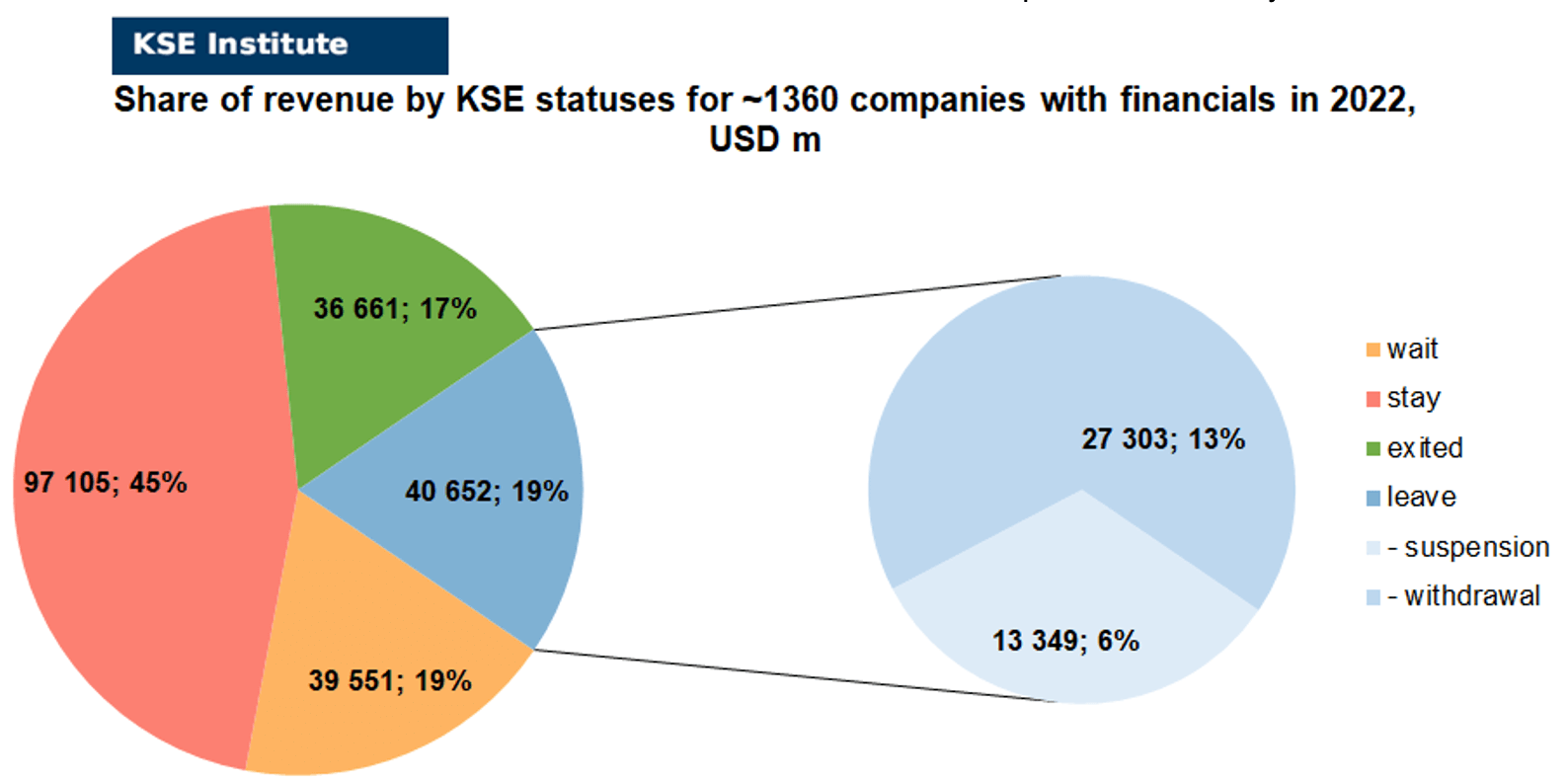

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for 1360 companies (about 100 companies the data of which we have collected previously have not provided their reporting yet) and provides below the first ever available analysis (as far as we know, this kind of data is being made public for the first time), more details will be provided soon, once we get full information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.6% less of revenue in 2022 (17.1% from total volume) than in 2021 (19.7% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.7%) revenue in 2022 (19.0% from total volume) than in 2021 (26.7% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+12.9%) more revenue in 2022 (45.4% from total volume) than in 2021 (32.5% from total volume). This is partly explained by reclassification of statuses that we did for some companies (e.g. Cargill, Carlsberg Group, Danone, Japan Tobacco International, Mars, Pepsi, Raiffeisen Bank) which significantly increased their revenue in 2022 vs 2021. Companies with status “wait”⁴ gained almost the same share (-2.6%) of revenue in 2022 (18.5% from total volume) vs 21.1% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have not almost changed ($276.0bn in 2022 vs $288.5bn in 2021) and will probably even increase once we receive remaining reporting for ~80-100 companies. KSE Institute has already published a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

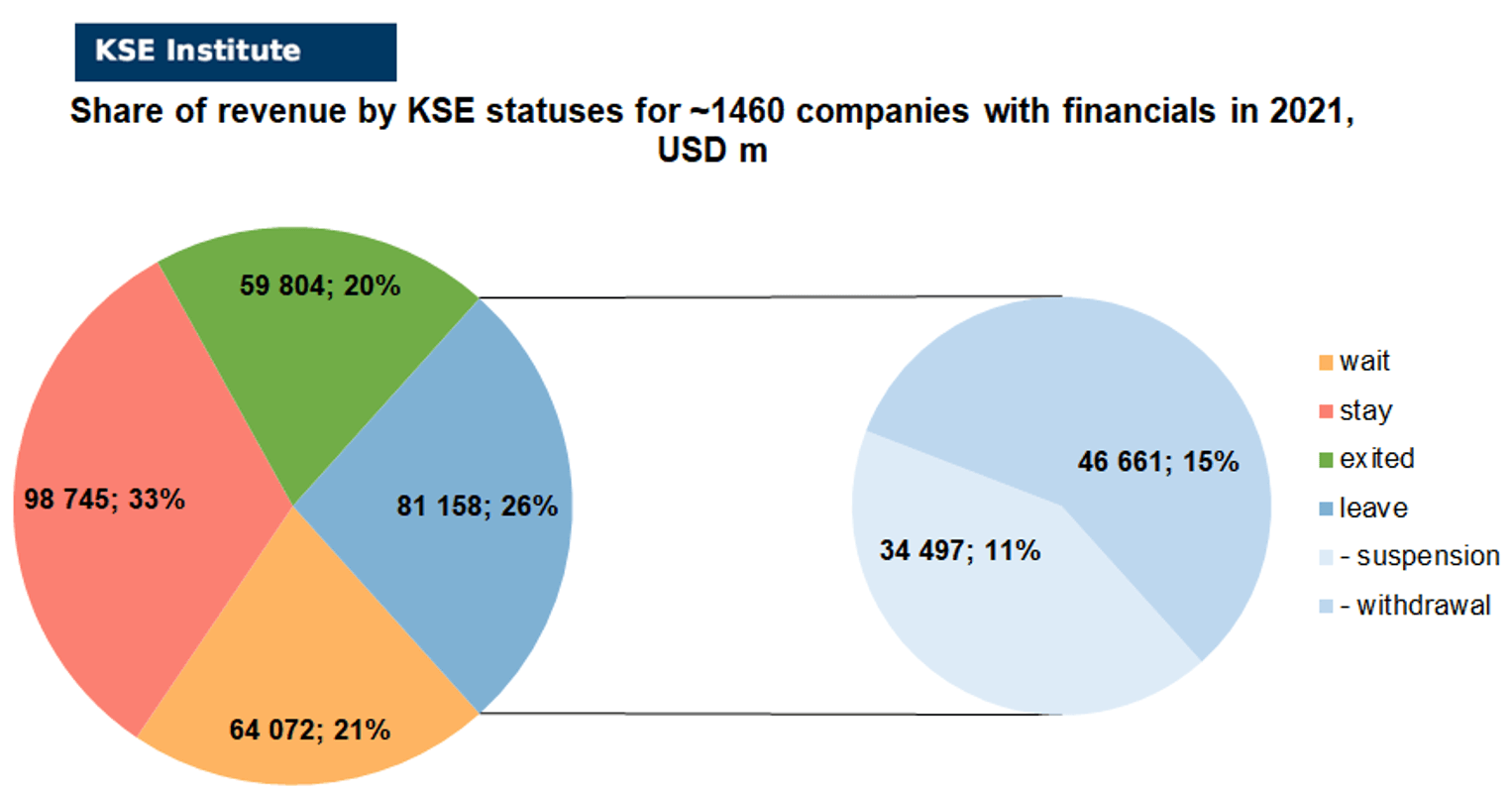

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 20% based on revenue allocation, those who are leaving represent 26% of total revenue (with 44% share of suspensions and 56% of withdrawals sub-statuses), % of staying companies represent 33% of revenue and 21% are waiting companies based on revenue generated in Russia in 2021.

If we take a look at the same chart based on revenue-2022 distribution – the picture will be totally different:

% of exited is 17% based on revenue allocation, those who are leaving represent only 19% of total revenue (with 33% share of suspensions and 67% of withdrawals sub-statuses), % of staying companies represent 45% of revenue and 19% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

President Vladimir Putin gave instructions to consider the possibility of issuing permits for the sale of enterprises controlled by foreigners from unfriendly countries, only with the consent of the regional authorities. This is stated in the list of instructions following the meeting of the Presidium of the State Council on April 4. The instruction was given to the government, the report must be submitted by June 15, 2023⁵

Also recently, Vladimir Putin sent a secret decree to the government, in which he demanded the preparation of a law giving the state the priority right to buy the assets of Western companies “at a significant discount.” This is reported by the Financial Times, which has read the text of the document. In the future, such assets can be resold at a profit.

In addition, the Kremlin intends to respond to Western sanctions with a policy of carrots and sticks, punishing companies in those countries that seize Russian assets and rewarding those that play by its rules. To do this, the economic bloc is discussing the issue of nationalization, people familiar with this told the FT. Putin signed the decree last week. It also requires that all private companies acquiring Western assets in Russia either have no foreign shareholders or are in the process of getting rid of them.

All this should make it even more difficult for foreigners to leave Russia. They already have to sell their assets at a significant discount and pay a kickback to the budget. Now the deal cannot be concluded without the approval of the government commission on foreign investment. The sale price must be at least half below the market price, and another 5 or 10% of the real value (depending on the size of the discount from the market price) must be given to the state.

WEEKLY FOCUS: Bypassing the Western sanctions in trade of Russian energy resources

For quite a long time, Russia has been under the influence of Western economic sanctions. Since 2014, Western sanctions have been imposed on Russia in several stages, namely: after the Crimean referendum, after the start of hostilities in the east of Ukraine and after the downing of a passenger plane in the Donetsk region.

Already in 2014, economic sanctions against Russia were aimed exclusively at competitive sectors of the economy, in particular, at the gas and oil industry. It is the raw materials orientation of the Russian economy that has become the main target of sanctions by the United States and its allies. But, despite this, until the beginning of the large-scale Russian-Ukrainian war in 2022, Russia was the world’s largest producer of gas, and the dependence of European countries on Russian gas fluctuated up to one hundred percent (Germany and Italy consumed the most Russian gas).

From the very beginning of the introduction of anti-Russian sanctions, some states declared their desire to abandon Russian gas, but in order to take such a step, it was necessary to find suppliers to replace Russian gas, and there are few such companies in Europe. At the same time, the European Union covers natural gas reserves with its own gas development, as well as supplies from Norway and Algeria, but even this was not enough to completely abandon Russian gas, even with gas supplies from the USA.

For reference: in recent years, before the full-scale conflict in Europe, EU countries accounted for 67.5% of Russian oil exports and 64.7% of Russian gas exports. For comparison, 16.9% of Russian oil was supplied to China⁷

After the start of a large-scale Russian-Ukrainian war in Ukraine in 2022, Western countries increased sanctions pressure on Russia. The main goal of the Western countries was to limit the revenues of the Russian budget.

Oil is of great importance to Russia. There is even a term “oil needle”, which means the strong dependence of the country on this type of resource. Export of energy resources is the cornerstone of the Russian economy. It was thanks to the rich subsoil that Russia was able to earn money and political influence in the world, and it was this sector that first found itself at the center of Western sanctions.

For reference: in 2021, 540 million tons of crude oil were produced in Russia, which is 13% of world production, of which 260 million tons were exported directly in the form of crude oil, which is 13% of world exports. On the domestic market, Russia processed the remaining 290 million tons, of which 140 million tons were exported as petroleum products (11% of global petroleum product exports) and 150 million tons were consumed domestically⁸

In 2021, Russia supplied EU countries with 40% of their natural gas, while Germany was the largest importer, followed by Italy and the Netherlands. According to the EU, by August 2022, this figure has fallen to around 17%. In 2021, Great Britain received only 4% of its gas supplies from Russia. EU countries increasingly seek to deliver liquefied natural gas by tankers from producers such as the USA and Qatar⁹

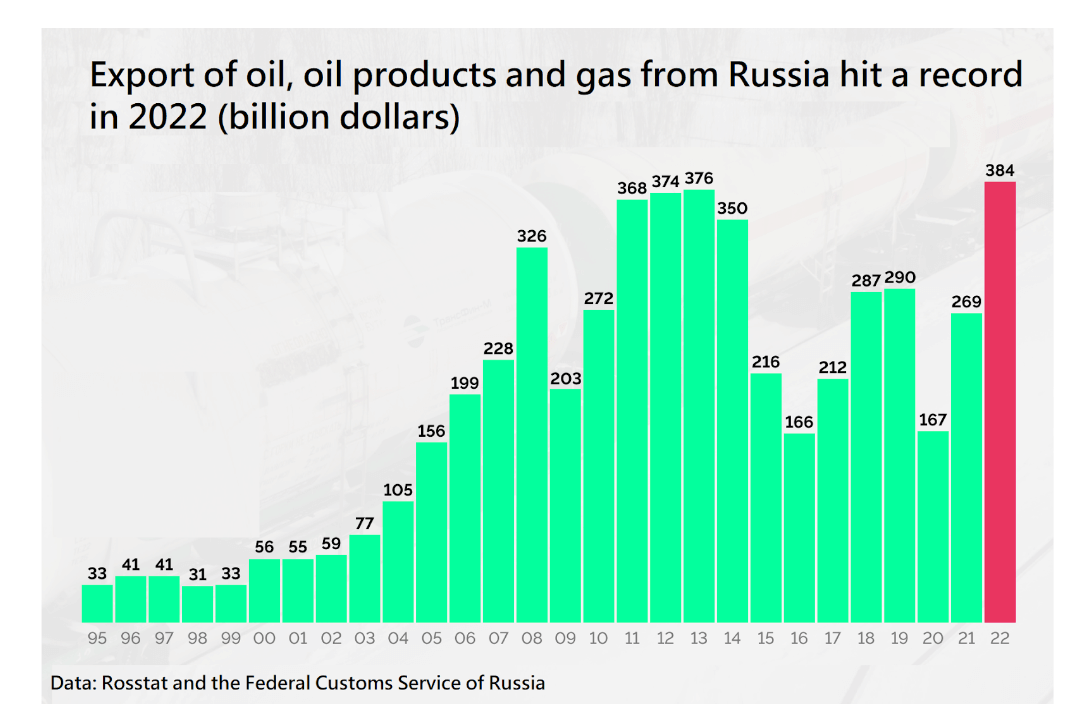

Exports of Russian oil, oil products and gas in 2022 reached 383.7 billion US dollars, which is 43% more than in 2021. This is an absolute record for 27 years. Prior to that, Russia earned the most from the export of oil, oil products and gas in 2013 – 376 billion US dollars. Record sales of hydrocarbons in 2022 increased the revenues of the Russian budget: they were planned at the level of 25 trillion rubles, but the budget received almost 3 trillion rubles more. According to the International Energy Agency, in January 2023 Russia’s revenues from oil and gas exports decreased by 38% compared to January 2022 and amounted to 18.5 billion US dollars, which is 38% less than in the same period of 2022 – then the country’s export revenues amounted to 30 billion US dollars¹⁰

One of the new Western sanctions against Russia was the EU approval on December 3, 2022 of a decision to set a ceiling price for Russian oil at $60. per barrel (EU Council Decision dated 03.12.2022 CFSP No. 2022/2369)¹¹

G7 countries and Australia have also introduced price caps on oil shipped by sea from Russia.

For its part, the Decree of the President of the Russian Federation dated December 27, 2022 No. 9612 prohibited the supply of Russian oil and petroleum products to foreign legal enterprises and individuals, provided that the contracts for these supplies directly or indirectly provide for the use of the oil price fixing mechanism. Thus, the restrictions introduced by the EU on the supply of Russian oil, taking into account the need to protect Russiaт national interests in terms of the sale of a strategically important resource on world markets at market prices, force Russian companies to look for alternative routes of supply to other countries.

The ongoing processes require Russia to change both the structure of the economy and the structure of external economic partners. The possibilities of reorienting supplies of Russian oil and petroleum products to other export destinations, primarily to Asian countries, are determined by the presence of relevant market niches and the existing capabilities of the transport infrastructure (oil pipeline capacity, railway carrying capacity, oil refining capacity of port infrastructure).

For reference: the total volume of oil supplied by Russia to Europe in 2021 was 468 million tons, while the volume of imports of Russian oil by China in 2021 took a share of 16.9%¹²

Since the beginning of February 2023, when the window to Europe for the Russians loudly closed, it has become very difficult to sell oil products at market prices. The circle of buyers among neighboring countries rapidly narrowed and this forced the Russians to make fantastic discounts on fuel so that it was profitable to deliver it.

For reference: in November 2022, before the EU cap and embargo, Russia produced an average of 1 487 million barrels of oil per day (10.9 million barrels per day). In December 2022, production remained virtually unchanged at 1 486 million tons per day. Until recently, the Russian authorities expected that the ceiling would work differently and lead to a reduction in oil production in Russia in the event of an increase in the average price of its sale. Thus, the budget for 2023 included an 8.5% drop in oil production compared to 2022, as well as a 13% reduction in the export of petroleum products¹³

Russian oil companies began to find ways to bypass the EU embargo, in particular, by using schemes to mix their oil with crude oil from other countries to hide the Russian origin. Russian oil mixing schemes are practiced in tanks in Asia and the Middle East. Also, there is a scheme of swaps with companies from “friendly countries” with Russia, thanks to which de facto Russian oil enters Europe. Such schemes allow European countries to continue purchasing oil of Russian origin, since it is difficult to find a full replacement for it.

For example, India has become one of the biggest buyers of Russian crude after Russia’s full-scale invasion of Ukraine, and its refineries are making big profits by buying crude at deep discounts, now banned in the EU, before selling the fuel at full price to Europe. The trade is legal under EU sanctions but has been criticized by those who want tougher sanctions against Russia, who say it has allowed Moscow to continue to earn more revenue from oil sales, the largest component of the Russian budget.

For reference: India’s annual trade with Russia more than tripled to 44.4 billion US dollars in the fiscal year ending March 31, 2023, from 13.1 billion US dollars a year earlier¹⁴

It is worth noting that in May 2023, China’s import of Russian crude oil increased by 55% compared to last year, reaching a record level. Chinese companies started buying Russian oil because it has become cheaper against the backdrop of Western sanctions. In May 2023, the volume reached almost 8.42 million tons. This is equivalent to approximately 1.98 million barrels per day. At the same time, China increased its imports of Russian gas. In May 2023, it reached almost 400,000 tons, which is 56% more than a year earlier. In the first five months of 2022, the import of Russian gas increased by 22% to 1 84 million tons¹⁵

Considering this, it is worth emphasizing that the largest Asian companies have filled the forced vacated market part, helping Russia to raise seaborne exports of crude oil to a record level after its invasion of Ukraine.

Due to the suspension of overland supplies to Europe in the first quarter of 2023, the export of diesel fuel from Russian ports increased by 17% compared to the same period last year. Unable to unload in Europe, the ships move to the sea terminals of Turkey, Saudi Arabia, UAE, Morocco and other countries. Huge volumes are transferred at sea to other vessels (ship-to-ship operation). In March and April 2023, almost 20% of the volume of diesel fuel shipped from Russia by sea changed ships on the way to the port of destination. At the same time, Turkey has become the largest hub in the Black Sea and Mediterranean regions¹⁶

Considering the above, it is worth noting the following. India or other countries could stop buying Russian oil if they believed the EU market could be cut off as a destination for their refined fuel.

In order to stop the flow of Russian oil, their own control mechanism must be implemented with compliance with Western sanctions by the “national authorities” of certain countries, assuming that the EU can target buyers of this refined fuel, which they believe is derived from Russian oil.

Western markets tend to offer higher prices and yields. Most of the volume of Russian crude oil, which should have been destined for Europe, was redirected to Asia.

The prospects for natural gas are hardly better, even if gas brings the Russian state less profit than oil. Gas, especially pipeline gas, is inelastic, unlike oil. That is why most of the gas volumes that Russia no longer exports to Europe due to the war will remain unrealized or will be sold for nothing in the near future.

The gas machine gave Moscow both money and political influence. It is currently largely destroyed by the war and will not be restored to its former state. Europe’s future dependence on Russian gas supplies will be very little compared to what it was before February 24 last year. This is a major strategic defeat for the Kremlin. China will not be able to replace Europe as a sales market for Russian gas in the near future, not in terms of volume and certainly not in terms of value.

As a conclusion, as a result of the war in Europe, the Russian oil and gas industry is shrinking. Russia’s income potential is eroding. At first, this process will be gradual, but later it can become more sudden and dramatic for the aggressor country.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)¹⁷

04.06.2023

*FATF (France, Аssociation, NGO) Status by KSE – leave

The International Financial Crimes Commission (FATF) is seriously considering including Russia in its blacklist.

https://eadaily.com/ru/news/2023/06/04/denezhnye-perevody-iz-rossii-mogut-popast-pod-zapret

*Nokian Tyres (Finland, Automotive) Status by KSE – exited

Remaining Western firms face tricky Russian exits

https://www.reuters.com/business/remaining-western-firms-face-tricky-russian-exits-2023-06-01/

*Air China (China, Air transportation) Status by KSE – wait

Air China’s new flight from Beijing to New York avoids Russian airspace

https://onemileatatime.com/news/chinese-airlines-avoid-russian-airspace/

*Henkel (Germany, Chemical industry) Status by KSE – exited

Henkel AG has the right to buy back its Russian operations in the next 10 years if conditions fundamentally change, Chief Executive Officer Carsten Knobel said

*HP Enterprise (Independent from HP Inc.) (USA, IT) Status by KSE – leave

*Acer (Taiwan, Electronics) Status by KSE – leave

*Pure Storage (USA, IT) Status by KSE – leave

*Asus (Taiwan, Electronics) Status by KSE – leave

*Micro-Star International Co. (MSi) (Taiwan, IT) Status by KSE – stay

*Dell (USA, Electronics) Status by KSE – leave

*IBM (USA, IT) Status by KSE – leave

*NetApp (USA, IT) Status by KSE – leave

*Inspur (China, IT) Status by KSE – stay

*Hitachi (Japan, Conglomerate) Status by KSE – leave

*Oracle (USA, IT) Status by KSE – leave

The Ministry of Industry and Trade is discussing with a number of domestic manufacturers the restriction of parallel import of computer equipment.

05.06.2023

*Polymetal (Great Britain, Metals and Mining) Status by KSE – leave

Polymetal considers divestment of Russian business

Update on the Company’s Russian-registered subsidiary, JSC Polymetal

*United Airlines (USA, Air transportation) Status by KSE – leave

United Airlines CEO expresses concern over flights crossing Russia

https://finance.yahoo.com/news/united-airlines-ceo-expresses-concern-080117523.html?guccounter=1

*Mondi Group (Great Britain, FMCG) Status by KSE – stay

UK’s Mondi scraps $1.17 bln deal to sell largest Russian plant

*Imperial Brands (Great Britain, Alcohol&Tobacco) Status by KSE – exited

The Imperial Tobacco tobacco factory suffered from the Russian attack on Kyiv

06.06.2023

*Southwind Airlines (Turkey, Air transportation) Status by KSE – stay

The US authorities have banned the Turkish airline Southwind Airlines from flying to Russia on American Boeing 737 MAX aircraft

*LG Electronics (South Korea, Electronics) Status by KSE – wait

The Polish plant of the South Korean LG has started installing Smart TV software adapted for the Russian market on the TVs it produces.

https://www.kommersant.ru/doc/6027428

*Home Credit (Netherlands, Finance and payments) Status by KSE – exited

From July 1, 2023, Home Credit Bank will change its name to Home Bank in order not to duplicate the brand of its former shareholder, the Czech Home Credit B.V

https://www.rbc.ru/finances/06/06/2023/647dc6c59a79471125731072

*Chery Automobile (China, Automotive) Status by KSE – stay

*Haval Motor (China, Automotive) Status by KSE – stay

*Geely (China, Automotive) Status by KSE – stay

*KIA Motors (South Korea, Automotive) Status by KSE – wait

Sales of cars are catching up with demand

https://www.kommersant.ru/doc/6027483

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

*China’s Silk Road Fund (China, Finance and payments) Status by KSE – stay

Novatek asked to introduce benefits for Chinese investors of Yamala LNG

07.06.2023

*ITS (Kazakhstan, Online trading) Status by KSE – leave

The new Kazakhstan ITS exchange will not work with Russian brokers and securities

https://www.interfax.ru/business/905167

*Hikvision (China, Electronics) Status by KSE – stay

Included in the list of international war sponsors by NACP

https://sanctions.nazk.gov.ua/en/boycott/31/

*Dahua Technology (China, Electronics) Status by KSE – stay

Included in the list of international war sponsors by NACP

08.06.2023

*Shaanxi Baoji Special Vehicles Manufacturing (China, Defense) Status by KSE – stay

The head of Chechnya, Ramzan Kadyrov, demonstrated Chinese armored vehicles from Shaanxi Baoji Special Vehicles Manufacturing. According to Kadyrov, the “Akhmat” battalion, which is fighting in Ukraine, will be equipped with this equipment.

https://newformat.info/news/kytaj-postavliav-vijskovu-tekhniku-dlia-vijny-proty-ukrainy/

*Vans (USA, Consumer goods and clothing) Status by KSE – wait

*VF Corporation (USA, Consumer goods and clothing) Status by KSE – wait

The American clothing and footwear manufacturer VF Corporation (brands Vans, The North Face, etc.) has decided to close its stores in Russia, and transfer the local division to wholesale deliveries. This is stated in the reporting of the Russian structures of VF Corporation LLC “VF Sys-I-S”.

https://www.kommersant.ru/doc/6029734

*Nasdaq (USA, Finance and payments) Status by KSE – leave

Yandex granted Nasdaq lifeline subject to Russia restructuring

https://finance.yahoo.com/news/1-yandex-granted-nasdaq-lifeline-081802822.html

*Mondelez (USA, Food & Beverages) Status by KSE – stay

SAS is halting sales of all products from food giant Mondelez because the company is said to be contributing to Russian coffers.

*Toyota (Japan, Automotive) Status by KSE – leave

FSUE NAMA will sell the former Toyota plant in Russia to Almaz-Anteya

09.06.2023

*Nasdaq (USA, Finance and payments) Status by KSE – wait

Following Yandex, Qiwi achieved the reversal of NASDAQ’s decision to delist shares

https://lenta.ru/news/2023/06/09/qiwi/

*DenizBank (Turkey, Finance and payments) Status by KSE – wait

The Turkish bank began to reset and close the accounts of Russians

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The press service of Raiffeisenbank reported that from June 20 the bank will introduce a commission of 50% of the amount of transfers to individuals in dollars from other banks

https://www.gazeta.ru/business/news/2023/06/09/20632034.shtml

10.06.2023

*Essity (Sweden, Consumer goods and clothing) Status by KSE – leave

Essity divests Russian operations

https://www.essity.com/media/press-release/essity-divests-russian-operations/f052f2ced7021a69/

11.06.2023

*Medium (USA, Online Services) Status by KSE – leave

Medium is Blocked in Russia. Russian regulator Roskomnadzor has restricted access to the website of online publishing platform Medium in Russia on June 1, 2023

https://medium.com/@antonkrutikov/medium-is-blocked-in-russia-640902472c6b

12.06.2023

*EBLAN (China, Consumer goods and clothing) Status by KSE – stay

Chinese clothing brand called “EBLAN” is about to open in Russia

https://nashaniva.com/ru/318949

*International Skating Union (Switzerland, Sport) Status by KSE – leave

The International Skating Union has extended the suspension of Russians from tournaments

*Toyota (Japan, Automotive) Status by KSE – leave

Toyota plant in St. Petersburg was sold to FSUE “NAMI” without the right to buy back

https://www.pravda.ru/news/auto/1845651-toyota_ostalas_bez_zavoda/

*Mondelez (USA, Food & Beverages) Status by KSE – stay

Oreo-maker Mondelez faces Nordic backlash over Russia business

13.06.2023

*Airwork (New Zealand, Air transportation) Status by KSE – leave

New Zealand-based Airwork writes off $176m for aircraft stuck in Russia

*Bridgestone Corporation (Japan, Automotive) Status by KSE – leave

Bridgestone Corp. is “making progress” with plans to withdraw from tire manufacturing activities in Russia, the Japanese tire maker told European Rubber Journal recently.

https://www.rubbernews.com/acquisition/bridgestone-making-progress-russian-withdrawal

*Revolut (Great Britain, Finance and payments) Status by KSE – leave

Russians living in Europe complained about the blocking of operations at Revolut Bank

14.06.2023

*Softline International (Great Britain, IT) Status by KSE – wait

Softline system integrator is negotiating the purchase of Forward Leasing (Forward Leasing LLC)

https://www.kommersant.ru/doc/6043218

*Robert Bosch (Germany, Electronics) Status by KSE – leave

Russian state entity NAMI said it had acquired a 100% stake in a factory producing anti-lock brakes and other systems for cars that was formerly owned by German technology group Robert Bosch.

https://finance.yahoo.com/news/russia-takes-over-another-western-080305910.html

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

UBS sets ‘red lines’ for Credit Suisse staff as it completes takeover

https://www.ft.com/content/dcadb6dc-482f-4a76-9db8-9bcbb337c40f

*Fortenova Group (Croatia, Food & Beverages) Status by KSE – wait

The European retail group still struggling to ditch its Russian owners

https://www.ft.com/content/c667cc5d-a03c-4afb-a160-d4faf5d39d43

*DTEK (Ukraine, Energy, oil and gas) Status by KSE – exited

The shareholder of the former coal assets of Rinat Akhmetov in the Rostov region, “Donskoy anthracite” and the mine “Obukhovskaya”, became “SBK Premier” – previously the structure of Sberbank

15.06.2023

*Euroclear (Belgium, Finance and payments) Status by KSE – wait

Euroclear resumes settlements on several issues of federal loan bonds (OFZ) and sovereign eurobonds of the Russian Federation in euros maturing in 2025

*Swarovski (Austria, Luxury) Status by KSE – leave

Swarovski: No layoffs at Wattens, exit from Russia complete

*Starbucks (USA, Public catering) Status by KSE – exited

Bean counters: how Russia’s wealthy profited from exit of western brands

*GAIL (India, Energy, oil and gas) Status by KSE – stay

Russia’s Yamal LNG to resume LNG supplies to India’s GAIL

*D-Link (Taiwan, Electronics) Status by KSE – stay

The joint company of Rosatom and D-Link in the first year of production of switches was able to earn 183 million rubles. The main company received 4.2 billion rubles of revenue in 2022.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

In May 2023, the KSE Institute published a new research entitled “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave”, you can download its full text in English using the following links: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963 and https://www.researchgate.net/publication/370902501

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 15 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

¹⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website