- Kyiv School of Economics

- About the School

- News

- 46th issue of the regular digest on impact of foreign companies’ exit on RF economy

46th issue of the regular digest on impact of foreign companies’ exit on RF economy

5 June 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 15.05-04.06.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

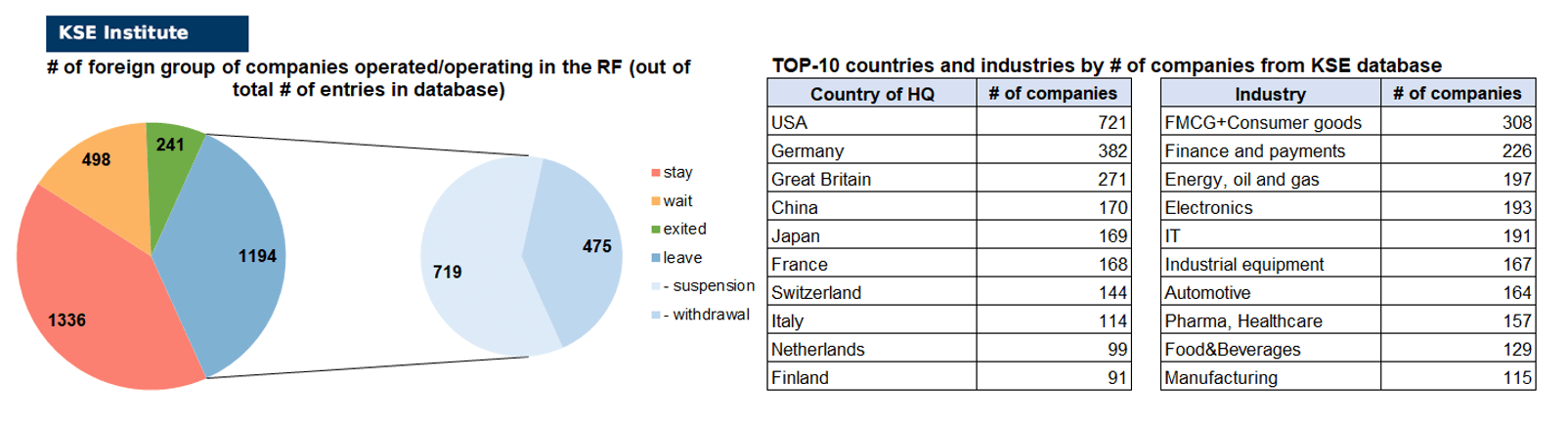

KSE DATABASE SNAPSHOT as of 05.06.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 336 (+60 per 3 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 498 (-10 per 3 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 194 (-3 per 3 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 241 (+8 per 3 weeks)

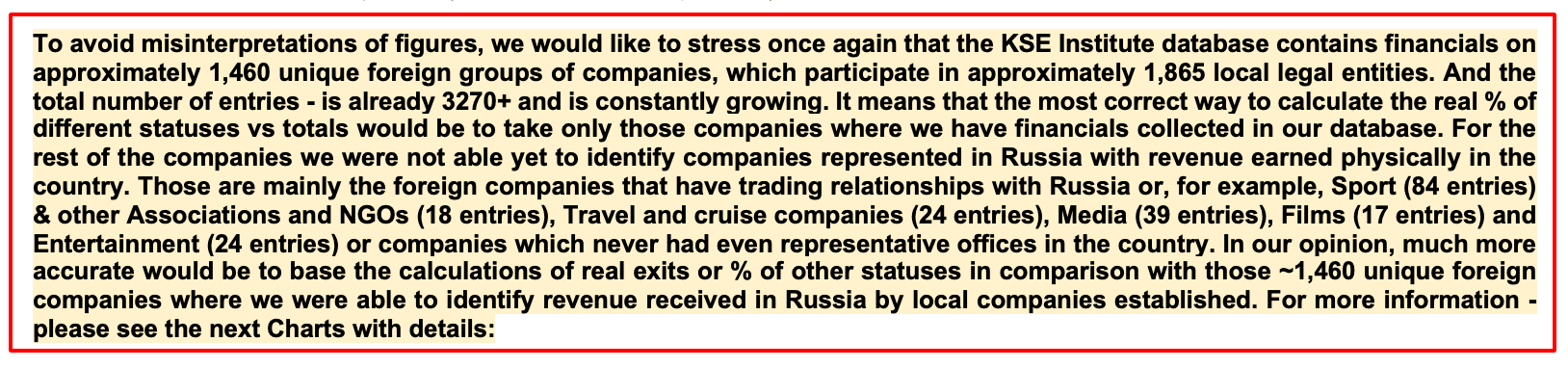

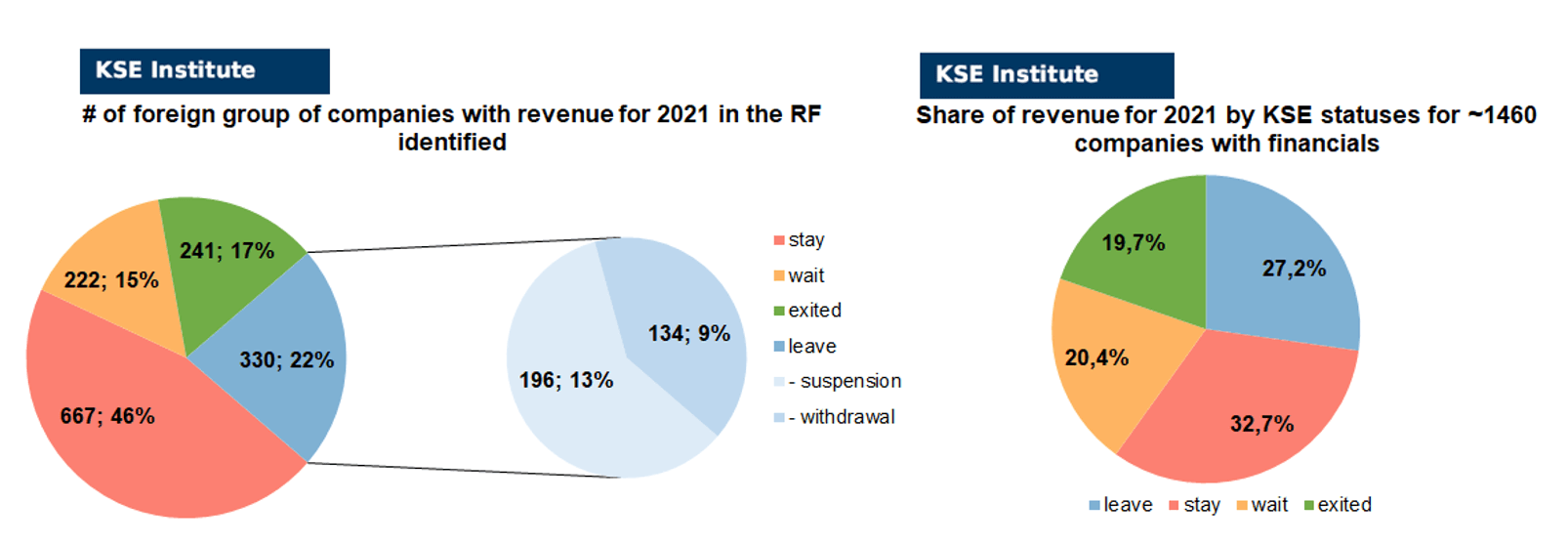

As of June 04, we have identified about 3,269 companies, organizations and their brands from 89 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 460 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.5 billion), local revenue (about $303.7 billion), local assets (about $288.5 billion) as well as staff (about 1.428 million people) and taxes paid (about $25.0 billion). 1,692 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 241 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

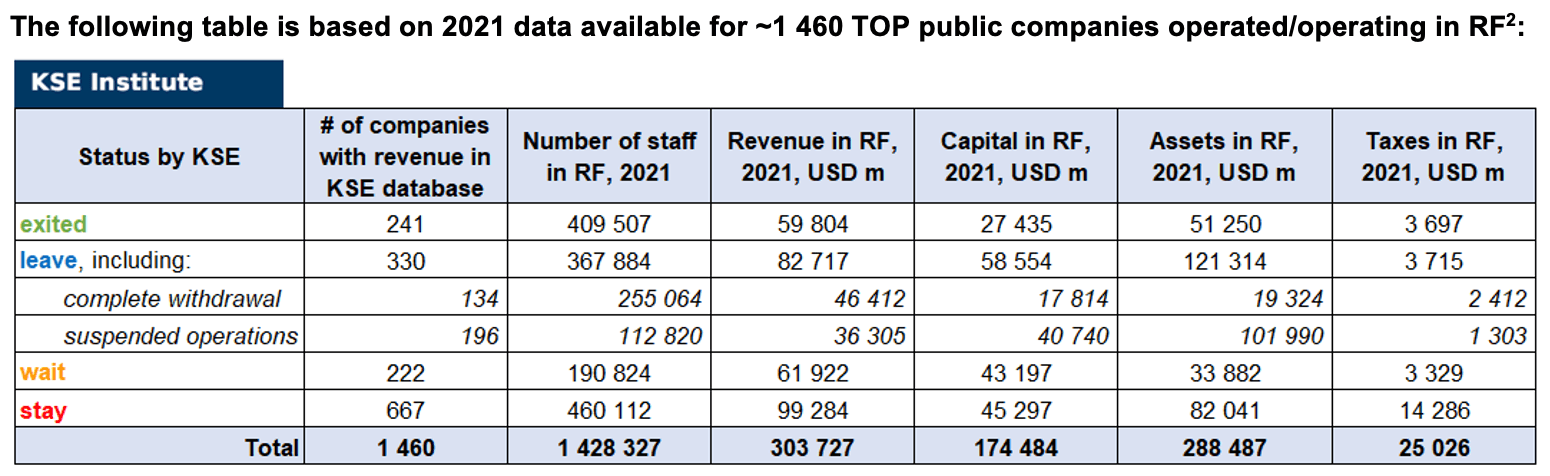

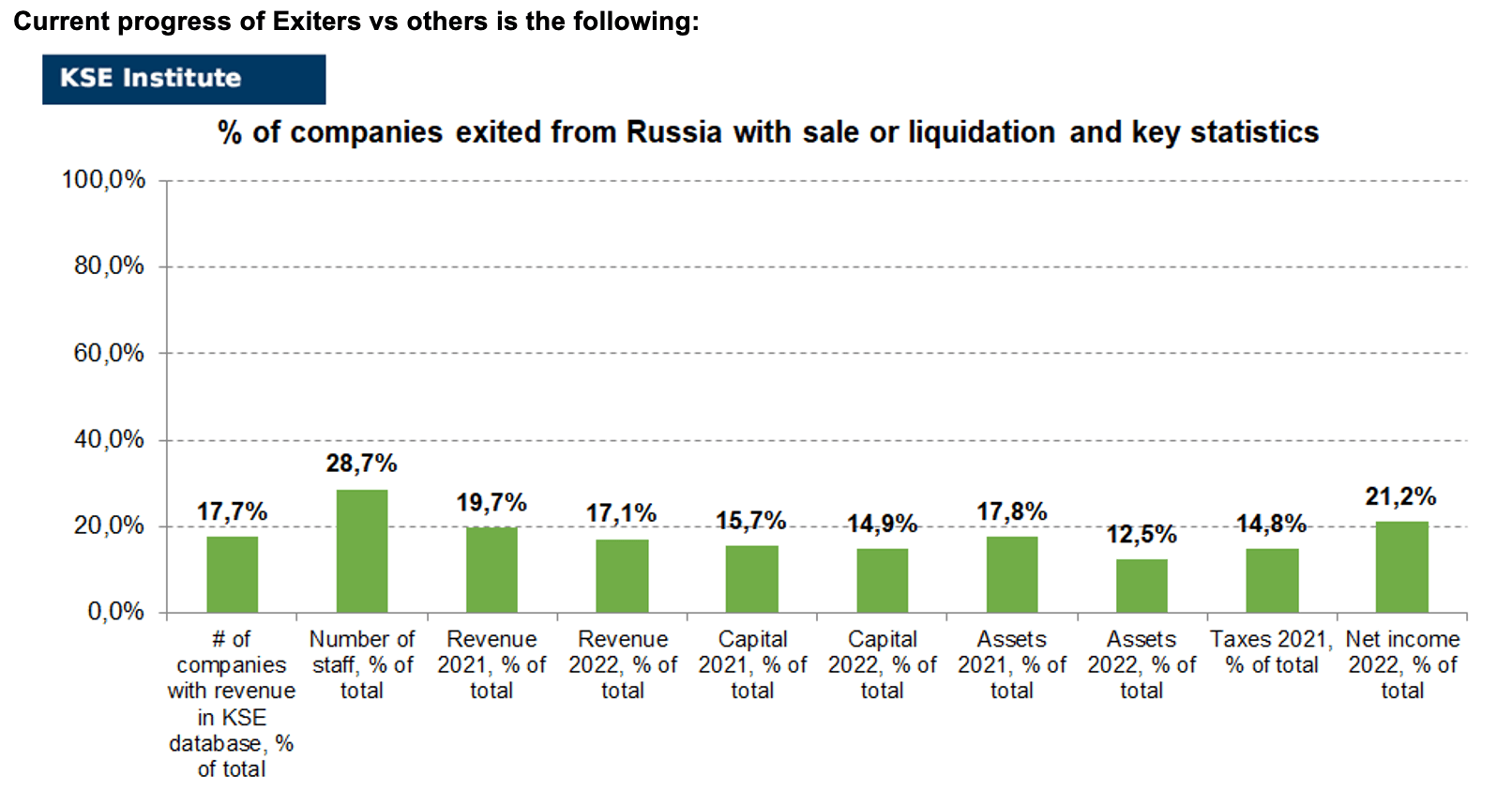

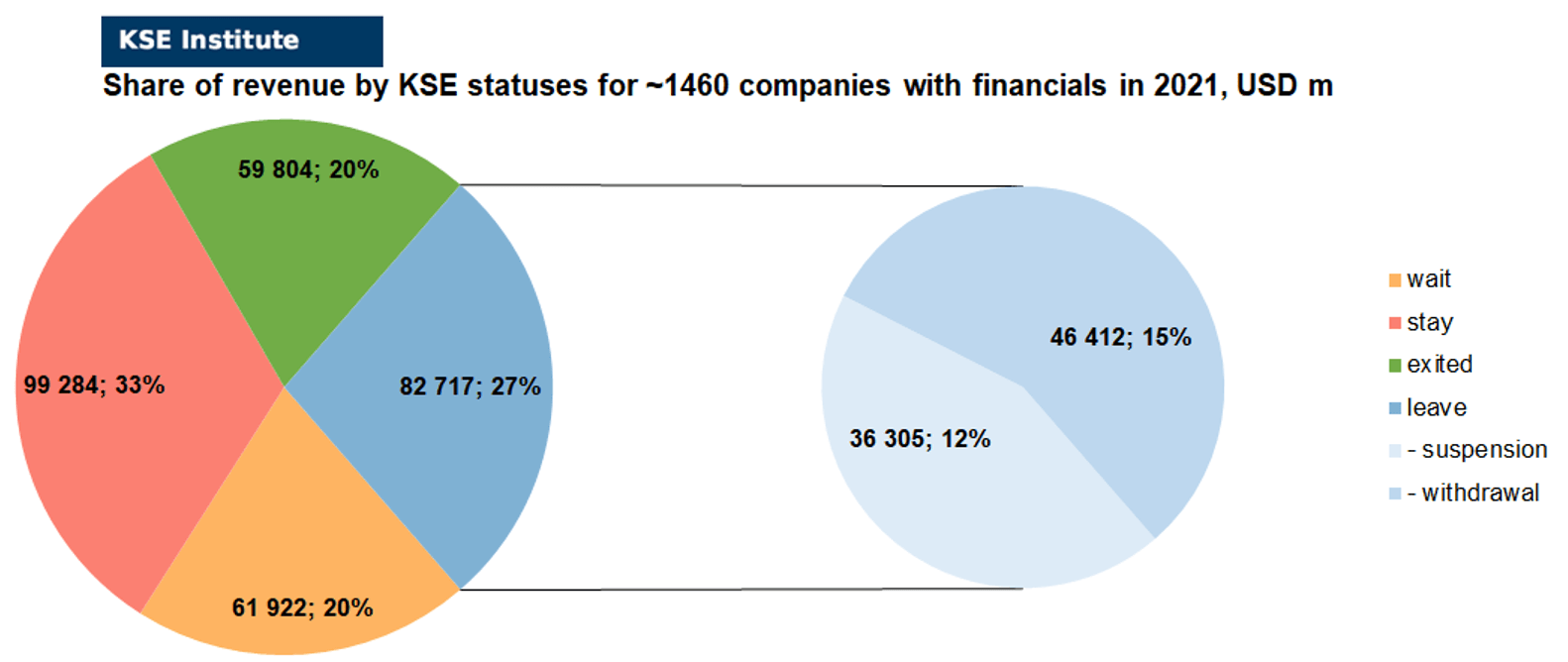

As can be seen from the tables below, as of June 04, 241 companies which had already completely exited from the Russian Federation, in 2021 had at least 409,500 personnel, $59.8 bn in annual revenue, $27.4bn in capital and $51.3bn in assets; companies, that declared a complete withdrawal from Russia had 255,100 personnel, $46.4bn in revenues, $17.8bn in capital and $19.3bn in assets; companies that suspended operations on the Russian market had 112,800 personnel, annual revenue of $36.3bn, $40.7bn in capital and $102.0bn in assets.

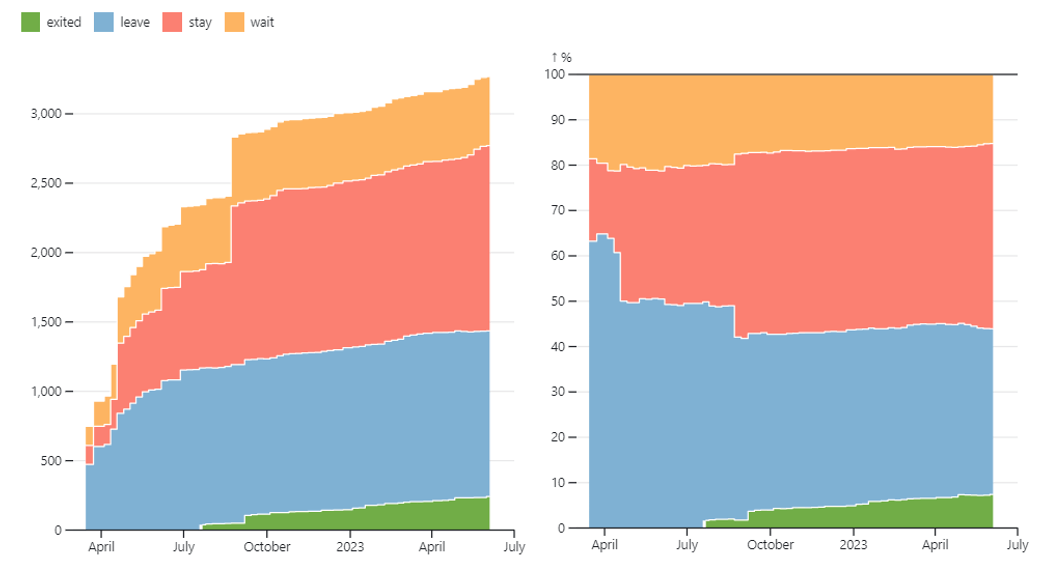

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 9 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database, 89 were added in May 2023). However, if to operate with the total numbers in KSE database, about 36.5% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 40.9% are still remaining in the country, 15.2% are waiting and only 7.4% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 241 companies that completely left the country, since in 2021 they employed 28.7% of the personnel employed in foreign companies, the companies owned about 17.8% of the assets, had 15.7% of capital invested by foreign companies, and in 2021 they generated revenue of $59.8 billion or 19.7% of total revenue and paid $3.7 billion of taxes or 14.8% of total taxes paid by the companies observed. Data on 1,460 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (17%) and on share of revenue withdrawn (20%). At the same time, a totally different picture is for those who are still staying – 46% of companies represent 33% of revenue and 15% of waiting companies represent 20% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

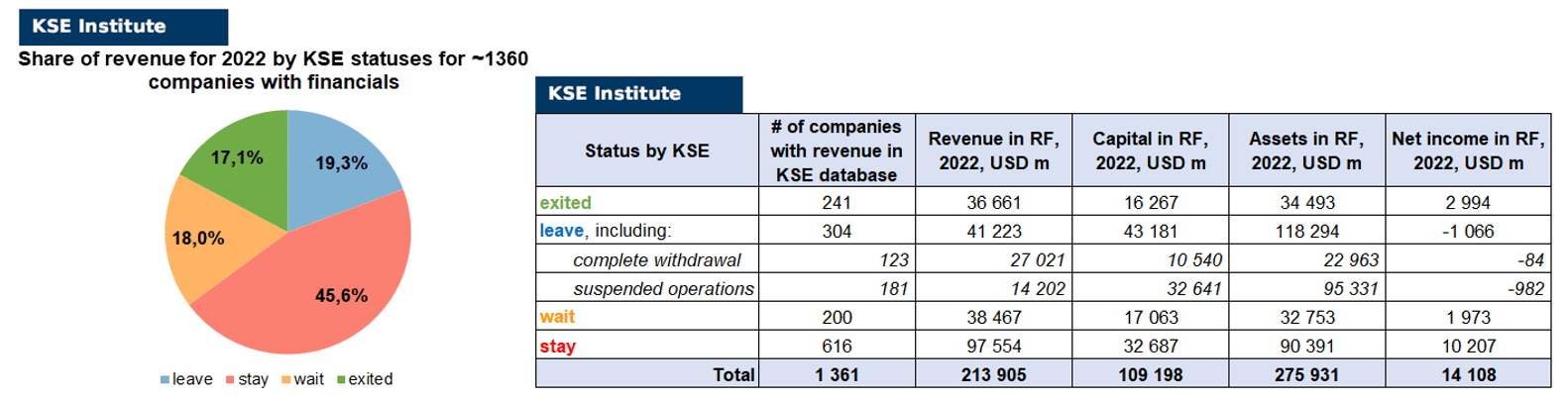

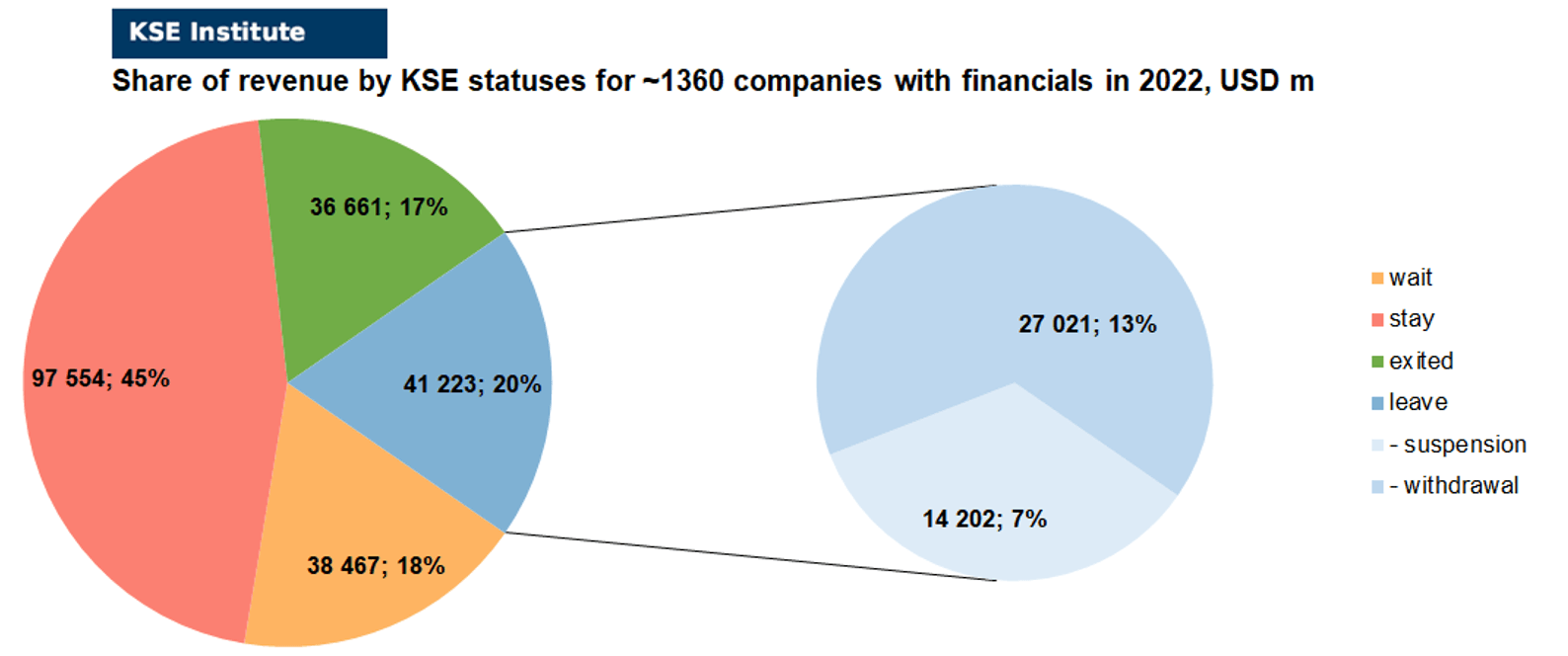

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for 1360 companies (about 100 companies the data of which we have collected previously have not provided their reporting yet) and provides below the first ever available analysis (as far as we know, this kind of data is being made public for the first time), more details will be provided soon, once we get full information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2.6% less of revenue in 2022 (17.1% from total volume) than in 2021 (19.7% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-7.9%) revenue in 2022 (19.3% from total volume) than in 2021 (27.2% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+12.9%) more revenue in 2022 (45.6% from total volume) than in 2021 (32.7% from total volume). This is partly explained by reclassification of statuses that we did for some companies (e.g. Cargill, Carlsberg Group, Danone, Japan Tobacco International, Mars, Pepsi, Raiffeisen Bank) which significantly increased their revenue in 2022 vs 2021. Companies with status “wait”⁴ gained almost the same share (-2.4%) of revenue in 2022 (18.0% from total volume) vs 20.4% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have not almost changed ($275.9bn in 2022 vs $288.5bn in 2021) and will be even probably increased once we receive remaining reporting for ~80-100 companies. KSE Institute has already published a large-scale study “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave“. You can familiarize yourself with the English version by downloading the report at the following link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963.

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: On leaving the Russian Federation. Results of May 2023

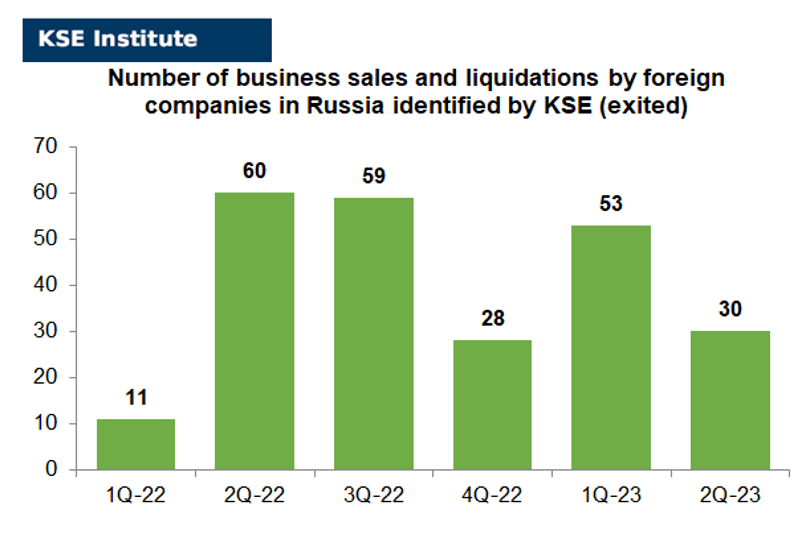

In this digest, we will summarize the results of May 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies) or based on company’s liquidation.

There are about 1.46 thousand companies identified in the KSE database with revenue data available of more than $300 billion in 2021 and ~$214 billion in 2022. And at least 241 of them have already been sold by local companies or were liquidated and left the Russian market. In May 2023 KSE Institute identified +8 new exits⁵, total number of exits observed since the beginning of Russia’s invasion reached 241+.

On the chart below, share of exited and other statuses based on revenue-2021 allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 20% based on revenue allocation, those who are leaving represent 27% of total revenue (with 44% share of suspensions and 56% of withdrawals sub-statuses), % of staying companies represent 33% of revenue and 20% are waiting companies based on revenue generated in Russia in 2021.

If we take a look at the same chart based on revenue-2022 distribution – the picture will be totally different:

% of exited is 17% based on revenue allocation, those who are leaving represent only 20% of total revenue (with 34% share of suspensions and 66% of withdrawals sub-statuses), % of staying companies represent 45% of revenue and 18% are waiting companies based on revenue generated in Russia in 2022.

Key conclusion could be the following: on the general background of falling revenue in 2022 companies which made the decision to leave earned less than those who stayed and more companies migrated from the “suspension” sub-status to “withdrawal” showing their increased intention to cut ties with Russia.

Geography is the most important factor that explains companies’ decisions. Companies from “unfriendly countries” (a term coined by the Russian Federation to describe countries that joined the international sanctions policy against the Russian Federation in response to its invasion of Ukraine) are much more likely to exit.

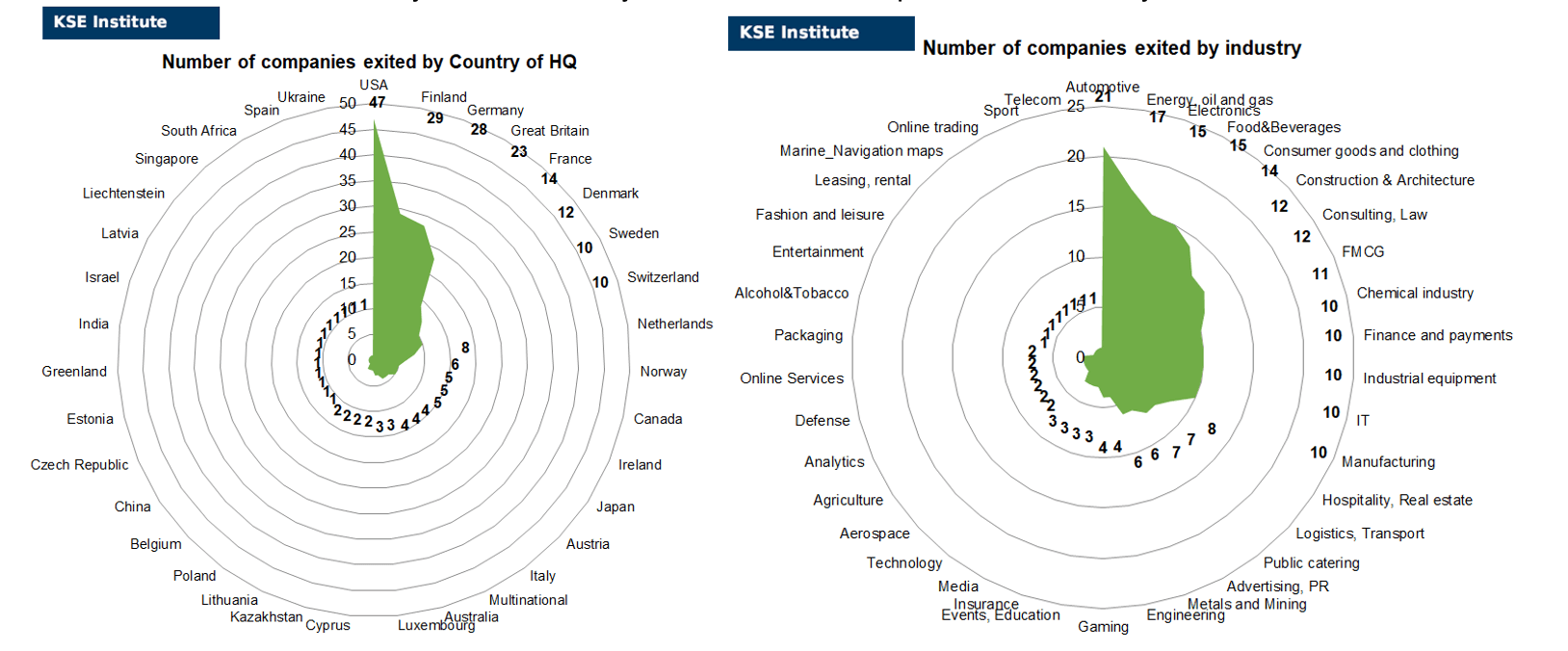

Here are also the breakdowns by countries and by industries of the companies which already exited:

So, as of the end of May 2023, companies from 35 countries and 38 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, and Great Britain and operated in the “Automotive”, “Energy, oil and gas”, “Electronics”, “Food & Beverage”, and “Consumer goods and closing” industries.

For a more accurate explanation of the behavior of companies, it is necessary to take into account several factors at the same time. According to our analysis, companies in the technological and communication sector are most prone to exit (as opposed to those who remain in the Russian Federation). Partially due to the fact that they have fewer physical assets in the Russian Federation than in the production sectors. Companies that produce products for the daily consumption of the population in the Russian Federation are less likely to leave (this is one of their key explanations why they do not leave). Pharmaceutical companies that explain their decisions by concern for public health tend to be the “staying” companies.

Companies with larger local revenue and public companies are also inclined to leave the market: presumably, large multinational corporations are more responsible for their reputation and respond to investors’ requests. In addition, it is likely that the exit of the largest multinationals from the Russian Federation is not as painful for them for global business as it is for smaller companies, for which the share of the Russian market can be significant.

Here is the list of “exiters” that we were able to identify recently: Aspo, Authentic Brands Group (Reebok), Continental, Emerson Electric, Ford Motor Company (identified with delay, left in 2022), HAVI, ISAB, OCSiAl, Volkswagen Group.

Most of these exits were identified before in their preparation phase. Also, we are not yet in a hurry to assign “exited” status to dozens of companies that are literally on the verge of exit, although have not yet finalized this process.

Here are just some of them: Allianz (The German insurance giant Allianz closed the deal for the sale of control in the Russian business, the company will leave Russia within three months, CEO Ihor Fatyanov said), Aytemiz Akaryakit (Tatneft bought Turkish fuel company Aytemiz Akaryakit for $336 million), Fonterra (Exit its businesses in Russia, 1% of annual exports for Fonterra. Promised to close office in Moscow, re-deploying staff where possible, and withdraw from joint venture Unifood. Exports halted but Moscow sales office still open, awaiting final regulatory clearances), Fortum (The Federal Property Management Agency received foreigners’ shares in Unipro and Fortum under temporary management. Fortum has formally notified the administration of the President of the Russian Federation that it strongly objects to the Decree No. 302 of 25 April 2023, based on which the Russian State Property Management, Rosimushchestvo, has seized Fortum’s Russian subsidiary PAO Fortum. Fortum to write off $1.9 billion after Russia seized assets), Michelin Tyre (Michelin found a buyer for a plant in the Moscow region and sells its activities in Russia. Selling its activities – Russia Tyre Manufacturing Company (MRTMC) and Camso CIS in Russia to Power International Tires, a tire distributor in the country. The agreement, approved by local authorities, will save 250 jobs, mainly based in Davydovo), Nintendo (The Japanese developer of game consoles and video games Nintendo is finally closing down its operations in Russia), ON Semiconductor (“KVANTENNA COMMUNICATIONS” LLC is in the process of liquidation), Oriflame Cosmetics (Oriflame sells russian manufacturing unit. Partial sale – SETES COSMETICS LLC (tax id 5024055294) was sold. But still no changes in the register for a key company – Oriflame Cosmetics LLC, tax id 7704270172), Robert Bosch (Bosch sold the Russian business in Engels. We are talking about three plants for the production of spark plugs, power tools and heating boilers. The assets of the German group were acquired by the S8 Capital holding of Armen Sargsyan), Uniper SE (Uniper had found a local buyer for Unipro, it had to receive “presidential approval”, suggesting the sale was being personally blocked by Putin. Rosymuschestvo received temporary management of shares in PJSC “Unipro” and PJSC “Fortum” belonging to foreign shareholders, according to the decree of the President of the Russian Federation. Uniper takes €4bn hit after losing control of its Russian subsidiary), Uniqlo/Fast Retailing (The Japanese clothing chain Uniqlo received more than 10 billion rubles of losses in Russia at the end of 2022, decided to close most of its large stores here. Uniqlo to sell most of its stores in Russia after incurring significant losses), Viterra (The Russian division of the global grain trader Viterra (Viterra Rus) will continue to work in Russia under a new name, the company will be called “MZK Export”. Viterra’s operating business is planned to be handed over to local management).

Foreign investors who left Russia, having sold their business, withdrew about $36 billion in a year, Maxim Osadchiy, head of the analytical department of BKF Bank, calculated for RIA News Agency⁶ after analyzing data from the Bank of Russia.

According to the Central Bank of Russia, from March 2022 to March 2023, there were ~200 transactions for the sale of assets by companies leaving Russia, while only 20% of them sold assets worth more than $100 million. As indicated in the materials of the regulator, the government commission intends in the future to limit the monthly volume of exit of non-residents from the Russian market. “Assuming the fulfillment of the Pareto 80/20 rule in relation to the size of assets, it is possible to estimate the amount of capital withdrawn by foreign investors from Russia for the period from March 2022 to March 2023 at the level of $36 billion,” Osadchy said.

Based on the abovementioned, correctness of KSE Institute data has another proof, as we also identified 200+ exits as of the end of March 2023 and amount of the capital withdrawn at that moment was exactly at the level $36.5 billion and assets of exited companies reached even more, $45.4 billion.⁷

The next review of deals for June 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)⁸

15.05.2023

*Suzuki (Japan, Automotive) Status by KSE – stay

The Suzuki company said that it is not going to leave the Russian market

https://news.finance.ua/ua/kompaniya-suzuki-zayavyla-shho-ne-zbyrayet-sya-zalyshaty-rosiys-kyy-rynok

*Volkswagen (Germany, Automotive) Status by KSE – exited

Russia approves sale of Volkswagen plant to domestic dealership

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

Hungary threatens to block EU sanctions until Ukraine excludes OTP Bank from the list of war sponsors

16.05.2023

*Pulp Mill Holding GmbH (Austria) Status by KSE – stay

Obukhov toilet paper with traces of the Russian Federation. How a former member of the Duma tries to save business in Ukraine

https://www.epravda.com.ua/publications/2023/05/16/700160/

*International Paralympic Committee (IPC) (Germany, Sport) Status by KSE – stay

The appeals tribunal of the IPC satisfied the appeal of the PKR and confirmed that the decision of the General Assembly of the IPC to suspend the membership of the PKR in the IPC was canceled.

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Georgia issued the first permit for direct flights to an airline from the Russian Federation

https://www.eurointegration.com.ua/rus/news/2023/05/15/7161718/

*Boeing (USA, Aircraft industry) Status by KSE – leave

U.S.-Made Technology Is Flowing to Russian Airlines, Despite Sanctions

https://www.nytimes.com/2023/05/15/business/economy/russia-airlines-sanctions-ukraine.html

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

Czech banks close the accounts of Russians and Belarusians without warning

17.05.2023

*Total Energies (France, Energy, oil and gas) Status by KSE – exited

*China National Petroleum Corporation (China, Energy, oil and gas) Status by KSE – stay

*China’s Silk Road Fund (China, Finance and payments) Status by KSE – stay

Russia’s Yamal LNG ramps up dividend to $9.5 bln in 2022

*JOGMEC (Japan, Energy, oil and gas) Status by KSE – stay

*Mitsui & Co. (Japan, Conglomerate) Status by KSE – stay

Consul General of the Russian Federation in Sapporo: Japan can increase purchases of Russian LNG by 9% by 2026

https://www.kommersant.ru/doc/5986519

*Ultimate Fighting Championship (UFC) (USA, Sport) Status by KSE – stay

UFC maintains links with Russian fighters and others connected to sanctioned Chechen warlord despite Ukraine invasion

https://edition.cnn.com/2023/05/17/sport/ufc-chechnya-ramzan-kadyrov-russia-spt-intl/index.html

*International Skating Union (Switzerland, Sport) Status by KSE – leave

Ukraine asks ISU for full Russian ban until end of war

https://www.reuters.com/sports/athletics/ukraine-asks-isu-full-russian-ban-until-end-war-2023-05-16/

18.05.2023

*Allianz (Germany, Finance and payments) Status by KSE – leave

The German insurance company Allianz has closed a deal for the sale of a controlling stake in its Russian subsidiary Alliance to Interholding, which owns Zetta Insurance. The company fully transfers control over its Russian portfolio to the Zetta Strahovanie group and ceases participation in the operational activities of the business, reports the press service of Allianz in Russia.

*Viterra (Netherlands, Agriculture) Status by KSE – leave

The Viterra division can be renamed to “MZK Export”, using the brand under which the company operated in 2004-2017.

https://www.kommersant.ru/doc/5987862

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

“Luzales” closed the deal on the purchase of IKEA plants in the Leningrad and Kirov regions

https://www.interfax.ru/business/892829

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – wait

The Ministry of Economy confirmed. The Yerevan brandy factory will stop exporting products to Russia

19.05.2023

*Aspan Arba (Kazakhstan, Electronics) Status by KSE – stay

*Da Group 22 (Kazakhstan, Electronics) Status by KSE – stay

*Elix-St (Germany, Electronics) Status by KSE – stay

*DJI (China, Technology) Status by KSE – stay

Russia imports drones and microcircuits for missiles through Kazakhstan – investigation

https://www.epravda.com.ua/news/2023/05/19/700322/

*CK Birla Group (India, Conglomerate) Status by KSE – stay

The National Agency for the Prevention of Corruption (NACP) has included the Indian company CK Birla Group in the list of international war sponsors.

*GAIL (India, Energy, oil and gas) Status by KSE – stay

A former unit of Russian energy giant Gazprom has resumed supplying LNG to Indian state gas utility GAIL a year after it halted supplies due to the Ukraine war, GAIL chairman Sandeep Kumar Gupta

*Europol Gaz (Poland, Energy, oil and gas) Status by KSE – stay

The Russians owe EuRoPol Gaz a fortune. International arbitration for PLN 850 million and PLN 5 billion

https://www.tvp.info/69943741/gazprom-jest-winny-europol-gazowi-gigantyczne-pieniadze

*Leica Camera AG (Germany, Engineering) Status by KSE – stay

After the beginning of the great war between the Russian Federation and Ukraine, the German camera manufacturer Leica Camera AG announced the cessation of imports to the Russian Federation and the closing of the company store in Moscow, but contrary to the promise, it not only continued deliveries, but also began importing binoculars with a laser rangefinder and night vision scopes.

https://www.epravda.com.ua/news/2023/05/18/700270/

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Moscow’s decision to resume flights to Georgia sparks backlash

https://www.ft.com/content/e4a5e19c-0aa2-4af3-ba73-28031e12e0ca

20.05.2023

*Volkswagen (Germany, Automotive) Status by KSE – leave

VW completes sale of Kaluga plant in Russia

22.05.2023

*Weatherford (USA, Energy, oil and gas) Status by KSE – stay

The Russian branch of the international oil service company Weatherford intends to continue to fulfill existing contracts and conclude new agreements with customers.

https://www.kommersant.ru/doc/5999182

*Gasum (Finland, Energy, oil and gas) Status by KSE – wait

Finnish state-owned gas wholesaler Gasum said it had terminated a contract to buy natural gas from Gazprom Export via pipelines from Russia.The termination concerns only pipeline supply, Gasum said. “The long-term LNG supply contract Gasum has with Gazprom Export remains in place,” the Finnish company said.

*Hyundai (South Korea, Automotive) Status by KSE – leave

The Russian government has reportedly rejected Hyundai Motor’s application to sell off its Russian plant.

http://www.businesskorea.co.kr/news/articleView.html?idxno=115103

*Continental (Germany, Automotive) Status by KSE – leave

Continental Sells Plant in Russia

https://www.continental.com/en/press/press-releases/continental-in-russia/

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Georgian Airways Bans President Over Russia Comments

https://onemileatatime.com/news/georgian-airways-bans-president/

23.05.2023

*Huriya Private (United Arab Emirates,Finance and payments) Status by KSE – stay

US Treasury sanctions Huriya Private for ‘moving Russian finance into the UAE and money laundering’

*Dahua Technology (China, Electronics) Status by KSE – stay

Fall in revenue and loss

https://www.tadviser.ru/index.php/

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

Austria’s Raiffeisen attempts last-ditch Russian spin-off – sources

*Leica Camera AG (Germany, Engineering) Status by KSE – stay

*Leica Geosystems (Switzerland, Engineering) Status by KSE – stay

Leica continues to work in the Russian Federation despite the withdrawal statement. Its equipment is used in war

https://theins.ru/news/261760

https://ain.ua/2023/05/23/leica-prodovzhuye-praczyuvaty-v-rf-na-vijni/

*Novo Nordisk (Denmark, Pharma, Healthcare) Status by KSE – wait

Novo Nordisk can transfer the Russian distribution of the drug to a third-party company

https://www.kommersant.ru/doc/5999876

*Julius Baer (Switzerland, Finance and payments) Status by KSE – wait

The Swiss bank Julius Baer, on the instructions received from the Belgian depository Euroclear, will carry out the segregation of securities of Russian citizens

24.05.2023

*Strada (Germany, Pharma, Healthcare) Status by KSE – stay

*Solgar (USA, Pharma, Healthcare) Status by KSE – stay

*Pharmamed (Lebanon, Pharma, Healthcare) Status by KSE – stay

*Unipharm (Canada, Pharma, Healthcare) Status by KSE – stay

Additives are not needed: the Russian Federation can introduce barrier duties on imported dietary supplements

*Uniqlo/Fast Retailing (Japan, Consumer goods and clothing) Status by KSE – leave

Japan’s Uniqlo to exit Russia, paving way for sale of business

*Pernod Ricard (France, Alcohol & Tobacco) Status by KSE – wait

The Luding Group alcohol company continues to supply Ararat cognac to the Yerevan Cognac Plant in Russia as usual, Luding informed Kommersant. They added that the distribution contract with the owner of the Pernod Ricard brand and plant is valid, and it has not received any notifications about the establishment of cooperation with the Ararat Luding brand.

https://www.kommersant.ru/doc/6000329

*Alibaba (China, Online trading) Status by KSE – stay

*Huawei (China, Electronics) Status by KSE – wait

Russia and China are discussing promising areas of cooperation in the IT sphere

https://www.kommersant.ru/doc/6000629

*Thales/Gemalto (France, Electronics) Status by KSE – exited

The SSJ-100 aircraft had problems with imported navigation

25.05.2023

*ELA Container (Germany, Construction & Architecture) Status by KSE – leave

ELA Container ceases operations in Russia

https://www.ela-container.com/news/ela-container-ceases-operations-in-russia

*OpenWay Group (Belgium, Finance and payments) Status by KSE – stay

*Auchan (France, FMCG) Status by KSE – stay

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

Ukraine has a list of ‘war sponsors.’ But how exactly does it work?

*FATF (France, Аssociation, NGO) Status by KSE – leave

Ukraine is concerned about Russia’s blackmail of FATF members on the eve of the organization’s June plenary meeting

*Johnson & Johnson (USA, FMCG) Status by KSE – wait

Suppliers of Johnson & Johnson goods began to send notices to opticians about the suspension of imports

*Guess (USA, Fashion and leisure) Status by KSE – stay

The American manufacturer and seller of clothes Guess bought 30% from the local partner Vyacheslav Shikulov

https://www.kommersant.ru/doc/6001381

*International Ski Federation (Switzerland, Sport) Status by KSE – leave

International Ski Federation extends ban on Russian and Belarusian athletes

https://www.insidethegames.biz/articles/1137305/fis-extend-russia-belarus-ban

*Mondelez (USA, Food & Beverages) Status by KSE – stay

NAZK included the manufacturer “Barney the Bear” in the list of international sponsors of the war

26.05.2023

*Cross-Border Interbank Payment System (CIPS) (China, Finance and payments) Status by KSE – stay

About 30 Russian banks have already connected to the national Chinese bank transfer system CIPS (Cross-Border Interbank Payment System), which allows you to make payments in yuan.

*Michelin (France, Automotive) Status by KSE – leave

French tyre maker Michelin sells its activities in Russia

*Mondi Group (Great Britain, FMCG) Status by KSE – wait

*Campari (Italy, Alcohol&Tobacco) Status by KSE – wait

*Titan International Inc (USA, Automotive) Status by KSE – stay

*Anadolu Efes (Turkey, Alcohol&Tobacco) Status by KSE – stay

Which companies are leaving Russia and which are staying? Here’s a look

https://apnews.com/article/what-companies-left-russia-5f7ec93e6bee1ffe1758811d2f450fb3

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Georgian Airways Announces Controversial Plan For Transit Flights For Russians Via Tbilisi

https://www.rferl.org/a/georgia-airways-russia-transit-flights/32427876.html

27.05.2023

*Meilin Auto (China, Automotive) Status by KSE – stay

Meilin Auto unveils plans to begin sales to Russia

https://motor.ru/news/meilin-auto-russia-24-04-2023.htm

*Polar Seafood (Greenland, Food & Beverages) Status by KSE – exited

Polar Seafood takes $8.2m hit after sale of Russian subsidiary

*Lloyd’s Register (Great Britain, Аssociation, NGO) Status by KSE – leave

Lloyd’s Register has told India’s Gatik Ship Management, which has become a major carrier of Russian oil since the Ukraine war, that it will withdraw certification of 21 of its vessels by June 3

*GlaxoSmithKline (Great Britain, Pharma, Healthcare) Status by KSE – stay

GSK (GlaxoSmithKline) Exports into Russia

28.05.2023

*Studio Ghibli, Inc. (Japan, Entertainment) Status by KSE – stay

The Russian film company Russian World Vision (RWV) became the owner of the rights to ten animated films of Studio Ghibli by the Japanese animation director Hayao Miyazaki

https://www.kommersant.ru/doc/6011565

*De Beers (Great Britain, Luxury) Status by KSE – wait

De Beers issued a flat denial over a “damaging” and “unsubstantiated” newspaper allegation that it had violated sanctions on Russian diamonds.

http://www.idexonline.com/FullArticle?Id=48586

*UEFA (Switzerland, Sport) Status by KSE – leave

The Court of Arbitration for Sport (CAS) published the motivational part of the decision on the suspension of Russian clubs from participating in tournaments under the auspices of the Union of European Football Associations (UEFA)

29.05.2023

*TJX Companies (USA, Consumer goods and clothing) Status by KSE – leave

The American TJX Companies, which received 25% of the Russian chain of Familia stores about two years ago, ceased to be its co-owner, possibly writing off $218 million after this transaction.

30.05.2023

*Adobe (USA, Online Services) Status by KSE – stay

The American developer of software for working with graphics and video Adobe automatically extends licenses for users in the Russian Federation for free due to the difficulties of paying with Russian bank cards

https://tass.ru/ekonomika/17874445

*Wikimedia Foundation Inc. (USA, Online Services) Status by KSE – leave

The Wikimedia Foundation, which owns Wikipedia, sued the Prosecutor General’s Office and Roskomnadzor

https://www.kommersant.ru/doc/6013158

*Intel (USA, IT) Status by KSE – wait

The Russians continue to create combat drones using technologies from Intel, Raspberry, and other Western companies

*Azadea Group (Lebanon, Consumer goods and clothing) Status by KSE – stay

*FLO Magazacilik (Turkey, Consumer goods and clothing) Status by KSE – stay

*Decathlon (France, Consumer goods and clothing) Status by KSE – leave

The Turkish holding FLO Retailing (acquired the business of the American company Reebok in Russia) and the Lebanese company Azadea Group (owns the franchise of the Inditex brands in Algeria, Bahrain, Qatar and Oman) are negotiating the purchase of the assets of the French chain Decathlon in Russia

31.05.2023

*New Development Bank (China, Finance and payments) Status by KSE – wait

BRICS bank NDB thinking about ways to fulfill commitments to Russia, exec says

*Badminton World Federation (Malaysia, Sport) Status by KSE – wait

The Badminton World Federation (BWF) will consider allowing Russian and Belarusian athletes to compete as neutrals in international competitions, the sport’s governing body said 01.06.2023, a month after they had extended the ban.

*VEON (Netherlands, Telecom) Status by KSE – leave

VEON enters the final stages in the sale of its Russia operations

*Johnson & Johnson (USA, FMCG) Status by KSE – wait

*Acuvue (USA, Pharma, Healthcare) Status by KSE – wait

Johnson & Johnson: deliveries of Acuvue lenses to Russia did not stop

https://www.kommersant.ru/doc/6014149

*Volkswagen (Germany, Automotive) Status by KSE – leave

The transaction for the purchase of Russian Volkswagen assets by the Avylon structure does not include a buyback option

01.06.2023

*Nintendo (Japan, Gaming) Status by KSE – leave

The Nintendo eShop will close indefinitely in Russia on 31 May 2023, after a year of suspended service that began when the country invaded Ukraine

https://www.gameshub.com/news/news/nintendo-eshop-shut-down-russia-june-2023-2618374/

https://www.gamespot.com/amp-articles/nintendo-effectively-shuts-down-eshop-in-russia/1100-6514690/

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

An official partner and distributor of Rockwool supplied materials to the Russian Navy for use in the construction of three advanced frigates.

*Bonava (Sweden, Construction & Architecture) Status by KSE – exited

Bonava to Divest Russian Business in RUB3.3 Billion Deal

*Hugo Boss (Germany, Consumer goods and clothing) Status by KSE – stay

*L’Oreal (France, Consumer goods and clothing) Status by KSE – stay

*Samsung (South Korea, Electronics) Status by KSE – wait

Norway National TV program on sanctions yesterday. Probably not possible to see outside Norway, and in Norwegian, but interestingly the Russia correspondent went to shops and found new luxury goods from Hugo Boss, L’Oreal, Samsung, and lots of expensive cars.

02.06.2023

*Budějovický Budvar (Czech Republic, Alcohol & Tobacco) Status by KSE – wait

The Czech beer producer Budweiser Budvar also lied about leaving Russia. Since March, this concern has supplied Russia with more than 1 million liters of beer worth more than 1 million dollars.

https://www.unian.ua/economics/finance/v-rosiji-dosi-mozhna-kupiti-ukrajinsku-gorilku-12279258.html

*Apple (USA, Electronics) Status by KSE – leave

Apple denies working with the US special services to infect the smartphones of Russian diplomats

https://www.kommersant.ru/doc/6015651

https://www.reuters.com/technology/apple-denies-surveillance-claims-made-by-russias-fsb-2023-06-01/

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

The Georgian company Georgian Airways and its founder and manager appeared on the website of the National Agency for the Prevention of Corruption in the list of persons and companies threatened with sanctions in connection with the Russian Federation’s war against Ukraine.

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

In May 2023, the KSE Institute published a new research entitled “How the income of foreign businesses in the Russian Federation has changed in 2022 and why so many companies still do not leave”, you can download its full text in English using the following links: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4453963 and https://www.researchgate.net/publication/370902501_How_the_income_of_foreign_businesses_in_the_Russian_Federation_has_changed_in_2022_and_why_so_many_companies_still_do_not_leave/

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 15 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies marked with statuses “stay” and “wait” essentially there are no differences.

⁵ It needs to be mentioned that open access to Russia’s EGRUL register was partly classified recently, so KSE Institute could miss some of the exits but we found the new solution allowing us to get the proper access to the registers in the future.

⁸ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website