- Kyiv School of Economics

- About the School

- News

- 45th issue of the regular digest on impact of foreign companies’ exit on RF economy

45th issue of the regular digest on impact of foreign companies’ exit on RF economy

15 May 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 01.05-14.05.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

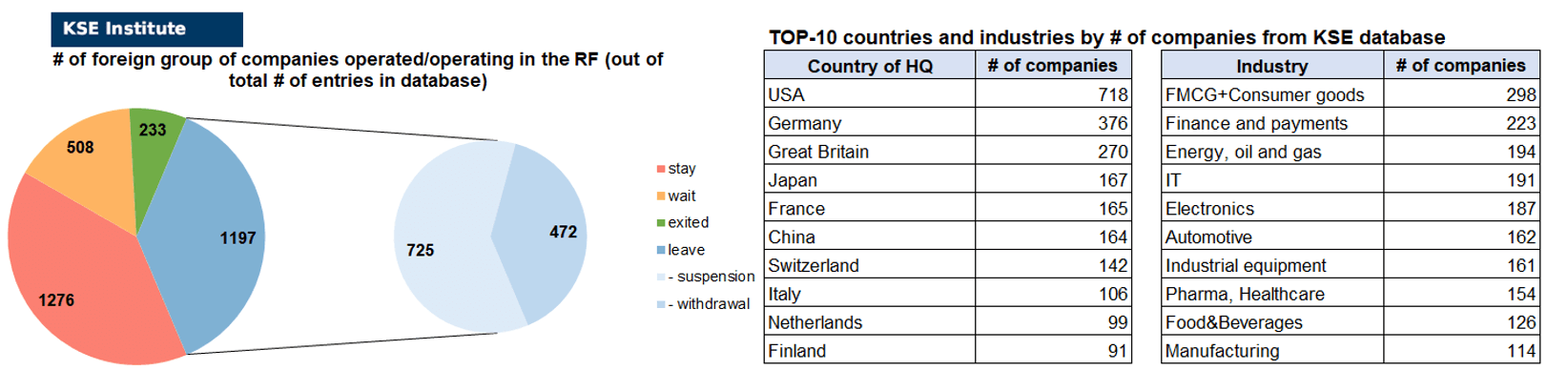

KSE DATABASE SNAPSHOT as of 15.05.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 276 (+36 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 508 (-1 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 197 (-6 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 233 (0 per 2 weeks)

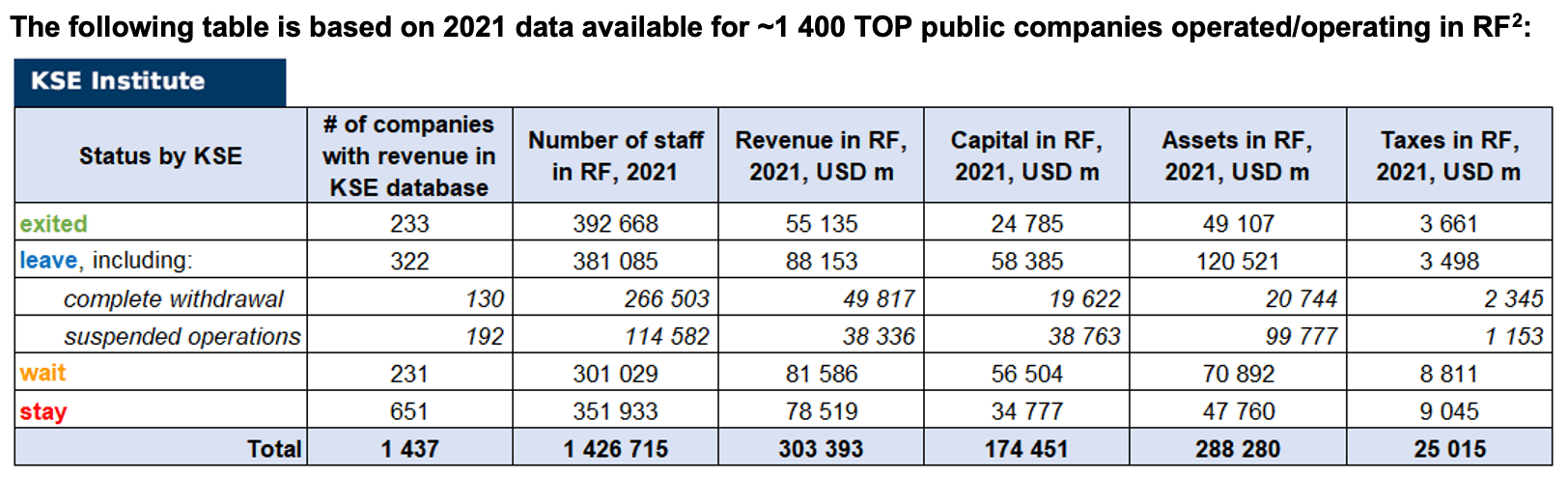

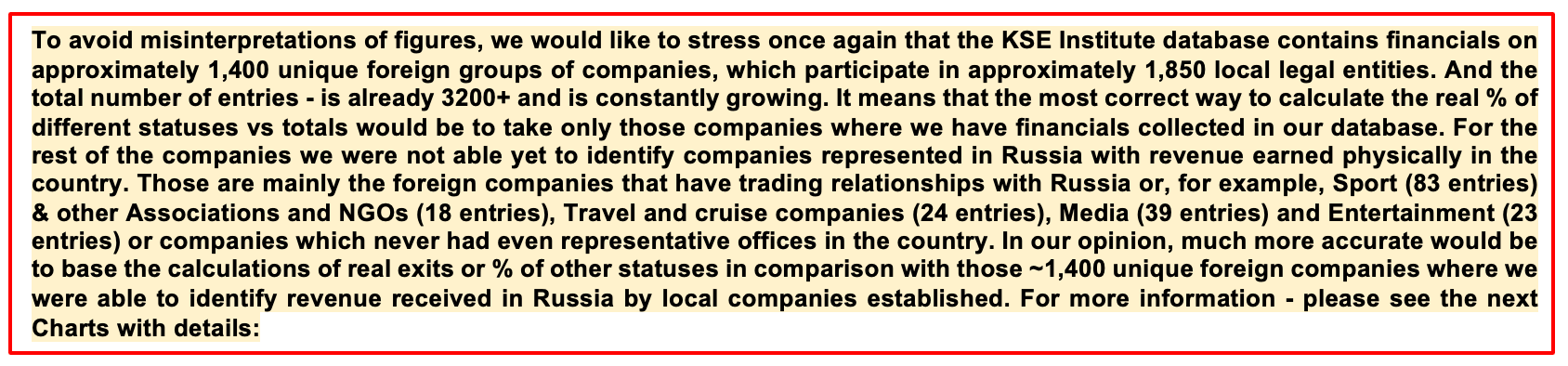

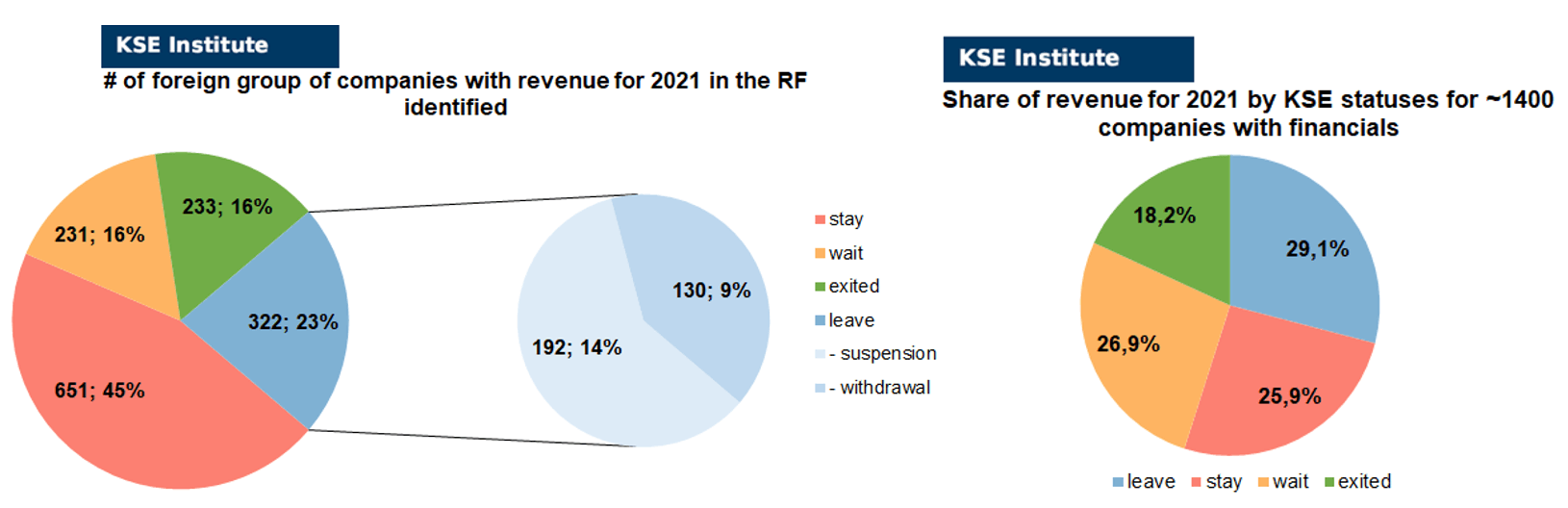

As of May 14, we have identified about 3,213 companies, organizations and their brands from 88 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and found the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.5 billion), local revenue (about $303.4 billion), local assets (about $288.3 billion) as well as staff (about 1.427 million people) and taxes paid (about $25.0 billion). 1,705 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 233 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

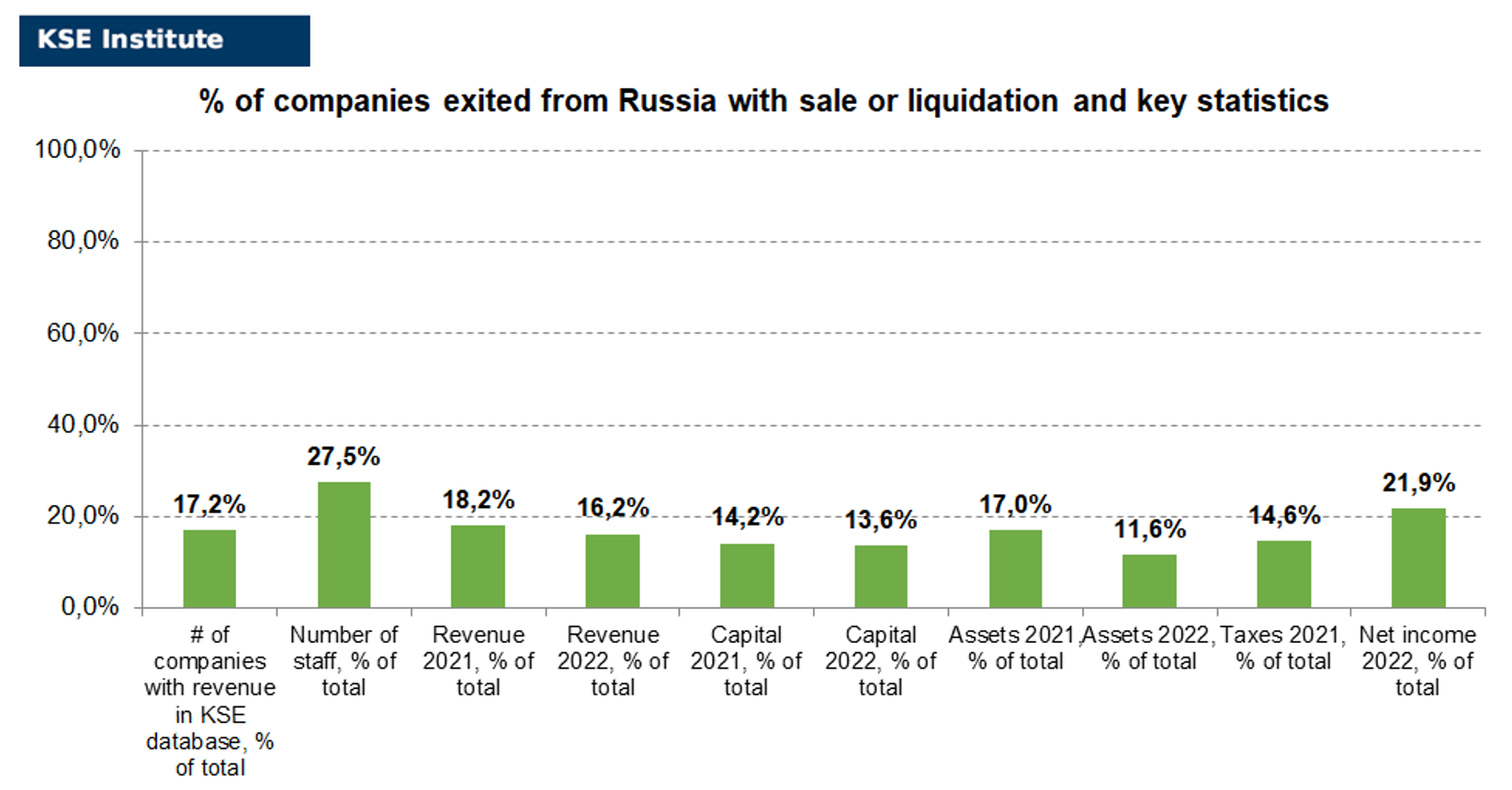

As can be seen from the tables below, as of May 14, 233 companies which had already completely exited from the Russian Federation, in 2021 had at least 392,700 personnel, $55.1 bn in annual revenue, $24.8bn in capital and $49.1bn in assets; companies, that declared a complete withdrawal from Russia had 266,500 personnel, $49.8bn in revenues, $19.6bn in capital and $20.7bn in assets; companies that suspended operations on the Russian market had 114,600 personnel, annual revenue of $38.3bn, $38.8bn in capital and $99.8bn in assets.

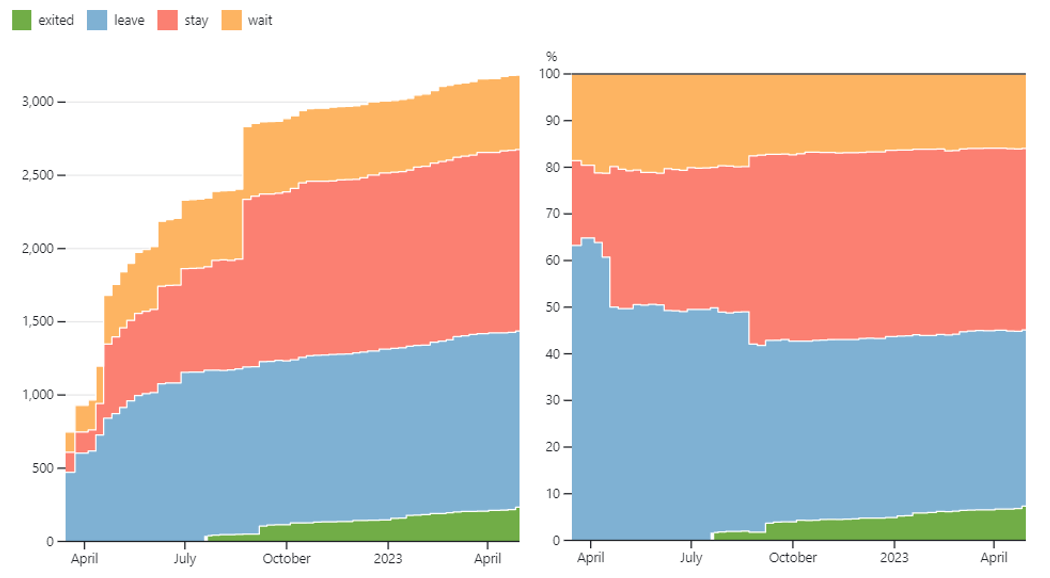

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 8 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 37.3% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 39.6% are still remaining in the country, 15.8% are waiting and only 7.2% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 233 companies that completely left the country, since in 2021 they employed 27.5% of the personnel employed in foreign companies, the companies owned about 17.0% of the assets, had 14.2% of capital invested by foreign companies, and in 2021 they generated revenue of $55.1 billion or 18.2% of total revenue and paid $3.7 billion of taxes or 14.6% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts based on data for 2021 above, roughly similar % of exited is obtained based on number of companies (16%) and on share of revenue withdrawn (18%). At the same time, a totally different picture is for those who are still staying – 45% of companies represent 26% of revenue and 16% of waiting companies represent 27% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

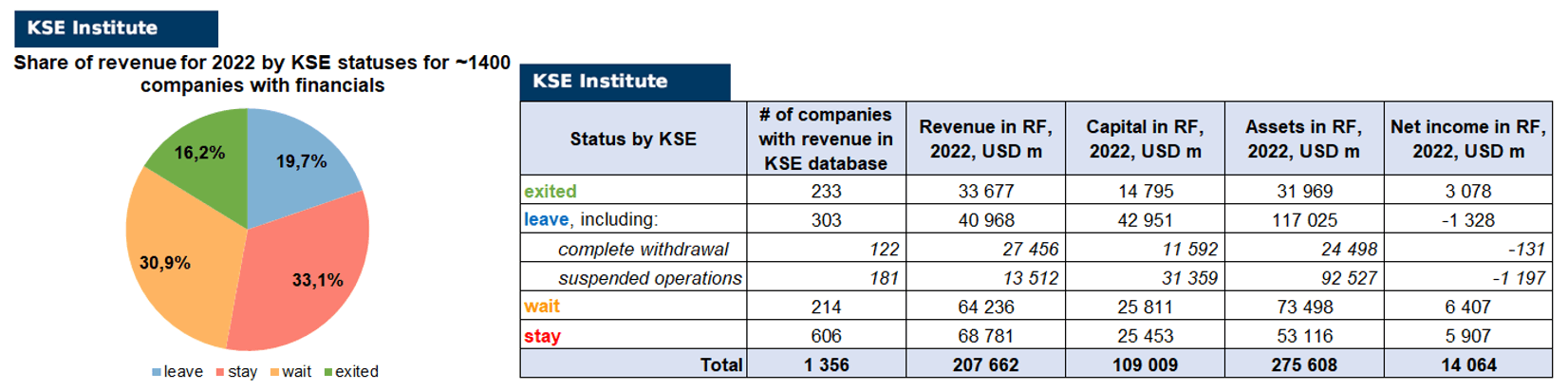

KSE Institute has already collected and analyzed data on revenue, capital, assets and net income (profit or loss) in 2022 for 1356 companies (about 80 companies the data of which we have collected previously have not provided their reporting yet) and provides below the first ever available analysis (as far as we know, this kind of data is being made public for the first time), more details will be provided soon, once we get full information.

As you can see from the charts above, companies which fully exited Russia were able to generate 2% less of revenue in 2022 (16.2% from total volume) than in 2021 (18.2% from total volume, which is clear as most of them left the country before the year-end). Leaving companies also generated much less (-9.4%) revenue in 2022 (19.7% from total volume) than in 2021 (29.1% from total volume). Also, the group of the companies with KSE status “leave” is the only one which became loss-making in terms of net income received in 2022. At the same time, staying companies were able to generate much (+7.2%) more revenue in 2022 (33.1% from total volume) than in 2021 (25.9% from total volume). Also, companies with status “wait”⁴ also gained a higher share (+4%) of revenue in 2022 (30.9% from total volume) vs 26.9% from total volume in 2021. So the key conclusion is that money matters for those companies who are still tied with its local business in Russia.

Here is a list of TOP-10 companies with KSE statuses “stay” and “wait” in terms of revenue generated in 2022:

1. Philip Morris – $7.888bn

2. Japan Tobacco International – $7.358bn

3. Pepsi – $4.663bn

4. Auchan – $3.463bn

5. Metro AG – $3.405bn

6. Danone – $3.002bn

7. Mars – $2.646bn

8. Procter & Gamble – $2.234bn

9. Chery Automobile – $2.154bn

10. Cargill – $2.130bn.

As Leroy Merlin and Nestle (they are also one of the biggest revenue gainers in Russia based on data for 2021) have not provided their financial reporting in the RF yet – but we believe that they also generated a very high amount of revenue but will be able to confirm it once we receive their financials.

Summarizing the first results of new data received for 2022 and comparing it with 2021 we can see the positive trends in terms of significant revenue and capital decline. Only assets have not almost changed ($275.6bn in 2022 vs $288.3bn in 2021) and will be even probably increased once we receive remaining reporting for ~80-100 companies. KSE Institute will shortly present a more detailed analysis of the key findings as announced above, please check our news for the special issue of the research study that will be published soon.

Current progress of Exiters vs others is the following:

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Changing the geography of financial and economic cooperation with Russia, which leads to the leveling of Western sanctions

In the spring of 2022, due to the invasion of Ukraine, Russia found itself under powerful collective Western sanctions imposed by a coalition of more than 40 countries. The sanctions regime against Russia was truly unprecedented. For the first time in the last half century, restrictions of an extraordinary scale were introduced against a large world economy (with a GDP of 1.78 trillion US dollars in 2021)⁵. The Russian economy is widely embedded in global communication networks and is the most important supplier of energy resources in the world.

A total of almost 13 000 sectoral economic restrictions have been imposed on Russia. The Russian economy has a simplified structure for the extractive sector, working mainly for the export of industrial and energy raw materials, which is the source of the formation of significant international currency reserves and the majority of the revenue part of the budget. At the end of 2021, Russian share of global gas exports was about 25%⁶.

On the face of it, Western sanctions appear to be effective: the Russian economy has shrunk, many Russian banks and companies are cut off from international financial and trading systems, and EU and US technology sanctions have weakened key industries and undermined their ability to innovate. However, statistics show that the actual impact of the sanctions in a number of areas is still lower than expected, and Russian imports have almost returned to the “pre-war” level of 2020. In some cases, exports of dual-use technologies that could be used in a war with Ukraine jumped “from virtually zero to tens of millions of dollars”⁷.

However, the situation that developed in the Russian economy last year can be considered unique – the expansion of the trade balance surplus (according to the results of the year, it increased from 190.3 billion US dollars to 308 billion US dollars) against the background of the rise in world prices for energy resources, which supported the ruble exchange rate and the budget. This significantly restrained the expected decline in the economy.

Russian oil exports have been largely unaffected by the sanctions, with Russian exporting roughly the same amount of oil as it did before the war, with supplies that used to go to the USA and Europe now going to Asia, Africa and the Middle East. It is worth noting that the share of the US dollars in trading on the Russian stock exchange has sharply decreased – in February 2023, the Chinese yuan accounted for almost 40% of the total volume of trades in major currencies, the US dollar – 38%, and the euro – 21.2%. Last year in February, the US dollars accounted for 87.6%, the Chinese yuan — 0.32%, the Euro — 11.9%⁸.In 2022, there was a surge in exports to countries neighboring Russia. This indicates that prohibited products could enter Russia through a “backdoor”.

As an example, the official Lamborghini dealer Russian “Avtodim” opened a mono-brand salon of the brand in “Moscow-City”, although the supply of new cars of this brand to the country was stopped in the spring of 2022. The salon is replenished with cars from parallel imports. In fact, these are new cars with low mileage, but not bought from an official importer⁹.

Trade statistics show that exports of certain goods to third countries, which had remained stable for years, suddenly rose sharply after the outbreak of war or the imposition of sanctions. It can’t just be a coincidence¹⁰. It can be argued that Russian trade at this time became focused towards Asian countries.

While Western countries unite to arm the Ukrainians to continue their fight against Russia, their own technology is being used by Russia to fight back.

As an example, direct sales of chips to Russia from the USA and its allies have dropped to zero. From 2017 to 2021, Russia purchased an average of 163 million US dollars worth of advanced chips and integrated circuits from the EU, the USA, Japan, and Great Britain. In 2022, this indicator decreased to 60 million US dollars. But it was possible to fill this deficit due to supplies from Turkey, Serbia, UAE and other countries¹¹.

Trade data shows that other countries have stepped in to provide Russia with some of what it needs. After a sharp drop immediately after the invasion of Ukraine, Russian imports of microchips have started to rise again, especially from China.

For reference: in 2022, Armenia imported 515% more chips and processors from the USA and 212% more from the EU than in 2021. Then Armenia exported 97% of these products to Russia¹². In this context, China is not just a supplier of sensitive goods to the Russian market, but probably also a supplier of them to the Russian military industry, providing 57% of semiconductor supplies¹³.

In 2022, Kazakhstan sent 3.7 million US dollars worth of advanced semiconductors to Russia. At the same time, in 2021, this indicator was only 12 thousand US dollars¹⁴.

There are at least six sanctions evasion schemes that Washington believes the Kremlin is using to acquire semiconductors and other electronics that are central to Russian production of guidance systems for its missiles, drones, tanks and other military equipment. Most of this technology is dual purpose, meaning it could also be used in making regular consumer products like cell phones, radios, printers and washing machines. In some cases, Russia appears to be buying these sorts of goods, then stripping them for their high tech parts¹⁵.

In February 2023, the European Bank for Reconstruction and Development published a report¹⁶, according to which, after the introduction of the first sanctions in March 2022, exports from the EU and Great Britain to Russia more than halved, and exports from Europe to Armenia, Kazakhstan and Kyrgyzstan suspiciously jumped by 15-90%. Also, the “suspicious boom” on German goods in Central Asia drew attention in Germany. The income of German companies from trade with Kazakhstan in 2022 increased by 210% compared to 2018-2020, with Kyrgyzstan by 1 157%, respectively. The export of goods from the Netherlands to Kyrgyzstan increased by 142%, and from Kyrgyzstan to Russia by 233%. Countries bordering Russia are buying more and more goods from Europe and undermining the Western sanctions regime by reselling them to Moscow. At the same time, tracking the entire supply chain is sometimes very difficult¹⁷.

The German authorities believe that it may be about supplying Russia with parallel imports to circumvent sanctions, especially within the framework of the Eurasian Economic Union. In Berlin, this is considered unacceptable. According to Bild, the EU special representative for sanctions, David O’Sullivan, has already drawn attention to this. In general, according to the calculations of the Eastern Committee of the German Economy, in 2022 the export of cars and auto parts from Germany increased (to Kazakhstan – by 507%, to Armenia – by 761%), chemical products (to Kazakhstan – by 129%, to Armenia – by 110 %), electrical equipment (to Uzbekistan – by 105%, to Armenia – by 344%), metal products (to Kazakhstan – by 137%) and clothing (to Kazakhstan – by 88%)¹⁸.

In 2022, the US Treasury stated that at least 18 countries were helping Russia circumvent sanctions. Among them were Armenia, Kazakhstan, Kyrgyzstan, Tajikistan and Uzbekistan¹⁹.

In Washington, they made it clear that Russian key partners in the region are being offered a choice: “remain connected to the world economy or provide material support to Russia and lose access to the most important world markets.” In other words, the USA threatened secondary sanctions for organizing the re-export of prohibited products to Russia. The stated goal is to “deprive Russia of the resources and equipment it needs on the battlefield and limit the revenues that the Kremlin relies on.

Turkey was the first of Russia’s major “friendly” trade partners to close the possibility of transit of sanctioned goods to Russia as a result of the EU’s pressure on Turkey regarding the transit of European goods. In 2022, Turkey became the largest transport hub for sanctioned goods destined for Russia, including parallel imports. The monthly transit of goods through Turkey amounted to 200-400 million US dollars²⁰.

An additional confirmation from our side of the fact that countries “friendly” to Russia help it circumvent sanctions can be the fact that almost half of the new companies added to the KSE database in 2023 were headquartered in Asian and Middle Eastern countries, namely: China and Hong Kong: +54 companies, UAE: +17 companies, Turkey: +8 companies, India, Iran and Japan: +6 companies each, Uzbekistan: +3 companies, Kazakhstan: +2 companies. On the other hand, it is unfortunate to observe that the so-called countries of the “sanction coalition” are also not far behind and continue to enter Russia’s toxic market, for example, the USA: +38 companies, Great Britain: +17 companies, Germany: +10 companies, France: +8 companies. Of course, we could not identify some companies earlier, but the general trend cannot but be alarming.

In this regard, it should be noted that in 2023, the European Union adopted the tenth package of sanctions against Russia in response to Russia’s full-scale invasion of Ukraine, in particular, the strengthening of sanctions compliance is expected, which is becoming increasingly important²¹.

Considering the above, it is already clear that the Western sanctions did not lead to a severe crisis in the Russian economy, although it caused considerable damage to it.

Implementation of sanctions was slow and ineffective. Western leaders initially poorly articulated their ambitions — from “degrading and destroying” Russia’s supply chains to “shaking” the foundations of its economy.

But, unfortunately, the loopholes in the sanction “nets” turned out to be still significant and numerous. The behavior of many countries has been mixed at best, and at worst has led to further profits from providing opportunities to circumvent Western sanctions for the Kremlin and its proxies. But there is much more that can be done, starting with better domestic enforcement of sanctions in allied countries and more active diplomatic engagement to reverse the progress Russia has made in countering international support for sanctions. There is no doubt that Ukraine’s allies have learned from their weak sanctions response to Russia’s annexation of Crimea in 2014 and have come a long way from their earlier start last year. But as the Kremlin adapts and disguises its supply chains and financial ties, the West will need to assess and adjust its activities accordingly²².

In this regard, the EU plans to approve the eleventh package of sanctions against Russia. Unfortunately, the permanent representatives of the member states of the European Union at a meeting on Friday, May 12, 2023, were unable yet to agree on the eleventh package of sanctions against Russia, but another meeting is scheduled for the next week²³. Currently, there is an urgent issue of introducing secondary sanctions in relations with those countries that help Russia circumvent the existing restrictions. One of these measures is the introduction of a general sanctions regime for all Western and Asian countries²⁴. An example of this is the growing interest in the CIS markets, when it was necessary to establish logistics chains for parallel imports to Russia, which already exceeded 20 billion US dollars²⁵.

Nevertheless, in the matter of monitoring compliance with sanctions, there is still more hope for the US, which is trying to partially stop the flow of parallel imports using secondary sanctions. Turkey’s sudden stop in the transit of sanctioned goods to Russia is indicative in this regard²⁶.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)²⁷

13.05.2023

*Exolum (Spain, Energy, oil and gas) Status by KSE – leave

Exolum CEO: Russian energy products may be entering Europe indirectly

*IC Holding (Turkey, Energy, oil and gas) Status by KSE – stay

Time to invest: Turkish firms invited to Russia to fill void left by Western brands

12.05.2023

*Georgian Airways (Georgia, Air transportation) Status by KSE – stay

Georgia Airways founder Tamaz Gayashvili welcomes Russia’s decision to start direct flights between the Sahara.

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – wait

Pernod Ricard can confirm that it has stopped all exports of its international brands to Russia at the end of April 2023.

https://www.pernod-ricard.com/en/media/pernod-ricard-cease-its-operations-russia

*Geely (China, Automotive) Status by KSE – stay

Geely chief defends Chinese car brand’s sales push in Russia

https://www.ft.com/content/b77603d9-5a10-4e33-852e-2d31bea4161a

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

Pinsent Masons on the sale of Inditex business in Russia to the Daher Group

*Space Exploration Technologies Corp. (USA, Aerospace) Status by KSE – stay

Starlink Terminals On Sale In Russia, Although System Does Not Work On Country’s Territory

11.05.2023

*Hikvision (China, Electronics) Status by KSE – stay

The revenue of Hikvision, the Russian office of the world’s largest Chinese manufacturer of video surveillance solutions, grew by 42% in 2022 to 10.9 billion rubles.

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

Fortum to write off $1.9 billion after Russia seized assets

https://www.reuters.com/business/energy/fortums-q1-core-profit-beats-estimates-2023-05-11/

*Gasum (Finland, Energy, oil and gas) Status by KSE – leave

Finnish Gasum has stopped taking LNG shipments from NOVATEK’s Kryogaz-Vysotsk project in Lenoblast, according to Kpler data

https://www.kommersant.ru/doc/5978473

*Google (USA, Online Services) Status by KSE – wait

The “Ъ” source in the Russian electronics market said that Google is increasingly refusing GMS (Google Mobile Services, which includes YouTube, Google Play, cards, etc.)

https://www.kommersant.ru/doc/5978452

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

Raiffeisenbank International tightened the conditions for its current accounts in CIS banks

https://www.kommersant.ru/doc/5978699

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – stay

Unilever breaks pledge: profits in Russia doubled, advertising spending increased

https://www .ftm.eu/articles/unilever-doubles-profits-russia

10.05.2023

*Svitzer (Denmark, Marine Transportation) Status by KSE – wait

Maersk (Denmark, Logistics, Transport) Status by KSE – exited

“Sakhalin-2” risks being left without chartered Dutch vessels

https://www.kommersant.ru/doc/5977766

*Philips (Netherlands, Electronics) Status by KSE – wait

Philips will continue to deliver hospital equipment to Russia, CEO says https://www.reuters.com/business/healthcare-pharmaceuticals/philips-will-continue-deliver-hospital-equipment-russia-ceo-says-2023-05-09/

*International Judo Federation (Hungary, Sport) Status by KSE – stay

IJF bans spectators wearing Russian military symbol at World Judo Championships

https://www.insidethegames.biz/articles/1136813/ijf-ejects-spectators-military-symbo

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

Oilfield firm SLB retrenches as Russia sanctions squeeze

09.05.2023

*Eni (Italy, Energy, oil and gas) Status by KSE – exited

Eni Opened Gazprom Arbitration Proceedings After Gas Supply Cuts

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

The Austrian banking group Raiffeisenbank International (RBI), the parent structure of the Russian Raiffeisenbank, terminated correspondent relations with all Russian banks, with the exception of its “daughter” before leaving the Russian Federation.

https://www.rbc.ru/finances/05/05/2023/6454ad459a794721b5f13b83

*UnionPay (China, Finance and payments) Status by KSE – wait

The Chinese payment system UnionPay, which was presented as an alternative to the discontinued Visa and MasterCard in Russia, did not live up to expectations.

https://t.me/moscowtimes_ru/12658

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

NACP included the Chinese car manufacturer Great Wall in the list of sponsors of the war

https://www.epravda.com.ua/news/2023/05/9/699913/

*International Motorcycling Federation (Switzerland, Sport) Status by KSE – leave

FIM’s ban on Russian, Belarusian riders to remain for 2023

https://www.thecheckeredflag.co.uk/2023/05/fims-ban-on-russian-belarusian-riders-to-remain-for-2023/

08.05.2023

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – wait

Russian oil ban costs Polish oil company PKN Orlen millions a day, says boss

https://www.ft.com/content/a059a287-7a59-4f65-b1e9-9f6c19a36627

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – stay

IOC works to return Russian, Belarusian athletes to international competitions under neutrality

https://english.news.cn/20230507/afe29c77caf149fbbaa920afd114c7cd/c.html

06.05.2023

*Binance (China, Finance and payments) Status by KSE – stay

Binance Faces US Probe of Possible Russian Sanctions Violations

*Volkswagen (Germany, Automotive) Status by KSE – leave

Russian carmaker files third lawsuit against Volkswagen

05.05.2023

*Luxoft (Switzerland, IT) Status by KSE – wait

Luxoft increased the volume of orders of its remaining Russian “daughter” in 2022

https://www.tadviser.ru/index.php/Компания:Integrity_Solutions_(Интегрити_Солюшнс)

*Metro AG (Germany, FMCG) Status by KSE – stay

*Auchan (France, FMCG) Status by KSE – stay

“Aushan” and Metro continue their work in the Russian Federation and do not plan any changes, the press services of the companies told “Izvestia” on May 5.

*ISAB (Italy, Energy, oil and gas) Status by KSE – leave

*GOI Energy (Cyprus, Energy, oil and gas) Status by KSE – stay

Lukoil closed the deal on the sale of the ISAB refinery in Italy

*Uniqlo (Japan, Consumer goods and clothing) Status by KSE – leave

The Japanese clothing chain Uniqlo received more than 10 billion rubles in Russia at the end of 2022. losses, decided to close most of its large stores here.

https://www.kommersant.ru/doc/5968252

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

Austrian bank Raiffeisen triples Russia profit in first quarter

https://www.reuters.com/markets/europe/austrias-rbi-triples-profit-russia-first-quarter-2023-05-05/

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

Fortum has formally notified that it objects the unlawful seizure of Russian subsidiary

04.05.2023

*Brinks (USA, Security & Protection) Status by KSE – leave

*Loomis (Sweden, Finance and payments) Status by KSE – leave

*Paloma Precious DMCC (United Arab Emirates, Metals and Mining) Status by KSE – stay

*VPower Finance Security (Hong Kong) Ltd. (China, Metals and Mining) Status by KSE – stay

*Al Bahrain Jewellers LLC (United Arab Emirates, Metals and Mining) Status by KSE – stay

*Actava Trading DMCC (United Arab Emirates, Agriculture) Status by KSE – stay

With Russian gold shut out of Western markets, little-known companies are stepping in to help the country’s bullion find new buyers.

*SAIPA (Iran, Automotive) Status by KSE – stay

Iran’s SAIPA signs $497 million car deal with Russia, Belarus

https://www.al-monitor.com/originals/2023/05/irans-saipa-signs-497-million-car-deal-russia-belarus

*Union Cycliste Internationale (Switzerland, Sport) Status by KSE – stay

The International Union of Cyclists approved the return of Russians and Belarusians to competitions in neutral status

*Ericsson (Sweden, Telecom) Status by KSE – wait

“Maxcomm” LLC, established in February, declared the import of components to Russia for 20,000 base stations of the Swedish Ericsson AB, which officially stopped working in the country an hour ago.

https://www.kommersant.ru/amp/5967047

*Gatik Ship Management (India, Energy, oil and gas) Status by KSE – stay

The unknown Indian company shipping millions of barrels of Russian oil

https://www.ft.com/content/6f81585c-321a-41fb-bcdb-579e93381671

https://www.globalwitness.org/en/campaigns/stop-russian-oil/inside-murky-trade-russian-oil/

*Henkel (Germany, Chemical industry) Status by KSE – exited

Henkel delivers very strong organic sales growth in the first quarter

*JPMorgan (USA, Finance and payments) Status by KSE – wait

JPMorgan could process another 40 Russian grain export payments

*VEON (Netherlands, Telecom) Status by KSE – leave

Telecoms firm Veon granted U.S. license for sale of Russian business

*OTP Bank (Hungary, Finance and payments) Status by KSE – stay

They lend to the occupiers: NAZK included OTP Bank in the list of international sponsors of the war https://nazk.gov.ua/uk/novyny/kredytuyut-okupantiv-nazk-vneslo-otp-bank-do-pereliku-mizhnarodnyh-sponsoriv-vijny/

03.05.2023

*Danieli Group (Italy, Industrial equipment) Status by KSE – wait

The manufacturer is studying options for selling its assets in Russia. The company’s exit can take up to six months, its representative noted.

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – wait

Coca-Cola HBC’s revenue fizzes almost 25 per cent – but Russia exit still hurts a year on

*Continental (Germany, Automotive) Status by KSE – leave

Continental may get as little as £70 million for Russian business

https://www.kommersant.ru/doc/5955063

*Google (USA, Online Services) Status by KSE – wait

The revenue of the Russian “daughter” of Google in 2022 fell by 82%

https://www.kommersant.ru/doc/5967070

*Vanke Group (China, Hospitality, Real estate) Status by KSE – stay

The Chinese Vanke Group, which received the rights to the restoration of the Imperial Educational House and the complex of the former buildings of the Academy of Missile Forces near the Kremlin, began to look for co-investors due to the increase in the project budget

02.05.2023

*British Petroleum (BP) (Great Britain, Energy, oil and gas) Status by KSE – leave

British energy giant BP reported a net profit of $8.2 billion for the first quarter, recovering from a record loss a year earlier as it ended operations in Russia after the Ukraine invasion.

https://news.yahoo.com/bp-back-q1-profit-record-082112293.html

BP beats profit forecasts but slows pace of share buybacks

*ONGC Videsh Ltd (India, Energy, oil and gas) Status by KSE – stay

India Energy Firms’ $400 Million Stuck in Russia, Official Says

*FLO Magazacilik (Turkey, Consumer goods and clothing) Status by KSE – stay

*Adidas (Germany, Consumer goods and clothing) Status by KSE – leave

*Authentic Brands Group – Reebok (USA, Sport) Status by KSE – exited

The German manufacturer of sportswear, shoes and accessories Adidas is considering the possibility of transferring the Russian division to a foreign investor

https://www.kommersant.ru/doc/5966391

*Hyundai (South Korea, Automotive) Status by KSE – leave

Kazakhstan’s Astana Motors announced that it does not plan to buy the Hyundai plant in Russia

01.05.2023

*Harbin Bank (China, Finance and payments) Status by KSE – stay

*China Construction Bank (China, Finance and payments) Status by KSE – stay

*Agricultural Bank of China (China, Finance and payments) Status by KSE – stay

Chinese banks seize on Russia, oil trade to internationalize yuan

*JCB (Great Britain, Manufacturing) Status by KSE – wait

The curious case of the Russian JCB dealer and the millionaire

*International Canoe Federation (Switzerland, Sport) Status by KSE – stay

The International Canoe Federation (ICF) Executive Board has opted to allow Russian and Belarusian athletes to return to its competitions under a neutral flag

https://www.insidethegames.biz/articles/1136514/icf-allows-russia-return

*Euroclear (Belgium, Finance and payments) Status by KSE – leave

Euroclear publishes another quarter of growth in Q1

*Inditex (Spain, Consumer goods and clothing) Status by KSE – leave

How Russian fashion brands replace foreign ones

https://www.forbes.ru/biznes/488502-kak-rossijskie-fesen-brendy-zamesaut-inostrannye

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – leave

Exposing the connections between Wintershall’s Siberian gas fields and Russia’s military supply chain

*Match Group (USA, IT) Status by KSE – leave

«We are committed to protecting human rights. Our brands are taking steps to restrict access to their services in Russia and will complete their withdrawal from the Russian market by June 30, 2023.» -the company’s report says

https://d1sud0deeo84nn.cloudfront.net/5BD8c7EsN8WLsfEt9cAkPA2ZV0S30Wt3FDQkHDiO.pdf

*Framatome (France, Energy, oil and gas) Status by KSE – stay

Paris approves the building of Russian-led nuclear reactors in Hungary

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

In early April, the KSE Institute also published its methodology entitled “How to Identify Foreign Business in Russia and What are the Key Issues of Creating and Keeping a Full List of the Largest Foreign Companies in Russia”, you can download its full text using the following links:

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ After almost 15 months of war started by Russia in Ukraine we assume that there was quite enough time to make the decision to leave the country-aggressor for all international business. That’s why for KSE Institute companies with statuses “stay” and “wait” essentially are no different. Probably it’s the right time for us to delete the status “wait” combining it with KSE status “stay”; these changes may be introduced soon.

⁵ https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locale=ru&locations=RU

⁶ https://cyberleninka.ru/article/n/rossiya-v-usloviyah-sanktsiy-predely-adaptatsii/viewer

⁸ https://www.kommersant.ru/doc/5915726

⁹ https://www.kommersant.ru/doc/5680204

¹⁰ https://www.ft.com/content/6489d5a4-9c66-40be-bd3b-55b31e94542f

¹² https://www.pravda.com.ua/rus/news/2023/04/19/7398458/

¹⁴ https://www.kommersant.ru/doc/5861980

¹⁶ https://www.ebrd.com/publications/working-papers/the-eurasian-roundabout

¹⁷ https://www.kommersant.ru/doc/5941916

¹⁸ https://interfax.com.ua/news/general/908762.html

²⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website