- Kyiv School of Economics

- About the School

- News

- 43rd issue of the regular digest on impact of foreign companies’ exit on RF economy

43rd issue of the regular digest on impact of foreign companies’ exit on RF economy

17 April 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 03.04-16.04.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we agreed on partnering with the Push To Leave team. “Push To Leave” allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

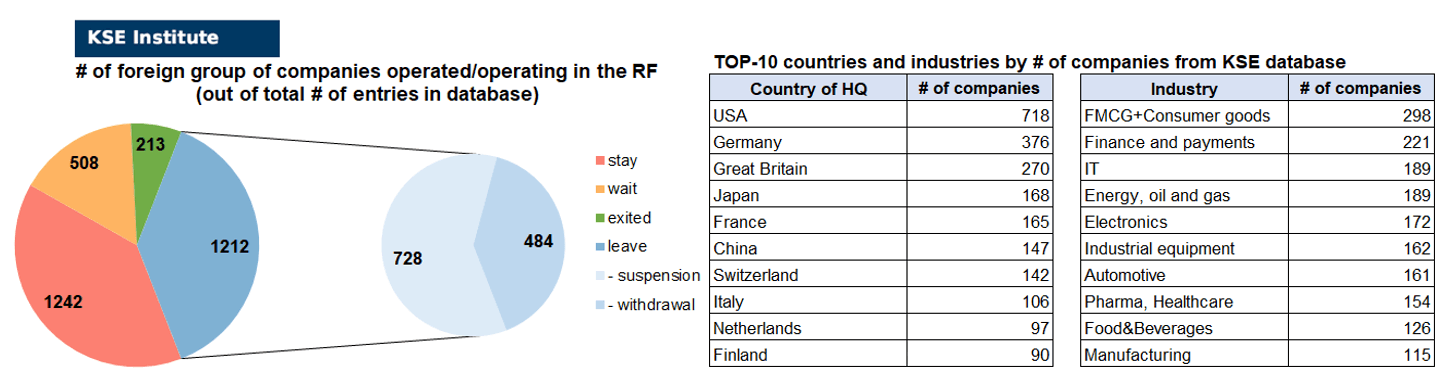

KSE DATABASE SNAPSHOT as of 16.04.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 242 (+11 per 2 weeks)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 508 (+1 per 2 weeks)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 212 (0 per 2 weeks)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 213 (+2 per 2 weeks)

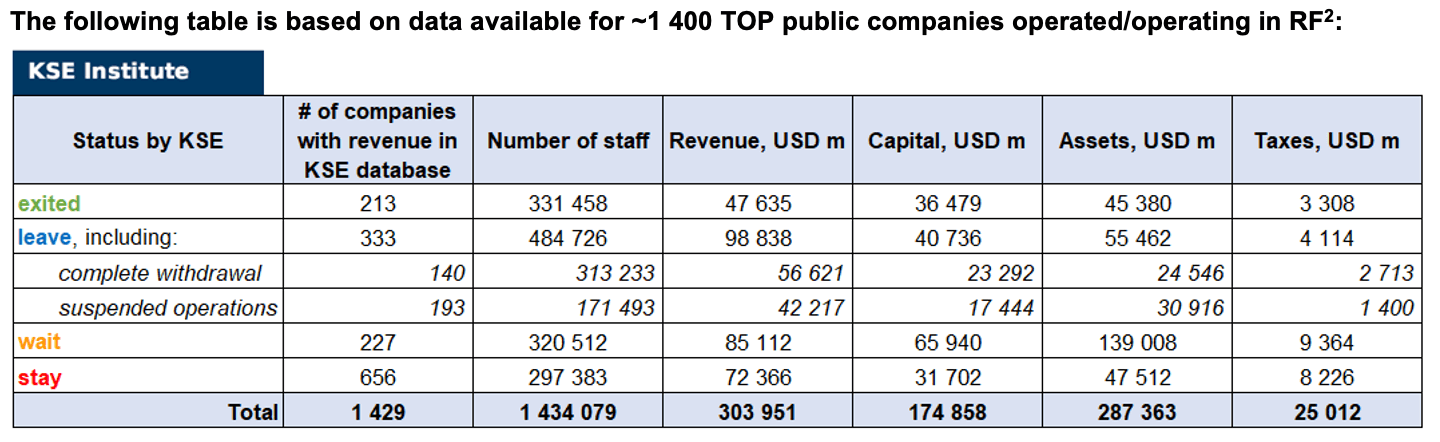

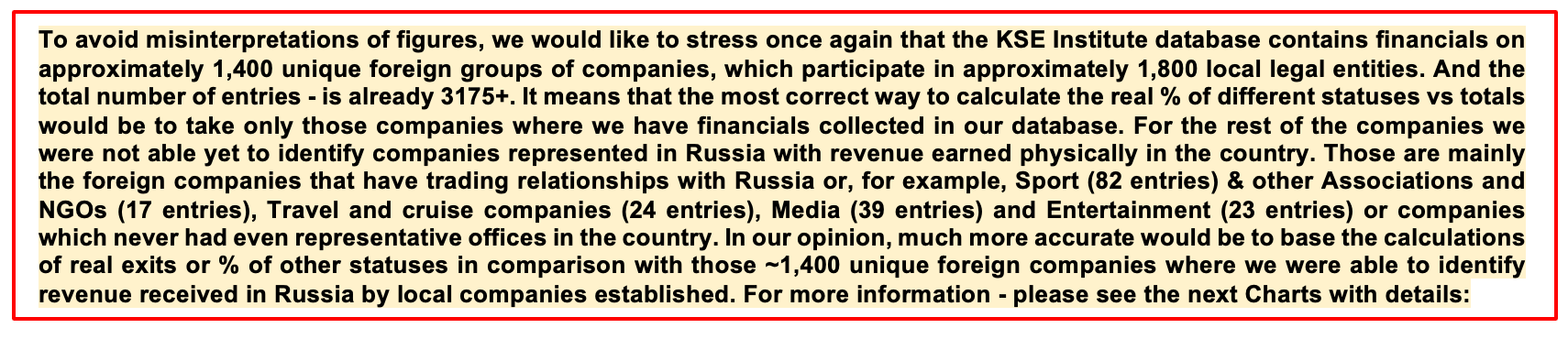

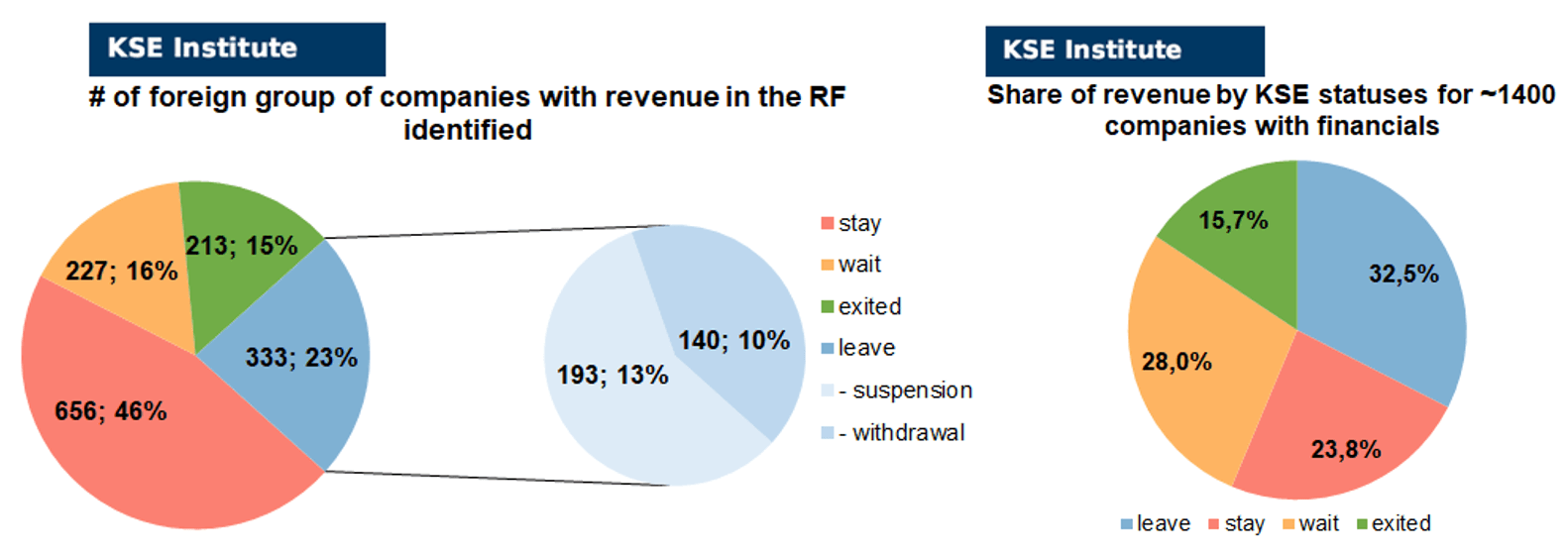

As of April 16, we have identified about 3,175 companies, organizations and their brands from 87 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.9 billion), local revenue (about $304.0 billion), local assets (about $287.4 billion) as well as staff (about 1.434 million people) and taxes paid (about $25.0 billion). 1,720 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 213 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of April 16, 211 companies which had already completely exited from the Russian Federation, had at least 331,500 personnel, $47.6 bn in annual revenue, $36.5bn in capital and $45.4bn in assets; companies, that declared a complete withdrawal from Russia had 313,200 personnel, $56.6bn in revenues, $23.3bn in capital and $24.5bn in assets; companies that suspended operations on the Russian market had 171,500 personnel, annual revenue of $42.2bn, $17.4bn in capital and $30.9bn in assets.

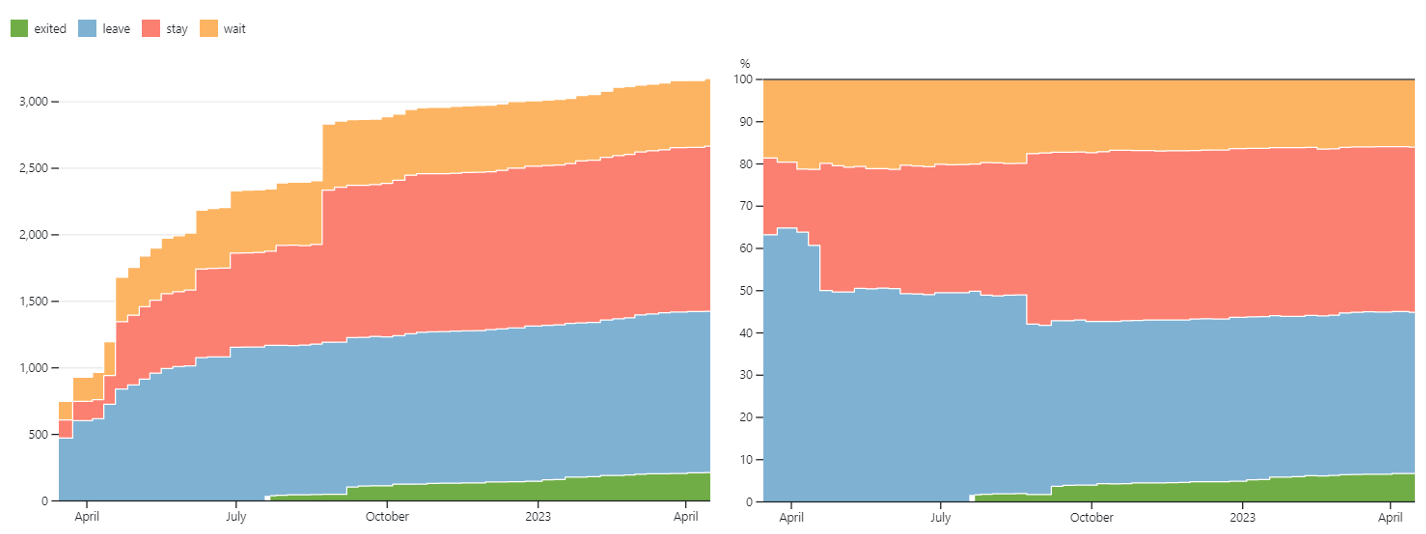

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 7 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 38.2% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 39.1% are still remaining in the country, 16.0% are waiting and only 6.7% made a complete exit³.

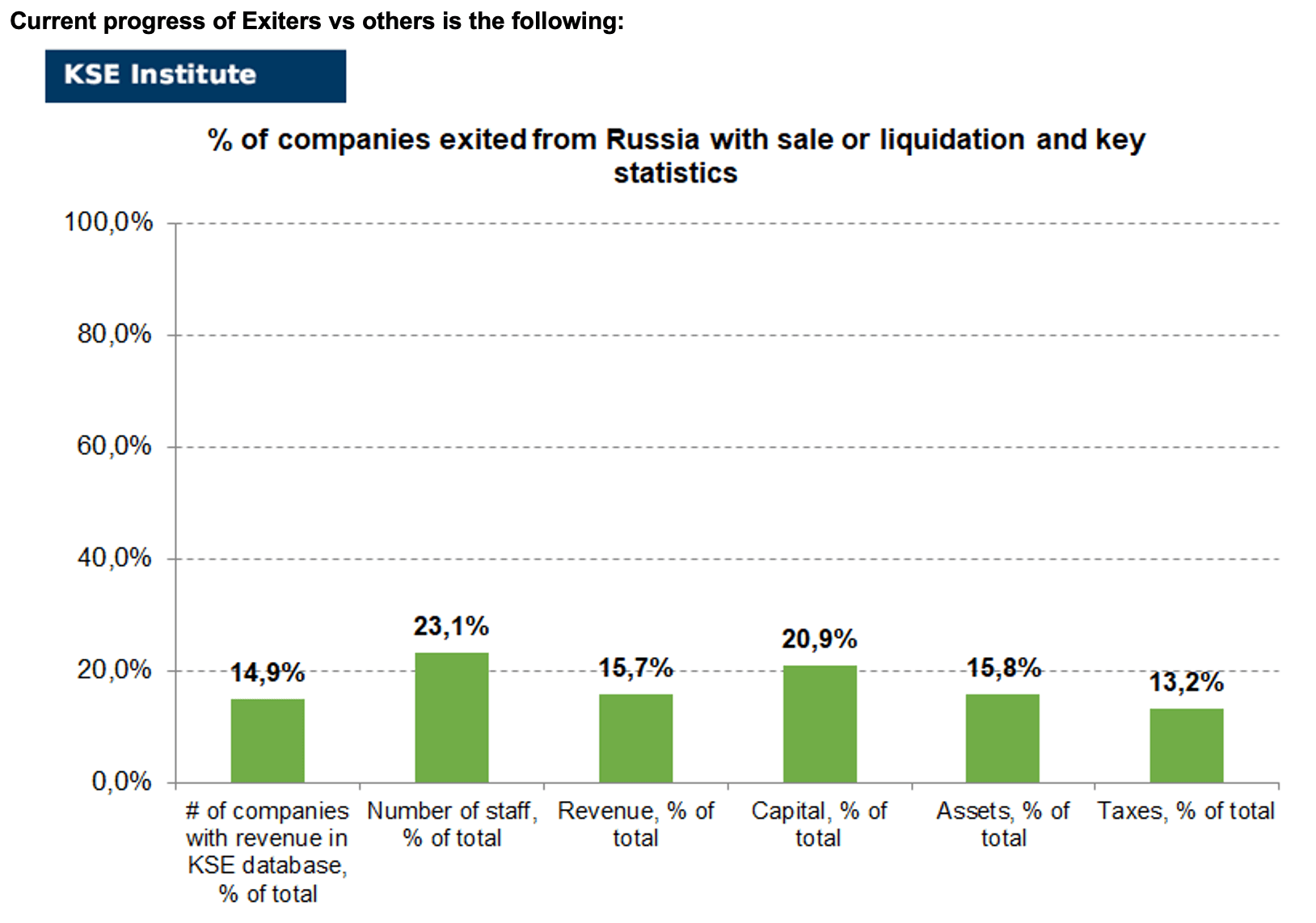

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 213 companies that completely left the country, since they employed 23.1% of the personnel employed in foreign companies, the companies owned about 15.8% of the assets, had 20.9% of capital invested by foreign companies, and in 2021 they generated revenue of $47.6 billion or 15.7% of total revenue and paid $3.3 billion of taxes or 13.2% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (15%) and on share of revenue withdrawn (16%). At the same time, a totally different picture is for those who are still staying – 46% of companies represent 24% of revenue and 16% of waiting companies represent 28% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Activities of foreign companies in Russia in the light of rejection of the values of the Free World

In response to the Russian military invasion of Ukraine in late February 2022, many countries reacted quickly to impose sanctions against Russia. The situation is developing rapidly, and throughout 2022, new measures against Russia were constantly announced.

A year has passed since the West imposed a series of financial and economic sanctions against Russia after its invasion of Ukraine. It is fair to ask the question, how did the sanctions affect Russia during 2022? For foreign companies that cooperated or still cooperate with Russia, in particular, for the governments of the respective countries, against the background of the war in Europe, a choice arises, namely, to continue the movement of development on the side of the Free World or on the side of the aggressor country and its allies?

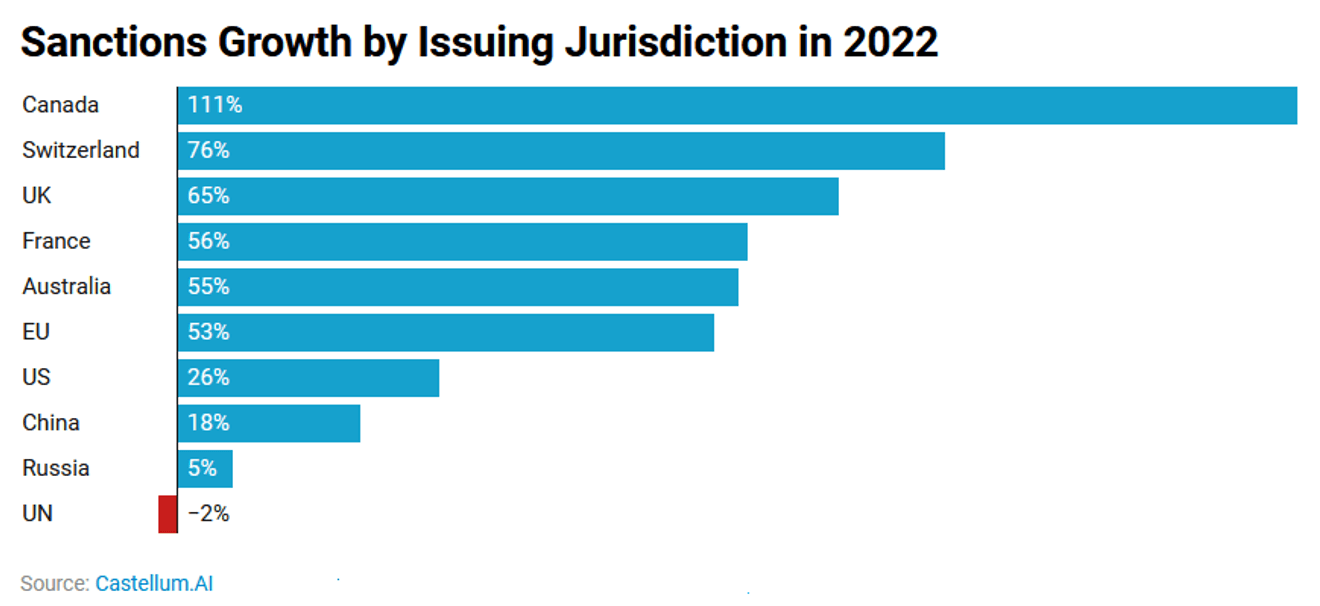

The growth of sanctions programs in the USA, Canada, Switzerland, UK, Australia, France and the EU also rose sharply last year as authorities in those jurisdictions responded to the Russian incursion.

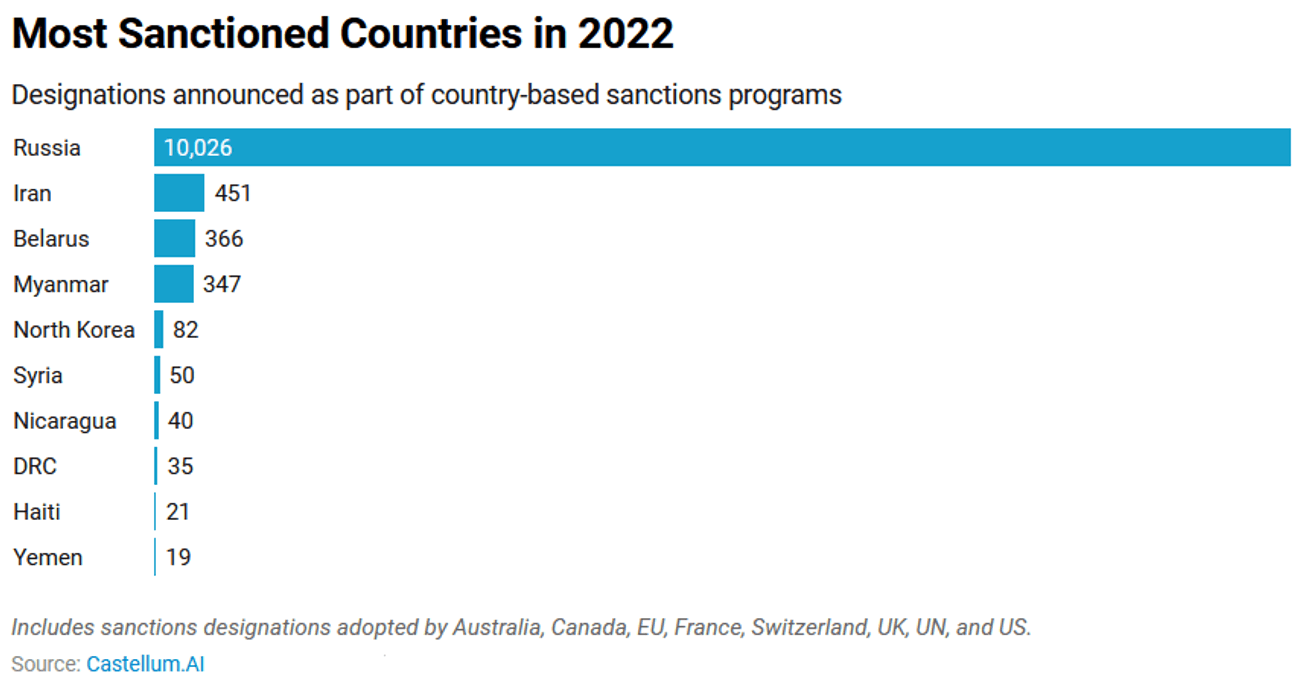

In 2022, sanctions against Russia led the number imposed in 2022, surpassing the next most sanctioned country, Iran, by 20 times⁴:

At the same time, many foreign companies have begun to make statements about their work in the aggressor country. For some companies, the very fact of Russian invasion of Ukraine became a red line, which crossed out the possibility of conducting business “as usual”. Some companies have been forced to suspend their activity or withdraw as they faced new logistical and economic realities. And some, on the contrary, decided to take advantage of the opportunity to gain the share of the Russian market vacated by competitors.

The sanctions currently in effect against Russia have a very wide impact on the business and financial sector, the energy sector and manufacturing. For example, the ban on the export of technology to Russia from the West has a negative impact on production as a whole, including the technology needed by the military to continue the war against Ukraine. Sanctions targeting the energy sector will continue to affect the Russian economy in 2023.

When it comes to banning the import of certain goods, for example, there are cases when third countries suddenly increase the import of these products, and there is a suspicion that they are then sold to Russia. In addition, China and India continue to import large volumes of Russian oil. Other countries also continue to trade with Russia. In the meantime, Russia has a way to offset some of the problems caused by sanctions⁵.

How to make sanctions more effective? There are attempts to make the existing sanctions more effective by eliminating relevant loopholes.

The Russian economy managed to avoid the worst effects of the sanctions, mainly by the extremely high oil and gas prices that the world has seen in 2022. Extremely high energy prices led to Russia’s total revenue from oil and gas exports rising in 2022⁶.

In the year that has passed since the Russian invasion of Ukraine, the Western alliance has united against Russia, but the world is still far from unity on the issues raised by the war in Ukraine.

US officials point out that 141 of the 193 nations at the United Nations Organization voted to condemn Russia after the invasion, and that 143 voted in October 2022 to condemn the Kremlin’s annexation of parts of Ukraine. But only 33 countries have imposed sanctions on Russia, and the same number send lethal weapons to Ukraine. As an example, India announced that since the beginning of the Russian invasion of Ukraine, its trade with Russia has increased by 400%⁷.

For reference: economically, Russia is an important supplier of mineral raw materials, diamonds, fertilizers and agricultural products for India. India actually benefits from the sanctions imposed on Russia by the West, as it gets cheaper Russian energy, diamonds and fertilizers.

Before the war, the share of oil from Russia in Indian imports was traditionally less than 1% – the country mainly received from Iraq and Saudi Arabia, but from March 2022 the share began to grow and reached peaks in June and October 2022⁸.

The trade turnover of Russia and India increased by 2.4 times in 2022 due to the growth of exports of fuel and energy products and products of the chemical industry⁹.

China has not approved of Russia’s full-scale invasion of Ukraine, but has expanded trade and other ties with Moscow since it began in February. In 2022, with the start of Russia’s large-scale military aggression against Ukraine, China’s economic relationship with Russia deepened as Russia found itself embroiled in a grueling war and its economy hit by Western sanctions. In this regard, Russia has a thousand reasons to seek better relations with China. As an example, at the beginning of the war, Chinese companies were the least active in withdrawing from Russia.

For reference: Trade between Russia and China in 2022 increased by 29.3% compared to the previous year and amounted to 190.27 billion US dollars. Exports from Russia to China for the year increased by 43.4% until 2021 and reached 114.15 billion US dollars. Imports from China increased by 12.8% to 76.12 billion US dollars¹⁰.

The trade turnover between Russia and China in January-March 2023 increased year-on-year by 38.7%, reaching $53.84 billion, the Main Customs Administration of China announced on Thursday, April 13, 2023.

The main part of the cost of goods imported from the Russian Federation to China falls on oil, natural gas and coal. Other key imports from Russia include copper and copper ore, timber, fuel and seafood. China exports a wide range of products to the Russian Federation, a significant share of which is smartphones, industrial and specialized equipment, children’s toys, shoes, vehicles, air conditioners and computers. According to Russian Ambassador to China Igor Morgulov, the Russian-Chinese trade turnover in 2023 should reach the target of $200 billion and overcome it with a large margin. He recalled that Russia is “a reliable supplier of hydrocarbons, and its cooperation with China is based on mutual respect and benefit.”¹¹.

In this context, China is not just a supplier of sensitive goods to the Russian market, but probably a supplier to Russian military industry in general, providing 57% of semiconductor supplies¹².

Austria is one of the countries most affected by Western sanctions against Russia, as approximately 80% of Austria’s natural gas demand relies on Russian imports¹³.

Austrian companies have invested heavily in Russia and are feeling the effects of Western sanctions against Russia. Austrian companies and industry feared gas shortages, but supported the sanctions policy.

For reference: the management of Austria’s Raiffeisen Bank International discussed a possible asset swap scheme with Russia’s Sberbank to receive the amount of proceeds that the RBI received in Russia in 2022 and cannot withdraw due to Russian government restrictions.

This is written by the Austrian publication Falter¹⁴with reference to a “confidential” document from the RBI board meeting. Sberbank is under sanctions, and part of its assets, for its part, have been frozen by the European authorities. According to the publication, the management of Raiffeisen Bank International discussed the idea of transferring the dividends due from its Russian business to Sberbank in exchange for the assets of its European subsidiary, Sberbank Europe, which is registered in Austria.

At the same time, according to the newspaper, we are talking about the value of assets of approximately 2 billion euro – that was the net profit of Raiffeisenbank in Russia last year. Sberbank can receive either this money, or the entire subsidiary of Raiffeisen Bank International in Belarus – “Priorbank”, the total balance of which is also about 2 billion euros, writes Falter¹⁵.

Also, the Russian subsidiary of the Austrian “Raiffeisen Bank International”, which continues to work in Russia, paid 559 million euros to the Russian budget in 2022, which is 4.8 times more than for the whole of 2021.

This is evidenced by the financial statements of Raiffeisen Bank International published on the RBI website. In general, the Russian subsidiary provided 54% of the total net profit of Raiffeisen Bank International for 2022 and became the most profitable business of the Austrian financial group. At the same time, the bank uses the names of the Ukrainian territories illegally occupied by Russia in its official documents, and calls the war of the Russian Federation against Ukraine a “special military operation”¹⁶.

However, after the announcement of a possible asset swap with Sberbank, Raiffeisen Bank International realized that it is technically impossible to do this with a bank that is under sanctions. Also, pressure from the ECB, which forces the Austrian bank Raiffeisen to withdraw from Russia¹⁷ and the Group finally announced that Raiffeisen Bank decided to sell the Russian subsidiary or withdraw it from the Group’s perimeter¹⁸.

Despite Austria refusing any military involvement in the war in Ukraine, citing its constitutional “permanent neutrality”, Austria has signed up to the European Union’s sanctions against Russia and its financial aid regime in support of Ukraine. Also, Austrian Minister for Foreign affairs confirmed the position of the federal government regarding the need to continue the EU sanctions against Russia, which are effective and in a few months will have an “even more dramatic effect” for Russia, in particular, the course of the federal government of Austria in the matter of the EU sanctions policy against Russia is “clear and absolutely unchanging.” However, it is emphasized that in Austria there is a question of mitigating the negative consequences for the Austrian economy¹⁹. After all, the import of Russian gas in Austria is approaching the pre-war level, in particular, last December 71% of natural gas came from Russia. And such large Austrian companies as Raiffeisen Bank International and wood producers Kronospan and EGGER remain active in Russia despite the sanctions²⁰.

For its part, the Russian government is taking various measures in response to Western sanctions.

Thus, every Western company that wants to exit the Russian market and sell its assets will now be obliged to transfer a direct payment to the budget of the aggressor state. Thus, all companies that decided to postpone the decision to end their cooperation with Russia until the beginning of a full-scale invasion, will now somehow finance the Russian budget with direct payments in the event of leaving the country. Previously, companies leaving Russia could choose between a “voluntary contribution” to the Russian budget, which amounted to 10% of the sale price, or agree to defer payment from the sale for several years. “Many companies wanted to get out of Russia as quickly as possible, so they chose this 10 percent payment and got cash right away instead of the uncertainty of a deferred payment,” said the agency’s source, who was involved in a recent deal on exit from the Russian market.

Approximately 2 000 applications to exit the Russian market are awaiting approval, but it will take at least 8 years just to process them all.

The first publicized “voluntary payment” deal was made by the Norwegian company Wenaas after selling its hotels in Russia to the Russian conglomerate “Sistema”, controlled by sanctioned oligarch Vladimir Yevtushenkov. In February, “Sistema” stated that the price of the deal was “up to 203 million euros, including a 10 percent payment to the budget of the Russian Federation“²¹.

Considering the above, it is worth noting that the economic sanctions against Russia after its invasion of Ukraine are aimed at weakening its ability to wage the war. Russia is vulnerable to export restrictions on military components, many of which come from abroad. Russian imports fell significantly not only from the countries that are part of the sanctions coalition, but, surprisingly, also from the countries that refused to accept the sanctions. A reduction in Russian imports means that the sanctions are “suffocating” the Russian economy. The drop in imports across the board has caused considerable pain to the aggressor, and “unofficial data” suggests that the unavailability of foreign technology and components harms the further development of Russia and the competitiveness of its business.

Many countries imposed sanctions on Russia after its invasion of Ukraine in 2022, making it the most sanctioned country in the world, with new measures announced constantly. The sanctions have a wide impact on Russia’s business and financial sectors, energy, and manufacturing, and while some foreign companies have withdrawn, others have sought to gain a share of the Russian market, and the economy temporarily managed to avoid the worst effects of the sanctions due to extremely high oil and gas prices. China and India are continuing to trade with Russia, while the Western alliance united against it, but, unfortunately, the world is still far from unified on the issues raised by the war in Ukraine.

What’s new last month – key news from Daily monitoring

(updated on a bi-weekly basis)²²

14.04.2023

*Nintendo (Japan, Gaming) Status by KSE – wait

Russian Nintendo CEO Is Reportedly Using Nintendo Russian HQ to Sell Nintendo Games Through Import Company

https://wccftech.com/russian-nintendo-ceo-is-reportedly-using-nintendo-russian-hq-to-sell-nintendo-games-via-import-company/

*Kemmler Präzisionswerkzeuge GmbH (Germany, Manufacturing, Industrial equipment) Status by KSE – stay

The data from Russia available to the ZET shows that tools and machine parts from German manufacturers end up with the Russian armaments industry.

*Emirates NBD (United Arab Emirates, Finance and payments) Status by KSE – wait

One of the largest banks in the UAE — Emirates NBD — will begin transferring assets of Russians to separate accounts, where all payments on securities belonging to them will go.

*PowerJet (France, Aircraft industry) Status by KSE – leave

Airlines are asking ODK to take responsibility for French engines

https://www.kommersant.ru/doc/5928576

*Pandora (Denmark, Consumer goods and clothing) Status by KSE – leave

Pandora jewelry stores in Russia will change their name and format

13.04.2023

*International Investment Bank (IIB) (Hungary, Finance and payments) Status by KSE – leave

Hungary’s government has decided to withdraw its representatives from the Russia-controlled International Investment Bank (IIB) and will quit it

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell may get nearly £1bn from sale of stake in Russian gas project

https://www.theguardian.com/business/2023/apr/12/shell-sakhalin-2-gas-project-stake

Russia’s Novatek to acquire Shell’s stake in Sakhalin-2 for $1.16 bln

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

*Vestas (Denmark, Energy, oil and gas) Status by KSE – leave

Fortum chases $218 million from Vestas over Russia wind project

*Imperial Brands (Great Britain, Alcohol&Tobacco) Status by KSE – exited

Tobacco giant Imperial Brands on track for ‘similar’ results after Russia exit

https://www.business-live.co.uk/manufacturing/tobacco-giant-imperial-brands-track-26686492

*Apple (USA, Electronics) Status by KSE leave

*Samsung (South Korea, Electronics) Status by KSE – wait

Smartphone manufacturers are defined by the use of metals from the Russian Federation

https://www.kommersant.ru/doc/5927860

*Xiaomi (China, Electronics) Status by KSE – stay

Xiaomi Corporation, the leader in the sale of smartphones in the Russian Federation, was included in the list of international sponsors of the war.

12.04.2023

*UBS (Switzerland, Finance and payments) Status by KSE – wait

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

Since March, Swiss banks have started warning clients from Russia about closing their accounts if they discover that taxes have been paid to the Russian budget.

*Philip Morris (USA, Alcohol & Tobacco) Status by KSE – stay

CEO of Philip Morris International Inc. in Russia, Jacek Olczak received a diploma for meritorious services to Russia in 2022

*ISAB (Italy, Energy, oil and gas) Status by KSE – leave

*GOI Energy (Cyprus, Energy, oil and gas) Status by KSE – stay

Italy conditionally approves Lukoil refinery sale

*Pernod Ricard (France, Alcohol&Tobacco) Status by KSE – stay

The Swedish producer of Absolut vodka and the French concern Pernod Ricard, which absorbed it in 2008, are starting to export alcohol to Russia again after a one-year break.

https://www.epravda.com.ua/rus/news/2023/04/12/699046/

*Deutsche Bank (Germany, Finance and payments) Status by KSE – leave

Deutsche Bank is winding down its remaining software centers in Moscow and St. Petersburg and plans to cut 500 jobs.

About 500 employees of IT centers who still remain in Russia will be offered to resign within six months with severance pay.

https://www.epravda.com.ua/news/2023/04/12/699073/

https://www.ft.com/content/647069d9-6f89-4e5d-8781-bef4bfaeccda

11.04.2023

*inDrive (USA, Online Services) Status by KSE – leave

Against the background of sanctions, the international taxi service InDrive transferred the Russian legal entity to the ownership of the Kazakh structure. The new team headed by the company’s former operations director plans to relaunch under the INDELS brand

https://www.rbc.ru/technology_and_media/10/04/2023/642fdccb9a794725b5dc713d

*AFRY (Sweden, Engineering) Status by KSE – exited

AFRY completes divestment of its operations in Russia

*Porsche (Germany, Automotive) Status by KSE – wait

Porsche Board Member Allegedly Seeks Deal With Putin To Rebuild Russia’s Auto Industry

*Twitter (USA, Online Services) Status by KSE – wait

The State Duma proposed to unblock Twitter after lifting restrictions on pro-Kremlin accounts

*Volkswagen (Germany, Automotive) Status by KSE – leave

Russia’s GAZ Group files $348M suit against VW

https://europe.autonews.com/automakers/vw-faces-new-court-case-russia-gaz

*Fennovoima (Finland, Energy, oil and gas) Status by KSE – leave

Rosatom demands that Finland return a €920.5 million loan after termination of the NPP contract

https://www.kommersant.ru/amp/5926551

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

SLB Isn’t Going Anywhere

https://www.globalwitness.org/en/campaigns/stop-russian-oil/slb-isnt-going-anywhere/

*Ingenico (France, Finance and payments) Status by KSE – leave

The Association of Banks of Russia (ABR) asked the Ministry of Industry and Trade to allocate subsidies to representatives of the payment industry for the import replacement of POS terminals for accepting cards from the French manufacturer Ingenico, which has withdrawn from the Russian market.

*Takeda (Japan, Pharma, Healthcare) Status by KSE – wait

The Japanese pharmaceutical manufacturer Takeda is considering options for the sale of its Russian plant, where more than €117 million was invested.

10.04.2023

*ISAB (Italy, Energy, oil and gas) Status by KSE – stay

*GOI Energy (Cyprus, Energy, oil and gas) Status by KSE – stay

Italy is reviewing the agreement on the sale of the Lukoil refinery

https://www.ft.com/content/41f45060-9d08-4875-a159-2555471cb479

08.04.2023

*Mykines Corporation (Great Britain, Electronics) Status by KSE – stay

The British company Mykines Corporation LLP could supply electronics to Russia for $1.2 billion

https://www.ft.com/content/bdd8c518-bf10-4c9c-b53b-bfbe512e2e92

*Twitter (USA, Online Services) Status by KSE – wait

Twitter has removed restrictions on Kremlin-linked accounts in the wake of its acquisition by tech billionaire Elon Musk, a review of the website has found.

*Raiffeisen (Austria, Finance and payments) Status by KSE – wait

From April 10, Raiffeisenbank refuses to connect new “Salary” service packages

https://www.rbc.ru/finances/07/04/2023/643057fd9a79475cd5a22f76?from=newsfeed

*Danone (France, FMCG) Status by KSE – wait

The French manufacturer of dairy products Danone plans to abandon international brands in the Russian Federation. We are talking about such names as Activia, Alpro, Actimel and Danone.

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

The National Agency for the Prevention of Corruption (NACP) has included the leading global oil company SLB (formerly Schlumberger), headquartered in the USA, on the list of international sponsors of the war.

07.04.2023

*Daher Group (United Arab Emirates, Consumer goods and clothing) Status by KSE – stay

Inditex SA, which runs the Zara and Bershka clothing chains, obtained approval to sell its business in Russia to Daher Group of the United Arab Emirates.

*Aytemiz Akaryakit (Turkey, Energy, oil and gas) Status by KSE – stay

On April 4, the Board of Directors of the Turkish Dogan Holding (Istanbul) approved the sale of 50% of the shares of Aytemiz Fuel Distribution Inc. to the Russian PJSC Tatneft. (Aytemiz Akaryakit, Turkey). This is stated in the message of Dogan Holding, published in the national information disclosure system.

https://www.interfax.ru/world/894671

*Net4Gas (Czech Republic, Energy, oil and gas) Status by KSE – wait

Czech natural gas transmission system operator Net4Gas (N4G) has decided to start arbitration proceedings against a major Russian gas supplier over missed payments

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – leave

Poland’s PKN Orlen ends final Russian oil contract without penalties

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

Russia’s Sibur exports LPG to Africa, Middle East and Asia as EU cuts buying

*UEFA (Switzerland, Sport) Status by KSE – leave

UEFA chief says ‘very hard’ to lift Russia ban until war ends

https://www.aljazeera.com/sports/2023/4/5/uefa-ceferin-hard-to-lift-russia-ban-ukraine-war

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

At the height of the war: Rockwool advertised the insulation of the headquarters of the Russian Navy

*Microsoft (USA, IT) Status by KSE – wait

Settlement Agreement between the U.S. Department of the Treasury’s Office of Foreign Assets Control and Microsoft Corporation

https://ofac.treasury.gov/recent-actions/20230406

*Schlumberger (USA, Energy, oil and gas) Status by KSE – stay

As oilfield service companies left Russia after Ukraine invasion, Houston’s SLB stayed – and profited

*Fortum (Finland, Energy, oil and gas) Status by KSE – wait

Fortum Oyj : Russian joint venture has participated in a local wind auction – will not invest in Russia

*Softline International (Great Britain, IT) Status by KSE – leave

The Softline group of companies, which remained in Russia after the separation from the global business, is 100% under the control of ZPIF, which is under the control of the Tethys Capital management company.

06.04.2023

*Hyundai (South Korea, Automotive) Status by KSE – leave

*Volkswagen (Germany, Automotive) Status by KSE – leave

Transactions on the sale of Russian assets of Hyundai and Volkswagen are close to completion and are included in the agenda of the upcoming meetings of the Law Commission on Foreign Investments

https://www.kommersant.ru/doc/5915063

*Adobe (USA, Online Services) Status by KSE – wait

A number of Russian software suppliers continue to sell licenses for the extension of corporate Adobe subscriptions. Softline explained to Kommersant that this is happening by agreement with the vendor.

https://www.kommersant.ru/amp/5914374

*L’Oreal (France, Consumer goods and clothing) Status by KSE – stay

The French L’Oreal, which announced an hour ago about the termination of direct sales in the Russian Federation, was able to earn more than 60 billion rubles on the Russian market by the end of 2022 – almost the same amount as before the start of military operations in Ukraine

https://www.kommersant.ru/doc/5913619

*Foraco (France, Metals and Mining) Status by KSE – leave

Foraco International exits Russia

https://finance.yahoo.com/news/foraco-international-exits-russia-103100265.html

*Inditex (Spain,Consumer goods and clothing) Status by KSE – leave

Inditex, owner of the Zara clothing chain, has received permission from Russia to sell its business in the country

https://www.ft.com/content/11b7edb5-8d3e-4d82-9249-cd15a80b56bc

More than 200 stores of Inditex, which has left Russia (owns the brands Zara, Bershka, Pull&Bear, Oysho, Stradivarius), will open in May under the names Maag, Dub, Ecru, Vilet.

https://www.kommersant.ru/doc/5914776

*Li Auto Inc. (China, Automotive) Status by KSE – stay

Li Auto quietly begins selling cars in Russia: report

https://technode.com/2023/04/04/li-auto-quietly-begins-selling-cars-in-russia-report/

*Coca-Cola (USA, Food & Beverages) Status by KSE – wait

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – wait

Did Coca-Cola Ever Really Leave Russia?

https://thedeepdive.ca/did-coca-cola-ever-really-leave-russia/

05.04.2023

*Bank of Baroda (India, Finance and payments) Status by KSE – wait

India’s Bank of Baroda (BOB.NS) has stopped clearing payments for Russian oil sold above the price cap set by the West.

*Vontobel (Switzerland, Finance and payments) Status by KSE – leave

Vontobel Terminates Business with Clients Residing in Russia

https://www.finews.com/news/english-news/56662-vontobel-russian-business-clients-hong-kong

*Allianz (Germany, Finance and payments) Status by KSE – wait

*Munich Re Group (Munich Reinsurance Company) (Germany, Insurance) Status by KSE – wait

German insurers Allianz and Munich Re have renewed cover for the damaged Russia-controlled Nord Stream 1 gas pipeline

*Pernod Ricard (France, Food & Beverages) Status by KSE – stay

The Pernod Ricard company, which owns Ireland’s largest Jameson whiskey brand, has resumed supplies to the Russian market. Sales were suspended in March last year after the start of a full-scale war between the Russian Federation and Ukraine.

https://www.epravda.com.ua/news/2023/04/4/698736/

*Cisco Systems Inc (USA, IT) Status by KSE leave

Due to reduced sales, Cisco destroyed spare parts for equipment in the Russian Federation for 1.9 billion rubles.

https://tass.ru/ekonomika/17451425

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

The Austrian group Raiffeisen Bank International, after the scandals related to its active work on the territory of the terrorist country of Russia, said that it is working on the sale of its bank or its separation from the main group.

https://www.unian.ua/economics/finance/u-rayffayzen-bank-vidpovili-shcho-robitimut-z-biznesom-v-rosiji-12199074.html

*Forest Stewardship Council (FSC) (Germany, Certification) Status by KSE – leave

FSC ends Russian certification because ‘safety can’t be guaranteed’

04.04.2023

*Winninc Electronics (China, Electronics) Status by KSE – stay

*AOOK Technology (China, Electronics) Status by KSE – stay

In June 2022, the U.S. Commerce Department placed Shenzhen-based Winninc Electronics on the Entity List. Seven months later, it sanctioned another Shenzhen-based firm, AOOK Technology, as well. As exporters of semiconductors and electronic components, the companies were accused of supporting Russia’s military and defense industrial base.

https://www.thewirechina.com/2023/04/02/the-sanctions-sieve-winninc-aook/

*World Taekwondo (South Korea, Sport) Status by KSE – stay

The World Taekwondo Federation (World Taekwondo) became the first major sports organization that, after the meeting of the IOC Executive Committee, officially sanctioned almost full admission of Russians to its tournaments, including the world championship starting at the end of May.

https://www.kommersant.ru/doc/5913515

*Louis Dreyfus (France, Agriculture) Status by KSE – leave

Louis Dreyfus joins global grain merchants’ exodus from Russia

*China State Construction Engineering (China, Construction & Architecture) Status by KSE – stay

NAZK included in the list of international sponsors of the war

*Sri Lankan Airlines (Sri Lanka, Air transportation) Status by KSE – leave

Sri Lanka will sell the national carrier SriLankan Airlines, it is possible that one of the Russian companies will become the buyer

https://www.vedomosti.ru/economics/news/2023/04/02/969144-shri-lanki

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Putin allowed British Shell to withdraw 95 billion rubles from Russia

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Russia shifts to Dubai benchmark in Indian oil deal

03.04.2023

*Electronic Arts (USA, Gaming) Status by KSE – exited

The legal entity of the American developer and publisher of computer games Electronic Arts (EA) in Russia has been liquidated, according to information in the unified state register of legal entities.

https://tass.ru/ekonomika/17425655

*UPM (Finland, Consumer goods and clothing) Status by KSE – leave

UPM has completed withdrawal of its businesses from Russia by selling all its Russian operations, including the Chudovo plywood mill, to Gungnir Wooden Products Trading.

https://finance.yahoo.com/news/upm-sold-business-operations-russia-060000873.html?guccounter=1

02.04.2023

*FlyDubai (United Arab Emirates, Air transportation) Status by KSE – stay

*Air Arabia (United Arab Emirates, Air transportation) Status by KSE – stay

*Emirates (United Arab Emirates, Air transportation) Status by KSE – stay

Foreign airlines are actively resuming acceptance of Russian Visa and MasterCard cards for ticket payment. So, Air Arabia and Fly Dubai offer to conduct a link operation through the fast payment system (SBP).

01.04.2023

*Wimbledon (Great Britain, Sport) Status by KSE – stay

Wimbledon lifts ban on Russian, Belarusian players that was imposed after invasion of Ukraine

*Toyota (Japan, Automotive) Status by KSE – leave

Japan’s Toyota hands St Petersburg plant over to Russian state

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

Great Wall Motor’s Russia revenue jumps 73% as rivals recede

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

²² A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website