- Kyiv School of Economics

- About the School

- News

- 42nd issue of the regular digest on impact of foreign companies’ exit on RF economy

42nd issue of the regular digest on impact of foreign companies’ exit on RF economy

3 April 2023

We will continue to provide updated information on a bi-weekly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 06.03-02.04.2023.

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 02.04.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 231 (+6 per month)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 507 (+5 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 212 (+15 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 211 (+10 per month)

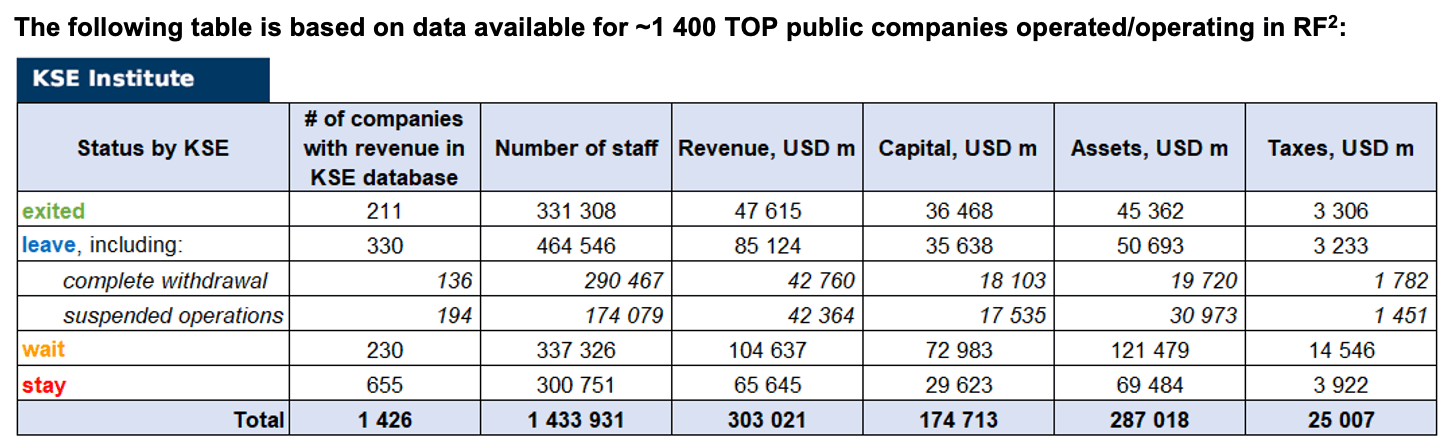

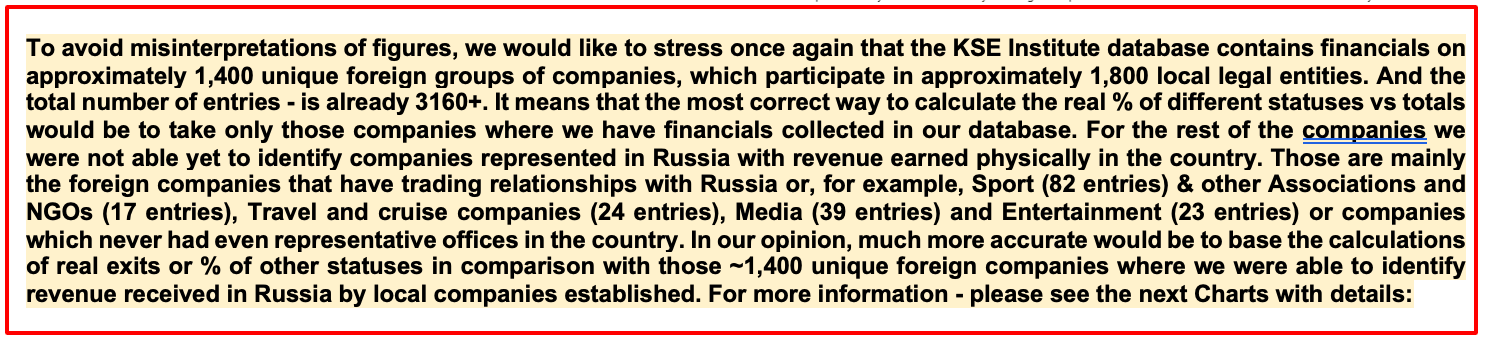

As of April 02, we have identified about 3,161 companies, organizations and their brands from 87 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.7 billion), local revenue (about $304.0 billion), local assets (about $287.0 billion) as well as staff (about 1.434 million people) and taxes paid (about $25.0 billion). 1,719 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 211 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

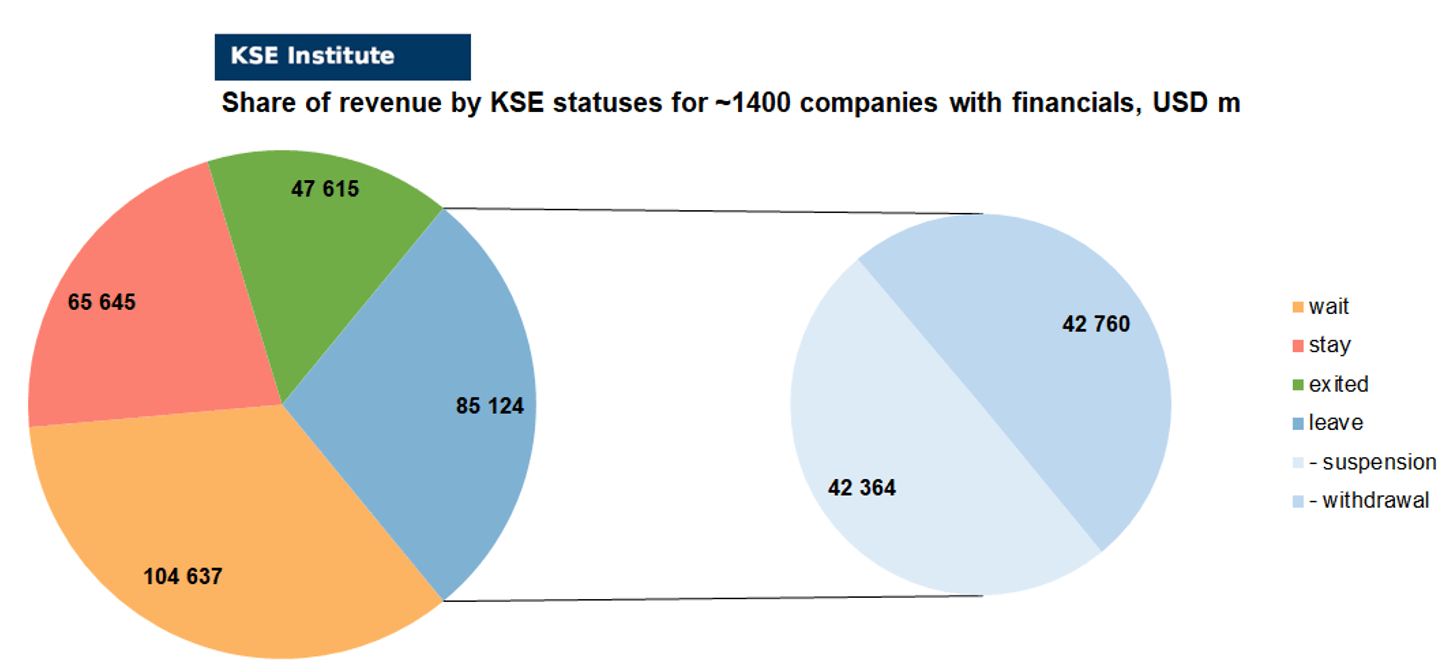

As can be seen from the tables below, as of April 02, 211 companies which had already completely exited from the Russian Federation, had at least 331,300 personnel, $47.6 bn in annual revenue, $36.5bn in capital and $45.4bn in assets; companies, that declared a complete withdrawal from Russia had 290,500 personnel, $42.8bn in revenues, $18.1bn in capital and $19.7bn in assets; companies that suspended operations on the Russian market had 174,100 personnel, annual revenue of $42.4bn, $17.5bn in capital and $31.0bn in assets.

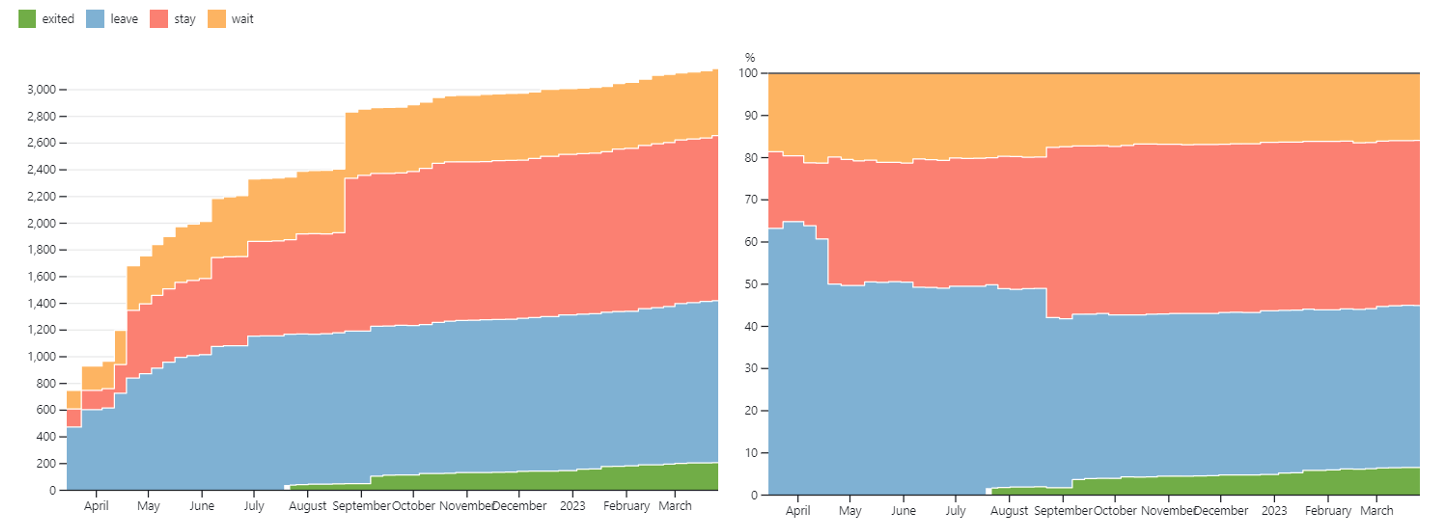

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-April 2022, in the last 7 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 38.3% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 38.9% are still remaining in the country, 16.0% are waiting and only 6.7% made a complete exit³.

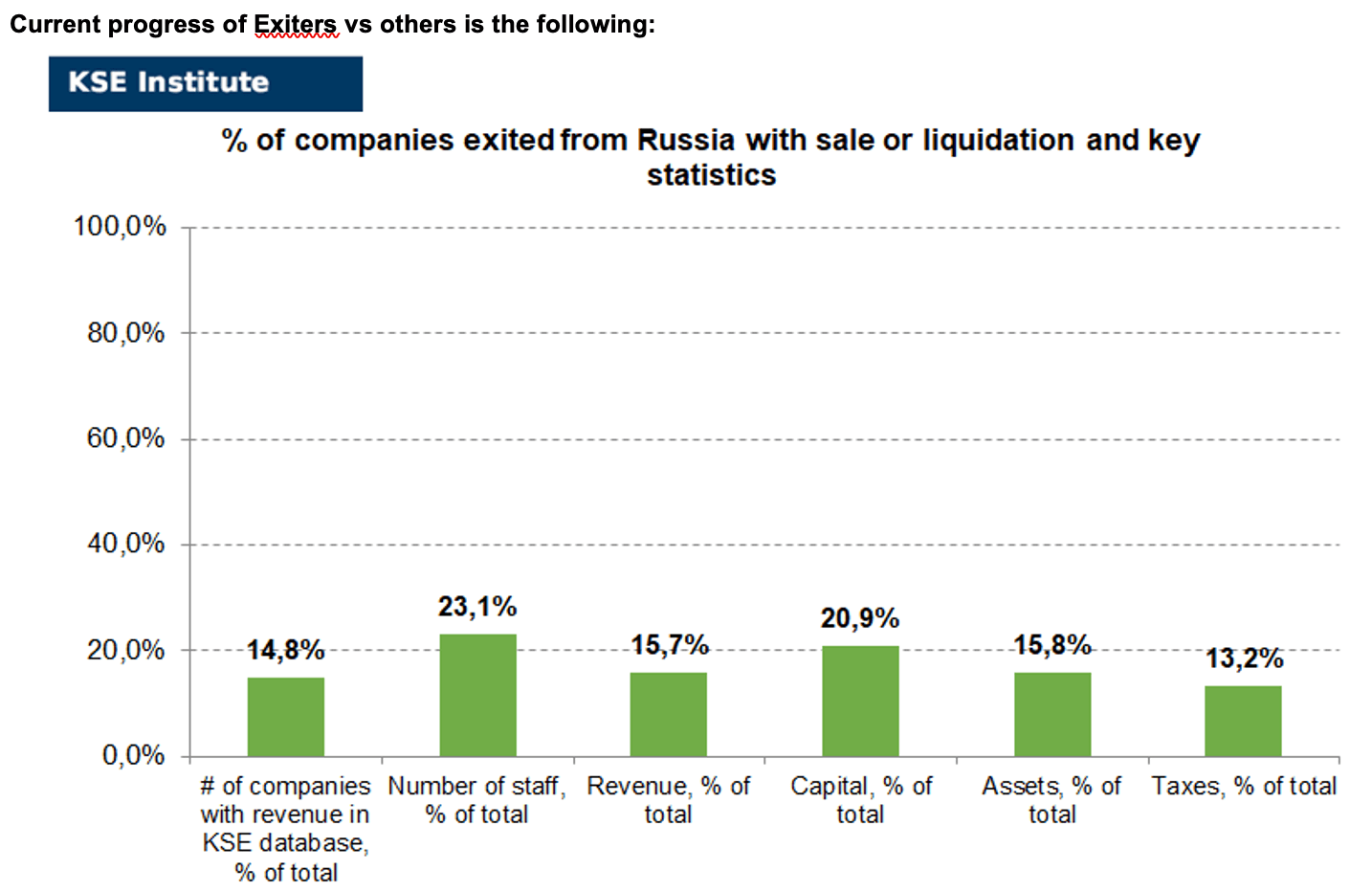

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 211 companies that completely left the country, since they employed 23.1% of the personnel employed in foreign companies, the companies owned about 15.8% of the assets, had 20.9% of capital invested by foreign companies, and in 2021 they generated revenue of $47.6 billion or 15.7% of total revenue and paid $3.3 billion of taxes or 13.2% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

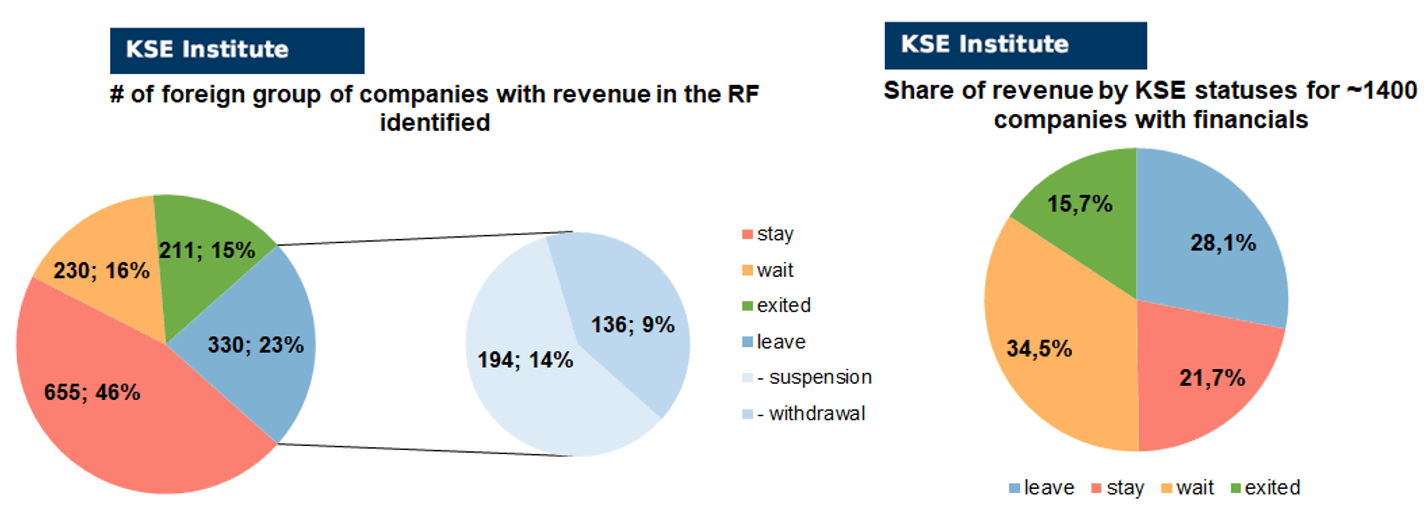

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (15%) and on share of revenue withdrawn (16%). At the same time, a totally different picture is for those who are still staying – 46% of companies represent 22% of revenue and 16% of waiting companies represent 34.5% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

MONTHLY FOCUS: On leaving the Russian Federation. Results of March 2023

In this digest, we will summarize the results of March 2023 and provide year-to-date statistics on full exits since the beginning of the war.

In our project, we pay special attention to companies that have their own legal entities in Russia, pay taxes, hire staff, etc.

We would like to remind you that we assign the status of “exited” exclusively based on the results of changes in the composition of company owners in the Russian Federation reflected in the official register, or when the closing of the transaction was notified in another official way (for example, in press releases or during the disclosure of information on the Stock Exchange by public companies).

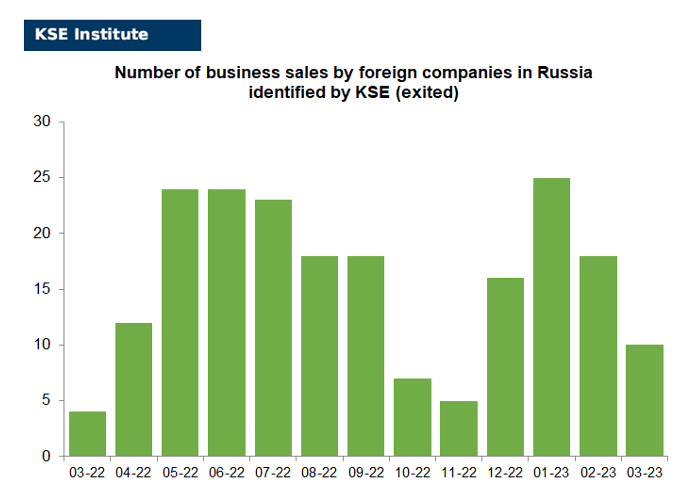

There are about 1.4 thousand companies identified in the KSE database with revenue data available of more than $300 billion. And at least 211 (about 15%) of them have already been sold by local companies or were liquidated and left the Russian market. In March 2023 KSE Institute identified +10 new exits, total number of exits⁴ observed since the beginning of Russia’s invasion reached 210+.

On the chart below, share of exited and other statuses based on revenue allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit Russia in full).

% of exited is 16% based on revenue allocation, those who are leaving represent 28% of total revenue (with 50% share of suspensions and 50% of withdrawals sub-statuses), % of staying companies represent 22% of revenue and 34% are waiting companies based on revenue generated in Russia in 2021.

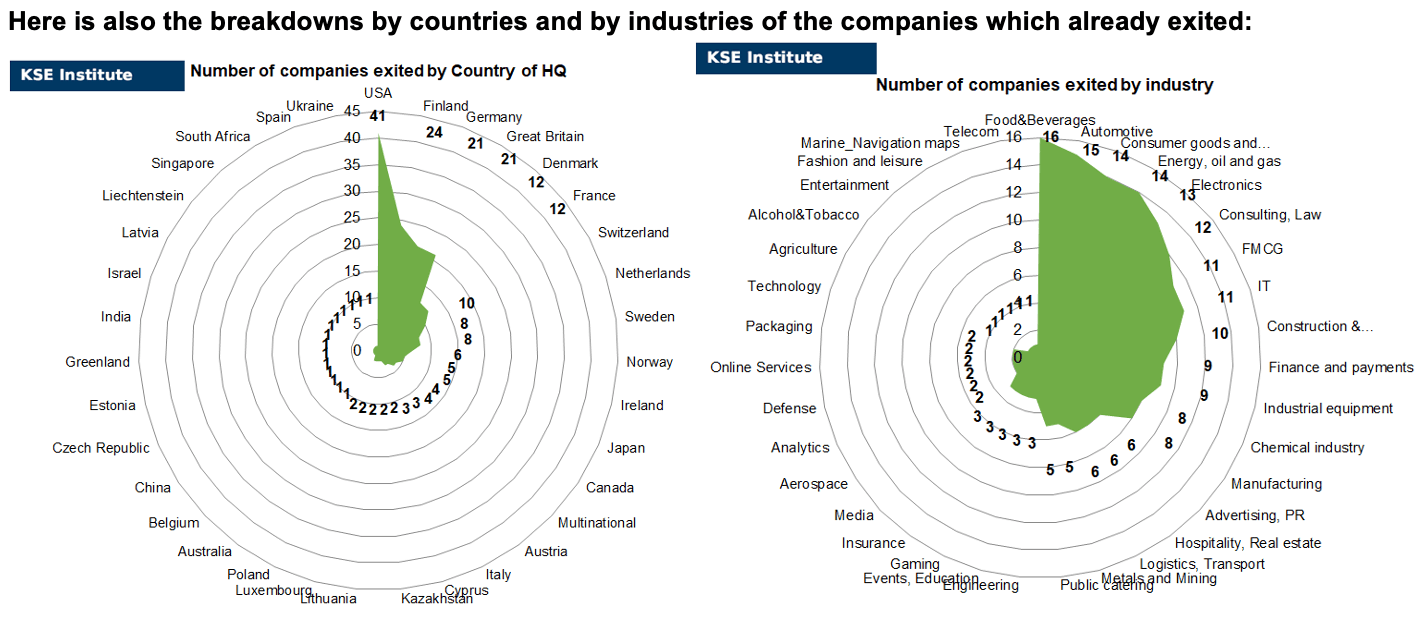

So, as of the end of March 2023, companies from 34 countries and 35 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, and Great Britain and operated in the “Food & Beverage”, “Automotive”, “Consumer goods and closing” and “Energy, oil and gas” industries.

Here is the list of “exiters” that we were able to identify recently: Aarsleff, Cargobull Finance Holding, Harvia, Nokian Tyres, Reima, Smurfit Kappa, TotalEnergies, TP-Link, Uber (the government has approved a deal to sell Uber’s stake in a joint venture with Yandex), Wenaasgruppen.

Also, we are not yet in a hurry to assign “exited” status to dozens of companies that are literally on the verge of exit, although have not yet finalized this process.

Here are just some of them: Carlsberg (plans to sell business in Russia by summer), CNH Industrial (sold 2 out of 3 local entities (LLC “EXPOCAPITAL MANAGEMENT” and LLC “CNH INDUSTRIAL FINANCIAL SERVICES RUSSIA”, were renamed after sale) but the plant left (LLC “CNH INDUSTRIAL RUSSIA”) generated ~50% of revenue), Continental (plans to close the Russian business, said the company’s CEO Nikolai Setzer), Henkel (aims to complete sale of Russia business soon), Hyundai (in talks to sell Russia plant to Kazakhstan), John Deere (sold one of the company but has another – the main one – and it has not yet been sold), Kraft Heinz (agreed to sell Russian baby food business), Michelin Tire (found a buyer for a plant in the Moscow region), Porsche (the agreement reached in December 2022 on the sale of Porsche showrooms in Russia to an investor unrelated to the German corporation. The transaction assumes the possibility of repurchase of assets, but not earlier than in five years, and the deadline for repurchase is ten years. At the moment, the deal is being evaluated by the Russian government), Schaeffler (is selling its business in Russia to Austrian businessman Siegfried Wolff, who is a long-time business partner of sanctioned Russian oligarch Oleg Deripaska), Solvay (will sell its stake in Russian vinyl venture).

These examples, like dozens of others, unite the fact that despite the complex procedure for sale of business in Russia and all the formalities required a lot of companies were already able to successfully pass these complex procedures and leave Russia. Moreover, as recently reported by the Financial Times⁵, each Western company (HQ of which is located in so-called “unfriendly country”) that wants to exit the Russian market and sell its assets will now be obliged to transfer a direct contribution to the budget of the aggressor state. Previously, companies leaving Russia could choose between a “voluntary contribution” to Russia’s budget, which amounted to 10% of the sale price, or agree to defer payment from the sale for several years. A person involved in one of the ongoing exit talks said that about 2,000 applications are pending approval. “The Foreign Investment Commission under the Ministry of Finance meets three times a month and considers no more than seven applications in one meeting – you can count,” said the interlocutor. The first publicized “voluntary donation” deal was made by the Norwegian company Wenaasgruppen after selling its hotels in Russia to the Russian conglomerate Sistema, controlled by sanctioned oligarch Vladimir Yevtushenkov. In February, Sistema stated that the price of the deal was “up to 203 million euros, including a 10 percent contribution to the budget of the Russian Federation”⁶. At this rate, it will take almost eight years for the commission of the Ministry of Finance to consider already submitted applications, which allows us to conclude that the Russian authorities are deliberately delaying the process of foreign companies exiting the country and have implemented a “manual mode” for further exits, which can be seen from the much slower statistics of new exits in March 2023 compared to previous months.

At the same time, some of the companies, even after sale of their local entities in Russia, prefer to keep trading relations with the aggressor country. As we reported in the previous digest, based on customs data Otis Worldwide continued to supply equipment after sale of the Otis business in Russia. Also, the Singapore branch of Baker Hughes in January 2023 supplied spare parts for drilling equipment to former Russian subsidiaries. The Scottish Government has threatened to stop funding Baker Hughes over these breaches. Also, our colleagues from B4Ukraine Coalition, the project https://squeezingputin.com/ analyzed some continuous trade relations of the foreign companies in Russia. In addition to Otis Worldwide and Baker Hughes a few more cases were analyzed in detail, namely: AUMA Riester GmbH, Yokohama, Procter & Gamble, Reckitt Benckiser Group, Guess etc. Full information and charts are available here: https://squeezingputin.com/support.html.

Also, we updated dashboards on the changes in revenue of parent companies by KSE status for 4q2022 vs 3q2022 and as you can see, companies which already exited (+7%) from Russia and those which announced withdrawal or suspended activity (KSE status “leave”, +6%) were able to increase their revenue much faster than those who still staying (+2.5%) or waiting (+2.3%).

For more information – please visit https://leave-russia.org/revenue.

The next review of deals for April 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis)⁷

31.03.2023

*Kraft Heinz (USA, Food & Beverages) Status by KSE – leave

Kraft Heinz Agrees to Sell Russian Baby Food Business

30.03.2023

*Windar Renovables (Spain, Electronics) Status by KSE – wait

Spanish firm Windar Renovables is exploring selling its 51% stake in its Russian joint venture to partner and steelmaker Severstal

*Indian Oil Corporation (India, Energy, oil and gas) Status by KSE – stay

Russia’s largest oil producer Rosneft and India’s top refiner Indian Oil Corp have signed a term agreement to substantially increase oil supplies and diversify oil grades delivered to India

*Viterra (Netherlands,Agriculture) Status by KSE – wait

Glencore-backed Viterra is planning to exit the Russian export market and intends to announce the decision soon, according to people familiar with the matter.

*Novo Nordisk (Denmark, Pharma, Healthcare) Status by KSE – wait

Novo Nordisk to stop supplies of diabetes drug Ozempic to Russia this year

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen Bank decided to sell the Russian “daughter” or withdraw it from the perimeter of the group

29.03.2023

*Aarsleff (Denmark, Construction & Architecture) Status by KSE – exited

After almost a year-long process, Aarsleff has now obtained all the required approvals in both Denmark and Russia, and the sale of Aarsleff’s Russian business has now been completed.

*Cargill (USA, Food & Beverages) Status by KSE – wait

The Russian “subsidiary” of the American corporation Cargill will stop exporting grain from Russia in the next agricultural year.

https://www.rbc.ru/business/29/03/2023/642347359a79478fddf671fa

28.03.2023

*Eli Lilly (USA, Pharma, Healthcare) Status by KSE – wait

*Swixx BioPharma (Switzerland, Pharma, Healthcare) Status by KSE – stay

The American pharmaceutical company Eli Lilly has decided to leave Russia and transfer its business to its partner in Central and Eastern Europe — the Swiss-registered distributor Swixx Biopharma.

The company will hand over business in the country to Swixx BioPharma. Through it, Eli Lilly will continue to supply drugs to Russia.

https://www.rbc.ru/business/28/03/2023/6422866c9a794735ed7e79fd

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

IKEA completes sale of Russian factory to local firm

https://www.reuters.com/markets/deals/russian-firm-says-it-closes-deal-buy-ikea-factory-2023-03-27/

*Wenaasgruppen (Norway, Hospitality, Real estate) Status by KSE – leave

The first publicized “voluntary donation” deal was made by the Norwegian company Wenaas after selling its hotels in Russia to the Russian conglomerate Sistema

27.03.2023

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citibank cannot sell due to problems with the IT system

25.03.2023

*Clearstream (Luxembourg, Finance and payments) Status by KSE – leave

Clearstream wrote off the debts of NSD in the amount of EUR 134 million

*OOCL Logistics (China, Logistics, Transport) Status by KSE – leave

China’s largest logistics company has stopped shipments to Russia

*UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

UniCredit Bank, a subsidiary bank of the Italian group UniCredit, in 2022 increased its net profit according to the RAS by 4 times, to 56.5 billion rubles, according to the reporting of the credit organization.

24.03.2023

*Leroy Merlin (France, FMCG) Status by KSE – leave

French DIY retailer Leroy Merlin, which employs 45,000 people in Russia, intends to hand over ownership of operations in the country to local management, its parent company ADEO

*World Athletics Council (Sweden, Sport) Status by KSE – leave

World Athletics upholds ban on Russian athletes ahead of Paris Olympics

https://www.ft.com/content/5ba2e913-7fec-41f8-8376-ce0ba0e7d66a

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – exited

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

*Gunvor Group (Switzerland, Energy, oil and gas) Status by KSE – wait

Big Oil Traders Stay Circumspect on Reviving Russia Dealings

*International Ice Hockey Federation (Switzerland, Sport) Status by KSE – leave

The International Ice Hockey Federation (IIHF) Council has banned Russian and Belarus from competition for the 2023-24 championship season.

*Canara Bank (India, Finance and payments) Status by KSE – exited

*State Bank of India (SBI) (India, Finance and payments) Status by KSE – stay

Canara Bank sells stake in Russian joint venture to SBI for Rs 121 crore

23.03.2023

*Supercell (Finland, Gaming) Status by KSE – leave

Supercell to block access to all its games for Russian and Belarusian players this spring

https://gameworldobserver.com/2023/03/22/supercell-block-access-to-games-russia-belarus-spring-2023

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

IOC’s Bach defends Russia stance amid pro-Ukraine protest

https://www.arabnews.com/node/2273961/sport

*Hongqi (China, Automotive) Status by KSE – stay

The former Mercedes-Benz plant in the Moscow region will start producing cars of the Chinese luxury brand Hongqi (“Hongqi”), which originally produced cars for the political elite of China

22.03.2023

*Bellatrix Energy Ltd. (China, Energy, oil and gas) Status by KSE – stay

*QR Trading DMCC (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

*Coral Energy DMCC (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

*Concept Oil Services (China, Energy, oil and gas) Status by KSE – stay

*Tejarinaft FZCO (United Arab Emirates, Energy, oil and gas) Status by KSE – stay

New Kings of Russian Oil Were These Six Traders in December

*Nokia (Finland, IT) Status by KSE – leave

Tele2 Russia withdraws case against Nokia

*Nord Axis Limited (China, Energy, oil and gas) Status by KSE – stay

New Kings of Russian Oil Were These Six Traders in December

21.03.2023

*Samsung Pay (South Korea, Finance and payments) Status by KSE – stay

Private masters and small service centers began to provide services for changing the region code embedded in the Samsung phone.

https://www.kommersant.ru/doc/5887472

*Smurfit Kappa (Ireland, Packaging) Status by KSE – exited

Smurfit Kappa completes exit from Russia, selling to local managers

20.03.2023

*Volkswagen (Germany, Automotive) Status by KSE – wait

*Skoda (Czech, RepublicAutomotive) Status by KSE – wait

*Porsche (Germany, Automotive) Status by KSE – leave

“There is no chance of resuming machine production in Russia.” How VW will leave

https://www.autonews.ru/news/64136b289a794728f6173c08

The court seized VW’s assets in the Russian Federation as part of the security for GAZ’s lawsuit against the concern

https://www.interfax.ru/russia/891872

*Yves Rocher (France, Consumer goods and clothing) Status by KSE – stay

Yves Rocher has been placed on the sponsors of war list by the National Agency on Corruption Prevention (NACP).

https://sanctions.nazk.gov.ua/en/boycott/22/

*AUMA Riester GmbH (Germany, Manufacturing) Status by KSE – wait

AUMA statement on business with Russia

https://www.auma.com/en/company/auma-statement-on-business-with-russia/

*Success Aviation Services FZC (Success Aviation) (United Arab Emirates, Air transportation) Status by KSE – stay

*I Jet Global DMCC (iJet) (United Arab Emirates, Air transportation) Status by KSE – stay

Ukraine introduced sanctions against the Iranian drones produces and air transportation companies from UAE

*Shahed Aviation Industries (Iran, Defense) Status by KSE – stay

*Iran Aircraft Manufacturing Industrial Company (HESA) (Iran, Defense) Status by KSE – stay

*Aerospace Industries Organization (Iran Aviation Industries Organization) (Iran, Defense) Status by KSE – stay

*Safiran Airport Services (Iran, Aircraft industry) Status by KSE – stay

Assad, the manufacturer of “Shakhed” and “Kalashnikov”: Zelensky introduced sanctions against 300 people and more than 140 companies

*Coca-Cola HBC AG (Switzerland, Food & Beverages) Status by KSE – wait

Coca-Cola continues To Remain Top Seller in Russia Despite Withdrawal

*UBS (Switzerland, Finance and payments) Status by KSE – wait

The Swiss bank UBS has begun mass inspections of clients of Russian origin.

18.03.2023

*Logicor (Great Britain, Logistics, Transport) Status by KSE – leave

Developer Logicor sold a complex in St. Petersburg

https://www.kommersant.ru/doc/5874153?tg

*Papa John’s (USA, Public catering) Status by KSE – wait

The president of Papa John’s in Russia, Christopher Wynn, after the publication, told Kommersant that the network remains in Russia and continues to work, without changing the format, brand or logo, in compliance with international standards

https://www.kommersant.ru/doc/5874182?from=top_main_3

*Ekaterra (Netherlands, Food & Beverages) Status by KSE – leave

The application of “United Tea Company” LLC for preliminary consent to the purchase of production facilities and intangible assets of “Ekaterra” LLC was received by the Federal Antimonopoly Service.

*Nasdaq (USA, Finance and payments) Status by KSE – leave

NASDAQ intends to delist the shares of Yandex, Ozon, Qiwi and HeadHunter

https://www.kommersant.ru/doc/5875625

*OneWeb (Great Britain, IT) Status by KSE leave

OneWeb to launch internet service in Asia; abandons Russian-held satellites

*Nokian Tyres (Finland, Automotive) Status by KSE – leave

Nokian Tyres paid for Russian operations sale

https://www.just-auto.com/news/company-news/deal-news/nokian-tyres-paid-for-russian-operations-sale/

*Boeing (USA, Aircraft industry) Status by KSE – leave

Turkey Stops Servicing Russian-Operated Boeing Aircraft

https://simpleflying.com/turkey-stops-servicing-russian-airbus-boeing-aircraft/

16.03.2023

*Konecranes (Finland, Engineering) Status by KSE – wait

KONCRANES begins final delivery of cranes to Russia for a European customer

*Toyota (Japan, Automotive) Status by KSE – wait

Toyota can transfer the factory in St. Petersburg to NAMA

https://rg.ru/2023/03/16/toyota-mozhet-peredat-zavod-v-sankt-peterburge-nami.html

*Glencore (Switzerland, FMCG) Status by KSE – wait

Glencore Won’t Renew Rusal Aluminum Deal as Things Stand

*Volkswagen (Germany, Automotive) Status by KSE – wait

Volkswagen hopes to finalize sales process for Russia plant soon – brand chief

*Intesa Sanpaolo (Italy, Finance and payments) Status by KSE – wait

Intesa’s Russian subsidiary sees huge profit jump in 2022

*Yanmar (Japan, Marine_Engines producers) Status by KSE – leave

Yanmar suspends Russian operations

https://www.construction-europe.com/news/yanmar-suspends-russian-operations/8027460.article

*Skoda (Czech Republic, Automotive) Status by KSE – wait

VW’s Skoda in final stages of deal to sell Russian assets, says CEO

15.03.2023

*Haas Automation (USA, Industrial equipment) Status by KSE – stay

Haas Automation accused of violating sanctions, doing business with the Russian arms industry.

*Buzzi Unicem (Italy, Construction & Architecture) Status by KSE – leave

Buzzi Unicem rejects the latest accusations against its reputation

*Carlsberg Group (Denmark, Alcohol & Tobacco) Status by KSE – wait ; Anadolu Efes (Turkey, Alcohol & Tobacco) Status by KSE – stay

Carlsberg denies report it sold Russian breweries to Turkey’s Anadolu

14.03.2023

*JOMA (Spain, Consumer goods and clothing) Status by KSE – leave

Joma insists it has no sponsorship deals with Russian clubs after Zenit controversy

https://www.insidethegames.biz/articles/1134641/joma-insists-no-deals-russia-belarus

*Auchan ( France, FMCG) Status by KSE – stay

Auchan denies opening new store in Russia, says rebranding existing one

*Continental (Germany, Automotive) Status by KSE – leave

Armen Sargsyan’s S8 Capital wants to acquire the assets of German Continental in Russia, including the tire production plant in Kaluga.

https://www.kommersant.ru/doc/5873584?tg

*Nokian Tyres (Finland,Automotive) Status by KSE – leave

The government allowed Tatneft to buy the Finnish tire manufacturer Nokian Tires

13.03.2023

*Wenaasgruppen (Norway, Hospitality, Real estate) Status by KSE – leave

Sistema Group completes acquisition of hotel business from Wenaas Hotel Russia

*Texas Instruments (USA, Electronics) Status by KSE – leave

*Microchip Technology (USA, IT) Status by KSE – leave

*NXP USA, Inc. (USA, Electronics) Status by KSE – leave

*Analog Devices (USA, Electronics) Status by KSE – leave

*Linear Technology (USA, IT) Status by KSE – leave

*Traco Power (Switzerland, Electronics) Status by KSE – leave

*HALO Electronics (USA, Electronics) Status by KSE – leave

Western-made components found in weapons used in Russia’s suspected Ukraine war crimes, new investigation reveals

*Schaeffler (Germany, Industrial equipment) Status by KSE – leave

Schaeffler sells business in the Russian Federation to an Austrian businessman

*Wimbledon (Great Britain, Sport) Status by KSE – stay

Wimbledon cave in to pressure and LIFT ban on Russian players for this year’s Championships – but stars will be kicked out if they show any support for Vladimir Putin’s country and will compete under neutral flag

*Inditex (Spain, Consumer goods and clothing) Status by KSE – wait

Foreign clothing brands Bershka, Zara and Pull&Bear are returning to Russia with their products. On the territory of the Russian Federation, they will work under new names – Ecru, Maag and DUB.

https://trueua.info/news/brendi-odyagu—ta–povertayutsya-v-rosiyu

*International Fencing Federation (Switzerland, Sport) Status by KSE – stay

FIE approves return of Russian and Belarusian fencers in time for start of Paris 2024 qualifying

https://www.insidethegames.biz/articles/1134597/fie-russia-decision-return

*AVIC International Holding Corp. (China, Defense) Status by KSE – stay

*Poly Technologies (China, Defense) Status by KSE – stay

China and Russia have deep defense sector ties

*Beam Suntory (USA, Alcohol&Tobacco) Status by KSE – leave

*Edrington (Great Britain, Alcohol&Tobacco) Status by KSE – leave

Importers of alcohol from the Russian Federation crowded out global ones

https://www.kommersant.ru/doc/5863781

*Buzzi Unicem (Italy, Construction & Architecture) Status by KSE – stay

Italian cement maker Buzzi denies sponsoring Russia’s war in Ukraine

*Philips (Netherlands, Electronics) Status by KSE – wait

The Philips company organizes scientific, practical and educational initiatives

https://www.philips.ru/healthcare/education-resources/education-training

10.03.2023

*Harvia (Finland, Electronics) Status by KSE – exited

Harvia closes divestment of its ownership in EOS Group’s Russian operations

https://finance.yahoo.com/news/harvia-closes-divestment-ownership-eos-120000466.html

*Kverneland Group (Norway, Agriculture) Status by KSE – stay

The plow manufacturer Kverneland in Oksnavada will resume plow exports to Russia.

https://www.jbl.no/kverneland-gjenopptar-eksport-til-russland/s/5-103-878951

*Solvay (Belgium, Chemical industry) Status by KSE – leave

Solvay will sell its stake in Russian vinyl venture

*Auchan (France, FMCG) Status by KSE – stay

French retailer Auchan plans to open a new store in Russia selling almost exclusively private label products, doubling down on its presence in a market that many other Western retailers have shunned over Russia’s actions in Ukraine.

*Hyundai (South Korea, Automotive) Status by KSE – wait

Hyundai reviewing Russia plant after reports of Kazakhstan sale

09.03.2023

*Ovoca Bio (Ireland, Pharma, Healthcare) Status by KSE – leave

Ovoca Bio jumps on EUR1.1 million sale of Russian assets

*Taiyo Oil (Japan, Energy, oil and gas) Status by KSE – stay

Japan returned to importing crude oil from Russia in January

*John Deere (USA, Automotive) Status by KSE – leave

Russia-based Insight Group acquires Deere & Co leasing arm

*Swarovski (Austria, Luxury)Status by KSE – leave

Things are currently at a standstill – Swarovski: complete withdrawal from Russia

https://todaytimeslive.com/economy/236176.html

*Commerzbank (Germany, Finance and payments) Status by KSE – leave

The German Commerzbank, which is the second largest in Germany, stopped making payments to Russia.

https://ghall.com.ua/2023/03/09/vtoroj-po-velichine-bank-germanii-prekratil-provodit-platezhi-v-rf/

08.03.2023

*Gasunie (Netherlands, Energy, oil and gas) Status by KSE – leave

The Dutch natural gas grid operator Gasunie said on Wednesday it has written off its 9% stake in the Nord Stream gas pipeline that was badly damaged in September 2022.

*Continental (Germany, Automotive) Status by KSE – leave

Continental predicts higher margins, selling Russia operations

*Yanmar (Japan, Marine_Engines producers) Status by KSE – leave

Yanmar Group Suspends All Business Operations in Russia

https://www.yanmar.com/eu/news/2023/03/08/121416.html

*Michelin (France, Food & Beverages) Status by KSE – leave

The deal for the sale of Michelin’s Russian assets is close to completion, the buyer is the distributor of tires of this and other brands Power International Tires LLC

https://www.kommersant.ru/doc/5862770

https://www.european-rubber-journal.com/article/2093021/michelin-still-working-on-exit-from-russia

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – leave

Heineken blames Russia exit delay on local paperwork

https://www.reuters.com/markets/europe/heineken-blames-russia-exit-delay-local-paperwork-2023-03-07/

*Henkel (Germany, Chemical industry) Status by KSE – leave

Germany’s Henkel promised to stop operations in Russia by the end of the first quarter.

07.03.2023

*PKN Orlen SA (Poland, Energy, oil and gas) Status by KSE – wait

Polish state energy firm Orlen has announced that it will take legal action over the recent suspension of oil supplies from Russia to Poland via the Druzhba pipeline

*JPMorgan (USA, Finance and payments) Status by KSE – wait

Dimon Says Ukraine War, China Relations Are His Top Concerns

*UnionPay (China, Finance and payments) Status by KSE – wait

The Chinese payment system UnionPay has removed from its Russian-language website information about issuing its cards in Russian banks, which have recently been sanctioned by the United States and Great Britain.

06.03.2023

*Eastnine AB (Sweden, Hospitality, Real estate) Status by KSE – leave

The contract for the sale of Eastnine’s share in Sistema PATFC MFG has been terminated. Eastnine will continue to look for an exit from its investment and is in dialogue with potential buyers.

https://www.eastnine.com/en/press/agreement-regarding-sale-holding-mfg-terminated-2100417

05.03.2023

*VORAGO (USA, Electronics) Status by KSE – stay

Washington called on American business to ensure compliance with sanctions against Russia. The Ministry of Justice, the Department of Commerce and the Department of the Treasury of the United States published a joint statement in which they warned of legal prosecution for those who will not comply with the restrictions.

https://home.treasury.gov/system/files/126/20230302_compliance_note.pdf

*Wimbledon (Great Britain, Sport) Status by KSE leave

Wimbledon to scrap Russia player ban

https://www.france24.com/en/live-news/20230303-wimbledon-to-scrap-russia-player-ban-reports

04.03.2023

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell completes withdrawal from Salym project in Russia

*Google (USA, Online Services) Status by KSE – wait

Google has removed over 7,000 YouTube channels with links to ..

*JOMA (Spain, Consumer goods and clothing) Status by KSE – stay

UAF appealed to Joma regarding the company’s cooperation with Russian Zenit

03.03.2023

*SuperJet International (Italy, Aerospace) Status by KSE – leave

Russia’s UAC to divest stake in SuperJet International JV

*AerCap (Ireland, Air transportation) Status by KSE – leave

Russian losses leave AerCap with €685m deficit

https://www.irishtimes.com/business/2023/03/02/russian-losses-leave-aercap-with-685m-deficit/

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

In Russia, Raiffeisen Bank suspended the opening of accounts for new legal entities

*Auchan (France, FMCG) Status by KSE – stay

Why Auchan’s management is lying about aid to Russian military

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ It needs to be mentioned that open access to Russia’s EGRUL register was classified recently, so KSE Institute could miss some of the exits but we are currently working under the new solution allowing us to get the proper access to the registers in the future.

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website