- Kyiv School of Economics

- About the School

- News

- 41st issue of the regular digest on impact of foreign companies’ exit on RF economy

41st issue of the regular digest on impact of foreign companies’ exit on RF economy

6 March 2023

Starting with this digest we will continue to provide updated information on a monthly basis.

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 13.02-05.03.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, the University of St.Gallen latest Paper, epravda.com.ua, squeezingputin.com, https://bloody.energy/ and leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains much more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute and Leave Russia project are the part of B4Ukraine Coalition since mid-2022.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we became partners with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia just by scanning barcodes.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

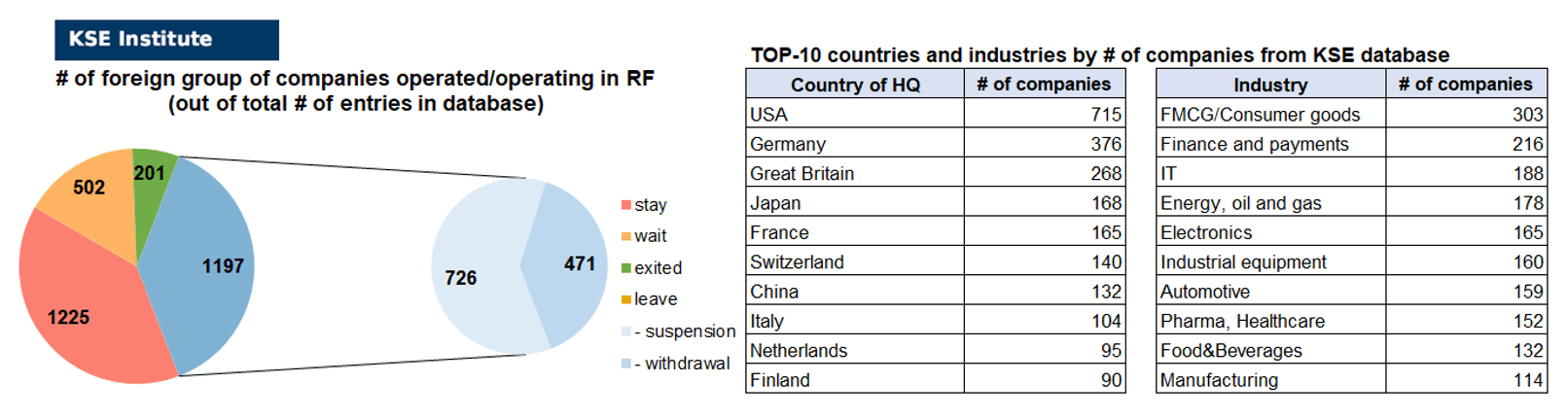

KSE DATABASE SNAPSHOT as of 05.03.2023

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 225 (+2 per month)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 502 (+8 per month)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 197 (+39 per month)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 201 (+18 per month)

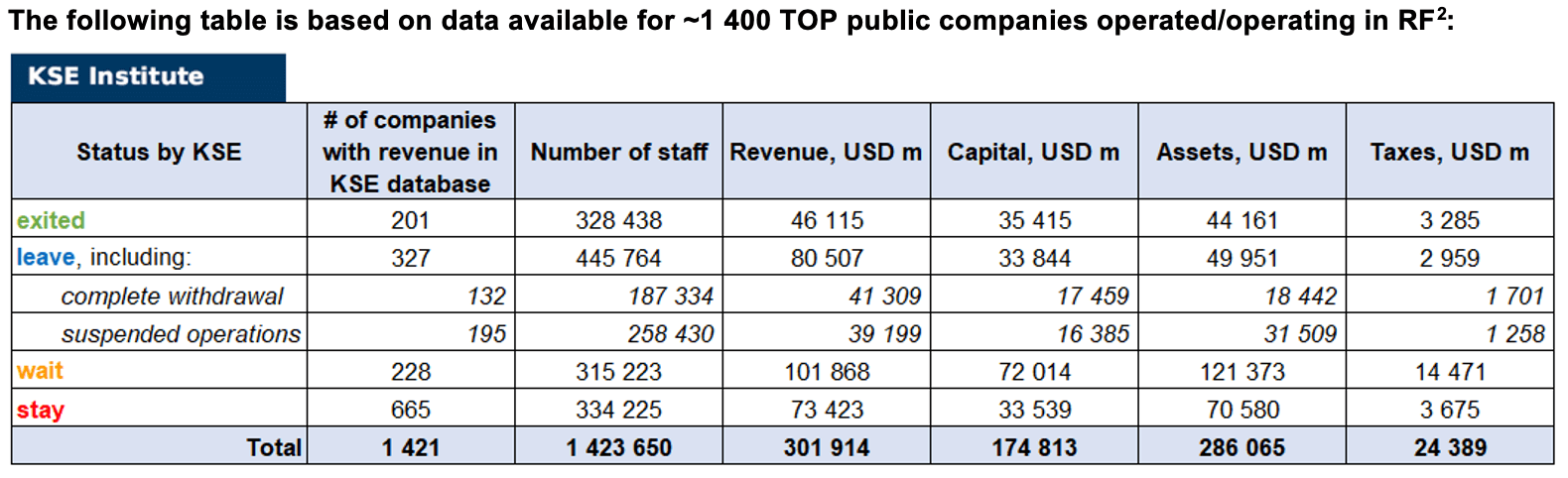

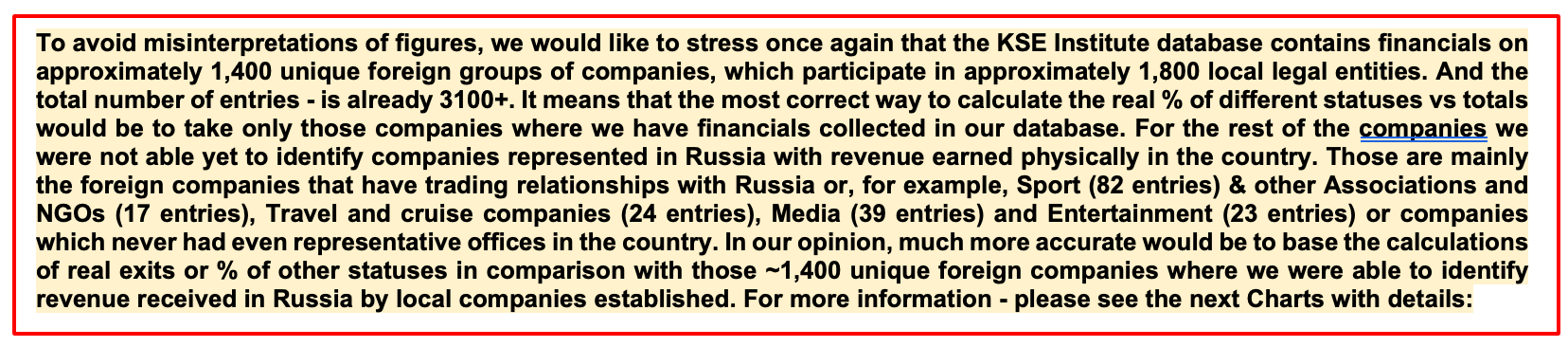

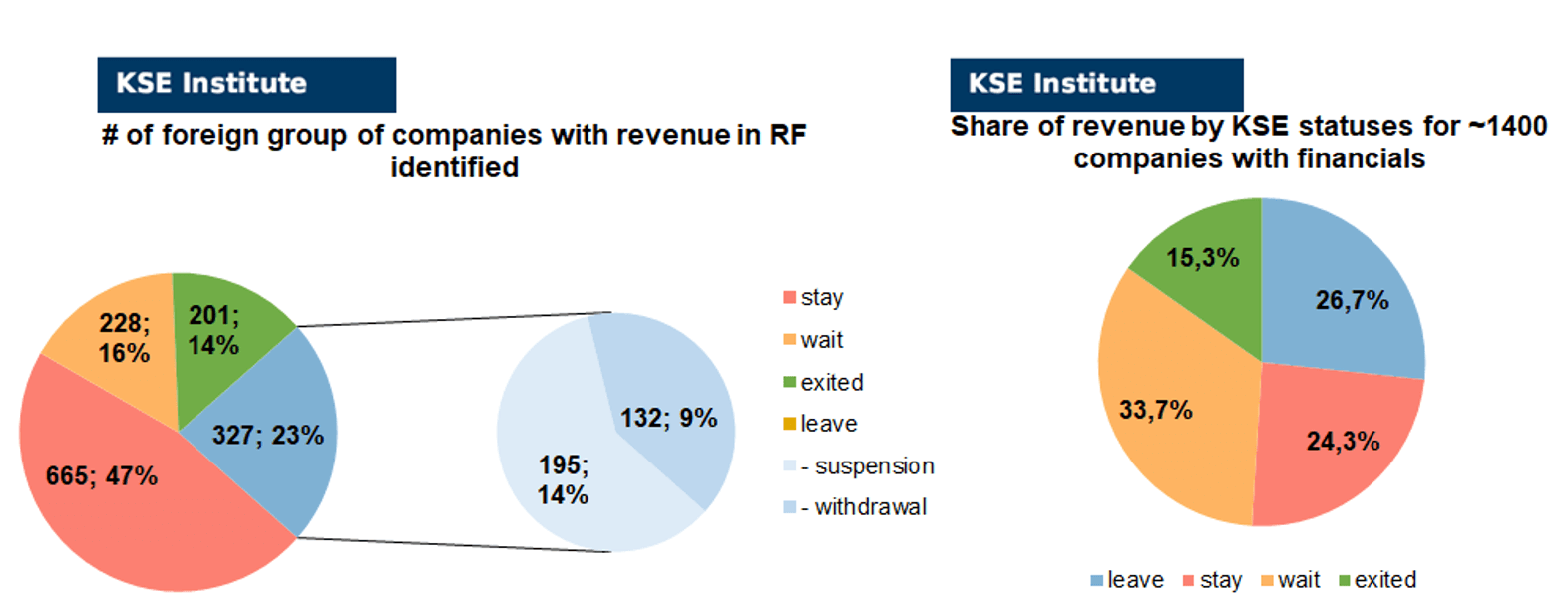

As of March 05, we have identified about 3,125 companies, organizations and their brands from 87 countries and 57 industries and analyzed their position on the Russian market. About 40% of them are public ones, for ~1 400 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity and revenue received) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $174.8 billion), local revenue (about $301.9 billion), local assets (about $286.1 billion) as well as staff (about 1.424 million people) and taxes paid (about $24.4 billion). 1,699 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 201 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

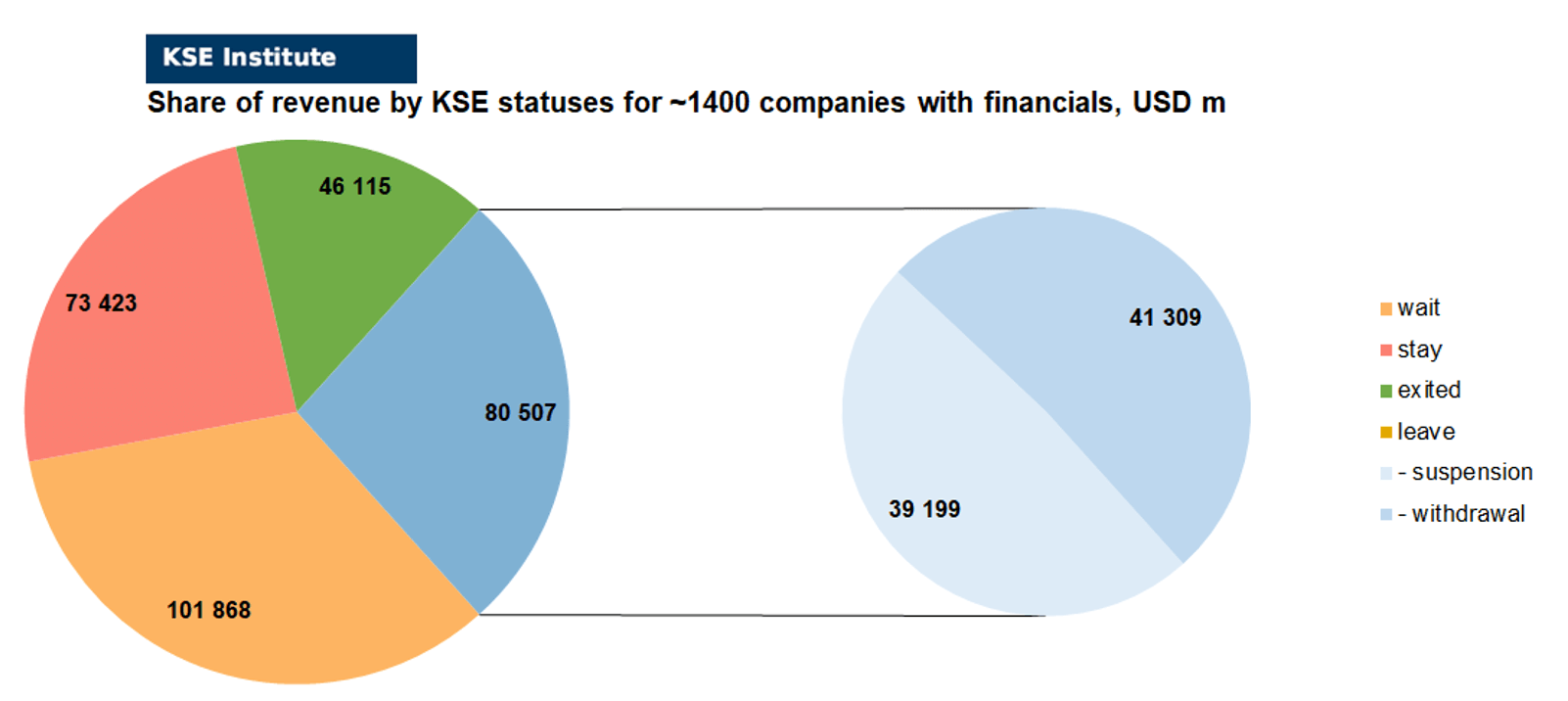

As can be seen from the tables below, as of March 05, 201 companies which had already completely exited from the Russian Federation, had at least 328,400 personnel, $46.1 bn in annual revenue, $35.4bn in capital and $44.2bn in assets; companies, that declared a complete withdrawal from Russia had 187,300 personnel, $41.3bn in revenues, $17.5bn in capital and $18.4bn in assets; companies that suspended operations on the Russian market had 258,000 personnel, annual revenue of $39.2bn, $16.4bn in capital and $31.5bn in assets.

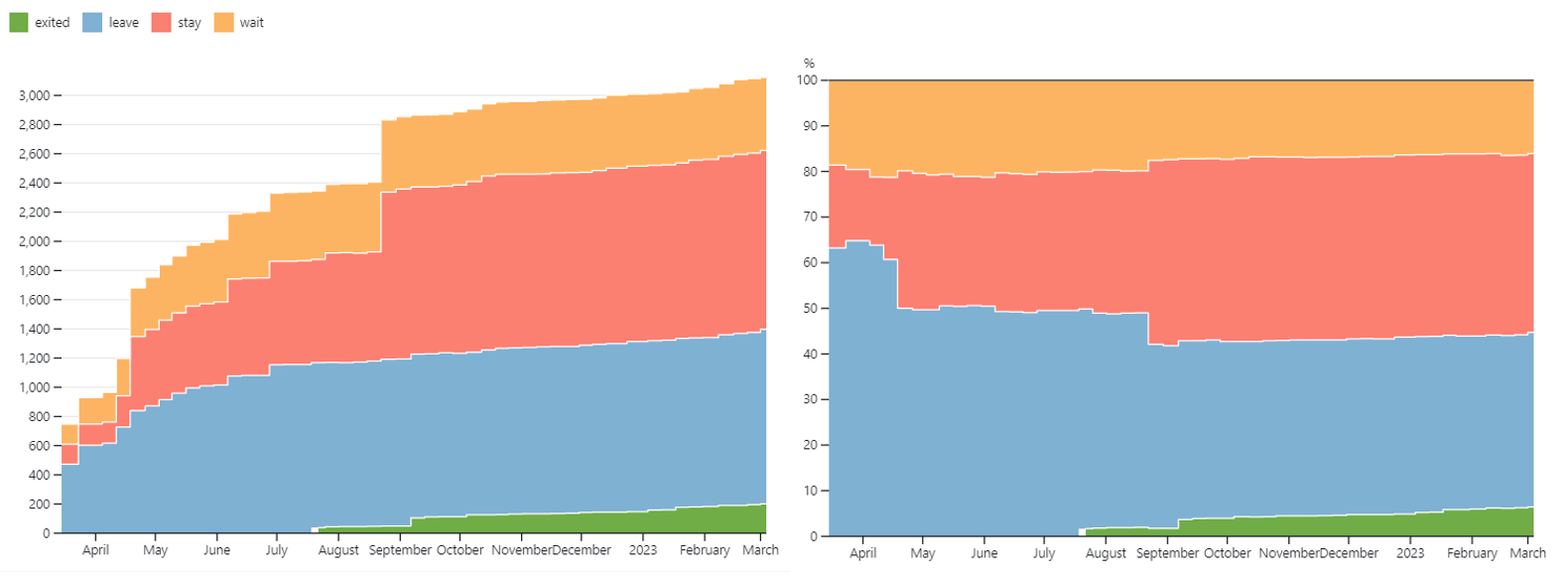

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 6 months the ratio of those who leave or stay is virtually unchanged, although we still see a periodic increase in the share of those companies that remain in the Russian market (by adding new companies to the database). However, if to operate with the total numbers in KSE database, about 38.3% of foreign companies have already announced their withdrawal from the Russian market or suspended their activity, but another 39.2% are still remaining in the country, 16.1% are waiting and only 6.4% made a complete exit³.

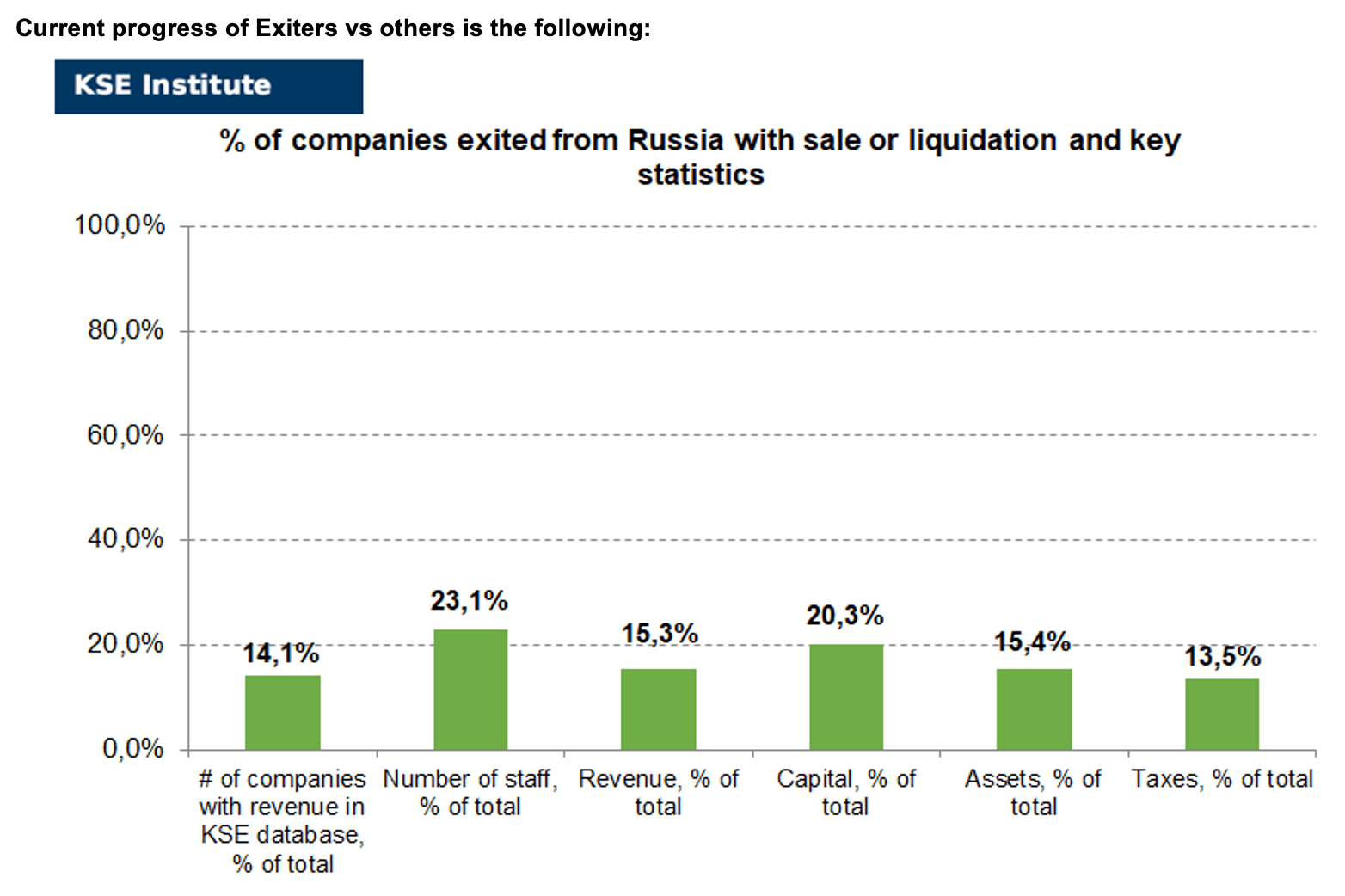

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 201 companies that completely left the country, since they employed 23.1% of the personnel employed in foreign companies, the companies owned about 15.4% of the assets, had 20.3% of capital invested by foreign companies, and in 2021 they generated revenue of $46.1 billion or 15.3% of total revenue and paid $3.3 billion of taxes or 13.5% of total taxes paid by the companies observed. Data on 1,400 TOP companies is presented in the table above.

As it is visible on the charts above, roughly similar % of exited is obtained based on number of companies (14%) and on share of revenue withdrawn (15%). At the same time, a totally different picture is for those who are still staying – 47% of companies represent 24% of revenue and 16% of waiting companies represent 34% of revenue generated in Russia. The conclusion could be that smaller companies with lower revenue prefer to stay and those who have higher revenue are more eager to wait, limiting their investments as an excuse (at the same time they continue to earn and reinvest their local profit).

More infographics and analytics see in the special section of our website at the link https://leave-russia.org/bi-analytics

MONTHLY FOCUS: On leaving the Russian Federation. Results of February 2023

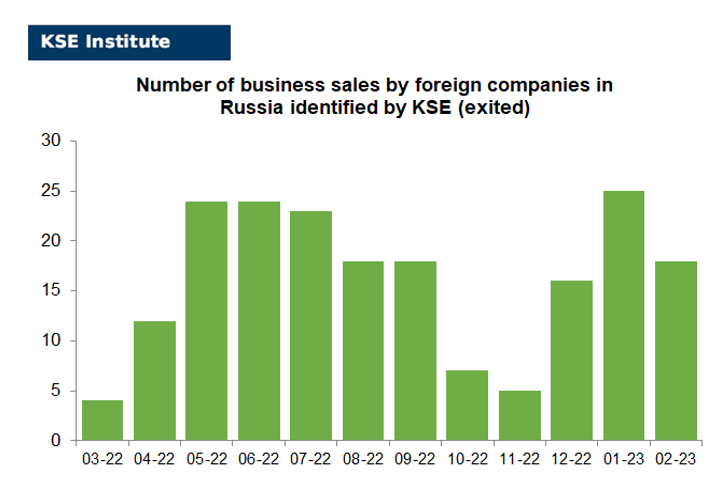

There are about 1.4 thousand companies identified in the KSE database with revenue data available of more than $300 billion. And at least 201 (more than 15%) of them have already been sold by local companies or were liquidated and left the Russian market. In February 2023 KSE Institute identified +18 new exits⁴, total number of exits observed since the beginning of Russia’s invasion reached 200+.

On the chart below, share of exited and other statuses based on revenue allocation is shown. It is worth mentioning when we analyze status “leave” also pay attention to sub-statuses (suspension could be treated as a temporary pause in operations while withdrawal – is a clear sign of the company’s intention to exit

% of exited is 15% based on revenue allocation, those who are leaving represent 27% of total revenue (with 49% share of suspensions and 51% of withdrawals sub-statuses), % of staying companies represent 24% of revenue and 34% are waiting companies based on revenue generated in Russia in 2021.

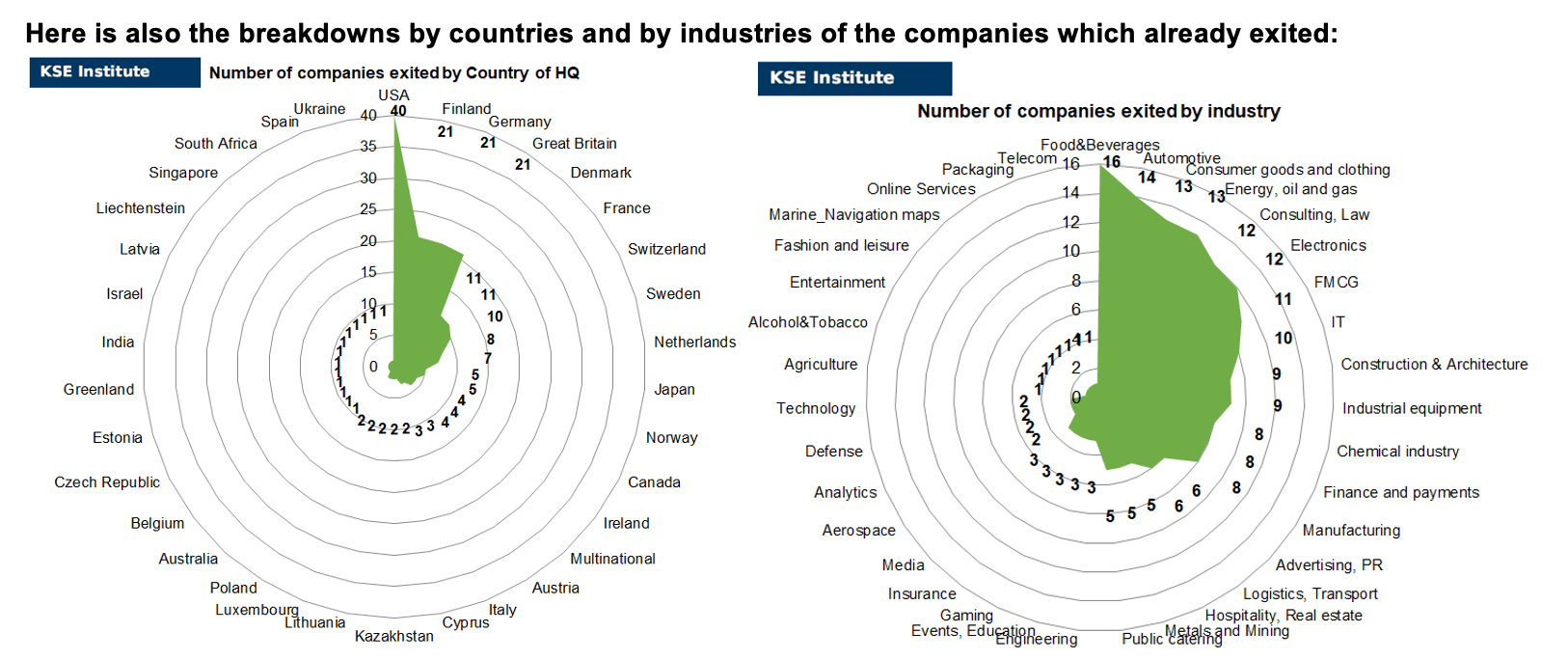

So, as of the end of February 2023, companies from 34 countries and 35 industries have already exited showing their true reaction to the war started by Russia and its not provoked aggression against Ukraine. Most of the companies were headquartered in the USA, Finland, Germany, and Great Britain and operated in the “Food & Beverage”, “Automotive”, “Consumer goods and closing” and “Energy, oil and gas” industries.

Here is the list of “exiters” that we were able to identify recently: Arconic, Azarga Metals, Campina LLC, Columbus, Daimler Truck, Dentsu Inc., Ejot, Elopak, Freedom Holding, Game Insight, Hines, Hitachi Energy, Iponweb (part of Criteo)⁵, Koskisen, Linas Agro Group, Nissan, PHX Energy Services, Resbud, Uponor.

Also, we are not yet in a hurry to assign “exited” status to dozens of companies that are literally on the verge of exit, although have not yet finalized this process.

Here are just some of them: AAK, AGCO⁶, ALD Automotive, Broadridge Financial Solutions, Castorama, CMA CGM, Eastnine AB, Mammoet, Mantsinen, Mercedes-Benz Group, OMV, Parker Hannifin, Rehau, Smurfit Kappa, VEON, Volkswagen Group.

These examples, like dozens of others, unite the fact that despite the complex procedure for sale of business in Russia and all the formalities required a lot of companies were already able to successfully pass these complex procedures and leave Russia. We understand that the process of final exit is not so simple. Although inevitable. Because companies don’t just pay taxes. They create value chains, and most importantly, they compete and innovate in the market and keep it in a state of development. And assets, received by oligarchs connected to the Kremlin, are worthless without competition.

At the same time, some of the companies, even after sale of their local entities in Russia, prefer to keep trading relations with the aggressor country. For example, based on customs data Otis Worldwide continued to supply equipment after sale of the Otis business in Russia. Also, the Singapore branch of Baker Hughes in January 2023 supplied spare parts for drilling equipment to former Russian subsidiaries. The Scottish Government has threatened to stop funding Baker Hughes over these breaches. Therefore, Ukraine and other countries over the world need not only to continue pressure on those companies who stay but also carefully identify the true behavior of companies, and introduce new trade restrictions and sanctions.

The next review of deals for March 2023 will be available in a month.

What’s new last month – key news from Daily monitoring

(updated on a monthly basis)⁷

02.03.2023

*Asian Chess Federation (ACF) (China, Аssociation, NGO) Status by KSE – stay

The Asian Chess Federation (ACF) overwhelmingly approved the decision to join the FSR

https://www.kommersant.ru/doc/5843836

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

HSBC Applies for Sale of Russian Unit

https://www.kommersant.ru/doc/5844605

*AliExpress (China, Consumer goods and clothing) Status by KSE – wait

Aliexpress blocked Russians from buying drones

https://espreso.tv/aliexpress-zablokuvav-rosiyanam-kupivlyu-droniv-zmi

*Technip Energies (France, Engineering) Status by KSE – exited

Technip Energies’ annual revenue, 2023 guidance hit by Russia exit

*Total Energies (France, Energy, oil and gas) Status by KSE – wait

TotalEnergies continues to hold stake in Russia’s LNG-linked business

*Airbus (Brazil, Aircraft industry) Status by KSE – leave

*Boeing (USA, Aircraft industry) Status by KSE – leave

Russian Airlines Are Flying High Despite Sanctions

01.03.2023

*Spacety (China, Aerospace) Status by KSE – stay

Blacklisted Chinese satellite company Spacety provided aerial photos to Russian mercenaries of the Wagner Group, a US official said.

*Reel Shipping (Cyprus, Logistics, Transport) Status by KSE – stay

Zhonggu Logistics (China, Logistics, Transport) Status by KSE – stay

Torgmoll (China, Logistics, Transport) Status by KSE – stay

Worldwide Logistics (USA, Logistics, Transport) Status by KSE – stay

Safetrans Line, sister company of Transfar Shipping, has launched a liner service linking China with Morocco and Russia, joining several other newcomers on the Russian lane. Transfar and Safetrans are owned by China-based forwarder Worldwide Logistics, in which Alibaba’s logistics unit Cainiao has a minority stake.

https://theloadstar.com/safetrans-latest-to-join-booming-china-russia-box-tradelane/

*OVP Shipping (China, Logistics, Transport) Status by KSE – stay

OVP Shipping launched China-Baltic Sea Service to Russia

https://www.linerlytica.com/post/ovp-shipping-launch-china-baltic-sea-service

*London Metal Exchange (Great Britain, Finance and payments) Status by KSE – leave

The London Metal Exchange (LME) said on Tuesday it has suspended the inflow of Russian base metals into its US registered warehouses due to the planned imposition of tariffs on Russian metal by the United States.

https://www.mining.com/web/lme-halts-flow-of-russian-metals-into-its-us-warehouses/

*DSM (Netherlands, Pharma, Healthcare) Status by KSE – stay

DSM must leave RU immediately. By remaining active in RU, you are not only supporting Putin’s war machine through paying taxes, you are also indirectly supporting mass slaughter in Russia

https://m.limburger.nl/cnt/dmf20230228_97012951

https://twitter.com/KBurgerDirven/status/1630820281559273474

*Uponor (Finland, Construction & Architecture) Status by KSE – exited

Uponor Corporation, a leading provider of sustainable water solutions, has completed its exit from the Russian market in accordance with local government authority requirements.

https://finance.yahoo.com/news/uponor-completes-russian-market-exit-080000765.html

*Metro (Germany, FMCG) Status by KSE – stay

The National Agency for the Prevention of Corruption included the Metro Cash & Carry company in the list of international sponsors of the war due to the decision of the company’s management to continue its activities in Russia.

https://www.epravda.com.ua/rus/news/2023/02/28/697537/

*Volkswagen (Germany, Automotive) Status by KSE – leave

No decision on sale of Volkswagen’s last Russian factory, says govt

*Uber (USA, Online Services) Status by KSE – leave

Uber – the world’s largest taxi service – is finally saying goodbye to the Russian market. As “Interfax” reports with reference to an informed source, the government has approved a deal to sell Uber’s stake in a joint venture with Yandex.

28.02.2023

*allied blenders & distillers (India, Alcohol&Tobacco) Status by KSE – stay

The Indian company Allied Blenders & Distillers (ABD), producer of the third most popular whiskey in the world

https://www.kommersant.ru/doc/5842943?tg

*Kazakhstan Stock Exchange (Kazakhstan, Finance and payments) Status by KSE – wait

The Kazakhstan Stock Exchange (KASE) has decided to delist the shares of some Russian companies, including Yandex.

https://www.epravda.com.ua/news/2023/02/27/697501/

*Harting (Germany, Manufacturing) Status by KSE – stay

*TE Connectivity (Switzerland, Electronics) Status by KSE – stay

*Trimble (USA, IT)Status by KSE – wait

Trade data indicate that components manufactured by Harting, Trimble and TE Connectivity continue to be imported into Russia through official distributors or through third countries such as Hong Kong and Turkey.

https://www.epravda.com.ua/news/2023/02/28/697513/

*Mediterranean Shipping Company (Switzerland, Logistics, Transport) Status by KSE – wait

MSC retains strong presence in Russian trades

*Glencore (Switzerland, FMCG) Status by KSE – wait

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

Commodity trader Trafigura Group is in talks to buy aluminum from United Co. Rusal International PJSC, highlighting its willingness to strike new deals with Russian companies even as its biggest rival balks.

*AmRest (Spain, Public catering) Status by KSE – exited

*KFC (USA, Public catering) Status by KSE – leave

AmRest sells KFC restaurant business in Russia to different local investor

*Rockwool (Denmark, Construction & Architecture) Status by KSE – stay

The Rockwool company earned millions of crowns on orders from the Russian Ministry of Defense. Among other things, Rockwool products are part of a warship that participated in the war against Ukraine last year.

https://danwatch.dk/rockwool-i-rusland-har-tjent-millioner-paa-putins-krigsmaskine/

The Danish Business Authority will investigate whether Rockwool breached EU sanctions

27.02.2023

*Freedom Holding (Kazakhstan, Finance and payments) Status by KSE – exited

Freedom Holding Completes Sale of Russian Subsidiaries

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – leave

Update on our exit from Russia

Timeline of decision to exit Russia and where we are now

https://www.theheinekencompany.com/newsroom/update-on-our-exit-from-russia/

*HSBC (Great Britain, Finance and payments) Status by KSE – leave

HSBC AM shuts last Russia ETF in Europe one year on from Ukraine invasion

*Apple (USA, Electronics) Status by KSE – leave

Apple pulled out of Russia in March, but Russians can still buy the new iPhone 14

https://www.businessinsider.com/apple-exited-russia-iphone-14-preorders-2022-9

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Almost half of Russian foreign money transfers go through Raiffeisenbank

26.02.2023

*KuCoin (USA, Finance and payments) Status by KSE – stay

*Huobi Global (Seychelles, Finance and payments) Status by KSE – stay

Two major crypto exchanges failed to block sanctioned Russians

*Great Wall Motor Co. (China, Automotive) Status by KSE – stay

Chery Automobile (China, Automotive) Status by KSE – stay

Xiaomi (China, Electronics) Status by KSE – stay

Chinese brands have replaced iPhones and Hyundai in Russia’s war economy

*Volkswagen (Germany, Automotive) Status by KSE – wait

Volkswagen banned the supply of its products from China to Russia

25.02.2023

*Xi’an Bingo Intelligent Aviation Technology (China, Electronics) Status by KSE – wait

A Chinese drone manufacturer has denied it has any commercial dealings with Russia, following a report claiming it was negotiating with the country’s military over the mass production of “kamikaze” drones.

*Copelouzos Group (Greece, Energy, oil and gas) Status by KSE – leave

Gazprom exited the capital of the Greek Prometheus Gas. As of 21st February 2023 Copelouzos Group holds 100% of the share capital of PROMETHEUS GAS S.A.

https://neftegaz.ru/news/Acquisitions/771320-gazprom-vyshel-iz-kapitala-grecheskoy-prometheus-gas/

*Qazaq Gaz (Kazakhstan, Energy, oil and gas) Status by KSE – stay

The gas company Qazaq Gaz offered Gazprom to consider the possibility of creating a new transit gas pipeline along the route from Russia to China, which could also be used for gasification of the east of the republic.

*FATF (France, Аssociation, NGO) Status by KSE – leave

FATF Plenary has today suspended the membership of the Russian Federation.

https://www.fatf-gafi.org/en/publications/Fatfgeneral/outcomes-fatf-plenary-february-2023.html

*AGC (Japan, Construction & Architecture) Status by KSE – leave

*Japan Tobacco International (Switzerland, Alcohol&Tobacco) Status by KSE – wait

*Iida Group (Japan, Hospitality, Real estate) Status by KSE – stay

Japanese firms split on staying in business in Russia

https://www.asahi.com/ajw/articles/14847256

*Metro AG (Germany, FMCG) Status by KSE – stay

Metro CEO Defends Choice to Hold on to Russian Business

https://www.marketwatch.com/story/metro-ceo-defends-choice-to-hold-on-to-russian-business-45b73289

*Accor (France, Hospitality, Real estate) Status by KSE – wait

French owner of Orient Express claims pulling out of Russia is ‘not an option’

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – wait

Heineken Faces Boycott Calls as It Warns Russia Could Nationalize Its Business

*Auchan (France, FMCG) Status by KSE – stay

*Leroy Merlin ((France, FMCG) Status by KSE – stay

Decathlon (France, Consumer goods and clothing) Status by KSE – leave

“Auchan”, “Leroy Merlin” and “Dekathlon” will be checked for money laundering and withdrawal of assets

https://svpressa.ru/economy/article/363257/

*Wintershall Dea AG (Germany, Energy, oil and gas) Status by KSE – wait

Wintershall Dea has written off its fate in the Nord Stream due to the unpredictability of recovery times

23.02.2023

*International Federation of Journalists (IFJ) (Belgium, Аssociation, NGO) Status by KSE – leave

IFJ suspends Russian union

*ID Logistics (France, Logistics, Transport) Status by KSE – leave

During the 4th quarter of 2022, ID Logistics finalized the transfer of its 8 active files in Russia to its customers or their

partners. At the end of these transfers, ID Logistics has no more activity in Russia since the beginning of January 2023.

https://www.id-logistics.com/en/wp-content/uploads/sites/20/2023/01/PR_ID-Logistics-Q4-2022_EN.pdf

*Auchan (France, FMCG) Status by KSE – stay

The National Agency for Prevention of Corruption included the French corporation “Auchan” in the list of international war sponsors.

https://t.me/NAZK_gov_ua/2093?fbclid=IwAR2CPmLWPUYDfD2PPdgmx9vUgmZVR-ZFNJN8OCeVk7Nkub3_SONU-nct53U

*Philip Morris (USA, Alcohol&Tobacco) Status by KSE – wait

Tobacco group Philip Morris admits it may never sell its Russian business

https://www.ft.com/content/656714b0-2e93-467b-92d6-a2d834bc0e2b

*Game Insight (Lithuania, Gaming) Status by KSE – exited

Game Insight hit with $2 million lawsuit from its bankrupt Russian subsidiary.

https://gameworldobserver.com/2023/02/22/game-insight-russia-lawsuit-parent-company

*FIDE (International Chess Federation) (Switzerland, Sport) Status by KSE – leave

In January the Russian Chess Federation applied for membership of the Asian Chess Federation and announced its intention to withdraw from ECU.

https://en.chessbase.com/post/ecu-on-russia-transferring-to-asia

22.02.2023

*Komerční banka (Czech Republic, Finance and payments) Status by KSE – wait

Due to the events related to the war in Ukraine caused by Russian aggression involving Belarus, Komerční banka has decided not to make payments to Russia and Belarus in any currency from March 1, 2023, outside the framework of legal sanctions.

*Shaanxi Automobile Group (China, Automotive) Status by KSE – stay

*SINOTRUK (China, Automotive) Status by KSE – stay

Chinese truck manufacturers took half of the Russian market and squeezed KamAZ

*Engie (France, Energy, oil and gas) Status by KSE – wait

In the fourth quarter of 2022, the French energy company Engie initiated arbitration proceedings against Gazprom Export due to the failure of the Russian side to fulfill its gas supply obligations.

https://www.epravda.com.ua/news/2023/02/21/697268/

*Hindustan Petroleum (India, Energy, oil and gas) Status by KSE – stay

India’s state-owned refiner Hindustan Petroleum Corp Ltd is facing payment issues for its purchases of Russian crude oil due to a price cap imposed on exports from the OPEC+ producer.

*Elopak (Norway, Consumer goods and clothing) Status by KSE – leave

Elopak ASA – Closing of sale of Russian subsidiary and full divestment of Russian operations

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – wait

Heineken says it still plans to exit Russia, take 300 million euro loss

*ATP Tour (Great Britain, Аssociation, NGO) Status by KSE – stay

ATP Chief repeats opposition to Russian player ban at Wimbledon

https://uk.sports.yahoo.com/news/atp-chief-repeats-opposition-russian-202106184.html?guccounter=1

21.02.2023

*ComNav Technology (China, Electronics) Status by KSE – stay

The National Agency for the Prevention of Corruption (NACP) listed the Chinese company ComNav Technology on the list of international sponsors of the war: ComNav manufactures and still supplies Russia with navigation and radar equipment.

https://www.epravda.com.ua/news/2023/02/20/697227/

*Mammoet (Netherlands, Logistics, Transport) Status by KSE – leave

President Vladimir Putin allows Shell and Mammoet to exit Russia

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen shares slide after U.S. sanctions office asks about Russia

*International Olympic Committee (IOC) (Switzerland, Sport) Status by KSE – wait

IOC should consider banning Russia from Paris 2024 Olympics, 34 countries urge

https://www.politico.eu/article/boot-russia-from-paris-2024-olympics-more-than-30-countries-urge-ioc-neutral-flags-vladimir-putin-zelenskyy/

*HSBC (Great Britain, Finance and payments) Status by KSE – wait

HSBC takes $300 million hit on Russia business sale, says deal on track for 2023

https://finance.yahoo.com/news/hsbc-takes-300-million-hit-052010858.html

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

President Vladimir Putin allows Shell and Mammoet to exit Russia

20.02.2023

*ABB (Switzerland, Electronics) Status by KSE – leave

Only 18 Swiss companies have completely exited Russia, says Yale professor

*Maersk (Denmark, Logistics, Transport) Status by KSE – exited

Maersk nears complete Russia exit after selling logistics sites

https://www.reuters.com/business/maersk-divests-logistics-sites-russia-2023-02-20/

*Societe Generale (France, Finance and payments) Status by KSE – exited

Societe Generale is negotiating the sale of ALD assets in Russia

*Vitol Group (Switzerland, Energy, oil and gas) Status by KSE – exited

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Shell and Vitol accused of prolonging Ukraine war with sanctions ‘loophole’

19.02.2023

*Global Jet Technic (United Arab Emirates, Air transportation) Status by KSE – stay

Rosaviatsia has approved Dubai-based Global Jet Technic to maintain Russian-registered Airbus and Boeing aircraft.

https://simpleflying.com/airbus-ceo-concerned-russia-plane-operations/

*Union Cycliste Internationale (Switzerland, Sport) Status by KSE – leave

Russian team takes UCI to court over ban

https://www.cyclingweekly.com/news/russian-team-takes-uci-to-court-over-ban

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

U.S. sanctions authority probes Raiffeisen on Russia

*Twitch (USA, Online Services) Status by KSE – wait

Twitch was under threat of complete blocking in Russia

https://www.moscowtimes.ru/2023/02/17/twitch-okazalsya-pod-ugrozoi-polnoi-blokirovki-v-rossii-a34468

*YouTube (USA, Online Services) Status by KSE – wait

The Russian authorities are discussing the possibility of further tightening of Internet censorship and the introduction of a complete blocking of YouTube

*Henkel ( Germany, Chemical industry) Status by KSE – leave

*Johnson & Johnson (USA, FMCG) Status by KSE – wait

*Wella (Germany, FMCG) Status by KSE – exited

In Russia, the assortment of hygiene and household chemicals has been sharply reduced after the departure of foreign brands

*World Athletics Council (Sweden, Sport) Status by KSE – leave

World Athletics to deal with Russian doping ban before considering Ukraine invasion, Coe announces

https://www.insidethegames.biz/articles/1133802/athletics-seb-coe-doping-ban-ukraine

17.02.2023

*Azarga Metals (Canada, Metals and Mining) Status by KSE – exited

AZARGA METALS CORP. is pleased to announce the sale of its wholly-owned subsidiary, Azarga Metals Limited, a BVI corporation pursuant to a share purchase agreement with a non-sanctioned third-party buyer

https://azargametals.com/news/2023/azarga-metals-completes-its-exit-from-russia

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – leave

Uniper had found a local buyer for Unipro; it had yet to receive “presidential approval”, suggesting the sale was being personally blocked by Putin.

https://www.ft.com/content/0754d081-09e0-4e0a-867a-dd13c891b6d6

*Heineken (Netherlands, Alcohol&Tobacco) Status by KSE – wait

CEO Dolf van den Brink said Heineken was aiming to sell the Russian operations, which still employ around 1,800 people, in the first half of this year – but suggested the process could take longer than initially thought.

*Ingka (Netherlands, Consumer goods and clothing) Status by KSE – wait

The Swedish Ingka Group, which owns the IKEA chain of furniture and home goods stores and Mega shopping centers, has started looking for buyers for its real estate in Russia

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

The government commission approved the sale of IKEA plants in Russia.

*Cisco Systems Inc (USA, IT) Status by KSE – wait

Inside the Gray Market Keeping Cisco Tech in Stock in Russia

https://www.wsj.com/articles/inside-the-gray-market-keeping-cisco-tech-in-stock-in-russia-23b60391

16.02.2023

*South Asian Football Federation (SAFF) (Bangladesh, Аssociation, NGO) Status by KSE – stay

“We are delighted to announce that Russia will be competing in SAFF U17 Women’s Championship 2023…” a statement read.

*Kerry group (Ireland, Food & Beverages) Status by KSE – exited

Kerry Group’s after tax profits down on Russian withdrawal

https://www.rte.ie/news/business/2023/0216/1356949-kerry-group-full-year-results/

*Fidelity (USA, Finance and payments) Status by KSE – wait

Fidelity separates Russian assets from EMEA fund via split to new sustainable portfolio

https://www.investmentweek.co.uk/news/4074509/fidelity-separates-russian-assets-em-split-emea-fund

*Renault (France, Automotive) Status by KSE – exited

French automaker Renault said Thursday it boosted manufacturing profitability in 2022 but the sale of its operations in Russia pushed the company into a net loss.

*BASF SE (Germany, Chemical industry) Status by KSE – leave

The withdrawal of subsidiary Wintershall Dea has left parent company BASF with a billion-dollar loss in 2022

*Maersk (Denmark, Logistics, Transport) Status by KSE – exited

Maersk Tanker Denied Entry to Spanish Port Over Russian-Linked Oil Transfer

https://gcaptain.com/maersk-tanker-denied-entry-to-spanish-port-over-russian-linked-oil-transfer/

15.02.2023

*PetroChina (China, Energy, oil and gas) Status by KSE – stay

*Sinopec Limited (China Petroleum & Chemical Corporation ) (China, Chemical industry) Status by KSE – wait

China’s top refiners PetroChina and Sinopec are resuming purchases of discounted Russian crude after a brief pause in late 2022, just before the European Union embargo on Russian oil started

*Viatris (USA, Pharma, Healthcare) Status by KSE – wait

The American company Viatris suspended the supply of Viagra tablets to the Russian Federation

https://www.interfax.ru/russia/886264

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – wait

Unilever defends decision to remain in Russia, but says position is under ‘close review’

*Michelin (France, Food & Beverages) Status by KSE – leave

Michelin’s Russia exit taking longer than planned

https://www.tyrepress.com/2023/02/michelins-russia-exit-taking-longer-than-planned/

*AliExpress (China, Consumer goods and clothing) Status by KSE – wait

AliExpress launches “parallel import” of spare parts to Russia

https://www.moscowtimes.ru/2023/02/13/aliexpress-nachinaet-par-a33942

14.02.2023

*Goldman Sachs (USA, Finance and payments) Status by KSE – leave

Goldman Sachs completely exited the capital of the owner of Cian PLC

https://www.rbc.ru/rbcfreenews/63eb5d6e9a794701ff9d00b0

*Fidelity (USA, Finance and payments) Status by KSE – wait

According to documents filed with the US Securities and Exchange Commission (SEC), the American investment firm FMR LLC increased its stake in Yandex N.V. to almost 19.5 million shares (5.983% of capital)

https://www.rbc.ru/technology_and_media/13/02/2023/63ea4d599a79473423e8f041

*SUN Ship Management Ltd (United Arab Emirates, Marine Transportation) Status by KSE – stay

EU to mull sanctions on Dubai shipper suspected of running Russian tanker fleet

https://www.politico.eu/article/eu-sanction-dubai-russia-tanker-fleet-oil-export/

*Amundi (France, Finance and payments) Status by KSE – leave

Amundi closes Russia ETF as MSCI calls time on index

https://www.etfstream.com/news/amundi-closes-russia-etf-as-msci-calls-time-on-index/

*Hellenic Bottling Company (Greece, Food & Beverages) Status by KSE – wait

Coca-Cola bottling firm posts ‘record’ revenue despite exit from Russia and energy crisis eating into profits

*International Automobile Federation (France, Аssociation, NGO) Status by KSE – leave

FIA extends restrictions on Russian drivers

*Baker Hughes (USA, Energy, oil and gas) Status by KSE – wait

Scottish Government threatens to stop funding US oil firm over Russia exports

*AGC (Japan, Construction & Architecture) Status by KSE – leave

AGC Considers Leaving Russia

https://www.usglassmag.com/2023/02/agc-considers-leaving-russia/

13.02.2023

*CUAV Tech Inc. (China, Electronics) Status by KSE – leave

Primorye announced the creation of a new drone. It is sold on Aliexpress

*PetroNeft Resources (Ireland, Energy, oil and gas) Status by KSE – leave

PetroNeft Resources set to sell Russian assets

https://ukinvestormagazine.co.uk/aim-weekly-movers-petroneft-resources-set-to-sell-russian-assets/

*Hines (USA, Hospitality, Real estate) Status by KSE – leave

Hines To Exit $2.3B Russia Business As Real Estate Works Through Post-War Breakup

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

UniCredit Bank (Italy, Finance and payments) Status by KSE – stay

Loans to Russian soldiers fuel calls for European banks to quit

*Colgate-Palmolive (USA, FMCG) Status by KSE – wait

*L’Oreal (France, Consumer goods and clothing) Status by KSE – wait

*Procter & Gamble (USA, FMCG) Status by KSE – stay

*Unilever (Great Britain, Consumer goods and clothing) Status by KSE – wait

*Reckitt Benckiser Group (Great Britain, Consumer goods and clothing) Status by KSE – leave

*Danone (France, FMCG) Status by KSE – wait

*Philip Morris (USA, Alcohol&Tobacco) Status by KSE – wait

*Mondelez (USA, Food & Beverages) Status by KSE – wait

For Fear or Money, Consumer Giants Are Staying in Russia

*OBI Group (Germany, Consumer goods and clothing) Status by KSE – exited

*Starbucks (USA, Public catering) Status by KSE – exited

A businessman close to Kadyrov “grabbed” shares in OBI and Starbucks, which have left Russia

*Kraft Heinz (USA, Food & Beverages) Status by KSE – wait

Kraft Heinz in Russia

https://actionwithukraine.net/kraft-heinz-in-russia/

*Credit Suisse (Switzerland, Finance and payments) Status by KSE – wait

Credit Suisse is shocked, with 17.6 billion Swiss francs blocked in CS alone

https://www.tagesanzeiger.ch/17-6-milliarden-franken-russen-gelder-793972606992

*VEON (Netherlands, Telecom) Status by KSE – leave

Veon Receives Approval for VimpelCom sale

https://telecomtalk.info/veon-receives-approval-for-vimpelcom-russia-sale/675381/

*Coty (USA, Consumer goods and clothing) Status by KSE – leave

Coty Delivers Strong 2Q23 Results Ahead of Expectations

Recently we made a lot of significant improvements in our Telegram-bot with improving the interface, adding overall statistics and reflecting on the latest KSE statuses of companies taken from the KSE public database.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ It needs to be mentioned that open access to Russia’s EGRUL register was classified recently, so KSE Institute could miss some of the exits but we are currently working under the new solution allowing us to get the proper access to the registers in the future.

⁵ Criteo completed a $250M deal for ad-tech firm Iponweb. The initial agreement to buy the company was made before Russia invaded Ukraine in late February 2022. Iponweb, while founded in the United Kingdom by Russian-born Boris Mouzykantskii, had the majority of its engineering team based in Russia. For IPONWEB, its commercial and revenue activities are primarily in Western Europe and the United States, with no revenue customers in Russia, while its R&D team is primarily based in Moscow with a smaller team based in Berlin.

⁶ One of the local companies, “AGCO MACHINERY” LLC, changed its owner (OPTITEK DISTRIBUTION HOLDING B.V. becomes the new founder of the organization).

⁷ A “Company news” section is available on the project site https://leave-russia.org/, follow daily updates directly on the website