- Kyiv School of Economics

- About the School

- News

- 36th issue of the weekly digest on impact of foreign companies’ exit on RF economy

36th issue of the weekly digest on impact of foreign companies’ exit on RF economy

16 January 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 09-15.01.2023

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 15.01.2023

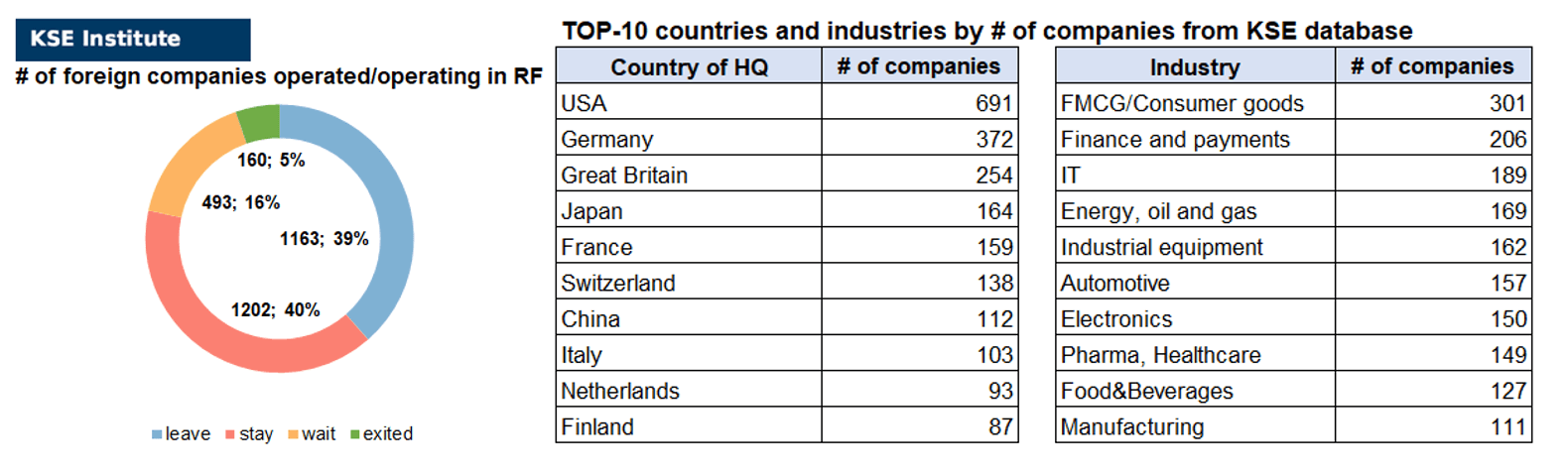

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 202 (0 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 493 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 163 (+2 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 160 (+2 per week)

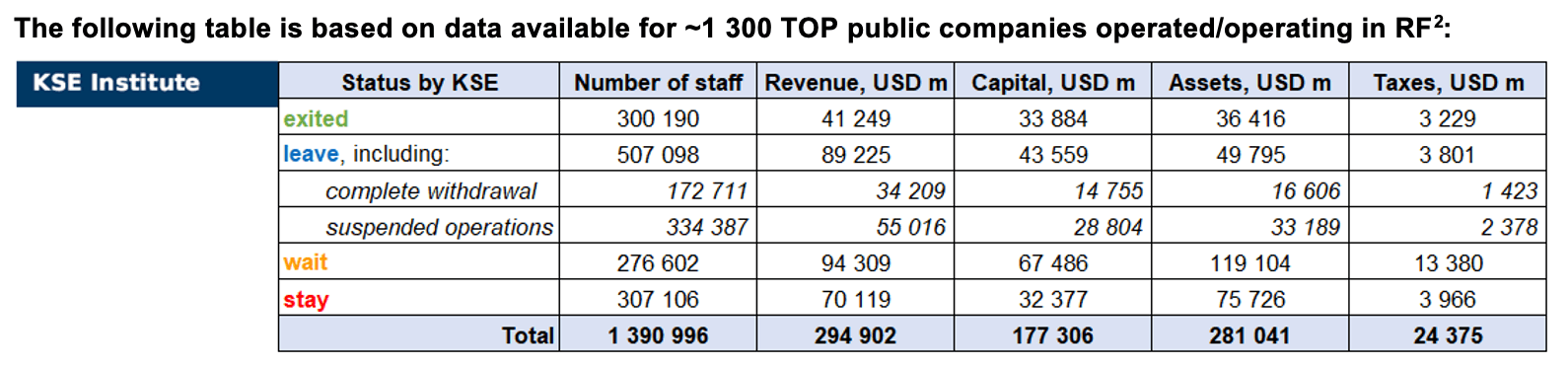

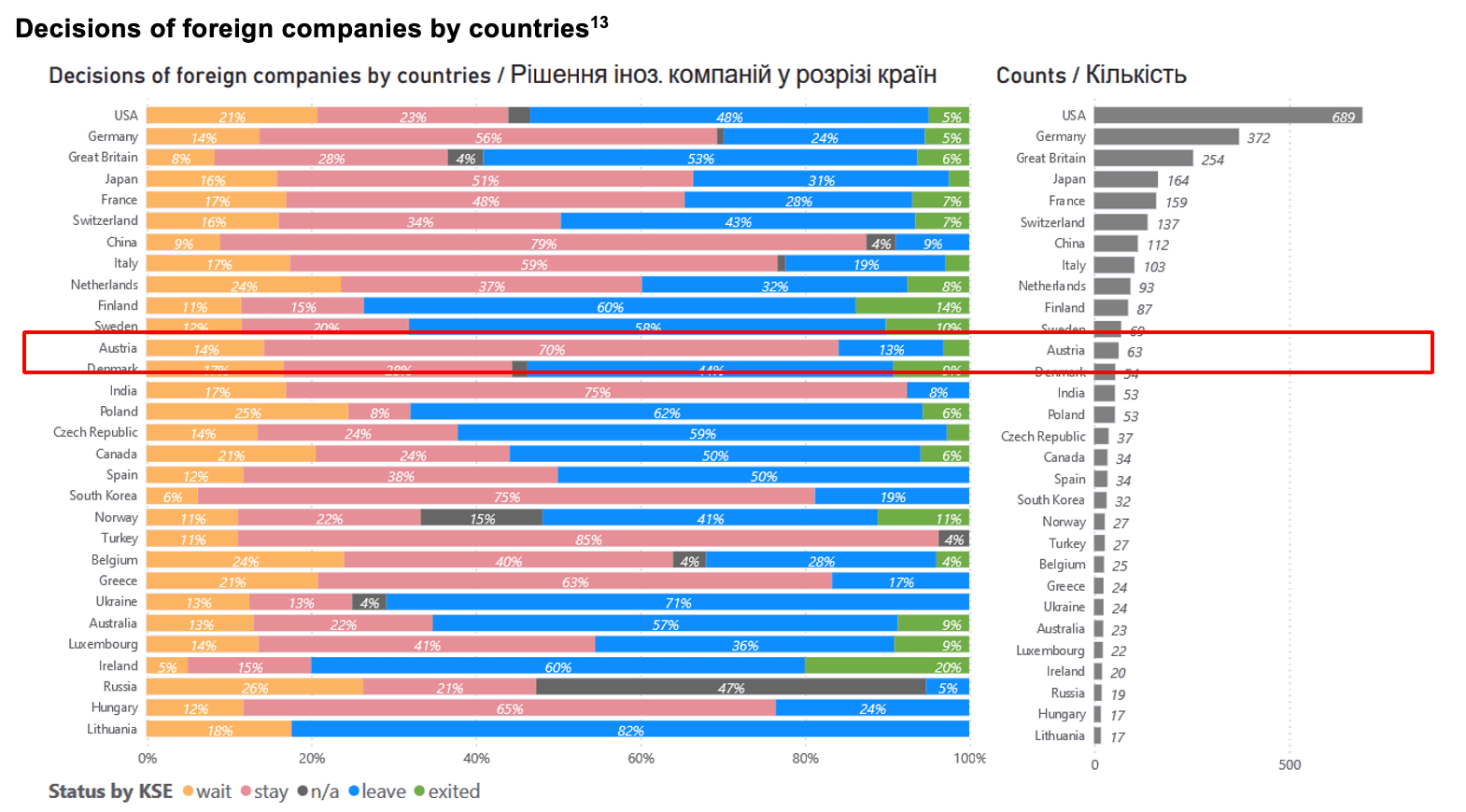

As of January 15, we have identified about 3,018 companies, organisations and their brands from 87 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $177.3 billion), local revenue (about $294.9 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,656 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 160 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of January 15, companies which had already completely exited from the Russian Federation, had at least 300,200 personnel, $41.2 bn in annual revenue, $33.9bn in capital and $36.4bn in assets; companies, that declared a complete withdrawal from Russia had 172,700 personnel, $34.2bn in revenues, $14.8bn in capital and $16.6 bn in assets; companies that suspended operations on the Russian market had 334,400 personnel, annual revenue of $55.0bn, $28.8bn in capital and $33.2 bn in assets.

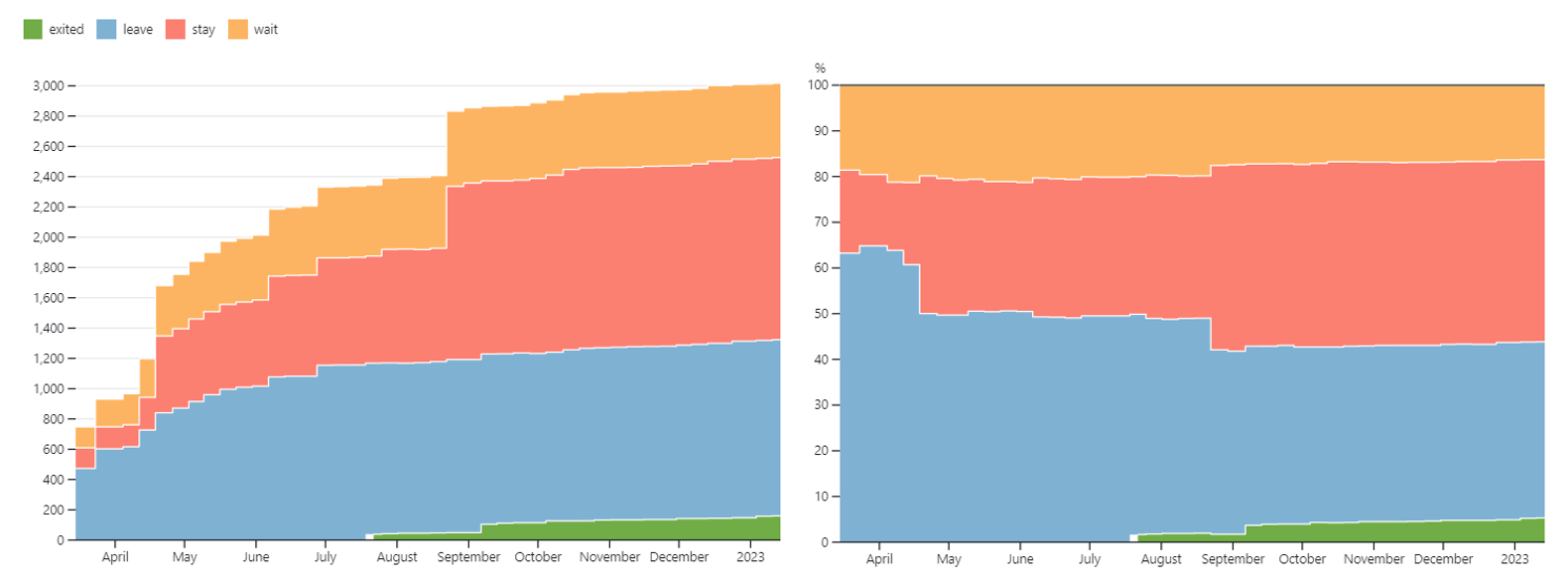

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 4 months the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.5% of foreign companies have already announced their withdrawal from the Russian market, but another 39.8% are still remaining in the country, 16.3% are waiting and only 5.3% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 160 companies that completely left the country, since they employed 21.6% of the personnel employed in foreign companies, the companies owned about 13.0% of the assets, had 19.1% of capital invested by foreign companies, only last year they generated revenue of $41.2 billion or 14.0% of total revenue and paid $3.2 billion of taxes or 13.2% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Austrian companies and their positions in Russia

Before the war in Europe, Russia remained the key external partner of the European Union, and the EU was Russia’s main trading partner. At the same time, as of 2020, Austria held the 23-rd place in the foreign trade turnover of Russia, and Russia the 5-th place in the foreign trade turnover of Austria among the countries that are not part of the European Union⁴.

For reference in 2022, Russia ranked the 17-th with 1.2% in Austria’s foreign trade⁵.

The location of Austria practically in the very geographical center of the modern European Union makes Austria the most valuable partner of Russia, not only from an economic point of view, but also from a geostrategic point of view, since this EU country is a large-scale sales market for Russian energy carriers. Also, many wealthy Russians have purchased and continue to purchase real estate in Austria, especially in its capital, Vienna.

For reference: in 1968, Austria became the first country in Western Europe to conclude a gas contract with the USSR⁶. In June 2018 it was signed the Agreement on the extension of the current contract between “Gazprom Export LLC” and “OMV Gas Marketing & Trading GmbH” for the supply of Russian natural gas to Austria until 2040. According to data for August 2021, the total supply of Russian gas since 1968 exceeded 260 billion cubic meters of gas⁷.

In 2021, Russia’s trade with Austria amounted to 5.89 billion US dollars, an increase of 42.73% (1.76 billion US dollars) compared to 2020, of which exports – 3.22 billion US dollars, imports – 2.66 billion US dollars. In the structure of Russia’s exports to Austria in 2021, the main share of supplies fell on energy carriers – 93.46% of the total volume. Austrian investments in Russia as of 2021 amounted to about 6 billion US dollars, Russian investments in Austria 29 billion US dollars. As of 2022, about 1 500 Austrian companies were registered in Russia and more than 500 enterprises with the participation of Russian capital operate in Austria⁸.

В 2014 році Австрія частково підтримала введення санкцій США та ЄС проти Росії через розпочату нею війну в Україні. При цьому, активність економічного двостороннього співробітництва Австрії та Росії почала знижуватися.

After Russian further military escalation in Ukraine in 2022, the European Union introduced new anti-Russian sanctions, to which Austria was forced to join.

However, despite this, against the background of the current geopolitical crisis in Europe, Russia views Austria as a mediator in global politics, particularly European politics. At the same time, Russia is trying to take advantage of Austria’s neutral status to create a platform for communication with interested politicians from all over Europe.

But, as early as March 5, 2022, the Austrian state gas company OMV Gas Marketing & Trading GmbH announced that it would no longer invest in Russia. The company also wants to sell 24.99% of the shares or leave the list of shareholders of the company that is developing an oil and gas field in Siberia. The negotiations are suspended with the Russian company “Gazprom” about the purchase of a share in the development of one of the horizons of the Urengoy-region gas condensate field.

For reference: during the two months of the Russian-Ukrainian war, the EU countries paid 44 billion euros for Russian energy carriers, more than 1 billion euros of this amount was Austria’s payment for Russian gas⁹.

Also, at the beginning of the large-scale Russian-Ukrainian war in 2022, Austria has frozen 254 million euros of Russian assets on 200 accounts¹⁰.

At the same time, it is worth noting that about 8 000 Austrian companies sent an open letter to the Austrian Government with the aim of accepting their demands regarding peace negotiations with Ukraine. The letter states that in order to prevent the threatened “destruction” of Austrian small and medium-sized businesses, the Austrian Government should take a number of measures both in domestic and foreign policy aimed at improving the economic situation in Austria. Austrian companies demand that the Austrian Government suspend all sanctions against Russia to prevent further damage to Austria. According to the letter, Austria should immediately govern as a neutral country and represent a neutral place for peace negotiations. For this, Vienna also needs to accept Russian proposals for peace talks, stop any arms deliveries to Ukraine, and also use the territory of Austria for such negotiations¹¹.

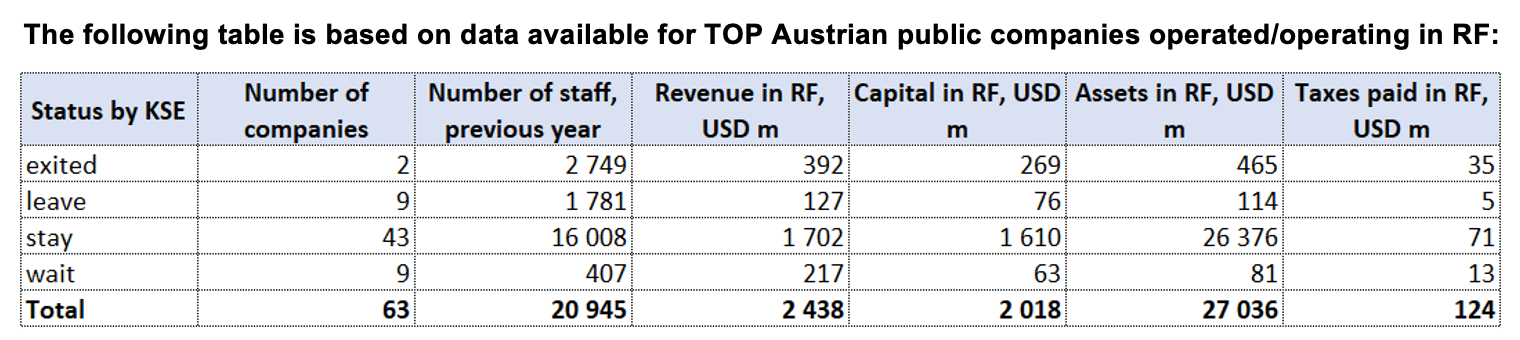

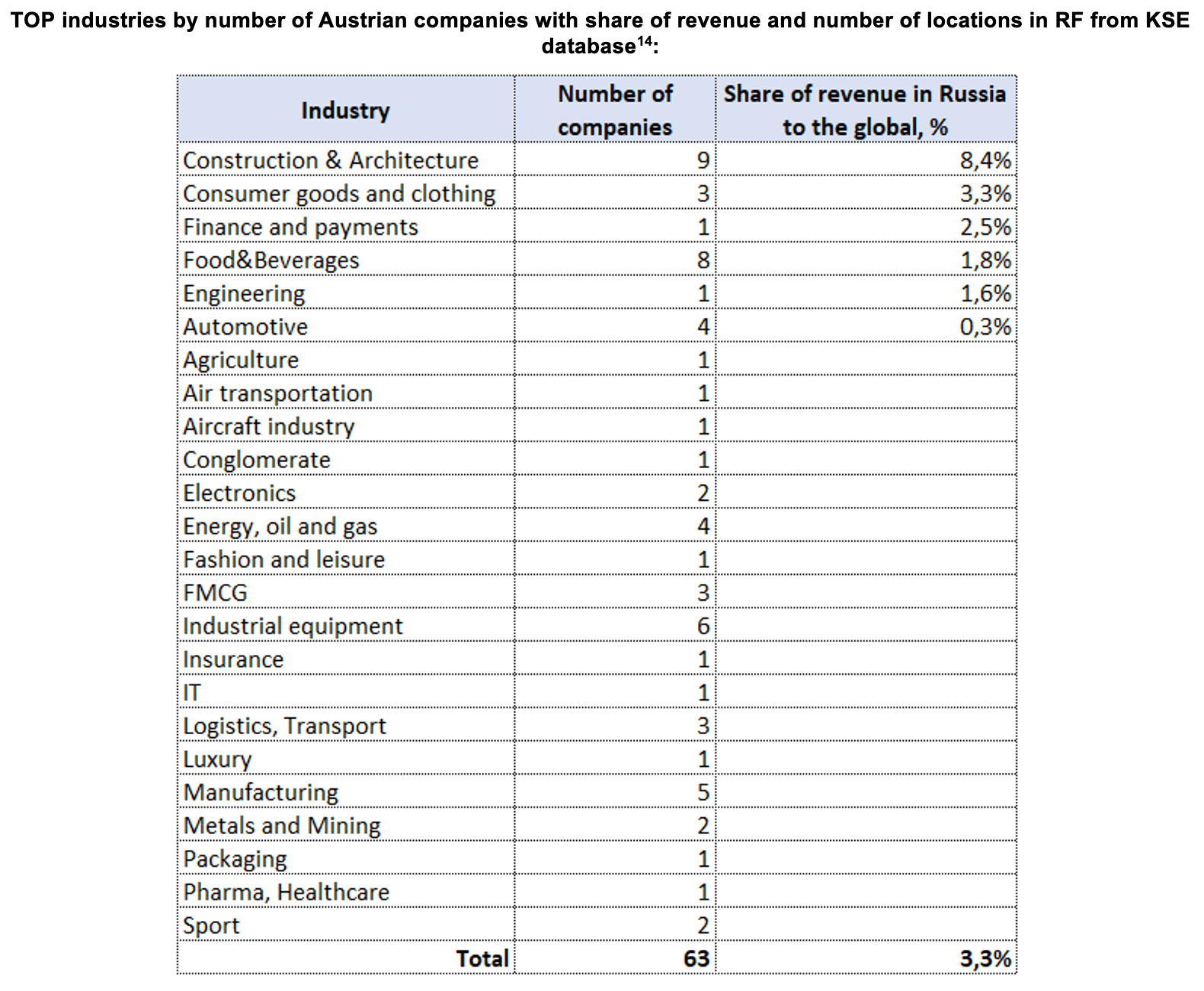

According to data collected by the KSE Institute¹², in 2021 63 Austrian companies (with share in capital 50+%) provided jobs for at least 20,945 people in Russia, those companies generated $2.4 bn in annual revenue, paid $124 mn of taxes, had $2.0 bn in capital and $27.0 bn in assets.

2 companies (only 3%) have completely left the Russian market and sold their shares, 9 companies (only 14% of 63 companies observed) have announced plans to leave Russia, in 2021 they employed only 1 781 people (it need to be noted that a lot of companies are trading ones and don’t have staff or offices in the country), generated $127 mn (5%) in annual revenue, had $76 mn in capital and $114 mn in assets. But most of the Austrian companies (at least 43 or 69%!) are still staying and 9 companies (14%) are waiting and limiting their investments. These 2 groups generated a significant part of the revenue ($1.92 bn or 79%) received by Austrian companies in Russia and employed 78% of staff.

The most “dependent” on Russia in terms of revenue share in this country are Austrian companies in the following industries: Construction & Architecture, Consumer goods and clothing, Finance and payments, Food&Beverages and Engineering.

How are Austrian companies reacting?

Out of 63 companies in the KSE database, 69% of Austrian companies stay in Russia, another 14% are waiting and somewhat limiting their activities, 14% are leaving and 3% have already left with the sale of their shares. Only some of the Austrian companies are among the examples of planned leave from the Russian market, while others defy demands for exit despite pressure.

Planned suspension and withdrawal

2 Austrian companies (or 3%) included in the KSE database have completely left the Russian market and sold their shares (all of them have “exited”¹⁵, status by KSE, legally there are no Austrian beneficiaries anymore):

MM Packaging (Packaging, Status by KSE – exited) The Mayr-Melnhof Group (MM) has sold its two Packaging sites in Russia, St. Petersburg and Pskov, to the local investor Granelle following approval by the governmental authorities. The selling price amounts to approx. EUR 134 million. In 2021, the plants generated combined sales of approx. EUR 124 million. The transaction is expected to have a neutral impact on MM’s net profit.

Petro Welt Technologies (Energy, Oil & Gas, Status by KSE – exited) – is an Austrian stock corporation that operates as a service provider in the natural gas and oil production business. PeWeTe sold and transferred its participatory interests held directly and indirectly in its Russian LLC which was sold to a local legal entity, which is held by a group of Russian top managers of the Petro Welt Group.

Swarovski (Luxury, Status by KSE – leave) is an Austrian company specializing in the production of loose crystals, jewelry, crystal figurines and the cutting of synthetic and natural gemstones. Suspend all sales in Russia.

Fischer Sports (Consumer goods and clothing, Status by KSE – leave) is an Austrian winter sports equipment manufacturing company, more specifically Nordic skiing, Alpine skiing and ice hockey equipment. As a company that employs more than half of its workforce at production sites in Ukraine, Fischer has been particularly moved by Russian aggression towards its neighboring country. As a result, sales activities in Russia have been severely restricted and all investments stopped.

ams-OSRAM AG (Manufacturing, Status by KSE – leave) is a global leader in optical solutions. The company halted all shipments and activities to Russia and Belarus.

Uniqa (Insurance, Status by KSE – leave) Austrian insurance company Uniqa UNIQ.VI is looking into the possibility of a complete exit from Russia. “We want out but this will take quite some time yet,” Andreas Brandstetter said at the Gewinnmesse conference for shareholders in Vienna.

Wienerberger (Construction & Architecture, Status by KSE – leave) brick giant Wienerberger is active in Russia, but does not see a serious impact on business as a whole. “Wienerberger’s exposure to Russia is less than 1 percent of sales, we don’t operate in Ukraine — we don’t see any short-term consequences for our business,” CEO Haimo Schoich said in reference to the military conflict. 1 percent of the annual turnover means about 40 million euros for the building materials group. Later Wienerberger decided to sell its operations in Russia.

Companies that ignore the exit

Raiffeisen Bank (Finance and payments, Status by KSE – stay) Raiffeisenbank is a universal Russian bank, a subsidiary of the Austrian banking group Raiffeisen Bank International. Included in the list of systemically important Russian banks. Raiffeisenbank ranks second in terms of assets in the RBI Group and first in terms of profit. “This unprecedented situation leads RBI to consider its position in Russia. We are therefore assessing all strategic options for the future of Raiffeisenbank Russia, up to and including a carefully managed exit from Raiffeisenbank in Russia,” RBI CEO Johann Strobl said in the spring. But at the beginning of 2023, the Russian subsidiary of JSC Raiffeisenbank not only officially recognized the so-called Donetsk and Luhansk “people’s republics”, but also provided favorable credit terms to the Russian occupiers in Ukraine.

Rotax (Aircraft industry, Status by KSE – stay) Trademark of a range of internal combustion engines developed and manufactured by the Austrian company BRP-Rotax GmbH & Co KG. The discovery of the Ukrainian military was that the Iranian drone contained a high-class Austrian Rotax 912iS engine, which is used in small civilian aircraft. Manufacturer Rotax immediately denied supplying engines to Iran and launched an investigation.

EGGER (Construction & Architecture, Status by KSE – stay) is a global family company founded in 1961 in Tyrol, Austria, where it is currently based. The company produces wood-based panel products. It has 2 plants in Russia, employed in 2021 1161 people and received $478m of revenue, invested $604m of capital. The company has production facilities and a sales office in Russia.

Agrana (Food & Beverages, Status by KSE – stay) is a Vienna-based food company that produces sugar, starch, fruit fillers, juice concentrate and ethanol fuel. Agrana mainly supplies products to the international food industry, and also deals with small end-users. In Russia, AGRANA is present only in the fruit segment. In Serpukhov, about 100 km south of Moscow, fruit harvesting is produced and almost 300 people work. AGRANA tries to continue to fulfill its tasks as a supplier of basic food products and meet the food needs of the local population. Therefore, at the moment, he is not planning to leave Russia.

ALPLA (Consumer goods and clothing, Status by KSE – stay) is an Austrian international plastics manufacturer and plastics processor headquartered in Hardy, specializing in blow-molded bottles and caps, injection molded parts, preforms and tubes. In 2021, the number of personnel in Russia was 547. The company’s income in the same year was $138 million, and it invested $93 million in capital. The addresses of representative offices and factories in the Russian Federation still remain on the company’s website.

Kotanyi (Food & Beverages,Status by KSE – stay) is an Austrian manufacturer of spices and seasonings. “If the federal government or the EU approve the legal requirements, we as an Austrian company will of course comply with them. From a current perspective, we maintain business relationships with our suppliers, partners and supermarket chains and evaluate them on a daily basis,” – says the company’s statement.

Summary

The Austrian economy remains vulnerable to gas disruptions in 2022, with around 50% of gas imported from Russia, up from 80% at the start of 2022. As of October 2022, gas reserves cover about 90% of its annual consumption. At the same time, gas imports from Russia cannot be replaced by other sources, and a complete stoppage of gas imports from Russia will have significant negative consequences for the Austrian economy.

Austria is one of the countries most affected by Western sanctions against Russia, as approximately 80% of Austria’s natural gas demand relies on Russian imports¹⁶.

It is worth noting that despite the geopolitical crisis in Europe, according to the OECD¹⁷, the Austrian GDP growth will be 0.1% in 2023 and 1.2% in 2024. The Austrian economy will remain vulnerable to gas disruptions in 2023 as around 50% of gas is imported from Russia, up from 80% in early 2022.

As of October 2022, Austria also accepted 83 000 refugees from Ukraine.

Considering the above, it is necessary to state that Austrian companies have invested a lot in Russia and feel the consequences of Western sanctions against Russia. Austrian companies and industry feared gas shortages, but supported the sanctions policy. For years, Europe, including Austria, relied on cheap and reliable gas supplies from Russia, and trade relations were at the center of the EU policy of rapprochement with Russia

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁸

10.01.2023

*Raiffeisen (Austria, Finance and payments) Status by KSE – stay

Raiffeisen in Russia recognized the so-called “LPR” and “DNR”. How they reacted in Ukraine.

11.01.2023

*Jazeera Airways (Kuwait, Air transportation) Status by KSE – stay

Jazeera Airways plans to launch its first route to Russia in February, offering a nonstop service between Kuwait City (KWI) and Moscow Domodedovo (DME).

https://www.routesonline.com/news/29/breaking-news/299152/jazeera-airways-to-enter-russian-market/

*Lear Corporation (USA, Manufacturing) Status by KSE – leave

The company is aiming to sell its assets in Russia within the first half of this year, CEO Ray Scott said, adding that legal issues and other complexities have made the process slow moving.

https://www.autonews.com/suppliers/lear-moves-sell-its-russian-plants

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

Trafigura sells out of Russia-backed Indian refiner Nayara Energy

12.01.2023

*Veolia (France, Utilities & Communal Services) Status by KSE – wait

Veolia’s continued business in Russia ‘could bring council into disrepute’

*Yum Brands (USA, Public catering) Status by KSE – leave

A number of KFC franchisees in Russia have asked the government to stop the sale of the Yum! Brands restaurant business to the local operator

13.01.2023

*JPMorgan (USA, Finance and payments) Status by KSE – wait

*Goldman Sachs (USA, Finance and payments) Status by KSE – wait

Goldman and JPMorgan Diverge on Response to Richest Russian’s Sanctions

15.01.2023

*Intel (USA, IT) Status by KSE – wait

Intel Reportedly Resumes Driver And Software Support In Russia On The Down Low

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁵ https://www.statistik.at/fileadmin/announcement/2022/06/20220624AH2021EN.pdf

⁶ https://tass.ru/mezhdunarodnaya-panorama/5099061

⁷ https://ria.ru/20220411/avstriya-1782816118.html

⁸ https://ria.ru/20220411/avstriya-1782816118.html

⁹ https://www.bbc.com/ukrainian/features-61329077

¹⁰ https://www.vindobona.org/article/sanctions-200-russian-bank-accounts-frozen-in-austria

¹⁴ https://leave-russia.org/uk?flt%5B131%5D%5Beq%5D%5B0%5D=424

¹⁵ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

¹⁸ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site