- Kyiv School of Economics

- About the School

- News

- 34th issue of the weekly digest on impact of foreign companies’ exit on RF economy

34th issue of the weekly digest on impact of foreign companies’ exit on RF economy

2 January 2023

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 26-31.12.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

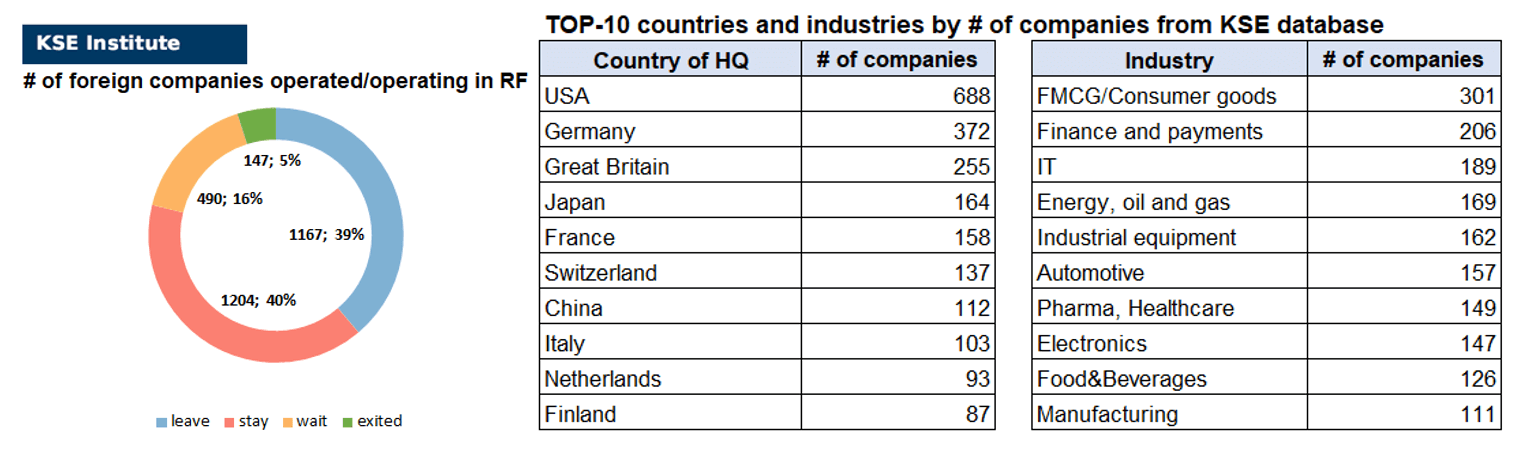

KSE DATABASE SNAPSHOT as of 31.12.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 204 (+3 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 490 (-5 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 167 (+3 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 147 (+3 per week)

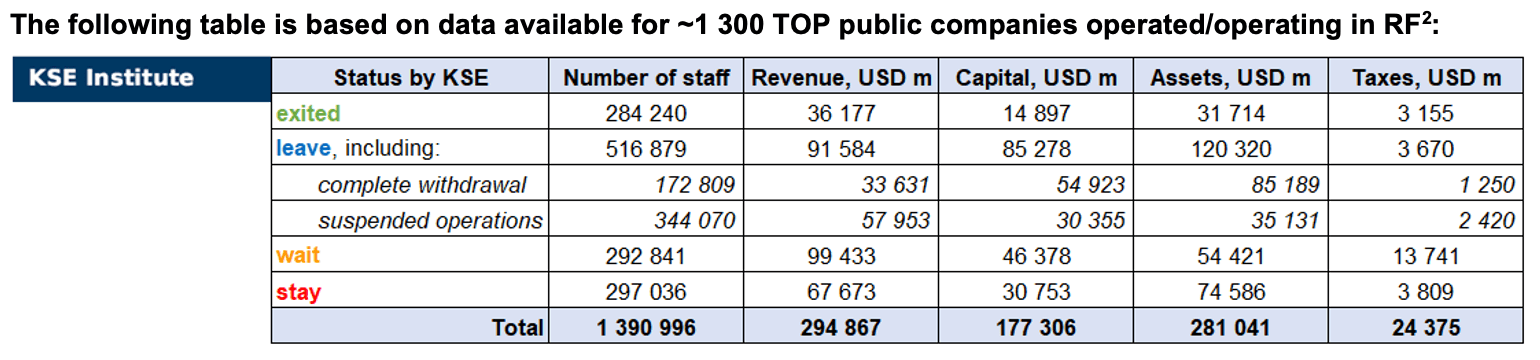

As of December 31, we have identified about 3,008 companies, organisations and their brands from 86 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $177.3 billion), local revenue (about $294.9 billion), local assets (about $281.0 billion) as well as staff (about 1.391 million people) and taxes paid (about $24.4 billion). 1,657 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 147 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of December 31, companies which had already completely exited from the Russian Federation, had at least 284,200 personnel, $36.2 bn in annual revenue, $14.9bn in capital and $31.7bn in assets; companies, that declared a complete withdrawal from Russia had 172,800 personnel, $33.6bn in revenues, $54.9bn in capital and $85.2 bn in assets; companies that suspended operations on the Russian market had 344,100 personnel, annual revenue of $58.0bn, $30.4bn in capital and $35.1 bn in assets.

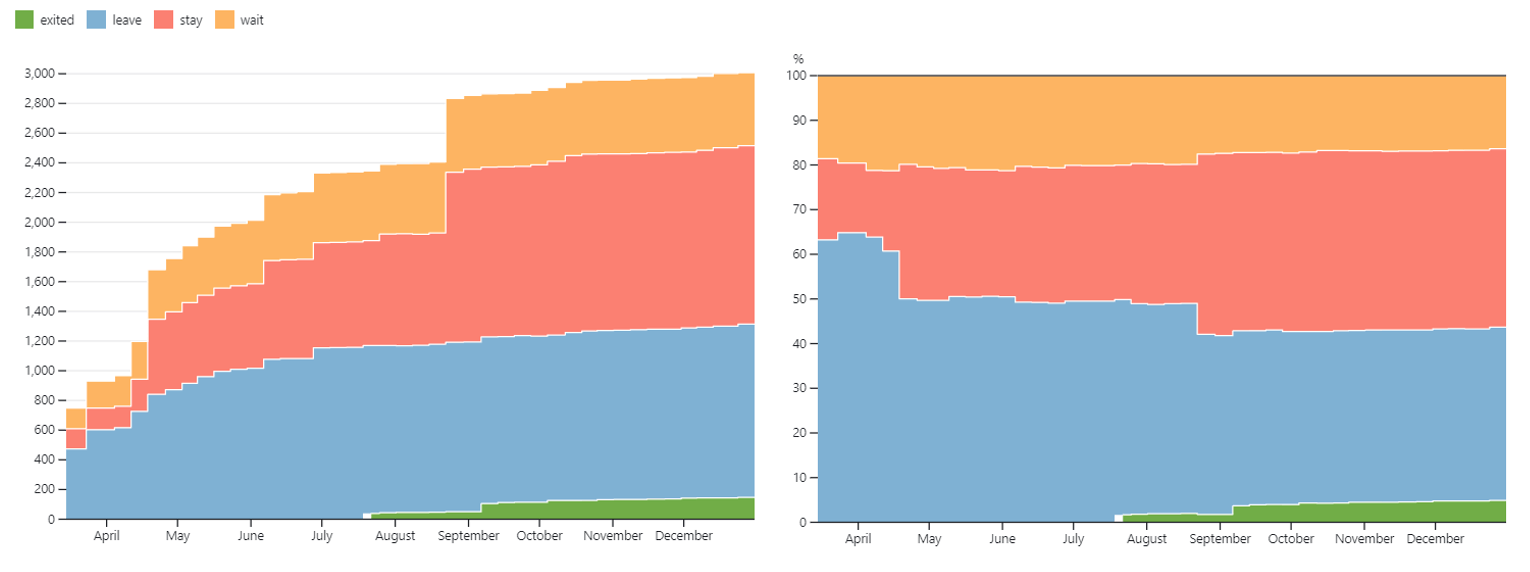

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last 3 months the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.8% of foreign companies have already announced their withdrawal from the Russian market, but another 40.0% are still remaining in the country, 16.3% are waiting and only 4.9% made a complete exit³.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 147 companies that completely left the country, since they employed almost 20.4% of the personnel employed in foreign companies, the companies owned about 11.3% of the assets, had 8.4% of capital invested by foreign companies, only last year they generated revenue of $36.2 billion or 12.3% of total revenue and paid $3.2 billion of taxes or 12.9% of total taxes paid by the companies observed. Data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

New Year and Christmas congratulations from B4Ukraine Coalition!

Dear friends,

2022 has been a year like no other. Russia’s invasion of Ukraine has sparked a global crisis in food and energy and shaken democratic, open societies. This time last year, Ukraine was at peace and Ukrainians were living normal lives. As we approach 2023, the picture is starkly different, with many facing a cold and dark winter without electricity, heating or loved ones. So it’s with mixed feelings that we are writing this end-of-year message. We would like to take a moment to reflect on and acknowledge the incredible work of the Coalition over the past five months.

The war is not of our choosing but all of us stood up and took on this new challenge, each making a unique contribution. Thank you all for that!

We’ve come a long way since our launch in late July, with the Coalition growing in size and impact. Today we have 70 members from all corners of the world bringing their incredible expertise and experience under the B4Ukraine banner.

We have directly engaged with over 40 multinational companies, built 360° campaigns on Rockwool, Raiffeisen Bank and Mondelez, and are campaigning for a U.S. government business advisory. And looking ahead to 2023, we are building our plans for a Week of Action around the one-year anniversary of the invasion to ratchet up the pressure on corporate Remainers.

We are also grateful to all 147 companies that have completed their exit from Russia and are no longer funding its war against Ukraine and the free world!

Our comms team in Kyiv built the Coalition website and social media presence from scratch to a point where we now reach tens of thousands of people, two thirds of whom are in the US, the UK and EU states. Our voice has been heard in tier-1 media publications globally, including Fortune and FT. We sparked passionate discussions in Brussels and Geneva. Our messages resonated in the halls of the Capitol and Westminster.

In short, we have achieved incredible things together – in large part, down to the energy and commitment the Coalition members bring to the table. So, while it’s true we would prefer not to have to be doing this work, but we are very grateful to be campaigning for peace in Ukraine and justice in the world alongside you.

Together, we can achieve so much more in the next year and beyond. So let’s celebrate, regroup, and then roll up our sleeves to change the world in 2023.

Onwards in solidarity and hope,

Members of B4Ukraine Coalition

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)⁴

26.12.2022

*Glencore (Switzerland, FMCG) Status by KSE – leave

Sberbank has taken legal action to recover debt and penalties from Glencore Energy UK Ltd over the two consignments, supplied by a subsidiary of Russia’s largest bank in March.

*Shell (Great Britain, Energy, oil and gas) Status by KSE – exited

Russian court permits Shell to offload stake in Salym oil venture

27.12.2022

*Procter & Gamble (USA, FMCG) Status by KSE – wait

Procter & Gamble continues sponsoring Russia’s war with two giant factories

28.12.2022

*DP Eurasia (Netherlands, Public catering) Status by KSE – wait

The Russian arm of Pizza chain Domino’s is considering whether to sell up, more than 10 months after the Kremlin launched a war against Ukraine.

*New York Stock Exchange (USA, Finance and payments) Status by KSE – leave

The staff of NYSE Regulation has determined to commence proceedings to delist the Franklin FTSE Russia ETF

*UEFA (Switzerland, Sport) Status by KSE – leave

The Russian Football Union decided on Tuesday to postpone a vote on leaving Uefa in a bid to join the Asian Football Confederation as a response to the European association’s suspension of all Russian teams over the country’s invasion of Ukraine.

https://www.laprensalatina.com/russian-football-delays-vote-on-leaving-uefa/

30.12.2022

*PPF (Czech Republic, Finance and payments) Status by KSE – exited

PPF CEO buys stake in Home Credit Bank Kazakhstan from Russian entity

https://www.retailbankerinternational.com/news/ppf-home-credit-bank-kazakhstan/

*VanEck (USA, Finance and payments) Status by KSE – leave

VanEck is liquidating two Russia exchange-traded funds nearly a year into Vladimir Putin’s invasion of Ukraine.

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/

⁴ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site