- Kyiv School of Economics

- About the School

- News

- 23rd issue of the weekly digest on impact of foreign companies’ exit on RF economy

23rd issue of the weekly digest on impact of foreign companies’ exit on RF economy

17 October 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 10-16.10.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

Also, we are in the negotiation phase of partnering with Rubargo. Rubargo allows you to find any brand or company that is operating in Russia. With our service, you can not only find such a company, but also check proof links with information about the company’s public statement or public research that can confirm this information. You are able to scan barcodes and dynamically receive information about specific products and their origin.

Impose your personal sanctions by downloading app here: Apple App Store | Google Play.

KSE DATABASE SNAPSHOT as of 16.10.2022

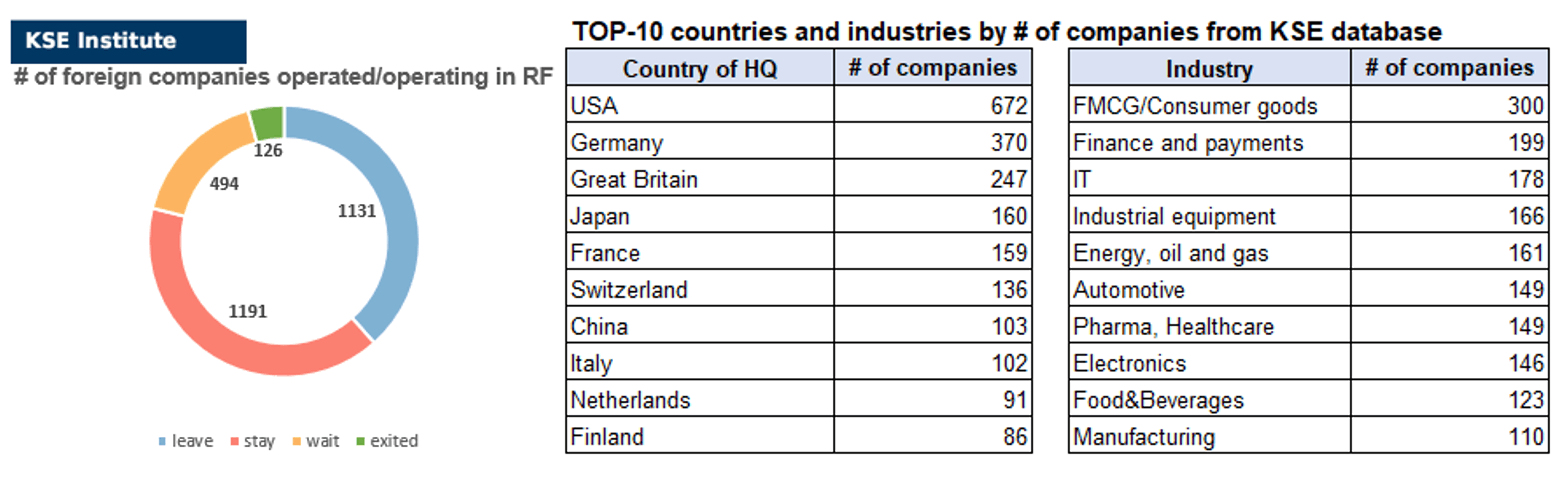

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 1 191 (+22² per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 494 (-3 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 131 (+16 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 126 (0 per week)

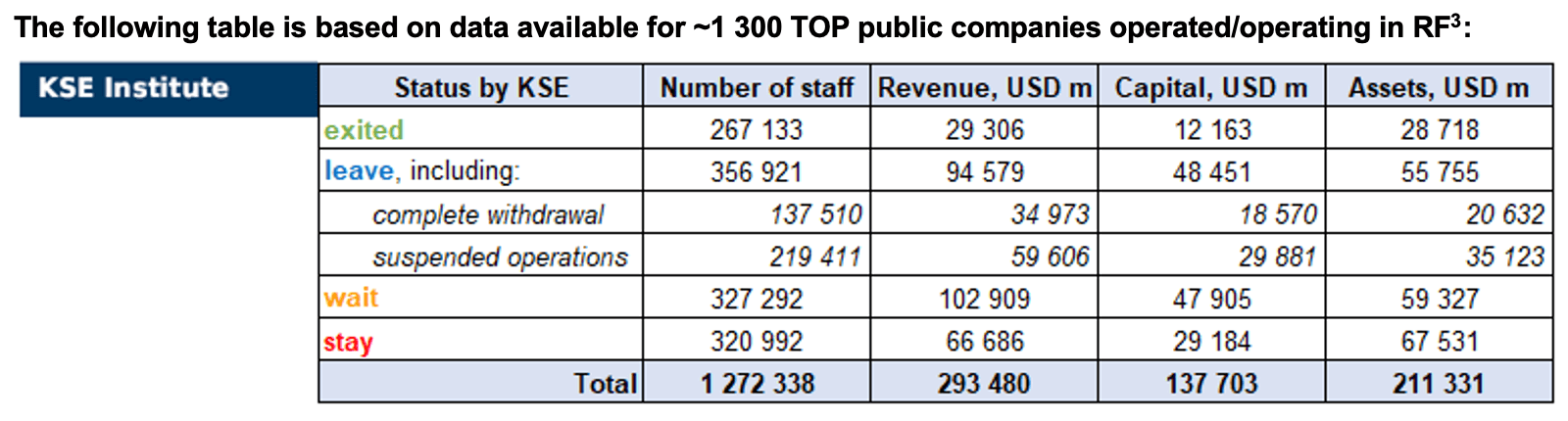

As of October 16, we have identified about 2,942 companies, organisations and their brands from 85 countries and 56 industries and analysed their position on the Russian market. About 40% of them are public ones, for ~1 300 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $137.7 billion), local revenue (about $293.5 billion), local assets (about $211.3 billion) as well as staff (about 1.272 million people). 1,625 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 126 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

As can be seen from the tables below, as of October 16, companies which had already completely exited from the Russian Federation, had at least 267,100 personnel, $29.3 bn in annual revenue, $12.2 bn in capital and $28.7 bn in assets; companies, that declared a complete withdrawal from Russia had 137,500 personnel, $35.0bn in revenues, $18.6bn in capital and $20.6 bn in assets; companies that suspended operations on the Russian market had 219,400 personnel, annual revenue of $59.6bn, $29.9bn in capital and $35.1 bn in assets.

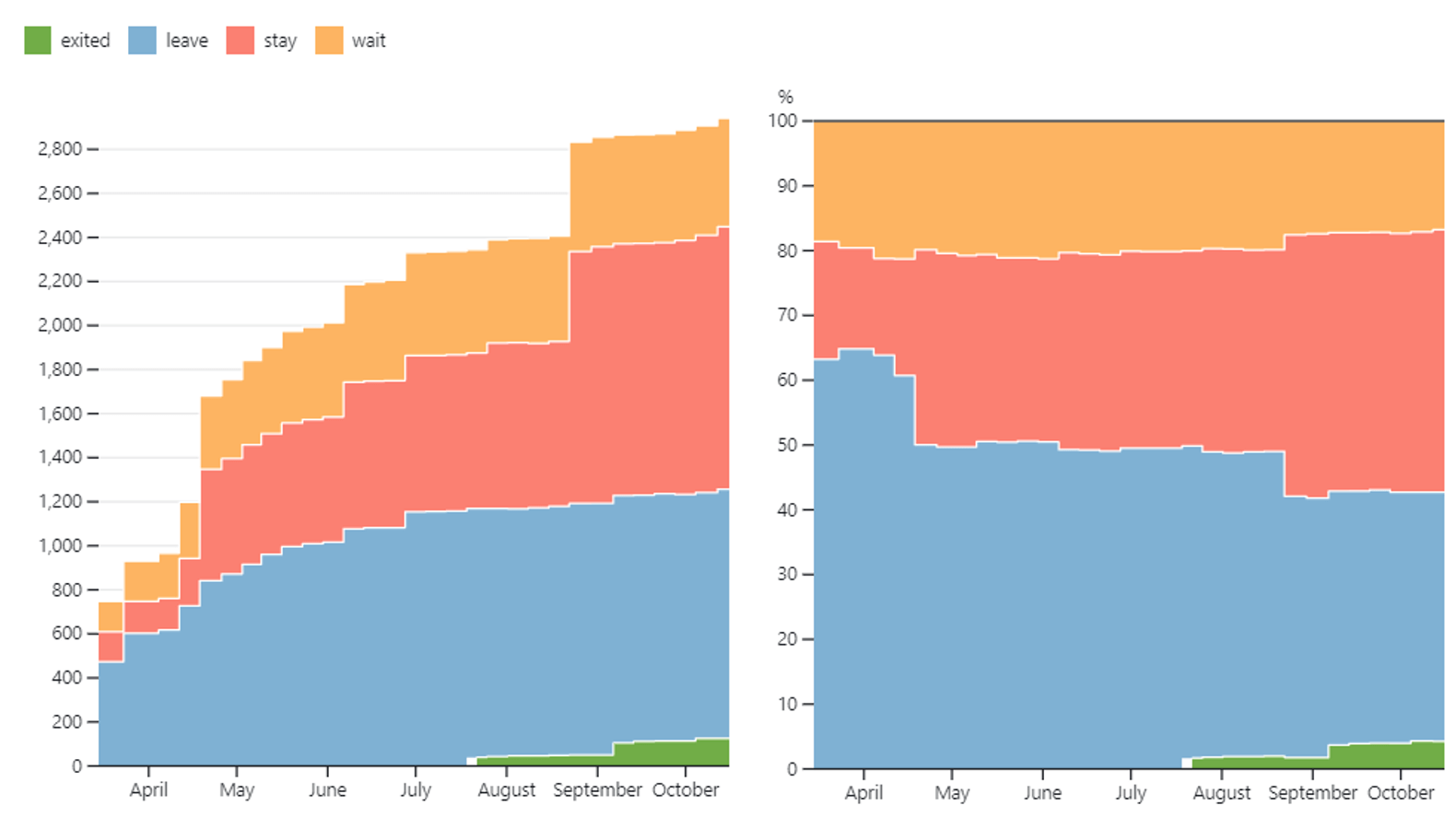

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about 38.4% of foreign companies have already announced their withdrawal from the Russian market, but another 40.5% are still remaining in the country, 16.8% are waiting and only 4.3% made a complete exit⁴.

At the same time, it is difficult not to overestimate the impact on the Russian economy of only 126 companies that completely left the country, since they employed almost 21.0% of the personnel employed in foreign companies, the companies owned about 13.6% of the assets, had 8.8% of capital invested by foreign companies, and only last year they generated revenue of $29.3 billion or 10.0% of total revenue, data on 1,300 TOP companies are presented in the table above.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: Analysis on Italian companies and their positions in Russia

Italy, as before, is an important partner of Russia in the EU and one of the most liberal countries towards Russia. Even in the most difficult and crisis times in 2014-2022, relations between Russia and Italy never experienced a fundamental change in terms of economic course.

Due to the development of Italian-Russian trade and economic relations, until 2022, Italy has taken fifth place in the volume of trade with Russia after China, Germany, the Netherlands and Belarus.

For reference: before the year 2022, the leading position of Italian imports to Russia was machine-building and equipment products (40%). It is followed by the chemical and pharmaceutical industry (20%), textiles, textile products and footwear (15%), food and agricultural products (9%) and inferior goods (9%)⁵.

The Russian-Ukrainian war has become a serious challenge for the economic relations of both countries, and despite the fact that the general positive trend in the development of bilateral relations after 2014 was preserved, the economic sanctions introduced in 2022, as well as the restrictions caused by the war, led to a decrease in business activity and volume of trade between countries. At the same time, despite the war in Europe, the predominant share of Russian exports is energy resources, namely, more than 70-80% of the total volume of exports. Italy continues to be one of the main importers of Russian gas in Western Europe.

For reference: in 2019 Gazprom Export delivered 22.1 billion cubic meters to Italy (2nd position after Germany), and three long-term contracts for the supply of Russian gas to Italy until 2035 were concluded between the Italian energy company ENI and the Russian Gazprom. In addition, ENI actively participates in gas transportation system projects, the implementation of various infrastructure projects, and the supply of lubricants.

As of February 2022, there were about 500 Italian companies permanently in Russia, 70 of which had manufacturing facilities, as well as 68 banks and several law firms⁶. At the same time, the seven largest Italian banks operate on a permanent basis in the country: Intesa SanPaolo and Unicredit, which also carry out retail activities, as well as, Banca Monte dei Paschi, Banco Popolare, Iccrea, Mediobanca and Ubi Banca⁷. Before the start of the war in Europe, the most prominent part on the Russian market was Intesa SanPaolo, which for many years participated in various infrastructure projects of the Russians.

For reference: because of Russia’s war against Ukraine, the Italian banking group Intesa SanPaolo stopped financing Russian and Belarusian counterparties. Also, Intesa stopped investing in Russian and Belarusian financial instruments, regardless of the sanctions applied by the West. At the same time, the bank created a crisis unit to oversee its activities in Russia, as its presence in Russia is under strategic review⁸.

Since the Kremlin initiated the invasion of Ukraine, most Italian companies operating in Russia are trying to follow the Western trend of ending their business in Russia, reducing it to a minimum, or have announced plans to do both. However, the majority of Italian small and medium-sized enterprises (SMEs) have not yet left Russia. They want to continue working with Russian companies or stay in the Russian market. In particular, it should be noted the ability of Italian companies to adapt and flexibility in the face of adverse market conditions in Russia, as was the case, for example, in 2014, after the West introduced sanctions against Russia in connection with its annexation of Crimea⁹.

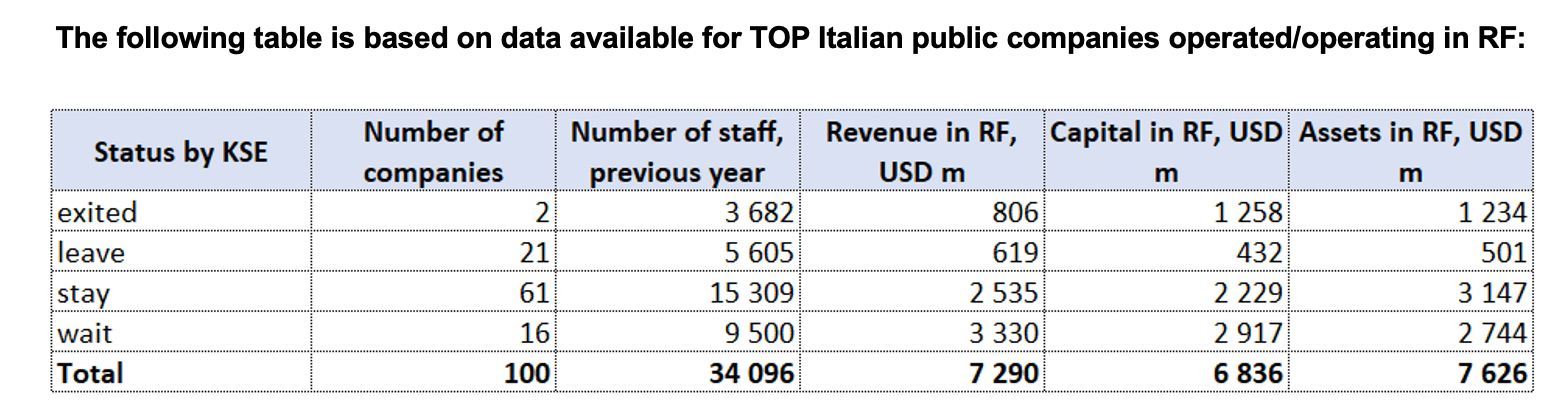

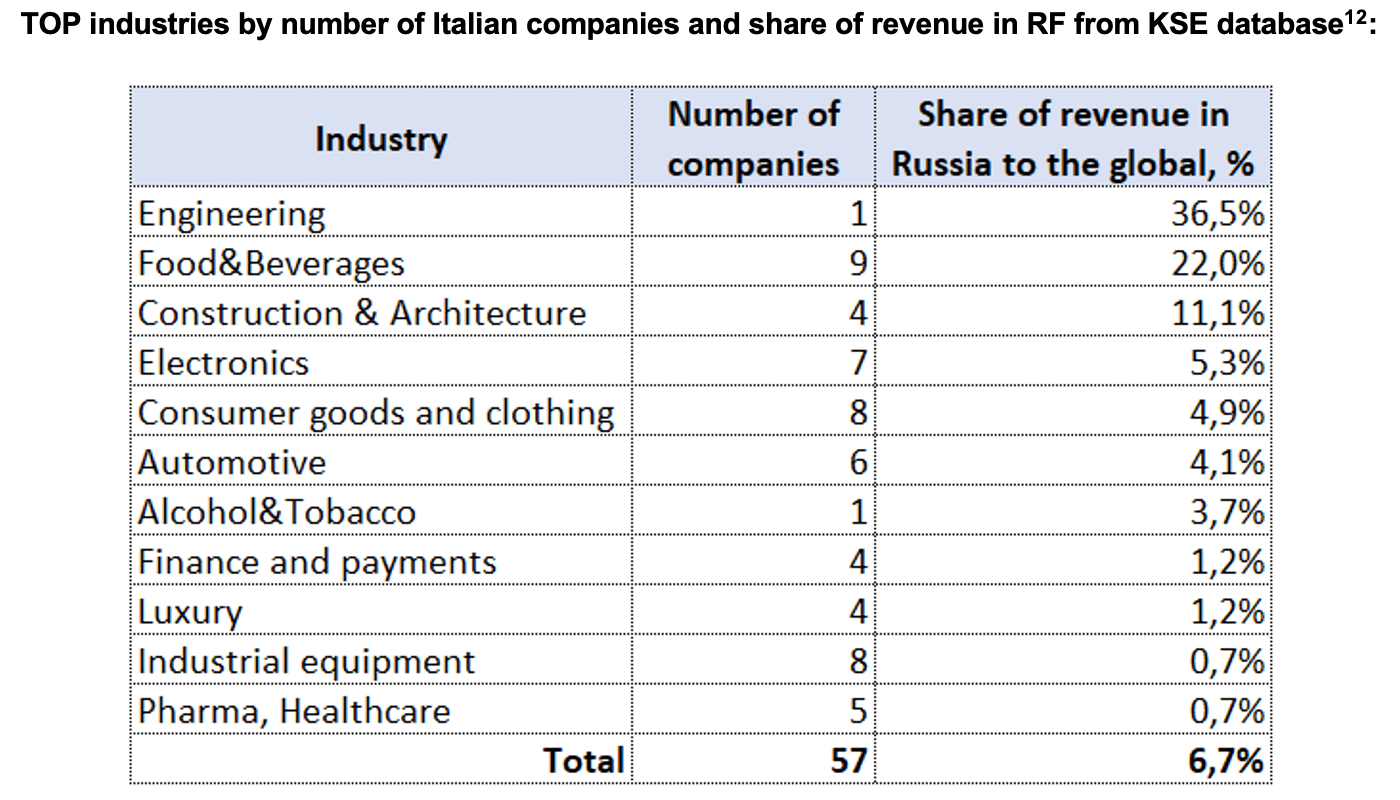

According to data collected by the KSE Institute¹⁰, in 2021 100 Italian companies provided jobs for 34,000 people, those companies generated $7.3 bn in annual revenue, had $6.8 bn in capital and $7.6 bn in assets.

Only 2 companies have already completely exited Russia by selling their shares (namely Eni and Enel), about 11% of employees have already left or will soon leave their previous jobs due to their exit.

The most “dependent” on Russia in terms of revenue share (more than 10%) in this country are Italian companies in 3 industries: Engineering, Food & Beverages and Construction & Architecture.

How are Italian companies reacting?

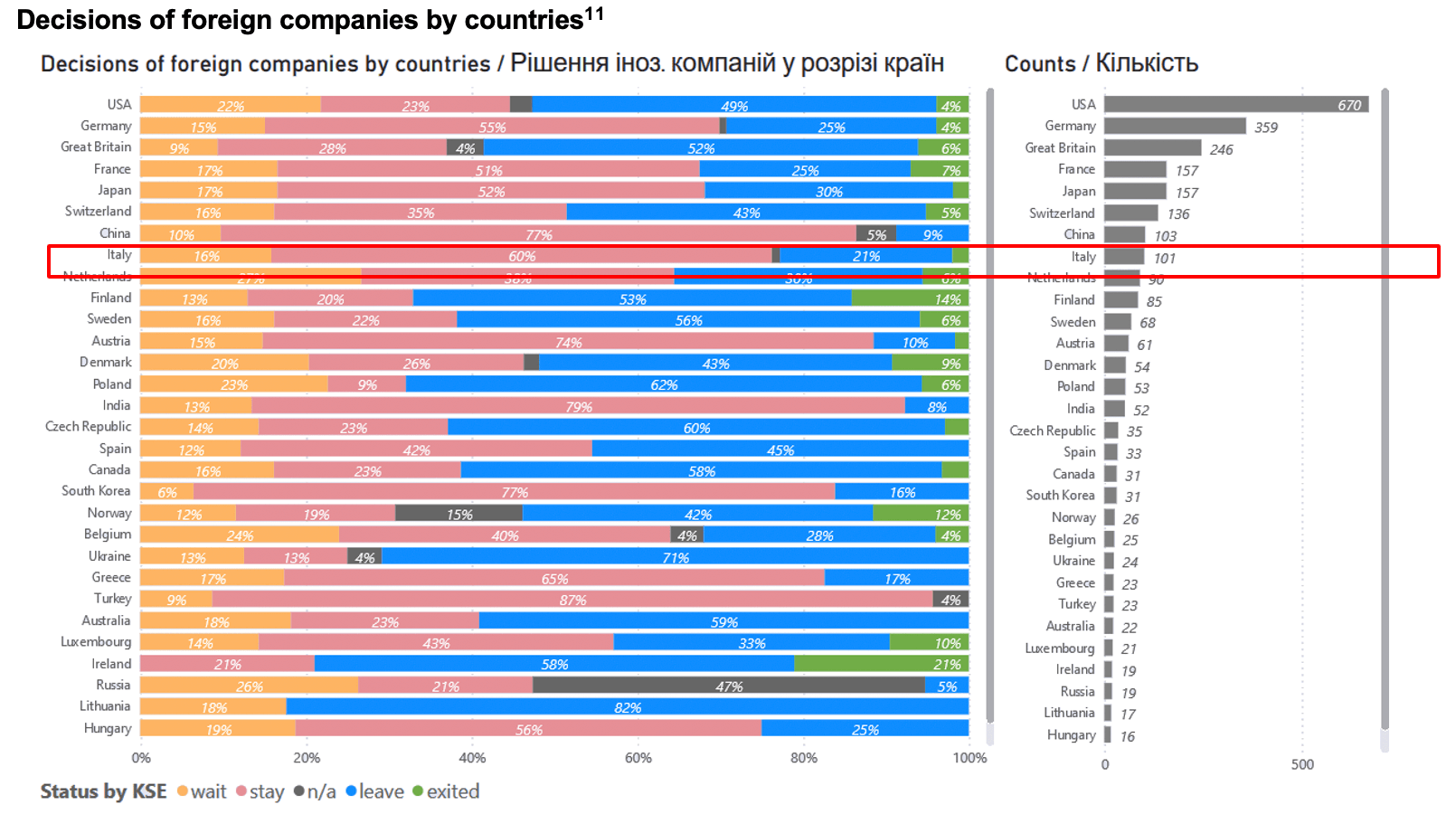

Out of 100 companies in the database, 60% of companies stay in Russia, 16% somewhat limit their activities and only 21% leave. Some of the Italian companies are among the examples of clean breaks from the Russian market, while others defy demands for exit despite pressure.

Clean breaks

• Italian energy company Enel (Status by KSE – exited¹³) On October 12, it said it had sold its entire stake in PJSC Enel Russia to Lukoil and Gazprombank-Frezia investment fund for a total consideration of 137 million euros ($133 million). In September, Russian President Vladimir Putin issued a decree that allowed the Italian energy company Enel to sell a controlling stake in the Russian company Lukoil and the Gazprombank-Frezia investment fund. The deal had been held up by Moscow’s counter-sanctions that prohibit Russian firms from closing some deals with foreign companies without Putin’s direct approval.

• Eni (Status by KSE – exited) In March, the Italian energy group Eni suspended oil purchases from Russia after its invasion of Ukraine and is closely monitoring developments in gas purchases. In August, the LLC was sold to a local legal entity.

Companies that ignore exit requirements or partially remain in Russia

• UniCredit Bank (Status by KSE – stay) Italian bank is considering selling its Russian unit through a structure that would allow the bank to buy out the subsidiary after the end of Russia’s war against Ukraine. UniCredit has already suffered losses of 1.85 billion euros from its Russian division.

• Intesa Sanpaolo (Status by KSE – wait) is an Italian international banking group. It is Italy’s largest bank by total assets and the world’s 27th largest. Intesa Sanpaolo has been working on a potential sale of its Russian business since the summer. The company said it was looking for the “best solution” for its Russian exposure, which includes both onshore business serving corporate clients and international loans.

Selected industries analysis

Automotive companies that have suspended deliveries

Ferrari (Status by KSE leave) the Italian manufacturer of luxury sports cars, suspended exports to Russia in the spring. There are two authorized Ferrari dealerships in Russia, both in Moscow, that sold several dozen Ferrari vehicles in 2021. “Given the ongoing situation Ferrari has taken the decision to suspend the production of vehicles for the Russian market until further notice,” the Italian company said in a statement¹⁴.

Lamborghini (Status by KSE leave) The Italian manufacturer of supercars Lamborghini announced the suspension of business activities in the Russian market in connection with the events in Ukraine. In 2021, Russian Lamborghini dealers sold 200 cars, which is 48% more than the year before.

Iveco (Status by KSE leave) On 20th July, Iveco Group N.V. executed a dissolution agreement with the Russian JV, IVECO AMT, also formally presenting its withdrawal from the legal entity. Accordingly, the Iveco Group stake (33.3%) was returned to IVECO AMT. Previously Iveco had been part of a joint venture with a Russian partner in a truck assembly partnership, but the company has now decided to cut all ties with the joint venture.

Automobile companies ANAS (Status by KSE – stay) and Magneti Marelli (Status by KSE – stay) received revenues in Russia in 2021. After the full-scale invasion of Russia into Ukraine, the companies did not make statements about their further cooperation.

Electronics

Well-known Italian electronics companies Ariston (Status by KSE – stay) , Candy (Status by KSE – stay), De’Longhi (Status by KSE – wait) don’t rush to leave the Russian market and do not make official statements regarding further work in the Russian Federation.

Only the Indesit company (Status by KSE leave), 60% of whose shares belong to the American corporation Whirlpool, exits the Russian market. In the summer, Turkish home appliance giant Arcelik announced the signing of an agreement with Whirlpool EMEA to acquire Indesit International JSC and Whirlpool LLC. The acquired firms have facilities in the western Russian province of Lipetsk with a total production capacity of 2.8 million units of refrigerators and laundry products — and approximately 2,500 staff.

Luxury companies that have suspended retail trade with Russia: Ferragamo (Status by KSE leave) , Moncler (Status by KSE leave), Prada (Status by KSE leave). “Prada Group suspends retail operations in Russia. Our main concern is for all colleagues and their families affected by the tragedy in Ukraine, and we will continue to support them. The group will continue to monitor further developments”. – the company announced in the spring

Summary

It should be noted that the development of Italian-Russian economic relations is hindered by the geopolitical crisis in Europe, which, in the opinion of many Italian companies, contradicts the traditional Italian business model, namely, “politics cannot enter into business.” However, some Italian companies, especially small and medium-sized businesses, want to continue doing business in Russia as usual, despite the opinion of the Italian public regarding the events in Ukraine.

Having regard to the Russian-Ukrainian war has a significant impact on Italy’s investment policy in Russia. Uncertainty and Western sanctions against Russia linked to the war are leading to inflation in both countries, which is holding back consumption by businesses. Thus, according to the OECD¹⁵, Italy’s GDP growth was affected by the war and will be 2.5% in 2022 and 1.2% in 2023. At the same time, one of the main factors related to the slowdown in Italy’s GDP growth and the deterioration of Italy’s investment opportunities is its dependence on Russian energy sources. Since Russian gas accounts for 42% of Italy’s total energy consumption, the main risk for Italian companies is the price of supplying this energy, the rise of which undermines the purchasing power of corporations and their ability to invest properly. At the same time, the Italian Government will initiate steps to completely eliminate dependence on Russian gas by the end of 2024 by searching for alternative sources of gas supply to Italy.

In view of the above, it should be noted that Western sanctions against Russia have a significant impact on the investment climate in Italy itself, which has slowed down the growth of Italy’s GDP with an increase in the inflation rate, however, at the same time, most Italian companies continue to work on the Russian market, but not because they approve of the war in Europe, but because they have a “different approach”, that is, when businessmen become politicians and vice versa, it cannot work further.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

You can also contribute by spreading the status of the company calling for the exit from Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹⁶

10.10.2022

*Sephora (France, Consumer goods and clothing) Status by KSE – stay

Former Sephora stores reopen in Russia under new ownership, Ile de Beauté brand

11.10.2022

*Nissan (Japan, Automotive) Status by KSE – leave

Japanese automaker Nissan is selling its Russian assets to Russian state ownership, with an option to buy back the business within six years, Russia’s industry and trade ministry said on Tuesday.

12.10.2022

*Extreme Networks (USA, IT) Status by KSE – stay

U.S. firm supplied networking tech to maker of Russian missiles

https://www.reuters.com/technology/how-us-firm-supplied-net

*Enel (Italy,Energy, oil and gas) Status by KSE – exited

Enel completes sale of Russian assets to domestic investors

13.10.2022

*VEON (Netherlands, Telecom) Status by KSE – stay

Dutch mobile operator Veon may separate its assets in Russia from the wider company, Russia’s Izvestia daily quoted three unidentified sources as saying on Thursday – a report that pushed Veon’s Moscow-listed shares over 20% higher.

14.10.2022

*Total Energies (France, Energy, oil and gas) Status by KSE – stay

Two associations have lodged a legal complaint against French energy giant TotalEnergies for “complicity in war crimes” for allegedly helping fuel Russian planes that have bombed Ukraine, a source close to the case said Friday.

*Mondi (Great Britain, FMCG) Status by KSE – wait

Paper and packaging group Mondi believes it will remain resilient and deliver good progress despite geopolitical and macroeconomic concerns as it awaits regulatory approval for the sale of most of its assets in Russia. https://www.businesslive.co.za/bd/companies/industrials/2022-10-14-mondi-expects-improved-results-while-russian-sale-awaits-approval/

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – exited

IKEA says it laid off 10,000 employees in Russia after suspending ops

*Mondelez (USA, Food & Beverages) Status by KSE – wait

Mondelez CEO explains why the snacking giant still does business in Russia

https://finance.yahoo.com/news/mondelez-ceo-why-were-still-doing-business-in-russia-204049695.html

*Danone (France, FMCG) Status by KSE – wait

Danone to Take €1 Billion Hit From Exiting Russia Dairy Unit

*Naspers (South Africa, Media) Status by KSE – leave

Naspers’s Prosus has entered into an agreement to sell its shareholding in Russian classifieds business, Avito, to Kismet Capital Group (Kismet), for a total cash consideration of RUB 151 billion

https://www.naspers.com/news/statement-on-sale-of-avito/

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

The American Citigroup will completely stop banking business in Russia

https://www.ft.com/content/732324f6-465c-4ff1-80cf-eaac65be300d

*Siemens Energy (Germany, Energy, oil and gas) Status by KSE – leave

Siemens Energy has sold a 65% stake in a Russia-based gas turbine joint venture to local state company InterRAO in line with its strategy to exit the country

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² Including 25 new companies with status “stay” added from https://bloody.energy/ website, without them the number of companies in this category would decrease by 3

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 28/08/2022, we have updated data for another 422 companies with data on personnel, revenue, capital and assets for 2021. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The collected information is already available and systematised in the form of a newKSE’s status “exited”.

⁶ https://www.panorama.it/economia/industria/italia-aziende-rapporti-russia-sanzioni-affari

⁷ https://altreconomia.it/lesposizione-delle-banche-italiane-in-russia/

⁹ https://decode39.com/3634/italian-companies-in-out-russia-enel-st-petersburg-confindustria/

¹⁰ https://docs.google.com/spreadsheets/d/1EFlhBQYyvRdSn4U6CY2yomeHEhTqbMKS/edit

¹³ The status relies on data from the Uniform State Register of Legal Entities in Russia (USRLE or EGRUL) and complementary analysis such as companies’ announcements and media publications of company activities.

¹⁶ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site