- Kyiv School of Economics

- About the School

- News

- 15th issue of the weekly digest on impact of foreign companies’ exit on RF economy

15th issue of the weekly digest on impact of foreign companies’ exit on RF economy

22 August 2022

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 15-21.08.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

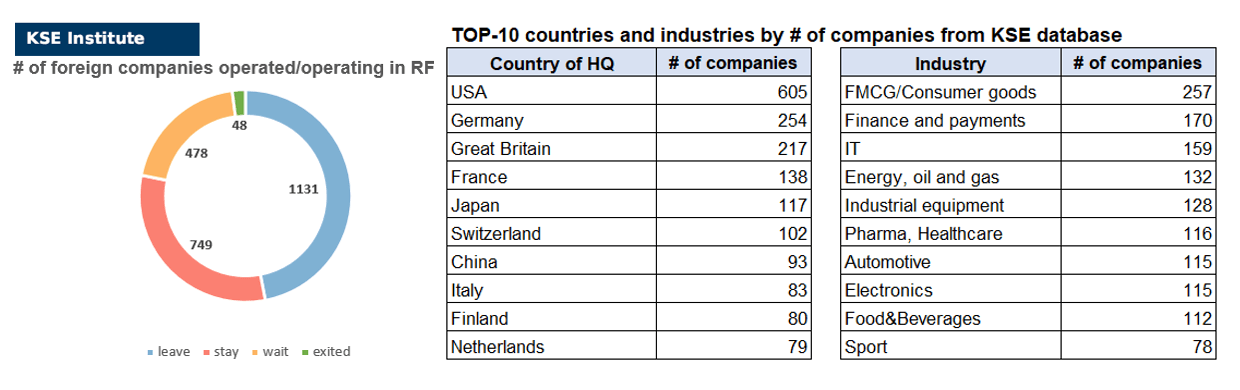

KSE DATABASE SNAPSHOT as of 21.08.2022

Number of the companies that continue Russian operations (KSE’s status «stay»¹) – 749 (+2 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status «wait») – 478 (+1 per week)

Number of the companies that have curtailed Russian operations (KSE’s status «leave») – 1 131 (+5 per week)

Number of the companies that completed withdrawal from Russia (KSE’s status “exited”) – 48 (+2 per week)

As of August 21, we have identified about 2,406 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~ 800 public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity) and updated the data for 2021, which allowed us to calculate the value of capital invested in the country (about $128.8 billion), local revenue (about $262.6 billion), local assets (about $192.7 billion) as well as staff (about 1.049 million people). 1,657 foreign companies have reduced, suspended or ceased operations in Russia. Also, we added information about 48 companies that have completed the sale of their business in Russia based on the information collected from the official registers.

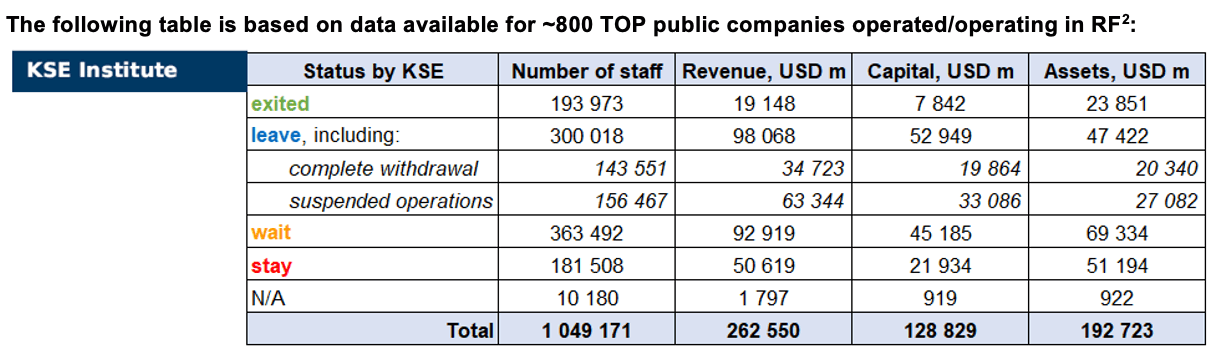

As can be seen from the tables below, As of August 21, companies which had already completely exited from the Russian Federation, had 194,000 personnel, $19.1 bn in annual revenue and $7.8 bn in capital; companies, that declared a complete withdrawal from Russia had 143,600 personnel, $34.7bn in revenues and $19.9bn in capital; companies that suspended operations on the Russian market had 156,500 personnel, annual revenue of $63.3bn and $33.1bn in capital.

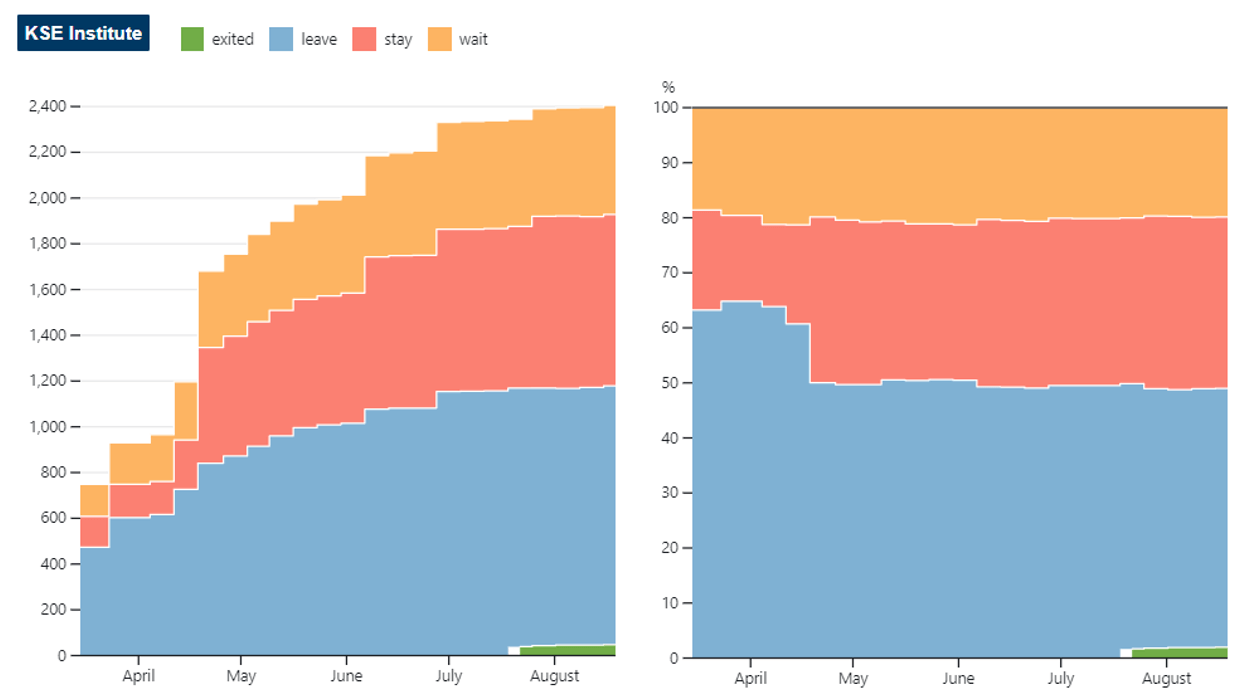

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (47.0%) of foreign companies have already announced their withdrawal from the Russian market, but another 31.1% are still remaining in the country, 19.9% are waiting and only 2.0% made a complete exit³.

More infographics and analytics see in a special section at the link https://leave-russia.org/bi-analytics

WEEKLY FOCUS: PHARMA COMPANIES STAY IN RUSSIA

After the full-scale Russian invasion of Ukraine, international pharmaceutical companies issued press releases expressing their deep sadness and concerns. At the same time, they did not stop supplying drugs due to humanitarian reasons. While some companies scaled back their activities and limited the supply to essential medicines7, many others continue to supply the whole range of their products.

“We can’t just withhold life-saving cancer drugs from Russian patients. There is international consensus that medicines are exempt from sanctions,” Roche’s chief executive Severin Schwan told Swiss newspaper TagesAnzeiger⁴.

Of 112 foreign pharmaceutical and healthcare companies in Russia, only 14 left the market, 35 scaled back, or withheld investments, and 63 kept business as usual. Companies’ actions limiting operational activities included:

- Suspension of marketing expenditures (Novo Nordisk, Novartis etc.)

- Suspension of investments (Pfizer, Bayer, Merck, Novartis, including Sandoz etc.)

- Cancelation of future clinical trials or not involving new patients in existing trials (Roche, Novartis, Pfizer, Merck, AbbVie, Sanofi, Johnson & Johnson, GSK)⁵. Only Bristol Myers Squibb⁶ stopped conducting clinical trials. It handed over its Russian commercial operations to its distribution partner in June, safeguarding access to its marketed drugs in Russia.

- Some companies stopped selling medicines that are also produced in Russia or are “non-essential medicines”⁷ (Eli Lilly, Pfizer, Bayer, AbbVie, Roche, GSK etc.).

Still, many companies could have made more efforts to stop financing the Russian war in Ukraine via taxes. Pharmagate⁸ shows examples of the pharmaceutical companies KRKA and Berlin-Chemie. Among all active substances or combinations that KRKA imported to Russia, only eight out of 105 (7.62%) are classified as “essential medicines” and are not produced in Russia. For Berlin-Chemie, this share is 10.71%. Russian producers can replace other medicines.

Russia has been highly dependent on medicines supplied by foreign companies and components for domestic production. According to rbc.ru share of foreign drugs constituted 55.5% of the market in 2021⁹. Since 2014, after the introduction of the first Western sanctions against Russia following the annexation of Crimea, Russia has been encouraging foreign companies to localize their production¹⁰. For instance, Russia introduced tender regulations, under which non-Russian drugs were banned from bidding if at least two (one since 2019) Russian drugs were registered. Russian strategy has been to deepen production localisation. Companies such as Pfizer, Bayer, Sanofi, Roche, Boehringer Ingelheim, AbbVie, Merck, etc., have been localizing their production in Russia and producing their medicines jointly with Russian pharmaceutical companies.

Despite localisation efforts, high dependency remained. Due to sanctions and logistics difficulties, patients in Russia face price increases and shortages of domestic and foreign medicines. Even though foreign companies continue shipping, there is a shortage of fillers, colorants, and packaging. But the situation is not disastrous as Russian companies buy a significant portion of substances in China and India, increasing the supply. Dr Reddy’s planned to launch new products in Russia. During the first quarter, its sales in Russia rose 70% year-over-year¹².

Since 2014 the Russian government has been preparing to avoid sanctions in various sectors, including pharmaceuticals promoting the localisation of production of foreign companies. After the full-scale invasion, large international companies reviewed their plans for localisation and canceled future investments but continued to supply medicines. And many of them did not limit the supply to only essential ones, continuing to support the war.

You can also contribute by spreading the status of the company with a call to leave Russia on social networks directly from the company cards on the website https://leave-russia.org/.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)¹³

15.08.2022

*Xiaomi (China, Electronics) Status by KSE – stay

In July, Xiaomi and its sub-brand POCO combined accounted for 42% of the Russian smartphone market, ranking first in terms of sales volume.

https://www.gizchina.com/2022/08/13/russian-smartphone-market-booms-xiaomi-claims-top-spot/

Kingdom Holding Company (United Arab Emirates, Conglomerate) Status by KSE – stay

Invested in Russian energy groups Gazprom, Rosneft and Lukoil between Feb. 22 and March 22 2022

https://twitter.com/Kingdom_KHC/status/1558818926041120768

*Tinno Mobile (China, Electronics) Status by KSE – stay

Russian mobile and electronics retail chain M.Video-Eldorado has introduced smartphones Wiko (French brand of Chinese company Tinno Mobile) in the country

16.08.2022

*Bayer (Germany,Chemical industry) Status by KSE – wait

Bayer will continue to export goods to Russia

https://alekseev.biz/news/bayer-will-continue-to-export-goods-to-russia/

https://twitter.com/smenewsorg/status/1559419421378191361

*IKEA (Sweden, Consumer goods and clothing) Status by KSE – leave

IKEA decided to liquidate its Russian “daughter”

https://www.epravda.com.ua/news/2022/08/16/690461/

*Henkel (Germany, Chemical industry) Status by KSE – leave

Henkel put up assets in Russia and Belarus for sale.

https://www.vedomosti.ru/business/articles/2022/08/15/936146-henkel-vistavil-prodazhu-aktivi-rossii

*Savills (Great Britain,Hospitality, Real estate) Status by KSE – leave

Savills real estate agency decided to leave Russia. Its Russian division will continue to work in the country under the name Intermark Real Estate.

https://www.kommersant.ru/doc/5513403?tg

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – wait

A growing number of Wall Street banks are willing to trade Russian bonds that were once viewed as untouchable.

17.08.2022

*Lindt & Sprüngli (Switzerland, Food&Beverages) Status by KSE – leave

Lindt & Sprüngli Group decided to exit the Russian market

*Uniper SE (Germany, Energy, oil and gas) Status by KSE – wait

Pummelled by gas crisis, Germany’s Uniper posts $12.5 bln net loss

18.08.2022

*Sinopec Limited (China Petroleum & Chemical Corporation ) (China, Chemical industry) Status by KSE – wait

China’s imports of US oil have hit an 18-month high as it pivots away from Russian crude

*Cleaves (Norway, Logistics, Transport) Status by KSE leave

divested from shipping companies that continue to handle Russian cargoes

https://splash247.com/cleaves-shipping-fund-divests-from-firms-handling-russian-cargoes/

19.08.2022

*SBI (Japan, Finance and payments) Status by KSE – leave

SBI Holdings Inc., Japan’s biggest online brokerage, said it will shut crypto-mining operations in Russia. Chief Financial Officer Hideyuki Katsuchi announced the plan to sell machinery and withdraw earlier this week.

*Chery Automobile (China, Automotive) Status by KSE – stay

Chery is ready to organize the production of its cars in Russia

https://iz.ru/1381396/2022-08-18/chery-gotova-organizovat-vypusk-svoikh-avtomobilei-v-rossii

*Eurasian Resources Group (Luxembourg/Kazakhstan, Metals and Mining) Status by KSE leave

halted iron ore supplies to Russia’s MMK MAGN.MM from its Kazakh operation due to Western sanctions against the Russian company

https://www.nasdaq.com/articles/erg-halts-iron-ore-supply-to-russias-mmk-due-to-sanctions

20.08.2022

*Enel (Italy, Energy, oil and gas) Status by KSE – leave

Enel writes down Russian unit’s value pending sale completion.

*Wizz Air (Hungary, Air transportation) Status by KSE – wait

WizzAir UAE planned to resume flights to Moscow from October but suspends relaunch of Russia-UAE flights as criticism mounts.

*Orsu Metals (Great Britain, Metals and Mining) Status by KSE – leave

Orsu Metals entered into a share purchase agreement (the “SPA”) providing for the sale (the “Disposition”) of Orsu’s 90% interest (the “Majority Interest”) in the Sergeevskoe gold project (the “Russian Assets”) to the holders of the other 10% interest in the Russian Assets.

https://finance.yahoo.com/news/orsu-metals-provides-disposition-russian-221000197.html

*Amcor (Australia, Consumer goods and clothing, Packaging) Status by KSE – leave

Amcor to sell factories in Russia.

https://packagingeurope.com/news/amcor-to-sell-factories-in-russia/8608.article

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ – KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

– KSE status “exited” – Companies that sold its business/assets or its part of the business to a local partner and leaved the market

² As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies, and as of 07/08/2022, we have updated data for some companies on personnel, revenue, and capital for 2021 (and will continue to do so as new data is processed). Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. The first collected information is already available and systematized in the form of a newKSE’s status “exited”.

³ On 24 July 2022, we introduced the new status “exited”, which reflects the companies’ actions to finalise the exit from the Russian market. The status relies on data from the Uniform State Register of Legal Entities in Russia and complementary analysis such as companies’ announcements and media publications of company activities. At the same time, companies’ activities can be hard to track and can be missed in the analysis, especially for companies less covered in the media. We encourage our readers to inform us if they are familiar with the companies’ actions that contradict their announcements about the exit via the Feedback Form at https://leave-russia.org/.

⁵ https://www.thepharmaletter.com/article/global-drugmakers-refusing-to-test-new-drugs-in-russia/

⁷ “Essential medicines”, as defined by the World Health Organization, are the medicines that “satisfy the priority health care needs of the population”. These are the medications to which people should have access at all times in sufficient amounts. The prices should be at generally affordable levels.

⁸ https://interfax.com.ua/news/general/853036.html

⁹ https://www.rbc.ru/business/16/03/2022/62307a2a9a7947e4d9ee0895/

¹³ Recently, a new section “Company news” was added to the project site https://leave-russia.org/, follow daily updates directly on the site