- Kyiv School of Economics

- About the School

- News

- 10th issue of the weekly digest on impact of foreign companies’ exit on RF economy

10th issue of the weekly digest on impact of foreign companies’ exit on RF economy

18 July 2022. Release №10

Prepared by the KSE Institute team and KSE members of the Board of Directors with the support of the International Renaissance Foundation; 11-17.07.2022

Disclaimer: At the beginning of the Russian invasion of Ukraine KSE Institute launched an analytical project, which was named “SelfSanctions”, aimed to collect data on foreign companies operating in the Russian market and limiting or terminating their activities. Examination of data was conducted jointly with specialists from the Ministry of Economy, the Ministry of Foreign Affairs and the Ministry of Digital Transformation of Ukraine. The database contains a lot of information, we collect daily statistics on changes in the status of foreign companies operating/operated in the Russian market and limiting or terminating their activities. Also, we created the Telegram bot https://t.me/exit_ru_bot for tracking/monitoring of news on priority foreign companies (coverage 1, 2, 3 or 7 days of monitoring). Also, we do regular analysis of changes in share prices and capitalization of parent groups of companies that have or have had business in Russia.

KSE database is partly based on the Yale’s School of Management database, epravda.com.ua, squeezingputin.com, leave-russia.org websites and other open sources. Data is verified and KSE status is assigned. Data on stocks is taken from Google and Yahoo Finance. At the same time, the KSE database is more complete and comprehensive and contains ~40 percent more information than most other similar databases, as it also includes data on number of staff, revenue, capital and other financial indicators, the latest updates and changes in statuses, links to used sources, and daily updates from the telegram-bot etc.

KSE Institute is glad to announce have finalized merging with project leave-russia.org which was developed by a team of volunteers.

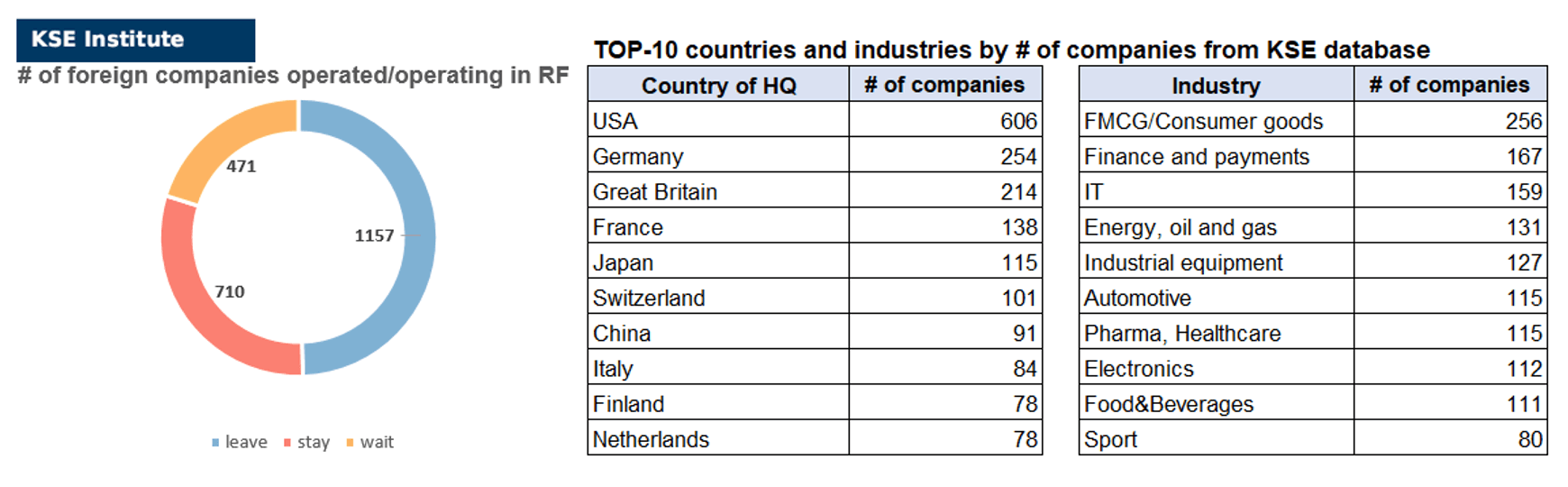

KSE DATABASE SNAPSHOT as of 17.07.2022

Number of the companies that continue Russian operations (KSE’s status “stay”¹ ) – 710 (+1 per week)

Number of the companies that have reduced current operations and hold off new Investments (KSE’s status “wait”) – 471 (+2 per week)

Number of the companies that have curtailed Russian operations (KSE’s status “leave”) – 1 157 (0 per week)

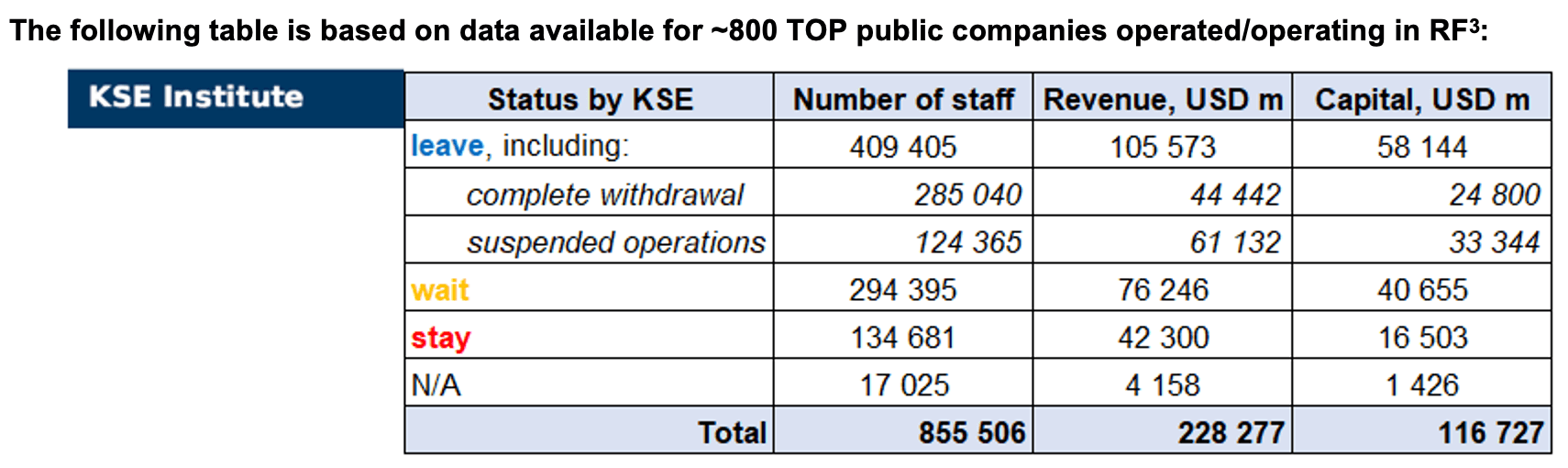

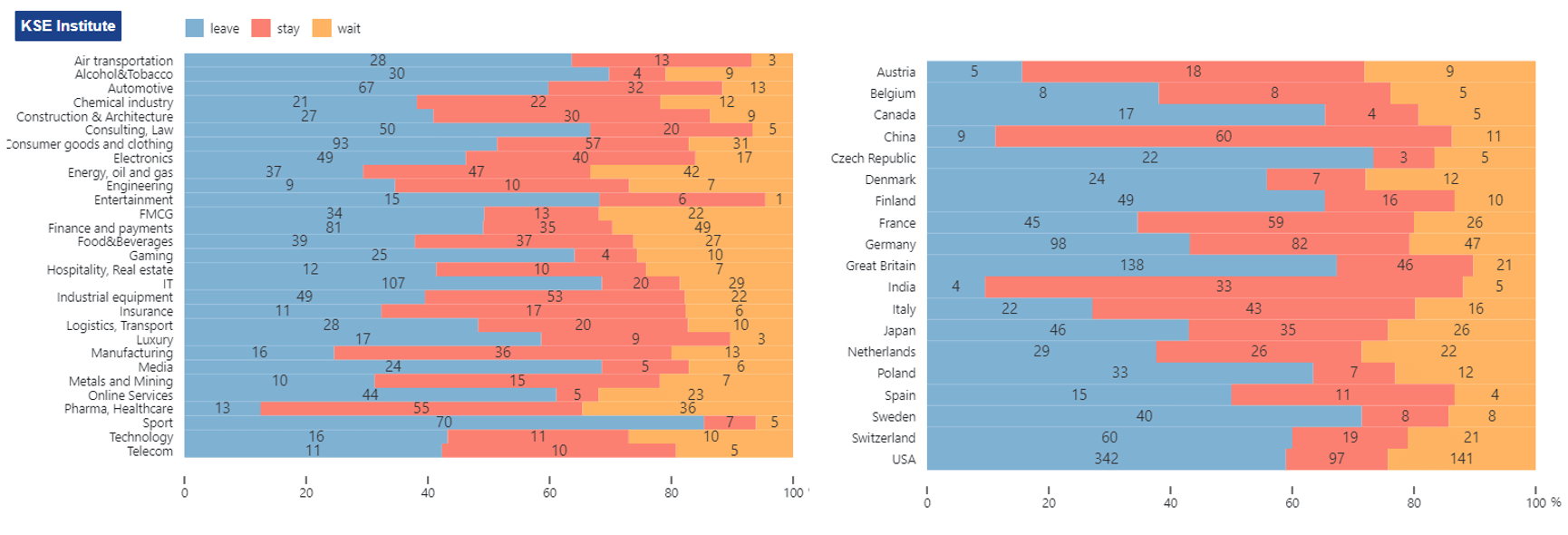

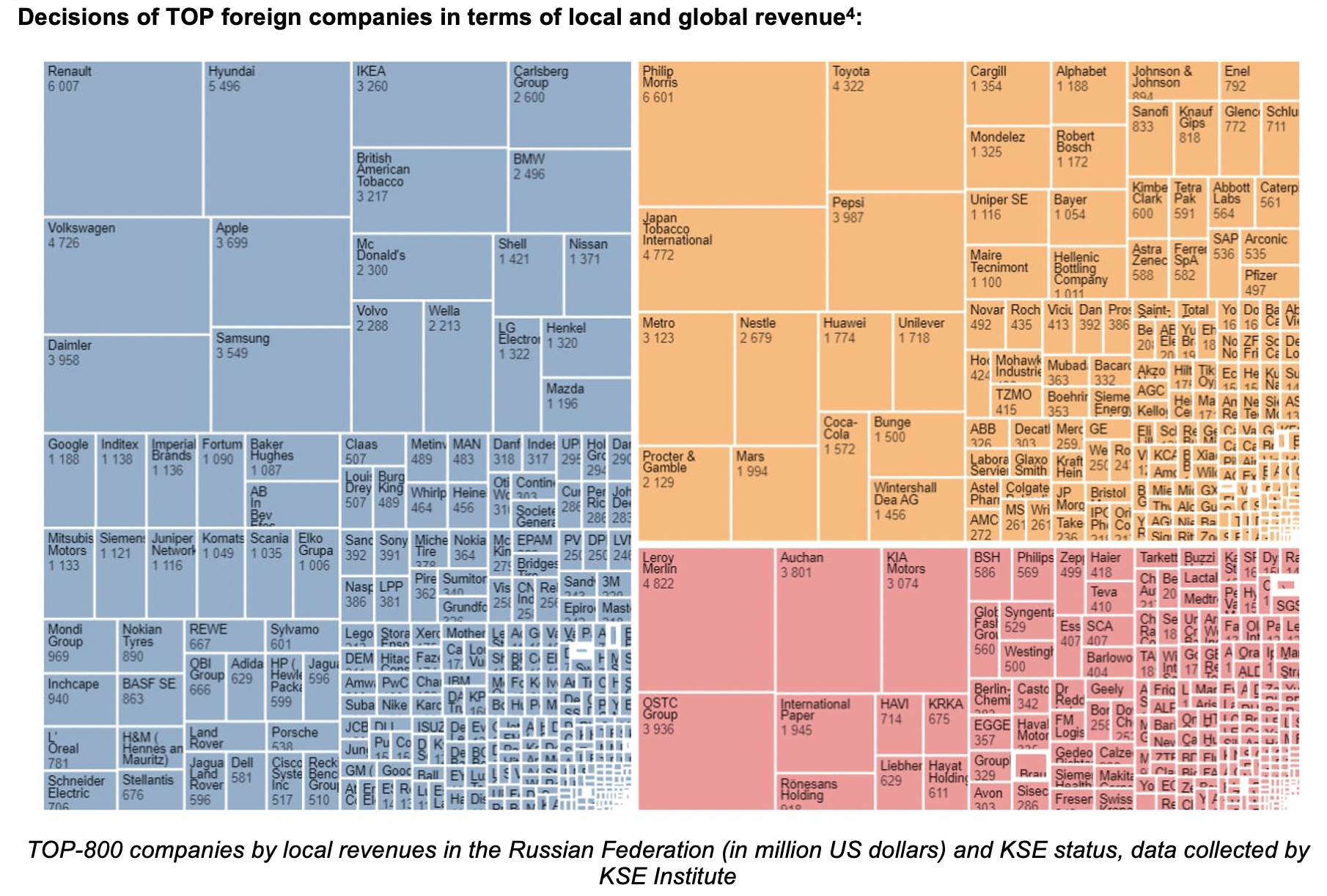

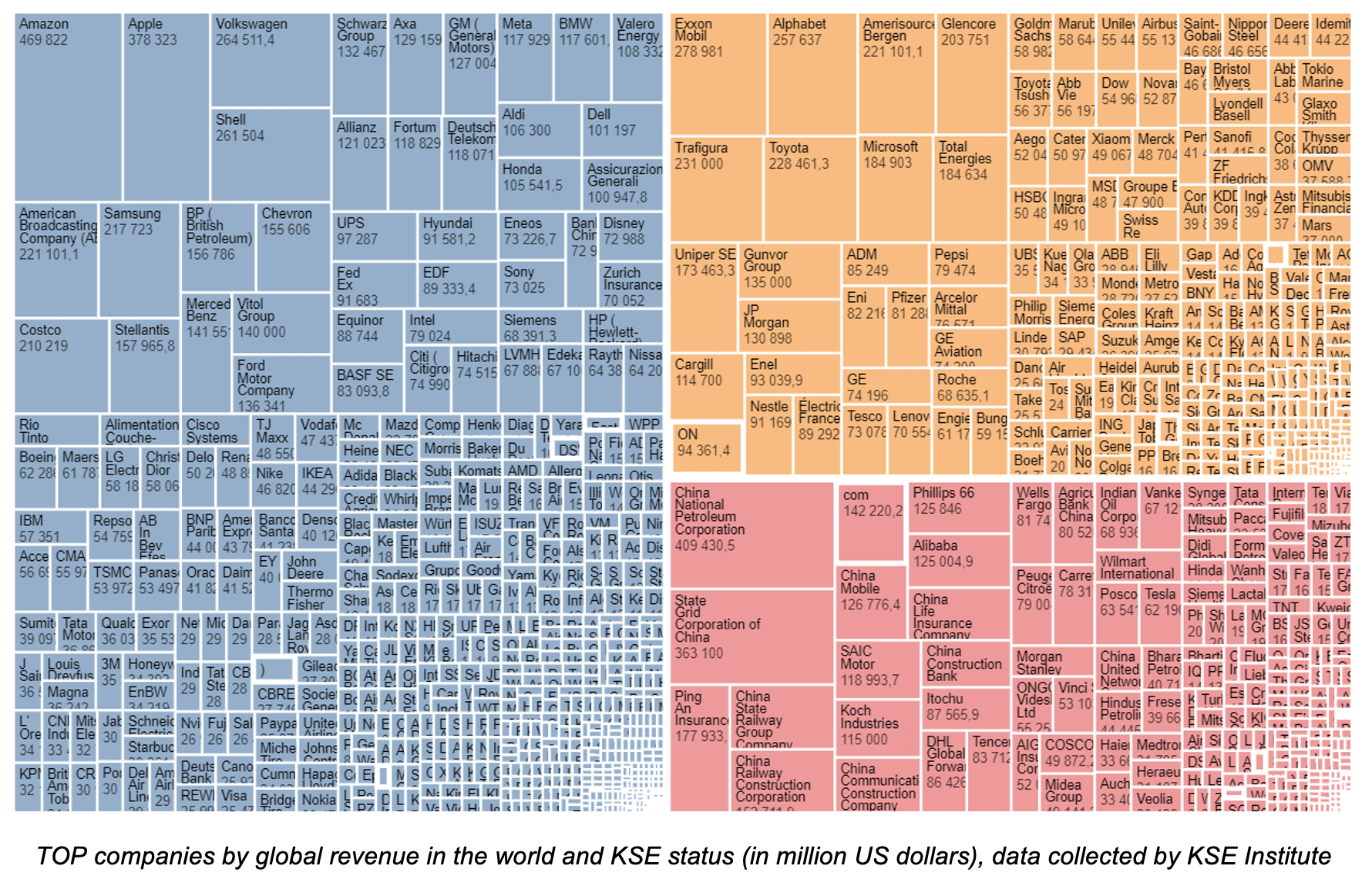

As of July 17, we have identified about 2,338 companies, organizations and their brands from 78 countries and 56 industries and analyzed their position on the Russian market. About half of them are public ones, for ~800² public groups of companies, we also identified (where it was possible) their operating business in Russia (the presence of a controlling stake in a legal entity), which allowed us to calculate the value of capital invested in the country (about $116.7 billion), local revenue (about $228.3 billion), as well as staff (about 0.855 million people). 1,628 foreign companies have reduced, suspended or ceased operations in Russia.

As can be seen from the tables below, As of July 17, companies that declared a complete withdrawal from Russia had $44.4bn in revenues and $24.8bn in capital; companies that suspended their operations on the Russian market had yearly revenue of $61.1bn and $33.3bn in capital. TOP-70 companies-the largest taxpayers paid ~ $20,2bn of taxes annually – haven’t completely withdrawn yet, although suspended or scaled back.

If since the beginning of the Russian invasion of Ukraine, the percentage of companies that closed operations in Russia has risen sharply by mid-March, in the last month the ratio of those who leave or stay is virtually unchanged. although we still see a periodic increase in the share of those companies that remain in the Russian market. However, about a half (49.5%) of foreign companies have already announced their withdrawal from the Russian market, but another 30.4% are still remaining in the country.

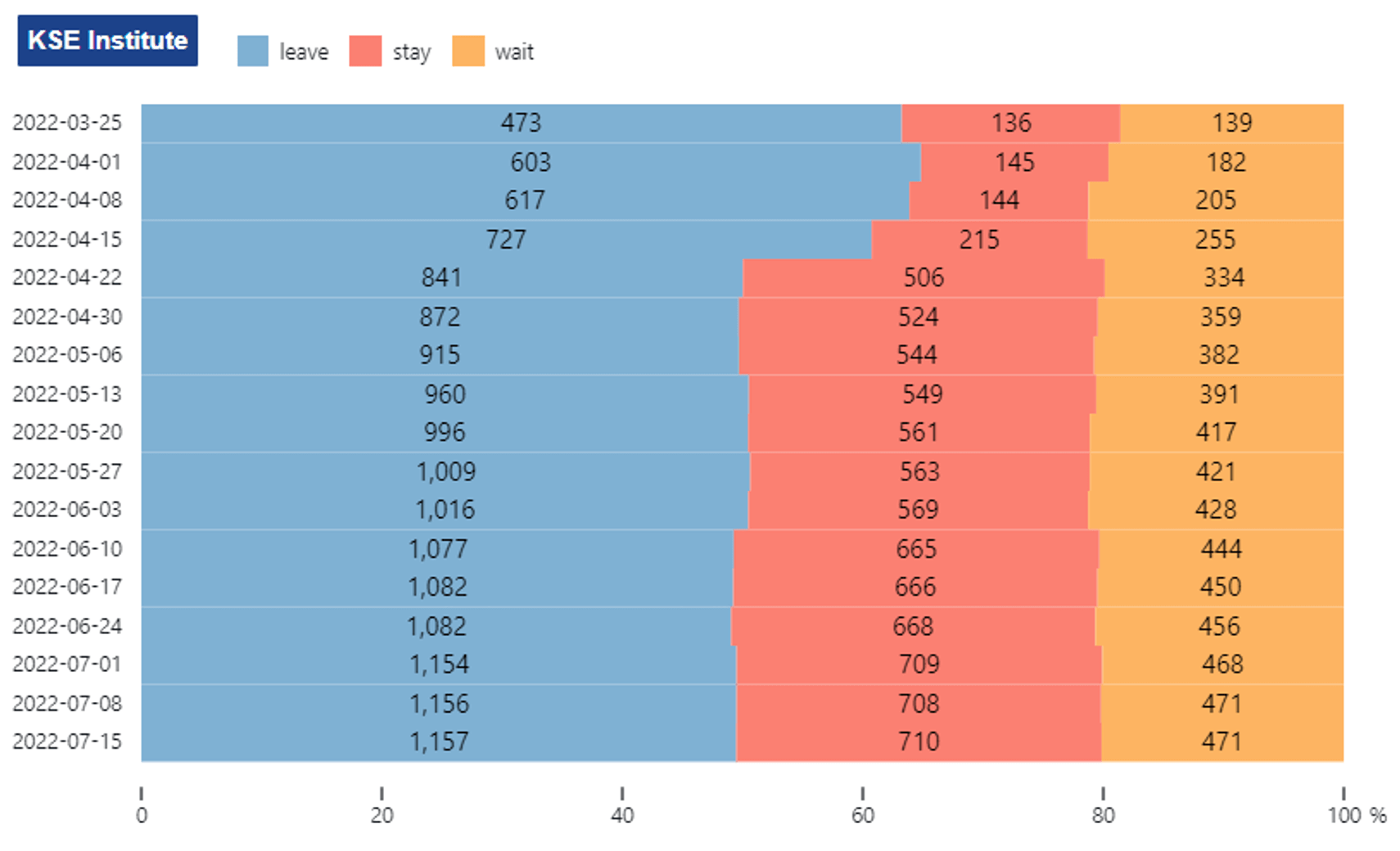

The actions of companies by sector (based on the KSE database, with at least 20 companies representing the industry or country) are shown in the graphs below.

Decisions of foreign companies by country and sector:

WEEKLY FOCUS. BIG FOUR INTERNATIONAL OIL SERVICE COMPANIES IN RUSSIA

The big four international oil servicing companies are Baker Hughes (US), Halliburton (US), Schlumberger (Netherlands), and Weatherford (US). Sanctions heavily restrict their operations in Russia, and companies are reported to look for ways to exit the market. However, at the moment, they remain in the country.

Oilfield service companies provide geological exploration services, produce equipment for drilling wells, maintain pipelines, and develop IT solutions for the oil and gas industry. There are different estimates of the market share of international oil field service companies in Russia, but not higher than 20%. According to Vygon Consulting, as published in Russian media, the share of Schlumberger in the Russian market of oilfield services reaches 8%, Weatherford – 3%, and Halliburton and Baker Hughes – 2% each. The market share is not large, but in some spheres, dependency is substantial. Advanced technologies of international companies are essential for developing complex fields, geological exploration, enhanced oil recovery, and software for oil and gas companies.

First sanctions that limited companies’ activities were introduced by the US on 8 March 2022. The US imposes restrictions on equipment exports to Russia for oil and gas production. In response, Weatherford, Baker Hughes and Schlumberger announced that they stopped all new investments, will not take new projects and will not supply new equipment. These sanctions did not forbid the implementation of the ongoing projects. Only Halliburton announced that it would wind down all of its operations. Though it did not happen overnight, the company has remained on the market like its competitors.

On 15 March 2022 EU introduced the fourth package of sanctions. It banned all transactions with publicly controlled companies, including Rosneft and Gazprom Neft. After a two-month wind-down period, it came into effect on 15 May 2022. As a result, companies’ operations in Russia were limited further. Companies have not made any new statements on their operations in Russia, though Russian media sporadically publish updates on their activities. In particular, The American Baker Hughes, according to Kommersant, has terminated all existing contracts with its Russian counterparties, agreeing to pay fines for non-performance.

Kommersant also cites the Letter from Halliburton’s Vice President Graham Taylor to employees. It states that Halliburton, in agreement with the authorities of the United States and Switzerland, transferred the ownership of its business in Russia from the Swiss legal entity Halliburton International GmbH to LLC Burservis. It also mentions that Halliburton eventually plans to transfer its business in the Russian Federation to Russian management.

Schlumberger has also been reported as considering transferring its business to local management. Before the Russian invasion of Ukraine, the company’s strategy was investing in local personnel, infrastructure and technology. As a result, the company has many subsidiaries and partners, invests in education and R&D. The company’s website states that Schlumberger has 11,500 employees in Russia, 95% of them are RF citizens, 2,500 Russian suppliers, and 50 universities participate in the company’s programs.

Schlumberger has the highest exposure to Russia among the companies. JPMorgan estimates that the share of RF in total companies revenues is 8%. For Weatherford, it is 5-7%. For Baker Hughes, it is up to 5%, while for Halliburton, it is only 2%. Still, exposure is not extremely high for any international oil service companies. They can and should leave Russia. Their exit will not have an immediate impact on oil production but will lead to the deterioration of imported equipment and the inability to replace it. It may impact future oil production and its efficiency.

What’s new last week – key news from Daily monitoring

(updated on a weekly basis)

11.07.2022

*AB Electrolux (Sweden, Electronics) Status by KSE – leave

Electrolux Professional, a subsidiary of Swedish home appliance manufacturer Electrolux, is selling its Russian business.

*Metso Outotec (Finland, Industrial equipment) Status by KSE – leave

Metso Outotec to book a non-recurring charge of EUR 150 million related to winding down its business in Russia.

*Mercedes-Benz (Germany, Automotive) Status by KSE – leave

German carmaker Mercedes-Benz is considering selling the property of its distributor in Russia to one of its dealers, including Panavto, Avtodom, Avilon and Major Auto, Russian business newspaper Kommersant reported on Monday, citing sources close to the matter. The Mercedes-Benz plant in the RF is not included in the deal, it does not operate, like most automotive industries in the country.

12.07.2022

*Sephora (France, Consumer goods and clothing) Status by KSE – leave

Sephora enters into an agreement for the sale of 100% of the shares of its subsidiary in Russia

https://ria.ru/20220307/sanktsii-1777012355.html

*Lush (Great Britain, FMCG) Status by KSE – leave

Lush will close its remaining stores in Russia

https://ipress.ua/news/kosmetychna_merezha_lush_ta_sephora_zakryvaie_biznes_u_rosii_331477.html

https://www.kommersant.ru/doc/5458686

*Lego (Denmark, Consumer goods and clothing) Status by KSE – leave

Considering the continuing significant violations of the operating environment, we have decided to suspend commercial activities in Russia for an indefinite period. This includes the termination of most of our Moscow team and our partnership with Inventive Retail Group

https://incrussia.ru/news/lego-leaves/?amp

*Citi (Citigroup) (USA, Finance and payments) Status by KSE – leave

Citigroup and Citibank refused to be payment and transfer agents for Eurobonds of Belarus

https://www.minfin.gov.by/ru/public_debt/pressreleases/dc6ebeb871d54308.html

*Atlassian (Australia, IT) Status by KSE – wait

suspended new software sales to Russia, suspending existing Russian government-owned licenses as well as licenses to specific Russian businesses that support the war, but did not terminate the relationships and obligations to existing small business customers in Russia, will donate all future revenue generated from Russia to Ukrainian causes

13.07.2022

*AirSlate (Ukraine, IT) Status by KSE – stay

Ukraine’s unicorn AirSlate has an office in Russia, no plans to shut it down

https://ain.capital/2022/07/13/airslate-does-not-plan-to-shut-down-its-office-in-russia/

*European Space Agency (ESA) (France, Aerospace) Status by KSE – stay

That momentary suspension has now been made ultimate. Because the conflict grinds on and the West makes an attempt to additional isolate Russia, Josef Aschbacher, ESA’s director common, introduced on Tuesday that ties on the rover mission had been reduce for good.

https://twitter.com/AschbacherJosef/status/1546899245998948354

https://specialnews.net/european-space-agency-cuts-ties-with-russia-on-its-mars-mission/

*Pepsi (USA, FMCG) Status by KSE – wait

PepsiCo reported a quarterly loss of $1.17 billion due to the impairment of assets in the Russian Federation

https://ru.investing.com/news/cryptocurrency-news/article-2167403

14.07.2022

*Nord Axis Limited (China, Energy, oil and gas) Status by KSE – stay

*Trafigura (Singapore, Metals and Mining) Status by KSE – wait

Trafigura said in a statement on Wednesday that its 10 per cent stake in Vostok Oil, a gargantuan Arctic development backed by Russian president Vladimir Putin, had been sold to “an independent Hong Kong registered trading company”, Nord Axis Limited.

https://www.ft.com/content/62cc84da-3737-41eb-8d3c-d26590506430?shareType=nongift

*Tik Tok (China, Online Services) Status by KSE – leave

TikTok is no longer advertising for employees in Moscow, following a Washington Free Beacon report that the company was seeking hires in Russia a few months after announcing it had suspended operations in the country.

15.07.2022

*Elopak (Norway, Packaging) Status by KSE – leave

Elopak to sell Russian operations to local management and exit market, previously suspended operations since March 4th.

*Hortex (Poland, Food & Beverages) Status by KSE – leave

Hortex left the Russian market. The new owner of Ortika Frozen Foods, which is responsible for the import and sale of frozen products under this brand in RF, is the Agama group. “Interfax” reports with reference to the data of the Unified State Register of Legal Entities.

16.07.2022

*Starbucks (USA, Food & Beverages) Status by KSE – leave

Starbucks set to sell Russian business to restaurateur Anton Pinskiy

*Danfoss (Denmark, Industrial equipment) Status by KSE – leave

Danfoss have signed agreement to divest the business in Russia and Belarus to the local management to exit Russia completely

*Calrec Audio (Great Britain, Media) Status by KSE – wait

Calrec Responds to Critics Who Claim Company Supports Russian Aggression

It says it maintains stringent compliance controls and immediately took steps to cease all commercial activities in Russia and Belarus.

Get more details on a daily basis:

KSE Telegram bot on news monitoring @exit_ru_bot

Twitter of SelfSanctions project

¹ KSE status “leave” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that are completely shutting down in Russia or companies that have officially announced that they are temporarily reducing operations in Russia

– KSE status “wait” – Companies that have published on the company’s official website (or their release has appeared in a foreign publication such as FT, NYT, etc.) that they are reducing only part of their business operations by continuing to work on other operations or companies that have reported delaying future investment / development / marketing , while continuing their core business

– KSE status “stay” – Companies that ignore exit / downsizing requirements in Russia, as well as companies that have officially stated that they remain in Russia or news of their exit have not been found

² +400 new public groups of companies added a total of approximately + $30 billion in annual revenue and +114 thousand staff as of 19/06/2022

³ As of 19/06/2022, we updated the database with extended information on ~ + 400 new companies. Also, we started to monitor additionally whether companies really stated any actions to exit the country (currently we observe a very small number of such companies). So far we found information only about a few companies which started selling their business in Russia. Even for most of them – it’s just an intention or they just started the process of sale. Everything else is mostly the statements or some preliminary steps. More details will be available soon once we analyze more data/information and find the reputable sources for verification.

⁴ KSE Institute started to develop new BI analytics module with a lot of dashboards, which will be available at the https://leave-russia.org/ website soon, follow us for updates

⁵ https://www.angi.ru/news/2899058-Что+не+так+с+импортозамещением+в+нефтесервисном+секторе/?_utl_t=tw

⁸ https://www.slb.com/newsroom/press-release/2022/pr-2022-0318-update-on-russia

¹¹ https://www.kommersant.ru/doc/5412128

¹² https://www.kommersant.ru/doc/5356225