- Kyiv School of Economics

- On the Taxation of Heated Tobacco Products: The Benefits of Following Current Law’s Schedule for for HTPs: Analysis of 5600 proposal

On the Taxation of Heated Tobacco Products: The Benefits of Following Current Law’s Schedule for for HTPs: Analysis of 5600 proposal

2021

Heated Tobacco Products (HTP)

Until 2020, the heated tobacco units, or sticks (e.g., PMI’s HEET sticks, BAT’s Neosticks), used with heated tobacco products’ devices (e.g., PMI’s IQOS, BAT’s iGlo) have been taxed, by default, under the category “Tobacco and tobacco substitutes”. HTP devices are not subject to excise tax. Since Jan 1, 2020, this tax rate was UAH 1,139.76 (€ 39) per 1 kg or UAH 347.63 per 1000 HTP sticks. On May 21, 2020, President Volodymyr Zelenskyi signed Bill #1210, “On Amending the Tax Code of Ukraine on Improving Tax Administration, Eliminating Technical and Logical Inconsistencies in Tax Law,” which became Law 466-IX. The law imposed a pure specific excise tax on heated tobacco, starting from 1st January 2021 with a rate of UAH 1,456.33 per 1,000 pieces, equivalent to that of cigarettes. The rate will keep increasing every year after that, in line with the tax rate on cigarettes, to reach a total excise of UAH 2,516.54 per 1,000 pieces by 2024.

The tobacco industry has proposed a different tax increase schedule for new tobacco products that would automatically annul the provision for heated tobacco products under Law 466-IX. The proposal #5600 proposes to fix the specific excise tax at 2021 level of 1,456.33 per 1,000 pieces for the next three years. Correspondingly, the rate will not keep increasing every year after that and would not reach a total excise of UAH 2516,54 per 1,000 pieces by 2024.

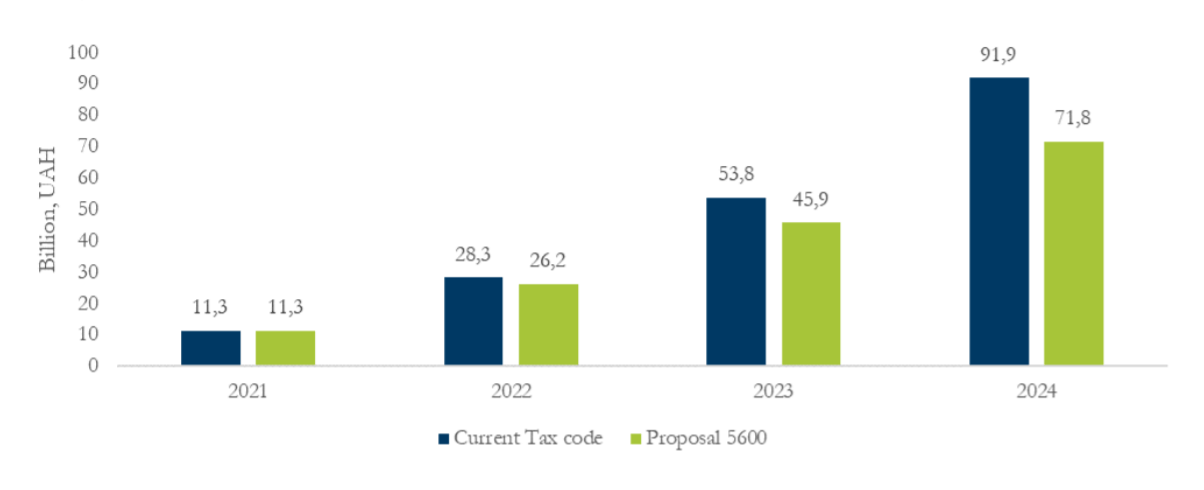

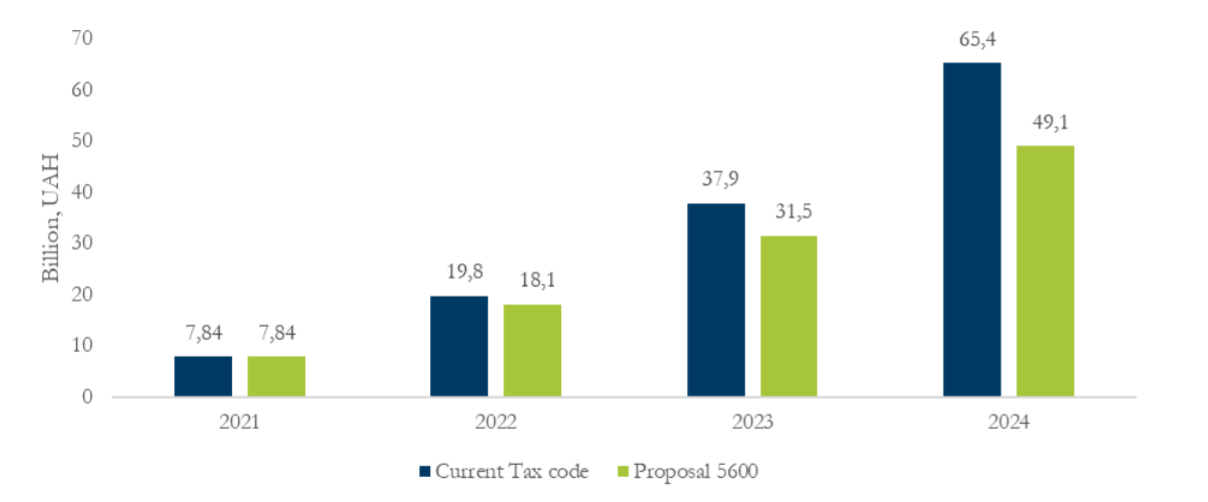

Under the current tax system, the total tax revenue from HTUs (VAT, state excise tax, local retail tax) over the next four years (2021-24) would be UAH 20 billion larger than the industry’s proposal. We estimate the total tax revenue accumulated over the next 4 years as UAH 91,9 billion under the current tax system (including UAH 65,4 billion of state excise tax revenue), but only UAH 71,8 billion under the industry’s schedule for the same period (including UAH 49,1 billion of state excise tax revenue).

It is important to note that the market for HTP is in a natural growing phase, as users are becoming more exposed to it due to growing manufacturing and sales promotions from the tobacco companies that sell them. As of 2019, only 3.3 billion HTUs were legally sold in Ukraine, representing only 7% of the size of the legal cigarette market (45 billion cigarette sticks sold in 2019). This amount was 4.4 times as large as the amount imported in 2017 (about 0.75 billion sticks of heated tobacco). We estimate the total consumption of HTUs including illicit sales of HTUs to be 3.5 billion sticks in the base year. Our model accounts for the natural growth of HTP sales due to market forces and in spite of tax and price increases. Our assumption is an annual natural growth of 33%. That’s the annual growth rate of HTP and cigarettes sales (volumes of sticks) in the “Eastern European Region” from 2016-2020. As a result, over the next 4 years, 3 current law would reduce the natural growth rate of HTP consumption by a larger amount than that of the industry proposal.

Accumulated total HTU tax revenue flows under current Tax Code and industry’s proposal

#5600, 2021-2024

Accumulated HTU excise tax revenue flows under current Tax Code and industry’s

proposal #5600, 2021-2024

Authors:

• Estelle P. Dauchy, PhD, Campaign for Tobacco Free Kids, International Research. E: [email protected]

• Pavlo Iavorskyi, Kyiv School of Economics & Vox Ukraine. E: [email protected]