- Kyiv School of Economics

- About the School

- News

- Ukraine’s economy is showing resilience, but another year of war will have serious consequences for macroeconomic stability — Ukraine Macroeconomic Handbook by KSE Institute

Ukraine’s economy is showing resilience, but another year of war will have serious consequences for macroeconomic stability — Ukraine Macroeconomic Handbook by KSE Institute

8 July 2025

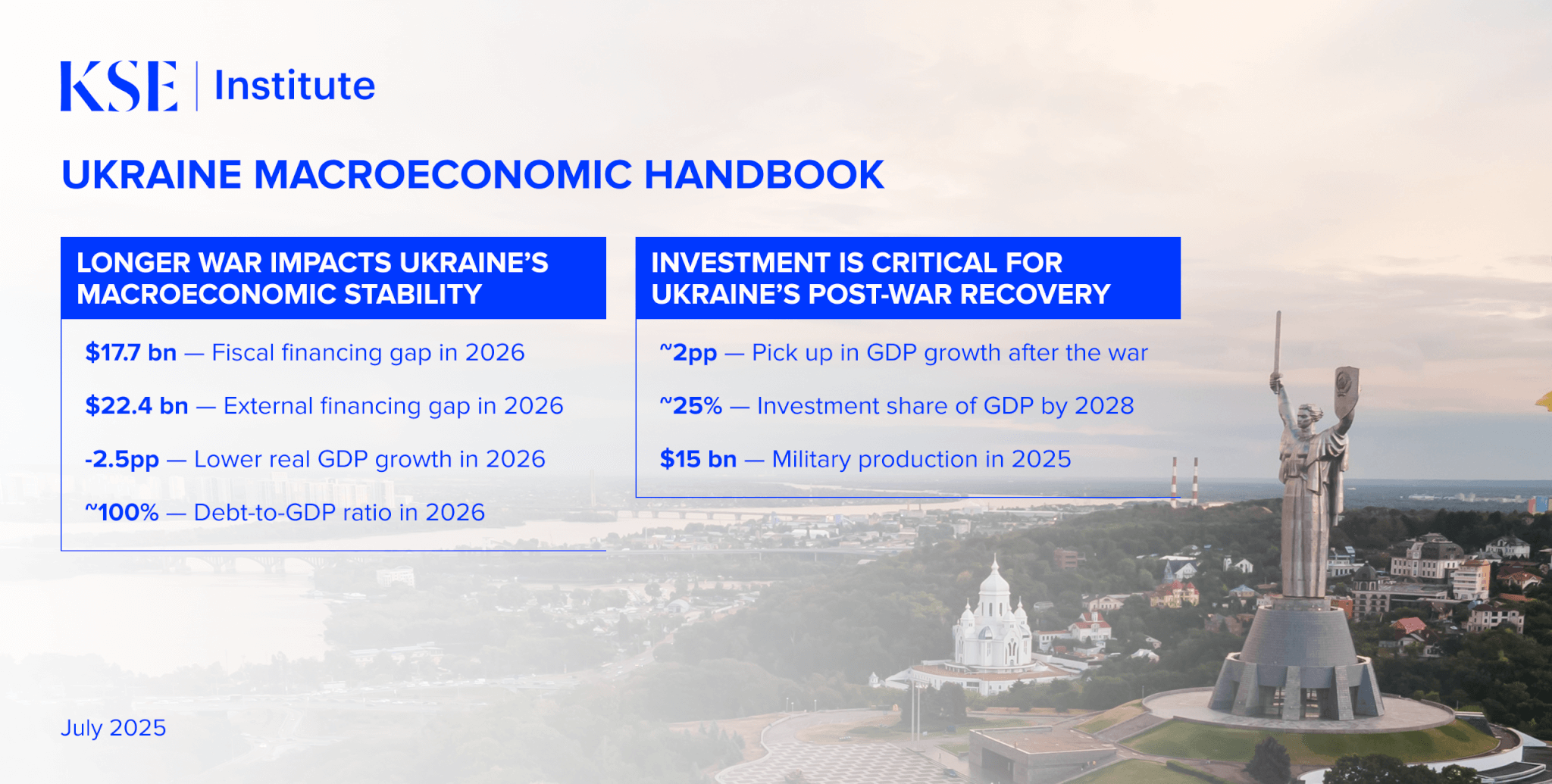

In its July Ukraine Macroeconomic Handbook, KSE Institute highlights the impact of a longer war on Ukraine’s macroeconomic stability, including fiscal and external financing. Recent developments clearly show that Russia currently has no interest in any ceasefire or peace agreement. As the aggressor’s assessment of the situation is unlikely to change in the absence of significantly stepped-up economic pressure on Russia via sanctions and increased military aid to Ukraine, it is no longer prudent to base economic projections on an assumed end to the war this year. Thus, the July forecast is based on the assumption that hostilities will continue throughout most of 2026 with some kind of ceasefire before the end of the year.

The war’s extension far into 2026 has serious consequences for macroeconomic stability, while also weighing on growth and delaying the recovery. Due to sharply higher defense spending, the 2026 budget is underfinanced by $17.7 billion. At the same time, weaker foreign investments, elevated resident outflows, lower remittances, and other war-related distortions to the balance of payments will widen the external financing gap to $22.4 billion next year. This will lead to substantial reserve losses and the erosion of important macroeconomic buffers, which have been built up over the last three years.

An additional year of war creates significant challenges for the viability of Ukraine’s macroeconomic frameworks, with a growing debt burden potentially crowding out investments in the economy’s future. Even without further borrowing or the provision of additional financial assistance, debt as a share of GDP is projected to approach 100% in 2026. Sharply wider fiscal and external financing gaps mean, however, that Ukraine’s partners urgently need to consider new support mechanisms that ensure the sustainability of the country’s debt. One option would be to model them after the ERA, which is repaid using proceeds from frozen Russian assets. For the post-war period, a dedicated funding mechanism for defense needs should be established (see Special 2).

Ukraine’s economy will grow at a robust pace and undergo structural changes after the war. Real GDP is projected to grow by around 5% annually in 2027-28, driven by reconstruction efforts and stronger investment. As defense spending declines, investment—particularly in energy, transport, manufacturing, and the military-industrial sector—will become the main growth engine, alongside private consumption. Capital investment is expected to reach about one-fourth of GDP by 2028. The war’s legacy will continue to shape the recovery, with persistent challenges, including infrastructure damage, energy insecurity, and labor shortages weighing on growth. Each additional year of war deepens these problems and makes the return of migrants less likely. Even with robust growth, real GDP is expected to remain around 10% below pre-war levels by 2028, highlighting the need for reforms, improved investor confidence, and efficient use of capital.

Inflation is projected to ease gradually to around 7% y-o-y by mid-2027. The NBU’s tight stance will help to decrease inflation after its peak of 15.9% y-o-y in May 2025; however, a return to the 5% target will likely be delayed beyond 2028 as monetary policy is loosened to support the recovery. Upside risks remain, especially from weather-related shocks. Inflation expectations, while elevated (~10%), remain broadly stable, reflecting the NBU’s credibility. Wage pressures and energy costs will continue to shape the inflation trajectory. The NBU will gradually shift towards a softer monetary policy from 2027 as inflation pressures ease. The exchange rate is set to stabilize, with the Hryvnia expected to gradually align with improving fundamentals. A shift of foreign exchange reserves towards the Euro would reflect deeper EU integration and help reduce currency mismatches, supporting monetary stability.

Structural mismatches in the labor market will not disappear with the end of the war, but may be softened due to reskilling policies and the reintegration of vulnerable groups. The unemployment rate is expected to drop to ~7.5% during the post-war period, with a spike right after the end of the war. The average wage will continue to grow swiftly—due to the unmet labor demand—by 6-8% y-o-y in real terms, reaching UAH 40,000 in 2028.

The forecast differs from those of other institutions due to the assumption about the war’s timeline. Both the IMF and the Ministry of Finance (in its baseline scenario) continue to base their numbers on an end to hostilities in 2025. This has major implications for the budget deficit and Ukraine’s external balance. However, other institutions fundamentally align with our view on the economy’s gradual recovery, the overall inflation and exchange rate outlook, and wage dynamics after the war. Overall, Ukrainian authorities, the IMF, and KSE Institute all see sustained robust growth, fiscal consolidation, and external support as essential for maintaining macroeconomic and financial stability, as well as debt sustainability.

The forecast presented in the Ukraine Macroeconomic Handbook covers Ukraine’s macroeconomic trajectory for 2024-28 under ongoing Russian aggression and takes into account current and future opportunities for the country after the end of the war. The July 2025 edition of the Macroeconomic Handbook provides an overview of economic activity, sectoral dynamics, foreign trade, capital flows, the budget, public debt, inflation, monetary policy, exchange rate dynamics, and the labor market. In addition, the document includes two special features on the cost of an additional year of war and on further defense financing.