- Kyiv School of Economics

- About the School

- News

- Russian Sanctions Digest, August 2024

Russian Sanctions Digest, August 2024

13 August 2024

August Sanctions Digest: Urgent Need for Stricter Enforcement, Lower Price Caps, Active Vessel Designations, and Secondary Sanctions

KSE Institute has presented the Russian Sanctions Digest for August 2024. The digest provides an overview of the latest key research projects by KSE Institute, including the Russia Chartbook, Russian Oil Tracker, KSE Talks New Season Episode on Russia’s Shadow Fleet, and SelfSanctions/LeaveRussia.

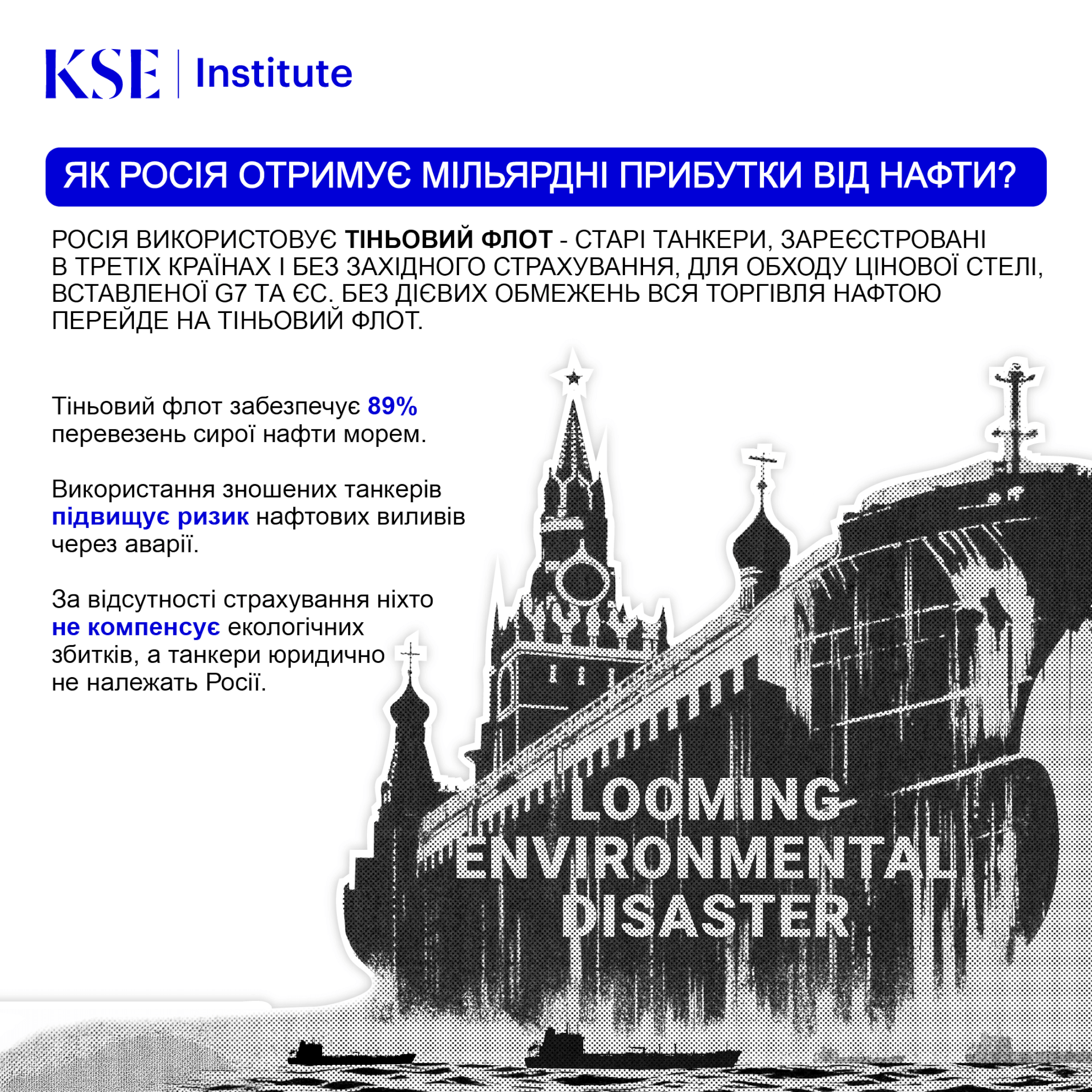

Russia Chartbook. Russia’s crude exports in June used ~90% shadow tankers, further undermining the G7/EU price cap and raising oil earnings by 22% in H1 2024 vs. H1 2023. Russia’s trade balance reached $68 bn in H1 2024 (+19% vs. H1 2023), and the current account surplus was $41 bn (+74%). The budget deficit was 929 bn rubles, a 60% decrease vs H1 2023, as higher oil/gas revenues (+69%) and non-oil revenues (+27%) covered increased war-related spending (+22%).

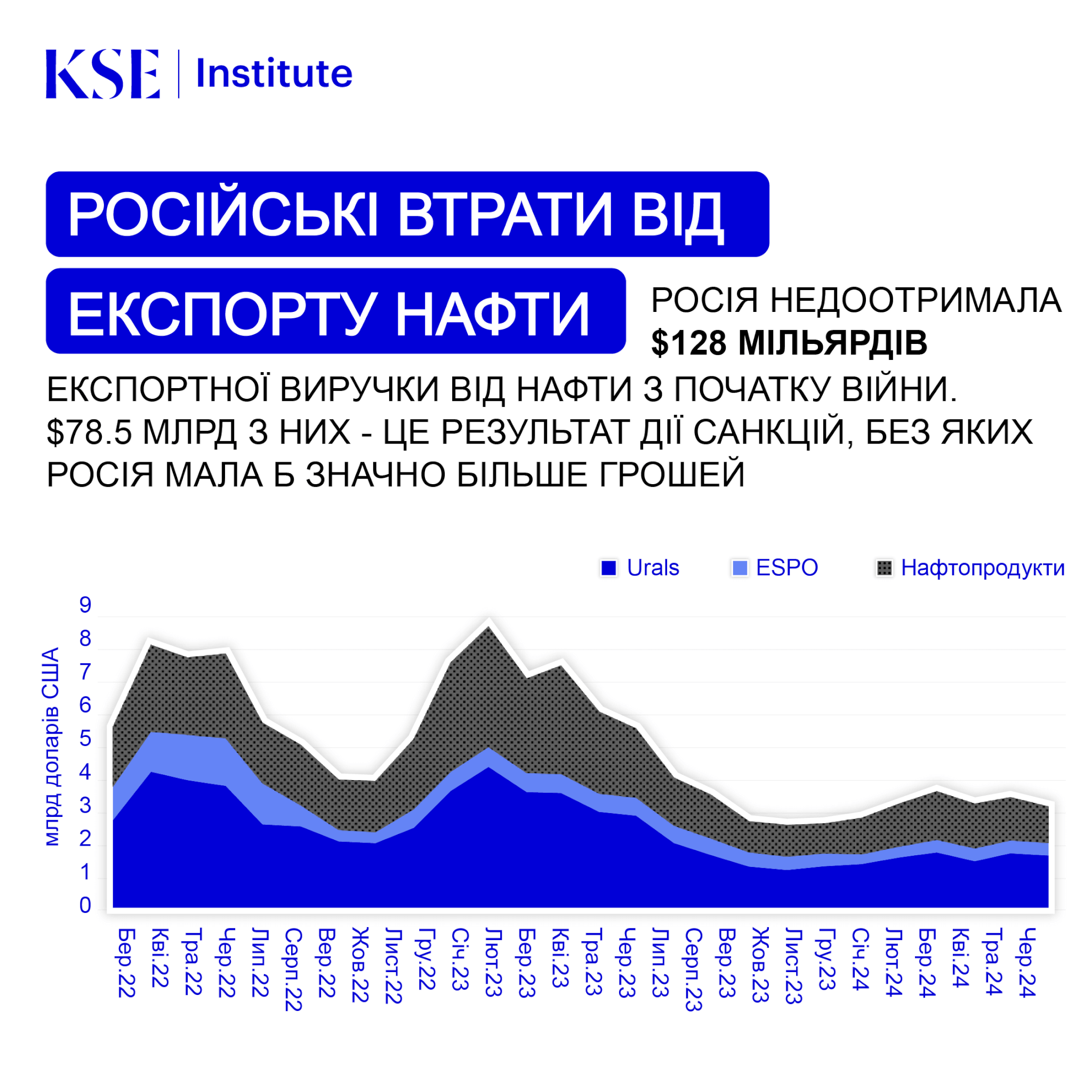

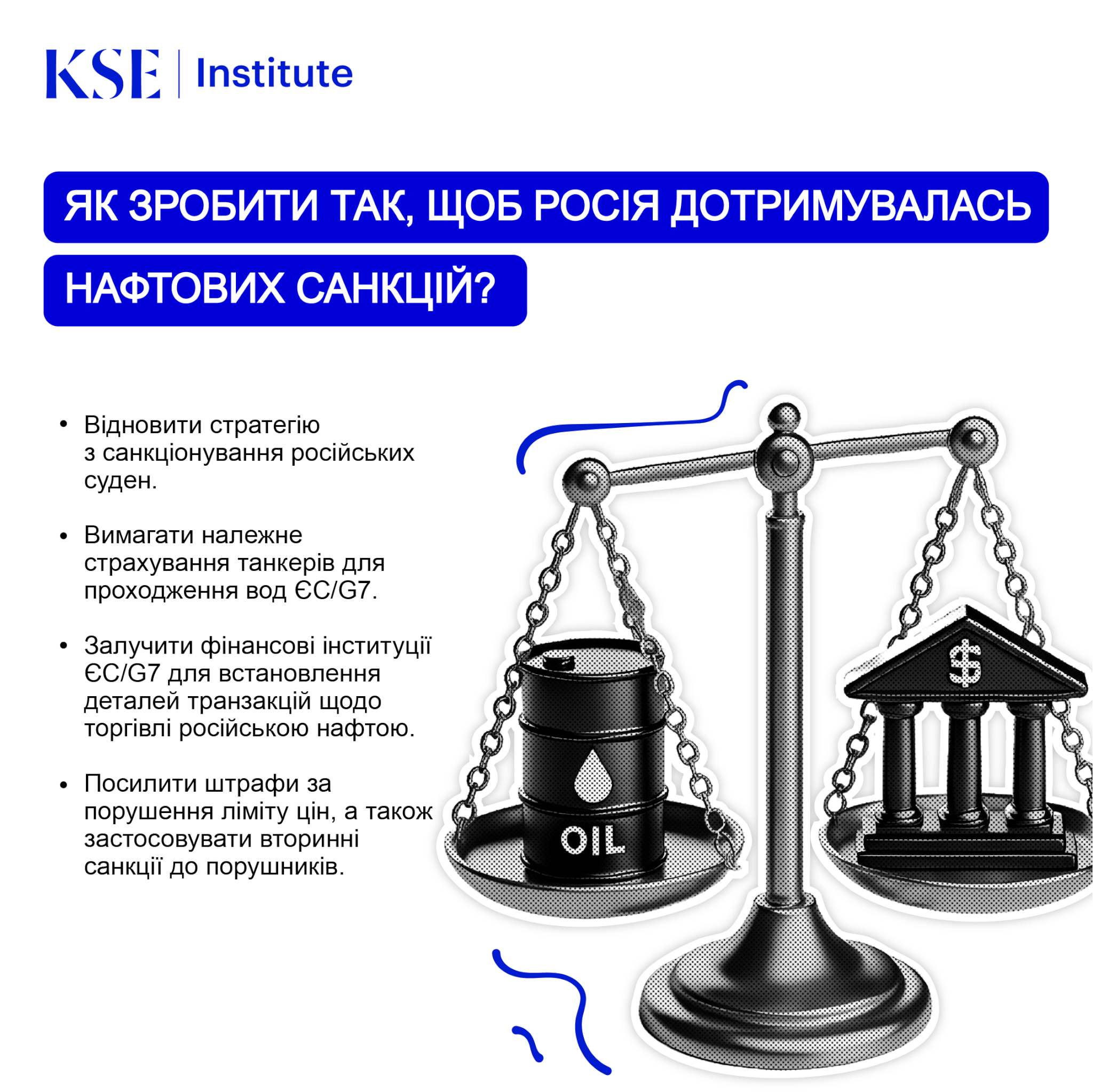

Russian Oil Tracker. In June 2024, oil export revenues decreased slightly to $16.7 bn due to reduced product exports. Stricter enforcement and lower caps could have cut June revenues by $2.6 bn more. Crude oil revenues hit $11 bn, with $7.7 bn from seaborne shipments subject to the cap. Russia’s active use of the shadow fleet allows it to bypass the price cap. In June, 209 tankers, 84% over 15 years old, left ports. By July 15, the US, EU, and UK sanctioned 55 tankers for transporting Russian oil, with the UK adding 11 more on July 18. India led in Russian crude oil imports, while Turkey remained the top buyer of Russian oil products.

KSE Talks New Season Episode on Russia’s Shadow Fleet. In the latest KSE Talks episode, KSE Institute experts Benjamin Hilgenstock, Anatoliy Kravtsev, and Oleksii Hrybanovskyi join Yuliia Pavytska to discuss their study on Russia’s shadow fleet. Key topics include the creation and structure of the shadow fleet, its expansion potential, environmental risks, threats to global sanctions, countries aiding Russia, and measures to curb the fleet.

SelfSanctions/LeaveRussia. 417 companies (10.7% of total) ceased operations in Russia. 1349 foreign businesses (34.5%) either scaled back or announced intentions to leave. 2139 (54.8%) have no plans to leave. In July 2024, 8 international companies left Russia, with 5 through liquidation. In 2023, top-10 companies and banks in Russia paid ~$1.78B in profit tax, up from ~$1.6B in 2022, showing increased tax pressure. KSE estimates ~1,000 foreign firms paid ~$6.4B in profit tax in 2023 vs. ~$6.2B in 2022. Despite fewer active foreign companies, total taxes likely exceeded 2022 levels, estimated at ~$20B annually.

These are the key findings that cover only a part of the digest. To subscribe to new, full issues of KSE Institute digests, please fill out the special form here: https://bit.ly/472Vu9Z.