- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker – September 2025: Export revenues declined, but the shadow fleet offsets the losses

Russian Oil Tracker – September 2025: Export revenues declined, but the shadow fleet offsets the losses

20 October 2025

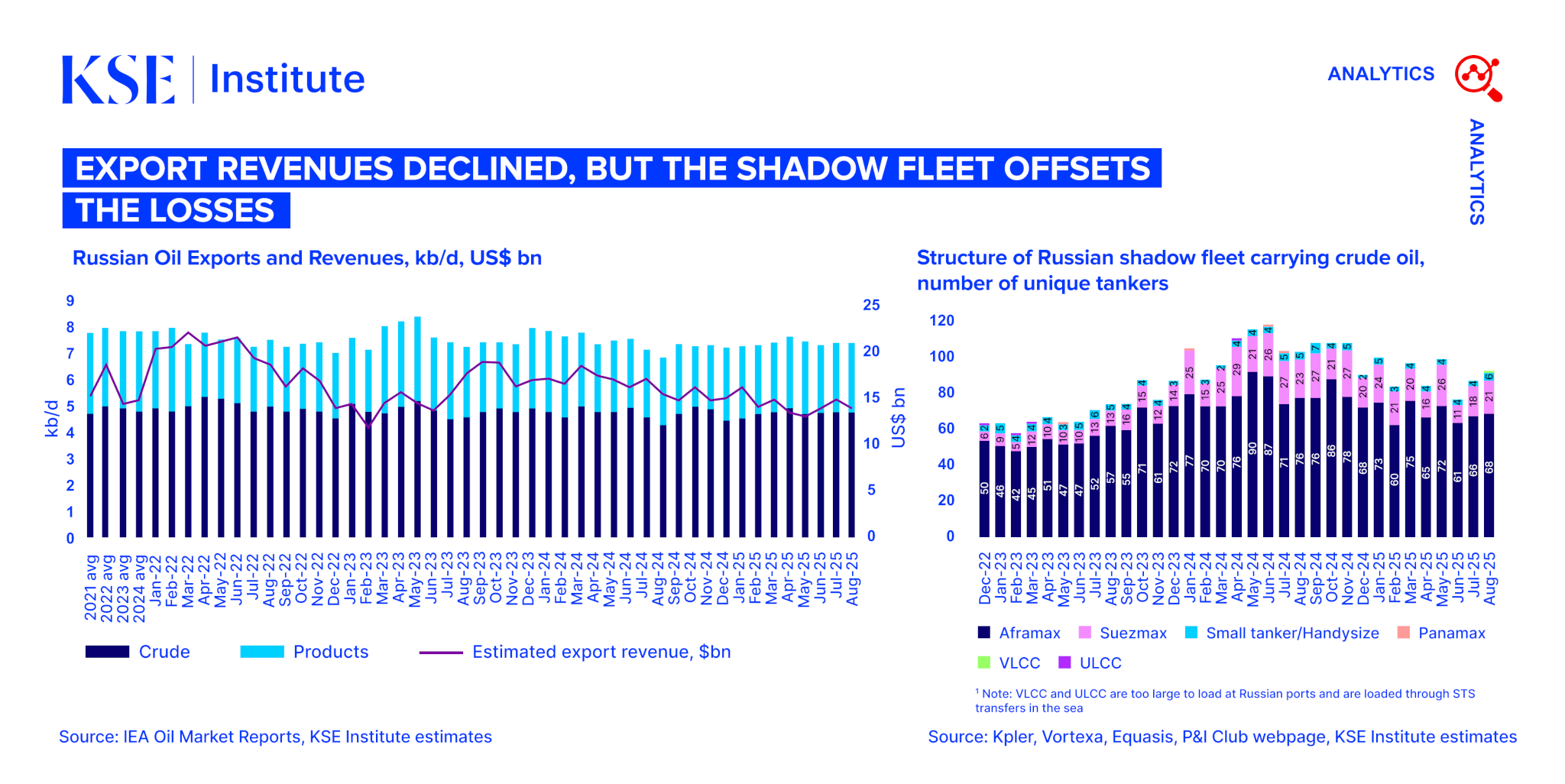

In August 2025, Russia’s oil export revenues decreased by $0.9 billion to $13.5 billion compared to July, driven by lower prices for crude oil and most oil products, except naphtha, according to the September edition of the Russian Oil Tracker by the KSE Institute. Crude oil revenues dropped by $0.4 billion to $8.8 billion, while revenues from oil products fell by $0.6 billion to $4.8 billion, despite stable volumes.

Seaborne exports of crude oil decreased by 1.4% and oil products by 1.7% compared to July. Tankers with International Group (IG) P&I insurance coverage carried only 21% of crude oil and 82% of oil products.

According to the KSE Institute, in August, 155 Russian shadow fleet tankers transporting crude oil and oil products departed from Russian ports and were involved in ship-to-ship (STS) transfers, with 86% of them over 15 years old.

India continues to lead as the largest importer of Russian seaborne crude oil: in August 2025, its seaborne crude imports decreased by 11% month-on-month to 1,504 kb/d, yet the country maintained its top position with a 45% share. Turkey continued to dominate oil product imports with a volume of 425 kb/d.

The EU, US, UK, Canada, Australia, and New Zealand imposed sanctions on 535 Russian oil tankers; however, the number of tankers violating these sanctions continues to rise monthly, indicating weak enforcement.

In August 2025, Urals traded below the G7/EU price cap, while ESPO significantly exceeded it. All products, except naphtha, traded below the cap due to its inflated level.

Based on KSE Institute estimates, under current price caps and the status quo of sanctions, Russia’s oil revenues are expected to reach $155 billion in 2025 and $125 billion in 2026. Should discounts on Urals and ESPO widen to $40/barrel and $30/barrel, revenues could drop to $136 billion in 2025 and $46 billion in 2026. However, with weak sanctions enforcement, revenues could rise to $161 billion and $146 billion in 2025 and 2026, respectively.

Overall, Russia’s oil export losses from the full-scale invasion are estimated at $159 billion from March 2022 to August 2025.