- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker – May 2025: Low prices hit Russia’s oil revenues, with Greek tankers returning to trade as Russian crude fell below the cap

Russian Oil Tracker – May 2025: Low prices hit Russia’s oil revenues, with Greek tankers returning to trade as Russian crude fell below the cap

11 June 2025

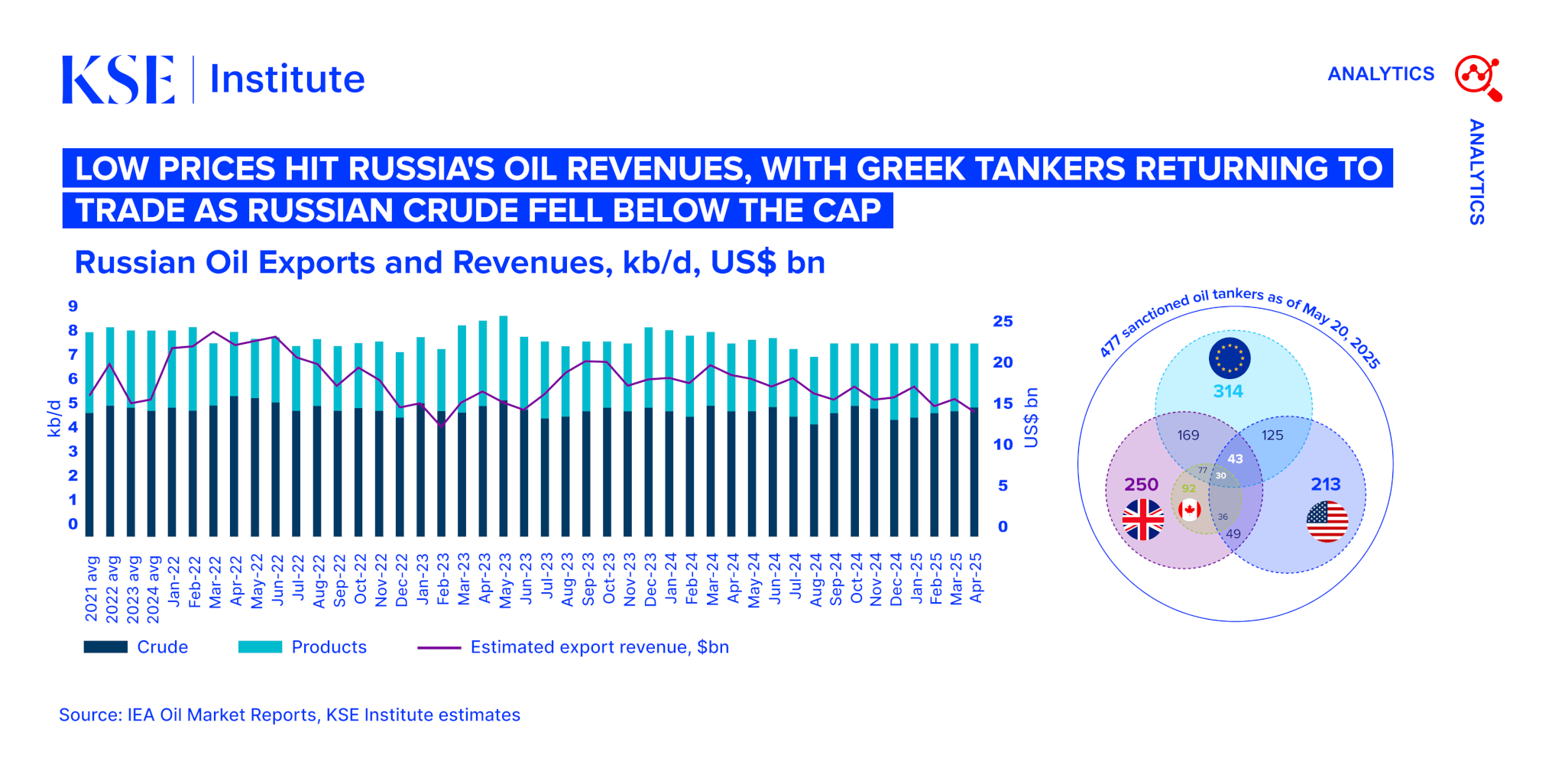

In April 2025, Russia’s oil export revenues fell by $1.1 billion to $13.2 billion, according to the May edition of the Russian Oil Tracker by KSE Institute. Despite an increase in overall export volumes by 150 kb/d, lower global prices drove the decline in revenues. Crude oil revenues fell by $0.8 billion to $8.4 billion, while oil product revenues declined by $0.4 billion to $4.8 billion.

In April, Russia’s seaborne crude oil exports decreased by 2.5% compared to March, while oil product exports rose by 9%. The share of shipments insured by members of the IG P&I remained low: only 25% of crude and 70% of oil product shipments were carried by tankers with IG P&I coverage. A total of 159 shadow fleet tankers departed from Russian ports or lifted cargo following ship-to-ship (STS) transfers. Notably, 88% of these tankers were over 15 years old, significantly increasing the risks of accidents and oil spills.

As of May 20, 2025, the US, UK, Canada, and the EU had imposed sanctions on 477 tankers for violating restrictions on transporting Russian oil. More than half of these tankers (258) are managed by companies based in Russia, the UAE, and China.

India remains the largest importer of Russian seaborne crude oil, although its purchases in April declined by 5% to 1,810 kb/d (53% of total Russian seaborne crude exports). In contrast, China increased its imports by 20% to 1,321 kb/d. Turkey remained the main buyer of Russian oil products, increasing imports by 30% to 546 kb/d.

In April 2025, the price of Urals FOB and ESPO FOB dropped by ~ $4/bbl to $53/bbl and $56/respectively, making all Russian crude grades eligible to trade within the price cap amid weak global oil prices. Premium oil products, as in previous months, were traded noticeably below the cap due to the inflated threshold, while discounted products declined to levels that made them eligible for legitimate shipping.

According to updated KSE Institute estimates, under the current price cap and sanctions (assuming improved enforcement), Russia’s oil revenues could fall to $151 billion in 2025 and $137 billion in 2026 (down from $189 billion in 2024 and $185 billion in 2023). If discounts on Urals and ESPO widen to $40 and $30 per barrel, respectively, revenues could fall to $102 billion in 2025 and $54 billion in 2026. In contrast, under weak enforcement, Russia may earn up to $163 billion in 2025 and $159 billion in 2026, preserving substantial resources to continue its war against Ukraine.