- Kyiv School of Economics

- About the School

- News

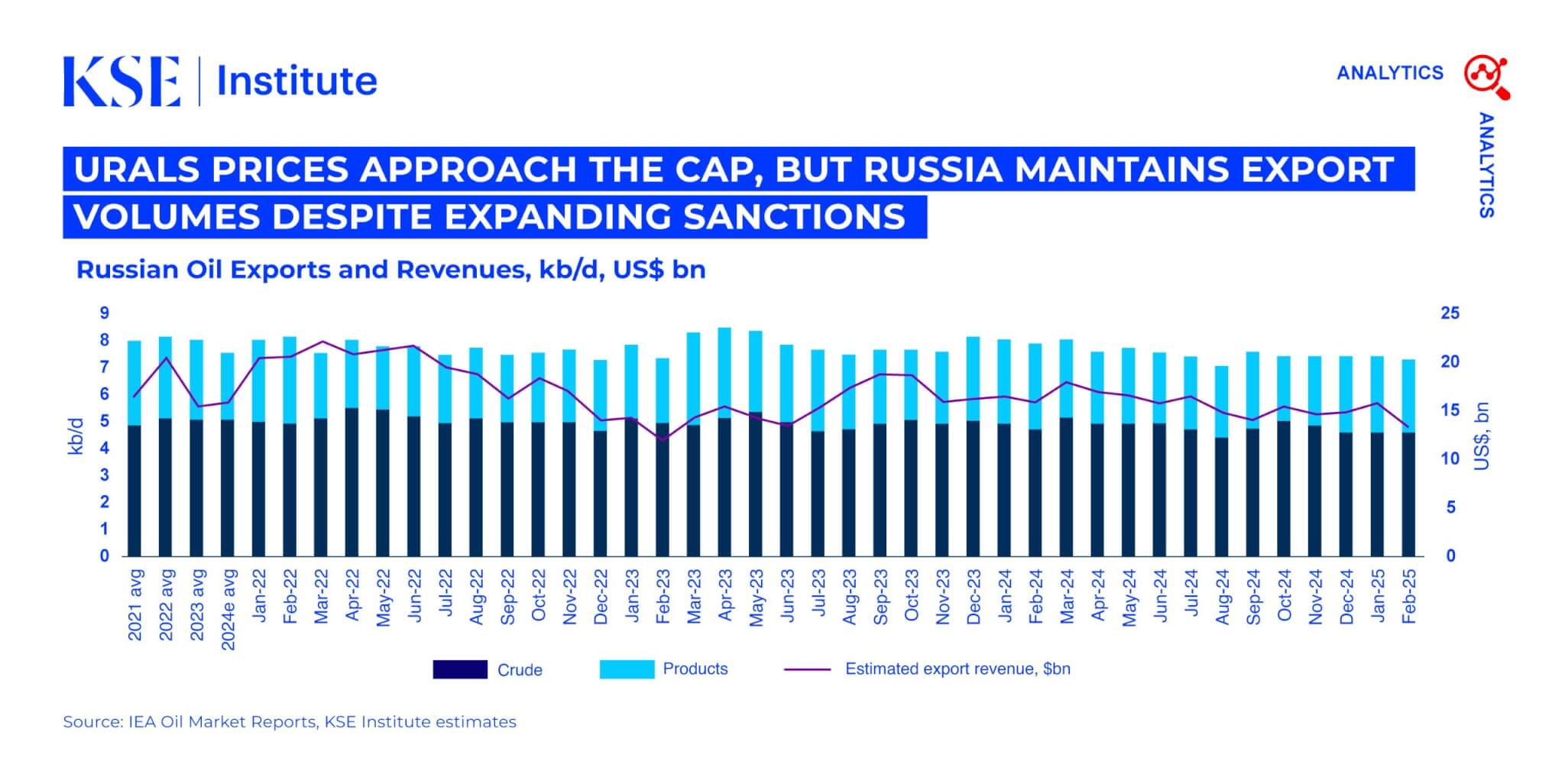

- Russian Oil Tracker March 2025: Urals Prices Approach the Cap, but Russia Maintains Export Volumes Despite Expanding Sanctions

Russian Oil Tracker March 2025: Urals Prices Approach the Cap, but Russia Maintains Export Volumes Despite Expanding Sanctions

17 April 2025

In February 2025, Russian oil export revenues fell by $2.4 billion to $13.3 billion, which is $2.6 billion lower than in February 2024, according to KSE Institute’s March “Russian Oil Tracker.” The main reasons were deeper discounts on Urals crude and a reduction in oil product exports. Crude oil revenue dropped by $1.4 billion to $8.3 billion, while oil product revenue declined by $1.1 billion to $5.0 billion.

Russian seaborne crude exports barely changed, whereas oil product shipments contracted by 3.8%. Only 22% of crude and 70% of oil products were shipped by tankers with IG P&I insurance coverage. In February, 152 shadow fleet tankers carrying either crude or oil products departed Russian ports or conducted STS transfers; 91% of these vessels were over 15 years old, posing heightened environmental risks due to accident potential and possible oil spills.

As of 20 March 2025, the United States, the United Kingdom, Canada, and the European Union sanctioned 311 oil tankers for violating restrictions on transporting Russian oil. Of these, 72 continue operating post-designation. Under intensifying sanctions pressure, the share of Russian seaborne crude carried by the shadow fleet declined to 78% (8 percentage points lower than in January) to 2.5 mb/d, while shadow oil product exports dropped by 7% to 701 kb/d.

India remains Russia’s largest importer of seaborne crude, increasing purchases to 1,808 kb/d (57% of total seaborne exports). China reduced imports by 4% to 1,121 kb/d, whereas Turkey — although still the main buyer of Russian oil products at 451 kb/d — cut its crude imports by 48% after its largest refiner Tupras halted Urals purchases following new U.S. sanctions.

In February, the price of Urals FOB Primorsk and Novorossiysk dropped by around $6 per barrel, pulling the price near the established cap. Meanwhile, ESPO FOB Kozmino remained about $6.6 per barrel above that limit. Premium products traded below the price ceiling, while discounted products continued exceeding it.

KSE Institute projects Russian oil revenues to reach $149 billion in 2025 and $132 billion in 2026 under the current price caps and sanctions (with stronger enforcement), compared to $189 billion in 2024 and $185 billion in 2023. If discounts on Urals and ESPO widen to $40 and $30 per barrel respectively, revenues could shrink to $92 billion and $59 billion. Under weak sanctions enforcement, however, Russia’s oil revenues could still climb to $169 billion in 2025 and $160 billion in 2026, enabling it to continue wagging its war in Ukraine.