- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker – June 2025: Low prices push oil revenues down to the second-lowest level since the start of the full-scale invasion

Russian Oil Tracker – June 2025: Low prices push oil revenues down to the second-lowest level since the start of the full-scale invasion

17 July 2025

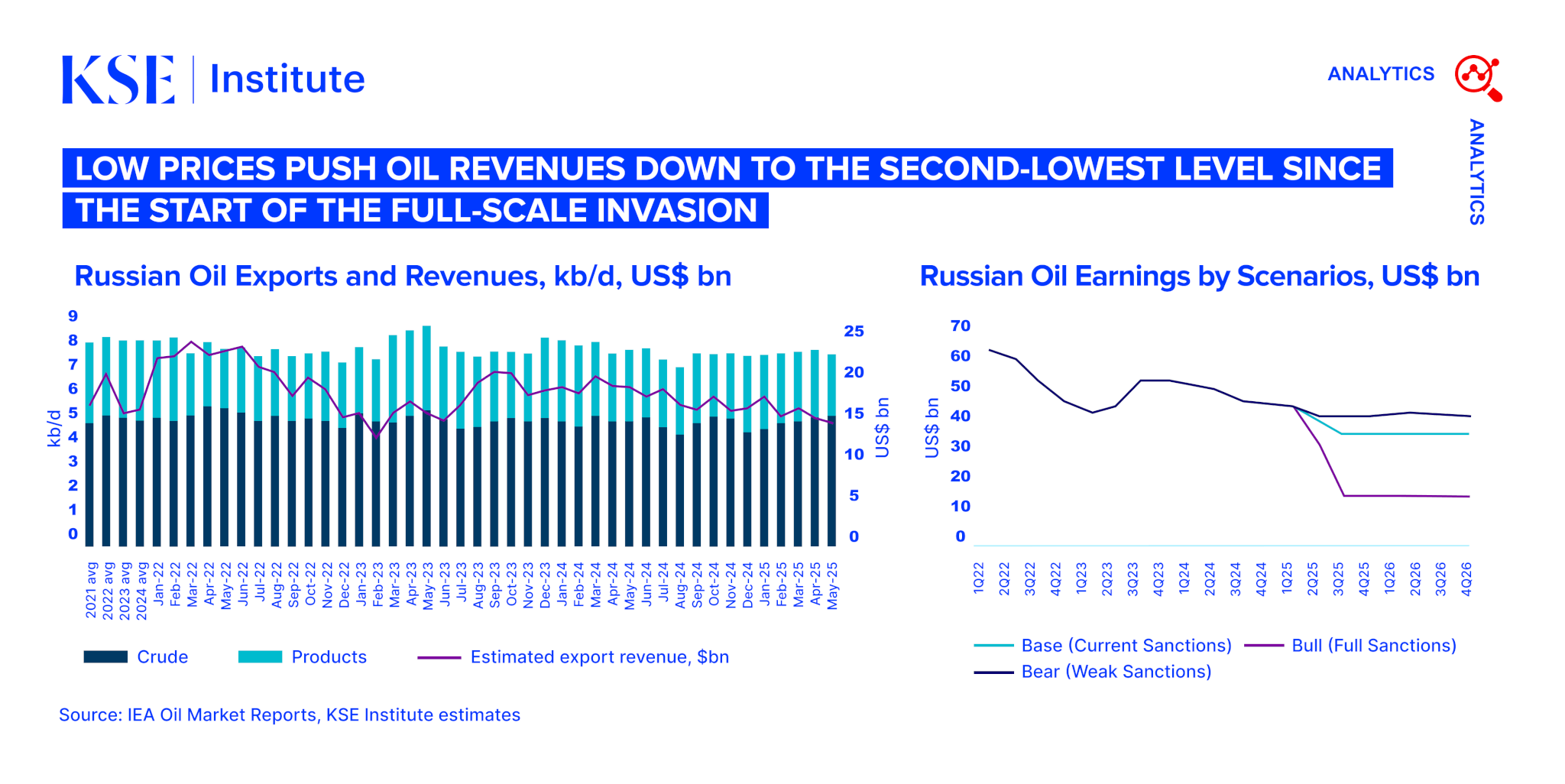

In May 2025, Russia’s oil export revenues declined by $0.4 billion to $12.6 billion, according to the June edition of the Russian Oil Tracker by KSE Institute. The decline was driven by both lower export prices and reduced volumes. Seaborne oil export revenues also fell by $0.4 billion to $9.7 billion, with crude down $0.3 billion and oil products down $0.1 billion.

Seaborne crude export volumes remained largely unchanged compared to April, while oil product exports fell by 7% month-on-month. The share of crude shipments covered by IG P&I insurance remained low: only 18% of crude though 77% of oil products were transported by insured tankers.

KSE Institute estimates that 165 tankers affiliated with the shadow fleet loaded Russian crude or oil products in May, either directly from ports or after ship-to-ship (STS) transfers. 89% of these vessels were more than 15 years old, highlighting significant environmental and safety risks.

India remained the largest importer of Russian seaborne crude, purchasing 1,746 kb/d (51% of total exports). Turkey remained the leading buyer of Russian oil products, importing 544 kb/d in May.

As of June 20, 496 oil tankers had been sanctioned by the US, UK, EU, Canada, Australia, and New Zealand for violating restrictions on Russian oil transportation.

However, enforcement remains weak: 135 unique sanctioned tankers loaded oil at Russian ports after their designation in March–May 2025. Also in May, three sanctioned tankers with unidentified flags transited through the Danish Straits and the English Channel, bypassing flag-state controls despite being sanctioned in multiple jurisdictions.

In May, all Russian crude oil grades remained eligible for shipments under the G7/EU price cap due to weak global oil prices. Premium oil products continued to trade well below the cap, while discounted products hovered around the threshold.

According to KSE Institute modelling, under the base case with current oil price caps and sanctions, Russia’s oil revenues may fall to $153 billion in 2025 and $136 billion in 2026, down from $189 billion and $185 billion in 2024 and 2023. In a stricter scenario, with wider discounts on Urals and ESPO, revenues could drop to $111 billion in 2025 and $54 billion in 2026. Under weak enforcement, however, Russia could still earn up to $163 billion this year and $157 billion next year.