- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker January 2025: Russian Oil Revenues and Shadow Fleet Dependence Remain High, While the Sanctioning Coalition Steps up Enforcement

Russian Oil Tracker January 2025: Russian Oil Revenues and Shadow Fleet Dependence Remain High, While the Sanctioning Coalition Steps up Enforcement

6 February 2025

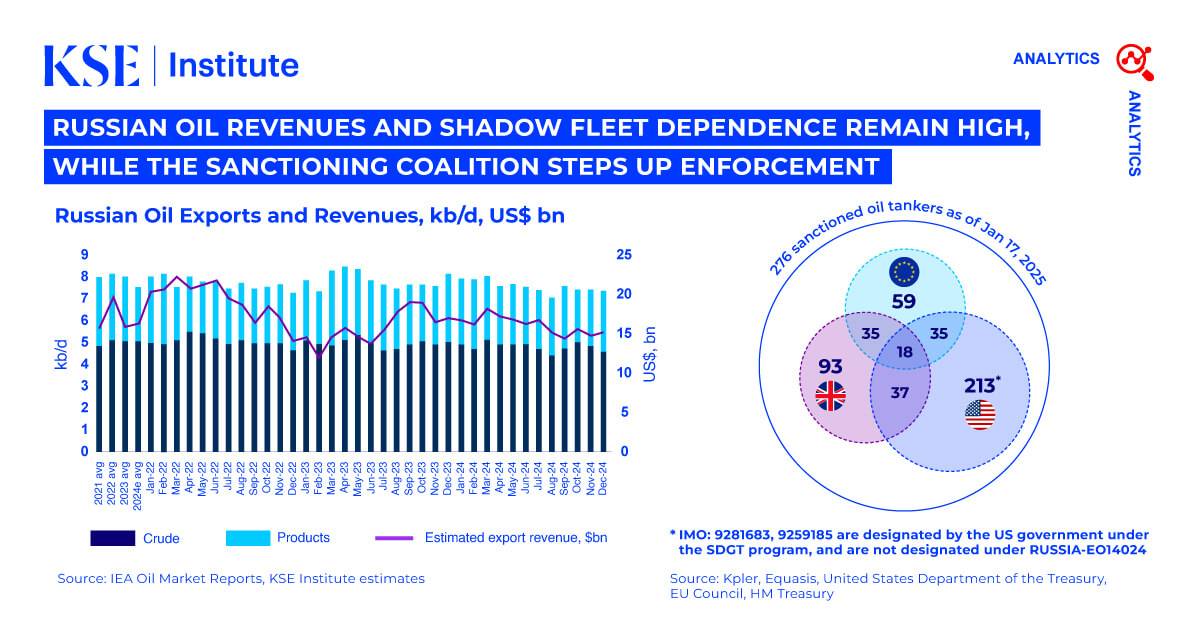

In December 2024, Russian oil export revenues increased by $0.4 billion to $15.1 billion, as product revenues’ increase by $0.5 billion was able to fully compensate for a decline in crude revenues by $0.1 billion, according to KSE Institute’s January ‘Russian Oil Tracker.’ Russia still heavily relies on the shadow fleet, leading to tougher sanctions from the sanctioning coalition. Meanwhile, Russia continues to exploit ways to evade restrictions.

Russian seaborne oil exports dropped by 2% in December 2024, reaching their lowest level since the invasion. Crude oil shipments dropped by 9.5% MoM to a two-year low, but a 9.5% rise in oil product exports, driven by seasonal refinery throughput increases, almost offset the decline. Only 11% of crude and 54% of oil products were transported by IG-insured tankers. By port, 23% of crude shipments from the Baltic Sea and 22% from the Black Sea used IG insurance, while Pacific and Arctic ports relied entirely on the shadow fleet in December.

The majority of Russian oil shipments rely on the shadow fleet, posing environmental risks. In December, 192 shadow tankers carrying crude and oil products left Russian ports, with 87% over 15 years old. The number of these vessels and the share of aging tankers remain consistently high, continuing to endanger marine ecosystems and support war financing.

To counter Russia’s shadow fleet, sanctioning coalition countries have intensified restrictions on individual tankers. As of January 17, the US, UK, and EU governments sanctioned 276 oil tankers for violating Russian oil transport terms. On January 10, the US Treasury designated 187 vessels, including 159 tankers that carried 1.65 mb/d of Russian oil exports in 2024. These measures could significantly disrupt Russia’s oil supply and distribution chains, but their effectiveness depends on consistent enforcement by the new US administration.

Despite sanctions, Russia continues to bypass restrictions. Of the 276 sanctioned tankers, 53 are currently lifting oil, loaded after the day of designation. Nearly 70% are managed by companies registered in the UAE, Seychelles, and Russia. To avoid detection, Russia has changed key vessel details—122 tankers have switched at least one parameter, such as flag, name, or manager, after being sanctioned. However, most designated tankers are staying idle. The Russian port of Nakhodka, the Suez Canal, and the Russian port of Murmansk are the top three places for idle designated tankers.

In December 2024, Urals FOB Primorsk and Novorossiysk prices remained stable, trading ~$1-2 per barrel above the price cap, with little change in their discount to Brent. All premium products remained below the price cap, while discounted products traded well above it.

Chinese and UAE ship managers continue to help Russia sell oil above the price cap. In December, China’s Prominent Shipmanagement Ltd overtook UAE-based Avebury Shipmanagement LLC-FZ, handling 5% of Russia’s seaborne crude exports. Three Chinese and four Emirati companies in the top ten were responsible for 9% and 16% of shipments, respectively. Meanwhile, Greek firms remained the leading shippers of oil products, holding five of the top ten spots and managing 15% of seaborne oil product exports.

Three major importers continue to drive demand for Russian oil. India remained the largest buyer of Russian crude, accounting for 51% (1,557 kb/d), followed by China at 1,244 kb/d. For oil products, Turkey led with imports of 545 kb/d.

KSE Institute projects Russian oil revenues to reach $141 billion and $135 billion in 2025 and 2026 under the base case. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $166 billion in 2025 and $164 billion in 2026.