- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker February 2025: Shadow Fleet Sanctions Expand, but Russia Continues Evasion, Requiring Stronger Monitoring by Coalition Countries

Russian Oil Tracker February 2025: Shadow Fleet Sanctions Expand, but Russia Continues Evasion, Requiring Stronger Monitoring by Coalition Countries

11 March 2025

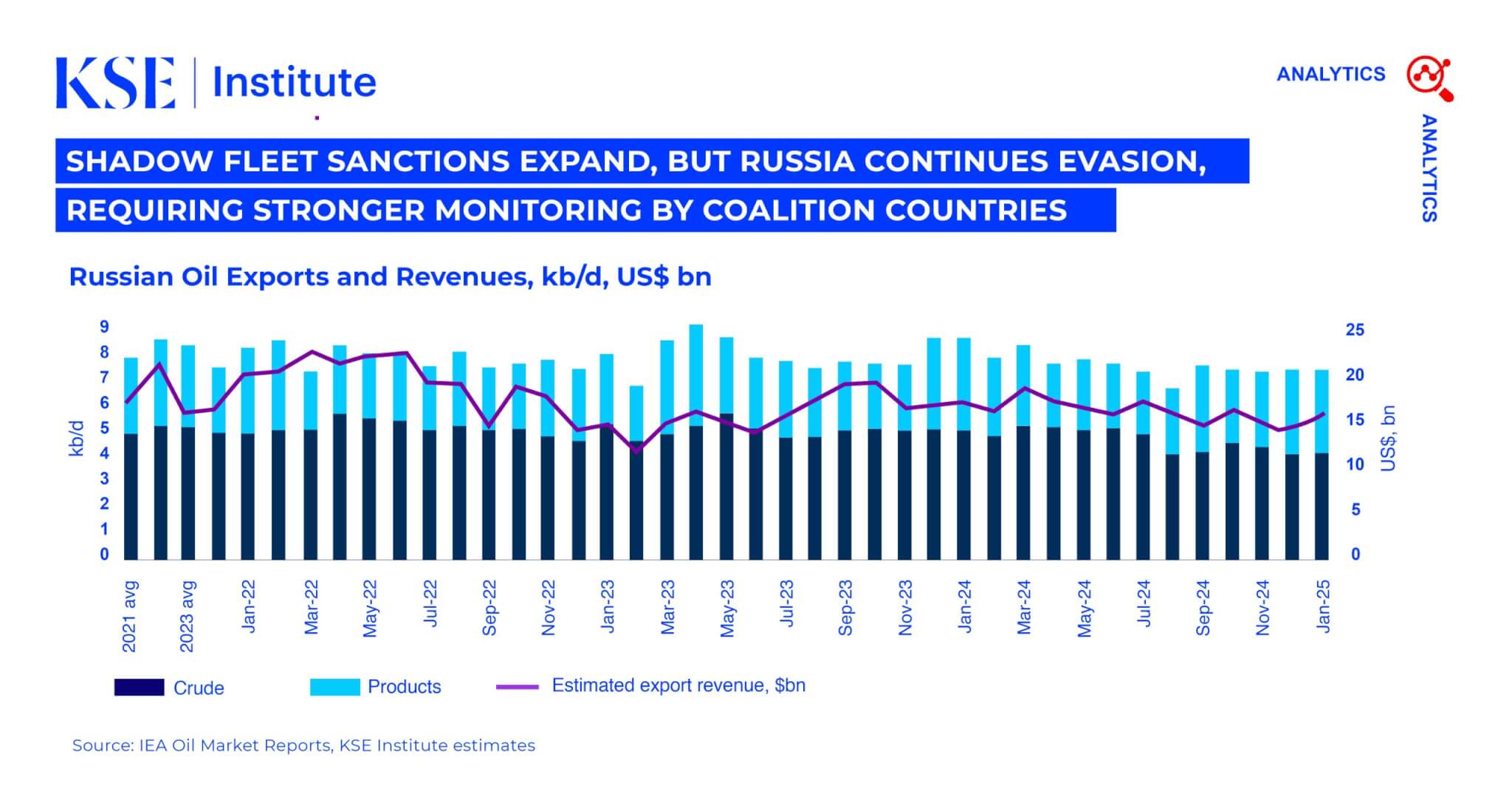

In January 2025, Russian oil export revenues increased by $1.0 billion to $15.8 billion due to higher crude and product prices, according to KSE Institute’s February ‘Russian Oil Tracker.’ Preliminary data for 2024 shows total revenues rose by $4.0 billion year-over-year to $189.1 billion. Despite increasing U.S. sanctions, Russia continues to rely on its aging shadow fleet, using both sanctioned and newly added vessels to sustain oil exports.

In January, Russian seaborne oil exports rose by 4.3% MoM, with crude increasing by 3.4% and product exports by 5.5%. However, only 14% of crude and 58% of oil products were transported by tankers with IG P&I insurance. Coverage increased slightly in the Black Sea to 27%, remained at 23% in the Baltic, while Pacific and Arctic ports relied entirely on the shadow fleet for crude shipments.

The majority of Russia’s oil exports continue to rely on the shadow fleet. In January, 192 shadow tankers carrying crude oil and oil products either left Russian ports or lifted cargo after STS transfers, with 94% over 15 years old. While export levels remain high, the growing use of aging vessels further increases environmental risks. The poor condition of these tankers raises the risk of oil spills, threatening marine ecosystems and coastal states.

In January, 86% of Russia’s crude oil exports were transported by the shadow fleet. Three UAE-based companies accounted for 19% of shipments, led by Stream Ship Management Fzco and Avebury Shipmanagement Llc-Fz. Five Chinese companies from the top 10 carriers handled 10% of total crude exports. Meanwhile, 37% of Russian oil product exports relied on the shadow fleet, with Turkish companies responsible for 13% of shipments.

Russia continues to use flags of convenience to evade sanctions, obscure vessel ownership, and sustain oil exports. The top three flags of its shadow fleet carrying crude are Panama, Barbados, and Sierra Leone. In January, the share of Panama-flagged shadow vessels fell 31% MoM to 33%, while unregistered tankers began operating.

As of February 24, 2025, the U.S., UK, and EU have sanctioned 311 oil tankers for violating restrictions on transporting Russian oil. Despite this, 63 sanctioned vessels continue lifting oil. Among the 159 tankers sanctioned by the U.S. on January 10 for carrying Russian oil in 2024, 31 have loaded cargo since the designation date, and some have discharged it. Meanwhile, 29 new tankers have started transporting Russian oil since January 10, despite not being involved in 2024.

China continues to facilitate Russia’s oil trade despite sanctions. Shandong Port Group received oil at Yantai Port that originated from U.S.-sanctioned tankers. These vessels, loaded at Sakhalin I after being designated, conducted an STS transfer to DABAN, which later discharged the cargo at Yantai, bypassing the declared ban.

India, China, and Turkey remain the key buyers of Russian oil. In January, India reduced its crude imports from Russia by 10% MoM to 1,406 kb/d. However, it remained the largest importer, accounting for 44% of total Russian seaborne crude imports. Meanwhile, Turkey retained its position as the top buyer of Russian oil products, with imports reaching 552 kb/d.

In January 2025, Urals FOB Primorsk and Novorossiysk discounts to Brent widened after U.S. sanctions on January 10, reaching $15 per barrel by month-end. Meanwhile, the ESPO FOB Kozmino discount to Dubai M1 rose $6.0 to $8.6, dropping to $15 per barrel by the end of the month.

KSE Institute projects Russian oil revenues to reach $149 billion and $131 billion in 2025 and 2026 under the base case. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $170 billion in 2025 and $163 billion in 2026.