- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker December 2024: Russian Oil Revenues Decline, but Coordinated US, UK, and EU Sanctions are Key in Countering Shadow Fleet and Evasion Tactics

Russian Oil Tracker December 2024: Russian Oil Revenues Decline, but Coordinated US, UK, and EU Sanctions are Key in Countering Shadow Fleet and Evasion Tactics

10 January 2025

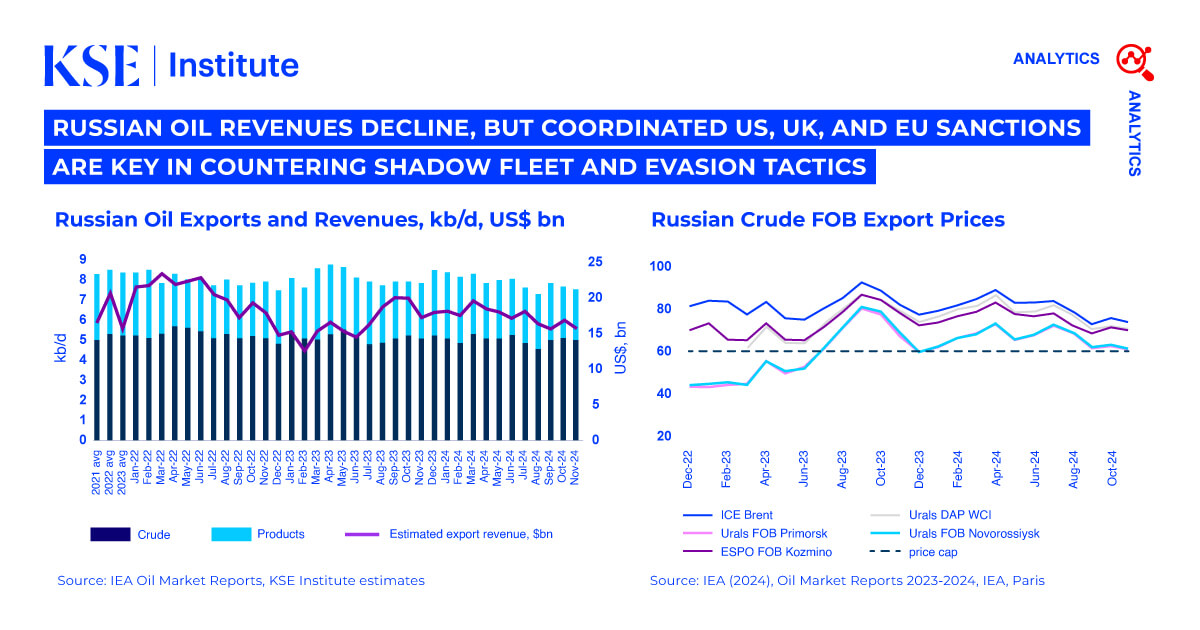

In November 2024, Russian oil export revenues dropped by $1.1 billion to $14.6 billion due to lower prices and export volumes, according to KSE Institute’s December ‘Russian Oil Tracker.’ Coordinated US, UK, and EU sanctions are crucial in tackling Russia’s shadow fleet. The unified “triple pressure” strategy raises the risks and costs of violations, prevents sanctions evasion, and reinforces accountability for shipowners and third countries.

Russian seaborne crude exports decreased by 4.2% MoM, while oil product exports rose by 0.9% MoM in November. Only 10% of crude and 62% of oil products were shipped by IG insured tankers. Coverage varied by port, with 45% of shipments from the Baltic Sea and 34% from the Black Sea using IG insurance. Meanwhile, all exports from Pacific and Arctic ports relied entirely on the shadow fleet, bypassing Western maritime services.

The majority of Russian crude exports rely on aging, uninsured shadow fleet tankers, posing significant environmental risks. In November 2024, 196 shadow tankers carrying crude and oil products left Russian ports, with 85% of the vessels being over 15 years old. These tankers account for 90% of crude exports and 36% of oil product shipments, enabling Russia to bypass the $60 per barrel price cap and fund its war in Ukraine.

As of December 19, 2024, the US, EU, and UK sanctioned 156 tankers transporting Russian oil. Despite this, Russia continues to evade restrictions — 22 tankers have completed or are completing voyages post-designation, while 11 are planning new trips. Meanwhile, 106 tankers have been removed from service. Greater coordination between jurisdictions is needed to strengthen sanctions enforcement and close loopholes, making it harder for Russia to sustain shadow fleet operations.

However, key vessels in Russia’s shadow fleet remain largely unsanctioned, highlighting the need for stronger enforcement. Only 7 of the top 20 tankers carrying Russian crude have been designated. To bypass restrictions, Russia regularly changes vessel managers. Since January 2023, 13 of these tankers have changed managers while keeping the same country of registration, complicating tracking and delaying sanctions.

Russian oil export prices declined in November, with Urals FOB Primorsk and Novorossiysk dropping by $1.4 and $1.1 per barrel to approximately $61.1 and $61.9 per barrel, respectively. The discount to ICE Brent narrowed to around $12 per barrel. All premium products were traded below the price cap, but discounted products despite the recorded decline continued trading significantly above the price cap in November 2024.

UAE and Chinese ship managers continue to facilitate Russian crude shipments above the price cap. In November 2024, Avebury Shipmanagement LLC-FZ (UAE) became the largest shipper, handling 11% of Russia’s seaborne crude exports, overtaking Stream Ship Management FZCO (UAE). Five Chinese companies from the top ten accounted for another 11%. Greek companies lead in oil product shipments, managing around 25% of exports. India, China, and Turkey continue to drive demand for Russian crude, with India alone responsible for 47% of total imports.

KSE Institute projects Russian oil revenues to reach $141 billion and $135 billion in 2025 and 2026 under the base case. However, if sanctions enforcement is weak, Russian oil revenues could increase, reaching $166 billion in 2025 and $164 billion in 2026.