- Kyiv School of Economics

- About the School

- News

- Russian Oil Tracker April 2025: Revenues Up Due to Calendar, Not Market Conditions

Russian Oil Tracker April 2025: Revenues Up Due to Calendar, Not Market Conditions

13 May 2025

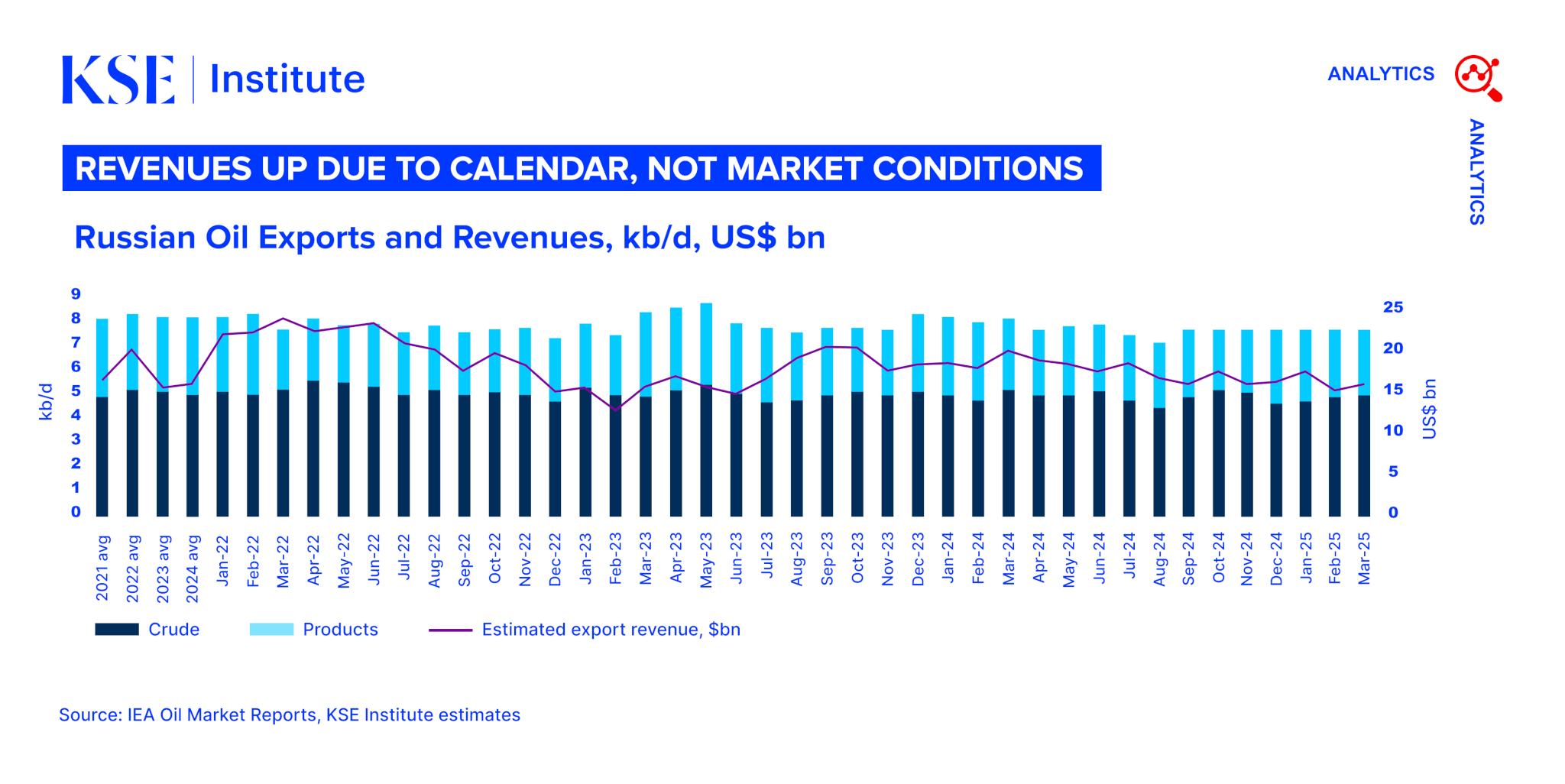

In March 2025, Russia’s oil export revenues increased by $0.7 billion to $14.3 billion, according to KSE Institute’s April “Russian Oil Tracker.” This increase was primarily due to the longer month rather than improved market conditions. However, on a year-over-year basis, total revenues lost by $3.7 billion.

In March, Russian seaborne crude exports increased by 10.6% compared to February, whereas oil product exports declined by 4.2%. Share of cargo covered with IG P&I insurance remained low: only 21% of crude oil and 73% of oil products were shipped by tankers with IG P&I insurance. A total of 158 shadow fleet tankers left Russian ports in March—five more than in February—including 100 carrying crude and 57 carrying oil products. Importantly, 94% of these tankers were older than 15 years, significantly increasing the risk of accidents and oil spills.

As of April 20, 2025, the United States, the United Kingdom, Canada, and the European Union have sanctioned 311 tankers for violating restrictions on transporting Russian oil. Nevertheless, 58 of these tankers are currently lifting oil, loaded after sanctions were imposed.

India remains the largest importer of Russian seaborne crude, and increased purchases by 5% to 1,896 kb/d in March (54% of Russia’s total seaborne crude exports). At the same time, China decreased imports by 2% to 1,103 kb/d, while Turkey remained the leading buyer of Russian oil products with imports of 419 kb/d.

In March, Urals FOB Primorsk and Novorossiysk prices fell by approximately $3/bbl, trading below the price cap. Meanwhile, ESPO FOB Kozmino remained ~$4/bbl above the cap. Discounts to Dubai M1 for Urals DAP WCI and ESPO FOB Kozmino stood at ~$2.7/bbl and $7.2/bbl, respectively. Discounted oil products continued trading significantly above the established cap.

According to updated KSE Institute estimates, under stronger enforcement of price caps and existing sanctions, Russian oil revenues could fall to $149 billion in 2025 and $136 billion in 2026 (compared to $189 billion in 2024 and $185 billion in 2023). If Urals and ESPO discounts widen to $40 and $30 per barrel respectively, revenues could drop further to $88 billion and $54 billion. Under weaker sanctions enforcement, however, Russia may still receive up to $162 billion in 2025 and $154 billion in 2026, preserving substantial financial resources to wage its war against Ukraine.