- Kyiv School of Economics

- About the School

- News

- Russia’s dependence on Western insurance makes its oil exports vulnerable — July issue of the Russian Oil Tracker by KSE Institute

Russia’s dependence on Western insurance makes its oil exports vulnerable — July issue of the Russian Oil Tracker by KSE Institute

17 August 2023

In June 2023, Russian oil exports decreased both in monthly and annual terms, despite an increase in global oil demand, according to the July edition of ‘Russian Oil Tracker’ by KSE Institute. Russian oil export revenues contracted by $1.5 bn to $11.8 bn (MoM), driven by lower export volumes. However, price discounts for Russian crude and oil products have played a pivotal role in sustaining robust demand for its oil exports. However, Russian oil export revenues are projected to rise by $2 bn in July due to higher global oil prices and a reduction in the discount on the Russian main export grade Urals to Brent.

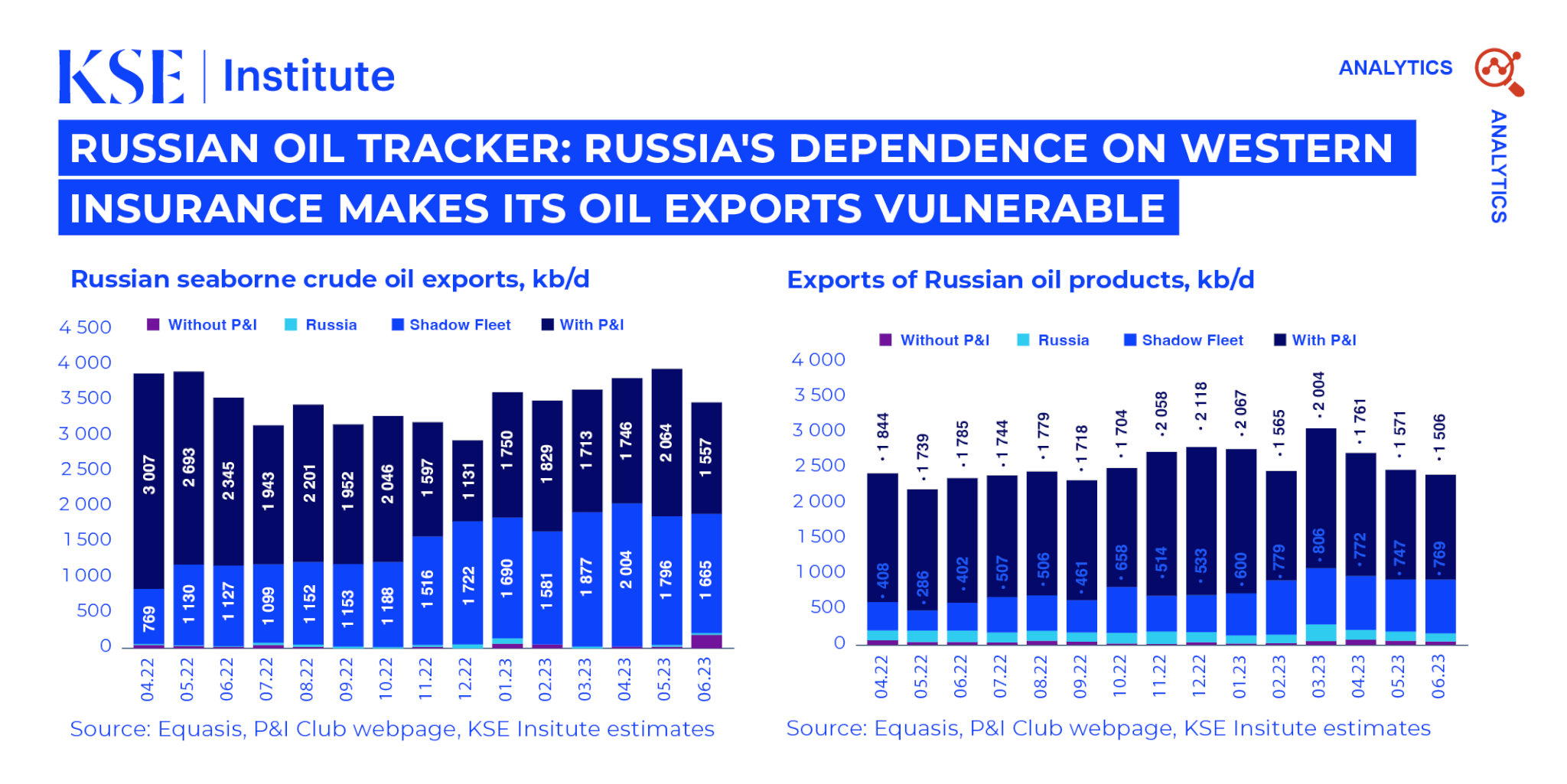

Russian oil exports registered a notable decrease, witnessing a decline of approximately 600 kb/d (MoM) or 300 kb/d (YoY). Total export revenues were 45% lower than a year ago compared with a 37% YoY decline in May, remaining several billions below per month compared to the pre-invasion levels. The shipment of seaborne crude oil decreased by 12.1% (MoM) and by 1.9 (YoY). The exports of oil products decreased by 2.8% (MoM) but increased by 2.1% (YoY). However, Russian oil exports revenues are projected to increase by $ 2 bn in July due to increased world oil prices and narrowing discount on Russian main export grade Urals over Brent.

Despite all its efforts to boost its shadow fleet, Russia still heavily relies on Western maritime services. The P&I Club insurance coverage varies by ports of shipment as 62% of crude oil exports from Black Sea ports were shipped by tankers with P&I Club insurance while only 12% of crude oil shipments from Pacific Ocean ports had P&I Club insurance in June 2023.

KSE Institute estimates the Russian ‘shadow fleet’ at 131 tankers, with 99 being over 15 years old. In June 2023, the shadow fleet accounted for around 1.7 mb/d of crude oil exports and 0.8 mb/d of oil products. The ageing tankers pose substantial environmental risks to European countries, as they navigate European coastlines, including sensitive areas such as the Danish Straits. The operators of these vessels lack the financial capacity to cover potential clean-up costs in the event of oil spills near EU coastlines.

Throughout June 2023, Urals and Arctic grades maintained prices around $52-53/bbl, remaining eligible for shipping with P&I insurance. Notably, the report highlighted that the prices of ESPO crude, which is shipped with Western maritime services, remained well above the price cap, indicating weak policy enforcement. Despite this, Western companies’ involvement in crude oil shipments from Pacific ports saw further decline in June.

Following the EU and G7 embargo on Russian seaborne oil, India has emerged as the largest buyer, witnessing imports surge from less than 0.1 mb/d to over 2.0 mb/d in March-April 2023. Additionally, Turkey has become a major importer of Russian oil products since the EU embargo was imposed in February 2023.

Under the current conditions of oil price caps and status quo of sanctions, but with stronger enforcement, according to KSE Institute’s projections, Russian oil revenues are anticipated to shrink to $153 bn and $144 bn in 2023 and 2024, respectively, compared to $218 bn in 2022. The study also explored scenarios of varying price caps, with the lowest cap of US$ 50/bbl forecasting revenues as low as $114 bn and $64 bn in 2023 and 2024. However, in scenarios of weak sanctions enforcement, Russian oil revenues could approach $175 bn and $188 bn over the next two years.

For more information and detailed insights, please refer to the full KSE Institute report ‘Russian Oil Tracker’ from July 2023 at the following link