- Kyiv School of Economics

- About the School

- News

- Russia Macro Update: BoP Data Shows Weakening External Position

Russia Macro Update: BoP Data Shows Weakening External Position

19 January 2023

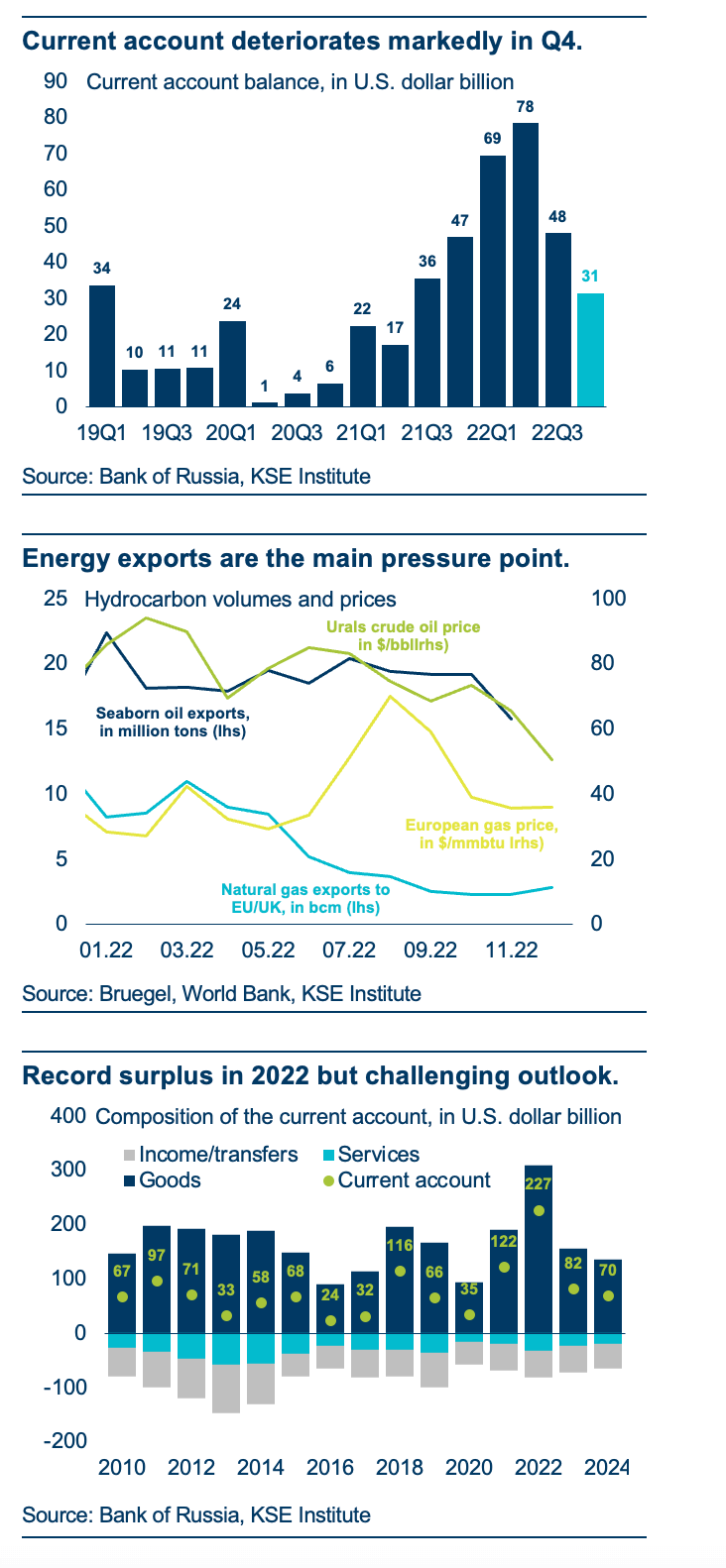

Balance of payments data by the Bank of Russia for 2022Q4 points to a rapidly changing external environment. A current account surplus of $31.4 bn over October-December represents the weakest reading since 2021Q2 and a dramatic turnaround from record-high numbers in the second and third quarter of last year. Sharply lower energy prices, the EU embargo on crude oil, and Europe’s fast exit from Russian natural gas are the main drivers. These trends will continue this year—if not intensify—and drive the external balance into territory where underlying financial and exchange rate fragilities will resurface. For the sanctions coalition, it means that this is the time to ramp up pressure via new restrictions on oil and gas, which we outlined in a recent publication.

External surplus falls sharply in 22Q4. Russia’s central bank (CBR) reported this week that the country’s current account surplus stood at $31.4 bn over the last three months of 2022. This is a much smaller number than in Q1-Q3, indicating that the external environment is becoming significantly less supportive (top chart). Previously released monthly data points to a particularly weak performance in December—the first month during which the EU embargo on Russian crude was (largely) in effect.

Oil and gas exports are the main driver. Energy exports largely determine Russia’s external balance and were responsible for record-high surpluses in 21Q4-22Q3. However, volume and price dynamics have changed considerably in recent months for a number of reasons (middle chart): (1) gas exports to Europe are down by more than 75% compared to the pre-war period; (2) successful storage refilling ample supply of LNG drove down prices following the peak in summer and early fall; and (3) the discount on Russian crude widened and drove down oil export prices.

Challenges will grow in 2023. Since the end of last year, normalization of energy prices has continued and the G7’s price cap on crude is driving the Brent-Urals spread wider. It is currently being reviewed and may be lowered, while similar caps on petroleum products will take effect on February 5 along with the EU embargo on such imports. Europe is also expected to exit the winter with record-high gas storage which will weigh on prices. At the same time, Russia has largely lost its biggest export market while redirecting flows to other destinations is much more difficult than for oil.

Current account surplus to fall sharply. Following a $227.4 surplus in 2022, which represented an 86% increase over 2021, Russia’s external balance will drop to way-below $100 bn this year and next. This will bring underlying fragilities back to the surface, including depreciation pressure and the ruble and much less policy space for the CBR to reconcile the competing priorities of financial and monetary stability.

Opportunity to increase pressure now. In a recent publication, we proposed a package of measures to exacerbate pressures, including a lower price cap on crude oil, aggressive caps on petroleum products, as well as sanctions on Russian gas pipelines, LNG exports, and energy sector companies.

Benjamin Hilgenstock, Senior Economist