- Kyiv School of Economics

- About the School

- News

- Russia Chartbook by KSE Institute – Lower oil prices becoming a problem at a time of accumulated vulnerabilities

Russia Chartbook by KSE Institute – Lower oil prices becoming a problem at a time of accumulated vulnerabilities

29 April 2025

KSE Institute has published its April Russia Chartbook: “Lower oil prices becoming a problem at a time of accumulated vulnerabilities.” Ukraine’s allies should leverage Russia’s deteriorating financial conditions and shrinking economic buffers to further intensify economic pressure, limiting the Kremlin’s capacity to fund its war.

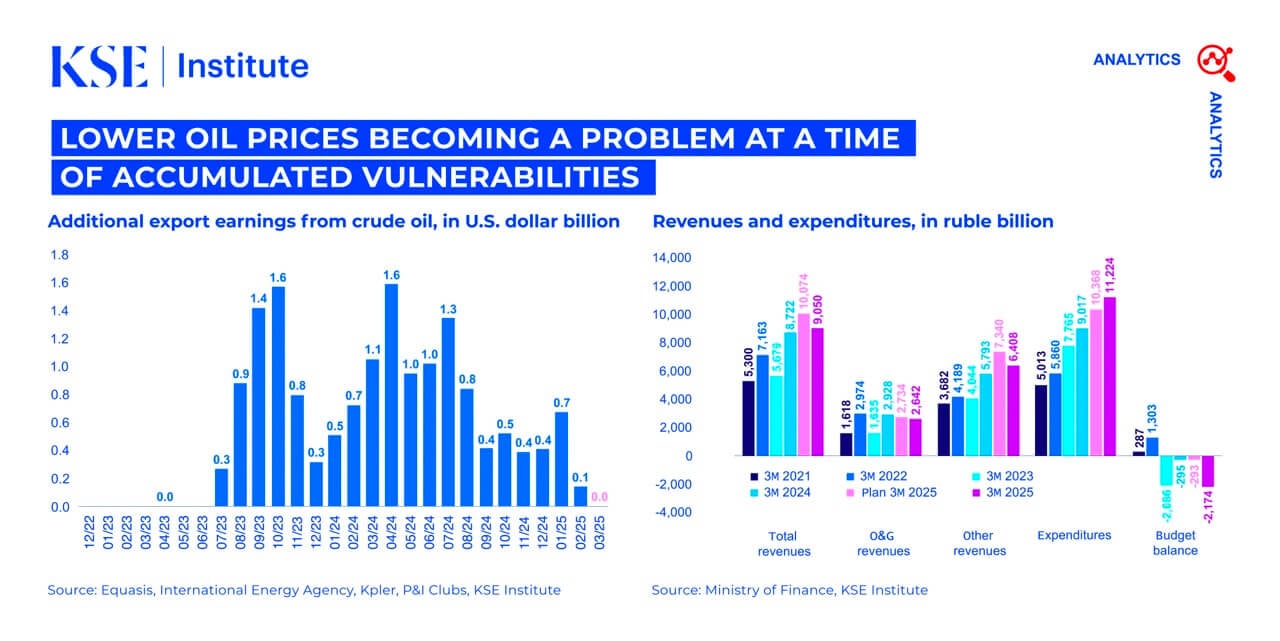

Despite a generally favorable external environment, Russian export revenues dropped sharply by $18.2 billion in the first quarter of 2025, although the current account surplus rose to $19.8 billion due to smaller deficits in services and income. This surplus is the largest since Q1 2024 and the second-highest since the 2022 energy price spike. However, if oil prices continue to decline, Russia’s external accounts may come under significant stress.

Russia’s federal budget recorded a deficit of 2.2 trillion rubles in Q1 2025—over six times higher than the same period in 2024 and nearly double the deficit planned for the full year. The shortfall was driven by a 10% drop in oil and gas revenues, coupled with a 24% increase in total spending. This deficit has been financed solely through domestic debt issuance, while the National Welfare Fund (NWF) remains untouched in 2025.

Russia’s macroeconomic reserves continue to rapidly decline under pressure from war-related spending and sanctions. The NWF’s liquid assets stood at only 3.3 trillion rubles in March, having decreased by 66% since the full-scale invasion began. These assets, now consisting solely of yuan-denominated holdings and gold, can sustain budget deficit financing for approximately one more year. Meanwhile, more than $350 billion in Russian international reserves remain frozen due to sanctions, severely constraining policy options for both the Central Bank and Ministry of Finance.

Despite tight monetary policy, inflation in Russia continues to accelerate, reaching 10.3% in March—the highest in over two years. Despite the Central Bank’s cumulative 1,350-basis-point hike in the key rate since mid-2023, inflation remains elevated due to a tight labor market, sustained war-related expenditures, and rapid private-sector credit growth.

Russia’s economic growth rate is expected to slow down significantly in 2025 to just 1-2%, constrained by labor shortages, limited external investment, and tightening credit conditions. Given these growing economic difficulties, Ukraine’s allies should strengthen sanctions and financial pressure, further reducing Russia’s capability to sustain its war efforts.