- Kyiv School of Economics

- About the School

- News

- Russia Chartbook by KSE Institute — Budget Reprieve Before the End-of-Year Crunch; Macro Situation Dependent on New US Sanctions

Russia Chartbook by KSE Institute — Budget Reprieve Before the End-of-Year Crunch; Macro Situation Dependent on New US Sanctions

10 November 2025

KSE Institute has published the October edition of its Russia Chartbook: “Budget Reprieve Before the End-of-Year Crunch; Macro Situation Dependent on New US Sanctions.” Russia’s deepening financial and economic challenges create an opportunity for Ukraine’s allies to intensify sanctions and economic pressure, limiting the Kremlin’s ability to fund the war.

Russia earned $13.4 billion from oil last month (vs. $13.6 billion in August) on the back of continuously weak global oil prices and a stable discount. It exported less in oil products and more in crude oil due to Ukrainian attacks on refineries. New US sanctions on Rosneft and Lukoil could mean significant challenges, dependent on the strictness of enforcement and the response from current buyers, primarily China and India. Oil prices have ticked up only moderately, and a wider discount will likely offset this effect. Should export volumes drop markedly and risk premia increase further, macroeconomic stability as well as the budget could be in serious trouble.

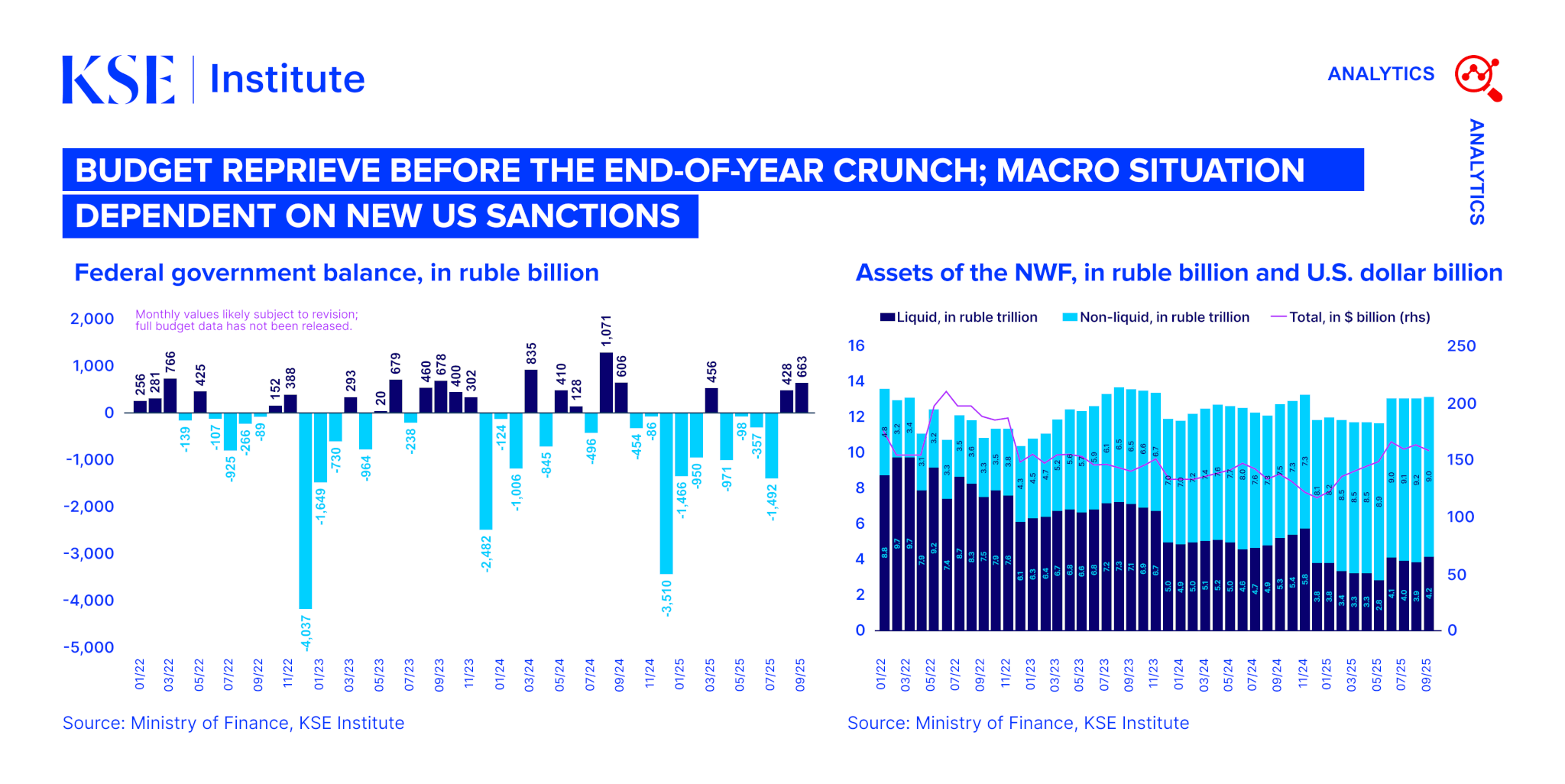

Over January-September, Russia’s federal budget recorded a deficit of 3.8 trillion rubles — a moderate improvement over the January-August number (4.5 trillion). Oil and gas revenues dropped 21% y-o-y, non-O&G revenues grew only 13% as the economy slows, and expenditures rose by 20%. The Ministry of Finance left planned expenditures unchanged but raised the full-year deficit target to 5.7 trillion rubles due to weaker revenues. Given the year-to-date performance and patterns observed in recent years (with large deficits in December), it is likely that Russia will also break through the new target.

In September, the NWF’s liquid portion remained broadly stable at 4.2 trillion rubles (or $50 billion) and accounted for 32% of total NWF assets (compared to 75% in February 2022). In the absence of fiscal consolidation, the regime could be forced to rely heavily on the NWF towards the end of the year, leading to the liquid portion being fully used up. Alternatively, authorities could continue to step up domestic borrowing, which has already been the case this year: OFZ issuance of 3.7 trillion rubles over January-September represents a 100% increase y-o-y and 77% of the original plan. Russia will likely be able to finance its growing deficit as banks can be incentivized to absorb additional issuance, including through further repo schemes by the CBR.

While the CBR has managed to reduce inflation — to 8.0% y-o-y in September from close to or above 10% in January-May with tight monetary policy, this has weighed heavily on businesses and households’ ability to borrow and, thus, economic activity. Despite the recent rate cut to 16.5%, real interest rates remain high, and many of the underlying drivers of inflationary pressure persist — including elevated budget deficits and a tight labor market. Continued Ukrainian attacks on Russia’s refining sector push up gasoline prices, which in turn feed into broader price growth across other goods.