- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook: What To Watch For In 2024 — External Conditions Undermine Macro Stability, Critical Buffers Under Pressure

KSE Institute’s Russia Chartbook: What To Watch For In 2024 — External Conditions Undermine Macro Stability, Critical Buffers Under Pressure

23 January 2024

KSE Institute released its January Russia Chartbook “What To Watch For In 2024: External Conditions Undermine Macro Stability, Critical Buffers Under Pressure.” There are clear signs that Russia’s economy has come under significant pressure over the past 12 months: exports are down, including those of oil and gas, trade and current account surpluses have dropped dramatically, the weakening ruble has forced authorities to implement a painful policy response, and macro buffers are being used up. But further action is needed to step up pressure on the aggressor, including better enforcement of the price cap and addressing of the shadow fleet.

KSE Institute’s analysis shows that recent actions by the coalition to improve the price cap’s effectiveness – sanctioning of entities and vessels, as well as changes to the attestation process – are having an effect. The discount on Russian Urals grade crude oil has widened again, from $13-14/bbl in September-October to $18-19/bbl in December. At the same time, global oil prices have also come down. Together, this has reduced Russia’s oil export earnings from over $18 bn in September-October to $14.4 bn in December. Last month, the price for Urals fell below the $60/bbl price cap again – for the first time since mid-2023. But more can be done and would push Russia’s external balance to a critically low level.

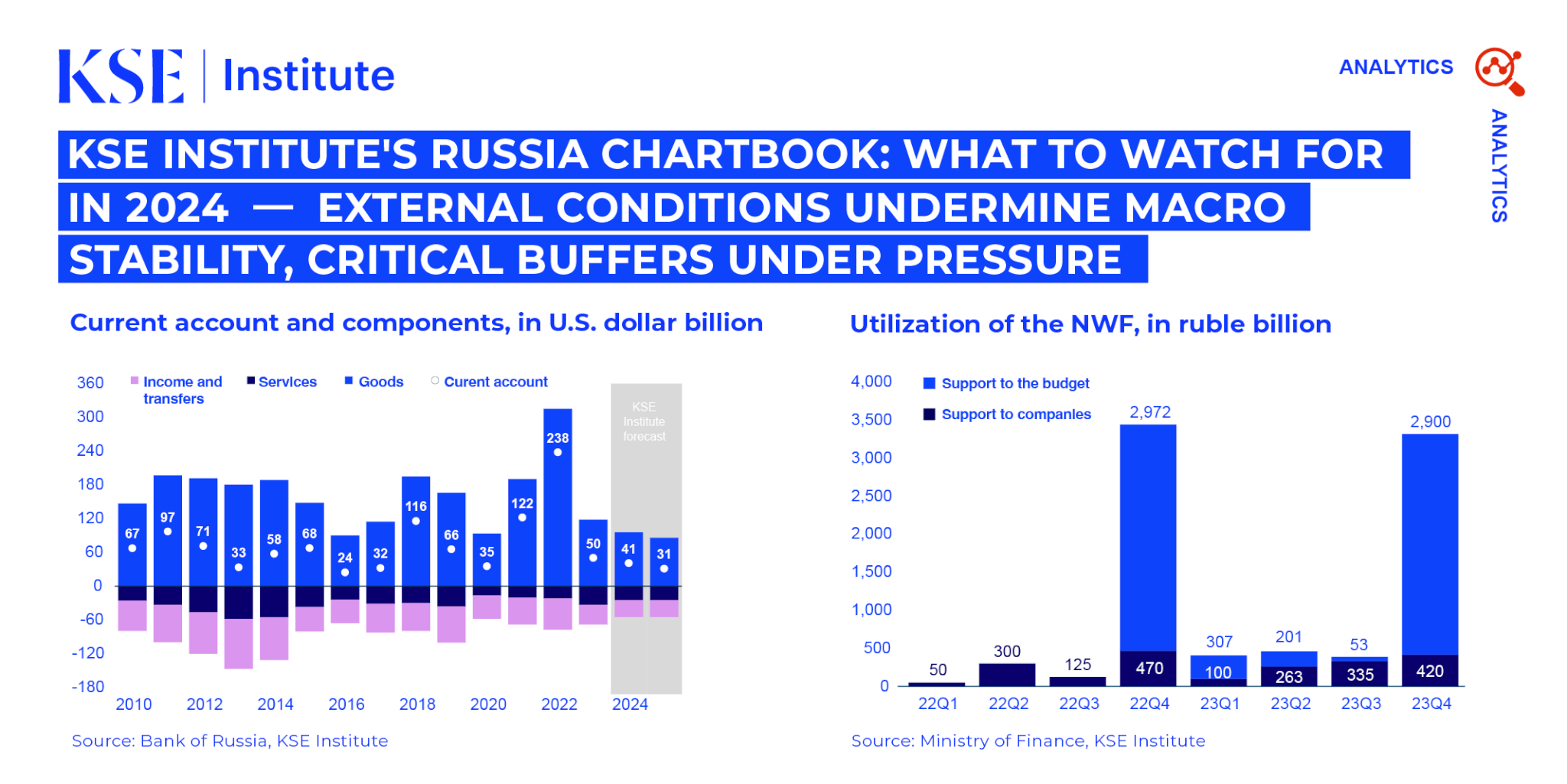

In 2023, Russia exported goods worth $243 bn, a 29% decline vs. 2022. Together with moderate growth in imports, this has driven down the trade surplus by 63% (to $118 bn) and the overall current account balance by 79% (to $50 bn). This much-less supportive external environment – comprising the effect of sanctions as well as moderating energy prices – has fundamentally undermined macroeconomic stability. The ruble has depreciated by approximately 40% against the euro and U.S. dollar since fall 2022, intensifying inflationary pressures. To address these challenges, the CBR has increased interest rates by a cumulative 850 basis points and reintroduced capital controls.

Moreover, macro buffers are under stress due to the war and sanctions. Despite the 2023 budget deficit being only 1.9% of GDP (~$45 billion) and rising non-oil and gas revenues allowing for additional spending, financing is set to become more challenging. In fact, with external sources cut off, Russia heavily relied on the National Welfare Fund, using up almost half of its liquid assets for the budget last year (~4.7 trillion rubles), including all hard currency. The banking system may need to absorb more domestic debt issuance.

However, the Russian economy is benefitting from a large war-related fiscal stimulus, set to increase further in 2024 with a significant rise in military spending. The government plans to allocate 10.7 trillion rubles (~$100 billion) for the military, marking a 68% rise from the previous year. This surge is expected to contribute ~2.5 percentage points to GDP growth in 2024. Despite a full rebound in economic activity from the initial shock of war and sanctions, the weak underlying fundamentals suggest potential challenges ahead.

KSE Institute predicts a decline in oil and gas exports from $228 billion in 2023 to $186 billion in 2024 and $176 billion in 2025. As a result, the overall current account is expected to have surpluses of only $41 billion and $31 billion in 2024-25, respectively. Maintaining pressure through sanctions is crucial, given that a $10/barrel change in oil prices can impact export earnings by approximately $25-30 billion per year.