- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Russia’s Economy At The End Of 2024: Weak Ruble, Growing Macro Imbalances, Economic Management Increasingly Challenging

KSE Institute’s Russia Chartbook – Russia’s Economy At The End Of 2024: Weak Ruble, Growing Macro Imbalances, Economic Management Increasingly Challenging

19 December 2024

KSE Institute has released its new December Russia Chartbook “Russia’s Economy At The End Of 2024: Weak Ruble, Growing Macro Imbalances, Economic Management Increasingly Challenging.” Ukraine’s allies should exploit Russia’s growing financial pressure and limited macroeconomic reserves to increase economic and strategic pressure.

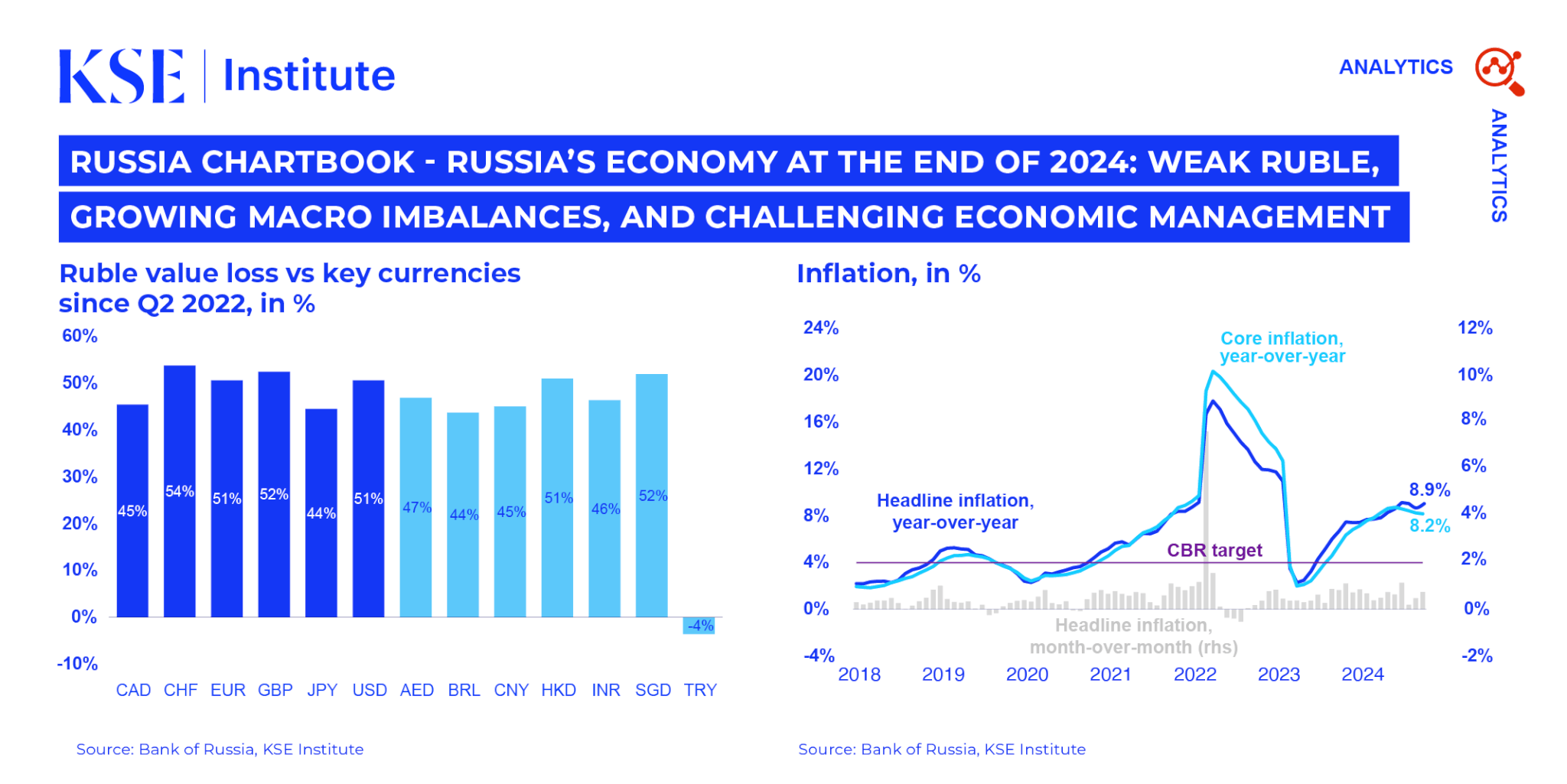

The ruble remains under significant depreciation pressure, reversing its earlier stability. This fall, the ruble’s decline has accelerated, losing over 50% of its value against the U.S. dollar and the euro, while also weakening against other major currencies. Reduced net hard currency inflows and sanctions on financial institutions and the Moscow Exchange are key factors driving this trend.

Russia’s Central Bank is struggling to contain inflation despite raising the key rate by 1,350 basis points to 21%. In November, headline inflation stood at 8.9% year-over-year, and core inflation at 8.2%. Key drivers include near double-digit real wage growth, war-related spending, ruble depreciation, and a 61% or almost $650 billion surge in private sector credit since mid-2022. The central bank is likely to tighten monetary policy further in December, with markets expecting a 200 basis point rate hike.

The external environment remains broadly supportive for Russia, despite lower oil prices. In November, Russian oil export prices dropped to $64.4 per barrel, with the discount staying below $10 per barrel—the lowest since the invasion. The shadow fleet, handling 90% of seaborne crude oil exports, generated $9.4 billion in extra revenue in the first 11 months of 2024. These revenues supported a current account surplus of $57.4 billion from January to November.

Russia faces no significant constraints on its budget or war spending. In January–November, the federal budget deficit was 389 billion rubles, down from 878 billion rubles a year earlier. A 26% rise in oil and gas revenues and other revenues offset a 24% increase in spending. To cover the deficit, Russia issued 1.9 trillion rubles in domestic debt in December to date, as constrained macroeconomic buffers limited other options. To attract sufficient interest from banks, the Central Bank introduced a repo scheme, providing nearly 1.2 trillion rubles in liquidity.