- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Large Budget Deficit In January Could Spell Trouble; Underlying Vulnerabilities May Surface

KSE Institute’s Russia Chartbook – Large Budget Deficit In January Could Spell Trouble; Underlying Vulnerabilities May Surface

4 March 2025

KSE Institute has released its new February Russia Chartbook “Large Budget Deficit In January Could Spell Trouble; Underlying Vulnerabilities May Surface.” Ukraine’s allies must reinforce sanctions to further reveal Russia’s economic vulnerabilities and compel the Kremlin to function under intensified financial pressure.

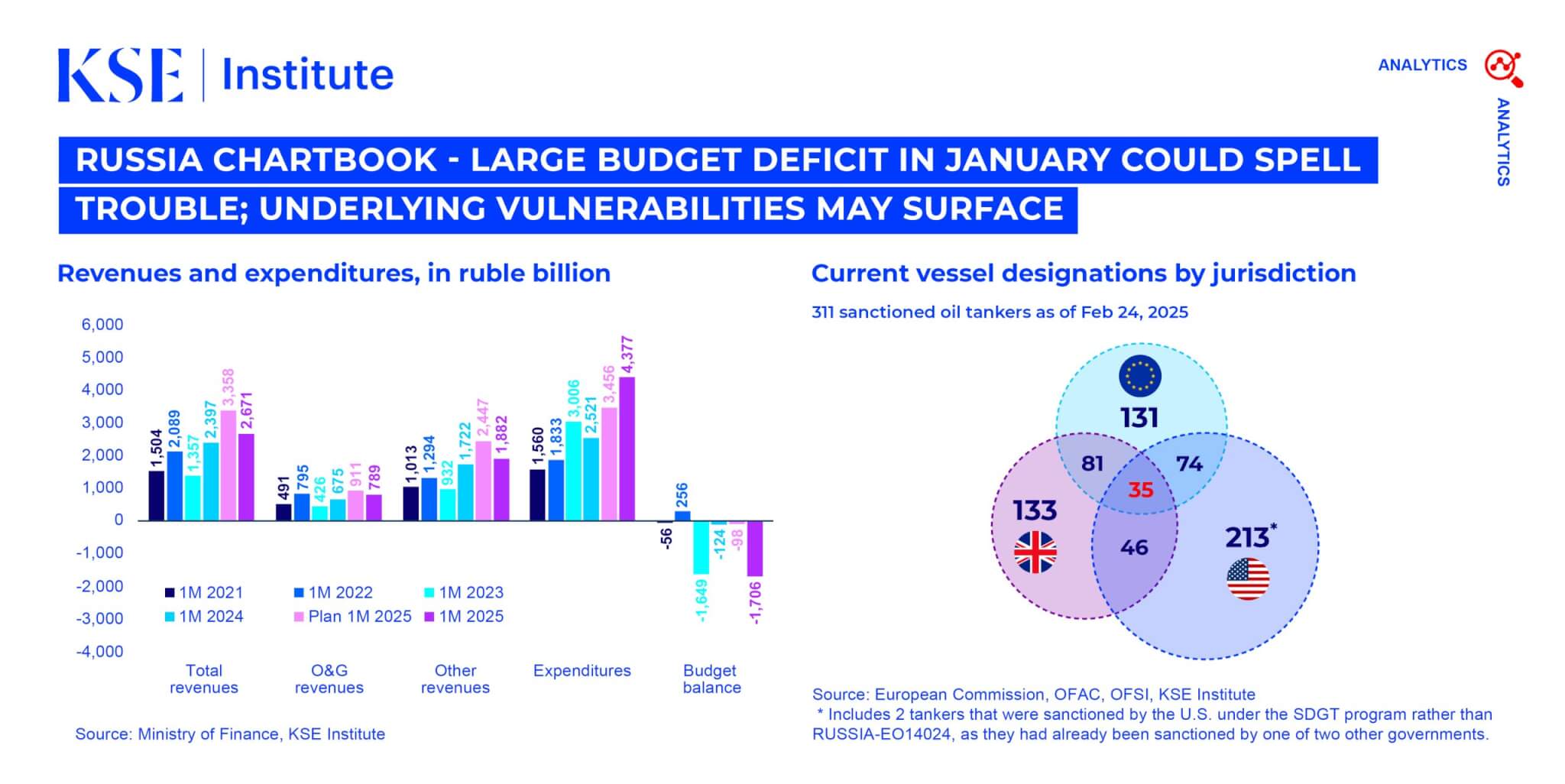

The U.S. sanctions on Russia’s shadow fleet are taking effect, widening the discount on Russian oil export prices. In January, Russian crude traded at a discount of $11.2 per barrel (vs. $8.7 in December), while ESPO crude saw a discount of $7.3 per barrel (vs. $3.2). With over 150 vessels sanctioned by the U.S. in mid-January, the impact is expected to grow in February. However, Russia’s export revenues rose to $15.8 billion in January, temporarily buoyed by higher global oil prices.

Russia’s current account remained in deficit for the second consecutive month, with a $0.7 billion shortfall in January as non-energy exports underperformed. This marks a sharp decline from a $1.6 billion monthly average surplus in Q4 2024 and a monthly surplus of $8.0 billion in Q1 2024. While weaker imports partially offset the decline, the long-term outlook will depend on further sanctions developments. Meanwhile, the ruble’s appreciation does not reflect underlying economic conditions, instead influenced by expectations surrounding U.S.-Russia negotiations.

The federal budget posted a record-high deficit of 1.7 trillion rubles (~$17 billion) in January, with expenditures rising to 4.4 trillion rubles—almost twice the amount spent in January 2024. Revenues covered only 61% of spending, raising concerns over fiscal stability. While the deficit may be driven by frontloaded military spending and deferred December expenditures, it remains uncertain whether Russia can implement the same fiscal adjustments as in 2023. Notably, no withdrawals from the NWF or major domestic debt issuance were used to cover the shortfall.

Russia’s macroeconomic buffers remain under pressure. The liquid assets of the NWF have fallen by 61% since February 2022, leaving only 3.8 trillion rubles ($37.5 billion), primarily held in yuan and gold. At the current rate, these reserves could be depleted by the end of 2025, forcing the Kremlin to rely on the domestic bond market as its primary source of financing. With sanctions restricting policy options and inflationary pressures rising, Russian authorities are increasingly facing competing objectives.