- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Global Prices Weigh On Oil Exports; CBR Continues To Struggle With Inflation

KSE Institute’s Russia Chartbook – Global Prices Weigh On Oil Exports; CBR Continues To Struggle With Inflation

2 October 2024

KSE Institute has released its new September Russia Chartbook “Global Prices Weigh On Oil Exports; CBR Continues To Struggle With Inflation.” Ukraine’s allies should take advantage of Russia’s economic vulnerabilities and step up sanctions pressure now.

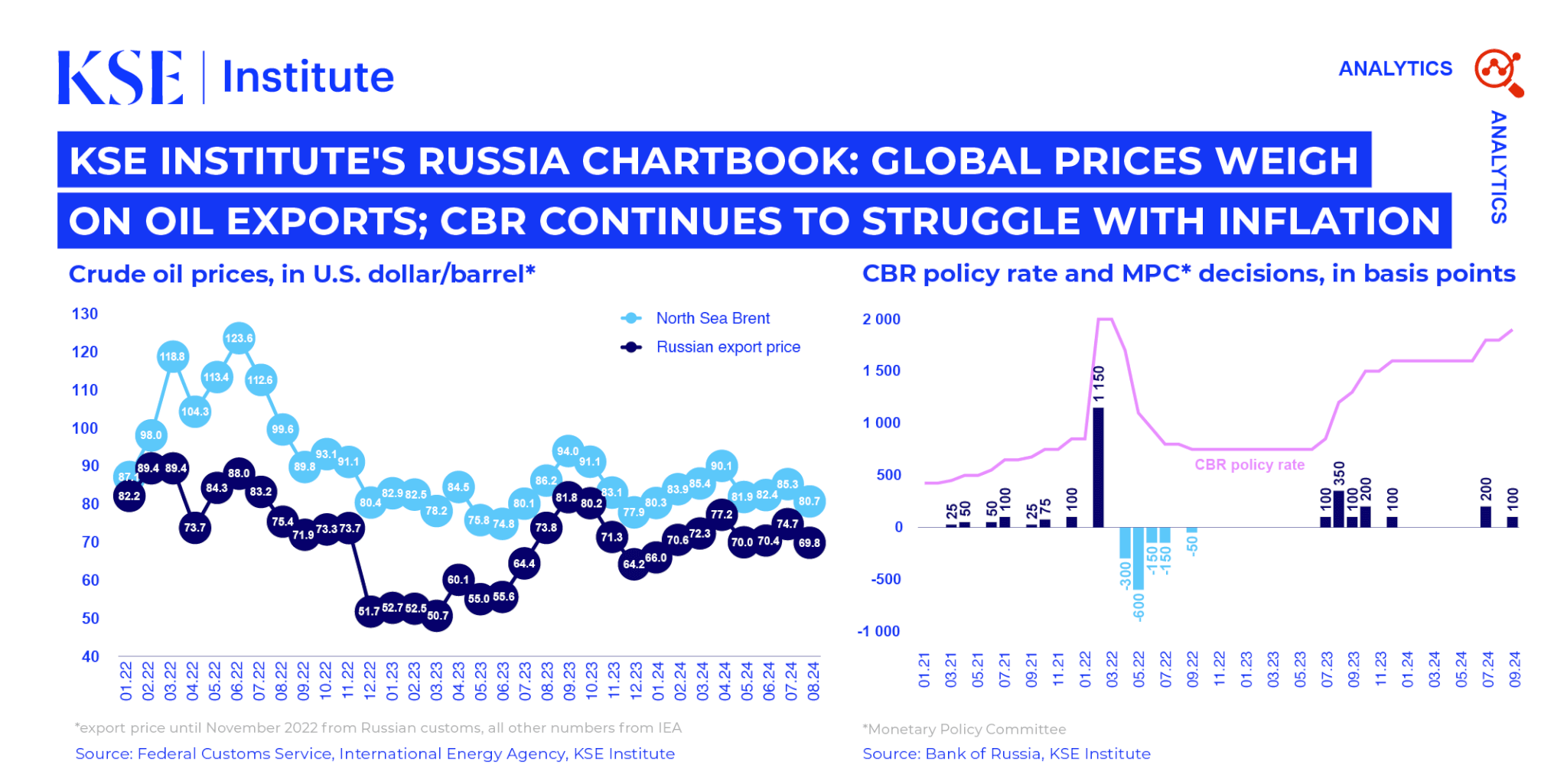

In August, Russian oil export revenues dropped to $15.3 billion, the lowest since the first half of 2023. This decrease is driven by lower global oil prices, not by enhanced sanctions enforcement. Although the discount on Russian oil remained stable, the reduced revenues reflect less favorable external conditions.

While the UK recently designated additional tankers, the overall effort to rein in Russia’s shadow fleet remains limited. The shadow fleet accounted for 90% of Russian seaborne crude exports in August, highlighting the need for more decisive actions from coalition countries to restrict its operations.

Despite lower oil revenues, Russia’s current account shifted back to a surplus in August after a July deficit, due to a smaller income and transfers deficit. From January to August, the surplus reached $40.5 billion, nearly 40% higher than the same period in 2023. For 2024, the surplus is projected to reach $60 billion, up from $51 billion in 2023, but is expected to decline in 2025-26 partially due to falling global oil prices.

As a result of sharply higher oil and gas revenues (+56%) and other revenues (+27%) compared to January-August 2023, Russia is not facing major fiscal constraints. From January to August 2024, the federal budget deficit fell to 0.3 trillion rubles, a sharp decline from the previous month due to a large surplus in July. The higher revenues offset the 23% spending rise, keeping Russia on track to meet its 2024 budget target, with the deficit at just 16% of the 2024 plan.

However, inflation remains a major concern for Russia, despite the CBR raising interest rates by 11.5pp since mid-2023, including a 1pp hike in September. In August, inflation reached 9.1% year-over-year, well above the 4% target. Key drivers include a tight labor market (2.4% unemployment in July), rising wages, high government war spending, and increased private sector lending.

Russia faces another economic vulnerability as reduced financial buffers limit its policy options. With $300 billion in CBR reserves frozen by sanctions and a significant drop in liquid assets in the NWF, Russia is left with mostly gold and yuan, which are harder to convert at scale. If tighter monetary conditions slow the economy and weaken revenues, this could pose a major challenge for authorities.