- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – External Environment Turning More Supportive, Fiscal Outlook No Constraint For Russia’s War

KSE Institute’s Russia Chartbook – External Environment Turning More Supportive, Fiscal Outlook No Constraint For Russia’s War

24 April 2024

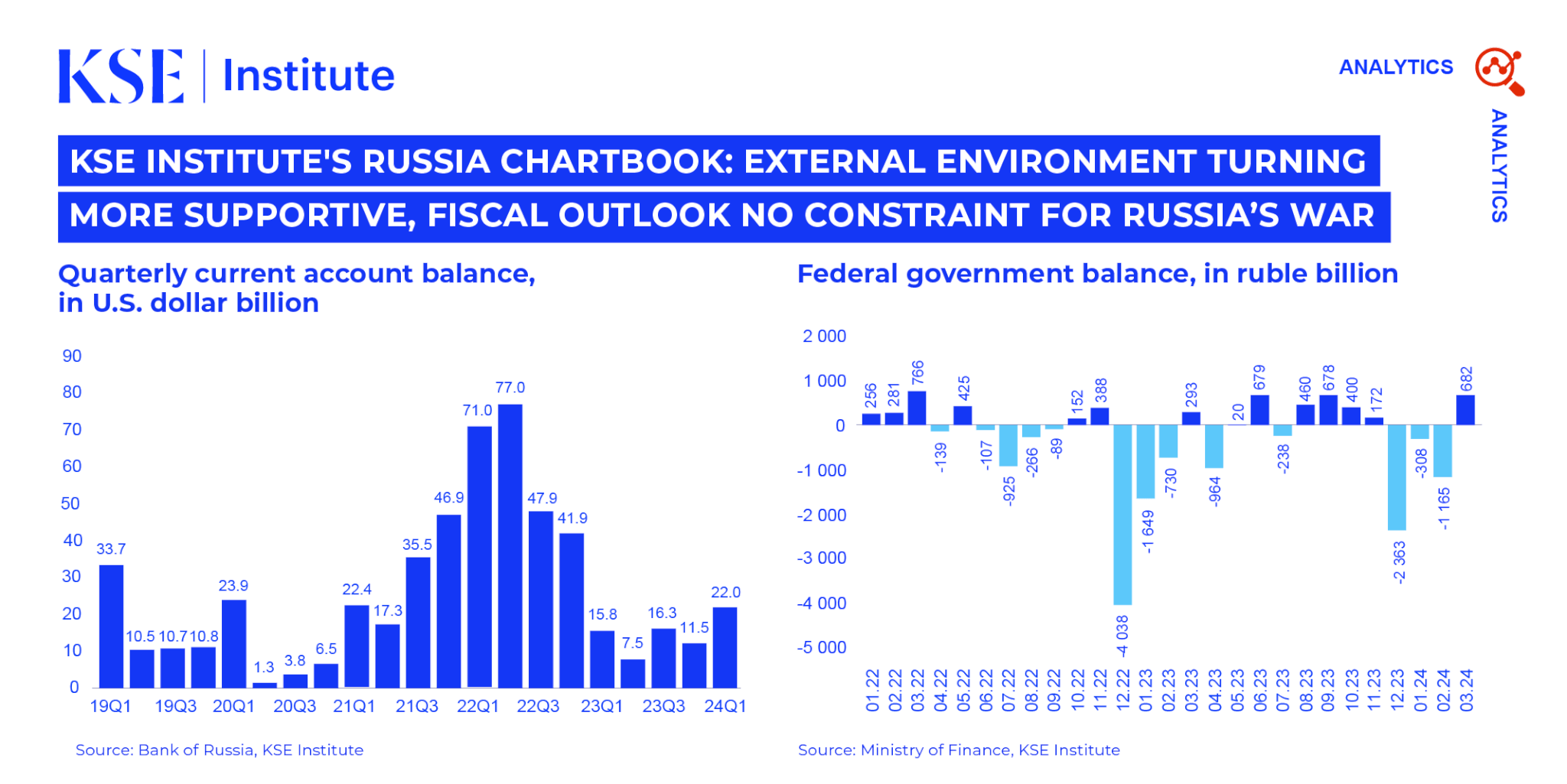

KSE Institute has published its April Russia Chartbook “External Environment Turning More Supportive, Fiscal Outlook No Constraint For Russia’s War.” The external environment is improving and rising oil and gas budget revenues help to reduce fiscal financing pressure. While sanctions weakened Russia’s macroeconomic stability in 2023, more action is needed in the coming months to hinder its ability to continue the war of aggression in Ukraine.

The external environment is becoming more supportive as Russia benefits from higher global oil prices. In March 2024, the trade surplus more than doubled to $16.8 billion compared to the January-February average of $7.3 billion. Meanwhile, the current account surplus rose from $4.2 billion on average in January-February to $13.4 billion in March. With foreign currency inflows projected to exceed $100 billion in 2024 vs. $51 billion in 2023 if current trends continue, Russia gains much policy space to manage the economy and sustain its war in Ukraine.

In March, Russia earned $17 billion from oil exports due to steady export volumes (refined products down 7% but compensated for by crude oil up 6% in March vs. February). Budget revenues from oil and gas surged due to higher oil prices, a weaker ruble, and tax changes (+79.1% vs. Q1 2023). Also, war-driven economic growth boosted non-O&G revenues (+43.2% vs. Q1 2023), funding increased expenditures (+20.1% vs. Q1 2023). In Q1 2024, the budget deficit stood at 0.8 trillion rubles and fiscal pressure will likely remain contained.

Better external conditions and fiscal improvements signal that energy sanctions are not as effective as in H1 2023. Price cap compliance is weak, with key Russian crude oil grades well above the $60/bbl threshold. Urals averaged $66/bbl in Q1 2024 and is currently trading at ~$78/bbl, while the respective numbers for ESPO are $76/bbl and $85/bbl. Enforcement faces challenges due to ongoing issues surrounding pricing information provided through the attestation system. In addition, Russia’s ability to expand/maintain its shadow fleet despite recent OFAC vessel designations undermines the effectiveness of current energy sanctions.

Due to the improved fiscal situation, Russia has not tapped heavily into its significantly-diminished sovereign wealth fund this year, and domestic borrowing remains stable and moderate. While ~$300 billion in reserves are immobilized in coalition countries, a favorable external environment has reduced pressure on the ruble and inflation. Consequently, the CBR has not needed to tighten monetary policy recently. This ensures sufficient liquidity for the economy.

To undermine Russia’s ability to wage war, Ukraine’s allies must step up sanctions and closely monitor their enforcement in the coming months.