- Kyiv School of Economics

- About the School

- News

- KSE Institute’s Russia Chartbook – Central Bank Struggles To Contain Inflation; Ruble Depreciation Shows Vulnerability

KSE Institute’s Russia Chartbook – Central Bank Struggles To Contain Inflation; Ruble Depreciation Shows Vulnerability

28 November 2024

KSE Institute has released its new November Russia Chartbook “Central Bank Struggles To Contain Inflation; Ruble Depreciation Shows Vulnerability.” Ukraine’s allies should leverage Russia’s economic vulnerabilities to intensify pressure, weaken its external environment, and reduce oil revenues funding the war in Ukraine.

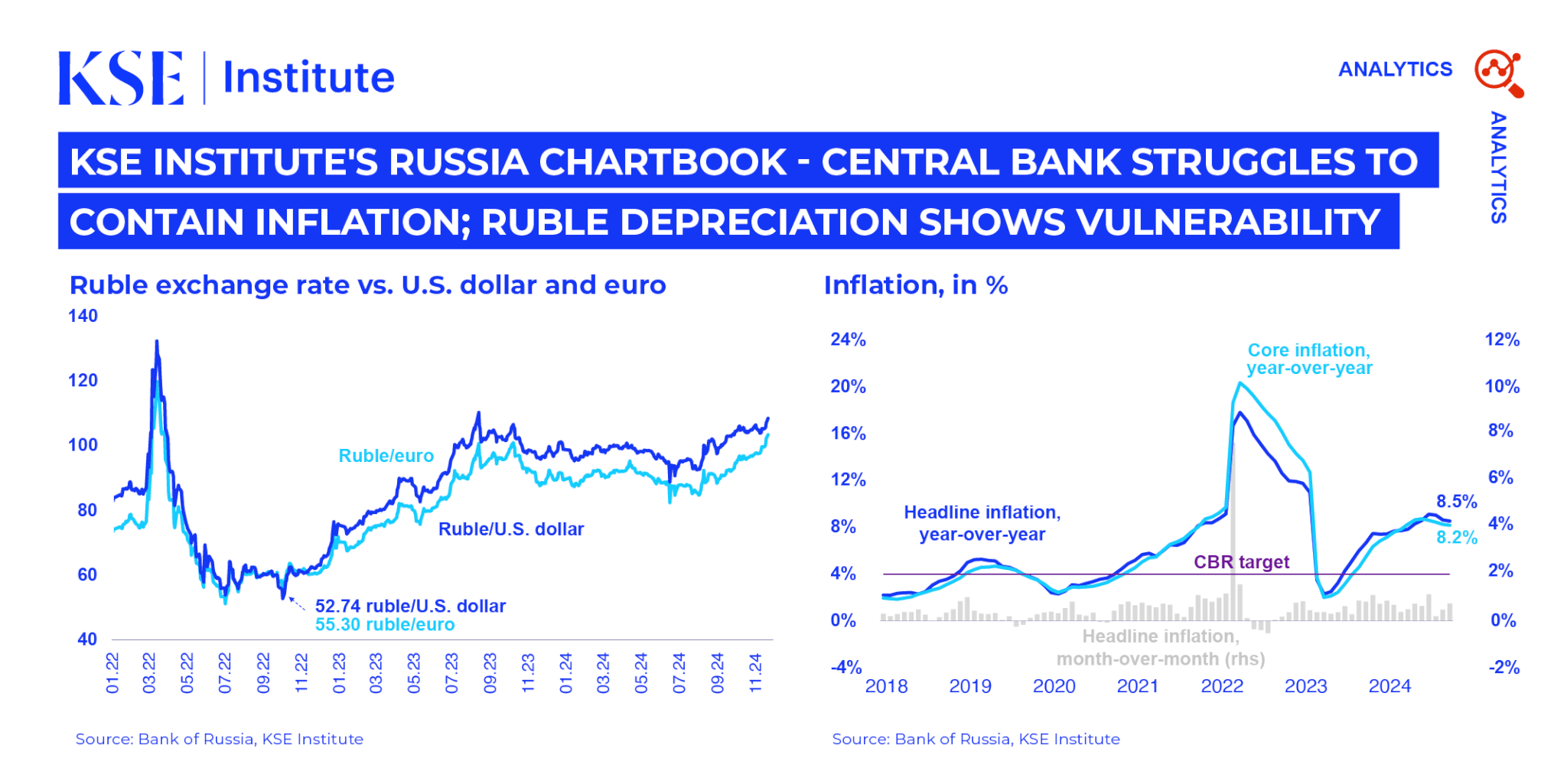

The Russian ruble has come under significant pressure, weakening sharply after a period of relative stability. In recent weeks, it crossed the key threshold of 100 rubles per U.S. dollar, reaching the highest level since early 2022. Overall, the ruble has lost 52% of its value against the dollar and 47% against the euro, with similar declines against other major currencies.

The ruble’s depreciation, combined with war-related spending, rapid credit growth, and a tight labor market with nearly double-digit real wage growth, has fueled strong inflation in Russia. The Central Bank raised the key rate by 1,350 basis points to 21% but has struggled to control it. In October, headline inflation stood at 8.5% year-over-year, with core inflation at 8.2%. Further monetary tightening is likely in December.

However, the external environment remains broadly favorable. In October, Russian oil export prices rose to $65.7 per barrel as global prices increased, while the discount fell below $10 per barrel—the lowest since the invasion. The shadow fleet, handling 85% of seaborne crude oil exports, added nearly $9 billion in extra revenue in the first ten months of 2024. The current account surplus for January-October reached $58.1 billion, marking a 31% increase year-over-year. Despite this, net foreign currency inflows from trade remain low.

Russia faces no major constraints on its budget or war spending. In January-October 2024, the federal budget deficit was 221 billion rubles, down from over 1 trillion rubles a year earlier. This was driven by a 32% rise in oil and gas revenues and a 27% increase in other revenues, which offset a 24% rise in spending. As a result, Russia is likely to meet its 2.1 trillion ruble deficit target for the year. Favorable fiscal conditions will also enable a 25% increase in military spending in 2025, reaching 13.5 trillion rubles (~$140 billion).