- Kyiv School of Economics

- About the School

- News

- KSE Agrocenter Discussion Series Discussion 4: Agricultural land market in Ukraine: current state, efficiency and transparency

KSE Agrocenter Discussion Series Discussion 4: Agricultural land market in Ukraine: current state, efficiency and transparency

7 December 2023

On November 30, 2023, the USAID Agriculture Growing Rural Opportunities Activity in Ukraine (AGRO) and the Food and Land Use Research Center at the Kyiv School of Economics (KSE Agrocenter) organized a public discussion «Agricultural land market in Ukraine: current state, efficiency, and transparency».

Main points of the speakers:

James Hope, USAID Mission Director in Ukraine

• Land reform is central not just today but for Ukraine’s future economic prosperity going down the road.

• There’s a lot of work about building the future, and land reform is one of the pillars of that future. For USAID and the US Embassy, support for the agricultural sector, land reform, and everything around will remain an important priority.

• We stand together to continue driving land reform and agricultural development for the domestic and export markets because, as we all know, Ukraine’s agriculture is feeding millions of people worldwide.

Mykola Solskyi, Minister of Agrarian Policy and Food of Ukraine

• The reform is transparent. Everything that happens with the land market is visible daily thanks to the electronic state registers.

• Only 0.3% of agricultural land is sold in Ukraine annually. That is an answer to skeptics who predicted that the initiation of the reform would lead to the mass buying up of Ukrainian land.

• From the very beginning, no corruption risks were possible. After all, the legislators did not succumb to demagoguery and populism and did not support the provisions on the primary right of ownership for the local community or the state, the need for a considerable number of approvals, etc.

• Any emotional statements about postponing certain stages of the reform are irrelevant. On the contrary, we should move faster towards the set goal. That is beneficial both from the point of view of economic development and for the arrival of real investments and the formation of an attractive business environment.

Oleksandr Haydu, Chairman of the Committee on Agrarian and Land Policy

• In 2020, the Law of Ukraine on the circulation of agricultural land was adopted, which canceled the 20-year land moratorium and opened the possibility of introducing the agricultural land market in Ukraine. This law formed a land market model, which provides for the gradual opening of the land market.

• Now, we expect the second stage on January 1, 2024, when it will be possible to buy additional land investments because financial institutions can lend under the pledge of land plots.

• The Committee constantly monitors the implementation of legislation on the circulation of agricultural land. It continues legislative work in implementing land reform, which meets today’s requirements and the country’s interests on the path of integration into the European Union.

• The Committee’s main task for now is the adaptation of land legislation to the needs of the war and post-war reconstruction of the state. In particular, in the second reading, we are currently considering a draft law aimed at providing an opportunity to change the intended use of some land plots outside the city limits as quickly as possible and without unnecessary bureaucratic problems during the period of hostilities when a lot of industrial facilities were destroyed, to build objects of industry or energy, or military objects. The Committee is also working on a draft soil protection and restoration law and many others.

Sergiy Kubakh, Land Reform Team Lead, USAID Agriculture Growing Rural Opportunities Activity (AGRO)

• During the first year of the war, direct losses to the agricultural sector of Ukraine reached 9 billion USD. Indirect losses make up more than 40 billion dollars and are growing. The losses require a significant capital investment and considerable financing attraction. The agricultural land market can help with this. The country will not wholly recover without a land market. The USAID Agro project and the Kyiv School of Economics introduced the research project “Unbreakable Land,” where we precisely monitor the state of land relations, its possibilities, and tools.

• Of the 880 days of the market’s existence, 645 fell during full-scale war. The market passed the strength test.

• The basis of the market is the legislative framework – these are eight laws that meet all the requirements of the EU in their main principles. There are issues to resolve, but the foundation is already in place.

• None of the myths of the market opponents came true: 99.5% of the plots purchased for more than two years remained in agricultural production.

• The market has become part of the economy: the circulation and use of agricultural land brings communities an average of 10%-12% of their total budget.

• Ukraine has a developed market for renting communal agricultural land through auctions-leasing communally owned agricultural land through Prozorro. Sales already bring communities an annual income of 355.2 million UAH.

• Only from the beginning of 2023 did the weighted average price increase by 10.4% to 38.5 thousand UAH/ha, i.e., the capitalization of the agricultural land market increased by 115.1 billion UAH. That is, the owners of land plots have become more prosperous by three billion dollars and can use this capital to attract production financing. However, this requires a timely opening of the market for legal entities.

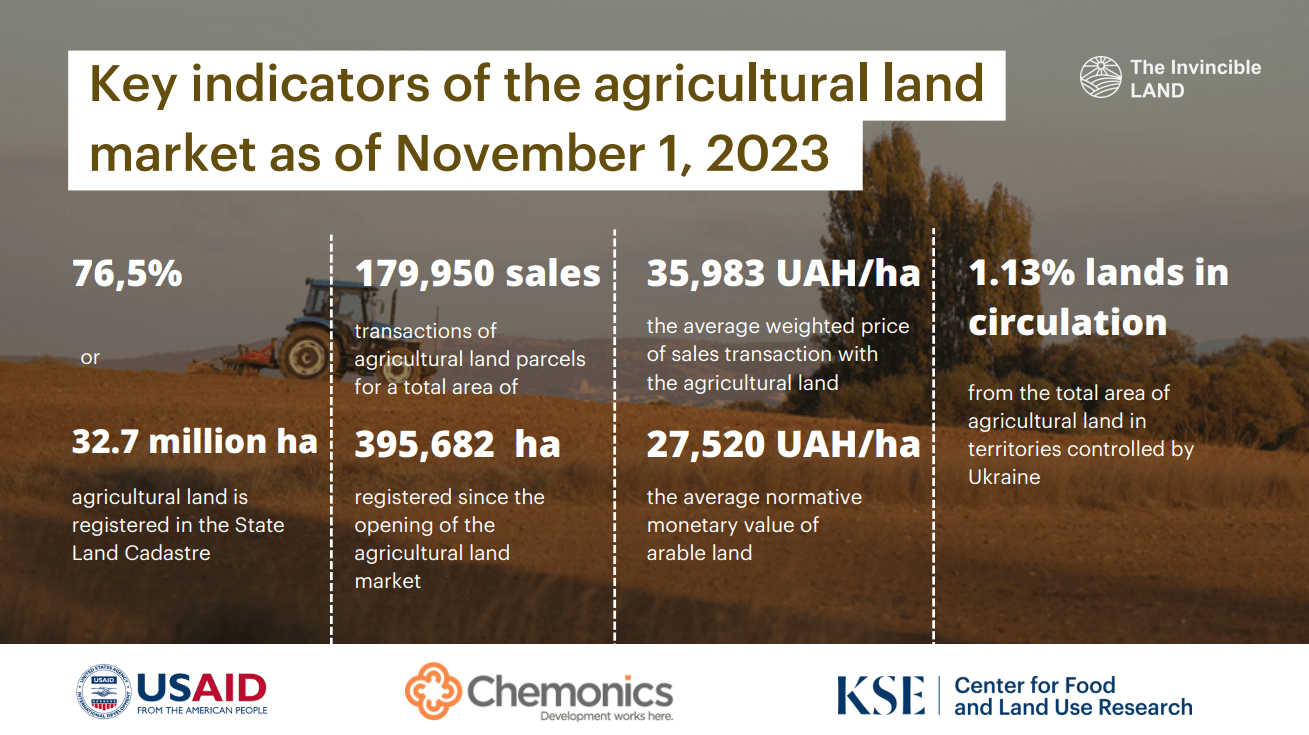

• As of the end of October, 179,950 sales agreements were concluded for over 395,000 hectares.

• About 1% of agricultural land is in circulation, corresponding to the indicators of countries with a developed land market. There is no mass buying up of land in Ukraine.

• The land market is recovering after the first months of the war when the registers did not work. The amount of land in circulation has been stable monthly and quarterly for over half a year.

• Poltava, Khmelnytskyi, and Kharkiv regions are the most active land markets. Prices vary across the country and depend on proximity to the front.

• Mainly, land for commercial farming that was under moratorium is in circulation.

• According to estimates from the Kyiv School of Economics, agricultural producers can potentially attract up to 70 billion hryvnias as collateral for farming land after opening the land market to legal entities. These funds will make it possible to partially compensate for those property losses, i.e., collaterals, which the farm sector suffered due to a full-scale war. That is, the second stage of the market will increase liquidity and market capitalization.

Denys Bashlyk, Deputy Minister of Agrarian Policy and Food of Ukraine for Digital Development, Digital Transformations, and Digitalization

• Opening the land market and land reform created opportunities for realizing landowners’ rights and business development. We can already see the synergy of the land reform with other government initiatives, such as the government’s program for providing grants for gardens and greenhouses. Most of the garden projects under the program are on owned land, not leased, which is a huge indicator.

• Today, the transformation of the agricultural sector is taking place due to the challenges caused by the war, among others. Many “raw” producers are now thinking about the development of processing. Redevelopment and long-term investment projects are complicated on leased land. Therefore, the importance of the land market increases in the context of reconstruction.

• When the market for legal entities opens, one more entity will appear, which will be checked according to all the existing procedures for individuals.

• Developing a system for monitoring land relations is essential for further market development, which should become operational next year. That will ensure maximum transparency of the land market. Because when there is transparency, there is no chance for any abuse.

Oleg Prykhodko, Acting Chairman of the Board of Directors of the Partial Credit Guarantee Fund in Agriculture

• The Fund is already working with banks to conclude the first cooperation agreements to offer products under the Fund’s guarantees and commercial banks before the land market opens for legal entities. The authorized capital of the Fund is now being replenished and will amount to 735 million hryvnias. That, following the requirements of the law and the National Bank of Ukraine, guarantees loans with a total volume of about 2.8 billion UAH. Since the Fund covers 50% of risks, it can contribute to forming credit portfolios in the segment of up to 500 hectares for more than UAH 5 billion.

• The target segment of the Fund, which before the full-scale invasion was about 28 thousand Borrowers, is now estimated at the level of 23 thousand Producers. More than 70% are ready to take loans and plan to increase their land base by buying or additional leases. Suppose the Fund will work with other state support programs, primarily the 5-7-9 program of affordable loans, which covers 80-90 percent of the SME segment in the agricultural sector. In that case, the Fund’s guarantees will allow agricultural producers to significantly increase their lending capacity for investment and replenishment of working capital. The Fund will also support mortgage lending to agricultural producers to purchase land for up to 10 years.

Inna Bernatska, Vice President of the Notary Chamber of Ukraine

• The model of the gradual opening of the agricultural land market proved correct. That made it possible to maintain people’s trust in legitimacy and prevent raiding.

• All notaries have access to the State Register of Real Property Rights, the Unified Register of Legal Entities and FOPs, and the National Cadastre System. However, further speeding verification procedures will reduce transaction costs.

• In particular, it is necessary to implement the electronic register of sanctions for the verification of land buyers as soon as possible since this information is currently available in the form of separate presidential decrees, the verification of which takes a long time. It is also necessary for notaries to access the Tax Service database to confirm the income of legal entities and individuals. In addition, we need access to the Demographic register because many people are missing, and their passports were stolen in the occupied territories.

• As for the second stage of the land market, additional safeguards are necessary to protect legal entities as the value of the corporate rights of the legal entity that purchased the land increases significantly, and the legal entity itself can become an object for raiding. The Verkhovna Rada is considering draft law 5644, which contains a requirement to establish a mandatory notarization of contracts to purchase and sell corporate rights. In 2024, this norm must appear to protect corporate rights owners.

• It is also necessary to improve the procedures for registering the results of land auctions.

Roman Neyter, Agrarian and land policy expert researcher of the «Invincible Land» project

• There are three outstanding tasks. The first is expanding the access of small agricultural producers to credit, which should be complemented by the full-fledged launch of the Fund for Partial Guarantee of Credit in Agriculture.

• The second task for improving the efficiency of the land market is the revision by the National Bank of Ukraine of the liquidity ratio of agricultural land as collateral, which is currently 0.35. Currently, for every 100 hryvnias of the land plot’s value, only 35 can be obtained, limiting the amount of available credit resources. Hopefully, opening the market to legal entities and increasing market liquidity will create prerequisites for revising and adjusting this ratio (Resolution No. 351).

• The third task to increase the land market efficiency is the reduction of transaction costs. Currently, the transaction costs for drawing up one contract amount to about 12-15 thousand hryvnias – on average, about 15% of the price of the agreement.

Yevhenii Horovets, First Deputy Minister of Justice of Ukraine

• We can state that during the two years of operation of the land market, there were several complaints to the Ministry of Justice regarding the work of notaries, and we did not find violations in any of those complaints. No registration action on transferring ownership rights to an agricultural plot of land has been canceled. There were some complaints about the prevailing law, but we left them without consideration. Therefore, the legal design of the agricultural land circulation system has already stood the test of time.

• Indeed, there is the problem of high transaction costs. It is affected by the volume of checks carried out by the notary. There were many of them at the first stage of the opening and the market. Certain legal conditions have been simplified since then, for example, in finding out how much land belongs to one of the spouses. In addition, checks were canceled for lands for individual gardening and personal peasant farming. Accordingly, we can continue to move forward by simplifying specific requirements. The second mechanism for reducing transaction costs is automation: data quality in all registers, high-quality exchange between them, and result automation.

• As a result, the state will create a resource that will provide a basic level of checks in automatic mode and reduce the cost of transactions. We are also working on ensuring notaries have access to the Unified Demographic Register. The government has approved the relevant regulation but has not yet entered into force. The corresponding software will be finalized shortly, and such access will be provided.

• Launching the second stage of the land market does not require any changes to the by-laws. The existing algorithm is quite universal and flexible.

• The legislation has a norm that sets the absence of a corresponding land bank in a legal entity as a condition for the alienation of a share. It is problematic, given our registries’ infrastructure, interaction, etc. We will move forward with this; such interaction will be ensured. A buyer of the corresponding share in the authorized capital should take care of that. That is standard practice, and it is established in business that when you buy a business and conduct the so-called due diligence, it can have different depths. As for the checklist, from January 1, 2024, the following procedures will appear: checking the legal entity’s land bank, comparing it with the land bank of an individual, and connecting individuals with legal entities. Software that would automatically track all this, control it, and issue aggregated data in a single interface is quite expensive. But we understand this problem and will work on its solution.

Dmytro Makarenko, Acting Head of the State Service of Ukraine for Geodesy, Cartography, and Cadastre

• The State Land Cadastre is probably Ukraine’s most global official information system. Today, it is 74% full. Although the cadastre has not worked for some time, and the public cadastral map is closed for martial law, the cadastre is working, new services and functionality are under development, extracts are issued, and plots are registered.

• Last year, with international partners, we finished the technical evaluation project of the Cadastre software and all its components and agreed on the next stage of reengineering the system.

• As for monitoring the agricultural land market, the State Geocadastre is already doing that thanks to established cooperation with the State Register of Property Rights. The result is publicly available on the official website of the State Geocadaster.

• The public monitoring system of land relations (the CMU Resolution adopted in May of this year) is already more complex. Nine authorities are subjects of information interaction. The State Geocadaster is preparing the terms of reference. We will begin developing the software at the beginning of next year.

• Recently, a new functionality for registering agricultural land massifs was launched. Currently, technicians and specialists of the DZK administrator are working on ensuring the possibility of notaries checking the concentration of land by legal entities. Such functionality should appear by the end of this month. Concentration data on legal entities and individuals (in depersonalized form) are published on the “Land Monitoring” page of the State Geocadastre website.

Inna Zaporovskaya, Deputy head of the Department of Minimization of Corruption Risks and Anti-Corruption Expertise of the National Agency on Corruption Prevention (NACP)

• Not long ago, the National Agency for the Prevention of Corruption (NAPC) had already conducted a land corruption study, revealing the TOP 30 corruption risks and ways to address them. The authorities implemented 63% of the recommendations. As for those pending, there is a corresponding mandate from the Prime Minister of Ukraine.

• The state anti-corruption program (SAP) covers most of the problematic issues in the field of land relations, which were identified by NAPC, in particular, in the mentioned study. NAPC monitors the implementation of SAP. For this purpose, the Agency developed a unique information system. Every quarter, the executors send a message describing the state of implementing the SAP activities to NAPC using the information system. Electronic files or links can be attached to the message as evidence.

• After conducting the monitoring, the experts of the NAPC assign a particular label to each activity, and the information is entered into the public part of the SAP monitoring system, which is located on the Agency’s website. Any person can leave feedback and an assessment of the performance of a particular activity.

• In addition, NAPC also carries out a mandatory examination of draft legislative acts submitted for consideration by the Cabinet of Ministers of Ukraine and the Verkhovna Rada of Ukraine. The conclusions of the examinations are publicly available on the Agency’s website. The Agency also accepts materials for public examinations.

Pervin Dadashova, Director of the Financial Stability Department of the National Bank of Ukraine

• Today, about 90 billion UAH of loans have already been granted to farmers, about a third of the entire loan portfolio.

• To a large extent, these loans were granted after a full-scale invasion of government programs. On these loans, firstly, the rate was lower than the market rate, and secondly, the state largely guaranteed them.

• The state program of affordable loans (5-7-9) program is being transformed. Now, we do not see zero rates, as was the case in March and April 2022. Depending on the direction, they can be pretty high, especially if it is just working capital. Therefore, we will move towards market lending. The 5-7-9 program incentivized this point of contact between banks and farmers. Banks, especially large ones, have already understood and learned to work with the segment in these two years.

• What gives us the further development of the land reform and the involvement of new participants? In the context of lending, we first talk about land as collateral. For the bank, collateral is exclusively a guarantee of collateral, which must have several components to accept this collateral at a high cost.

• The liquidity ratio, already mentioned today, measures all components that affect the attractiveness of such an object as a collateral object for the bank. It consists of several points. The first, regulated by law, is the ability to charge quickly and transparently. We do not have many bankruptcy cases for loans with agricultural land as collateral. But from the fact that banks lend to land, it is clear that the regulatory framework suits them. The second aspect is the speed of implementation. Again, there are not many examples of banks trading this land. But here, we make maximum use of information about the land market and its circulation to understand whether this object will be liquid and how quickly banks could sell it after foreclosure. And the third component is the sale price. The NBU, as a regulator, sets this liquidity ratio, which determines how this object will be considered when determining the requirement for the bank itself. We have specific arguments in favor of revising this liquidity ratio. We are not currently talking about liquidity at the level of the best types of collateral, such as guarantees. But we have already found a formula that suits both the Ministry of Agrarian Policy and us, and shortly, NBU will adopt corresponding changes to our regulations, which should revive the crediting process. We also consider making the Partial Credit Guarantee Fund’s guarantees eligible collateral. Therefore, farmers will be able to receive loans secured by land, with a higher ratio, and also, actually, under the guarantees of the partial guarantee fund with an even higher ratio.

• In addition to the liquidity ratio, the cost of the loan is also determined by the liquidity of the object itself. Therefore, even without such broad and attractive state programs, over time, the development of the land market and the expansion of the base of liquid collateral will contribute to lowering the cost of loans.

• Lastly, data transparency and openness are crucial because, as I mentioned, we focus our regulation on available information. Therefore, banks must have access to all official data about rights, prices, and fertility data to evaluate the collateral they take. It is equally important for the National Bank of Ukraine. Therefore, transparency is vital for the further development of the land market.

Ellina Yurchenko, Land expert

• Every farmer participating in the land market conducts their monitoring. The data available on the State Geocadaster website can be used to guide the number of transactions. Still, the actual purchase and sale price in some regions, for example, in Vinnytsia, Poltava, and Khmelnytskyi, may differ from the official price by one and a half or two times. Therefore, now the farmers rely on the actual market offers.

• Monitoring lease prices for privately owned land should also be established, and data should be officially published. For now, we can use data on rents for private land of public agricultural companies, which are available in their reports.